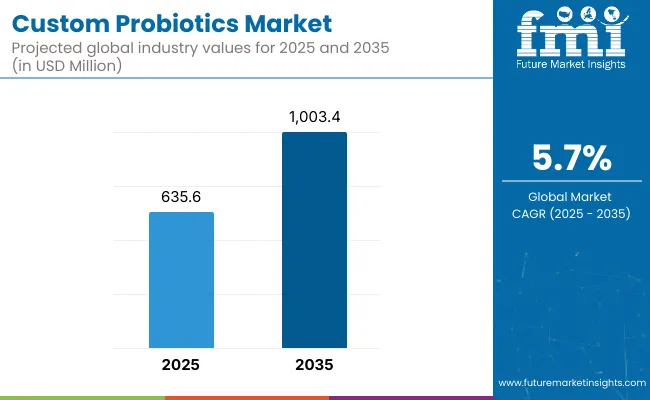

The Custom Probiotics Market is projected to reach a valuation of USD 635.6 million in 2025 and USD 1,106.6 million by 2035. This marks an increase of USD 471.0 million, representing an overall growth of approximately 74% across the decade. A compound annual growth rate (CAGR) of 5.7% has been forecasted, indicating robust yet sustainable expansion.

Custom Probiotics Key Takeaways

| Metric | Value |

| Estimated Value in (2025E) | USD 635.6 million |

| Forecast Value in (2035F) | USD 1,106.6 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

Over the first half of the forecast period (2025-2030), the market is expected to expand from USD 635.6 million to approximately USD 844.0 million, contributing USD 208.4 million or 44% of the total decade growth.

This initial phase is expected to be driven by increasing adoption of strain-specific and condition-targeted probiotic formulations, particularly among early adopters in North America, Europe, and South Asia & Pacific. Heightened consumer demand for personalized gut health and women’s wellness applications is projected to anchor early momentum, supported by the rise of at-home microbiome diagnostics.

During the second half (2030-2035), the market is forecasted to rise from USD 844.0 million to USD 1,106.6 million, adding USD 262.6 million, which represents 56% of the total growth. This phase is expected to be accelerated by the mainstream integration of AI-guided formulation platforms, direct-to-consumer (DTC) personalization models, and increasing inclusion of custom probiotics in clinical-grade nutrition protocols. Recurring revenue from subscription-based models and microbiome data services is anticipated to become more prominent, deepening market penetration and increasing lifetime customer value.

From 2020 to 2024, the Custom Probiotics market grew from an estimated USD ~410 million to USD 635.6 million, driven primarily by demand for pharmaceutical-grade and encapsulated cognitive support solutions. During this period, the competitive landscape was led by biological material suppliers, who held a dominant share by offering standardized, research-ready formulations across regulated industries.

Growth was driven by academic research, early cosmeceutical exploration, and clinical interest in neuro-supportive bioactives. Service-based models including custom formulation, GMP certification support, and regulatory documentation contributed under 15% of market value but showed rising potential.

By 2025, demand is expected to surpass USD 635.6 million, with revenue share gradually shifting toward functional and cosmetic-grade innovations. Traditional bulk extract suppliers are now facing competition from digitally integrated nutraceutical brands and therapeutic peptide formulators, offering enhanced traceability, application-specific peptides, and regionally customized delivery systems. Competitive advantage is moving beyond raw extract volume to ecosystem integration, bioavailability optimization, and B2B customization at scale.

Rapid growth in the Custom Probiotics Market is being fueled by increasing awareness of the gut microbiome’s role in systemic health. Demand has been amplified by a shift toward personalized wellness, where off-the-shelf formulations are being replaced by microbiome-matched probiotics. This transition is being supported by the widespread availability of at-home gut testing kits and digital health platforms capable of generating individualized strain recommendations.

Healthcare practitioners have increasingly prescribed personalized probiotic regimens for chronic digestive, immune, and women’s health concerns, further legitimizing the category. Direct-to-consumer subscription models have been adopted widely, ensuring continuous engagement and improving adherence rates.

Data-driven formulation strategies are being used to tailor probiotics based on consumer lifestyle, diet, and health goals, making the market more resilient to commoditization. As precision nutrition continues to be embraced, long-term growth is expected to be supported by AI-integrated formulation systems and growing clinical validation of strain-specific therapeutic effects.

The Custom Probiotics Market has been segmented across multiple axes to reflect the precision-driven nature of product development and consumer targeting. Key segments include customization type, application, formulation type, delivery technology, sales channel, and end user.

Each segment reflects the industry's shift toward personalized health outcomes, microbiome-based decision making, and functional delivery innovation. Among them, the customization type, application, and formulation type segments are viewed as core to competitive differentiation and consumer value creation.

These segments enable brands to tailor probiotics based not only on health objectives but also on lifestyle, convenience, and absorption efficacy. As demand for personalization intensifies, these segmental levers are expected to define category leadership and long-term consumer engagement.

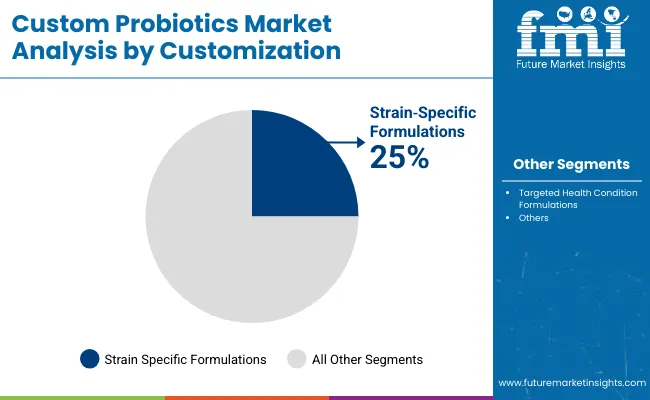

| Customization Type | 2025 Share % |

|---|---|

| Strain Specific Formulations | 25.0% |

| Targeted Health Condition Formulations | 20.0% |

The Customization Type segment has been characterized by a balanced distribution between Strain-Specific and Targeted Health Condition Formulations, each commanding a 25.0% share in 2025. Growth in this segment is being driven by consumer demand for targeted results and transparent health claims.

Strain-specific products have been validated through clinical studies and have been increasingly favored for their precision in addressing digestive and immune concerns. Meanwhile, multi-strain blends have been positioned as holistic wellness solutions, appealing to users seeking broad-spectrum benefits.

Notably, Personalized Gut Microbiome-Based Probiotics, although smaller in current share, are forecasted to grow the fastest, with a CAGR of 10.2%. This is being enabled by AI-driven diagnostics, at-home gut testing kits, and digital therapeutics platforms. As consumer expectations shift toward tailored, data-backed interventions, customization will remain a strategic growth lever in probiotic product development.

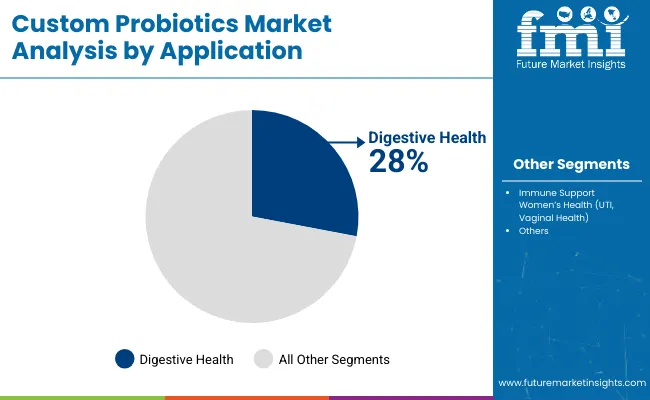

| Application | 2025 Share % |

|---|---|

| Digestive Health | 28.0% |

| Immune Support | 20.0% |

| Women’s Health (UTI, Vaginal Health) | 12.0% |

Digestive Health is expected to retain its dominant share of 28.0% in 2025, driven by widespread probiotic familiarity and rising cases of functional gastrointestinal disorders. Market penetration has been highest in this segment due to strong consumer trust and frequent recommendations from healthcare professionals.

Immune Support follows closely, benefiting from post-pandemic awareness and increased probiotic prescriptions for immunity modulation. In parallel, Women’s HealthandMental Health & Mood are gaining momentum, supported by expanding clinical literature on the gut-brain and gut-vaginal microbiome axes.

Innovations are increasingly being steered toward multifactorial formulations addressing these interconnected health domains. As end users grow more health-conscious and proactive in prevention, emerging applications such as SkinHealthandPediatric Care are also poised to contribute meaningfully. Strategic formulation will continue to revolve around scientifically validated outcomes, especially in consumer segments where condition-specific efficacy is prioritized.

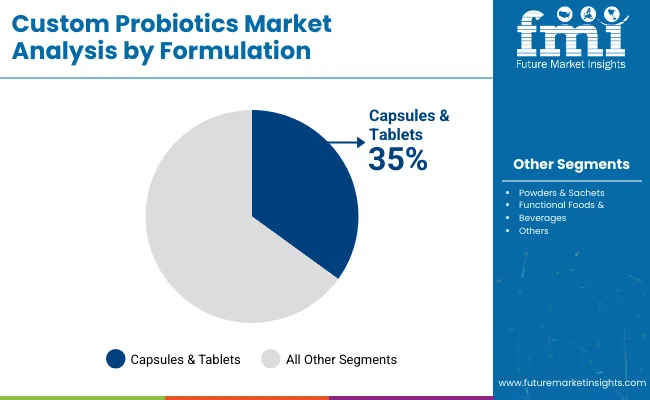

| Formulation Type | 2025 Share % |

|---|---|

| Capsules & Tablets | 35.0% |

| Powders & Sachets | 20.0% |

| Functional Foods & Beverages | 19.2% |

Capsules & Tablets are projected to lead the Formulation Type segment with a commanding 35.0% share in 2025. Their dominance has been sustained by ease of dosing, high consumer familiarity, and superior shelf stability. These formats have become the preferred choice for pharmaceutical-grade custom probiotics due to their compatibility with enteric coatings and precision-release mechanisms. In contrast, formats like Powders & Sachets and Functional Foods & Beverages are registering rapid adoption, especially among younger, convenience-driven consumers seeking lifestyle-integrated health options.

Growth in these segments is being catalyzed by improved strain viability and palatability enhancements. Oral Sprays and Reconstitution Sachets are gaining relevance in pediatric and geriatric segments where swallowing capsules may be challenging. As next-gen delivery innovations are brought to market, formulation strategy is expected to play a critical role in improving adherence, bioavailability, and user engagement across health-focused demographics.

Rising regulatory scrutiny and clinical validation demands are reshaping how custom probiotics are formulated and positioned, even as global interest accelerates in microbiome-targeted health solutions that promise personalized and measurable outcomes across gut, immune, and mental wellness categories.

AI-Powered Personalization Platforms Are Reshaping Product Development

Market growth is being catalyzed by the integration of AI-driven personalization platforms that match probiotic strains to individual microbiome profiles. Algorithms are now being used to analyze gut sequencing data, dietary habits, and health history to generate real-time probiotic recommendations.

These platforms have enabled custom product formulations to be developed at scale without compromising efficacy. As diagnostic costs decrease and data privacy protocols improve, a higher volume of users is expected to engage with such platforms, transforming product development from R&D-centric to user-centric. This advancement is expected to increase consumer confidence while reducing product return rates and compliance drop-offs.

Clinical-Grade Custom Probiotics Are Gaining Therapeutic Traction

A growing trend has been observed in the repositioning of custom probiotics from general wellness supplements to clinically validated therapeutic adjuncts. Leading manufacturers have begun to collaborate with academic institutions and hospitals to design condition-specific probiotics supported by randomized clinical trials. This shift is not only enhancing regulatory credibility but also opening new reimbursement pathways in integrative medicine.

As probiotic interventions become more targeted, new indications ranging from metabolic syndrome to anxiety are expected to be supported by custom formulations. This trend is positioning the market closer to pharmaceutical-grade therapeutics, potentially redefining the regulatory classification of advanced probiotic solutions.

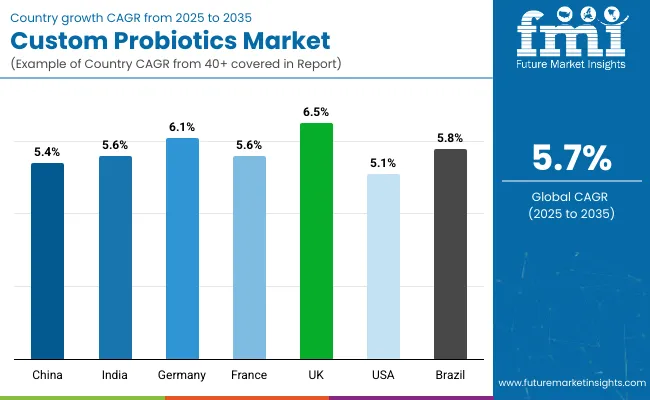

| Countries | CAGR |

|---|---|

| China | 5.4% |

| India | 5.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 6.5% |

| USA | 5.1% |

| Brazil | 5.8% |

Adoption of custom probiotics has been observed to vary widely across countries, shaped by national health priorities, regulatory maturity, and the integration of personalized nutrition into mainstream care pathways. Among key global economies, Europe has emerged as a frontrunner, with the UK projected to record the highest CAGR of 6.5%, followed by Germany at 6.1% and France at 5.6%. This growth has been supported by the region’s clinical validation standards, early integration of microbiome science into healthcare, and a strong consumer shift toward functional and personalized supplementation.

In the Asia-Pacific region, strong forward momentum has been reported in India (5.6%) and China (5.4%), where digital health platforms, D2C wellness brands, and gut health awareness campaigns have significantly expanded addressable markets. India’s rising nutraceutical manufacturing base has also supported export-oriented probiotic innovation. In North America, the United States is expected to post a CAGR of 5.1%, reflecting steady maturity in personalized nutrition platforms and functional food formulations.

Meanwhile, Brazil is gaining attention in Latin America with a projected 5.8% CAGR, fueled by demand in pediatric and digestive health categories. Country-specific regulatory harmonization and digital diagnostics adoption are expected to shape the competitive landscape over the next decade.

| Years | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USA Custom Probiotics | 152.5 | 161.8 | 171.3 | 183.0 | 193.3 | 205.0 | 218.7 | 233.4 | 247.1 | 261.7 | 276.0 |

The Custom Probiotics Market in the United States is projected to expand at a CAGR of 6.1% between 2025 and 2035, underpinned by rising consumer demand for condition-specific gut health interventions and the widespread integration of personalized nutrition platforms. Growth has been supported by high digital health literacy, robust e-commerce infrastructure, and the availability of at-home gut microbiome testing kits.

Functional medicine practitioners have increasingly prescribed custom probiotic formulations for digestive, immune, and metabolic health, leading to growing inclusion in patient-centric wellness protocols. Partnerships between diagnostics labs and D2C brands have enabled data-driven customization at scale.

The USA market is also witnessing growth in pediatric and senior health applications, where strain specificity and delivery format innovation are being prioritized. Trends in clean-label formulation, real-time AI-guided dosing, and practitioner-distributed personalized supplements are contributing to higher brand loyalty and consumer lifetime value.

The Custom Probiotics Market in the United Kingdom is projected to grow at a CAGR of 6.5% through 2035, fueled by increasing consumer preference for science-backed, personalized wellness solutions. The integration of gut microbiome testing into mainstream health services has been supported by NHS partnerships with digital health platforms.

Functional nutrition has been increasingly prescribed for managing stress, IBS, PCOS, and skin health, boosting clinical probiotic use. Brands offering condition-specific and age-adapted formulations have been widely adopted by health-conscious millennials and seniors alike. Formulation innovations such as dual-release capsules and vegan-friendly options are enhancing differentiation.

India’s Custom Probiotics Market is forecasted to expand at a CAGR of 5.6% from 2025 to 2035, driven by growing middle-class health awareness, increased gut health education, and digitization of preventive healthcare. Rising disposable incomes and the mainstreaming of functional nutrition are enabling higher probiotic uptake, particularly in urban and semi-urban centers.

The popularity of sachets, powders, and Ayurvedic-inspired synbiotic blends is enabling mass customization at accessible price points. Meanwhile, India's status as a nutraceutical manufacturing hub is supporting low-cost, high-quality custom probiotic production for both domestic and export markets.

The Custom Probiotics Market in China is projected to register a CAGR of 5.4% from 2025 to 2035, supported by strong national health-tech infrastructure and early consumer adoption of personalized nutrition. The market is being shaped by digitally native DTC brands offering gut microbiome kits paired with custom supplements.

Demand has surged in digestive, immunity, and skin health segments, especially among young adults and postnatal women. Integration with Traditional Chinese Medicine (TCM) principles has given rise to hybrid probiotic formulas tailored to body constitution types, creating localized innovation opportunities.

| Countries | 2025 | 2035 |

|---|---|---|

| UK | 18.3% | 19.9% |

| Germany | 21.5% | 21.6% |

| Italy | 10.5% | 11.4% |

| France | 13.3% | 13.1% |

| Spain | 11.3% | 10.3% |

| BENELUX | 6.2% | 5.9% |

| Nordic | 5.7% | 5.9% |

| Rest of Europe | 13.1% | 11.9% |

Germany’s Custom Probiotics Market is expected to grow at a CAGR of 6.1% between 2025 and 2035, driven by high clinical trust, integration of naturopathic protocols, and demand for scientifically validated formulations. Customized probiotics have been adopted as adjunctive therapies in gastroenterology, psychiatry, and dermatology, with strain specificity playing a key role in formulation.

Growth has been further supported by a maturing diagnostics ecosystem and insurer-backed preventive health programs. The availability of pharmacist-guided subscription models is also improving adherence.

| Customization Type | 2025 Share % |

|---|---|

| Strain Specific Formulations | 26.0% |

| Targeted Health Condition Formulations | 22.0% |

| Personalized Gut Microbiome Based Probiotics | 14.0% |

| Multi Strain Blends | 23.0% |

| Single Strain Probiotics | 15.0% |

The Custom Probiotics Market in Japan is projected to reach USD 26.7 million in 2025, with growth underpinned by the nation’s high health literacy, aging population, and clinical emphasis on digestive and immune support. Strain-Specific Formulations hold the largest share at 26.0%, driven by demand for clinically validated solutions addressing condition-specific symptoms. Close behind, Multi-Strain Blends account for 23.0%, reflecting interest in holistic wellness strategies. Meanwhile, Targeted Health Condition Formulations comprise 22.0%, bolstered by Japan’s rising focus on probiotics for skin health, metabolic function, and mental well-being.

Personalized microbiome-based products remain nascent at 14.0%, yet rapid digitization and AI-enabled diagnostic integration are expected to drive adoption. Custom probiotics are increasingly being positioned as adjuncts in managing chronic lifestyle disorders, particularly among elderly populations.

Formulation development is being guided by Japan’s emphasis on scientific substantiation and functional food regulation under FOSHU. As gut-brain axis research expands and digital diagnostics are embedded in preventive care, greater personalization is expected across probiotic formats.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Digestive Health | 30.0% |

| Immune Support | 20.0% |

| Women’s Health (UTI, Vaginal Health) | 12.0% |

| Mental Health & Mood (Gut Brain Axis) | 9.0% |

| Skin Health | 7.0% |

| Pediatric & Infant Health | 10.0% |

| Metabolic Health | 7.0% |

| Oral Health | 5.0% |

The Custom Probiotics Market in South Korea is projected to reach USD 15.3 million in 2025, led by growing consumer awareness of microbiome-linked wellness and a digitally sophisticated health ecosystem. Digestive Health is expected to remain the dominant application at 30.0%, reflecting its deep-rooted presence in daily dietary routines and its widespread clinical recommendation. Immune Support follows at 20.0%, bolstered by post-pandemic resilience trends and increased demand for daily immunity boosters.

Notably, Women’s Health and Mental Health & Mood applications are witnessing rapid acceleration, with CAGRs of 9.3% and 9.5%, respectively. These categories are being supported by expanding R&D into the gut-brain and gut-vaginal axes and by the adoption of condition-specific probiotic solutions through pharmacies and direct-to-consumer channels.

Consumer preference for beauty-from-within solutions is also propelling growth in Skin Health probiotics, especially among younger women. Meanwhile, Pediatric and Infant Health is gaining traction through age-specific delivery formats such as drops and sachets.

| Frontrunners | Global Value Share 2025 |

|---|---|

| Novonesis | 11% |

| Others | 89% |

The Custom Probiotics Market is moderately fragmented, with a blend of global biotech leaders, mid-sized innovators, and specialist formulators competing across therapeutic and wellness-driven application areas. Industry frontrunners such as DSM (including OptiBiotix), DuPont Nutrition & Health, and Chr. Hansen hold significant share, enabled by their proprietary strain libraries, clinical trial infrastructure, and vertically integrated manufacturing. Their strategies are increasingly centered on AI-guided personalization engines, microbiome diagnostics, and clinically backed strain portfolios tailored to condition-specific outcomes.

Established mid-sized players such as Probi AB, Winclove Probiotics, and BioGaia have focused on targeted formulations for immune, pediatric, and mental wellness. Partnerships with healthcare practitioners and e-pharmacies are being used to scale personalized delivery. These players are advancing competitive differentiation through spore-forming technologies, enteric coatings, and adaptive delivery formats.

Specialized providers like Lallemand Health Solutions, Yakult Honsha, Probiotec Group, and Seroyal operate with strong regional presence and formulation agility. Custom blends for niche needs such as UTI prevention, oral microbiome balance, or gut-brain axis modulation are being developed for practitioner-exclusive or direct-to-consumer (D2C) distribution.

Competitive advantage is shifting toward integrated personalization ecosystems that connect diagnostic platforms with dynamic probiotic recommendations, backed by subscription services, remote consultations, and digital adherence tracking.

| Item | Value |

|---|---|

| Quantitative Units | USD 635.6 Million |

| Customization Type | Strain-Specific Formulations, Multi-Strain Blends, Single-Strain Probiotics, Targeted Health Condition Formulations, Personalized Gut Microbiome-Based Probiotics |

| Application | Digestive Health, Immune Support, Women’s Health (UTI, Vaginal Health), Mental Health & Mood (Gut-Brain Axis), Skin Health, Pediatric & Infant Health, Metabolic Health, Oral Health |

| Formulation Type | Capsules & Tablets, Powders & Sachets, Functional Foods & Beverages, Oral Sprays & Lozenges, Sachets for Reconstitution |

| Delivery Technology | Enteric-Coated Probiotics, Spore-Forming Probiotics, Microencapsulated Probiotics, Symbiotic s (Probiotics + Prebiotics) |

| Sales Channel | Pharmacies & Drugstores, Nutraceutical & Supplement Manufacturers (B2B), Research Institutions & Laboratories, Cosmetic Ingredient Suppliers, Online Retail |

| End User | General Adult Consumers, Infants & Children, Seniors, Patients with Specific Health Conditions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novonesis, DSM-Firmenich, DuPont Nutrition & Health, BioGaia, Lallemand Health Solutions, Probi AB, Winclove Probiotics, Yakult Honsha, Probiotec Group, Seroyal |

| Additional Attributes | Segment-wise dollar sales by customization and delivery type, growing D2C and personalized health adoption, clinical trial-backed strain development, microbiome diagnostics integration, growth in AI-powered personalization engines, subscription models for recurring probiotic delivery, pediatric and women’s health focus, and regulation trends across N orth America, Europe, and APAC. |

The global Custom Probiotics Market is estimated to be valued at USD 635.6 million in 2025, driven by rising demand for personalized gut health solutions, clinically validated probiotic strains, and direct-to-consumer personalization platforms.

The market size for the Custom Probiotics Market is projected to reach approximately USD 1,106.6 million by 2035, reflecting a decade of sustained innovation, expanded microbiome testing access, and higher adoption in clinical nutrition.

The Custom Probiotics Market is expected to grow at a CAGR of 5.7% between 2025 and 2035, reflecting a nearly 74% cumulative increase over the decade, as personalized health solutions become increasingly integrated into everyday wellness routines.

The key customization type in the Custom Probiotics Market are custom probiotics market include strain-specific formulations, multi-strain blends, single-strain probiotics, targeted health condition probiotics, and personalized gut microbiome-based formulations.

In terms of formulation type, Strain-Specific Formulations are expected to command the largest share at 25.0% in the Custom Probiotics Market in 2025, supported by high clinical efficacy, regulatory clarity, and condition-specific application in digestive and immune health.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Custom Packaging Box Market Size and Share Forecast Outlook 2025 to 2035

Custom Face Care Market Forecast Outlook 2025 to 2035

Customized Skincare Market Size and Share Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Customer Service Software Market Size and Share Forecast Outlook 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Customer Revenue Optimization (CRO) Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Communications Management Market Size and Share Forecast Outlook 2025 to 2035

Customer Experience Management (CEM) In Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Custom Dry Ingredients Blends Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Customer Engagement Hub (CEH) Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Customer-To-Customer (C2C) Community Marketing Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Mapping Software Market Size and Share Forecast Outlook 2025 to 2035

Customized Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Custom Binders Market Growth & Industry Forecast 2025 to 2035

Custom Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Customisation and Personalisation in Travel Market Size and Share Forecast Outlook 2025 to 2035

Customer-Facing Technology Market Size and Share Forecast Outlook 2025 to 2035

Custom Display Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA