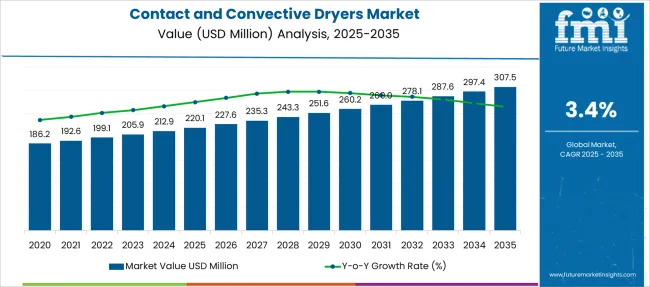

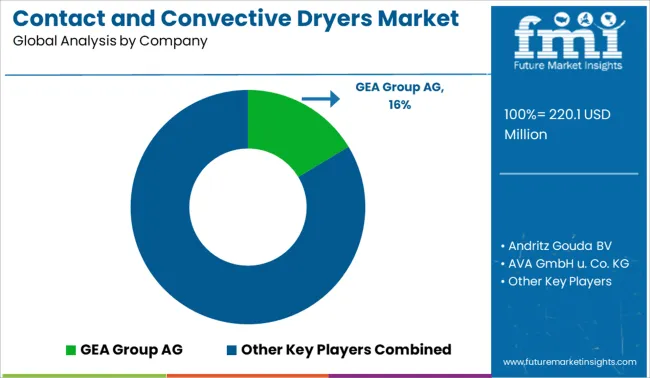

The Contact and Convective Dryers Market is estimated to be valued at USD 220.1 million in 2025 and is projected to reach USD 307.5 million by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Contact and Convective Dryers Market Estimated Value in (2025 E) | USD 220.1 million |

| Contact and Convective Dryers Market Forecast Value in (2035 F) | USD 307.5 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

The contact and convective dryers market is experiencing strong growth due to increasing demand for efficient drying solutions across various industries. The food and beverage sector, in particular, has driven market expansion as manufacturers seek reliable drying technologies to improve product shelf life and maintain quality.

Advancements in drying technology have enhanced energy efficiency and throughput, making convective drying a preferred choice for large-scale operations. Industry updates highlight the growing adoption of horizontal dryers, which offer operational advantages such as uniform drying and ease of maintenance.

The trend toward automation and process optimization in food processing plants has further propelled the use of advanced drying equipment. Looking ahead, market growth is expected to continue as producers focus on sustainability, reducing drying times, and improving product consistency. Segmental growth is forecasted to be led by convective dryers in product type, horizontal orientation in equipment design, and the food and beverage industry in applications.

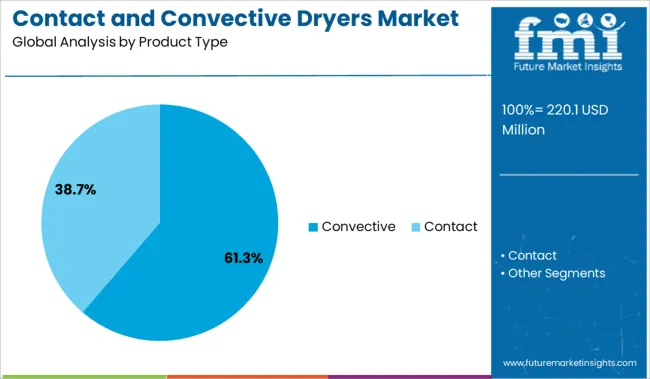

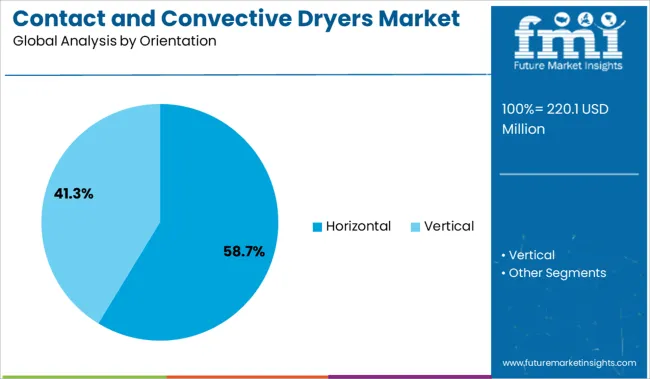

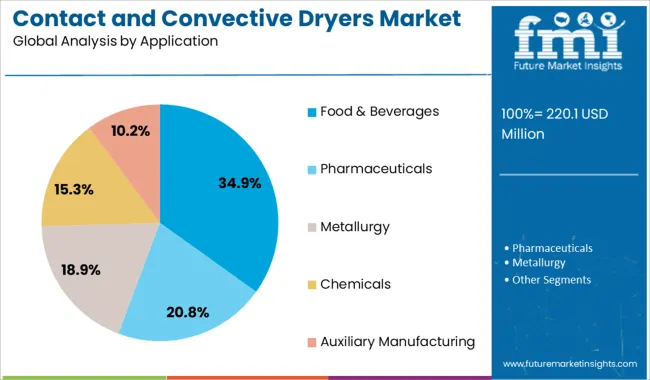

The market is segmented by Product Type, Orientation, and Application and region. By Product Type, the market is divided into Convective and Contact. In terms of Orientation, the market is classified into Horizontal and Vertical. Based on Application, the market is segmented into Food & Beverages, Pharmaceuticals, Metallurgy, Chemicals, and Auxiliary Manufacturing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Convective dryers segment is projected to hold 61.3% of the market revenue in 2025, establishing itself as the leading product type. This segment’s growth can be attributed to the widespread use of convective drying in industries requiring efficient moisture removal through hot air circulation.

Convective dryers offer advantages such as scalability, adaptability to various product types, and relatively low capital costs. Their ability to handle heat-sensitive products without damaging quality has made them especially popular in food processing.

Furthermore, improvements in air flow management and energy recovery systems have enhanced their operational efficiency. As industries continue to prioritize faster drying processes with minimal quality loss, the Convective dryers segment is expected to maintain its market dominance.

The Horizontal orientation segment is anticipated to contribute 58.7% of the market revenue in 2025, making it the preferred equipment configuration. Horizontal dryers provide uniform drying by allowing products to move steadily through the drying chamber, which reduces moisture gradients and prevents overheating.

Their design facilitates easier loading and unloading, leading to improved operational efficiency. The horizontal layout also supports modular construction, enabling capacity expansion and maintenance with minimal disruption.

These benefits have driven adoption in food and beverage processing facilities, where product quality and throughput are critical. As drying technology evolves, horizontal dryers are expected to retain their leadership due to their reliability and flexibility in handling diverse drying applications.

The Food & Beverages segment is projected to hold 34.9% of the market revenue in 2025, securing its position as the largest application area. Growth in this segment has been driven by the need for efficient drying solutions that preserve nutritional value, taste, and texture of food products.

The sector’s demand for dehydrated fruits, vegetables, and powdered ingredients has fueled the adoption of advanced drying equipment. Food safety regulations and consumer preferences for minimally processed foods have emphasized the importance of controlled drying processes.

Additionally, the expansion of convenience foods and ready-to-eat products has created a steady requirement for consistent and reliable drying technologies. As food manufacturers continue to innovate and optimize production lines, the Food & Beverages segment is expected to remain the dominant user of contact and convective dryers.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 3.5% |

| H1,2025 Projected (P) | 3.5% |

| H1,2025 Outlook (O) | 3.7% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (+) 22 ↑ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (+) 22 ↑ |

Future Market Insights estimated a comparison analysis for the Contact and Convective Dryers market which is primarily driven due to the high energy consumption rates of the product, government rules, and limits that have a significant impact on the market for contact and convective dryers. The growth of the target market in the country is anticipated to be moderately impacted by various government laws relating to the energy efficiency of products.

Over the past three decades, industrial drying has seen a tremendous increase in research and development (R&D) to keep up with the evolving product kinds that need to be dried. Before now, the drying industry research and development has turned from energy conservation to improving product quality, reducing emissions, and enhancing process safety.

Any sector that uses industrial drying, notably contact, and convective dryers, uses a significant amount of energy, and rising Research and Development expenditures are aimed at lowering that consumption. FMI evaluates the variations between the BPS points in this market in H1, 2025 - Outlook over H1, 2025 Projected a gain of 22 points. Notably, compared to H1, 2024, the market is expected to increase with 22 BPS points in H1 -2025.

Due to rising population needs, rising investments, and significant growth in Greenfield projects, the pharmaceutical, chemical, and food and beverage industries are expected to experience exponential growth in the country over the next few years. This is expected to further fuel demand for contact and convective dryers.

As per FMI, the demand in the global contact & convective dryers market grew at 2.9% CAGR over the assessment years between 2014 and 2024.

Contact & convective dryers are industrial dryers used for providing the heat necessary for evaporation and removing water or moisture from various products. These dryers offer consistent and even heating throughout the vessel, thereby, improving the quality and durability of the end product.

Due to these factors, contact & convective dryers are increasingly used as intermittent drying equipment to reduce moisture and cure products across food & beverage, chemicals, metallurgy, pharmaceuticals, and manufacturing industries.

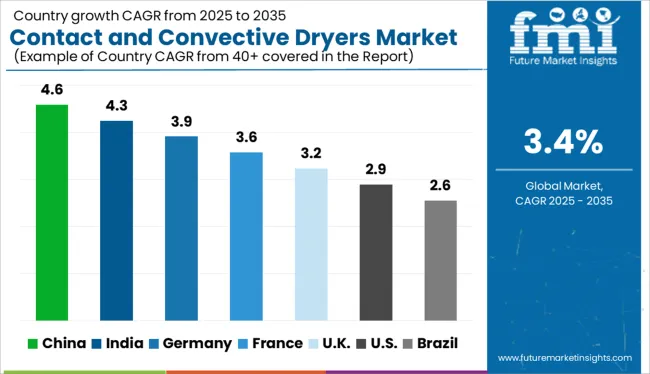

The rapidly expanding chemical and pharmaceutical industries across developing economies such as China and India are fuelling the demand in the market. On account of this, the global contact & convective dryers market is expected to grow at 3.4% CAGR over the forecast period 2025 to 2035.

Industrial drying has emerged as a vital process, accounting for 12% to 25% of the total industrial energy consumption. With the increasing emphasis on declining energy consumption, contact dryers are gaining popularity owing to their ability to improve industrial energy efficiency and reduce greenhouse gases emission.

Also, governments in various countries are implementing stringent regulations to curb carbon dioxide emissions and improve industrial energy efficiency. This also has resulted in higher uptake of contact dryers. Within the pharmaceutical sector contact dryers are often used in the preparation of granules for tablets and capsules.

Within the food processing industry, the typical application of drying includes dairy products, coffee and coffee surrogates, processed cereals, starch derivatives, and potatoes. Demand in diverse sectors is likely to increase as the focus on reducing energy consumption rises. This will present lucrative scope for the market.

Rapid Growth of Industrial Processing Verticals to Propel Demand for Contact and Convective Dryers

FMI states that China is projected to account for the dominant share in the East Asia contact & convective dryers market through 2035.

Fast-paced expansion of the industrial processing sector in China, owing to increasing production and exports of chemicals and pharmaceuticals products is favoring the growth in the market. Also, the increasing adoption of high-performance industrial equipment for meeting complex drying requirements, especially for powdered products is propelling the demand for contact & convective dryers in the country.

Driven by this, the sales in China are estimated to rise at a robust CAGR, assisting the East Asia market to account for around 32.8% of the revenue share in 2025.

Growing Popularity of Superheated Steams Technique to Bolster Convectional Dryer Sales

With increasing concerns regarding the use of volatile components, industrial players are increasingly adopting convective dryers to eliminate risks of cross-contamination while removing remove moisture and water content for products, especially for heat-sensitive products.

Hence, they are extensively using innovative drying techniques such as superheated steam to nullify the presence of any volatile components, keep the environment inside the vessel inert and ease the exhaust gas treatment in convection dryers.

On account of this, the sales of conventional dryers are projected to accelerate at a rapid pace in India through 2035. This rise in sales is estimated to assist the South Asia market to capture nearly 30.7% of the value share in 2025.

Regulation to Control Industrial Greenhouse Gas Emission to Favor Sales of Contact Dryers

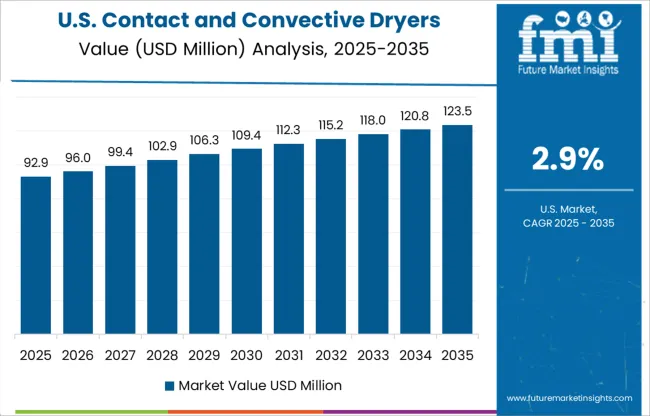

The government of the USA is increasingly focusing on curbing the country’s greenhouse emissions by implementing numerous regulations, especially across the industrial processing sector.

For instance, according to the Center for Climate and Energy Solutions, the Environmental Protection Agency in the USA has implemented a number of new source performance standards (NSPS) under Section 111(b) of the Clean Air Act for controlling industrial greenhouse gas emissions across the country in 2024.

As contact dryers assist in handling toxic materials, improving energy efficiency, and reducing carbon emissions, they are gaining immense popularity across the industrial sector. Hence, a slew of such regulations in the USA is projected to support the North American market to account for nearly 13.8% of total sales through 2025.

Surging Demand for Energy-Efficient Industrial Equipment to Augment the Contact Dryers Sales

As per Future Market Insights, the contact dryers segment is estimated to register growth at a robust CAGR between 2025 and 2035. Contact dryers use indirect methods for the removal of the liquid phase from products through the application of heat. They also assist in improving energy efficiency, eliminating solvent fumes, and providing faster drying.

Hence, the growing demand for energy-efficient industrial equipment across food & beverages, and chemical industries are spurring the sales of contact dryers.

Vertical Contact & Convective Dryers Demand to Soar through 2035

On the basis of orientation, the global contact & convection dryers market is segmented into vertical and horizontal. FMI states that the vertical segment is projected to account for the dominant share of the market over the assessment period.

Better product mixing capabilities, ability to fit in compact space, and high drying efficiency in comparison to horizontal dryers are primary factors favoring the sales of vertical contact & convection dryers.

Expanding Pharmaceutical Sector in China and India to Favor the Demand for Contact & Convective Dryers

As per FMI, the pharmaceutical segment is expected to account for a significant share of the market, expanding at a 3% CAGR during the forecast period 2025 to 2035.

Increasing applications of contact & convection dryers across the pharmaceutical industry for handling heat-sensitive products and removing moisture from powered products is favoring the growth in the segment. Hence, growing government investments in expanding pharmaceutical manufacturing capacity across India and China are expected to facilitate the sales of contact & convection dryers in the coming years.

Leading players operating in the global contact & convective dryers market are focusing on providing customized products as per the end-user requirements. Some of the other companies are aiming at entering into strategic collaboration, partnership, acquisition, and mergers with players to strengthen their market footprint.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Poland, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Vietnam, Indonesia, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Product Type, Orientation, Application, and Region |

| Key Companies Profiled | Andritz-Gouda B.V.; GEA Group AG; FLSmidth; ThyssenKrupp AG; Meter Group, Inc; Others |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, Drivers, Restraints, Opportunities and Threats analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global contact and convective dryers market is estimated to be valued at USD 220.1 million in 2025.

The market size for the contact and convective dryers market is projected to reach USD 307.5 million by 2035.

The contact and convective dryers market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in contact and convective dryers market are convective and contact.

In terms of orientation, horizontal segment to command 58.7% share in the contact and convective dryers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Contact Cement Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Industry Analysis in GCC Size and Share Forecast Outlook 2025 to 2035

Contactor Market Size and Share Forecast Outlook 2025 to 2035

Contactor-based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Contactless Delivery Services Market Size and Share Forecast Outlook 2025 to 2035

Contact Center Analytics Market Size and Share Forecast Outlook 2025 to 2035

Contact-Free Sleep Monitoring Systems Market Trends - Growth & Forecast 2025 to 2035

Contact Tracing Application Market by Connectivity (Bluetooth, GPS and Both) by Operating System (Android and iOS) & Region Forecast till 2035

Contactless Biometric Technology Market by Technology, Component, Application & Region Forecast till 2035

Contact Lenses Market – Trends, Growth & Forecast 2025 to 2035

Contact Lens Solution Market Analysis by Product Type, Volume, Purpose, Distribution Channel, and Region through 2035

Contactless Ticketing Market Analysis – Growth & Forecast through 2034

Contact Center as a Service Market Trends - Growth & Forecast through 2034

Contactless Ticketing ICs Market

Contact Thermometer Market

Contactless Smart Card Market

Contactless Payment Market

Contact Image Sensor Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA