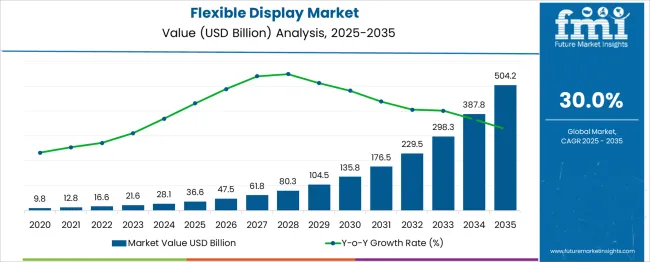

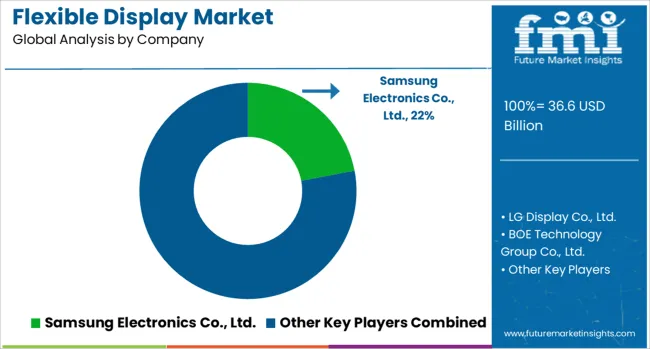

The Flexible Display Market is estimated to be valued at USD 36.6 billion in 2025 and is projected to reach USD 504.2 billion by 2035, registering a compound annual growth rate (CAGR) of 30.0% over the forecast period. Leading players such as Samsung Display, LG Display, and BOE Technology are expected to strengthen their positions due to their heavy R&D investments and early-mover advantages. However, the rapid technological advancements and increasing patent expirations are opening doors for newer entrants, especially from Southeast Asia and North America, to capture market share with niche innovations and cost-effective solutions. Traditional display manufacturers that fail to adapt quickly to flexible OLED, microLED, and rollable display technologies risk losing significant ground. As the market transitions from premium smartphones to broader applications such as wearables, automotive dashboards, foldable tablets, and even smart clothing, companies with adaptable product portfolios and scalable manufacturing capacity will gain dominance. Between 2025 and 2030, we are likely to see incumbent leaders maintaining over 60% market share, but by 2035, newer innovators and cross-industry entrants could erode their dominance, redistributing as much as 20–25% market share and reshaping the competitive hierarchy of the flexible display ecosystem.

| Metric | Value |

|---|---|

| Flexible Display Market Estimated Value in (2025 E) | USD 36.6 billion |

| Flexible Display Market Forecast Value in (2035 F) | USD 504.2 billion |

| Forecast CAGR (2025 to 2035) | 30.0% |

Between 2025 and 2035, the Flexible Display Market is projected to expand from USD 36.6 billion to USD 504.2 billion, growing at a CAGR of 30.0%, leading to significant shifts in competitive positioning. In 2025, dominant players like Samsung Display, LG Display, and BOE Technology command a combined market share exceeding 65%, driven by proprietary OLED technologies, strong patent portfolios, and large-scale production capabilities.

However, as the industry matures and demand diversifies across smartphones, wearables, automotive displays, tablets, and foldable laptops, newer entrants are expected to gain a foothold. Smaller and agile companies from regions like Southeast Asia and Europe are already developing advanced flexible display technologies, often targeting niche applications or leveraging strategic partnerships. By 2030, it is expected that the top three players’ market share could decline to 50–55%, as competitors offer lower-cost alternatives and new functionalities like stretchable and transparent displays.

Chinese firms, in particular, are poised to gain up to 15–20% market share by 2035 due to government-backed manufacturing scale-ups and aggressive pricing strategies. This decade will mark a redistribution of value, where innovation speed and adaptability to new end-use segments will define market share gains or erosion.

Manufacturers are increasingly investing in flexible substrates, roll-to-roll production, and low-temperature fabrication processes to reduce costs and expand application scope.

Advances in thin-film encapsulation and flexible backplanes have enhanced the durability and resolution of displays, making them suitable for mainstream deployment in consumer electronics, automotive dashboards, and wearable tech. Demand is also being fueled by the need for energy-efficient, space-saving designs that allow device miniaturization without compromising visual performance.

Government support for flexible electronics R&D and partnerships between material science innovators and OEMs are further accelerating technology commercialization.

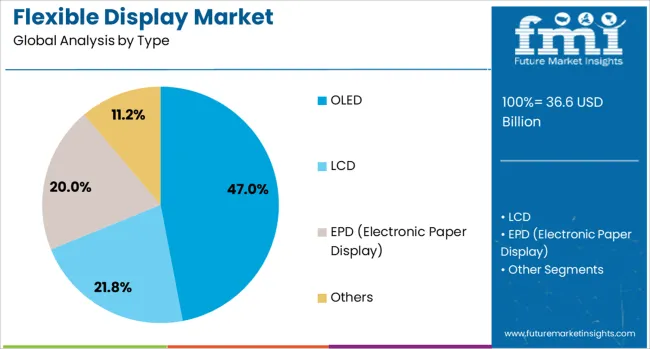

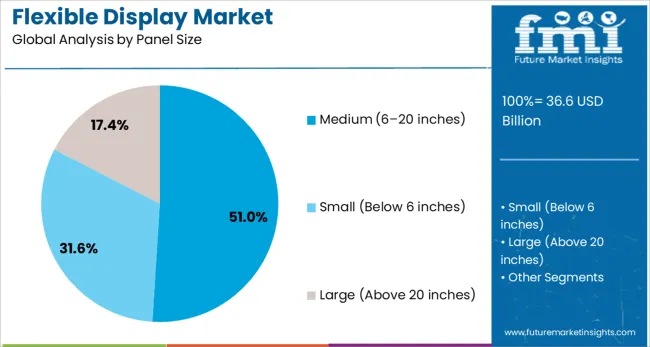

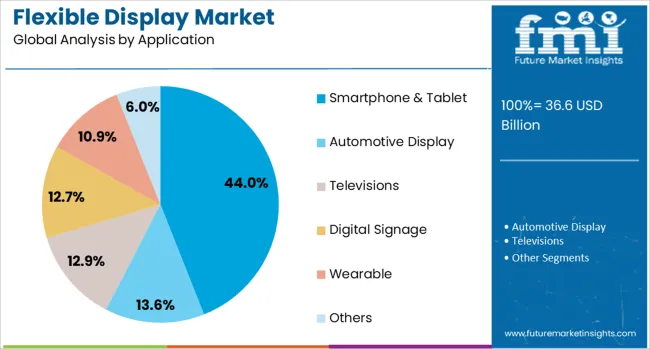

The flexible display market is segmented by type, panel size, application, and geographic regions. The flexible display market is divided by type into OLED, LCD, EPD (Electronic Paper Display), and Others. In terms of panel size of the flexible display market is classified into Medium (6–20 inches), Small (Below 6 inches), and Large (Above 20 inches). The flexible display market is segmented into Smartphone & Tablet, Automotive Display, television, Digital Signage, Wearable, and Others. Regionally, the flexible display industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

OLED technology is projected to dominate the flexible display market with a 47.0% share in 2025. This is due to its superior contrast ratio, color accuracy, and inherent flexibility when compared to traditional display technologies.

OLED panels can be bent, curved, or folded without image degradation, making them ideal for next-gen smartphones, foldable tablets, and futuristic consumer electronics. Furthermore, OLEDs do not require backlighting, allowing manufacturers to reduce panel thickness and weight while improving power efficiency.

Their ability to function under extreme temperature and mechanical stress conditions positions OLEDs as the foundational technology for the flexible display revolution.

Medium-sized panels, ranging from 6 to 20 inches, are expected to capture 51.0% of the flexible display market share by 2025. This segment's dominance stems from the high integration of flexible screens into foldable smartphones, tablets, e-readers, and in-car infotainment systems.

Manufacturers are prioritizing this size range due to its versatility, compatibility with consumer-grade devices, and favorable production economics. Medium panels balance portability with usability, offering sufficient surface area for immersive experiences while remaining lightweight and compact.

Continuous development of hinge mechanisms and impact-resistant materials has further bolstered confidence in mass-market adoption of medium-sized flexible displays.

Smartphones and tablets are projected to account for 44.0% of the flexible display market by 2025, making them the leading application area. This leadership is driven by rising consumer interest in foldable and rollable mobile devices that provide expanded screen real estate without increasing device footprint.

OEMs are leveraging flexible displays to differentiate flagship products, enhance user experience, and create new form factors that blend productivity with portability. The transition to 5G and demand for multi-screen functionality are also accelerating adoption in this category.

As competition intensifies among leading electronics brands, flexible displays are becoming a key innovation lever for gaining market share.

The flexible display market is progressing as manufacturers seek lighter, thinner, and bendable alternatives to traditional screens. These displays are gaining popularity in smartphones, foldable tablets, wearables, automotive panels, and signage. Their design flexibility supports unconventional product shapes and screen layouts. Consumer electronics brands use flexible displays to differentiate offerings with sleek aesthetics and multifunctionality. As product design priorities shift toward portability and adaptability, flexible displays present a strong appeal across industries, aiming to enhance user experience and space efficiency in compact or curved formats.

The flexible display market is expanding largely due to the increasing preference for devices that blend visual appeal with physical adaptability. Smartphone and tablet manufacturers now integrate flexible screens to achieve foldable and rollable formats, offering users larger viewing surfaces in pocket-sized devices. Wearable brands leverage flexible displays for lightweight and curved designs, improving comfort and visual interface. Automotive makers incorporate these displays into dashboards and control systems to support space-efficient, driver-focused layouts. Additionally, display vendors benefit from flexible screens’ ability to resist cracking under pressure, a key value proposition in mobile environments. In high-traffic commercial settings, curved digital signage powered by flexible displays is gaining traction due to better viewing angles and aesthetic integration. As electronics brands pursue ways to differentiate product lines through visual sophistication and reduced bulk, flexible displays offer a practical and visually striking solution that balances form and function across diverse consumer applications.

Manufacturing flexible displays involves a series of intricate processes and materials that differ significantly from conventional screen production. Thin substrates, organic compounds, and specialized backplanes are required to maintain flexibility while preserving image quality and durability. These components can be sensitive to heat, pressure, and alignment variations, making defect-free production more difficult. Low initial yield rates often result in higher per-unit costs and limited scalability. Specialized equipment and cleanroom conditions are necessary for layering materials with high precision, and minor errors can lead to dead pixels or structural defects. Integrating flexible displays into products also involves adapting assembly lines to handle curved or foldable elements, which not all manufacturers can accommodate. As a result, only a limited number of companies currently produce high-quality flexible displays at commercial volumes. Until production methods become more refined and cost-effective, these complexity-related hurdles continue to slow down wider industry adoption and profitability.

Flexible displays open up unique opportunities in sectors where traditional flat screens are impractical or inefficient. Medical wearables, smart labels, and in-flight displays benefit from lightweight, bendable formats that conform to non-linear surfaces. Flexible screens can be embedded into clothing, accessories, or irregular surfaces without compromising functionality, expanding use cases across fashion, defense, and industrial inspection tools. Home automation systems also explore flexible displays for seamless wall or furniture integration. For retail, curved or wraparound digital signage provides attention-grabbing interfaces in confined spaces. Even in publishing, companies are testing foldable e-readers that replicate paper-like handling while offering digital capabilities. These niche applications often favor flexibility not just for aesthetics but for environmental fit and spatial limitations. As display makers explore smaller-scale form factors and new material combinations, custom solutions for specialized uses will drive growth. Market participants able to deliver durability, clarity, and form-fit compatibility can access untapped demand beyond mainstream consumer electronics.

Despite strong interest in flexible displays, durability concerns limit their use in critical or rugged applications. Repeated bending, folding, or exposure to extreme temperatures can stress screen layers and reduce performance over time. While many displays can withstand light flexing, constant mechanical stress may cause delamination, image distortion, or loss of touch sensitivity. Moisture and oxygen sensitivity of some flexible components require barrier layers, which may add weight or compromise flexibility. For high-use environments such as automotive interiors or public kiosks, these factors raise concerns over long-term reliability. Furthermore, if a flexible screen is damaged, repairs or replacements are often more complex than with rigid alternatives. Consumer hesitation around screen life and repair costs also affects adoption. Until materials and manufacturing processes can reliably withstand extended use and exposure, flexible displays may remain limited to premium or controlled environments, reducing their role in broader industrial or public-facing applications.

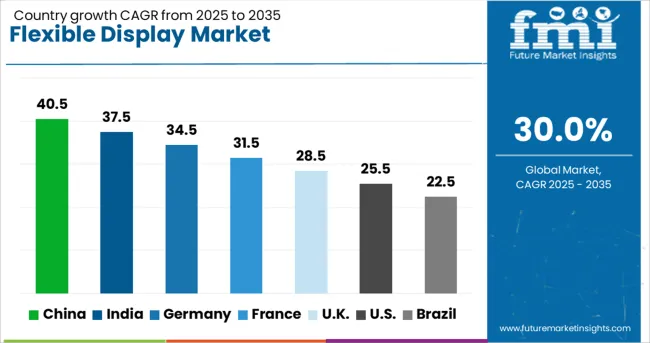

| Country | CAGR |

|---|---|

| China | 40.5% |

| India | 37.5% |

| Germany | 34.5% |

| France | 31.5% |

| UK | 28.5% |

| USA | 25.5% |

| Brazil | 22.5% |

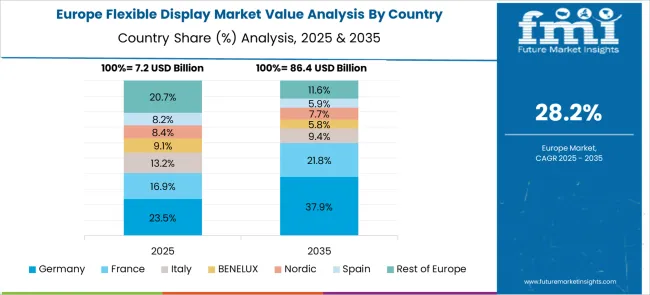

The global flexible display market is advancing at a robust CAGR of 30.0%, fueled by demand for next-generation consumer electronics, foldable devices, and wearable technology. China leads with 40.5% growth, driven by large-scale investments in OLED manufacturing and rapid commercialization of flexible screen technologies. India follows at 37.5%, supported by a growing electronics sector and government initiatives promoting domestic display production. Germany records 34.5% growth, reflecting strengths in materials engineering and high-end display applications. The United Kingdom shows steady growth at 28.5%, focusing on research-driven innovation and niche product development. The United States, at 25.5%, remains a mature but significant player, emphasizing R&D in flexible substrates and advanced display integration. Market dynamics are shaped by material innovation, durability standards, and integration with emerging technologies like 5G and AI. This report includes insights on 40+ countries; the top countries are shown here for reference.

The flexible display market in China has achieved a CAGR of 40.5%, leading global advancements in next-generation screen technologies. Local electronics manufacturers are introducing foldable smartphones, wearable devices, and rollable tablets at scale, creating significant domestic and international demand. Strategic government backing for semiconductor and display manufacturing parks has allowed rapid infrastructure buildup and research momentum. Several provinces have emerged as innovation clusters, supporting startups and established players alike. Displays with curved and bendable features are being adopted in smart appliances and automotive dashboards. With rising investments in design and materials, producers are pushing the limits of plastic-based OLEDs and flexible TFT-LCDs. This has also supported collaborations with global tech giants for supply chain integration.

India is witnessing strong growth in the flexible display market, with a CAGR of 37.5%, fueled by rising demand in mobile devices, wearables, and low-power signage. Domestic electronic brands are collaborating with display innovators to launch foldable screen smartphones at accessible price points. Government initiatives to enhance local manufacturing have boosted investor confidence in display fabrication and assembly facilities. Startups are experimenting with curved displays in wearable health monitors and compact tablets. Flexible displays are also gaining traction in the education sector, powering lightweight e-readers and tablets designed for rural deployment. Advertising companies are adopting rollable and flexible panels for mobile signage and transportation-based displays.

Germany’s flexible display market has reached a CAGR of 34.5%, driven by increasing deployment in automotive, consumer electronics, and medical devices. German automotive suppliers are integrating flexible OLED panels into dashboard and infotainment systems for enhanced ergonomics and aesthetics. Research institutions are working alongside manufacturers to create ultra-thin, durable substrates that allow form factor versatility. In healthcare, wearable diagnostics and patient monitoring devices are using bendable screens for compact, non-intrusive interfaces. Electronics retailers are offering foldable and dual-screen devices in premium segments. Additionally, the country’s strong printing and materials science expertise is supporting innovations in printable flexible electronics.

The United Kingdom has posted a CAGR of 28.5% in the flexible display market, reflecting its increasing role in specialty design and high-end applications. Tech firms and product designers are focusing on premium gadgets, concept phones, and foldable accessories that leverage flexible screen technology. Automotive electronics is another area of growth, with flexible panels being used in cockpit instrumentation and entertainment systems. Universities and design labs are collaborating to develop applications where displays can wrap around complex surfaces. Retail technology is adopting flexible displays for customer-interactive signage, particularly in luxury outlets. Home automation systems and compact smart devices are also using curved screens for enhanced visual appeal and user engagement.

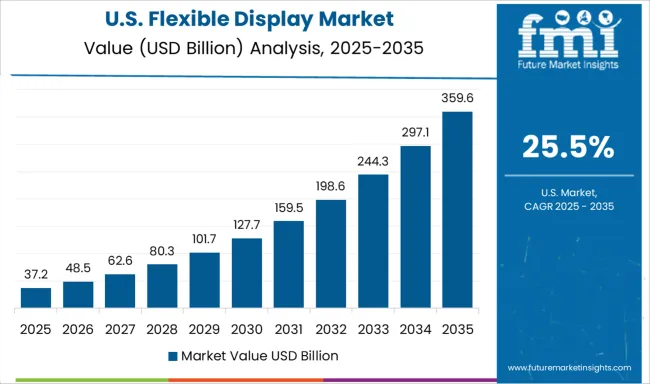

In the United States, the flexible display market has grown at a CAGR of 25.5%, with strong interest from consumer electronics, healthcare, and defense sectors. Major tech companies are introducing foldable smartphones, e-readers, and dual-screen laptops, targeting innovation-driven consumers. Medical device makers are implementing flexible panels in compact monitors and diagnostic wearables for continuous tracking. Defense and aerospace firms are exploring rugged, low-profile display solutions for communication and control panels. Flexible displays are also being tested in outdoor signage and advertising setups, especially in stadiums and transport hubs. The strong presence of tech hubs and research centers supports rapid development cycles and cross-industry deployment.

The Flexible Display Market is rapidly evolving as consumer electronics move toward more adaptive, lightweight, and compact form factors. From foldable smartphones and wearable screens to curved TVs and rollable signage, flexible displays are transforming the design possibilities across devices. These displays use plastic substrates instead of traditional glass, enabling bending, folding, and even rolling without compromising screen performance. The trend is particularly visible in premium mobile devices, where flexibility enables multitasking, improved portability, and futuristic aesthetics. Samsung Electronics leads the market with its foldable smartphones featuring AMOLED-based flexible displays, setting the commercial benchmark. LG Display has pioneered rollable OLED technology, targeting high-end TV segments and signage.

BOE Technology Group, one of China’s top panel makers, is aggressively expanding production capacity and investing in flexible AMOLEDs to compete globally. Japan Display Inc., though historically strong in LCDs, is pivoting towards OLED and flexible innovations to remain competitive. AU Optronics, Sharp, and Innolux are focusing on integrating flexible technology into automotive displays, wearables, and industrial applications, diversifying beyond consumer electronics. As production yields improve and costs decrease, flexible displays are expected to penetrate mid-range devices and new application areas such as foldable laptops and in-car curved dashboards. The market is not only defined by hardware innovation but also by panel durability, resolution retention during flexing, and integration with touch and sensor layers all of which are ongoing areas of differentiation among leading suppliers.

LG Display, in a November 2024 press release, unveiled the world’s first stretchable display that expands 50% from 12″ to 18″ while retaining RGB color, 100 ppi resolution, and durability across 10,000 stretches. Developed under South Korea’s national R&D program, the innovation reinforces LG’s leadership in next-gen flexible display technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 36.6 Billion |

| Type | OLED, LCD, EPD (Electronic Paper Display), and Others |

| Panel Size | Medium (6–20 inches), Small (Below 6 inches), and Large (Above 20 inches) |

| Application | Smartphone & Tablet, Automotive Display, Televisions, Digital Signage, Wearable, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Electronics Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., Japan Display Inc., AU Optronics Corp., Sharp Corporation, and Innolux Corporation |

| Additional Attributes | Dollar sales vary by display type and application, with OLED dominating, while EPD experiences fastest growth. Asia-Pacific leads in volume, while North America drives value. Pricing fluctuates with material, substrate, and manufacturing costs. Growth accelerates via foldable/rollable devices, wearables, automotive dashboards, and AR/VR integrations under innovation and supply‑chain expansion trends. |

The global flexible display market is estimated to be valued at USD 36.6 billion in 2025.

The market size for the flexible display market is projected to reach USD 504.2 billion by 2035.

The flexible display market is expected to grow at a 30.0% CAGR between 2025 and 2035.

The key product types in flexible display market are oled, lcd, epd (electronic paper display) and others.

In terms of panel size, medium (6–20 inches) segment to command 51.0% share in the flexible display market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Machinery Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electronic Market Size and Share Forecast Outlook 2025 to 2035

Flexible Foam Market Size and Share Forecast Outlook 2025 to 2035

Flexible Plastic Packaging Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Flexible Protective Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Flexible End-Load Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flexible Screens Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Substrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA