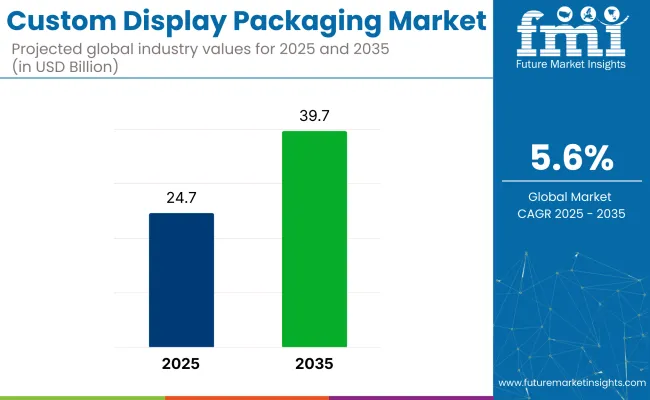

The global custom display packaging market is poised for consistent growth, with its value expected to increase from USD 24.7 billion in 2025 to USD 39.7 billion by 2035. This growth trajectory reflects a CAGR of 5.6% over the forecast period.

The market, valued at USD 23.4 billion in 2024, continues to gain momentum as businesses seek more visually appealing and functional packaging to differentiate their products and improve consumer engagement, particularly in retail and e-commerce environments.

As of 2025, the custom display packaging market occupies a niche yet valuable share across its broader parent markets. Within the global packaging market, it accounts for approximately 1-2%, as it focuses primarily on promotional and retail-facing formats. In the global retail packaging market, its share is higher at around 5-7%, driven by demand for in-store branding and shelf impact.

Within the point-of-sale (POS) display market, custom display packaging holds a significant 25-30%, as it plays a central role in visual merchandising and impulse purchases. In the corrugated and paperboard packaging segment, it contributes about 3-5%, due to widespread use in folding cartons and counter displays. In the consumer goods packaging market, its share is estimated at 4-6%, particularly for FMCG and promotional campaigns.

"We see this in the rate of adoption of some of the sustainable packaging solutions we have developed, where our customers and ultimately the end consumer have been reluctant to make the change due to cost considerations,"Mondi CEO Andrew King.This sustainability trend is not only a compliance necessity but also a competitive advantage, as brands that demonstrate environmental responsibility are more likely to earn customer trust and loyalty.

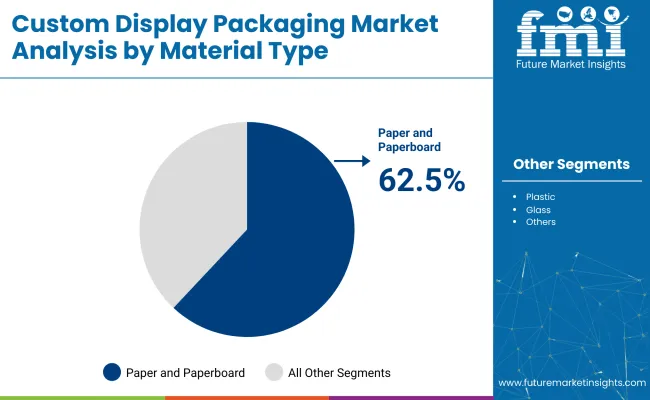

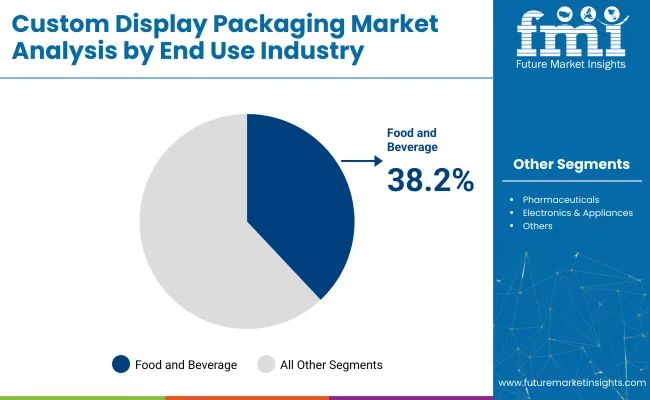

Floor stand displays lead the custom display packaging market due to their effectiveness in high-traffic retail areas and versatility across product categories. Paper and paperboard dominate as preferred materials, driven by sustainability and cost-efficiency. The food and beverage sector remains the largest end-user, relying heavily on visually appealing packaging to boost product visibility and consumer engagement.

Floor stand displays are projected to hold the largest share of the custom display packaging market, accounting for 33.8% of the total market value in 2025. This dominance is primarily driven by their strategic placement in high-footfall retail areas, where they serve both as a promotional tool and a functional product holder.

Paper and paperboard are expected to dominate the custom display packaging market, accounting for approximately 62.5% market share in 2025. This material type leads due to its eco-friendly nature, cost-effectiveness, and versatility in printing and structural design.

The food and beverage industry is projected to be the dominant end-use segment in the custom display packaging market, holding a market share of 38.2% in 2025. This strong position is driven by the sector's high demand for visually appealing and functional packaging solutions that enhance product visibility in retail environments.

The rapid growth of e-commerce and organized retail is driving demand for eye-catching custom display packaging that enhances product visibility and the unboxing experience. Simultaneously, increasing consumer preference and regulatory pressure for sustainable, eco-friendly materials are pushing manufacturers to adopt greener packaging solutions.

Growing Influence of E-commerce and Retail Branding

The rapid expansion of e-commerce and organized retail is one of the most significant drivers shaping the custom display packaging market. As consumer shopping behavior shifts toward online platforms and large retail chains, brands are investing heavily in distinctive and attractive packaging that enhances product visibility both on physical shelves and digital listings.

Custom display packaging, especially that designed with vivid graphics and interactive elements, plays a crucial role in attracting attention, boosting product recognition, and encouraging impulse purchases. In addition, the unboxing experience has become an extension of brand identity in the e-commerce space, prompting companies to innovate in packaging design to create memorable customer experiences.

Shift Toward Sustainable and Eco-friendly Packaging Solutions

Environmental concerns and regulatory pressures are driving a notable shift toward sustainable packaging materials, making sustainability a central dynamic in the custom display packaging market. Consumers are increasingly favoring brands that use recyclable, biodegradable, or reusable packaging solutions, pushing manufacturers to transition away from plastics and toward eco-friendly options like paperboard and recycled cardboard.

Additionally, governments across the globe are enforcing stricter regulations on packaging waste and carbon emissions, prompting companies to adopt greener practices in their supply chains.

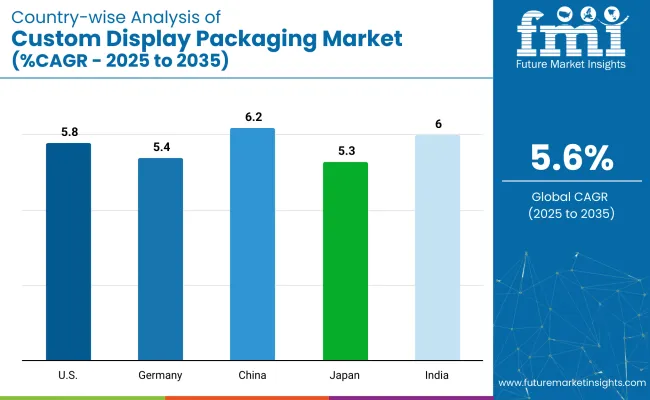

| Countries | CAGR (%) |

|---|---|

| USA | 5.8% |

| Germany | 5.4% |

| China | 6.2% |

| Japan | 5.3% |

| India | 6.0% |

The custom display packaging market is expected to be driven by the rapid expansion of e-commerce and growing consumer demand for sustainable packaging solutions. Rapid growth in China and India is anticipated due to increasing retail modernization and rising disposable incomes, while the USA and Germany focus on technological innovations and eco-friendly materials to enhance brand differentiation and meet regulatory standards.

The USA custom display packaging market is estimated to grow at a CAGR of 5.8% during the study period from 2025 to 2035.

The China custom display packaging market is expected to grow at a CAGR of 6.2% between 2025 and 2035.

The German custom display packaging market is projected to expand at a CAGR of 5.4% during the forecast period.

The Japan custom display packaging market is estimated to grow at a CAGR of 5.3% from 2025 to 2035.

The India custom display packaging market is expected to grow at a CAGR of 6.0% over the forecast period.

Key players like AlphaGlobal Packaging and Amcor plc dominate the custom display packaging market due to their innovative and sustainable packaging solutions. AlphaGlobal Packaging specializes in eco-friendly designs that enhance brand visibility, while Amcor plc leverages advanced printing technologies to create visually striking displays.

Other significant players, including DS Smith, International Paper, and Smurfit Kappa, focus on providing versatile and cost-effective packaging options for diverse industries. Emerging companies like PakFactory and Ibex Packaging target niche markets with customized, high-quality display solutions, catering to specific brand and consumer requirements.

Recent Custom Display Packaging Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 24.7 billion |

| Projected Market Size (2035) | USD 39.7 billion |

| CAGR (2025 to 2035) | 5.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in tons |

| Packaging Type Analyzed (Segment 1) | Counter & Pop-Up Display Boxes, Floor Stand Displays, Pallet Displays, Endcap Displays, And Transparent Packaging |

| Material Type Covered (Segment 2) | Plastic, Paper & Paperboard, Glass, Metal, And Others. |

| End Use Industry Covered (Segment 3) | Food & Beverage, Cosmetics & Personal Care, Pharmaceuticals, Electronics & Appliances, And Others. |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Market | AlphaGlobal Packaging, Amcor plc, CustomBoxline, DS Smith, Graphic Packaging International, LLC, Ibex Packaging, International Paper, Mondi Group, Orora Visual, Packaging Corporation of America, PakFactory, Rengo Co., Salazar Packaging, Smurfit Kappa, Stora Enso, and WestRock Company. |

| Additional Attributes | Dollar sales, market share, growth rates, key segments, top materials, competitive landscape, regional demand, consumer trends, sustainability impact, pricing strategies, and emerging opportunities to optimize production and marketing strategies. |

The market is segmented into counter & pop-up display boxes, floor stand displays, pallet displays, endcap displays, and transparent packaging.

The market covers plastic, paper & paperboard, glass, metal, flexible, and others.

The market is categorized into food & beverage, cosmetics & personal care, pharmaceuticals, electronics & appliances, and others.

The market spans North America, Western Europe, East Asia, and South Asia.

The market is expected to reach USD 39.7 billion by 2035.

The market size is projected to be USD 24.7 billion in 2025.

The market is expected to grow at a CAGR of 5.6% from 2025 to 2035.

China is expected to be the fastest growing with a CAGR of 6.2%.

Paper and paperboard, accounting for over 62.5% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Custom Face Care Market Forecast Outlook 2025 to 2035

Customized Skincare Market Size and Share Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Customer Service Software Market Size and Share Forecast Outlook 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Customer Revenue Optimization (CRO) Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Communications Management Market Size and Share Forecast Outlook 2025 to 2035

Customer Experience Management (CEM) In Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Custom Dry Ingredients Blends Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Customer Engagement Hub (CEH) Market Size and Share Forecast Outlook 2025 to 2035

Custom Probiotics Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Customer-To-Customer (C2C) Community Marketing Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Mapping Software Market Size and Share Forecast Outlook 2025 to 2035

Customized Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Custom Binders Market Growth & Industry Forecast 2025 to 2035

Custom Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Customisation and Personalisation in Travel Market Size and Share Forecast Outlook 2025 to 2035

Customer-Facing Technology Market Size and Share Forecast Outlook 2025 to 2035

Custom Hearing Aids Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA