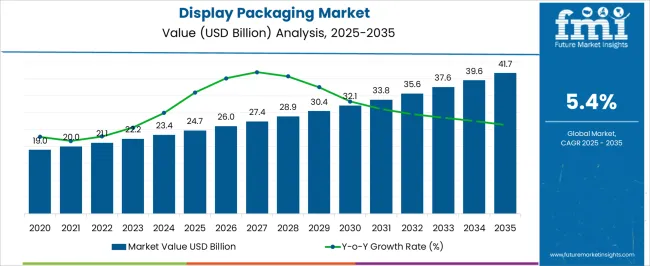

The display packaging market is projected to grow from USD 24.7 billion in 2025 to USD 41.7 billion by 2035, registering a CAGR of 5.4%. A peak-to-trough assessment shows that while the market follows a steady upward trajectory, annual growth intensity varies over different phases. From 2021 to 2025, the market rises from USD 19.0 billion to USD 24.7 billion. Peak growth is observed between 2021 and 2023, when annual gains approach 5.5–6%, supported by strong retail adoption, increased use of point-of-purchase displays, and demand for visually enhanced packaging in FMCG. By 2024 and 2025, trough patterns emerge with growth nearer to 5%, indicating early normalization. Between 2026 and 2030, the market is projected to grow from USD 26.0 billion to USD 32.1 billion. This block shows a narrower spread, with annual growth rates ranging between 4.8% and 5.3%. Demand is anchored by established FMCG and electronics packaging, while fluctuations in material costs and pricing strategies create minor trough effects without disrupting the growth trend. From 2031 to 2035, the market advances from USD 33.8 billion to USD 41.7 billion. Peak years such as 2032 and 2034 reach close to 5.5%, while trough years hover around 4.9%. Late-cycle maturity defines this phase, with eco-friendly and modular design innovations preventing stagnation.

| Metric | Value |

|---|---|

| Display Packaging Market Estimated Value in (2025 E) | USD 24.7 billion |

| Display Packaging Market Forecast Value in (2035 F) | USD 41.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The display packaging market holds a visible share across several interconnected parent sectors, with its importance linked to branding impact and shelf presence rather than sheer packaging volume. In the retail packaging market, display-ready formats contribute nearly 9 to 10%, given their pivotal role in driving impulse purchases and product differentiation at the point of sale. Within the corrugated and paperboard packaging market, display packaging represents about 5 to 6%, since corrugated trays, folding cartons, and rigid paperboard structures are often designed for retail-ready applications. The folding cartons market sees a similar influence, with display packaging accounting for nearly 7 to 8%, where cartonboard-based solutions are used for food, cosmetics, and consumer goods requiring brand-focused presentation. In the broader consumer goods packaging market, display formats form roughly 3 to 4%, reflecting their targeted use in categories where visual appeal drives brand recognition more than bulk protective packaging. Finally, within the promotional and point-of-purchase (POP) packaging market, display packaging commands a stronger share of nearly 12 to 14%, directly linked to its role in seasonal campaigns, product launches, and retail promotions. Its commercial weight lies in the ability to merge structural design with brand storytelling, creating packaging that not only protects but also persuades, making it a vital niche across consumer-driven retail ecosystems.

The Display Packaging market is experiencing consistent expansion, supported by the growing emphasis on brand visibility, point-of-sale impact, and retail differentiation. Businesses are increasingly adopting innovative packaging designs to enhance consumer engagement and drive purchase intent in competitive retail environments. The integration of advanced printing technologies, sustainable materials, and customizable formats is enabling brands to deliver both functional and aesthetically appealing packaging solutions.

Rising environmental concerns have prompted the industry to invest in recyclable and biodegradable materials, aligning with evolving consumer preferences and regulatory frameworks. The market’s future outlook is also shaped by increasing demand from sectors such as food and beverage, cosmetics, personal care, and electronics, where product presentation directly influences sales performance.

The ability of display packaging to act as a silent salesperson by communicating brand value and product information is expected to sustain its relevance With advancements in automation and digital design tools, manufacturers are enhancing production efficiency and flexibility, paving the way for further adoption across global markets.

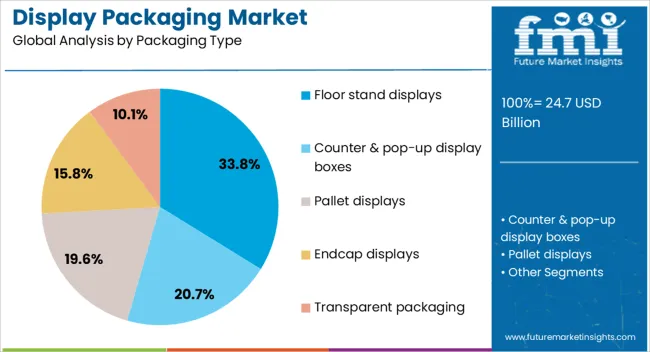

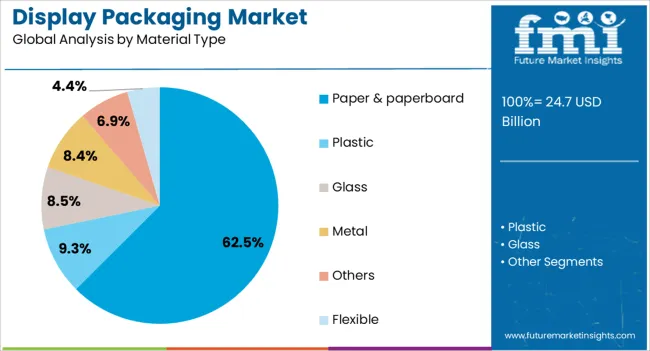

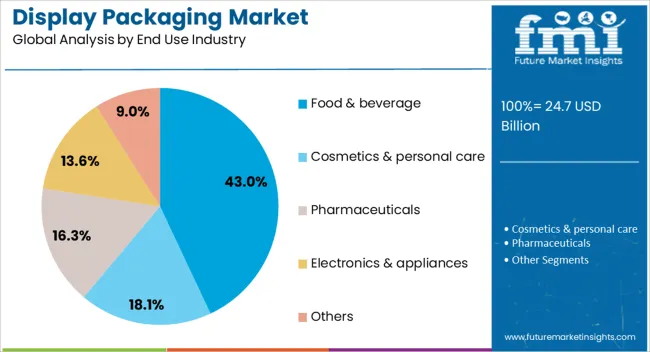

The display packaging market is segmented by packaging type, material type, end use industry, and geographic regions. By packaging type, display packaging market is divided into Floor stand displays, Counter & pop-up display boxes, Pallet displays, Endcap displays, and Transparent packaging. In terms of material type, display packaging market is classified into Paper & paperboard, Plastic, Glass, Metal, Others, and Flexible. Based on end use industry, display packaging market is segmented into Food & beverage, Cosmetics & personal care, Pharmaceuticals, Electronics & appliances, and Others. Regionally, the display packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The floor stand displays segment is expected to hold 33.80% of the Display Packaging market revenue share in 2025, making it the leading packaging type. This dominance has been attributed to their ability to provide high product visibility and create an impactful presence in retail spaces. Floor stand displays have been preferred by retailers for their flexibility in placement and their ability to accommodate a variety of products without requiring permanent fixtures.

The use of software-assisted design and high-quality printing has further enhanced their visual appeal, improving customer engagement at the point of purchase. These displays also enable efficient brand promotion by allowing seasonal or promotional graphics to be updated quickly, aligning with marketing campaigns.

Their adaptability across different product categories and retail formats has supported widespread adoption Additionally, their capability to maximize floor space utilization while enhancing consumer interaction has reinforced their strong position in the market.

The paper and paperboard segment is projected to account for 62.50% of the Display Packaging market revenue share in 2025, making it the leading material type. Growth in this segment has been supported by the rising demand for sustainable and eco-friendly packaging solutions that meet regulatory and consumer expectations. Paper and paperboard offer versatility in design, allowing for high-quality printing, custom shapes, and structural strength suitable for various display formats.

Their recyclability and biodegradability have made them a preferred choice for brands seeking to improve environmental credentials without compromising functionality. The availability of cost-effective sourcing and manufacturing processes has also enhanced adoption rates.

Additionally, advancements in paper coating and treatment technologies have improved durability, enabling these materials to withstand retail handling while maintaining visual appeal The growing alignment between sustainability initiatives and consumer purchasing behavior has positioned paper and paperboard as the dominant choice in display packaging applications.

The food and beverage segment is anticipated to hold 43% of the Display Packaging market revenue share in 2025, making it the leading end-use industry. This leadership has been driven by the critical role packaging plays in protecting products, maintaining freshness, and promoting brands in highly competitive retail environments. Display packaging in this sector has been increasingly used to showcase products prominently, encourage impulse purchases, and convey quality through visual presentation.

The ability to integrate branding, product information, and promotional messaging directly onto packaging has enhanced its marketing effectiveness. Compliance with food safety regulations and the use of materials that support shelf life preservation have further contributed to adoption.

In addition, the growing trend toward ready-to-eat, convenience, and premium packaged foods has increased demand for visually appealing and functional display packaging The combination of protective performance, marketing impact, and adaptability to diverse retail formats has reinforced the segment’s leading position in the overall market.

Display packaging gains momentum as shopper marketing teams pursue fast setup, strong brand blocking, and impulse conversion across aisles, end caps, and pallets. Cost volatility, complex retail rules, and store labor limits restrain execution, keeping trials, performance documents, and precise specifications essential. Upside emerges through digital print, late stage customization, modular footprints, and bundled co packing that simplify launches and regional campaigns. Automation, regional converting capacity, and audit driven compliance are shaping next steps. Vendors that deliver repeatable quality, swift kitting, and proven retail readiness are set to capture authorizations and repeat programs across key chains.

Demand for display packaging is being lifted by shopper marketing programs that seek faster turns, stronger brand blocking, and impulse conversion at store level. Corrugated and folding carton formats such as floor stands, end caps, sidekicks, counter units, and pallet displays are preferred for quick assembly and strong billboard space. Retail ready shippers and shelf ready trays are being specified to reduce backroom handling and speed facings to shelf. Seasonal events, club promotions, and new product launches require short windows and high design agility, so brands value partners that can execute structural design, graphics, and kitting under tight lead times. Ecommerce growth reinforces usage through click and collect stations and pop up activations where shippers convert to attention grabbing units. Print quality, color fidelity, and scuff resistance are being treated as table stakes, while ease of replenishment and clear planogram compliance drive repeat authorization from retailers.

Growth is limited by paperboard and liner price volatility, resin and ink costs, and freight swings that complicate landed pricing. Retail compliance is demanding, with strict specifications for footprints, heights, overhang rules, and safety requirements that vary by chain. Chargebacks arise when displays fail drop testing, lean under load, or do not meet planogram dimensions. Store labor shortages reduce appetite for complex assemblies, pushing buyers to fewer touch designs that are not always feasible for heavy or irregular products. Transit damage, glue failures in high humidity, and palletization errors lead to shrink and rework. Art and plate approvals can delay launches when color targets or brand assets are disputed across markets. Warehouse space constraints at co packers and limited access to quick turn die cutting or digital print capacity create bottlenecks. These realities keep procurement focused on specification discipline, packaging trials, and verifiable performance data.

Opportunity is expanding through late stage customization, short run digital print, and modular formats that let a single structure serve multiple campaigns. Variable graphics, localized messages, serialized QR, and dynamic codes enable targeted offers and post purchase engagement without tooling changes. Co pack services that bundle pick and place, pack out, and retail compliance documentation are being preferred by brands seeking single accountability. Pallet quarter, half, and full configurations with interchangeable headers allow fast set changes while preserving footprint approvals. For small electronics and beauty, premium boards, specialty varnishes, and metallic accents elevate shelf presence with controlled costs. Structural features such as integral theft deterrence, gravity feed pockets, and easy access replenishment improve shopper flow and reduce labor. Pop up stores, kiosks, and event sampling rely on flat pack designs that assemble quickly and repack safely, widening the role of display packaging beyond traditional aisles.

Operational trends point to pre filled displays, auto case erection, and automated pack lines that require tighter tolerances, consistent board calipers, and precise die registration. Converters are expanding regional footprints to shorten delivery miles, stabilize lead times, and provide rapid reprint coverage during promotions. Digital workflows connect dielines, color management, and press queues so that revisions move from art to press without extended delays. Retail audit photos and computer vision scoring are being used by merchandisers to verify placement, facings, and compliance, feeding post event scorecards for buyers. Material selections emphasize scuff resistance, stack strength, and safe edges for public areas. Graphics teams favor low odor inks and coatings suited for food adjacent locations and high touch displays. Partnerships across brand, converter, and co packer are being formalized through service level agreements that link uptime, on time arrivals, and damage rates to commercial outcomes.

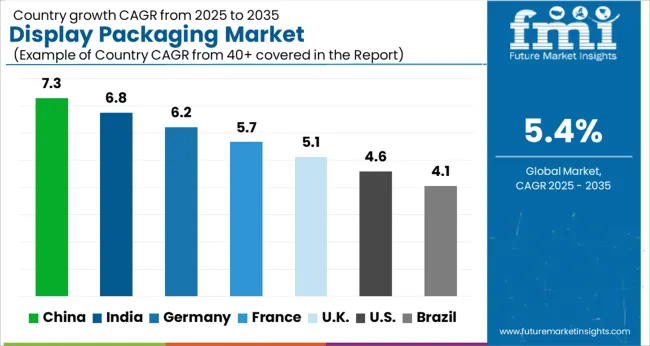

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The display packaging market is projected to grow globally at a CAGR of 5.4% from 2025 to 2035. China leads with 7.3%, followed by India at 6.8% and Germany at 6.2%, while the UK. grows at 5.1% and the USA. at 4.6%. China and India secure the highest growth premiums of +1.9% and +1.4% above baseline, supported by retail expansion and FMCG demand. Germany anchors Europe with innovation and export-driven supply. The UK shows consistent growth driven by retail packaging trends, while the USA reflects moderate expansion but high-value demand from large FMCG and retail chains. The analysis spans over 40+ countries, with the leading markets shown below.

The display packaging market in China is projected to grow at a CAGR of 7.3% from 2025 to 2035, the highest among the profiled regions. The surge in retail modernization, coupled with the rapid expansion of supermarkets, hypermarkets, and convenience stores, is driving demand. Chinese brands are increasingly using display-ready packaging to boost product visibility and enhance consumer engagement in crowded retail environments. E-commerce growth is also creating demand for eye-catching packaging formats that improve unboxing experiences and brand identity. Domestic packaging manufacturers are scaling up operations, while international companies are entering joint ventures to provide high-quality, innovative display packaging.

The display packaging market in India is expected to grow at a CAGR of 6.8% between 2025 and 2035. Growth is supported by the rapid development of organized retail and modern trade channels across tier-1 and tier-2 cities. Indian FMCG and food companies are adopting display-ready packaging to enhance product placement and improve shelf visibility. With rising consumer preference for branded products, manufacturers are investing in packaging that combines functionality with attractive design. The pharmaceutical and personal care sectors are also driving growth through adoption of high-visibility packaging for point-of-sale displays. Domestic producers are increasingly offering cost-competitive and customizable solutions to cater to diverse needs.

The display packaging market in Germany is forecast to expand at a CAGR of 6.2% from 2025 to 2035. Germany’s strong consumer goods and retail industries are significant contributors to demand, particularly in food, beverages, and household products. Display-ready packaging is being adopted to enhance promotional campaigns and capture consumer attention in highly competitive retail settings. German packaging firms are investing in innovative design, automation, and high-quality printing technologies to deliver premium solutions. Retailers are prioritizing efficient shelf-ready packaging formats that improve logistics and reduce handling costs. Exports also play a role, as German packaging manufacturers supply advanced display packaging to broader European markets.

The display packaging market in the United Kingdom is projected to grow at a CAGR of 5.1% between 2025 and 2035. Retail chains and supermarkets remain the primary drivers, with brands adopting display-ready packaging to improve product placement and consumer appeal. The UK market places emphasis on premium packaging design that communicates brand identity and increases visibility on store shelves. Display packaging is widely used across food, beverages, and health and beauty products, which dominate retail categories. Imports contribute significantly, though domestic producers are active in developing customized, design-focused solutions for retailers.

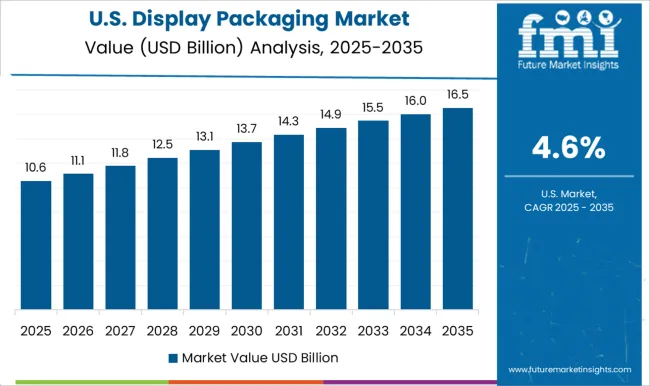

The display packaging market in the United States is expected to grow at a CAGR of 4.6%, slower than Asia and Europe but significant in value terms. The USA retail sector, particularly big-box stores, supermarkets, and convenience chains, is a major driver of adoption. FMCG and beverage companies are leading adopters, using display packaging for promotions, seasonal sales, and brand differentiation. Innovation in printing and automation is allowing USA manufacturers to supply versatile, high-impact designs tailored for retail marketing. While imports from Asia remain relevant, domestic firms focus on delivering high-quality, customized solutions for large retail chains.

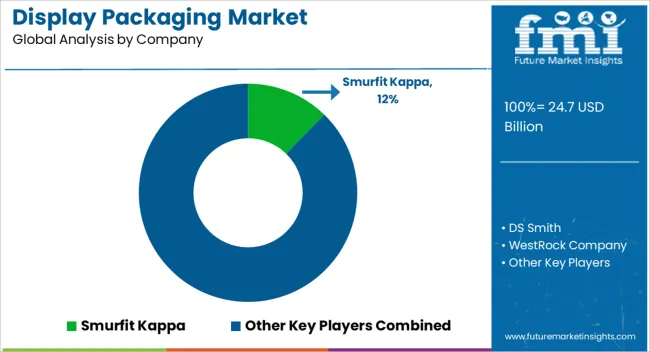

Competition in display packaging is decided by speed to retail floor, shopper impact, and execution at scale. Smurfit Kappa is positioned with integrated corrugated networks and design hubs that deliver fast-turn pallet displays, floor stands, and shelf trays with retailer guideline compliance. DS Smith competes through structural design depth and value engineering, where microflute and high graphic corrugated are specified for low waste assembly and reliable transit. WestRock is used for national programs that require high volumes, litho lamination, and synchronized co packing. International Paper is chosen for broad corrugated coverage, standardized components, and dependable replenishment for rollouts. Mondi focuses on display to shelf ready hybrids where quick setup and pack density matter. Sonoco brings display plus fulfillment services, offering prepack displays that move directly from DC to store. Bay Cities Packaging is known for rapid concept to launch cycles, club store compliance, and complex seasonal kits. Awards are won where uptime, print consistency, and assembly speed are proven. Lead times and kitting accuracy decide close calls. Strategies emphasize retailer playbooks, digital front ends, and regional fulfillment. Design libraries and tested die lines are reused to compress timelines. Digital print and short run litho lam are offered for seasonal drops without surplus inventory. Co packing near key retail nodes is used to cut transit and reduce damages. Data from launch recaps is pushed back into design rules to raise sell through and simplify replenishment. Multi wave campaigns are staged with vendor managed inventory and pre booked service windows. Product brochure content is precise. Pallet, half pallet, and quarter pallet displays listed with footprints, weight limits, and quick lock bases. Counter displays, dump bins, PDQ trays, and shippers detailed with perforations, tear tops, and auto bottoms. Print choices include high graphic flexo, single pass digital, and offset litho lam with matte or gloss finishes. Options cover shelf blockers, headers, trays, hooks, and integrated signage. ISTA transit notes, retailer spec checklists, and pack out instructions are included.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Packaging Type | Floor stand displays, Counter & pop-up display boxes, Pallet displays, Endcap displays, and Transparent packaging |

| Material Type | Paper & paperboard, Plastic, Glass, Metal, Others, and Flexible |

| End Use Industry | Food & beverage, Cosmetics & personal care, Pharmaceuticals, Electronics & appliances, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Smurfit Kappa, DS Smith, WestRock Company, International Paper, Mondi Group, Sonoco, and Bay Cities / Bay Cities Packaging |

| Additional Attributes | Dollar sales by product type and format span floor standing displays, pallet displays, shelf ready packs, counter units, and shipper trays, with cuts by print process such as flexo post print, preprint, litho lamination, and digital inkjet. Dollar sales by end use cover food and beverage, health and beauty, consumer electronics, toys, seasonal promotions, and club store programs. Demand dynamics are driven by promotional cadence, SKU proliferation, private label expansions, speed to market, and compatibility with retailer compliance standards. Regional trends indicate mature program scale in North America and Europe, with rapid capacity adds in Asia Pacific for corrugated and digital print that support export displays and turnkey co packing. |

The global display packaging market is estimated to be valued at USD 24.7 billion in 2025.

The market size for the display packaging market is projected to reach USD 41.7 billion by 2035.

The display packaging market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in display packaging market are floor stand displays, counter & pop-up display boxes, pallet displays, endcap displays and transparent packaging.

In terms of material type, paper & paperboard segment to command 62.5% share in the display packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Custom Display Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

IGZO Display Market Size and Share Forecast Outlook 2025 to 2035

Food Display Counter Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Shelf Display Trays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA