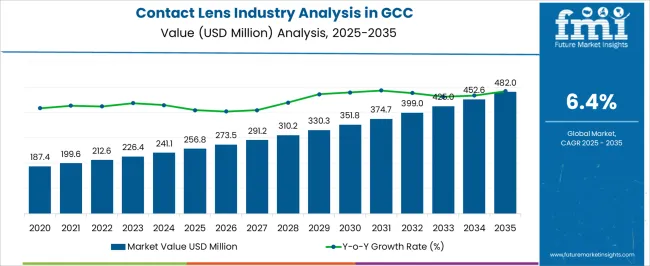

The Contact Lens Industry Analysis in GCC is estimated to be valued at USD 256.8 million in 2025 and is projected to reach USD 482.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Contact Lens Industry Analysis in GCC Estimated Value in (2025 E) | USD 256.8 million |

| Contact Lens Industry Analysis in GCC Forecast Value in (2035 F) | USD 482.0 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

The contact lens industry in the GCC is expanding steadily, driven by increasing prevalence of vision-related disorders, rising awareness of eye health, and growing acceptance of lifestyle-oriented eyewear solutions. Soft lenses, advanced designs, and disposable formats have contributed to the strong uptake among both young and adult populations.

The market benefits from higher purchasing power, a fashion-driven consumer base, and the availability of international brands. Regulatory frameworks supporting safe usage and the growth of e-commerce distribution are further accelerating accessibility.

The industry outlook remains favorable, supported by medical advancements, rising demand for corrective and cosmetic lenses, and the increasing popularity of daily disposable formats for enhanced hygiene and convenience. Continuous product innovation tailored to regional consumer preferences will further reinforce growth potential in the GCC market.

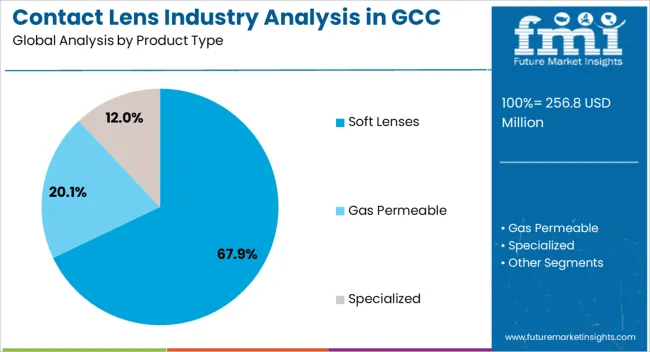

The soft lenses segment dominates the product type category, accounting for approximately 67.90% share in the GCC contact lens industry. This leadership is attributed to their comfort, ease of adaptation, and suitability for extended wear compared to rigid lenses.

Soft lenses cater to both corrective and cosmetic needs, reinforcing their popularity across diverse consumer groups. The segment’s growth is further supported by technological advancements in moisture retention and oxygen permeability, enhancing wearer comfort.

Rising demand for colored lenses in the GCC region, driven by fashion and lifestyle trends, also contributes to its market strength. With affordability, widespread availability, and continued innovation, the soft lenses segment is expected to maintain its dominance in the near future.

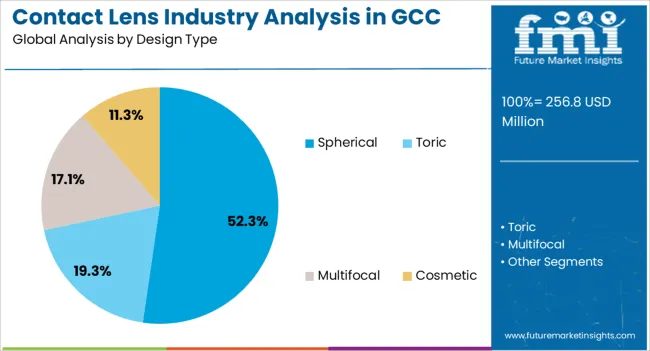

The spherical segment leads the design type category, holding approximately 52.30% share. This dominance is driven by the segment’s suitability for correcting common refractive errors such as myopia and hyperopia, making it the most widely prescribed lens type.

Its straightforward design, ease of fitting, and compatibility with disposable formats contribute to its market prominence. High adoption rates are supported by ophthalmologists and optometrists recommending spherical lenses as the primary corrective option.

With ongoing product development improving comfort and visual clarity, spherical lenses are anticipated to retain a strong presence in the GCC market.

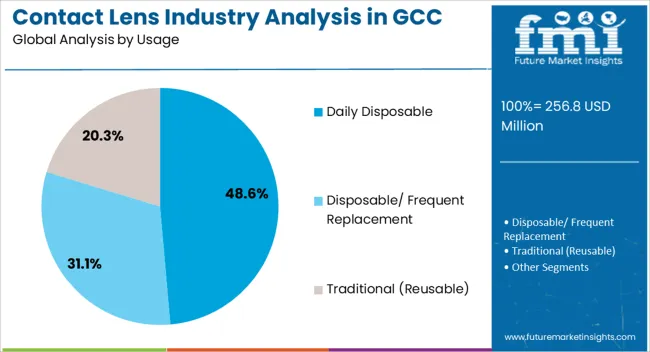

The daily disposable segment represents approximately 48.60% share in the usage category, underscoring its role as the fastest-growing preference among contact lens users in the GCC. The segment’s success is driven by convenience, improved hygiene, and reduced risk of eye infections compared to reusable lenses.

Daily disposables are increasingly favored by consumers seeking low-maintenance options, particularly in urban areas where busy lifestyles prioritize ease of use. Manufacturers have expanded offerings in both corrective and cosmetic daily disposables, broadening their appeal.

With rising awareness of eye safety and premiumization trends in eyewear, the daily disposable segment is expected to strengthen its share further, consolidating its leadership in the regional contact lens market.

The GCC contact lens industry experienced steady growth in the historical period from 2020 to 2025. The industry expanded at a CAGR of 4.7% during the same period. This was attributed to increased awareness of vision correction methods, technological advancements in lens materials, and a growing preference for alternatives to traditional vision correction products like eyeglasses.

| Historical CAGR (2020 to 2025) | 4.7% |

|---|---|

| Forecast CAGR (2025 to 2035) | 6.5% |

There is a notable rise in the demand for disposable and silicone hydrogel lenses due to their comfort and convenience. However, the GCC contact lens industry report anticipates a significant surge in sales owing to a more widespread acceptance of contact lenses as a lifestyle choice and advancements in smart contact lens technology.

Innovations such as augmented reality (AR)-based lenses and continuous glucose monitoring lenses are poised to revolutionize the market. These products are set to cater to vision correction needs and help companies expand into new health monitoring applications.

Targeted marketing and improved accessibility are two crucial factors pushing contact lens sales across the GCC. The rising aging population opting for multifocal and presbyopia-correcting lenses is further anticipated to fuel the exponential growth in the GCC contact lens industry through 2035. The aforementioned factors are estimated to propel the industry to exhibit a 6.5% CAGR in the forecast period.

Growing Awareness of Eye Health and Vision Care

The GCC has witnessed a notable shift in consumer behavior, with more individuals opting for contact lenses as an alternative to traditional eyeglasses. Factors such as rising disposable income, evolving eyewear industry trends favoring a more aesthetic appeal, and the convenience of contact lenses have spurred their adoption across diverse demographics.

The GCC's warm climate, coupled with an active lifestyle, has further propelled the preference for contact lenses, as they offer great ease during outdoor activities and sports.

The growing understanding of the importance of regular eye check-ups is projected to drive the optical lens industry. Besides, the need for corrective measures for refractive errors or vision-related issues is also set to play a pivotal role in pushing the adoption of contact lenses in the region.

For instance, in 2024, the Qatari Ministry of Public Health introduced the Qatar National Eye Health Strategy. The strategy aims to reduce the prevalence of preventable vision impairment in Qatar by 25% by 2035. The strategy includes a high focus on promoting the use of contact lenses as a safe and effective vision correction option.

Applications of Specialty Contact Lenses in Therapeutic and Cosmetic Segments

In the therapeutic realm, specialty lenses are increasingly prescribed for conditions such as keratoconus, irregular astigmatism, and post-surgical corneal irregularities. These are expected to offer improved visual acuity and comfort for patients.

The cosmetic use of specialty lenses for color enhancement or change has gained popularity, catering to consumers seeking personalized and aesthetically pleasing options. The convergence of advanced technologies, such as custom designs and materials, has further propelled the industry.

It has been providing practitioners and end-users with innovative solutions that address a diverse range of vision-related needs. The versatility and expanding applications of specialty contact lenses continue to fuel their adoption, driving positive momentum in the GCC therapeutic contact lens industry.

Geographic Expansion into Untapped and Emerging Areas

Geographic expansion into untapped and emerging areas across the GCC presents an enticing opportunity for manufacturers and distributors. With a burgeoning population and increasing awareness of eye health & vision correction, the GCC eyewear industry offers substantial growth potential. Penetrating these untapped areas allows manufacturers and distributors to tap into a demographic that values convenience and lifestyle choices.

The region's inclination toward technological advancements, coupled with rising disposable income, underscores the appeal of innovative and comfortable contact lens solutions. Strategic entry and expansion efforts across these emerging areas are set to lead to the establishment of a brand presence.

It is further estimated to result in the development of consumer trust and capitalization on the evolving preferences of the region's consumers. The above-mentioned factors are expected to help in fostering long-term growth and leadership in the GCC contact lens industry.

The section below highlights the CAGRs of the leading countries in the GCC ophthalmic equipment industry. The three main countries pushing contact lens demand include Bahrain, Kuwait, and the United Arab Emirates.

According to the analysis, Bahrain is set to lead the GCC contact lens industry by showcasing a CAGR of 12.2% in the forecast period. The country is anticipated to be followed by Kuwait and the United Arab Emirates, with CAGRs of 9.4% and 6.8%, respectively.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Arab Emirates | 6.8% |

| Kingdom of Saudi Arabia | 4.0% |

| Bahrain | 12.2% |

| Qatar | 5.2% |

| Kuwait | 9.4% |

Several parameters contribute to driving the sales of contact lenses in the United Arab Emirates (UAE). The country is anticipated to witness a CAGR of 6.8% in the assessment period.

The growth of the contact lens industry in Qatar is propelled by several key factors shaping consumer preferences and market dynamics. They are:

The below section shows the GCC contact lens industry analysis in terms of product type, design, and sale channel. The gas permeable segment is expected to lead the GCC contact lens industry based on product type. It is set to exhibit a CAGR of around 7.1% through 2035.

Based on the design type, the cosmetic segment is anticipated to showcase a dominant CAGR of 12.3% by 2035. By sales channel, the luxury boutique segment is expected to exhibit a CAGR of 9.2% from 2025 to 2035 in the GCC contact lens industry.

Market Growth Outlook by Product Type

| Product Type | Gas Permeable |

|---|---|

| CAGR (2025 to 2035) | 7.1% |

In terms of product type, the gas permeable category is expected to register a significant CAGR of 7.1% during the forecast period. This growth is attributed to the following factors:

Market Growth Outlook by Key Design Type

| Design Type | Cosmetic |

|---|---|

| CAGR (2025 to 2035) | 12.3% |

In terms of design type, the cosmetic segment is expected to exhibit a 12.3% CAGR through 2035 due to its strong consumer orientation. Other factors pushing their demand in the GCC contact lens industry include:

Market Growth Outlook by Key Sales Channel

| Sales Channel | Luxury Boutiques |

|---|---|

| CAGR (2025 to 2035) | 9.2% |

In terms of sales channels, luxury boutiques are significant in the GCC contact lens industry. The segment is expected to showcase a CAGR of 9.2% from 2025 to 2035. A handful of factors augmenting the segment’s growth are:

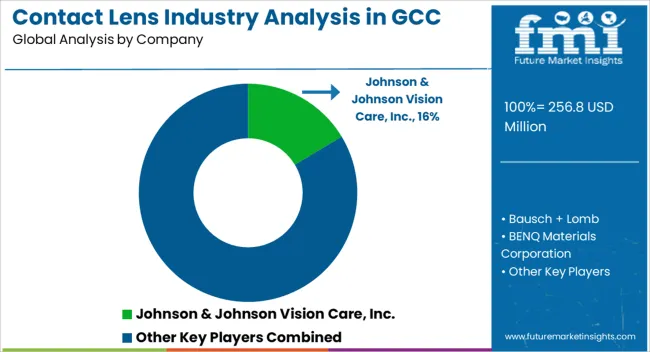

The GCC contact lens industry presents a competitive landscape characterized by a mix of established international players and regional eyewear brands. They are striving to cater to diverse consumer preferences and eye care needs in the region.

Leading global companies such as Johnson & Johnson Vision Care, Contamac, and Bausch + Lomb dominate the region due to their extensive product portfolios, technological advancements, and strong distribution networks. Regional players such as Yateem Opticians, Al-Manara Optical, and Muscat Optical have a significant presence, leveraging their local market understanding, customer service, and strategic partnerships.

The competitive landscape of the optical lens industry in Gulf countries is characterized by continuous innovation in lens materials, comfort, and designs. It also witnesses new marketing strategies and a growing emphasis on online sales channels to reach a wide consumer base across the GCC countries.

For instance,

| Attribute | Details |

|---|---|

| GCC Contact Lens Industry Value in 2025 | USD 241.1 million |

| GCC Contact Lens Industry Value in 2035 | USD 452.6 million |

| Anticipated Growth Rate of GCC Contact Lens Industry (2025 to 2035) | 6.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| GCC Contact Lens Industry Analysis | USD million for Value |

| Key Regions Covered | GCC |

| Key Countries Covered | United Arab Emirates, Kingdom of Saudi Arabia, Oman, Qatar, Kuwait |

| Key Segments Covered | Product Type, Design Type, Usage, Material, Sales Channel |

| Key Companies Profiled in GCC Contact Lens Industry Report | Johnsons & Johnsons; Bausch + Lomb; BENQ MATERIALS CORPORATION; Contamac; COOPERVISION, INC. (CooperCompanies); EssilorLuxottica; HOYA; Johnson & Johnson Vision Care, Inc.; MPG Optical; Al-Manara Optical; Kanoo Opticals; Yateem Opticians; Muscat Optical; Other Players (As Requested) |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities, and Trends Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global contact lens industry analysis in GCC is estimated to be valued at USD 256.8 million in 2025.

The market size for the contact lens industry analysis in GCC is projected to reach USD 482.0 million by 2035.

The contact lens industry analysis in GCC is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in contact lens industry analysis in GCC are soft lenses, gas permeable and specialized.

In terms of design type, spherical segment to command 52.3% share in the contact lens industry analysis in GCC in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Contact-lens Induced Infections Market Size and Share Forecast Outlook 2025 to 2035

Contact Lens Inspection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Contact Lenses Market – Trends, Growth & Forecast 2025 to 2035

Contact Lens Solution Market Analysis by Product Type, Volume, Purpose, Distribution Channel, and Region through 2035

Smart Contact Lens Market Size and Share Forecast Outlook 2025 to 2035

Hydrogel Contact Lenses Market

Disposable Contact Lenses Market Trends & Insights 2025-2035

Single Use Contact Lenses Market

Therapeutic Contact Lenses Market Report - Trends, Demand & Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Electrical Service Market Growth – Trends & Forecast 2024-2034

GCC Retail Glass Packaging Market Insights – Growth & Forecast 2023-2033

Lens Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

GCC Countries Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

GCC Adventure Tourism Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food & Beverage Market Size and Share Forecast Outlook 2025 to 2035

Contact Cement Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Contactor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA