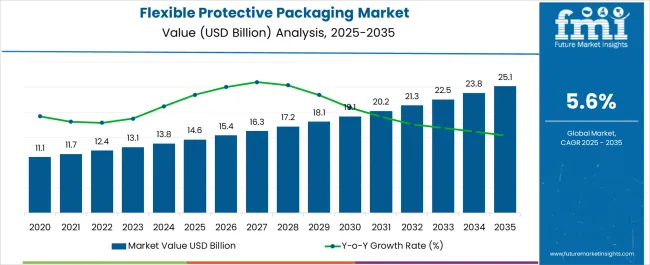

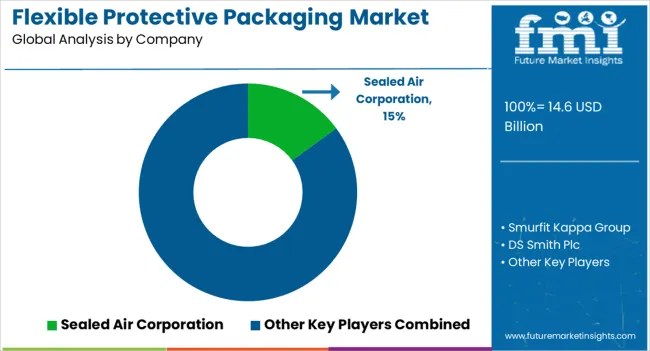

The flexible protective packaging market is estimated to be valued at USD 14.6 billion in 2025 and is projected to reach USD 25.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

This phase reflected gradual acceptance driven by the need for cost-efficient packaging formats across multiple sectors. By 2025, the scaling phase begins, marked by a sharper growth trajectory as adoption broadens across industries. Between 2025 and 2030, market value is expected to climb from USD 14.6 billion to nearly USD 18.1 billion. During the 2030–2035 consolidation phase, the market demonstrates a more structured growth path, advancing from USD 19.1 billion in 2030 to USD 25.1 billion by 2035.

This stage indicates strong market penetration and broader acceptance, where the majority of industry players integrate flexible protective packaging as a standard choice. Growth, while steady, becomes more predictable as the market stabilizes with established demand cycles. The adoption lifecycle reflects a clear progression: early adoption (2020–2024), robust scaling with accelerated uptake (2025–2030), and consolidation with widespread industry integration (2030–2035), creating a mature and resilient market landscape.

| Metric | Value |

|---|---|

| Flexible Protective Packaging Market Estimated Value in (2025 E) | USD 14.6 billion |

| Flexible Protective Packaging Market Forecast Value in (2035 F) | USD 25.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

Seasonality in the flexible protective packaging market is influenced by production cycles, consumer demand peaks, and product launch schedules. Data indicates that Q3 and Q4 often account for 35–40% of annual orders, coinciding with peak demand in electronics, food, and e-commerce packaging before the holiday season. Conversely, Q1 typically records 10–15% lower procurement, as manufacturers adjust inventory and plan for new production runs. Seasonal promotions and product launches can create short-term spikes of 10–15% above baseline demand. Suppliers coordinate production, logistics, and distribution around these peaks to maintain steady supply while avoiding overstock in slower quarters.

Cyclicality reflects broader industrial investment and replacement trends. Flexible protective packaging lines and materials are generally upgraded or expanded every 5–7 years, generating periodic surges in demand that can increase annual market size by USD 1–2 billion. Changes in packaging standards, regulatory requirements, or raw material availability can also temporarily accelerate procurement, producing short-term spikes of 5–10% above projected growth. These cyclical patterns overlay the underlying CAGR of 5.6%, creating alternating periods of rapid expansion and moderate stabilization. Recognizing these cycles allows suppliers and manufacturers to optimize production planning, inventory management, and supply chain coordination effectively.

The market is experiencing steady expansion as global supply chains increasingly prioritize product safety, cost efficiency, and sustainability. The growing demand for e-commerce, coupled with the need for effective packaging solutions that reduce damage during transit, has created strong momentum for flexible formats. Manufacturers are investing in advanced materials and production technologies that deliver lightweight yet durable packaging, which supports lower transportation costs and reduced environmental impact.

Increasing regulatory focus on sustainable packaging has also encouraged the adoption of recyclable and biodegradable materials in flexible protective solutions. Innovations in protective design, including multi-layer films and air-filled cushioning systems, are enabling improved product protection without significant increases in packaging volume.

As the market adapts to diverse industry needs, including electronics, consumer goods, and pharmaceuticals, flexible protective packaging is expected to maintain its relevance Continued growth will be supported by evolving e-commerce trends, rising global trade volumes, and heightened consumer expectations for both product integrity and environmental responsibility.

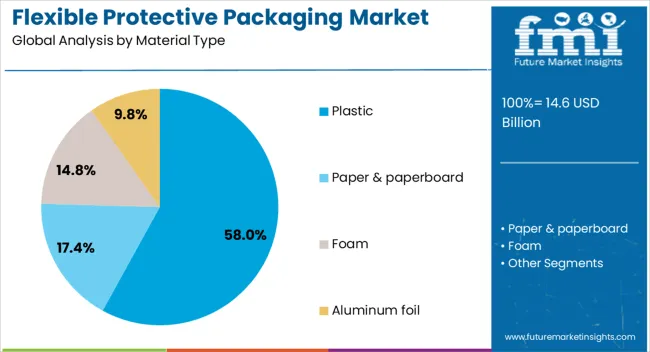

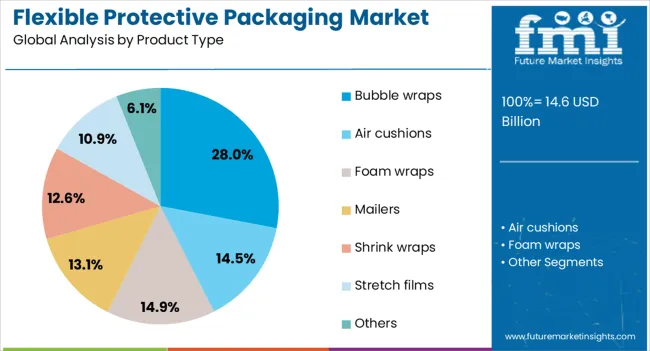

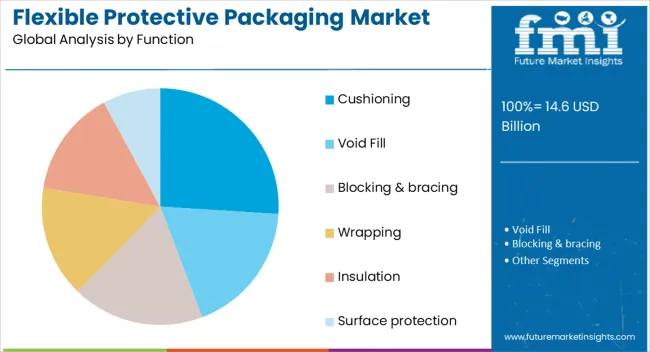

The flexible protective packaging market is segmented by material type, product type, function, end use, and geographic regions. By material type, flexible protective packaging market is divided into plastic, paper & paperboard, foam, and aluminum foil. In terms of product type, flexible protective packaging market is classified into bubble wraps, air cushions, foam wraps, mailers, shrink wraps, stretch films, and others. Based on function, flexible protective packaging market is segmented into cushioning, void fill, blocking & bracing, wrapping, insulation, and surface protection. By end use, flexible protective packaging market is segmented into e-commerce & retail, food & beverages, pharmaceuticals & healthcare, consumer, automotive, industrial, and others. Regionally, the flexible protective packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic material type segment is projected to hold 58% of the flexible protective packaging market revenue share in 2025, making it the leading material choice. The growth of this segment has been driven by the material’s versatility, durability, and ability to deliver high-performance protection across diverse product categories. Plastic offers a lightweight profile that reduces shipping costs while providing exceptional resistance to moisture, punctures, and impacts. Advancements in polymer technology have enabled the development of recyclable and bio-based plastics, addressing sustainability concerns while maintaining protective qualities. The material’s compatibility with various forming processes and its ability to integrate with cushioning systems have increased its adoption across multiple industries. Plastic’s adaptability to different shapes, sizes, and performance requirements, combined with its cost efficiency and global availability, has further strengthened its market position As companies seek to balance environmental objectives with functional performance, plastic is anticipated to continue leading in flexible protective packaging applications.

The bubble wraps product type segment is anticipated to account for 28% of the market revenue share in 2025, emerging as the leading product format. The segment’s growth has been supported by its proven effectiveness in providing cushioning, impact absorption, and surface protection during handling and transportation. Bubble wraps offer flexibility in application, allowing use across a wide range of industries from electronics to consumer goods. The material’s lightweight nature reduces shipping costs, while its reusability adds value for both businesses and consumers. Continuous product innovations, such as biodegradable bubble wraps and options with enhanced barrier properties, have aligned with sustainability goals without compromising performance. Their ease of use, ability to conform to different shapes, and cost efficiency have contributed to their dominance As e-commerce and global trade continue to expand, bubble wraps remain a preferred choice for ensuring that products reach their destinations intact, reinforcing their market leadership.

The cushioning function segment is expected to hold 26% of the market revenue share in 2025, securing its position as the leading functional application. This dominance has been attributed to the growing need for impact resistance and shock absorption in packaging to prevent damage during transit. Cushioning materials are engineered to distribute force evenly, minimizing product movement and mitigating potential breakage. The segment has benefited from the surge in e-commerce shipments, where goods undergo multiple handling stages before delivery. Material innovations, including air-filled designs and foam-based inserts, have enhanced protective performance while reducing material usage and overall package weight. Sustainability initiatives have led to the adoption of recyclable and biodegradable cushioning materials, broadening their appeal to environmentally conscious buyers The combination of performance reliability, adaptability to diverse product types, and contribution to cost-effective logistics has solidified the role of cushioning as a critical function in the flexible protective packaging market.

The flexible protective packaging market is experiencing rising adoption due to the growing demand for lightweight, cost-efficient, and space-saving packaging solutions across e-commerce, food, electronics, and healthcare sectors. Flexible formats such as bubble wraps, air pillows, padded mailers, and foam wraps provide superior protection during handling and transit while reducing material use and shipping costs compared to rigid packaging. Key players like Sealed Air, Pregis, Storopack, Smurfit Kappa, and Intertape Polymer Group lead the market through product innovation and expansion of recyclable or reusable options. The increasing reliance on e-commerce logistics has made protective packaging indispensable, with flexible solutions offering a balance between cushioning performance and cost efficiency. However, waste management and recycling challenges for multi-layered plastic packaging remain barriers, influencing purchasing decisions among environmentally conscious brands. Until scalable recycling systems expand globally, flexible protective packaging will continue to balance efficiency benefits against sustainability pressures.

The surge in e-commerce has created unprecedented demand for reliable protective packaging, making flexible formats essential for product safety during long shipping journeys. Unlike rigid packaging, air pillows, bubble wraps, and padded mailers offer cushioning without adding significant weight, reducing freight costs while maintaining product integrity. Companies like Pregis and Sealed Air have strengthened their portfolios with lightweight, on-demand air packaging systems that cater to fulfillment centers requiring scalable protective solutions. E-commerce platforms also favor flexible packaging for its ability to fit various product shapes and minimize returns caused by damages. The rise of cross-border online trade further amplifies this demand as products undergo multiple handling stages during transit. While rigid solutions dominate luxury categories, flexible packaging captures mass-market and mid-range product shipments. As e-commerce continues to expand in both mature and emerging markets, demand for lightweight flexible protection is expected to remain a core driver of growth.

High-value and sensitive products in the electronics and healthcare industries are fueling demand for advanced flexible protective packaging. Delicate items such as medical devices, surgical instruments, and consumer electronics require superior shock absorption and barrier properties to ensure product integrity during shipment and storage. Leading players like Storopack and Smurfit Kappa focus on developing customized solutions, such as anti-static air cushions and multi-layer bubble wraps, to address sector-specific needs. Healthcare packaging emphasizes sterility and tamper resistance, while electronics prioritize electrostatic discharge protection. Flexible packaging offers advantages over rigid containers by combining cost efficiency with adaptability for diverse product shapes. The expansion of global medical supply chains, particularly after disruptions caused by the pandemic, has underscored the importance of reliable protective packaging solutions. Although rigid materials maintain a presence for bulk items, flexible formats are increasingly favored for their ability to provide secure and lightweight product protection.

While flexible protective packaging offers efficiency and performance benefits, recycling remains a major challenge due to multi-layered structures and mixed plastic compositions. Many flexible solutions, such as bubble wraps and padded mailers, combine polyethylene with adhesives or barrier films, making them difficult to process in conventional recycling facilities. This has led to concerns among environmentally conscious consumers and brands. Companies like Sealed Air and Intertape Polymer Group are responding with initiatives to produce mono-material recyclable packaging and introduce take-back programs. However, large-scale recycling systems for flexible formats remain underdeveloped in many regions, limiting circular economy adoption. Regulations in Europe and North America are increasingly pressuring manufacturers to invest in recyclable and compostable alternatives, which adds costs but strengthens long-term competitiveness. Until recycling infrastructure catches up globally, flexible protective packaging adoption will face scrutiny, especially among companies with corporate environmental targets influencing their packaging material choices.

The flexible protective packaging market is highly competitive, with established players leveraging innovation and partnerships to maintain leadership. Sealed Air dominates with its diverse protective portfolio, while Pregis emphasizes automation-driven air cushioning systems. Smurfit Kappa integrates flexible protection into its sustainable paper-based product lines, offering hybrid solutions to attract environmentally focused clients. Partnerships with e-commerce platforms, logistics providers, and retailers are crucial to securing long-term contracts and expanding global reach. Regional players often compete through cost-effective offerings, though they lack the R&D capabilities of larger multinationals. Increasingly, competitive strategies involve developing recyclable films, reusable protective wraps, and automated dispensing systems that enhance warehouse efficiency. Mergers and acquisitions are also common, enabling global players to strengthen their geographic presence and technological edge. As demand continues to rise, competition will intensify between large corporations emphasizing innovation and smaller firms focusing on affordability in local markets.

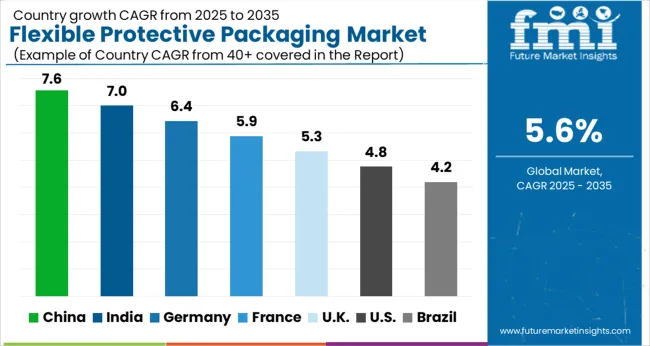

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global flexible protective packaging market is projected to grow at a CAGR of 5.6% through 2035, supported by increasing demand across e-commerce, consumer goods, and industrial applications. Among BRICS nations, China has been recorded with 7.6% growth, driven by large-scale production and deployment in protective and shipping packaging, while India has been observed at 7.0%, supported by rising utilization in logistics, retail, and industrial packaging. In the OECD region, Germany has been measured at 6.4%, where production and adoption for protective packaging in consumer and industrial applications have been steadily maintained. The United Kingdom has been noted at 5.3%, reflecting consistent use in shipping and retail packaging, while the USA has been recorded at 4.8%, with production and utilization across e-commerce, consumer, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The flexible protective packaging market in China is growing at a CAGR of 7.6%, driven by increasing demand for secure packaging in logistics, e-commerce, and retail sectors. Businesses are focusing on reducing product damage during transit, leading to higher adoption of flexible materials such as bubble wraps, padded envelopes, and protective films. The growth of e-commerce platforms and online retail channels boosts the need for lightweight and durable packaging solutions. Suppliers are expanding their distribution networks to serve manufacturers, retailers, and logistics providers across the country. Strong demand for cost-effective and efficient packaging materials is pushing manufacturers to improve quality and customization options. With rising awareness about product safety during shipping and storage, the market for flexible protective packaging is expected to maintain steady growth throughout China.

The flexible protective packaging market in India is expanding at a CAGR of 7.0%, supported by rising industrial production, e-commerce growth, and retail expansion. Manufacturers are increasingly using lightweight, durable, and adaptable materials to reduce damage to goods during storage and transportation. The demand for bubble wraps, flexible pouches, and cushioning films is strong across sectors such as electronics, food, pharmaceuticals, and consumer goods. Distribution networks through packaging suppliers and industrial distributors help reach both urban and semi-urban markets. Companies are offering tailored packaging solutions to meet the specific requirements of different industries. The market continues to grow as businesses prioritize product protection and safe delivery. Government focus on infrastructure and logistics efficiency also contributes to higher adoption of flexible protective packaging materials across India.

The flexible protective packaging market in Germany is growing at a CAGR of 6.4%, driven by industrial, retail, and logistics requirements. Manufacturers use flexible packaging solutions to protect goods such as electronics, food, and consumer products during transport and storage. Materials like bubble wraps, air cushions, and padded films are widely adopted due to their effectiveness and efficiency. Packaging suppliers and distributors ensure timely delivery to industries across the country. Companies focus on providing high-quality, customizable solutions to minimize product damage and improve operational efficiency. Regulatory standards and quality requirements support the adoption of certified protective packaging materials. Strong emphasis on supply chain reliability, safety, and product integrity continues to fuel market growth for flexible protective packaging solutions in Germany.

The flexible protective packaging market in the United Kingdom is expanding at a CAGR of 5.3%, with growing demand from logistics, e-commerce, and retail industries. Businesses increasingly require protective materials to safeguard goods during transport and storage. Commonly used solutions include bubble wraps, flexible pouches, and air cushions. Suppliers and distributors provide packaging solutions to meet the requirements of manufacturers, retailers, and logistics providers. Companies focus on cost-effective and efficient packaging to reduce losses and improve delivery reliability. The growth of online retail platforms and increasing shipments of fragile goods drive adoption. With emphasis on safety and protection standards, the market for flexible protective packaging is expected to grow steadily in the United Kingdom.

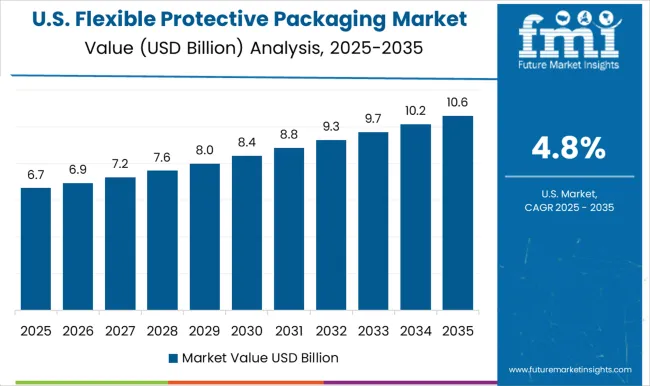

The flexible protective packaging market in the United States is growing at a CAGR of 4.8%, driven by rising e-commerce shipments, industrial goods transport, and retail product protection needs. Businesses rely on materials such as bubble wraps, padded films, and flexible pouches to minimize product damage during storage and distribution. Packaging suppliers serve both small and large enterprises across the country, offering solutions tailored to fragile and high-value goods. Industries including electronics, food, and healthcare are major adopters. Companies prioritize lightweight, durable, and cost-efficient packaging solutions. With increasing volumes of shipped goods and demand for reliable delivery, the market for flexible protective packaging in the USA continues to expand steadily, supporting the growing need for safe handling and secure transport of products.

The flexible protective packaging market has become a cornerstone of modern logistics and e-commerce, providing solutions that safeguard products during storage, handling, and transportation. The rising demand for lightweight, durable, and sustainable packaging solutions is driving the adoption of flexible protective materials across industries such as electronics, food, consumer goods, and healthcare. Companies in this sector are increasingly focusing on recyclable, biodegradable, and compostable packaging options to meet environmental regulations and sustainability goals. Sealed Air Corporation is a global leader, recognized for its innovative bubble, foam, and air cushion packaging solutions that protect fragile items.

Smurfit Kappa Group and DS Smith Plc specialize in sustainable flexible packaging with an emphasis on paper-based and corrugated alternatives that reduce plastic usage. Pregis LLC offers advanced air and foam protective systems for e-commerce and industrial shipments, while Storopack Hans Reichenecker GmbH focuses on tailored protective packaging solutions combining foam, paper, and air-cushion technologies. Sonoco Products Company provides comprehensive flexible packaging and protective materials for diverse industries, emphasizing lightweight, cost-efficient, and environmentally responsible solutions. The market is witnessing continuous innovation in material science and design, including multi-layered films, cushioning composites, and sustainable polymers. As e-commerce, global trade, and consumer demand for eco-friendly packaging grow, flexible protective packaging solutions are set to become indispensable in maintaining product safety, reducing supply chain losses, and minimizing environmental impact.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.6 billion |

| Material Type | Plastic, Paper & paperboard, Foam, and Aluminum foil |

| Product Type | Bubble wraps, Air cushions, Foam wraps, Mailers, Shrink wraps, Stretch films, and Others |

| Function | Cushioning, Void Fill, Blocking & bracing, Wrapping, Insulation, and Surface protection |

| End Use | E-commerce & retail, Food & beverages, Pharmaceuticals & healthcare, Consumer, Automotive, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sealed Air Corporation, Smurfit Kappa Group, DS Smith Plc, Pregis LLC, Storopack Hans Reichenecker GmbH, and Sonoco Products Company |

| Additional Attributes | Dollar sales by type including bubble wrap, air pillows, mailers, and protective films, application across e-commerce, electronics, food & beverages, and healthcare, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising online retail, increasing demand for product safety in transit, and sustainable lightweight packaging solutions. |

The global flexible protective packaging market is estimated to be valued at USD 14.6 billion in 2025.

The market size for the flexible protective packaging market is projected to reach USD 25.1 billion by 2035.

The flexible protective packaging market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in flexible protective packaging market are plastic, paper & paperboard, foam and aluminum foil.

In terms of product type, bubble wraps segment to command 28.0% share in the flexible protective packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Display Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Flexible Paper Battery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Tubing Market Size and Share Forecast Outlook 2025 to 2035

Flexible Barrier Films for Electronics Market Size and Share Forecast Outlook 2025 to 2035

Flexible Colored PU Foams Market Growth - Trends & Forecast 2025 to 2035

Flexible Endoscopes Market Growth - Trends & Forecast 2025 to 2035

Flexible Pipes Market Analysis by Application, Material, and Region: Forecast for 2025 to 2035

Flexible Thin Film Market Trends - Growth & Forecast 2025 to 2035

Flexible Glass for Flexible Electronics Market Analysis by Application, End User, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA