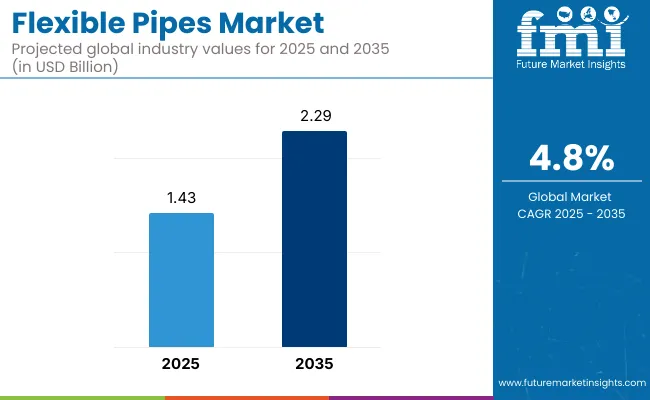

The flexible pipes industry in the world is set for tremendous growth responding to the growing demand for strong and flexible piping solutions for different industries. This industry is growing at a CAGR of 4.8% during the period 2020 to 2025 and it is expected to reach USD 1.43 billion by the end of 2025.

This trend, which is benefiting from the increasing requirement for long-lasting and corrosion resistant pipes and tubing in the sectors of oil and gas, water management and chemical processing, will result in its industry reaching a significant amount. Furthermore, the industry is projected to reach beyond USD 2.29 billion by 2035 due to continuous R&D in pipe materials and production processes, coupled with increasing infrastructure spending around the globe.

Another driving factor propelling the growth of this industry is the growing use of flexible pipes across difficult environments including offshore oil drilling and remote mining activities. In 2024 this industry is expected to reach an estimated value of 1.36 billion USD. We also witness a progressive incline for sustainable fashion, which led the industry towards eco-friendly materials and ethical production processes.

The industry is cut across sectors of the Americas, Asia-Pacific (APAC), and Europe, the Middle East, and African (EMEA) region, with emerging economies especially in the Asia-Pacific region have anticipated being essential to the industry growth, together with the quick industrialization and urbanization. The industry's future seems bright as consistent innovations and increasing applications will keep it afloat until 2035.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Market Growth: Moderate growth with a focus on recovery post-pandemic. | Market Growth: Accelerated growth driven by technological advancements and increased demand. |

| Primary Applications: Predominantly used in oil and gas sectors, especially offshore drilling. | Primary Applications: Diversification into renewable energy projects and infrastructure development. |

| Technological Focus: Emphasis on improving durability and cost-effectiveness. | Technological Focus: Integration of smart technologies for real-time monitoring and enhanced performance. |

| Regional Demand: High demand in North America and the Middle East. | Regional Demand: Significant growth in Asia-Pacific due to rapid industrialization. |

| Environmental Considerations: Initial steps towards sustainable practices and materials. | Environmental Considerations: Strong emphasis on eco-friendly materials and compliance with stringent environmental regulations. |

Conducted in Q4 2024, the survey gathered insights from 450 stakeholders evenly distributed across manufacturers, distributors, and end-users (including ranchers) in key regions such as the United States, Western Europe, Japan, and South Korea. The survey aimed to understand the dynamics of the flexible pipes market, including demand drivers, challenges, and future opportunities. Below is a detailed analysis of the findings.

Key Insights from Stakeholders

Demand Drivers

Challenges and Pain Points

Regional Variations

Future Opportunities

Based on material, the High-density Polyethylene segment is in the forefront of the flexible pipe industry during the forecast period. It is likely to accelerate at 4.7% CAGR during the forecast period 2025 to 2035. Flexible pipes are built from a variety of materials, each with its own set of characteristics designed for functions. High-density polyethylene (HDPE has a very good degree of flexibility and chemical resistance compared to other materials which makes it very suitable for the transportation of water and chemicals, onshore and offshore.

The durability and cost-effectiveness of HDPE have made it the material of choice in several industries. Polyamide, also known as nylon, is a thermoplastic polymer with high mechanical strength and thermal stability. This property makes it ideal for applications that need to withstand these high-pressure and high-temperature situations, such as certain oil and gas applications.

Polyvinylidene fluoride (PVDF) is best known for its high chemical and UV resistance. To ensure durability and reliability, this material is commonly used in situations where exposure to corrosive materials is possible. They are joined by composite structures and specialized polymers, among other materials, which help fulfill specific operational requirements-providing tailored solutions to unique challenges.

Based on Application, the Off-shore Application segment is in the forefront of the flexible pipe industry during the forecast period. It is likely to accelerate at 4.5% CAGR during the forecast period 2025 to 2035. Flexible pipes have a varying application range in both onshore and offshore environments. These applications are not limited to but include flexible pipes used in land-based operations including oil and gas extraction, water treatment plants and agricultural irrigation systems.

This scenario allows for versatile terrain adaptability and easy installation of such structures. In offshore oil and gas extraction, where flexible pipes transport hydrocarbons from underwater wells to production facilities, offshore applications are essential. The success of offshore projects hinges on their ability to resist dynamic marine circumstances and the extremely high pressures of the deep sea.

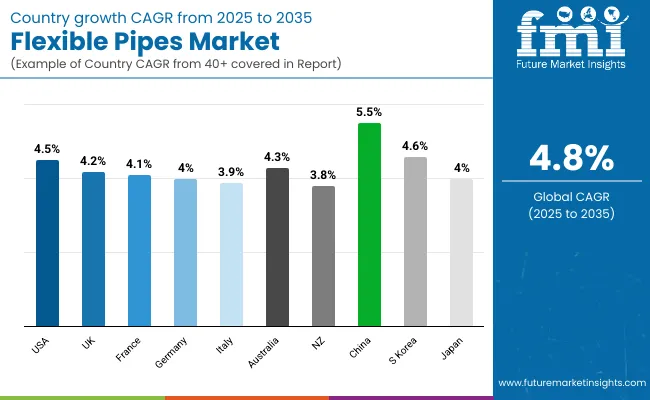

The United States' flexible pipes industry is projected to experience steady growth from 2025 to 2035, driven by ongoing investments in both onshore and offshore oil and gas exploration activities. The country's commitment to energy independence and technological advancements in drilling techniques have increased the demand for durable and adaptable piping solutions. Additionally, the rise in shale gas extraction and the need for pipeline infrastructure maintenance contribute to industry expansion.

The integration of smart technologies into flexible pipes, enabling real-time monitoring and predictive maintenance, is further enhancing their appeal across various industries. Future Market Insights (FMI) opines that the United States' sales of flexible pipes will grow at nearly 4.5% through 2025 to 2035.

In the United Kingdom, the flexible pipes industry is anticipated to grow steadily over the forecast period. The nation's focus on renewable energy projects, particularly offshore wind farms, has increased the demand for flexible pipes used in cable protection and fluid transfer applications. Moreover, the decommissioning of aging oil and gas infrastructure necessitates the replacement and upgrading of piping systems, providing further industry opportunities.

The UK's stringent environmental regulations also drive the adoption of eco-friendly piping solutions, aligning with global sustainability goals. FMI opines that the United Kingdom's sales of flexible pipes will grow at nearly 4.2% through 2025 to 2035.

Germany's flexible pipes industry is expected to witness moderate growth during the forecast period. The country's emphasis on industrial automation and advanced manufacturing processes has led to increased adoption of flexible piping systems in various sectors, including automotive and chemical industries.

Additionally, Germany's commitment to transitioning towards renewable energy sources, such as biogas and hydrogen, requires specialized piping solutions, further bolstering industry demand. However, limited offshore oil and gas activities may constrain higher growth rates. FMI opines that Germany's sales of flexible pipes will grow at nearly 4.0% through 2025 to 2035.

France's flexible pipes industry is projected to grow moderately over the next decade. The nation's investments in offshore wind energy projects and modernization of water treatment facilities have increased the demand for flexible piping solutions.

Furthermore, France's focus on reducing carbon emissions and enhancing energy efficiency aligns with the adoption of advanced piping technologies. The agricultural sector's need for efficient irrigation systems also contributes to industry growth. FMI opines that France's sales of flexible pipes will grow at nearly 4.1% through 2025 to 2035.

Italy's flexible pipes industry is anticipated to experience modest growth during the forecast period. The country's initiatives to upgrade its aging infrastructure, including water distribution networks and sewage systems, drive the demand for flexible pipes.

Additionally, Italy's involvement in Mediterranean offshore oil and gas exploration projects contributes to industry expansion. The agricultural industry's adoption of advanced irrigation techniques further supports the need for flexible piping solutions. FMI opines that Italy's sales of flexible pipes will grow at nearly 3.9% through 2025 to 2035.

Australia's flexible pipes industry is expected to grow steadily over the forecast period. The country's significant investments in offshore oil and gas exploration, particularly in regions like the Northwest Shelf, drive the demand for flexible piping systems capable of withstanding harsh marine environments.

Additionally, Australia's focus on enhancing its water management infrastructure, including irrigation and wastewater treatment, contributes to industry growth. The mining sector's reliance on durable and adaptable piping solutions further bolsters demand. FMI opines that Australia's sales of flexible pipes will grow at nearly 4.3% through 2025 to 2035.

New Zealand's flexible pipes industry is projected to experience modest growth during the forecast period. The country's emphasis on sustainable agricultural practices and efficient water management systems drives the demand for flexible piping solutions.

Additionally, New Zealand's initiatives to upgrade its infrastructure, including water supply and sewage systems, contribute to industry expansion. However, limited offshore oil and gas activities may constrain higher growth rates. FMI opines that New Zealand's sales of flexible pipes will grow at nearly 3.8% through 2025 to 2035.

China's flexible pipes industry is expected to witness significant growth over the next decade. The country's rapid industrialization and urbanization has led to substantial investments in infrastructure development, including oil and gas pipelines, water treatment facilities, and agricultural irrigation systems.

China's commitment to expanding its offshore oil and gas exploration activities further drives the demand for advanced flexible piping solutions. The government's focus on environmental sustainability also encourages the adoption of eco-friendly piping materials. FMI opines that China's sales of flexible pipes will grow at nearly 5.5% through 2025 to 2035.

South Korea's flexible pipes industry is anticipated to grow steadily during the forecast period. The country's advancements in shipbuilding and offshore engineering have increased the demand for flexible piping systems in marine applications. Additionally, South Korea's investments in renewable energy projects, such as offshore wind farms, contribute to industry expansion.

The nation's focus on technological innovation and smart infrastructure development further supports the adoption of advanced flexible pipes. FMI opines that South Korea's sales of flexible pipes will grow at nearly 4.6% through 2025 to 2035.

Japan's flexible pipes industry is projected to experience moderate growth over the forecast period. The country's initiatives to modernize its infrastructure, including water supply and sewage systems, drive the demand for flexible piping solutions. Japan's focus on renewable energy sources, such as geothermal and offshore wind energy, also contributes to industry growth.

Additionally, the nation's emphasis on technological innovation and automation supports the adoption of advanced piping systems in various industries. FMI opines that Japan's sales of flexible pipes will grow at nearly 4.0% through 2025 to 2035.

The flexible pipes industry is categorized under the industrial equipment and components sector, specifically within the oil and gas industry's equipment segment. Flexible pipes are essential for transporting fluids and gases in both onshore and offshore environments, offering advantages such as corrosion resistance, flexibility, and ease of installation.

From a macroeconomic perspective, the flexible pipes industry is poised for steady growth from 2025 to 2035. This expansion is primarily driven by the increasing global demand for energy, leading to heightened exploration and production activities in the oil and gas sector. As easily accessible reserves dwindle, companies are venturing into deeper and more challenging offshore locations, necessitating advanced piping solutions that can withstand harsh conditions. Flexible pipes, with their adaptability and durability, are well-suited for such applications.

Additionally, the global shift towards renewable energy sources, such as offshore wind and tidal energy, requires robust subsea infrastructure, further bolstering the demand for flexible pipes. Economic growth in emerging industries, particularly in Asia-Pacific and Latin America, is leading to increased industrialization and urbanization, thereby driving the need for efficient fluid transport systems.

However, potential challenges such as fluctuating raw material prices and stringent environmental regulations could impact industry dynamics. Nevertheless, technological advancements and the development of eco-friendly materials present opportunities for innovation and sustained industry growth.

Growth Opportunities

Strategic Recommendations

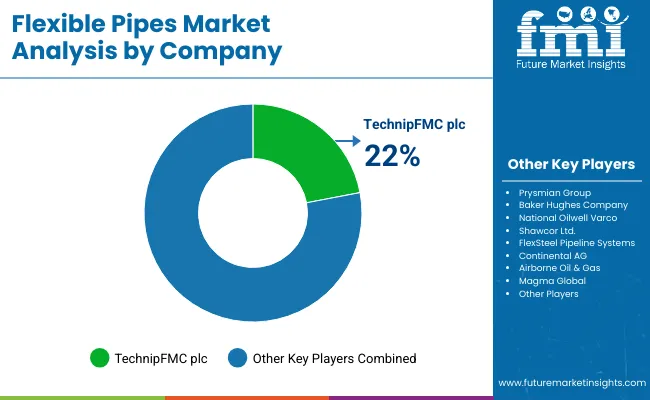

| Company | Market Share (2024) |

|---|---|

| TechnipFMC plc | 22% |

| Prysmian Group | 18% |

| Baker Hughes Company | 15% |

| National Oilwell Varco | 12% |

| Shawcor Ltd. | 10% |

| FlexSteel Pipeline Systems | 8% |

| Continental AG | 7% |

| Airborne Oil & Gas | 5% |

| Magma Global | 3% |

| Others | 10% |

High-density Polyethylene (HDPE), Polyamide, Polyvinylidene Fluoride, Others.

On-shore, Off-shore.

North America, Latin America, Europe, Asia Pacific, Middle East and Africa.

Flexible pipes are engineered conduits designed to transport fluids and gases, offering adaptability and resilience under various conditions. They are extensively utilized in industries such as oil and gas, water treatment, chemical processing, and mining, where their ability to withstand dynamic environments is crucial.

Unlike rigid pipes, flexible pipes can accommodate movements, vibrations, and thermal expansions without compromising structural integrity. This flexibility reduces the need for additional fittings and compensators, leading to simplified installations and maintenance procedures.

Flexible pipes are typically constructed from materials such as high-density polyethylene (HDPE), polyamides, and polyvinylidene fluoride (PVDF). These materials are selected for their durability, chemical resistance, and suitability for specific operational environments.

Yes, certain flexible pipes are designed to withstand elevated temperatures. For instance, specialized rubber hoses can operate effectively at temperatures up to 135ºC for oil applications. It's essential to consult manufacturer specifications to ensure compatibility with specific temperature requirements.

Flexible pipes exhibit excellent resistance to a wide range of chemicals, making them suitable for transporting various fluids in industrial settings. The choice of material, such as HDPE or PVDF, plays a significant role in determining the pipe's compatibility with specific chemicals.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA