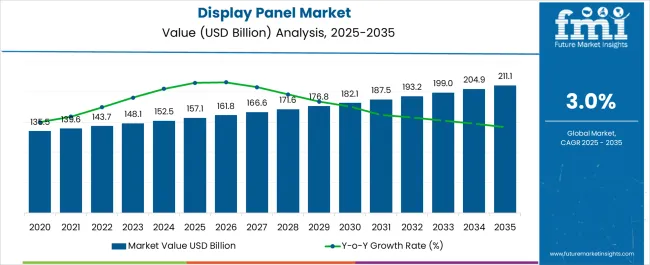

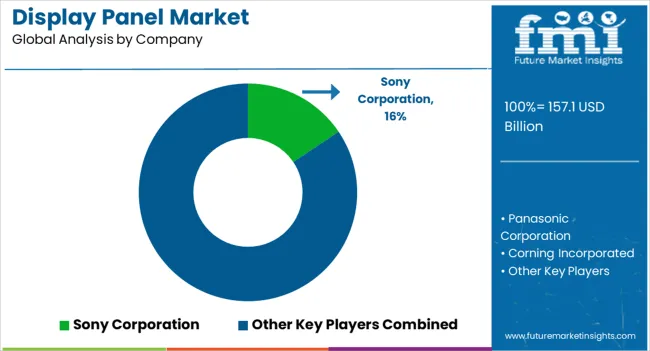

The Display Panel Market is estimated to be valued at USD 157.1 billion in 2025 and is projected to reach USD 211.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

| Metric | Value |

|---|---|

| Display Panel Market Estimated Value in (2025 E) | USD 157.1 billion |

| Display Panel Market Forecast Value in (2035 F) | USD 211.1 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The display panel market is advancing at a steady pace, driven by growing consumer demand for high-quality visual experiences across smartphones, televisions, automotive displays, and wearable devices. Industry announcements and investor presentations have emphasized the strong contribution of mobile devices to overall panel demand, supported by continuous product upgrades and widespread smartphone penetration.

Technology innovations such as high-refresh-rate displays, energy-efficient backlighting, and flexible panel designs are enhancing performance and broadening application possibilities. In addition, manufacturing advancements and increased production capacities in Asia-Pacific have ensured competitive pricing and wide accessibility of display technologies.

Strategic collaborations between panel manufacturers and device makers are shaping the design and supply pipeline, while government incentives for semiconductor and display production are strengthening regional ecosystems. Looking forward, market expansion is expected to be led by LCD technology in terms of volume, smartphones as the largest application base, and medium screen formats that balance portability and immersive viewing experiences.

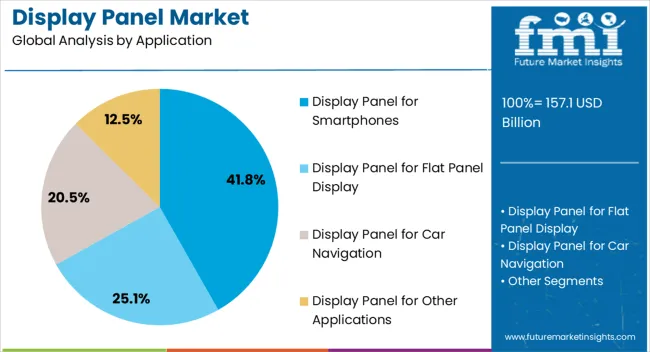

The Display Panel for Smartphones segment is projected to account for 41.8% of the display panel market revenue in 2025, underscoring its position as the largest application segment. Growth in this category has been driven by the increasing global penetration of smartphones, which has created sustained demand for advanced and durable display solutions.

Device makers have prioritized higher-resolution panels, thinner form factors, and improved color accuracy to enhance user experiences, further supporting segment expansion. Industry reports have also indicated rising replacement cycles and consumer preference for premium models, which typically integrate advanced display panels.

Moreover, smartphone manufacturers have invested heavily in display innovation as a key differentiator, leading to higher adoption across mid-range and flagship devices. With continued smartphone adoption in both developed and emerging markets, the Display Panel for Smartphones segment is expected to remain the primary demand driver for the overall market.

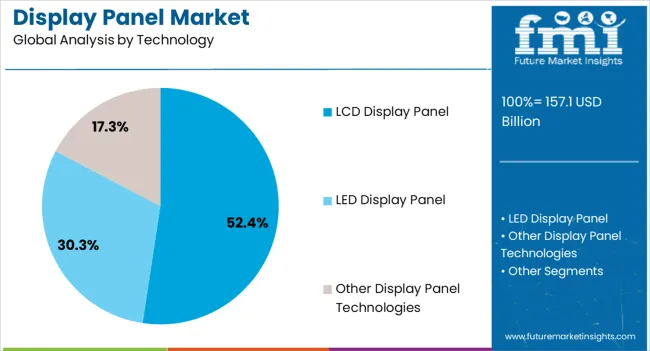

The LCD Display Panel segment is expected to hold 52.4% of the display panel market revenue in 2025, retaining its dominant position due to its cost-effectiveness and widespread availability. LCD technology has been favored for its mature production ecosystem, high reliability, and compatibility with a broad range of devices, from smartphones to televisions.

Manufacturers have achieved economies of scale, which have kept production costs competitive compared to emerging technologies, sustaining strong adoption. Furthermore, continuous improvements in backlight systems, contrast ratios, and energy efficiency have enhanced the performance of LCDs, prolonging their relevance in the market.

Consumer demand for affordable yet high-quality displays has further solidified LCD’s role in mainstream applications. While OLED and other advanced technologies are gaining ground, LCD remains the most accessible and versatile choice for manufacturers and consumers alike, supporting its continued leadership in the technology segment.

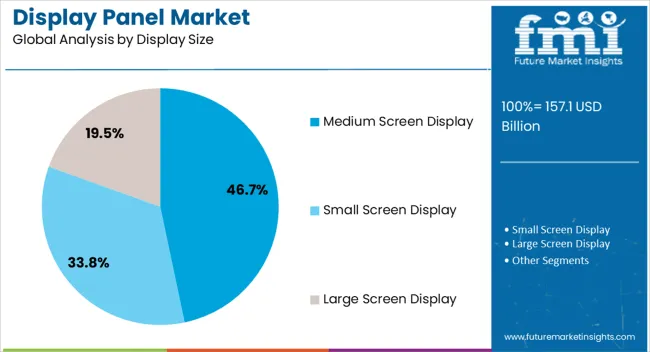

The Medium Screen Display segment is projected to contribute 46.7% of the display panel market revenue in 2025, reflecting its leadership within the size category. This segment’s dominance has been attributed to its balance between portability and visual immersion, making it ideal for smartphones, tablets, laptops, and mid-sized televisions.

Consumer electronics trends have favored medium screen formats that offer versatility for both entertainment and productivity applications. Additionally, device makers have focused on optimizing display performance in this size range, introducing higher resolutions, slimmer bezels, and touch responsiveness enhancements.

Manufacturing capabilities have also been aligned toward mass production of medium screen panels, ensuring consistent supply for high-volume device categories. With ongoing consumer demand for multifunctional devices and lifestyle integration, the Medium Screen Display segment is expected to maintain its leading role, driving steady growth within the display panel market.

Increasing Application of Display Panels in Different Sectors Provide Opportunity for the Growth of the Market

The application of display panels across various sectors, such as education and government offices, retail, and hospitality, is expected to boost the revenue of global display panels in the coming years.

Liquid Crystal Display (LCD) is gaining popularity as it is energy efficient and also offers better picture quality than other technologies. Flat panel display technology is also gaining popularity in the education system, hence flat panel display manufacturers are also working on developing interactive flat panel displays.

The emergence of multi-touch screens, reduction in replacement cycles, and changing consumer usage patterns are expected to drive the growth of display panels in the forecast period. Increasing demand in the automotive segment, technological advancements, and government initiatives toward smart cities is further positively impacting the growth of the global display panel market. Increasing demand for display panels from AR/VR, military, and defense is driving the market for display panels.

One of the major challenges of the display panel market is the higher cost and thickness of the display of these devices as compared to other modules. The display panel market is expected to witness sluggish and unpredictable growth owing to a quantitative decline in the number of LCD displays.

Moreover, financial uncertainty and macroeconomic situations around the world, such as fluctuating currency exchange rates and economic difficulties, are some of the major factors hindering the growth of the display panel market. However, increased competition from alternative technologies and LCD panel complex structures is likely to limit the growth of the display panel market.

Presence of Leading Manufacturers in the Region Boost the Growth of the Market in North America

As per FMI, the North American market is slated to account for 35.9% of the total market share. The rise in consumer demand for large LCD televisions, increasing the screen size of smartphones, and growth in the development of automotive displays are some of the factors driving demand for a display panel in the United States

Key players in the country have been developing, producing, and selling high-quality display panels. These display panels are implemented in different industry verticals such as automotive, entertainment, medical, and others. The manufacturers of the display panel are constantly undergoing product advancements as the factors such as increasing production of consumer electronics are creating a huge opportunity for display panels to drive the growth of the world display panel market.

The key factor for driving the display panel market in North America is the presence of major industry players. There is an increase in adoption of the touchscreen display panel in the country from video display device manufacturers. Such factors are contributing to the growth of the display panel market. For instance, in February 2025, Microtips Technology, the leading global manufacturer and supplier of LCD Modules, launched MTD0200DDP03RF-1, a great 2.0-inch IPS display for small projects. Also produce a full gamut of TFT Display Modules, Active Matrix and Passive Matrix OLED Modules, Graphic and Character Monochrome LCD Modules, and Fully Custom LCD Modules.

Growing Use of LCD Displays in Region Drives the Sales of Display Panel Market During Forecasting Period

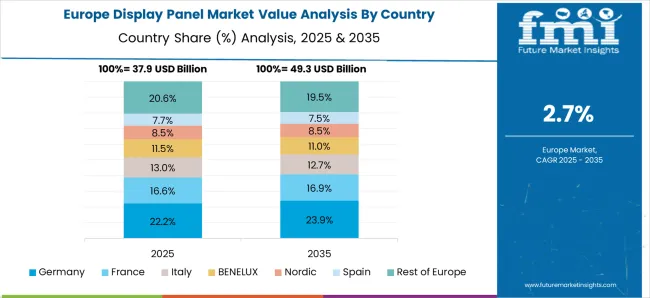

According to Future Market Insights, Europe is expected to provide immense growth opportunities for the display panel market due to an increase in the adoption of consumer electronics devices, including televisions, mobile devices, laptops, tablets, and desktop monitors. The European display panel market accounts for 24.7%share of the total global market

The demand for display panels has risen dramatically. The increasing usage of LCD displays in various industries in these regions is boosting the display panel market. Moreover, rapid advancements being made in technology coupled with increasing investments in Research and Development are anticipated to drive the market further.

There is a surge in demand for OLED displays in regions due to advantages like viewing angles and black levels. Smartphone manufacturers are developing foldable phone models that incorporate flexible OLED displays. This is likely to further have a massive potential for display panel growth over the forecast period.

Advancement in the Education Sector in The Region to Boost the Growth of the Display Panel Market

The Asia Pacific is anticipated to gain market share during the forecast period. Product launches, acquisitions, distribution agreements, alliances, and geographical expansion by local players, especially in China and India, are expected to propel the display panel market in the region.

The development of education infrastructure in Japan, China, and India also creates an opportunity for manufacturers to offer advanced interactive display panels. Governments in various countries in the region are also taking initiatives to modify education systems and make them technologically advanced. Governments are also investing in buying materials that are essential in interactive learning, including flat panel displays, tablets, etc. The increasing popularity of e-learning is driving the adoption of display panels to deliver content interactively.

With the rise in the development of smart classrooms and the adoption of new technologies to enhance the learning experience, the education sector is focusing on adopting interactive methods in countries like China and India. For instance, in the Union Budget 2024-22, the Indian government established the National Digital Educational Architecture (NDEAR) to strengthen digital infrastructure and support activities related to education planning.

The new entrants in the display panel market are continually indulging in several collaborations and highly investing in research and development activities to provide more convenient solutions to industry verticals. Some of the major start-ups that are leading the development of the market are -

Shijiazhuang Dianguang Hi-tech Electronics Co., Ltd, STONE Technology co., ltd., Teronix India Private Limited, RandServ Systems Pvt Ltd., Royal Display India and Vision Display Pvt. Ltd.

Some of the key participants present in the global display panel market include

Sony Corporation, Panasonic Corporation, Corning Incorporated, LG Electronics Inc., Asahi Glass, Nippon Electric Glass, Samsung Electronics Co. Ltd., Innolux Corporation, Sharp Corporation, and HannStar Display Corporation among others.

Attributed to the presence of such a high number of participants, the market is highly competitive. While global players such as Sony Corporation, Panasonic Corporation, Corning Incorporated, LG Electronics Inc., Asahi Glass, and Nippon Electric Glass account for considerable market size, several regional-level players are also operating across key growth regions, particularly in the Asia Pacific.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.3% from 2025 to 2035 |

| Expected Market Value (2025) | USD 148,053.0 million |

| Anticipated Forecast Value (2035) | USD 228451.9 million |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Application, Display Size, Technology, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Mexico, Brazil, Germany, Italy, France, UK, Spain, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Sony Corporation; Panasonic Corporation; Corning Incorporated; LG Electronics Inc.; Asahi Glass; Nippon Electric Glass; Samsung Electronics Co. Ltd.; Innolux Corporation; Sharp Corporation; HannStar Display Corporation; Toshiba Corporation; Hisense; AU Optronics Corporation |

| Customization | Available Upon Request |

The global display panel market is estimated to be valued at USD 157.1 billion in 2025.

The market size for the display panel market is projected to reach USD 211.1 billion by 2035.

The display panel market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in display panel market are display panel for smartphones, display panel for flat panel display, display panel for car navigation and display panel for other applications.

In terms of technology, lcd display panel segment to command 52.4% share in the display panel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flat Panel Display Market Analysis by Technology, Application, and Region through 2025 to 2035

Panel Mount EMI Filter Market Forecast and Outlook 2025 to 2035

Panel Saw Market Size and Share Forecast Outlook 2025 to 2035

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Panel Mounted Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Panel Level Packaging Market Analysis by Materials and Technologies Through 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA