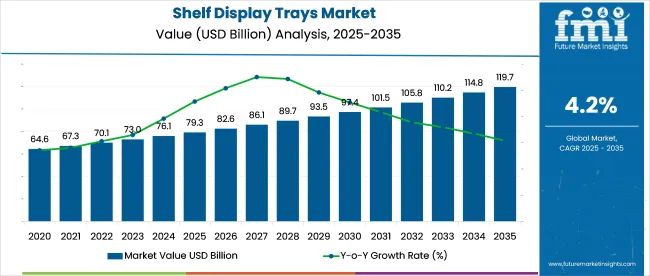

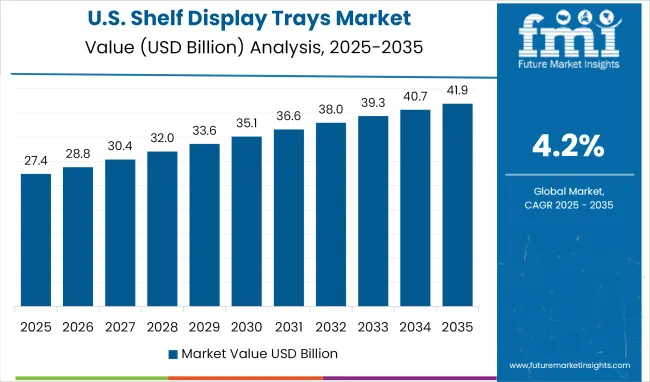

In 2025, the global shelf display trays market is valued at USD 79.3 billion and is projected to reach USD 119.7 billion by 2035 at a CAGR of 4.2%. Early growth through 2027 is driven by consistent demand from supermarket and hypermarket formats, with the market forecast to reach USD 86.0 billion.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 79.3 billion |

| Projected Market Size in 2035 | USD 119.7 billion |

| CAGR (2025 to 2035) | 4.2% |

From 2028 to 2032, increased adoption across food, beverage, and personal care segments supports growth. The use of die-cut corrugated trays and high-resolution folding cartons gains traction, pushing the market to USD 104.3 billion by 2032.

Between 2033 and 2035, the market emphasizes recyclable substrates and molded fiber solutions, aligning with packaging circularity and sustainability targets. By 2035, the market closes at USD 119.7 billion, with annual growth rates holding steady between 4.1% and 4.3%. Growth is reinforced by automated manufacturing, retail mandates for green packaging, and innovations in flat-pack tray formats and digitally printed short-run solutions.

The shelf display trays market holds a niche but growing share within its parent markets. In the retail packaging market, it accounts for roughly 5-8%, driven by the need for organized and visually appealing product displays. Within the point-of-purchase (POP) display market, its share is around 10-15%, as brands increasingly use trays for in-store promotions.

In the food and beverage packaging market, shelf display trays make up 6-10%, given their use in fresh produce, snacks, and ready-to-eat meals. The plastics and materials manufacturing market allocates 3-5% to these trays, as they compete with other packaging solutions.

In e-commerce and logistics packaging, their share is 4-7%, as retailers adopt them for omnichannel retail strategies. Growth is supported by ecofriendly trends, with a shift toward recyclable and biodegradable materials, driving a projected 5-7% CAGR over the coming years.

Jan Blankiewicz, product innovation manager at Mondi Corrugated Solutions, highlights the practical value of small portion packs in improving both hygiene and convenience. He explains that these packs allow consumers to pick up fresh produce directly from the shelf without handling, reducing the risk of contamination.

They simplify the shopping process by removing the need for scales or additional sachets. The packaging also protects fragile items such as tomatoes during transport. This format supports current retail preferences for safer, more efficient packaging solutions while helping preserve product integrity from store to home.

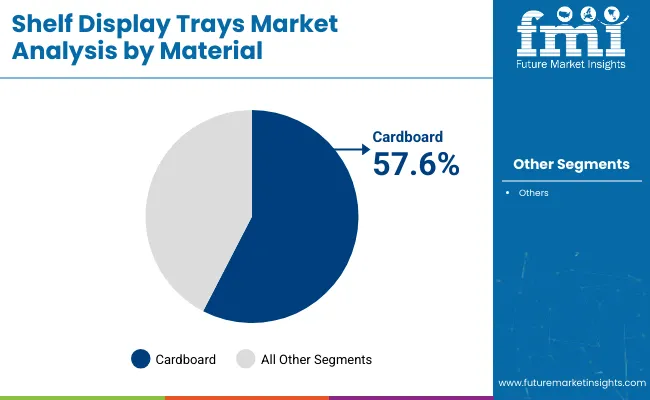

The shelf display trays market continues to gain traction across multi-format retail and point-of-sale merchandising. Over 55% of total units are produced using cost-efficient cardboard, while stackable tray formats are in high demand among warehouse clubs and modern retail chains.

Cardboard trays are forecasted to lead the global market with a commanding 57.6% share in 2025. Their lightweight, foldable design and print adaptability make them highly suitable for FMCG and promotional retail use. Producers like DS Smith, International Paper, and Georgia-Pacific are expanding corrugated tray production for regional and global distribution. E-commerce spillover into physical retail has led brands to demand shelf-ready formats that combine structural integrity with visual branding.

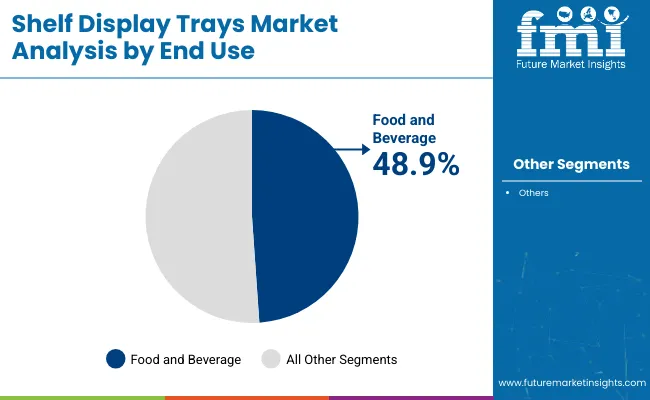

Food & beverage remains the largest consumer of shelf display trays, accounting for 48.9% of demand in 2025. The growth is tied to high rotation categories such as snacks, confectionery, RTD beverages, and dairy. Companies including Coca-Cola, Ferrero, and Danone use display trays for in-store promotion and bulk merchandising. Modern trade and convenience retail formats push demand for multipack display units that maximize shelf presence and SKU visibility.

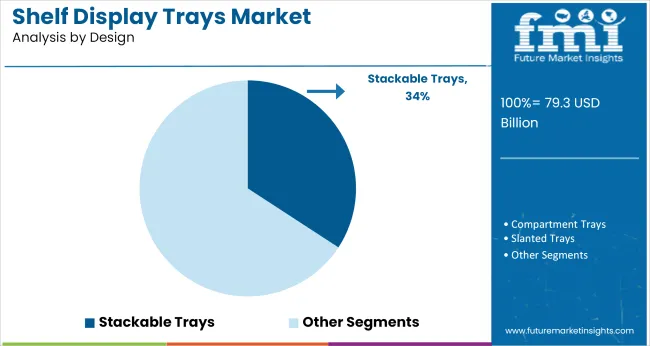

Stackable tray designs are projected to lead the format category with 34.2% market share. Their appeal lies in efficient vertical space usage and structural interlock during transport and shelf-stocking. Popular in beverages, snacks, and homecare, stackable trays are being adopted across cash-and-carry formats and high-volume discounters. Manufacturers like Mondi, FP International, and Sonoco focus on ergonomic stackable formats with modular load-bearing capability.

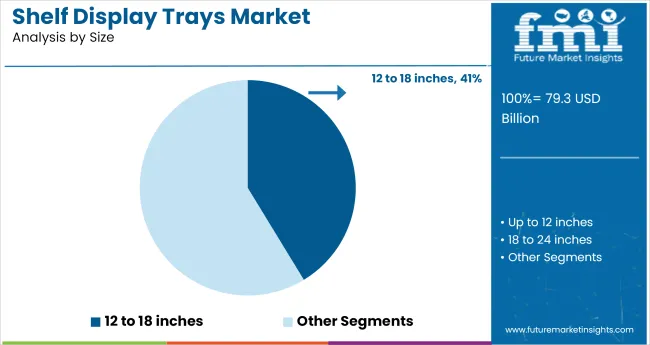

Trays sized 12 to 18 inches are projected to hold 41.3% market share, offering optimal space utility and merchandising flexibility. They support moderate product weight and are compatible with shelf depths in grocery, pharmacy, and cosmetic retail formats. Brands like L’Oréal, Kraft Heinz, and Revlon select this size for retail units needing strong facings without overloading shelf real estate. The size range aligns with retail compliance for both gondola and end-cap placement.

Shelf display trays are seeing broader use as retailer’s streamline shelf replenishment and enhance product visibility. Branded variants are gaining ground in discount and wholesale formats. Brands are adapting tray designs to comply with recyclability thresholds, while labor-reduction metrics continue to influence tray selection across large-format retail and grocery outlets.

Retail Format Shifts Drive Tray Integration in High-Turn Categories

Adoption of shelf display trays rose by 11.2% year-on-year across structured retail channels in the first half of 2025, led by discount and bulk-sale formats. High-rotation SKUs in beverages, personal care, and snack foods are increasingly shipped in shelf-ready formats, reducing in-store restocking times by 27-31%.

Retail operations data from the United Kingdom showed labor savings of 19 million British pounds in the second quarter alone through the expanded use of tray-enabled packaging in dry goods categories. In North America, over 68% of new FMCG product placements in hypermarkets now launch with corrugated shelf trays, aligning with planogram efficiency benchmarks and standardized shelving dimensions. Multi-pack configurations placed in branded die-cut trays are helping accelerate throughput at aisle ends and promotional displays.

Material Transition and Merchandising Function Shape Tray Evolution

Retail packaging policies and circularity targets are prompting a shift away from laminated plastic and mixed-material trays. As of mid to 2025, 54% of shelf display trays used across Western Europe met recognized recyclability benchmarks under EN 13430. Large converters reported a 17% uptick in tray demand incorporating more than 80% post-consumer recycled content.

Major European retailers have introduced new onboarding requirements mandating tray size compatibility with racking systems and pallet schemes. In Germany and the Nordic markets, own-brand SKUs accounted for more than one-third of tray-based merchandising campaigns in Q2, reflecting expanded use of shelf trays for visual blocking and private-label amplification.

Tray redesign cycles have been compressed to 45-60 days for seasonal rotations, aided by modular structural templates and faster turnaround in flexographic printing workflows.

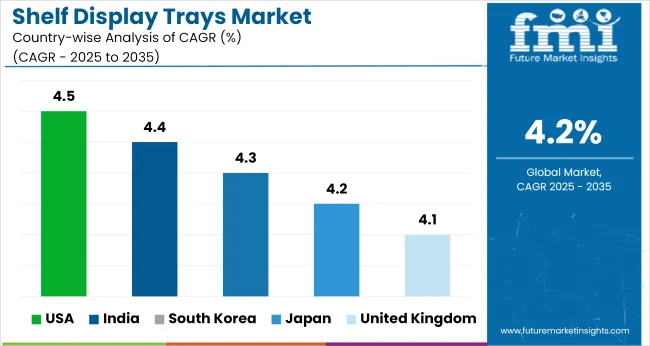

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5 |

| India | 4.4 |

| South Korea | 4.3 |

| Japan | 4.2 |

| United Kingdom | 4.1 |

The global shelf display trays market is projected to expand at a CAGR of 4.2% between 2025 and 2035. The United States (OECD) leads among the profiled countries with 4.5%, placing it 0.3 percentage points above the global baseline. India (BRICS) follows at 4.4% (+0.2%), while South Korea (OECD) records 4.3% (+0.1%) and Japan (OECD) matches the global average at 4.2%.

The United Kingdom (OECD) trails slightly with 4.1% (-0.1%). This variation reflects regional approaches to in-store visual merchandising, packaging integration in point-of-sale systems, and investments in modular retail infrastructure. BRICS and OECD markets both contribute to steady growth, though growth in BRICS economies is linked more to expansion in organized retail formats, while OECD markets show incremental gains from display redesign and marketing convergence.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

Between 2020 and 2024, shelf display trays gained wide acceptance in high-turnover retail formats such as club stores, dollar chains, and supermarkets. Growth was supported by rising SKU fragmentation and shelf-ready packaging adoption.

The market is forecast to grow at a CAGR of 4.5% through 2035, driven by automation in warehouse-to-shelf replenishment and growing demand for recyclable corrugated trays. Retailers are adopting display trays with high-graphic print and integrated merchandising features to drive impulse purchases. Seasonal product rotations in FMCG and pet food aisles are also boosting tray demand with shorter life cycles and modular designs.

The UK market grew steadily between 2020 and 2024, with retailers adopting shelf display trays to streamline restocking and reduce secondary packaging waste. Display trays became standard in supermarket bakery, beverages, and confectionery aisles. The market is projected to expand at a CAGR of 4.1% through 2035, driven by sustainability mandates and growth of private label offerings.

Retailers are demanding mono-material, easy-tear trays compatible with in-store logistics. E-commerce grocery and click-and-collect formats are also contributing to demand for hybrid shelf-display systems that double as shipping cartons.

The shelf displays trays industry in Japan expanded during 2020 to 2024 due to rising urban retail density and convenience store restocking frequency. Compact, high-visibility trays became integral in ready-to-eat, beauty, and functional beverage categories.

Through 2035, the market is expected to grow at a CAGR of 4.2%, driven by labor-saving logistics and demand for presentation-ready packaging. Manufacturers are investing in RFID-embedded trays and foldable PET tray structures to support reusability goals. Trays designed for space-efficient vertical displays are increasingly used in metro and suburban retail environments.

South Korea’s market expanded at a steady rate during 2020 to 2024, supported by the rise of modern retail formats, especially in beauty and beverage categories. Through 2035, shelf display trays are projected to grow at a CAGR of 4.3%, driven by demand for space-efficient displays, integrated QR-code marketing, and recyclable substrates.

Premium tray formats with UV printing and high stiffness are increasingly adopted in lifestyle and tech retail. Rapid inventory turnover in K-beauty and health product segments is reshaping structural requirements for modular, retail-ready trays.

The shelf displays trays industry in India is projected to grow at a CAGR of 4.4% through 2035. During 2020 to 2024, growth was driven by rapid penetration of organized retail and urban supermarket chains. Corrugated shelf trays gained traction across dairy, snacks, and OTC pharmaceuticals.

Looking ahead, expanding Tier 2 and Tier 3 retail, as well as the boom in modern grocery formats, will boost demand for low-cost, print-ready trays. Brands are adopting ready-to-sell tray formats to minimize in-store labor and enhance brand visibility. Flexo-printed and die-punched trays are becoming more common in regional distribution networks.

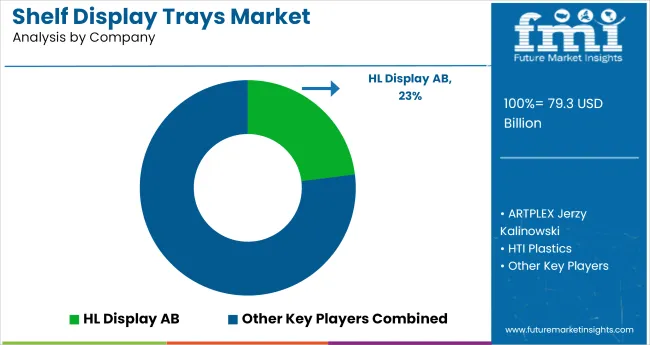

The shelf display tray market is dominated by key players like ANL Packaging, VPK Group, and Macpac Ltd., who invest in R&D and product launches to maintain competitiveness. For example, HL Display AB introduced modular tray systems for retail efficiency, while LINPAC Packaging developed lightweight yet durable designs.

Emerging players like Indigo Prints Private Limited and Bennett Packaging focus on customization and regional distribution to carve out niches. Larger firms such as Delkor Systems and HTI Plastics leverage automation and economies of scale, while smaller competitors like ARTPLEX Jerzy Kalinowski differentiate through bespoke solutions.

High entry barriers include substantial capital requirements for manufacturing equipment and compliance with industry standards. Established brands benefit from long-term retail contracts, making market penetration difficult for newcomers. Intellectual property protections further restrict competition, though regional manufacturers like Indigo Prints gain footholds with cost-effective alternatives. Dominant players control pricing, forcing smaller firms to rely on innovation or localized strategies.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 79.3 billion |

| Projected Market Size (2035) | USD 119.7 billion |

| CAGR (2025 to 2035) | 4.2% |

| Base Year | 2024 |

| Historical Data Range | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion (revenue), million units (volume) |

| Material Segmentation | Plastic, Cardboard, Metal, Others (Wood, Glass) |

| Size Segmentation | Up to 12 inches, 12 to 18 inches, 18 to 24 inches, Above 24 inches |

| Design Segmentation | Flat Trays, Compartment Trays, Slanted Trays, Stackable Trays |

| End Use Segmentation | Food & Beverage, Cosmetics & Personal Care, Electronics & Appliances, Retail |

| Regional Coverage | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa |

| Countries Tracked | United States, Canada, Germany, United Kingdom, France, China, Japan, India, Brazil, Australia, GCC countries |

| Key Companies Profiled | ANL Packaging, VPK Group, Macpac Ltd., Bennett Packaging, Indigo Prints Private Limited, HL Display AB, ARTPLEX Jerzy Kalinowski, HTI Plastics, LINPAC Packaging, Delkor Systems, Inc |

| Additional Attributes | Dollar sales, share by tray size and end-use sector, preference for stackable and slanted formats in retail merchandising, growth in shelf-ready packaging adoption, influence of automated warehousing and retail display upgrades |

The industry is expected to reach USD 119.7 billion by 2035.

The industry is projected to grow at a CAGR of 4.2% during the forecast period.

Cardboard holds the leading position with a 57.6% share in 2025.

The sector accounts for 48.9% of global shelf tray demand in 2025.

HL Display AB is the leading player, holding a 23% share of the global market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shelf-stable Soup Market Size and Share Forecast Outlook 2025 to 2035

Shelf-Stable Dough Market

Shelf Ready Packaging Market

On-shelf Availability Solution Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

On-shelf Availability Solution Market Analysis - Size, Share & Forecast 2025 to 2035

Heated Shelf Food Warmers Market - Efficient Hot Holding Solutions 2025 to 2035

Korea On-shelf Availability Solution Market – Demand & Forecast 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Western Europe On-Shelf Availability Solution Market Growth – Trends & Forecast 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for RTD Whey Deployments for Shelf-stable Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA