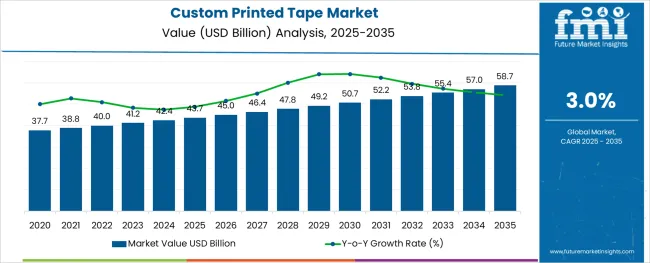

The Custom Printed Tape Market is estimated to be valued at USD 43.7 billion in 2025 and is projected to reach USD 58.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

The custom printed tape market is witnessing accelerated growth, fueled by the convergence of branding needs, supply chain security, and packaging optimization in fast-paced commercial environments. As global logistics volumes increase, the role of printed tapes has expanded from a basic sealing function to an integrated branding and security tool. Companies are leveraging custom-printed solutions for shipment authentication, promotional messaging, and product tracking, aligning packaging functionality with marketing strategy.

Regulatory pressures for traceable packaging and anti-counterfeit labeling in certain sectors are also reinforcing adoption. Simultaneously, advances in ink adhesion, substrate quality, and flexographic printing technology are enhancing print durability and customizability across various packaging materials.

The transition toward eco-conscious packaging and cost-efficient alternatives to printed cartons is further strengthening market growth. In the future, demand is expected to rise from SMEs and D2C brands seeking affordable, flexible packaging solutions that offer both security and shelf differentiation.

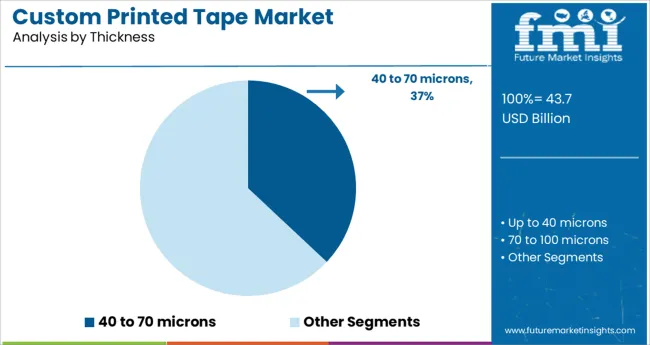

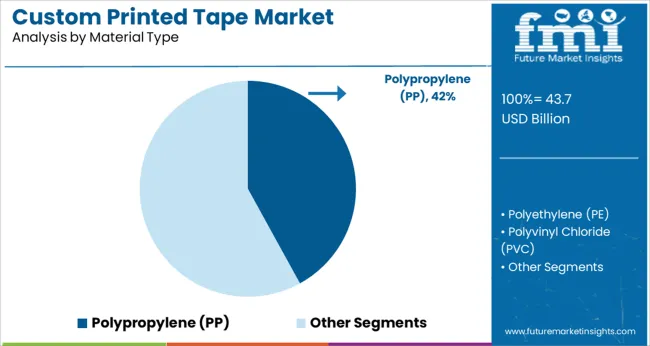

The market is segmented by Thickness, Material Type, and End-Use Industry and region. By Thickness, the market is divided into 40 to 70 microns, Up to 40 microns, 70 to 100 microns, and Above 100 microns. In terms of Material Type, the market is classified into Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), Bi-axially Oriented Polyethylene Terephthalate (BOPET), and Others.

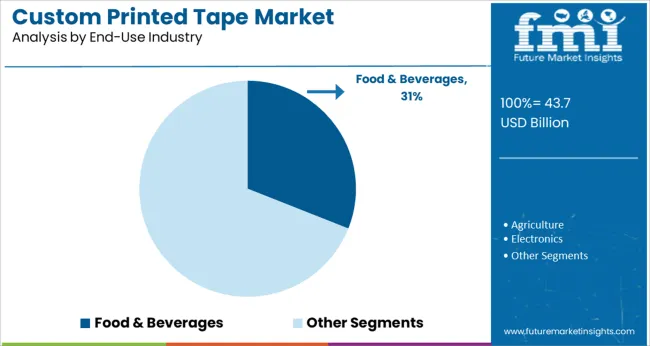

Based on End-Use Industry, the market is segmented into Food & Beverages, Agriculture, Electronics, Textile, Construction, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

In terms of thickness, the 40 to 70 microns segment is expected to contribute 37.0% of the total market revenue in 2025. This segment has gained prominence due to its optimal balance between strength, printability, and cost-effectiveness. Tapes within this thickness range offer sufficient tensile strength for general-purpose sealing applications, while enabling smooth ink application and image clarity.

Their moderate gauge ensures resistance to tearing during transit and maintains reliable adhesion on corrugated surfaces. The segment’s popularity is also supported by its adaptability across manual and automated taping systems, making it a preferred choice for high-throughput environments.

As packaging operations emphasize reliability without over-engineering, tapes in the 40 to 70 microns category remain a widely accepted standard across multiple end-use industries.

By material type, polypropylene (PP) is projected to dominate with a 42.0% revenue share in 2025, owing to its durability, print-friendliness, and wide-scale manufacturing compatibility. PP tapes offer high clarity, excellent surface energy for ink bonding, and strong resistance to moisture and abrasion characteristics essential for maintaining print quality and adhesion in transit environments.

The growing demand for lightweight, flexible packaging materials has further supported PP’s application, especially in combination with water-based and solvent-based adhesives. Additionally, polypropylene’s recyclability and availability in both biaxially oriented (BOPP) and cast variants allow customization based on operational and environmental requirements.

Its competitive pricing, along with its adaptability for automated taping lines, has ensured continued adoption across sectors prioritizing packaging efficiency and visual branding.

The food & beverages sector is anticipated to lead with a 31.0% share of the custom printed tape market in 2025. This dominance stems from the sector’s need for traceable, tamper-evident, and brand-centric secondary packaging solutions.

Custom printed tapes offer a practical method for conveying branding, batch information, handling instructions, and safety warnings on shipping cartons and outer packs. The segment’s growth is also influenced by increasing exports of packaged food products, where brand authentication and visual identification play a critical role in supply chain management.

Furthermore, stringent hygiene and safety regulations in the food industry necessitate secure sealing materials that do not compromise package integrity or print legibility. As e-commerce grocery and direct-to-consumer food models expand, demand for branded, compliant, and cost-effective packaging tapes is expected to remain high across the value chain.

Custom printed tapes are considered as an alternative solution to the costly printing on cartons. It is the best option for the marketer to emphasize on logo and name of the company. Custom printed tapes turn normal carton into highly visual promotional tools and we can say that it is an economical promoting tools of the company product and brand.

Custom printed tapes are also used for the purpose of tamper-proof security. It cannot be broken and released without detection and it warns the recipient not to accept traded goods with a broken seal. Apart from providing security and visual appeal, the custom printed tapes also help in immediate recognition of the package and water resistance to secure the package from the water.

Due to these added features, custom printed tapes demand is increasing and its market is expected to register tremendous growth during the forecast period

Growth in demand for custom printed tape market is expected to remain stable for various reasons. Firstly, the quick rise in the printing industry along with the demand for attractive packaging, product differentiation, and technological advancements are the key drivers for the growth in the custom printed tape market.

In addition, the rise in the e-business positively affects the growth of the custom printed tape market because it is used for the packaging of boxes. Custom printed tape is used in a wide range of applications, such as striping of goods, brand enhancement, and customized printing. In addition, printing on tapes is more convenient than printing on boxes and other materials.

This is also one of the key factors contributing to the growth of the global custom printed tape market. The demand for custom printed tape is rising due to the packaging of various goods for shipping and logistics.

The increasing shipping and logistics of the products through e-commerce is also fuelling the demand for the custom printed tape. The restraint which may resist the growth of the custom printed tape market is the higher cost of the high-quality printing.

Custom printed tape market has been segmented on the basis of the region into North America, Europe, Asia Pacific, Middle East & Africa (MEA), and Latin America. Among these regions, North America and Europe are expected to collectively dominate the market throughout the forecast period.

However, many tape suppliers and converter companies are investing in Asia Pacific to tap the demand and potential of the custom printed tape. Latin America and Middle East & Africa are expected to witness slow and steady growth during the forecast period.

In North America, Europe, and Asia Pacific, Europe is expected to create maximum incremental opportunities in terms of revenue for companies involved in custom printed tape.

However, China and India based tape manufacturers are looking to make most of the opportunity offered in terms of revenue from the global custom printed tape market.

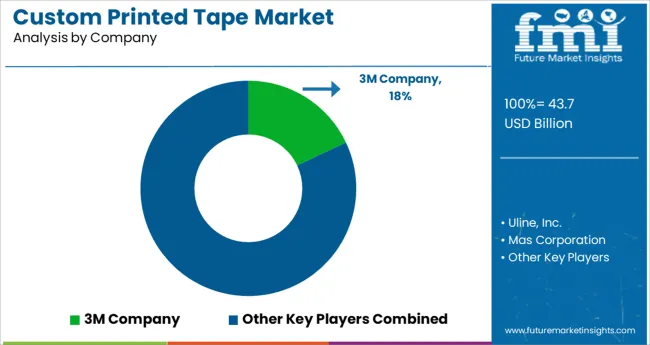

Few of the key players identified across the globe in the custom printed tape market are Uline, Inc., Mas Corporation, 3M Company, Sonoco Products Company, Custom Tapes, Inc., UK Industrial Tapes Ltd., Watershed Packaging Ltd, POLI-TAPE Klebefolien GmbH, etc.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global custom printed tape market is estimated to be valued at USD 43.7 billion in 2025.

It is projected to reach USD 58.7 billion by 2035.

The market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types are 40 to 70 microns, up to 40 microns, 70 to 100 microns and above 100 microns.

polypropylene (pp) segment is expected to dominate with a 42.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Pre-Printed Tape Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Pre-Printed Tape

Custom Supplement Formulation Service Market Size and Share Forecast Outlook 2025 to 2035

Custom Packaging Box Market Size and Share Forecast Outlook 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Custom Face Care Market Forecast Outlook 2025 to 2035

Customized Skincare Market Size and Share Forecast Outlook 2025 to 2035

Printed Electronics Market Size and Share Forecast Outlook 2025 to 2035

Custom Peptide Synthesis Services Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Customer Service Software Market Size and Share Forecast Outlook 2025 to 2035

Custom Vacation Planning Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Customer Revenue Optimization (CRO) Software Market Size and Share Forecast Outlook 2025 to 2035

Printed Chipless RFID Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Customer Communications Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA