The contact lenses market is set to experience significant growth from 2025 to 2035, driven by increasing demand for vision correction solutions, rising aesthetic preferences for coloured lenses, and technological advancements in lens materials.

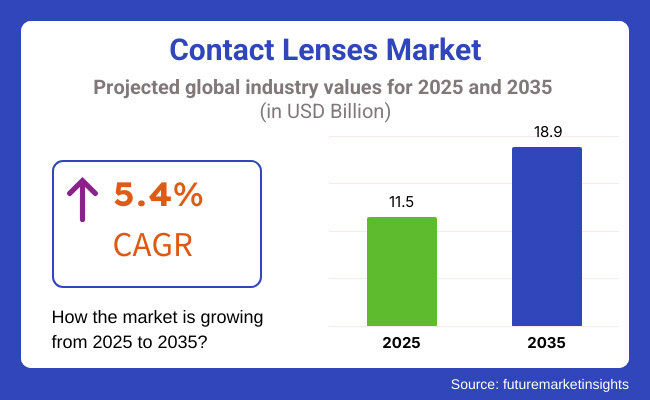

The market is projected to expand from USD 11.5 billion in 2025 to USD 18.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.4% over the forecast period.

This growth is supported by the rising frequency of diplopia and other vision-related diseases, coupled with a shift toward diurnal disposable and silicone hydrogel lenses for enhanced comfort and convenience.

Also, smart contact lenses with stoked reality (AR) capabilities and medicine-delivery mechanisms are becoming crucial inventions in the assiduity. The growing trend of online retail and subscription-grounded lens force services is further boosting request expansion.

North America is anticipated to lead the contact lens request due to the high frequency of vision impairments, strong consumer mindfulness, and a well-established eye care structure.

The region is witnessing a shift toward diurnal disposables and toric lenses, offering better eye health benefits. also, e-commerce platforms are playing a pivotal part in adding availability, with online retailers offering competitive pricing and subscription-grounded delivery models.

Europe will witness steady growth in contact lens requests, driven by a growing population, rising relinquishment of ornamental and specialty lenses, and strong nonsupervisory support for vision care.

The demand for multifocal and cold-blooded lenses is increasing among aged grown-ups, while youngish consumers are gravitating toward coloured and fashion lenses. Sustainable and bio-based lens accoutrements are gaining traction, pushing manufacturers to concentrate on eco-friendly inventions.

Asia-Pacific is anticipated to be the swift-growing region in the contact lens request, with countries like China, Japan, and South Korea driving demand. The increasing frequency of diplopia, especially among youngish populations, is a crucial growth factor. The influence of beauty trends and social media is also fueling the demand for coloured and circle lenses.Likewise, rising disposable inflows and bettered access to vision care services are accelerating request expansion in the region.

One of the major challenges in the contact lenses request is the high cost of advanced lenses, making affordability a concern, especially in developing requests.

Also, indecorous lens operation, lack of hygiene, and extended wear and tear durations increase the threat of eye infections, including corneal ulcers. Educating consumers on lens care, hygiene, and responsible operation remains a critical challenge for manufacturers and eye care professionals.

The rising interest in smart contact lenses, featuring stoked reality (AR), glucose monitoring, and medicine delivery capabilities, presents a significant occasion for request expansion. Leading companies are investing in R&D to develop lenses that go beyond vision correction, integrating technology for enhanced functionalities.

Also, the shift toward sustainable and biodegradable lens accoutrements is gaining instigation, as consumers and controllers emphasize eco-friendly results in the eye care assiduity.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 34.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 12.50 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 27.90 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 25.60 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 29.40 |

The USA leads the global contact lens request, driven by high relinquishment rates of diurnal disposable and specialty lenses. Inventions similar as blue light-blocking and humidity-retaining lenses contribute to increase per capita spending.Retail chains, online platforms, and direct-to-consumer subscription models boost availability and affordability

China’s contact lens request is expanding as youngish consumers shift towards aesthetic and vision-correcting lenses. The demand for multicolour lenses is high, told by beauty trends and K- pop culture. Domestic brands contend with transnational manufacturers, and e-commerce platforms similar as JD.com and Taboo drive deals.

Japan has one of the loftiest per capita spending rates on contact lenses, thanks to a strong preference for high-quality and advanced lens technologies. Day disposables dominate the request, and consumers prioritize comfort, UV protection, and antibacterial coatings. Regulatory norms ensure ultra-expensive product quality.

Germany’s contact lens request benefits from rising mindfulness of eye health and a preference for soft, silicone hydrogel lenses. Optic retailers and online platforms see strong growth, while tori and multifocal lenses gain fashion ability among growing consumers

The UK request is fuelled by growing demand for ornamental and corrective lenses.Subscription-grounded models and advancements in traditional digital tradition services simplify access.Consumers decreasingly conclude for decoration lenses with added hydration and anti-fatigue features, supporting request growth.

The contact lens market is expanding rapidly on the strength of mounting requirements for vision correction, cosmetic uses of lenses, and improvements in lens material technologies. The findings of a poll of 250 consumers, practitioners, and industry representatives are predictive of trends driving the market.

Single-use lenses influence consumer demand, and 59% of the subjects prefer single-use lenses as it is convenient, there is an advantage of hygiene, and a lesser opportunity for getting infected. While 27% continue opting for monthlies or fortnightlies as it is cheap and convenient for them.

Cosmetic and colour contact lenses are trendy, and 41% of young consumers (18-35 years) are keen on appearance-enhancing contact lenses for appearance, particularly for social media pictures and festive occasions. Top preferred are natural colour contact lenses and soft enhancement contact lenses with requirement for statement colour and bold colour at 19%.

Innovation in lens material and smart technology are driving demand, with 48% of industry experts selecting silicone hydrogel as their preferred material of choice because of its increased oxygen permeability and comfort.

Another 31% of optometrists predict higher adoption of smart lenses for potential use in augmented reality (AR), monitoring diabetic blood glucose levels, and blue light filtering.

Online shopping and subscription plans are changing the market with 64% of the consumers buying contact lenses online as it is affordable, convenient, and gets delivered to the doorstep.

While 34% of the consumers are enrolled under auto-replenishment and saving plans. Yet, 22% of consumers buy lenses from traditional optometry clinics because of professional fitting and consultation.

Sustainability is in vogue, and 38% of customers want brands to supply recyclable packaging and green disposal schemes. Whilst biodegradable lenses are at the moment a niche product, increased consciousness towards environmentalism will have further advances in sustainable lens production spearhead the charge into the future.

While increasing demands for corrective vision are being driven by innovations in lens technology and changing consumer demands, business stakeholders need to prioritize comfort, convenience, fashion, and sustainability in a quest to compete competitively in the new market of contact lenses.

Contact Lenses Market - Shifts from 2020 to 2024 and Future Trends 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced breathable, moisture-retaining lenses with UV protection. Hybrid lenses combining soft and rigid materials enhanced comfort and clarity. |

| Sustainability & Circular Economy | Companies adopted recyclable packaging, daily disposables made from biodegradable materials, and lens recycling programs. Water-efficient production processes gained traction. |

| Connectivity & Smart Features | IoT-enabled smart lenses monitored eye health, glucose levels, and hydration. AR-powered try-ons allowed users to visualize cosmetic lens effects before purchase. |

| Market Expansion & Consumer Adoption | Demand for vision correction, cosmetic, and specialty lenses (e.g., blue light filtering) surged. E-commerce and subscription-based delivery models expanded accessibility. |

| Regulatory & Compliance Standards | Stricter FDA and EU regulations mandated increased transparency in lens safety, antimicrobial coatings, and oxygen permeability. Certifications for sustainable production gained traction. |

| Customization & Personalization | Brands launched AI-assisted lens fitting tools, personalized prescription lenses, and customizable coloured contact lenses. Extended-wear and hybrid options catered to specific needs. |

| Influencer & Social Media Marketing | Eye health professionals, beauty influencers, and gaming communities promoted contact lenses. Tikor and Instagram fueled trends in cosmetic and coloured lenses. |

| Consumer Trends & Behavior | Consumers prioritized comfort, convenience, and long-lasting hydration. Demand surged for blue-light filtering, UV-blocking, and multifocal lenses. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered smart contact lenses offer real-time vision correction, augmented reality (AR) integration, and health monitoring capabilities. Self-cleaning and self-hydrating lenses revolutionize eye care. |

| Sustainability & Circular Economy | Zero-waste, biopolymer-based contact lenses become industry standard. AI-optimized material sourcing minimizes environmental impact while maximizing lens durability. |

| Connectivity & Smart Features | AI-driven adaptive lenses adjust focus dynamically based on lighting conditions and user activity. Blockchain ensures transparency in lens material sourcing and safety compliance. |

| Market Expansion & Consumer Adoption | Emerging markets drive adoption with cost-effective, AI-personalized contact lens solutions. AI-driven analytics refine product recommendations based on user lifestyle, vision needs, and environmental factors. |

| Regulatory & Compliance Standards | Governments mandate AI-driven safety compliance tracking for lens production and distribution. Blockchain enhances traceability of medical-grade lenses, ensuring quality assurance. |

| Customization & Personalization | AI-powered customization tailors contact lenses in real time based on user biometric data. 3D-printed, on-demand contact lenses provide hyper-personalized vision correction and aesthetic enhancements. |

| Influencer & Social Media Marketing | Virtual influencers and met averse-based eye care consultations redefine consumer engagement. AR-powered virtual try-ons enable users to test different lens shades and styles before purchase. |

| Consumer Trends & Behavior | Biohacking-inspired lenses integrate real-time vision enhancement, biometric tracking, and AI-driven eye health insights. Consumers embrace smart, sustainable, and high-tech contact lens solutions for everyday use. |

The USA contact lenses request is witnessing strong growth, driven by adding cases of diplopia and presbyopia, rising demand for diurnal disposable lenses, and advancements in lens material technology. Major players include Johnson & Johnson Vision Care, Alcon, and Bausch Lomb.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

The UK contact lens request is expanding due to adding relinquishment of vision correction results, rising demand for multifocal lenses, and the growing fashionability of online eye care retailers. Leading brands include Cooper Vision, Specsavers, and Acuvue.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.0% |

Germany’s contact lens request is growing, with consumers favoring high-quality, ophthalmologist-approved lenses and adding demand for diplopia-correcting lenses. crucial players include Carl Zeiss Meditec, Menicon, and Hoya Vision.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s contact lenses request is witnessing rapid-fire growth, fueled by adding mindfulness of vision correction, rising disposable inflows, and the growing influence of fashion-acquainted multicolored lenses. Major brands include Freshlook, Bausch Lomb, and Titan Eye.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.8% |

China’s contact lens requests is expanding significantly, driven by adding cases of diplopia among youthful consumers, the rising fashion ability of ornamental lenses, and rapid-fire relinquishment of smart contact lens technology. crucial players include Pegavision, Hydron, and SEED.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.0% |

The contact lens request is growing steady growth driven by adding cases of diplopia, presbyopia, and presbyopia, along with rising consumer preference for hassle-free vision correction. also, the fashionability of multicolored and ornamental lenses is expanding, particularly among youngish demographics and beauty suckers. diurnal disposable lenses continue to gain traction due to their convenience and hygiene benefits.

Technological inventions are reshaping the contact lens assiduity, with the preface of silicone hydrogel lenses, humidity- retaining coatings, and oxygen-passable accoutrements that enhance comfort and eye health. The emergence of smart contact lenses with AR/ VR capabilities, glucose monitoring, and medicine delivery systems is farther revolutionizing the request, attracting interest from both medical and tech sectors.

Consumers are decreasingly prioritizing eye health, leading to advanced demand for lenses with UV protection and blue light filtering to combat digital eye strain. With the swell in screen time due to remote work and digital cultures, companies are launching technical lenses designed to reduce fatigue and ameliorate long- term vision health.

Online retail and direct- to- consumer( DTC) models are transubstantiating the contact lens request, offering consumers lesser availability, affordability, and convenience. Subscription- grounded services furnishing automatic lens renewals and virtual eye examinations are gaining fashionability, enhancing client retention. Major brands are also fastening on Omni channel strategies to ground online and offline gests .

The contact lens request is passing steady growth, driven by rising vision correction needs, adding a preference for aesthetic lenses, and advancements in lens accoutrements and technology. Consumers are shifting toward diurnal disposable lenses, silicone hydrogel lenses, and smart contact lenses with UV protection and humidity retention. Leading manufacturers concentrate on invention, comfort, and expanding distribution through e-commerce and optometry networks.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Johnson & Johnson Vision | 35-40% |

| Alcon | 22-26% |

| CooperVision | 18-22% |

| Bausch + Lomb | 12-16% |

| Other Companies (combined) | 10-15% |

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson & Johnson Vision | Market leader with ACUVUE® brand. Pioneers daily disposable and UV-blocking contact lenses. Investing in smart lenses and digital eye health technologies. |

| Alcon | Strong in multifocal, toric, and colored lenses with DAILIES® and AIR OPTIX®. Expanding silicone hydrogel lenses and lens care solutions. |

| CooperVision | Specializes in Biofinity®, Clariti®, and MyDay® lenses. Focus on myopia control, toric lenses for astigmatism, and sustainability in packaging. |

| Bausch + Lomb | Innovates in moisture-retaining lenses with Ultra® and Biotrue ONEday®. Strengthens presence in eye health and lens care solutions. |

Strategic Outlook of Key Companies

Johnson & Johnson Vision (35-40%)

Johnson & Johnson dominates with its ACUVUE ® brand, known for high-quality disposable lenses with UV protection and humidity retention. The company is investing in smart contact lenses, AI-driven eye health diagnostics, and sustainability enterprise to reduce plastic waste.

Alcon (22-26%)

Alcon is a strong contender with a different portfolio of diurnal, yearly, and specialty lenses. The company is expanding its DAILIES ® and TOTAL30 ® silicone hydrogel lines while enhancing e-commerce and direct-to-consumer deals.

Cooper Vision (18-22%)

Cooper Vision differentiates itself through diplopia operation results, including MiSight ® 1 day, a FDA- approved lens for decelerating diplopia progression in children. The company also focuses on sustainable packaging and expanding into developing requests.

Bausch + Lomb (12-16%)

Bausch Lomb emphasizes comfort and humidity retention with its Ultra ® and Bio true ONE day ® lenses. The company is investing in eye health results, including nutritive supplements and lens care products, to round its contact lens portfolio.

Other Key Players (10-15% Combined)

Numerous emerging players and regional manufacturers contribute to market growth by offering specialized, aesthetic, and affordable contact lenses. Notable names include:

The Contact Lenses industry is projected to witness a CAGR of 5.4% between 2025 and 2035.

The Contact Lenses industry stood at USD 10.2 billion in 2024.

The Contact Lenses industry is anticipated to reach USD 18.9 billion by 2035 end.

North America is set to record the highest CAGR of 7.1% in the assessment period.

The key players operating in the Contact Lenses industry include Johnson & Johnson Vision Care, Alcon, Bausch + Lomb, CooperVision, Hoya Corporation, and Menicon.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Pairs) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 6: Global Market Volume (Pairs) Forecast by Design Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Wear Type, 2019 to 2034

Table 8: Global Market Volume (Pairs) Forecast by Wear Type, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Global Market Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 14: North America Market Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 16: North America Market Volume (Pairs) Forecast by Design Type, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Wear Type, 2019 to 2034

Table 18: North America Market Volume (Pairs) Forecast by Wear Type, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: North America Market Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 24: Latin America Market Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 26: Latin America Market Volume (Pairs) Forecast by Design Type, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Wear Type, 2019 to 2034

Table 28: Latin America Market Volume (Pairs) Forecast by Wear Type, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 30: Latin America Market Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: Western Europe Market Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 36: Western Europe Market Volume (Pairs) Forecast by Design Type, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Wear Type, 2019 to 2034

Table 38: Western Europe Market Volume (Pairs) Forecast by Wear Type, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Western Europe Market Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Eastern Europe Market Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 46: Eastern Europe Market Volume (Pairs) Forecast by Design Type, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Wear Type, 2019 to 2034

Table 48: Eastern Europe Market Volume (Pairs) Forecast by Wear Type, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Eastern Europe Market Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Pairs) Forecast by Design Type, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Wear Type, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Pairs) Forecast by Wear Type, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 64: East Asia Market Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 66: East Asia Market Volume (Pairs) Forecast by Design Type, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by Wear Type, 2019 to 2034

Table 68: East Asia Market Volume (Pairs) Forecast by Wear Type, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 70: East Asia Market Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Pairs) Forecast by Design Type, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Wear Type, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Pairs) Forecast by Wear Type, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Pairs) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Wear Type, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Pairs) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 15: Global Market Volume (Pairs) Analysis by Design Type, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Wear Type, 2019 to 2034

Figure 19: Global Market Volume (Pairs) Analysis by Wear Type, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Wear Type, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by Wear Type, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Global Market Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 27: Global Market Attractiveness by Design Type, 2024 to 2034

Figure 28: Global Market Attractiveness by Wear Type, 2024 to 2034

Figure 29: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by Wear Type, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 41: North America Market Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 45: North America Market Volume (Pairs) Analysis by Design Type, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by Wear Type, 2019 to 2034

Figure 49: North America Market Volume (Pairs) Analysis by Wear Type, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Wear Type, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Wear Type, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 53: North America Market Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 56: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 57: North America Market Attractiveness by Design Type, 2024 to 2034

Figure 58: North America Market Attractiveness by Wear Type, 2024 to 2034

Figure 59: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by Wear Type, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 71: Latin America Market Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 75: Latin America Market Volume (Pairs) Analysis by Design Type, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by Wear Type, 2019 to 2034

Figure 79: Latin America Market Volume (Pairs) Analysis by Wear Type, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Wear Type, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Wear Type, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 83: Latin America Market Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Design Type, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Wear Type, 2024 to 2034

Figure 89: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by Wear Type, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 101: Western Europe Market Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 105: Western Europe Market Volume (Pairs) Analysis by Design Type, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by Wear Type, 2019 to 2034

Figure 109: Western Europe Market Volume (Pairs) Analysis by Wear Type, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Wear Type, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Wear Type, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 113: Western Europe Market Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Design Type, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by Wear Type, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by Wear Type, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Pairs) Analysis by Design Type, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Wear Type, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Pairs) Analysis by Wear Type, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Wear Type, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Wear Type, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Design Type, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by Wear Type, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by Wear Type, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Pairs) Analysis by Design Type, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Wear Type, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Pairs) Analysis by Wear Type, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Wear Type, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Wear Type, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Design Type, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by Wear Type, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by Wear Type, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 191: East Asia Market Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 195: East Asia Market Volume (Pairs) Analysis by Design Type, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by Wear Type, 2019 to 2034

Figure 199: East Asia Market Volume (Pairs) Analysis by Wear Type, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Wear Type, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Wear Type, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 203: East Asia Market Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 207: East Asia Market Attractiveness by Design Type, 2024 to 2034

Figure 208: East Asia Market Attractiveness by Wear Type, 2024 to 2034

Figure 209: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by Wear Type, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Pairs) Analysis by Design Type, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Wear Type, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Pairs) Analysis by Wear Type, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Wear Type, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Wear Type, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Pairs) Analysis by Sales Channel, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Design Type, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by Wear Type, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogel Contact Lenses Market

Disposable Contact Lenses Market Trends & Insights 2025-2035

Single Use Contact Lenses Market

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Contact Cement Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Industry Analysis in GCC Size and Share Forecast Outlook 2025 to 2035

Contactor Market Size and Share Forecast Outlook 2025 to 2035

Contactor-based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Contactless Delivery Services Market Size and Share Forecast Outlook 2025 to 2035

Contact and Convective Dryers Market Size and Share Forecast Outlook 2025 to 2035

Contact Center Analytics Market Size and Share Forecast Outlook 2025 to 2035

Contact-Free Sleep Monitoring Systems Market Trends - Growth & Forecast 2025 to 2035

Contact Tracing Application Market by Connectivity (Bluetooth, GPS and Both) by Operating System (Android and iOS) & Region Forecast till 2035

Contactless Biometric Technology Market by Technology, Component, Application & Region Forecast till 2035

Contact Lens Solution Market Analysis by Product Type, Volume, Purpose, Distribution Channel, and Region through 2035

Contact Center as a Service Market Trends - Growth & Forecast through 2034

Contactless Ticketing Market Analysis – Growth & Forecast through 2034

Contactless Ticketing ICs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA