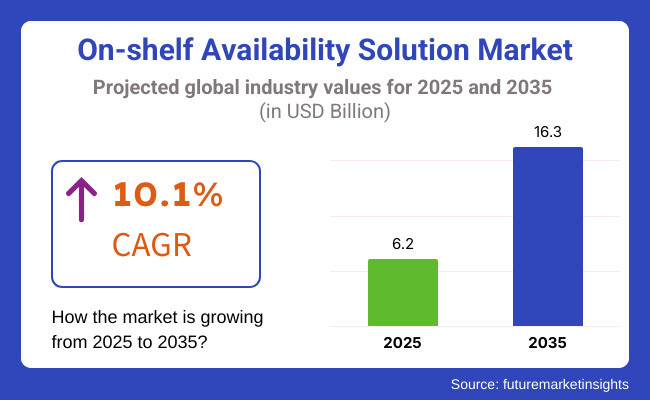

The on-shelf availability solution market is expected to be USD 6.2 billion in 2025 and to reach a total of USD 16.3 billion by 2035. Retail sales should increase at a CAGR of 10.1% over the outlook period from 2025 to 2035. On-Shelf Availability Solution had gross sales of USD 5.6 billion by 2024. The year 2025 shows a market growth of 9.2%.

On-Shelf Availability (OSA) solutions market mainly covers the technologies and software like real-time monitoring of store shelves, which are based on artificial intelligence mechanisms, IoT, RFID, computer vision, and cloud computing. These solutions use AI, IoT, RFID, computer vision, and real-time analytics to supervise the stock, monitor supply chain movements and give retailers and suppliers actionable insights accordingly. By automatic stock replenishment and demand forecasting, OSA solutions increase operational efficiency, speed up inventory turnover, and, in general, improve the shopping experience.

The drivers for the market are increasing customer demands on products, adoption of robotics, and using data to implement better decisions. In the case of OSA suppliers, they are widely incorporated into FMCG, pharmaceuticals, and electronics, among others, due to their importance in reducing out-of-stock problems, ensuring supply chain efficiency, and maximizing revenue. The global on-shelf availability (OSA) solution market is experiencing tremendous growth as the demand for real-time inventory management and automation in retail is significantly increasing.

Retailers and manufacturers in all sectors, including FMCG, pharmaceuticals, and electronics, are implementing AI-based OSA solutions, which not only reduce stock-outs but also streamline the supply chain and improve customer satisfaction. RFID, IoT, computer vision, and predictive analytics are the technologies that let retailers monitor their shelf stock computation quickly, automate the refill process and at last save their profit by not running out of goods in the stores.

The sector is rapidly progressing because of the advent of omnichannel retailing where inventory visibility across both physical and digital stores plays a central role. In addition, stringent compliance regulations and the requirement for fact-based decision-making are substantive forces driving this trend.

North America and Europe are the leading regions in the market owing to the high technological adoption, and Asia-Pacific is emerging as a prime region due to the retail digitalization phenomenon. The OSA solution market promises to continue the growth curve thanks to innovative and automation trends. One of the major challenges in the On-Shelf Availability Solution area is the difficulty caused by the integration of OSA technologies with the traditional legacy inventory management systems endured by many retailers. Many large retail chains and supermarkets, for instance, are reliant on traditional ERP or POS-based inventory systems, which may not be very supportive of AI-based OSA solutions. The processes of IoT sensors, RFID tagging, and the introduction of data dashboards for real-time analytics into these aged systems, apart from IT updates, transcending the data synchronization and staff training, also impose blockers.

The market is segmented based on component, application, deployment type, and region. By component, the market is divided into hybrid, public, and private. In terms of application, it is segmented into managed hosting, colocation applications, hybrid hosting, shared hosting, website hosting, virtual dedicated servers, and virtual private servers.

Based on deployment type, the market is categorized into SMEs and large enterprises. Regionally, the market is classified into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The large enterprises segment accounts for 63% market share in 2025, supported by increasing investments in advanced inventory monitoring, AI-driven analytics, and omni-channel retail operations. Large retailers and global brands rely heavily on on-shelf availability solutions to optimize inventory flow, reduce stockouts, and enhance customer satisfaction. Integration of these solutions with enterprise-wide ERP and supply chain systems further drives demand in this segment.

Growing emphasis on real-time data and predictive analytics is accelerating large enterprise adoption of hybrid and cloud-based solutions. As retail and consumer industries face rising competition, large enterprises are prioritizing seamless shelf replenishment to drive revenue and enhance shopper loyalty. Meanwhile, SMEs are gradually adopting cost-effective cloud-based on-shelf availability platforms, particularly in fast-growing e-commerce and specialty retail segments. Flexibility, scalability, and pay-as-you-go models are key enablers for SME adoption.

| Deployment Type | Share (2025) |

|---|---|

| Large Enterprises | 63% |

The managed hosting segment holds 38% market share in 2025, driven by strong demand for scalable, secure, and fully managed platforms. Retailers and consumer goods companies increasingly outsource hosting of their inventory monitoring and analytics platforms to managed service providers to ensure high availability, data security, and seamless integration with core systems.

Managed hosting allows businesses to focus on core operations while leveraging expert infrastructure management and 24/7 support. Rising e-commerce penetration and growing complexity in managing multi-channel retail networks are fueling demand for managed hosting-based on-shelf availability solutions.

Meanwhile, hybrid hosting and virtual private servers are gaining popularity for offering flexible and customizable environments. Colocation applications continue to serve enterprises needing greater control over hardware infrastructure, particularly in regulated sectors. Shared hosting and website hosting remain important for smaller retailers and localized solutions.

Virtual dedicated servers address high-performance needs in data-intensive applications. Overall, the market’s shift toward managed and hybrid hosting is expected to continue as retailers prioritize agility, uptime, and cost optimization.

| Application | Share (2025) |

|---|---|

| Managed Hosting | 38% |

The hybrid component segment is projected to grow at the highest CAGR of 7.1% from 2025 to 2035, driven by rising demand for flexible and scalable on-shelf availability solutions. Hybrid models offer an ideal balance between cloud-based scalability and on-premises control, allowing retailers to tailor solutions to their unique operational needs.

As retailers face growing complexity from omni-channel and cross-border operations, hybrid deployment provides seamless integration across multiple data sources and platforms. Public solutions continue to be favored by SMEs and cost-conscious enterprises seeking quick deployment and scalability with minimal upfront investment.

Public cloud components are particularly popular in e-commerce-driven retail segments and fast-moving consumer goods (FMCG). Private solutions remain the preferred choice for large enterprises and industries requiring stringent data security, regulatory compliance, and system customization.

As hybrid architectures evolve with advanced AI, machine learning, and IoT integration, their role in supporting real-time shelf monitoring and predictive analytics will expand further. With increasing pressure on retailers to optimize stock levels and enhance consumer experiences, hybrid solutions are poised to play a central role in driving innovation and efficiency across the on-shelf availability solution market.

| Component | CAGR (2025 to 2035) |

|---|---|

| Hybrid | 7.1% |

The need for real-time inventory management and demand forecasting in the retail and supply chain sector is what primarily drives this growth. Stock suppliers use advanced tracking technology and AI-driven analytics for optimal stock management and to protect their revenues against losses from out-of-stock situations.

Supermarkets are particularly concerned about the quality of their services, which, in turn, is directly correlated with full inventory visibility and customer satisfaction. Wholesalers are after the best possible product flow and the only way to secure that is by implementing dependable and financially feasible supply chain solutions.

Consumers reap the benefits with a higher selection of goods, hence making their shopping experience more pleasant. The pace of IoT, RFID, and AI-based solution penetration in the market is phenomenal, leading to better results in terms of accuracy and process automation.

On-Shelf Availability Solution Market Contract Analysis

| Company | Contract Value (USA USD Million) |

|---|---|

| IBM Corporation and Retail Solutions Inc. | Approximately USD 15 - USD 20 |

| Panasonic Corporation and Mindtree Ltd. | Approximately USD 10 - USD 15 |

Compliance with regulations is a key risk. Each region has its own different set of privacy laws regarding the data, like GDPR in Europe and CCPA in the USA, which directly or indirectly affect the way retailers take, keep, and use inventory and customer data. The retailers collect, store, and process customers' data. The consequences of this non-compliance are monetary fines, lawsuits, and limits on using data.

Cybersecurity risks are great indeed as OSA solutions tacitly operate a cloud-based platform, IoT-enabled sensors, and AI-driven analytics. A breach of data or system crash may result in deficient inventory tracking, disrupted supply chains, and loss of retailer trust. This is a risk that can be significantly mitigated by using strong encryption, multi-layer authentication, and performing regular security audits.

Enterprises have to keep on innovating, like predictive analytics, machine learning-based forecasting of demand, and real-time shelf monitoring to be different from their competitors. Failure to keep up with innovations may lead to a share loss in the market.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| The USA | 10.1% |

| Germany | 9.4% |

| UK | 9.9% |

| China | 11.3% |

| India | 11.7% |

The United States has been a dominant market for On-Shelf Availability (OSA) solutions, with retailers such as Walmart, Target, and Kroger using digital technologies to increase the visibility of inventory, reduce stock-outs, and automate. So, they have made substantive investments in RFID-based inventory tracking, AI-powered demand forecasting, and IoT-led smart shelves to ensure product availability.

Increased adoption of computer vision, robotic restocking units, and cloud analytics is now making it convenient to coordinate the inventory between omnichannel hubs and physical retail outlets. The establishment of e-commerce and hybrid model stores has similarly created a demand for real-time inventory syncing, allowing customers to become cognizant of accurate levels of available merchandise when they go online or shop offline. FMI opines that the USA market will grow at 10.1% CAGR during the forecast period with innovative AI integration, smart retail solutions, and robust predictive analytics focus.

Growth Drivers in the USA

| Key Drivers | Information |

|---|---|

| Advanced Retail Solutions | AIoT, IoIT, and RFID-based OSA solutions improve stock accuracy and prevent stockouts. |

| Omnichannel Retail Store Expansion | Retailers have synchrony between online and offline channels for round-the-clock availability. |

| Investment in Automated Systems | Intelligent shelf monitoring, computer vision, and predictive analytics enhance stock control. |

Germany sees increasing On-Shelf Availability (OSA) technology being used by retailers for digital, automated solutions to enhance efficiency. Aldi, Lidl, and Metro AG use RFID, computer vision, and autonomous shelf auditing to offer lower stockout risk and supply chain efficiencies.

Germany observes increased OSA (On-Shelf Availability) technology implementations from retailers looking to find digital, automated means to increase efficiency. RFID, computer vision, and autonomous shelf auditing help Aldi, Lidl, and Metro AG reduce stockout risk and improve supply chain efficiency. This also triggers OSA due to the demand for tighter regulations on conformance by inventory sizes in Germany, as they ensure that retailers comply with requirements on openness and optimization.

OSA is most commonly triggered to help be as compliant with controls and optimization requirements within inventory sizes in Germany; however, quite often, it is triggered simply by compliance with conformance by retailers. The boom in e-commerce and the need for predictive analytics and artificial intelligence (AI) driven demand forecasting have led to increased investment in smart shelf solutions with automation applications at the restocking level and inventory management. Others, such as Germany's green trend and desire to reduce waste, are influencing retailers to look for data-driven inventory solutions that focus on reducing overstocking and preventing product waste.

Germany Growth Drivers

| Key Drivers | Information |

|---|---|

| Retail Digitalization | The adoption of IoT and AI drives supply chain effectiveness and inventory precision. |

| Inventory Regulatory Compliance | Aggressive rules necessitate stock accountability to avert shortage and wastage. |

| Implementation of Smart Shelves | Aesthetic retailers implement autonomous shelf monitoring to provide timely product on-shelf status details. |

India's On-Shelf Availability (OSA) market is taking shape as chain retail stores, supermarkets, and instant-commerce portals scale up their activities. Companies such as Reliance Retail, Flipkart, and Amazon India are investing in IoT-based shelf monitoring, AI-based inventory checking, and cloud-based stockroom management to enhance efficiency and keep shrinkage in check.

With disjointed supply chains and very high retail shrink, the retailers are implementing real-time OSA solutions to effectively address exact inventory positions and reduce lost sales. Moreover, the expansion of hyperlocal modes of delivery and omnichannel shopping approaches is inducing the necessity for automated tracking products for stock with real-time stock visibility on e-commerce platforms, warehouses, and physical stores. FMI believes that the Indian market will grow at 11.7% CAGR during the research period with the support of accelerated retail digitalization, AI-driven inventory optimization, and expansion in quick-commerce models.

Growth Drivers in India

| Major Drivers | Information |

|---|---|

| Expansion of Retail Markets | Organized retail chains and online platforms expand their AI-driven inventory solutions. |

| High Shrinkage Rates in Retail | Stocks are monitored in real-time, reducing product loss and optimizing demand forecasting. |

| Implementation of Quick-Commerce Models | OSA solutions in hyperlocal delivery business provide real-time inventory accuracy within seconds. |

The Chinese OSA solution industry is growing with an e-commerce market, accelerated uptake of AI-based retail analytics, and increased expenditure on real-time inventory control. Alibaba, and Suning are adopting AI-based demand forecasting, RFID-tagged tracking, and automated inventory management systems to prevent out-of-stocks.

Alibaba and Suning are implementing AI-based demand forecasting with RFID-tagged tracking and automated inventory management systems to help eliminate out-of-stocks. The development of cashless retail, AI checkout systems, and computerized inventory replenishment systems in China also drives the application of OSA. Powering investments in automated supply chain management and IoT-based inventory solutions are China’s government-directed smart logistics and digital retailing transformation initiatives.

Growth Drivers in China

| Primary Drivers | Description |

|---|---|

| AI-Based Retail Analytics | Predictive analytics and machine learning power-optimized demand forecasting and inventory management. |

| Smart Logistics and Automation | Inventory management is enhanced with AI-powered inventory tracking. |

| Cashless Retail Expansion | IoT and RFID-based checkout systems enhance product availability in retail stores. |

The UK on-shelf Availability (OSA) market is growing as retailers focus on automation, real-time inventory monitoring, and AI-driven inventory systems. Leading retail chains like Tesco, Sainsbury's, and Marks & Spencer are implementing AI-driven stock replenishment platforms and computer vision-based shelf analysis to prevent stockouts and provide enhanced customer experience.

Increased e-commerce and omnichannel retailing penetration drive demand for cloud-based OSA solutions to enable transparent online and offline visibility of stocks. Additionally, increased consumer expectations for product availability and same-day delivery facilitation are forcing retailers to maximize supply chain efficiency with AI-powered demand forecasting solutions.

Growth Drivers in the UK

| Key Drivers | Information |

|---|---|

| AI-Enabled Shelf Analytics | Computer vision and machine learning accelerate real-time tracking of stock. |

| Expansion of E-Commerce | Omnichannel retailing fuels the demand for cloud-based inventory visibility solutions. |

| Automated Replenishment Systems | Retailers use AI-based restocking systems to minimize stockouts. |

The On-Shelf Availability Solution Market has become fiercely competitive with the advent of technologies such as AI, RFID, IoT, and real-time analytics to help increase the visibility of stock-in-hand and reduce stockouts further. In retail and related services, the companies need automated solution which takes data-driven decisions on inventory management optimization and customer satisfaction.

Key players driving the AI-based OSA, real-time tracking of inventories, and analytics predictions space include Zebra, Checkpoint, IBM, Cisco, and Oracle. IBM and Oracle have infused their supply chain management applications with AI-driven automation; Cisco offers its signature IoT-enabled connectivity service, designed for end-to-end in-store surveillance; Zebra and Checkpoint-built RFID-based tracking solutions.

Having mid-sized competitors like SAP SE, Panasonic, and Impinj helping the market grow with their scalable yet affordable inventory tracking solutions. New players such as Retail Solutions Inc. (RSi) and Advantech Co., Ltd. are creating on the markets niche for unique OSA solutions.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.2 billion |

| Projected Market Size (2035) | USD 16.3 billion |

| CAGR (2025 to 2035) | 10.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Component | Hybrid, Public, Private |

| By Application | Managed Hosting, Colocation Applications, Hybrid Hosting, Shared Hosting, Website Hosting, Virtual Dedicated Servers, Virtual Private Servers |

| By Deployment Type | SMEs, Large Enterprises |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Relex Solutions, Zebra Technologies, SAP, Retail Insight, Trax Retail, Checkpoint Systems, SES-imagotag, Fluent Commerce, Intel, IBM |

| Additional Attributes | Dollar sales by material type, Dollar sales by end-use industry, Semi-annual growth rates, Country-wise insights, Industry highlights, Competitive landscape |

| Customization and Pricing | Available upon request |

The market is projected to witness CAGR of 10.1% between 2025 and 2035.

The market is expected to reach USD 6.2 billion in 2025.

The market is anticipated to reach USD 16.3 billion by 2035 end.

East Asia is set to record the highest CAGR of 12.7% in the assessment period.

The key players in the industry include International Business Machines Corporation, Panasonic Corporation, SAP SE, Impinj, Inc., Mindtree Ltd., Retail Solution Inc., Retail Velocity, Market6, Inc., Lokad, Verix, Frontier Field Marketing, NEOGRID, eBest IOT, and Enterra Solution LLC.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 4: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: Latin America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 11: Western Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 12: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: East Asia Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 21: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Component, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 13: Global Market Attractiveness by Component, 2024 to 2034

Figure 14: Global Market Attractiveness by End User, 2024 to 2034

Figure 15: Global Market Attractiveness by Region, 2024 to 2034

Figure 16: North America Market Value (US$ Million) by Component, 2024 to 2034

Figure 17: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 18: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 23: North America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 24: North America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 28: North America Market Attractiveness by Component, 2024 to 2034

Figure 29: North America Market Attractiveness by End User, 2024 to 2034

Figure 30: North America Market Attractiveness by Country, 2024 to 2034

Figure 31: Latin America Market Value (US$ Million) by Component, 2024 to 2034

Figure 32: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 33: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 43: Latin America Market Attractiveness by Component, 2024 to 2034

Figure 44: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 45: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 46: Western Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 47: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 48: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: Western Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 58: Western Europe Market Attractiveness by Component, 2024 to 2034

Figure 59: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 60: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 61: Eastern Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 62: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 73: Eastern Europe Market Attractiveness by Component, 2024 to 2034

Figure 74: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 75: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 76: South Asia and Pacific Market Value (US$ Million) by Component, 2024 to 2034

Figure 77: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 88: South Asia and Pacific Market Attractiveness by Component, 2024 to 2034

Figure 89: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 91: East Asia Market Value (US$ Million) by Component, 2024 to 2034

Figure 92: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 93: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 103: East Asia Market Attractiveness by Component, 2024 to 2034

Figure 104: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 105: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 106: Middle East and Africa Market Value (US$ Million) by Component, 2024 to 2034

Figure 107: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 118: Middle East and Africa Market Attractiveness by Component, 2024 to 2034

Figure 119: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 120: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

On-shelf Availability Solution Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Korea On-shelf Availability Solution Market – Demand & Forecast 2025 to 2035

Western Europe On-Shelf Availability Solution Market Growth – Trends & Forecast 2025 to 2035

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

NGS Solution for Early Cancer Screening Market Size and Share Forecast Outlook 2025 to 2035

5PL Solutions Market

High-Availability Server Market Size and Share Forecast Outlook 2025 to 2035

High-Resolution Anoscopy Market Size and Share Forecast Outlook 2025 to 2035

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

G-3 PLC Solution Market – Smart Grids & Connectivity

Docketing Solution Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

WealthTech Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Geospatial Solution Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA