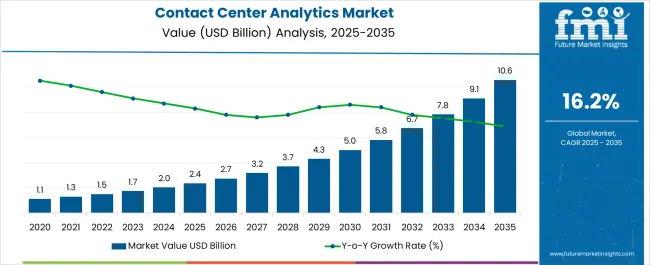

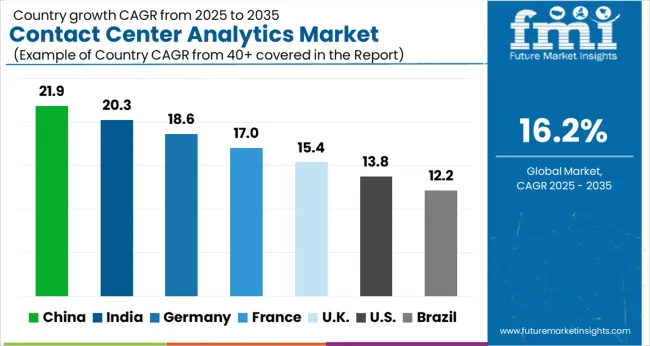

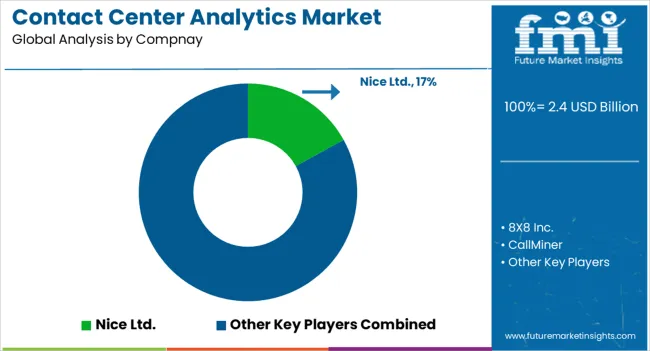

The Contact Center Analytics Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 10.6 billion by 2035, registering a compound annual growth rate (CAGR) of 16.2% over the forecast period.

| Metric | Value |

|---|---|

| Contact Center Analytics Market Estimated Value in (2025 E) | USD 2.4 billion |

| Contact Center Analytics Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 16.2% |

The contact center analytics market is experiencing sustained momentum due to the growing need for actionable customer insights, operational efficiency, and proactive engagement strategies. Organizations across sectors are leveraging advanced analytics to optimize agent performance, reduce call resolution time, and improve customer satisfaction.

The increasing volume of multichannel interactions spanning voice, email, social, and chat is creating demand for unified analytics platforms capable of real-time processing. Enterprise investments in AI-powered natural language processing, sentiment analysis, and predictive analytics are reshaping how contact centers operate, shifting them from cost centers to strategic engagement hubs.

Regulatory mandates for data retention, quality monitoring, and compliance are further driving the integration of analytics into core contact center workflows. Going forward, cloud-native analytics, speech-to-text AI, and seamless CRM integrations are expected to fuel deeper customer intelligence and competitive differentiation.

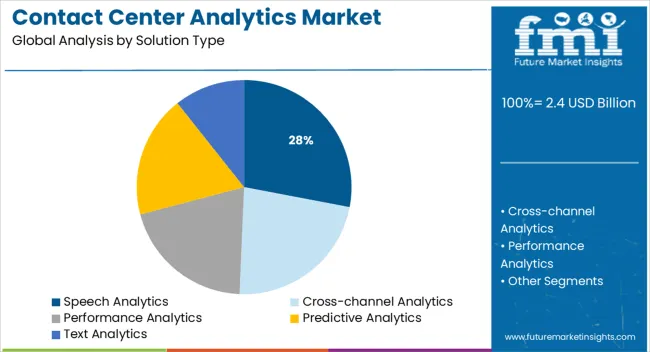

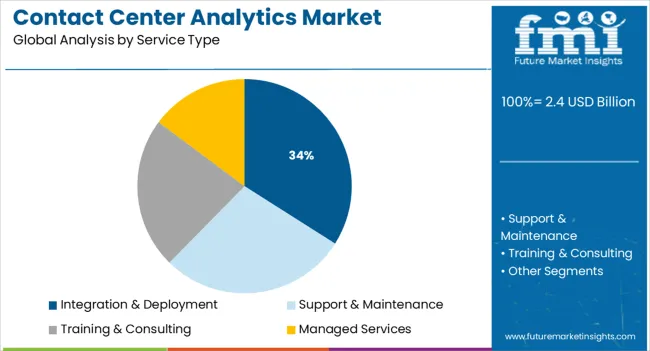

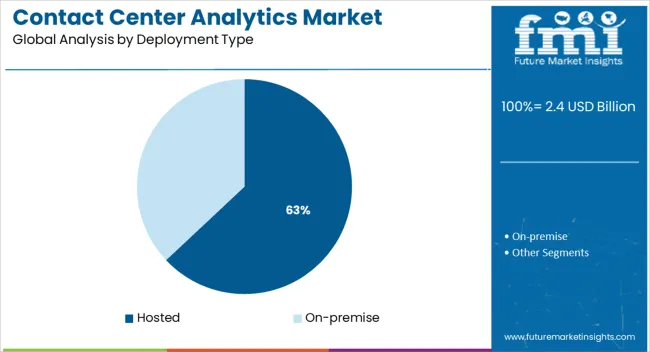

The market is segmented by Solution Type, Service Type, Deployment Type, Enterprise Size, Application Type, and End Use Industry and region. By Solution Type, the market is divided into Speech Analytics, Cross-channel Analytics, Performance Analytics, Predictive Analytics, and Text Analytics. In terms of Service Type, the market is classified into Integration & Deployment, Support & Maintenance, Training & Consulting, and Managed Services. Based on Deployment Type, the market is segmented into Hosted and On-premise. By Enterprise Size, the market is divided into Large Enterprises and Small & Medium Enterprises. By Application Type, the market is segmented into Customer Experience Management, Automatic Call Distributor, Log Management, Real-time Monitoring & Reporting, Risk & Compliance Management, Workforce Optimization, and Others. By End Use Industry, the market is segmented into BFSI, Consumer Goods & Retail, Healthcare, IT & Telecom, Travel & Hospitality, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Speech analytics is projected to account for 28.0% of the total revenue share in the contact center analytics market by 2025, positioning it as the leading solution type. This leadership is being driven by the increasing demand for real-time voice analysis to uncover customer sentiment, compliance gaps, and agent behavior patterns.

The integration of machine learning and natural language processing has enhanced the ability to derive meaningful insights from call recordings, supporting both operational efficiency and strategic planning. Speech analytics also plays a critical role in automating quality assurance processes and identifying early signs of customer churn.

Its adoption is being reinforced by industries with high compliance needs, such as banking, telecom, and healthcare, where conversational data is closely monitored. As enterprises aim to elevate customer experience while meeting service-level agreements, speech analytics continues to emerge as an indispensable component of contact center intelligence stacks.

Integration & deployment services are expected to contribute 34.0% of the overall market revenue in 2025, making this the dominant service type segment. This growth is being influenced by the complexity of aligning new analytics tools with existing telephony systems, CRMs, and enterprise data warehouses.

Organizations are increasingly relying on specialized service providers to ensure seamless deployment, configuration, and performance tuning of analytics platforms. The need for secure data pipelines, user access controls, and system interoperability has further strengthened demand for professional integration services.

In hybrid IT environments, custom integrations enable centralized dashboards, real-time alerts, and cross-channel reporting, enhancing the utility of analytics platforms. As data ecosystems grow in scale and complexity, integration & deployment services remain critical to unlocking full platform value and ensuring analytics capabilities are delivered without business disruption.

Hosted deployment models are anticipated to lead with a 63.0% revenue share in the contact center analytics market by 2025. This dominance is being supported by the scalability, cost-effectiveness, and minimal infrastructure investment offered by hosted solutions.

Organizations are increasingly choosing hosted platforms to accelerate time-to-value, enable remote agent access, and simplify ongoing maintenance. Cloud-based contact center analytics also allows for faster integration of AI features, software updates, and multi-tenant scalability—without the constraints of on-premise hardware.

Hosted deployments have gained further traction due to the hybrid work model, which demands secure and flexible data access across distributed teams. Enhanced disaster recovery options and reduced capital expenditure are reinforcing the long-term appeal of hosted models. As analytics becomes a core enabler of CX strategies, the agility and cost benefits of hosted deployment continue to attract enterprise adoption across verticals.

As per the Global Contact Center Analytics Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Contact Center Analytics Market increased at around 19.1% CAGR. With an absolute dollar opportunity of USD 10.6 Billion, the market is projected to reach a valuation of USD 6.10.6 Billion by 2035.

The benefits it offers, including improved service quality and the ability to measure service indicators from worker performance, call wait times, customer satisfaction, and efficiency, can be ascribed to the contact centers' growing need for analytics.

The increasing use of social media platforms is one of the key factors fuelling the demand for contact center analytics. Customer feedback given on social media platforms such as articles, blogs, and forums is analyzed using contact center analytics tools. Owing to this, businesses may review social media data in real time.

This creates a competitive advantage and enhances business operations. Additionally, it helps businesses understand user comments, particularly those made on social media in slang, jargon, and acronyms. It is projected that these factors will boost business demand for contact center analytics.

It is projected that the growing demand for artificial intelligence-powered contact center solutions would create new opportunities for market growth. The ability of these solutions to provide actionable data cut operating costs, customize the customer experience, and increase customer agent efficiency, is projected to be the driving force for contact center analytics demand.

To manage outgoing, inbound, and blended calls, web inquiries, chats, emails, and web inquiries, businesses equip their contact centers with strong analytics and software-based telephony technologies, such as APIs, ACDs, dialers, CTI, and Voice over Internet Protocol.

Advanced analytics tools are also used, including VoIP, ACDs, APIs, dialers and VoIP, CTI, real-time monitoring and analytics, social media analytics, and data and speech analytics.

Through instantaneous client preference adaptation, these technologies enable organizations to provide a better, more consistent experience. By enabling contact centers to communicate with their clients over computers, software-based telephony solutions do away with the need for a conventional phone infrastructure.

These tools provide features such as analysis of the interaction between customers and agents, real-time monitoring for the purpose of providing tailored responses, as well as video enablement for face-to-face video calls, advanced analytics technologies benefit modern contact centers.

These tools include customer analytics, text analytics, predictive analytics, and performance analytics. In the Cisco Contact Center Global Survey 2024, more than 80% of participants indicated that they preferred the incorporation of bots, data analytics, and AI robotic automation in contact center systems.

Contact center analytics solutions are widely employed in the IT and telecom sectors due to their strong business process automation capabilities. These systems also give IT and telecom personnel the ability to manage all phases of a service request and deal with all incoming client communications.

These solutions also offer a number of benefits, including improved client happiness, decreased operating expenses, and corporate intelligence. These technologies are also used by IT and telecom companies to identify the factors influencing the experiences of their clients.

Contact centers always encounter substantial issues with regard to data privacy and security due to the massive volume of sensitive customer data they store. Businesses were forced to respond with technologies created to identify suspicious calls in 2024 as a result of an alarming increase in call center fraud efforts.

According to the 2024 State of Call Center Authentication survey, 57% of respondents preferred a thorough identification process before accepting calls.

Call validation becomes essential in light of security concerns. Customers may become irritated as a result, which could harm their overall satisfaction. IVAs, also known as intelligent IVRs, are being created to address this issue and provide several levels of security for user authentication.

Future privacy and security concerns can be reduced by offering options for choosing trustworthy and privacy-compliant contact center solution providers.

The majority of firms, especially small and medium-sized businesses, with limited resources, find it difficult to install analytics solutions and provide financing for a specialized analytics workforce as the initial setup cost for analytics solutions can be significant.

Smaller businesses are also constrained in their adoption of reliable PRI phone systems as they cannot afford the high implementation and upgrade expenses, pricey monthly phone services, and participation of long-term contracts with traditional telecom carriers for local and long-distance calling.

The viability of cloud-based analytics solutions for organizations with constrained resources will rely on the organization's business model and level of cloud readiness.

During the projection period, the Contact Center Analytics Market in North America is projected to lead throughout the analysis period. A large number of existing and upcoming contact centers in the region are the primary factors driving the regional contact center analytics market.

The USA is expected to account for the highest market of USD 10.6 Billion by the end of 10.60310.6. Also, the market in the country is projected to account for an absolute dollar growth of USD 1.1 Billion. According to a government assessment, the federal government's budget for civilian IT in 10.6019 was USD 45 Billion.

The USA businesses are embracing hosted unified communication-as-a-service, which are managed by independent contractors using subscription-based packages that enable customers to purchase U.C. licenses and activate them as required.

Additionally, the cost-effective services and quicker product development cycles offered by smaller providers may be advantageous to SMEs. Due to this, there is an increase in demand for cloud-based services which is also influencing the demand for Contact Center Analytics Market.

Market revenue through BFSI is forecasted to grow at a CAGR of over 16.0% from 2025 to 2035. The market expansion may be connected to the increasing need for contact centers among banks, financial institutions, credit unions, and other organizations to improve their customer experience.

According to Deloitte, a significant portion nearly 26% of all contact centers used globally in 2020 were used for financial services. The two benefits that contact center analytics offers to BFSI businesses are reduced operational costs and greater call center volumes are the key growth drivers.

The market is estimated to expand over the course of the projected period as a result of the BFSI organizations' rising demand for speech analytics. Speech analytics helps banks prevent customer churn by analyzing and monitoring client interactions.

Owing to their advantages, speech analytics is being used by several banks to enhance the client experience. For instance, in November 2024, the provider of speech analytics solutions CallMiner stated that African Bank had selected the CallMiner Eureka platform to collect data from voice-based client engagements. This project has helped the bank to boost its digital transformation activities.

Players in the market are constantly developing improved analytical solutions as well as extending their product offerings. The companies in Contact Center Analytics market are focused on alliances, technology collaborations, and product launch strategies.

Some of the recent developments of key Contact Center Analytics providers are as follows:

Similarly, recent developments related to companies in Contact Center Analytics Market have been tracked by the team at Future Market Insights, which are available in the full report.

The global contact center analytics market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the contact center analytics market is projected to reach USD 10.6 billion by 2035.

The contact center analytics market is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in contact center analytics market are speech analytics, cross-channel analytics, performance analytics, predictive analytics and text analytics.

In terms of service type, integration & deployment segment to command 34.0% share in the contact center analytics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Contact Cement Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Industry Analysis in GCC Size and Share Forecast Outlook 2025 to 2035

Contactor Market Size and Share Forecast Outlook 2025 to 2035

Contactor-based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Contactless Delivery Services Market Size and Share Forecast Outlook 2025 to 2035

Contact and Convective Dryers Market Size and Share Forecast Outlook 2025 to 2035

Contact-Free Sleep Monitoring Systems Market Trends - Growth & Forecast 2025 to 2035

Contact Tracing Application Market by Connectivity (Bluetooth, GPS and Both) by Operating System (Android and iOS) & Region Forecast till 2035

Contactless Biometric Technology Market by Technology, Component, Application & Region Forecast till 2035

Contact Lenses Market – Trends, Growth & Forecast 2025 to 2035

Contact Lens Solution Market Analysis by Product Type, Volume, Purpose, Distribution Channel, and Region through 2035

Contactless Ticketing Market Analysis – Growth & Forecast through 2034

Contactless Ticketing ICs Market

Contact Thermometer Market

Contactless Smart Card Market

Contactless Payment Market

Contact Image Sensor Market

Contactless Payment Terminals Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA