The custom face care market is growing steadily as consumers increasingly seek personalized skincare solutions that cater to specific needs and preferences. Current market conditions are characterized by strong digital integration, with advanced algorithms and skin analysis tools driving precision-based customization. Rising consumer awareness regarding ingredient transparency and product efficacy is further supporting the adoption of tailored skincare formulations.

Manufacturers are focusing on leveraging AI-driven diagnostic tools and data analytics to enhance personalization accuracy and improve user experience. The future outlook remains positive as technological advancements and direct-to-consumer strategies expand market accessibility. Growing demand from younger demographics, coupled with rising disposable incomes, is expected to sustain product innovation and category diversification.

The market’s growth rationale lies in the ability of brands to deliver targeted, science-backed solutions through seamless digital channels This alignment of personalization, technology, and convenience continues to reinforce strong consumer engagement and consistent revenue growth across key regions.

| Metric | Value |

|---|---|

| Custom Face Care Market Estimated Value in (2025 E) | USD 19.2 billion |

| Custom Face Care Market Forecast Value in (2035 F) | USD 37.5 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The market is segmented by Product Type, Skin Concerns, Distribution Channel, and Packaging Type and region. By Product Type, the market is divided into Moisturizers, Cleansers, Toners, Serums, Eye Creams, Sunscreens, Masks, Exfoliators, Spot Treatments, and Others. In terms of Skin Concerns, the market is classified into Aging Skin, Acne-Prone Skin, Dry Skin, Oily Skin, Combination Skin, Sensitive Skin, Hyperpigmentation, Rosacea, Eczema, Psoriasis, and Others. Based on Distribution Channel, the market is segmented into Online Retail (Customization platforms, Brand websites) and Offline Stores. By Packaging Type, the market is divided into Bottles, Jars, Tubes, Pump Dispensers, Sachets, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

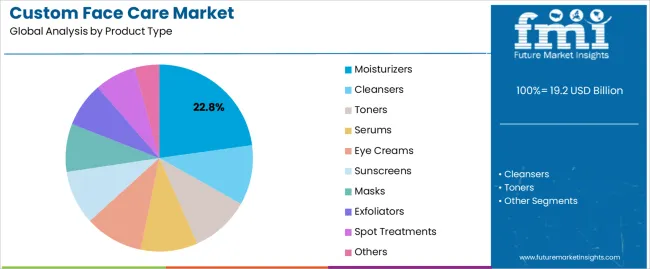

The moisturizers segment, holding 22.80% of the product type category, has been leading due to its central role in daily skincare routines and adaptability across all skin types. Growth has been supported by continuous formulation advancements focusing on hydration balance, texture improvement, and active ingredient infusion. Consumers are increasingly opting for custom-blended moisturizers that address multiple skin needs within a single product.

Brands have been capitalizing on this trend by integrating diagnostic quizzes and AI-based recommendation engines to tailor moisture levels and ingredient combinations. Demand resilience is further reinforced by the shift toward clean, cruelty-free, and sustainable formulations.

Enhanced packaging innovations and subscription-based delivery models have increased product accessibility As consumer trust in personalized skincare strengthens, customized moisturizers are expected to maintain their leadership position and drive recurring purchase behavior in the overall market.

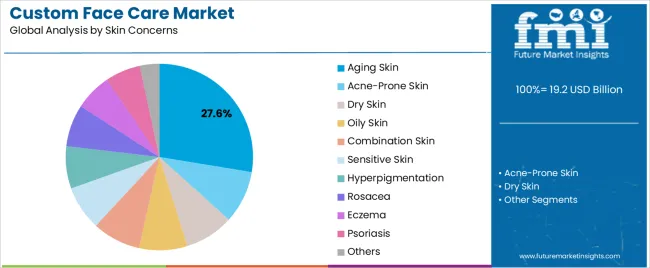

The aging skin segment, accounting for 27.60% of the skin concerns category, dominates due to the rising global focus on anti-aging solutions and preventive skincare. Increasing consumer education about early intervention and the benefits of active ingredients like peptides and retinoids has accelerated adoption. Demand has been particularly strong among middle-aged and urban populations seeking customized treatments that address wrinkles, fine lines, and elasticity loss.

Product developers are emphasizing formulation precision, ingredient safety, and dermatological validation to meet regulatory and performance standards. Digital consultation platforms are enhancing accessibility, allowing consumers to receive professional-grade recommendations at home.

The integration of adaptive skincare routines that evolve with user progress is also reinforcing brand loyalty Continuous R&D investments and consumer-centric marketing strategies are expected to sustain dominance of the aging skin category over the coming years.

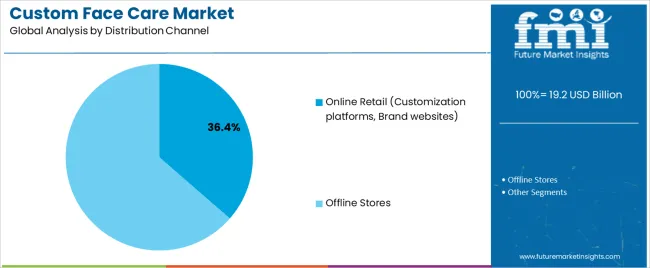

The online retail segment, encompassing customization platforms and brand websites, holds 36.40% of the distribution channel category and leads the market due to the growing adoption of digital-first purchase models. The segment’s dominance is supported by the convenience of online consultations, personalized product recommendations, and direct-to-consumer delivery frameworks. Brands have invested heavily in AI and AR technologies to simulate in-person experiences and improve product matching accuracy.

The availability of subscription options, virtual diagnostics, and interactive digital tools has enhanced customer retention and boosted engagement rates. Transparent ingredient information and review-driven marketing have further strengthened consumer trust.

This distribution model enables brands to collect valuable data insights, refining personalization algorithms and inventory planning As e-commerce infrastructure expands globally, online retail is expected to remain the preferred channel for customized face care solutions, ensuring continued growth momentum across developed and emerging markets.

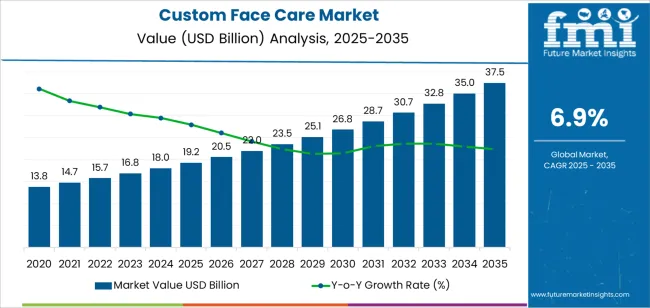

Between 2020 and 2025, the custom face care market steadily rose, with a historical CAGR of 5.7%. During this period, the market witnessed increasing consumer awareness regarding skincare ingredients, preferences for personalized solutions, and the emergence of innovative technologies in the beauty industry.

Customized face care products gained traction as consumers sought tailored solutions for their skin concerns and preferences. This period also saw the rise of direct-to-consumer brands offering personalized skincare regimens and technology integration for skin analysis and product recommendations.

Looking ahead to the forecasted period from 2025 to 2035, the market is projected to maintain a robust growth trajectory, with a forecasted CAGR of 6.9%. Several factors contribute to this anticipated growth, including continued consumer demand for personalized skincare solutions, ingredient technology advancements, and expanding distribution channels, particularly online platforms.

The forecasted period is expected to witness further integration of artificial intelligence and machine learning algorithms for enhanced personalization and customization in face care products. The market is poised to benefit from increasing consumer focus on sustainability, leading to the rise of eco-friendly and cruelty-free face care options.

| Historical CAGR from 2020 to 2025 | 5.7% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 6.9% |

The provided table illustrates the top five countries in terms of revenue, with China holding a prominent position in the market.

China leads the market due to its embrace of technologically advanced skincare solutions. Leveraging artificial intelligence and machine learning, brands of China offer personalized skin analysis and tailored product recommendations.

This tech-driven approach resonates with consumers seeking innovative and effective skincare solutions, positioning China at the forefront of the custom face care market.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 3.9% |

| Canada | 4.7% |

| Australia | 7.1% |

| China | 7.7% |

| Singapore | 6.2% |

In the United States, the market is a hub for skincare innovation. With a diverse population and varying skincare needs, customized face care products cater to individual preferences and concerns.

From personalized formulations for sensitive skin to targeted treatments for specific skin issues, the market thrives on delivering tailored solutions to American consumers.

Canada embraces a holistic approach to skincare, where the market plays a significant role. Customized face care products in Canada emphasize natural and organic ingredients, aligning with the commitment of the country to sustainability and wellness.

Canada customers prioritize skincare routines that promote overall skin health and well-being, from personalized serums to bespoke moisturizers.

In Australia, the market leads the charge towards sustainable beauty practices. With a strong focus on eco-friendly formulations and packaging, customized face care products cater to environmentally-conscious consumers.

The market pioneers sustainable beauty solutions, from personalized cleansers packaged in recyclable materials to bespoke moisturizers made with ethically sourced ingredients.

Tech-driven skincare solutions characterize the custom face care market in China. Leveraging advanced technologies such as artificial intelligence and machine learning, customized face care products offer personalized skin analysis and treatment recommendations.

From smart serums to personalized sheet masks, consumers embrace cutting-edge innovations in skincare to achieve optimal skin health and beauty.

In Singapore, the market offers a luxury personalization experience for discerning consumers. Customized face care products in Singapore combine high-quality ingredients with bespoke formulations, creating an indulgent skincare experience.

From personalized facial oils to customized night creams, custom face care market in Singapore caters to individuals seeking premium skincare solutions tailored to their unique needs.

The below section shows the leading segment. Based on product type, the cleansers segment is accounted to hold a market share of 29.6% in 2025. Based on the distribution channel, the offline stores are anticipated to hold a market share of 58.2% in 2025.

With consumers prioritizing clean and healthy skin, the demand for effective cleansers rises, as they play a crucial role in removing impurities, pollutants, and excess oil from the skin, thereby maintaining skin health and preventing issues like acne and blemishes.

The driver behind the continued dominance of offline stores as a distribution channel is the personalized shopping experience they offer.

| Category | Market Share in 2025 |

|---|---|

| Cleansers | 29.6% |

| Offline Stores | 58.2% |

In 2025, the cleansers segment commands a significant market share of 29.6%. This dominance is attributed to the essential role cleansers play in skincare routines, effectively removing impurities, makeup, and excess oil. With consumers prioritizing skincare hygiene, demand for cleansers, including traditional and specialized formulations, continues to drive growth in the skincare industry.

The offline stores segment is projected to maintain a substantial market share of 58.2% in 2025. Despite the rise of online shopping, offline stores remain preferred for skincare purchases, offering a tactile shopping experience and personalized assistance from beauty consultants.

Consumers value the immediacy of purchasing skincare products in-store, enabling them to make informed decisions based on product demonstrations and recommendations.

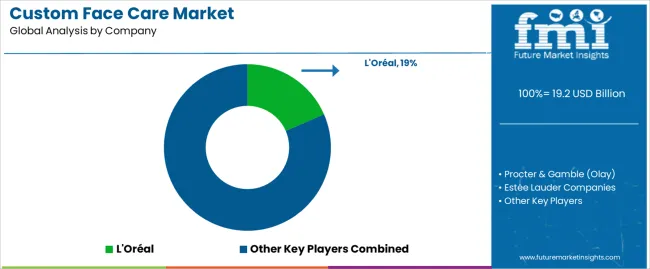

The custom face care market boasts a competitive landscape of established players and emerging brands vying for market share. Key companies like L'Oréal, Estée Lauder, and Procter & Gamble dominate with their extensive product offerings and global presence. These industry leaders invest in research, innovation, and marketing to maintain their competitive edge.

Niche and indie brands leverage innovation, sustainability, and personalization to carve out their market niche. With consumers increasingly seeking tailored skincare solutions, competition intensifies as brands strive to meet evolving preferences and capture a larger share of the market.

Some of the key developments are:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 19.2 billion |

| Projected Market Valuation in 2035 | USD 37.5 billion |

| Value-based CAGR 2025 to 2035 | 6.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Product Type, Skin Concerns, Distribution Channel, Packaging Type, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Procter & Gamble (Olay); L'Oréal; Estée Lauder Companies; Unilever; Johnson & Johnson; Shiseido; Beiersdorf AG; Amway; Avon Products Inc.; Mary Kay Inc.; Kiehl's (L'Oréal); Lancôme (L'Oréal); Neutrogena (Johnson & Johnson); Clinique (Estée Lauder Companies); Clarins; Caudalie; The Body Shop (L'Oréal); Origins (Estée Lauder Companies); Murad; Tatcha |

The global custom face care market is estimated to be valued at USD 19.2 billion in 2025.

The market size for the custom face care market is projected to reach USD 37.5 billion by 2035.

The custom face care market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in custom face care market are moisturizers, cleansers, toners, serums, eye creams, sunscreens, masks, exfoliators, spot treatments and others.

In terms of skin concerns, aging skin segment to command 27.6% share in the custom face care market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Customer Service Software Market Size and Share Forecast Outlook 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Customer Revenue Optimization (CRO) Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Communications Management Market Size and Share Forecast Outlook 2025 to 2035

Customer Experience Management (CEM) In Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Custom Dry Ingredients Blends Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Customer Engagement Hub (CEH) Market Size and Share Forecast Outlook 2025 to 2035

Custom Probiotics Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Customer-To-Customer (C2C) Community Marketing Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Journey Mapping Software Market Size and Share Forecast Outlook 2025 to 2035

Customized Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Custom Binders Market Growth & Industry Forecast 2025 to 2035

Custom Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Customisation and Personalisation in Travel Market Size and Share Forecast Outlook 2025 to 2035

Customer-Facing Technology Market Size and Share Forecast Outlook 2025 to 2035

Custom Display Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Custom Hearing Aids Market Growth - Trends & Forecast 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA