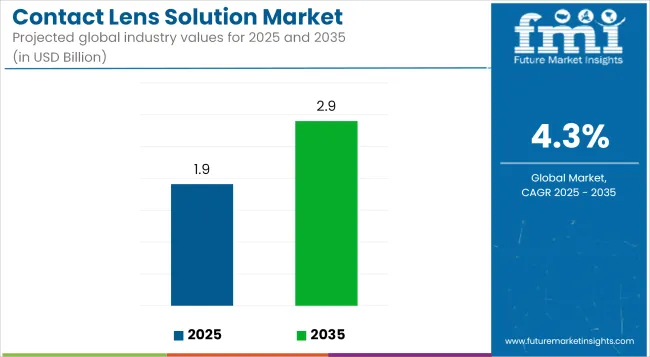

The contact lens solution market is set to register USD 1.91 billion in 2025. The industry is expected to grow at 4.3% CAGR from 2025 to 2035 and reach USD 2.90 billion by 2035.

The driving force behind this growth is the increasing popularity of multi-purpose solutions that combine cleaning, rinsing, disinfecting, and storage functions in a single solution. For instance, top brands Bausch, Lomb and Alcon have come up with Biotrue and Opti-Free Puremoist, two innovative multi-purpose solutions that not only remove dirt but also imitate natural tears for longer-wearers ensuring hydration and comfort.

One of the critical issues that the industry will have to deal with is the increasing incidences of eye diseases especially vision disorders like myopia and astigmatism which digital eye strain and prolonged screen time can worsen. Some research studies show that close to half of the world's population might have myopia by the year 2050 which means that more people will need to wear contact lenses and of course, lens care solutions.

Also, innovations in lens material and extended-wear contact lenses have augmented the demand for dedicated cleaning solutions that provide adequate hydration, removal of proteins, and antimicrobial protection. Consumers nowadays are increasingly giving importance to comfort, eye care, and convenience, and hence there has been growing popularity for multi-purpose and hydrogen peroxide-based solutions which provide better disinfection while being mild on the eyes.

The increase in disposable income and enhanced availability of eye care services in developing countries has also driven growth in the industry. As contact lenses are becoming more popular among individuals, eye care practitioners and optometrists are prescribing quality lens care solutions to avoid infection and extend lens lifespan.

In addition, escalating consciousness toward ocular hygiene and the potential hazards from lens care that is not done correctly, including corneal infections and dry eye syndrome, has fueled consumer dependence on professional cleaning and conditioning agents.

This table assesses critical parameters for four key stakeholder groups-end users, optometrists, retail pharmacies, and manufacturers-in the contact lens solution market. Cleaning and disinfection efficacy is accorded a high rating by all groups, highlighting its critical importance for ocular health.

Eye comfort and safety are also rated highly by end users and optometrists but are rated as moderately important by retail pharmacies and manufacturers, possibly reflecting a greater emphasis on operational or production considerations rather than patient-centred approaches. Price and value for money are extremely important to end users, while the other groups find cost to be moderately important.

Manufacturers find packaging and convenience less relevant and end users and retail pharmacies find these moderately essential. Brand trust and consistency gets high rating from end users and medium rating from other stakeholders. Finally, moderate ratings for the availability and distribution of products across most groups point to the need for consistent supply of a product.

The industry for contact lens solutions has grown steadily through 2020 to 2024 owing to increasing cases of eye defects, increasing contact lens adoption and several developments in multipurpose cleaning solutions. Demand for lens cleaning solutions has fluctuated due to the e-commerce boom and growing consumer health awareness.

Along with disinfecting, the introduction of preservative-free formulas and travel-size packages made them more flexible and obviously safer. Manufacturers also faced challenges with the regulatory burden with respect to preservatives, increasing environmental concerns about plastic waste, and product recalls due to sporadic contamination risks.

Between 2025 and 2035, AI-enabled smart lens solutions are expected to bring a change in lens care by providing real-time tracking of hygiene and automated reminders to clean. Sustainability will form one of the areas of focus, with companies launching biodegradable packaging, refillable dispensers, and chemical-free formulations.

Regulatory agencies will tighten their safety standards, which will work in favor of the antimicrobial and material compatibility. The enforcement of bioengineered cleaning agents and green processes will be further propelled by consumer demand for sustainable but high-performance lens care solutions.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Preservative safety and antimicrobial effectiveness under FDA and EU regulations. A few recalls for contamination issues. | Tighter worldwide quality control standards on long-term solution stability. More regulation on sustainable packaging materials. |

| Expansion of multipurpose and hydrogen peroxide-based lens solutions. | Restricted use of smart dispensing technology. |

| AI-powered recommendations for individualized lens care. | Bioengineered enzymes optimize cleaning effectiveness without compromising lens integrity. |

| High demand for single-use disinfectant and storage products. | Growing preference for preservative-free products. |

| Greater use of environment-friendly, biodegradable products. | Rise in digital eye care integration for lens hygiene reminders. |

| Growing contact lens usage, particularly among younger age groups. | Increased online sales and subscription-based lens care services. |

| Growth in AI-based personalized eye care. | Rise in reusable and sustainable lens care solutions to minimize environmental footprint. |

| Implementation of recyclable packaging and plastic minimization by some producers. | Widespread use of refillable dispensers and plant-based packaging materials. AI-optimized production minimizes chemical waste. |

| Reliance on North American, European, and Asian producers for chemical constituents. Supply chain interruptions impacted availability of specialized solutions. | Localized production centers improve supply chain resilience. Blockchain-based tracking for product safety and authenticity. |

The contact lens solution industry is subject to rigorous oversight, and must meet high standards as mandated by the FDA, CE, and international regulations. Failure to comply could lead to recalls, fines, and reputational damage. The 2006 Bausch & Lomb recall, which was tied to fungal infections, is one of the best-known examples of how safety can shake people’s confidence in the market. To cater to the stringent requisites and retain the trust of consumers, companies need to invest in quality assurance.

Manufacturing is dependent on specialized chemicals and sterile packaging. Geopolitical events or other logistics problems can disrupt raw material sourcing and slow down production. The coronavirus pandemic showed global crises can put pressure on supply chains and create shortages and bottlenecks in distribution. To mitigate such risks, companies need to diversify their supplier base and improve inventory planning.

The landscape is very competitive, with USA sales dominated by private-label solutions. These low-cost competitors force branded manufacturers to justify premium prices with innovation or branding. The increasing use of daily disposable lenses, which minimizes long-term needs for cleaning solutions is also a structural threat to the sector.

High price competition of branded vs private label solutions are in the market. Store brands account for sales, leaving premium brands dependent on promotions, multi-pack bargains and loyalty programs to keep customers. Regular discounts keep sales moving while avoiding a permanent reduction in retail prices.

Regular multipurpose products are cost-based price, while premium varieties - like peroxide or formulations made for sensitive eye - are value-based price. Manufacturers promote these products as providing better disinfection or comfort to justify the higher prices.

Premium brands such as Biotrue and Opti-Free are aimed specifically at consumers who are willing to spend for an extra benefit, but budget brands, including store brands, target consumers who are more cash conscious. Companies often make both segments, wholesaling private labels while keeping premium lines.

Subscription models, bulk purchase discounts and bundled offerings with contact lenses help keep customers in the fold and pricing more stable. Retailers design tiered packaging with small travel sizes at relatively high pricing per unit, while larger multi-packs decrease the unit cost so that bulk purchases become tempting to users. Rebates and promotions are utilized by manufacturers to improve competitive positioning in an environment that is sensitive to the cost.

Multipurpose solutions account for the largest share of the contact lens solution market due to their all-in-one capabilities, enabling users to clean, disinfect, rinse, and store lenses with a single product. These solutions are especially popular among those who wear soft contact lenses, which account for more than 85% of the global contact lenses industry.

Rising usage of the product for vision correction and cosmetic usage, along with developments in preservative free, hypoallergenic and hydrating formulations are further fueling the demand.

Bausch + Lomb’s Bio true® multipurpose solution contains hyaluronan, which closely resembles natural tears, and keeps contacts comfortable. The industry in North America and Europe has been driven by strong consumer preference and sophisticated retail networks, while Asia-Pacific is currently experiencing rapid growth as a result of increasing lens adoption and expanding pharmacy chains.

The most widely used volume size is between 160 ml to 250 ml, which is for daily and frequent contact lens users who desire cost-effective, convenience, and usability. They are available in pharmacies, supermarkets, and even online retail platforms, which makes them a top option for people that wear lenses regularly.

Increasing demand for subscription-based lens care kits, bulk purchase discounts, and travel-friendly but long-lasting solutions is fueling these trends. For instance, one of the most popular 300 ml options is Alcon’s Opti-Free Pure moist® which usually comes in twin-pack to promote affordability.

The major function of contact lens solutions is to clean and disinfect, keeping lenses free of bacteria, debris, and protein deposits. Contact lenses are subject to environmental residues, tear film deposits, and microorganisms during the day, so they must be cleaned often to ensure good eye health and avoid infection.

Multi-purpose solutions, being used most frequently, have both cleaning and disinfecting properties, making them suitable for everyday use. Hydrogen peroxide solutions offer a more penetrating disinfection process, effectively killing dangerous pathogens without being preservative-based, minimizing the potential for eye irritation.

Retail pharmacies continue to be the point of purchase of choice, as they provide instant access to lens care products, enabling consumers to purchase solutions at the point of need without having to wait for delivery. Consumers value pharmacies for their established reputation, expert advice, and multiple brand availability, and thus they are a leading distribution channel.

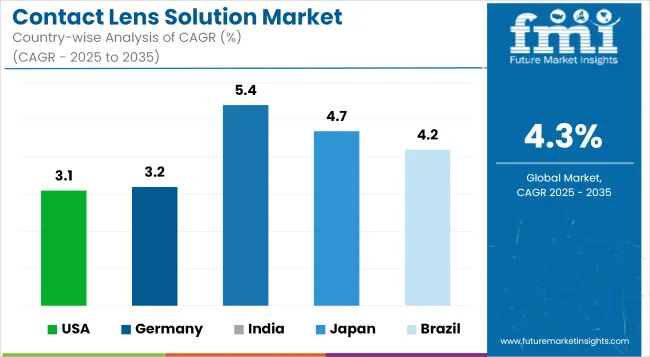

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.1% |

| Germany | 3.2% |

| India | 5.4% |

| Japan | 4.7% |

| Brazil | 4.2% |

The USA is experiencing a rising demand for contact lenses due to an increasing rate of vision loss and convenience culture over traditional glasses. FMI is of the opinion that the USA contact lens solution market is slated to grow at 3.1% CAGR during the study period.

The growth is driven by technological developments in lenses, rising awareness of eye care, and innovation in multipurpose contact lens fluids. Additionally, the presence of industry leaders and a well-established healthcare infrastructure are major contributory factors.

More than 150 million Americans have refractive defects, thus driving the market for corrective contact lenses. Beauty and convenience, particularly among young professionals, also drive contact lens demand. Technological advancements, like the development of silicone hydrogel lenses, allow for greater comfort and oxygen transmissibility, leading to greater user satisfaction. Contact lens solution washing, disinfecting, and storing in lenses are also reasons for their convenience and popularity.

Growth factors in the USA

| Key Drivers | Details |

|---|---|

| Increasing Vision Impairment | Over 150 million Americans have refractive disorders, which dictate the industry growth for correction contact lenses. |

| Aesthetic & Convenience Preference | Career-oriented young adults value convenience and looks over eyeglasses, and contact lenses are at the forefront. |

Germany's efficient healthcare sector is boosting the contact lens industry's ambitious growth. FMI is of the opinion that the German industry is slated to grow at 3.2% CAGR during the study period. The population trend of Germany's aging population also plays a big role in driving demand for contact lenses, backed by improvements in lens care technology.

The broad base of retailers and manufacturers in the optics sector also supports industry growth. Germany's elderly population needs vision correction, thus also driving increasing demand for contact lenses. Ongoing improvements in lens material and care products guarantee increased user comfort and safety.

The country has a high disposable income, enabling consumers to buy quality lenses and lens care products. Established channels such as optical outlets and pharmacies guarantee convenient availability of the products. Public health interventions make people aware of the significance of eye care, forcing them to clean lenses regularly.

Growth factors in Germany

| Key Drivers | Details |

|---|---|

| Older Population | An aging population necessitates vision correction, which is a cause for rising demand for lenses. |

| Innovation | Continuous advancements in lens technology and material make it safer and more comfortable. |

Urbanization and the fast-growing Indian population are the main drivers of growth for the contact lens market. FMI cites that the Indian industry is set to witness 5.4% CAGR from 2025 to 2035. In addition, cosmetic lenses like colored lenses are witnessing a surge in demand.

The wide availability of e-commerce sites is also improving the availability of contact lenses in the country. India boasts a large and youthful population, implying that there is a huge industry for contact lenses. People in urban areas are more receptive to contact lenses because of lifestyles and working needs.

More usage of electronic devices and higher screen times lead to digital eye strain, triggering correction demand. Decorative and coloring lenses are becoming increasingly popular, particularly among fashion-savvy customers. The presence of e-commerce websites leads to wider accessibility and convenience in purchasing contact lens products.

Growth factors in India

| Key Drivers | Details |

|---|---|

| Massive Population Base | Large and youthful population fuels the demand for contact lens consumers. |

| More Screen Time | More screen time results in vision issues, which creates demand for corrective lenses. |

FMI is of the opinion that the Japanese industry is predicted to grow at a CAGR of 4.7% from 2025 to 2035. The attention of the country toward quality and innovation in contact lens care products, as well as professional recommendations, is one of the primary drivers of the industry. Japanese consumers are highly technology conscious as well and expect innovative and superior lens products.

A majority of the population of Japan requires glasses for correction, and therefore, demand for contact lenses is growing. Japanese are fond of new and advanced lens care products. Cosmetically appealing contact lenses among young people generate demand. Stringent regulation results in improved products, as consumers require. Eye care practitioners actively encourage proper lens care, and this drives industry growth.

Growth factors in Japan

| Key Drivers | Details |

|---|---|

| High Prevalence of Myopia | There is a high prevalence of individuals requiring vision correction in Japan, thus raising the demand for lenses. |

| Savviness to Technology | Brazilians are fond of innovative and technologically sophisticated lens care products. |

Contact lens demand in Brazil is driven by rising awareness towards eye care, expanding middle class, and fashion. FMI is of the opinion that the industry will grow at a CAGR of 4.2% during 2025 to 2035. Cosmetic and colored lenses, especially among the youth, are one of the driving factors in Brazil. Rising healthcare infrastructure development and e-commerce website expansion also improve population access to lens products. Expansion in the middle class with rising disposable income makes consumers afford quality eye care products.

Decorative and colored contact lenses, particularly among young consumers, are gaining popularity and creating demand for contact lenses. More professional optometry services and eye care clinics make prescription of contact lenses easier. Government funding of vision care services increases accessibility and awareness of contact lens services.

Growth factors in Brazil

| Key Drivers | Details |

|---|---|

| Growth of the Middle-Class Population | Increased disposable income allows for investment in quality eye care items. |

| Fashion Contact Lenses | Decorative and colored lenses are highly popular among youth, fuelling demand. |

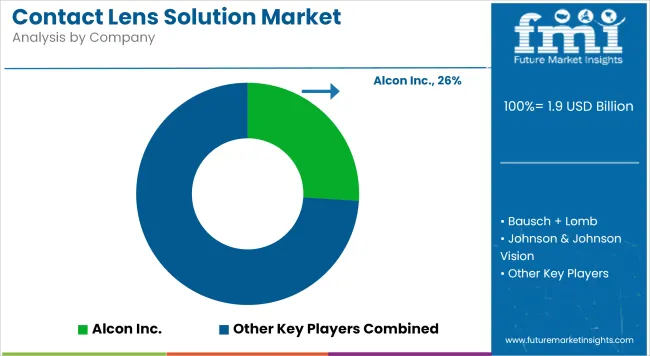

Key players include Alcon, Bausch & Lomb, Johnson & Johnson Vision Care, CooperVision, and Essilor. Johnson & Johnson Vision Care spends on research and development (R&D) to develop lens care formulations to make lenses more comfortable and efficient in disinfection. CooperVision concentrates on developing its contact lens ecosystem, providing bundled solutions to specialty lenses.

Menicon and other niche players target preservative-free and specialty lens solutions as consumers increasingly look for more gentle and biocompatible products. E-commerce growth, direct-to-consumer sales, and sustainability-focused packaging innovations are also among the most important strategies influencing competition in this changing industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Alcon Inc. | 22-26% |

| Bausch + Lomb | 18-22% |

| Johnson & Johnson Vision | 10-14% |

| CooperVision | 8-12% |

| Menicon Co., Ltd. | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Alcon Inc. | Provides a range of multi-purpose and hydrogen peroxide-based lens care solutions, including Opti-Free and Clear Care products. |

| Bausch + Lomb | Offers market-leading lens care solutions such as Biotrue and ReNu, designed for hydration and effective disinfection. |

| Johnson & Johnson Vision | Specializes in eye health solutions, including disinfecting and conditioning solutions for soft and rigid gas permeable lenses. |

| CooperVision | Develops advanced contact lens solutions that enhance comfort and prolong lens wear while maintaining eye health. |

| Menicon Co., Ltd. | Manufactures specialty lens care solutions, particularly for rigid and hybrid lenses, focusing on deep cleaning and disinfection. |

Key Company Insights

Alcon Inc. (22-26%)

Alcon creates multi-purpose and hydrogen peroxide-based contact lens solutions that deliver comfort and facilitate proper lens maintenance.

Bausch + Lomb (18-22%)

Bausch + Lomb has popular brands like Biotrue and ReNu that serve different types of lens users.

Johnson & Johnson Vision (10-14%)

Renowned for its eye care experience, Johnson & Johnson Vision offers high quality disinfecting and conditioning systems to improve lens cleanliness and wearability.

CooperVision (8-12%)

CooperVision broadens its product line to encompass lens care products that improve lens hydration and longevity.

Menicon Co., Ltd. (5-9%)

Menicon deals with specialty contact lens solutions for deep cleaning and safety of the eyes.

By product type, the segmentation is as multipurpose solution, hydrogen peroxide solution, rigid gas permeable solution, enzymatic protein removers, daily cleaners, and other product types.

By volume, the industry is divided into 50 ml to 150 ml, 160 ml to 250 ml, and more than 250 ml.

By purpose, the segmentation is as cleaning and disinfectant, anti-bacterial, and protein cleaners.

By distribution channel, the segmentation is as retail pharmacies, eye care practitioners, e-commerce, and other distribution channels.

By region, the segmentation is as North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry will be worth USD 1.91 billion in 2025.

The industry is predicted to reach a size of USD 2.90 billion by 2035.

Key companies include Alcon Inc., Bausch + Lomb, Johnson & Johnson Vision, CooperVision, Menicon Co., Ltd., Novartis AG, Avizor, Sensimed AG, Clerz (Abbott Medical Optics), OcuSoft, CLEAN CARE, Bausch+Lomb Pvt Ltd, ACUVUE, AbbVie, FreshKon, PuriLens Plus Saline, Stericon Pharma Pvt. Ltd., Ciba Vision, CLB VISION, and INTEROJO Co. Ltd.

Multipurpose solutions are widely used.

The Indian market, set to grow at 5.4% CAGR during the forecast period, is expected to witness fastest growth.

Table 01: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 02: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Volume

Table 03: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Purpose

Table 04: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 05: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Region

Table 06: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 07: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 08: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Volume

Table 09: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Purpose

Table 10: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 11: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 12: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 13: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Volume

Table 14: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Purpose

Table 15: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 16: Europe Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 17: Europe Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 18: Europe Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Volume

Table 19: Europe Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Purpose

Table 20: Europe Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 21: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 22: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 23: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Volume

Table 24: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Purpose

Table 25: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 26: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 27: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 28: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Volume

Table 29: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Purpose

Table 30: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 31: Oceania Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 32: Oceania Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 33: Oceania Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Volume

Table 34: Oceania Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Purpose

Table 35: Oceania Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 36: Middle East & Africa Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 37: Middle East & Africa Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Product

Table 38: Middle East & Africa Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Volume

Table 39: Middle East & Africa Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Purpose

Table 40: Middle East & Africa Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Figure 01: Global Market Value (US$ Million) Analysis, 2019 to 2023

Figure 02: Global Market Forecast & Y-o-Y Growth, 2024 to 2034

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2034

Figure 04: Global Market Value Share (%) Analysis 2024 to 2034, by Product

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Product

Figure 06: Global Market Attractiveness Analysis 2024 to 2034, by Product

Figure 07: Global Market Value Share (%) Analysis 2024 to 2034, by Volume

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Volume

Figure 09: Global Market Attractiveness Analysis 2024 to 2034, by Volume

Figure 10: Global Market Value Share (%) Analysis 2024 to 2034, by Purpose

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Purpose

Figure 12: Global Market Attractiveness Analysis 2024 to 2034, by Purpose

Figure 13: Global Market Value Share (%) Analysis 2024 to 2034, by Distribution Channel

Figure 14: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Distribution Channel

Figure 15: Global Market Attractiveness Analysis 2024 to 2034, by Distribution Channel

Figure 16: Global Market Value Share (%) Analysis 2024 to 2034, by Region

Figure 17: Global Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Region

Figure 18: Global Market Attractiveness Analysis 2024 to 2034, by Region

Figure 19: North America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 20: North America Market Value (US$ Million) Forecast, 2023 to 2032

Figure 21: North America Market Value Share, by Product (2024 E)

Figure 22: North America Market Value Share, by Volume (2024 E)

Figure 23: North America Market Value Share, by Purpose (2024 E)

Figure 24: North America Market Value Share, by Distribution Channel (2024 E)

Figure 25: North America Market Value Share, by Country (2024 E)

Figure 26: North America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 27: North America Market Attractiveness Analysis by Volume, 2024 to 2034

Figure 28: North America Market Attractiveness Analysis by Purpose, 2024 to 2034

Figure 29: North America Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 30: North America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 31: U.S. Market Value Proportion Analysis, 2021

Figure 32: Global Vs. U.S. Growth Comparison

Figure 33: U.S. Market Share Analysis (%) by Product, 2023 to 2034

Figure 34: U.S. Market Share Analysis (%) by Volume, 2023 to 2034

Figure 35: U.S. Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 36: U.S. Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 37: Canada Market Value Proportion Analysis, 2021

Figure 38: Global Vs. Canada. Growth Comparison

Figure 39: Canada Market Share Analysis (%) by Product, 2023 to 2034

Figure 40: Canada Market Share Analysis (%) by Volume, 2023 to 2034

Figure 41: Canada Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 42: Canada Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 43: Latin America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 44: Latin America Market Value (US$ Million) Forecast, 2023 to 2032

Figure 45: Latin America Market Value Share, by Product (2024 E)

Figure 46: Latin America Market Value Share, by Volume (2024 E)

Figure 47: Latin America Market Value Share, by Purpose (2024 E)

Figure 48: Latin America Market Value Share, by Distribution Channel (2024 E)

Figure 49: Latin America Market Value Share, by Country (2024 E)

Figure 50: Latin America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 51: Latin America Market Attractiveness Analysis by Volume, 2024 to 2034

Figure 52: Latin America Market Attractiveness Analysis by Purpose, 2024 to 2034

Figure 53: Latin America Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 55: Mexico Market Value Proportion Analysis, 2021

Figure 56: Global Vs Mexico Growth Comparison

Figure 57: Mexico Market Share Analysis (%) by Product, 2023 to 2034

Figure 58: Mexico Market Share Analysis (%) by Volume, 2023 to 2034

Figure 59: Mexico Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 60: Mexico Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 61: Brazil Market Value Proportion Analysis, 2021

Figure 62: Global Vs. Brazil. Growth Comparison

Figure 63: Brazil Market Share Analysis (%) by Product, 2023 to 2034

Figure 64: Brazil Market Share Analysis (%) by Volume, 2023 to 2034

Figure 65: Brazil Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 66: Brazil Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 67: Argentina Market Value Proportion Analysis, 2021

Figure 68: Global Vs Argentina Growth Comparison

Figure 69: Argentina Market Share Analysis (%) by Product, 2023 to 2034

Figure 70: Argentina Market Share Analysis (%) by Volume, 2023 to 2034

Figure 71: Argentina Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 72: Argentina Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 73: Europe Market Value (US$ Million) Analysis, 2019 to 2023

Figure 74: Europe Market Value (US$ Million) Forecast, 2023 to 2032

Figure 75: Europe Market Value Share, by Product (2024 E)

Figure 76: Europe Market Value Share, by Volume (2024 E)

Figure 77: Europe Market Value Share, by Purpose (2024 E)

Figure 78: Europe Market Value Share, by Distribution Channel (2024 E)

Figure 79: Europe Market Value Share, by Country (2024 E)

Figure 80: Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 81: Europe Market Attractiveness Analysis by Volume, 2024 to 2034

Figure 82: Europe Market Attractiveness Analysis by Purpose, 2024 to 2034

Figure 83: Europe Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 84: Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 85: UK Market Value Proportion Analysis, 2021

Figure 86: Global Vs. UK Growth Comparison

Figure 87: UK Market Share Analysis (%) by Product, 2023 to 2034

Figure 88: UK Market Share Analysis (%) by Volume, 2023 to 2034

Figure 89: UK Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 90: UK Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 91: Germany Market Value Proportion Analysis, 2021

Figure 92: Global Vs. Germany Growth Comparison

Figure 93: Germany Market Share Analysis (%) by Product, 2023 to 2034

Figure 94: Germany Market Share Analysis (%) by Volume, 2023 to 2034

Figure 95: Germany Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 96: Germany Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 97: Italy Market Value Proportion Analysis, 2021

Figure 98: Global Vs. Italy Growth Comparison

Figure 99: Italy Market Share Analysis (%) by Product, 2023 to 2034

Figure 100: Italy Market Share Analysis (%) by Volume, 2023 to 2034

Figure 101: Italy Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 102: Italy Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 103: France Market Value Proportion Analysis, 2021

Figure 104: Global Vs France Growth Comparison

Figure 105: France Market Share Analysis (%) by Product, 2023 to 2034

Figure 106: France Market Share Analysis (%) by Volume, 2023 to 2034

Figure 107: France Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 108: France Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 109: Spain Market Value Proportion Analysis, 2021

Figure 110: Global Vs Spain Growth Comparison

Figure 111: Spain Market Share Analysis (%) by Product, 2023 to 2034

Figure 112: Spain Market Share Analysis (%) by Volume, 2023 to 2034

Figure 113: Spain Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 114: Spain Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 115: Russia Market Value Proportion Analysis, 2021

Figure 116: Global Vs Russia Growth Comparison

Figure 117: Russia Market Share Analysis (%) by Product, 2023 to 2034

Figure 118: Russia Market Share Analysis (%) by Volume, 2023 to 2034

Figure 119: Russia Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 120: Russia Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 121: BENELUX Market Value Proportion Analysis, 2021

Figure 122: Global Vs BENELUX Growth Comparison

Figure 123: BENELUX Market Share Analysis (%) by Product, 2023 to 2034

Figure 124: BENELUX Market Share Analysis (%) by Volume, 2023 to 2034

Figure 125: BENELUX Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 126: BENELUX Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 127: East Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 128: East Asia Market Value (US$ Million) Forecast, 2023 to 2032

Figure 129: East Asia Market Value Share, by Product (2024 E)

Figure 130: East Asia Market Value Share, by Volume (2024 E)

Figure 131: East Asia Market Value Share, by Purpose (2024 E)

Figure 132: East Asia Market Value Share, by Distribution Channel (2024 E)

Figure 133: East Asia Market Value Share, by Country (2024 E)

Figure 134: East Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 135: East Asia Market Attractiveness Analysis by Volume, 2024 to 2034

Figure 136: East Asia Market Attractiveness Analysis by Purpose, 2024 to 2034

Figure 137: East Asia Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 138: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 139: China Market Value Proportion Analysis, 2021

Figure 140: Global Vs. China Growth Comparison

Figure 141: China Market Share Analysis (%) by Product, 2023 to 2034

Figure 142: China Market Share Analysis (%) by Volume, 2023 to 2034

Figure 143: China Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 144: China Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 145: Japan Market Value Proportion Analysis, 2021

Figure 146: Global Vs. Japan Growth Comparison

Figure 147: Japan Market Share Analysis (%) by Product, 2023 to 2034

Figure 148: Japan Market Share Analysis (%) by Volume, 2023 to 2034

Figure 149: Japan Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 150: Japan Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 151: South Korea Market Value Proportion Analysis, 2021

Figure 152: Global Vs South Korea Growth Comparison

Figure 153: South Korea Market Share Analysis (%) by Product, 2023 to 2034

Figure 154: South Korea Market Share Analysis (%) by Volume, 2023 to 2034

Figure 155: South Korea Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 156: South Korea Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 157: South Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 158: South Asia Market Value (US$ Million) Forecast, 2023 to 2032

Figure 159: South Asia Market Value Share, by Product (2024 E)

Figure 160: South Asia Market Value Share, by Volume (2024 E)

Figure 161: South Asia Market Value Share, by Purpose (2024 E)

Figure 162: South Asia Market Value Share, by Distribution Channel (2024 E)

Figure 163: South Asia Market Value Share, by Country (2024 E)

Figure 164: South Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 165: South Asia Market Attractiveness Analysis by Volume, 2024 to 2034

Figure 166: South Asia Market Attractiveness Analysis by Purpose, 2024 to 2034

Figure 167: South Asia Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 168: South Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 169: India Market Value Proportion Analysis, 2021

Figure 170: Global Vs. India Growth Comparison

Figure 171: India Market Share Analysis (%) by Product, 2023 to 2034

Figure 172: India Market Share Analysis (%) by Volume, 2023 to 2034

Figure 173: India Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 174: India Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 175: Indonesia Market Value Proportion Analysis, 2021

Figure 176: Global Vs. Indonesia Growth Comparison

Figure 177: Indonesia Market Share Analysis (%) by Product, 2023 to 2034

Figure 178: Indonesia Market Share Analysis (%) by Volume, 2023 to 2034

Figure 179: Indonesia Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 180: Indonesia Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 181: Malaysia Market Value Proportion Analysis, 2021

Figure 182: Global Vs. Malaysia Growth Comparison

Figure 183: Malaysia Market Share Analysis (%) by Product, 2023 to 2034

Figure 184: Malaysia Market Share Analysis (%) by Volume, 2023 to 2034

Figure 185: Malaysia Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 186: Malaysia Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 187: Thailand Market Value Proportion Analysis, 2021

Figure 188: Global Vs. Thailand Growth Comparison

Figure 189: Thailand Market Share Analysis (%) by Product, 2023 to 2034

Figure 190: Thailand Market Share Analysis (%) by Volume, 2023 to 2034

Figure 191: Thailand Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 192: Thailand Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 193: Oceania Market Value (US$ Million) Analysis, 2019 to 2023

Figure 194: Oceania Market Value (US$ Million) Forecast, 2023 to 2032

Figure 195: Oceania Market Value Share, by Product (2024 E)

Figure 196: Oceania Market Value Share, by Volume (2024 E)

Figure 197: Oceania Market Value Share, by Purpose (2024 E)

Figure 198: Oceania Market Value Share, by Distribution Channel (2024 E)

Figure 199: Oceania Market Value Share, by Country (2024 E)

Figure 200: Oceania Market Attractiveness Analysis by Product, 2024 to 2034

Figure 201: Oceania Market Attractiveness Analysis by Volume, 2024 to 2034

Figure 202: Oceania Market Attractiveness Analysis by Purpose, 2024 to 2034

Figure 203: Oceania Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 204: Oceania Market Attractiveness Analysis by Country, 2024 to 2034

Figure 205: Australia Market Value Proportion Analysis, 2021

Figure 206: Global Vs. Australia Growth Comparison

Figure 207: Australia Market Share Analysis (%) by Product, 2023 to 2034

Figure 208: Australia Market Share Analysis (%) by Volume, 2023 to 2034

Figure 209: Australia Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 210: Australia Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 211: New Zealand Market Value Proportion Analysis, 2021

Figure 212: Global Vs New Zealand Growth Comparison

Figure 213: New Zealand Market Share Analysis (%) by Product, 2023 to 2034

Figure 214: New Zealand Market Share Analysis (%) by Volume, 2023 to 2034

Figure 215: New Zealand Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 216: New Zealand Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 217: Middle East & Africa Market Value (US$ Million) Analysis, 2019 to 2023

Figure 218: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2032

Figure 219: Middle East & Africa Market Value Share, by Product (2024 E)

Figure 220: Middle East & Africa Market Value Share, by Volume (2024 E)

Figure 221: Middle East & Africa Market Value Share, by Purpose (2024 E)

Figure 222: Middle East & Africa Market Value Share, by Distribution Channel (2024 E)

Figure 223: Middle East & Africa Market Value Share, by Country (2024 E)

Figure 224: Middle East & Africa Market Attractiveness Analysis by Product, 2024 to 2034

Figure 225: Middle East & Africa Market Attractiveness Analysis by Volume, 2024 to 2034

Figure 226: Middle East & Africa Market Attractiveness Analysis by Purpose, 2024 to 2034

Figure 227: Middle East & Africa Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 228: Middle East & Africa Market Attractiveness Analysis by Country, 2024 to 2034

Figure 229: GCC Countries Market Value Proportion Analysis, 2021

Figure 230: Global Vs GCC Countries Growth Comparison

Figure 231: GCC Countries Market Share Analysis (%) by Product, 2023 to 2034

Figure 232: GCC Countries Market Share Analysis (%) by Volume, 2023 to 2034

Figure 233: GCC Countries Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 234: GCC Countries Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 235: Turkey Market Value Proportion Analysis, 2021

Figure 236: Global Vs. Turkey Growth Comparison

Figure 237: Turkey Market Share Analysis (%) by Product, 2023 to 2034

Figure 238: Turkey Market Share Analysis (%) by Volume, 2023 to 2034

Figure 239: Turkey Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 240: Turkey Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 241: South Africa Market Value Proportion Analysis, 2021

Figure 242: Global Vs. South Africa Growth Comparison

Figure 243: South Africa Market Share Analysis (%) by Product, 2023 to 2034

Figure 244: South Africa Market Share Analysis (%) by Volume, 2023 to 2034

Figure 245: South Africa Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 246: South Africa Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Figure 247: North Africa Market Value Proportion Analysis, 2021

Figure 248: Global Vs North Africa Growth Comparison

Figure 249: North Africa Market Share Analysis (%) by Product, 2023 to 2034

Figure 250: North Africa Market Share Analysis (%) by Volume, 2023 to 2034

Figure 251: North Africa Market Share Analysis (%) by Purpose, 2023 to 2034

Figure 252: North Africa Market Share Analysis (%) by Distribution Channel, 2023 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contact Cement Market Size and Share Forecast Outlook 2025 to 2035

Contactor Market Size and Share Forecast Outlook 2025 to 2035

Contactor-based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Contactless Delivery Services Market Size and Share Forecast Outlook 2025 to 2035

Contact and Convective Dryers Market Size and Share Forecast Outlook 2025 to 2035

Contact Center Analytics Market Size and Share Forecast Outlook 2025 to 2035

Contact-Free Sleep Monitoring Systems Market Trends - Growth & Forecast 2025 to 2035

Contact Tracing Application Market by Connectivity (Bluetooth, GPS and Both) by Operating System (Android and iOS) & Region Forecast till 2035

Contactless Biometric Technology Market by Technology, Component, Application & Region Forecast till 2035

Contactless Ticketing Market Analysis – Growth & Forecast through 2034

Contact Center as a Service Market Trends - Growth & Forecast through 2034

Contactless Ticketing ICs Market

Contact Thermometer Market

Contactless Smart Card Market

Contactless Payment Market

Contact Image Sensor Market

Contactless Payment Terminals Market

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Industry Analysis in GCC Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA