The global Eye Infections Treatment Market is projected to be valued at USD 8,160.6 million in 2025, reaching USD 11,400.7 million by 2035, with a compound annual growth rate (CAGR) of 4.7% during the forecast period. The market growth is being driven by rising incidence of ocular infections-such as conjunctivitis, keratitis, and endophthalmitis tied to increased contact lens use, environmental pollutants, and diabetic complications.

The demand for postoperative infection prevention following procedures like cataract surgery is also intensifying the market. Pharmaceutical innovation in antibiotic, antiviral, and antifungal therapeutics continues to expand treatment options. Simultaneously, growing patient awareness of eye hygiene and health-seeking behavior is raising therapy uptake.

As healthcare systems, particularly in Asia-Pacific and Latin America, improve access to ophthalmic care and invest in tele-ophthalmology, the market’s future opportunities are being shaped by integrated treatment protocols, emerging drug formulations, and complementary therapeutic delivery platforms.

Leading Manufacturers in eye infection treatment include Novartis, Alcon, Pfizer, Bausch + Lomb, Merck, Allergan, and Santen. These manufacturers are focusing on strategic investments that are being focused on expanding ophthalmic pipelines through targeted acquisitions and R&D collaborations. In 2025, Alcon Announces FDA Approval of TRYPTYR, that will be available in single-dose vials with a US launch in Q3 2025 and plans for global market expansion.

“Today marks a tremendous milestone for Alcon as TRYPTYR becomes our first prescription pharmaceutical treatment to be approved by the FDA since becoming an independent, publicly traded eye care company,” said David Endicott, CEO of Alcon. Lupin Limited also announced the launch of Bromfenac Ophthalmic Solution in USA in 2024 which is indicated for the treatment of postoperative inflammation and reduction of ocular pain in patients.

These launches coincide with rising incidence of eye infections tied to aging populations and diabetes, and increasing OTC access through pharmacies and telehealth platforms. As clinicians integrate new modalities and payers respond to treatment guidelines, market penetration is being strengthened by both pharmaceutical innovations and public health initiatives.

North America is expected to lead the eye infection treatment market in 2025, driven by rising diabetic retinopathy cases and postoperative infections at advanced ophthalmic centers. Reimbursement support for prescription and OTC eye drops, coupled with robust telemedicine expansion, has improved access in rural communities.

These streamlined approval pathways for ophthalmic antibiotics and antivirals have enabled rapid launch cycles, while consumer education campaigns have increased early treatment-seeking behavior and reduced vision loss rates. Europe’s market is being supported by strong public health investments in ocular care for aging societies.

Partnerships between ophthalmology clinics and pharma companies have accelerated post-market surveillance and registries for adverse event monitoring. This has enhanced confidence in new drug deployments and regulators’ endorsement of nanotherapy delivery systems, further propelling regional uptake.

The global eye infections treatment market's compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.8%, followed by a slightly lower growth rate of 4.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 4.8% (2024 to 2034) |

| H2 | 4.3% (2024 to 2034) |

| H1 | 3.9% (2025 to 2035) |

| H2 | 3.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.9% in the first half and remain relatively moderate at 3.4% in the second half. In the first half (H1) the industry witnessed a decrease of 90 BPS while in the second half (H2), the industry witnessed a decrease of 90 BPS.

In 2025, the antibiotic segment has retained its dominance within the eye infection treatment market, accounting for 55.3% of the total revenue. This leadership position has been driven by the widespread prevalence of bacterial conjunctivitis, blepharitis, keratitis, and other anterior segment infections.

The segment’s growth has been supported by a high incidence of gram-positive and gram-negative pathogens in both hospital-acquired and community-acquired infections. Prescriptions of broad-spectrum agents such as fluoroquinolones and macrolides have remained frequent due to their superior bioavailability and faster resolution times.

Additionally, new-generation formulations with improved ocular penetration and lower toxicity have been introduced by key manufacturers. Regulatory approvals have also been expedited for fixed-dose combinations that improve compliance and clinical outcomes.

The increasing demand for post-surgical infection prophylaxis and empiric therapies has further expanded antibiotic usage across ambulatory and inpatient care. These factors, combined with rising antimicrobial resistance surveillance, have positioned antibiotics as the cornerstone of pharmacological intervention in ophthalmic infections.

Eye drops have emerged as the leading dosage form in 2025, contributing to 60.0% of the total revenue share in the global eye infection treatment market. This segment’s growth has been attributed to its non-invasive nature, ease of self-administration, and rapid localized action on ocular tissues. Patients have shown strong preference for topical applications due to minimal systemic absorption and reduced side effect profiles.

Clinicians have increasingly favored eye drops for treating anterior segment infections, given their direct targeting of affected sites and ability to maintain therapeutic drug concentrations. Market expansion has also been catalyzed by the widespread availability of preservative-free formulations, which have improved tolerability in patients with chronic conditions or dry eye syndromes.

Furthermore, the rise in e-prescriptions and tele-ophthalmology platforms has enhanced access to topical therapies. The segment’s dominance has also been reinforced by continuous innovations in viscosity-enhancing agents and multi-dose delivery systems that promote compliance and reduce wastage.

Rising Prevalence of Eye Infections is driving the market growth

Growing cases of eye infections globally are a major reason for the growth in the eye infections treatment. Such conditions as conjunctivitis, keratitis, and endophthalmitis have been increasing in recent times because of the environmental changes, life habits, and other particular health states. Poor hygiene practices as well as inappropriate use of contact lenses further increase the chances of developing bacterial and fungal infections.

Moreover, the high incidence of systemic diseases like diabetes makes the individual more susceptible to ocular complications, including infection. High levels of pollution in urban areas are mostly responsible for irritation and inflammation within the eyes, which creates an adequate background for infections to develop further. Viral epidemics such as adenoviral conjunctivitis present a common condition of highly contagious eye infections that have been occurring in large groups.

Advancement in diagnostic techniques, along with an increase in awareness about eye health, have resulted in detection and treatment at earlier stages than ever before. As the incidences of these infections continue to increase, new and innovative forms of treatment with effective and affordable antibiotics, antivirals, and combinations of both continue to fuel exponential growth in this market.

Growing awareness regarding eye infections is driving the industry growth

A growing public concern about the requirement for early diagnosis and treatment of eye infections contributes to the high growth rate in the global market for eye infections treatment. With improved educational campaigns and health initiatives, people are becoming more vigilant about the complications associated with eye infections if they are left untreated, including the risk of impairment, corneal scarring, or even blindness. This heightened awareness encourages individuals to seek timely medical attention, thereby driving the demand for effective treatments.

Increased media campaigns, both print and electronic, and increased presence in healthcare facilities, have now brought about an awareness of redness, discharge, and pain among patients to seek healthcare providers earlier. The healthcare providers also now focus on measures of prevention, including hygiene and proper care of contact lenses, to avert infections.

Rising understanding of the possible severity of untreated eye infections will increase demand for over-the-counter medication or prescription treatment from ophthalmologists, driving market growth. This awareness is strong in developed countries but spreads to emerging markets where increased healthcare access coincides with more knowledgeable patients seeking effective treatments.

Increased adoption of combination therapies is a major trend in the market

Increasing the prevalence of antibiotic resistance are behind the increasing application of combination therapy in eye infections. Combination therapy, in the eye infections context, describes simultaneous use of two or more drugs-antibiotics, antivirals, antifungals, or corticosteroids-in the treatment of infections caused by a wider scope of pathogens. Such approach holds relevance at this time as single-agent treatments often fail to treat different types of microorganisms responsible for eye infections.

Combination treatments improve treatment outcome, lower resistance development possibilities, and short recovery periods. For example the antibiotic combination can target both Gram-positive and Gram-negative bacterial conjunctivitis for their severe type, in the case of viral infection for keratitis using antiviral drugs along with corticosteroids that assist in inflammation regulation and managing infections.

Recent worries over antibiotic resistance, which decrease the effectiveness of age-old treatments, accelerate this trend more. The frequency of complex, multi-pathogen infections, including those in the immunocompromised, contributes to the upward trend in a combination treatment adopted by healthcare service providers. That is how market trends are molded and where innovation is compelled and multi-drug formulations have a growing requirement.

Growing resistance to conventional antibiotics may restrict market growth

Antibiotic resistance is a crucial constraint in eye infections treatment, with the fact that it undermines antibiotic effectiveness to treat bacteria-caused ocular infections as a major inhibitor. As bacteria evolve over time and result in resistance, the commonly administered antibiotics become relatively ineffective, lengthening infection time, increasing hospital costs, and raising the level of complications during treatment. This is very critical in the case of eye infections, which require immediate and effective treatment to avoid loss of vision.

Development of resistance Overuse and misuse of antibiotics, for example when there is no infection, or against viral infections. Misuse of eye medications, for example, administering too much or not taking the full-prescribed course, worsens the issue.

For instance, MRSA, a resistant bacterium, is among the most common agents causing severe eye infection, endophthalmitis. Such infections are more challenging to treat because they require stronger antibiotics or alternative therapies that are usually more expensive. With the increasing number of antibiotic-resistant pathogens, there is an increase in the need for new drugs that are effective against the pathogen, but drugs are not developed overnight, and designing a new drug is expensive, constituting a challenge to timely treatment and increases market share.

The global eye infections treatment industry recorded a CAGR of 3.2% during the historical period between 2020 and 2024. The growth of eye infections treatment industry was positive as it reached a value of USD 11,890.2 million in 2035 from USD 8,125.2 million in 2025.

Previously, eye infections have been treated with a single class of drugs, such as antibiotics for bacterial infections, antivirals for viral infections, or antifungals for fungal infections. Common treatments include eye drops or ointments, often with broad-spectrum antibiotics like chloramphenicol or tobramycin for bacterial conjunctivitis. For viral infections, acyclovir is used, while natamycin serves as an antifungal agent for fungal eye infections.

The current scenario of treatment landscape has changed, given the emerging challenges of antibiotic resistance and multi-pathogen infections. Combination therapy, where instead of using just one type of drug, different drugs are used against multiple pathogens, is now quite common.

The novel treatments of antimicrobial peptides, biologics, and nano-based therapies are also designed to combat resistant strains and are effective. Advances in personalized medicine and telemedicine for more rapid diagnosis represent the shift to more individualized and accessible care. This change away from a one-size-fits-all model towards more specific and effective solutions represents a great opportunity for companies operating in the eye infections treatment market.

The growth of the elderly population, particularly in developed countries, is further increasing the demand for effective eye infection treatments. This demographic shift not only fuels market growth but also propels innovation in therapies designed to address age-related vulnerabilities.

Tier 1 companies are the industry leaders with 40.2% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include AbbVie, Alcon Laboratories Inc., Bausch + Lomb and Pfizer Inc.

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 20.1% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Johnson & Johnson Services Inc., Sanofi S.A., GlaxoSmithKline plc and Akron Pharma Inc.

Compared to Tiers 1 and 2, Tier 3 companies offer eye infections treatment, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. The companies such as Intas Pharmaceuticals Ltd, Macleods Pharmaceuticals Ltd., and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

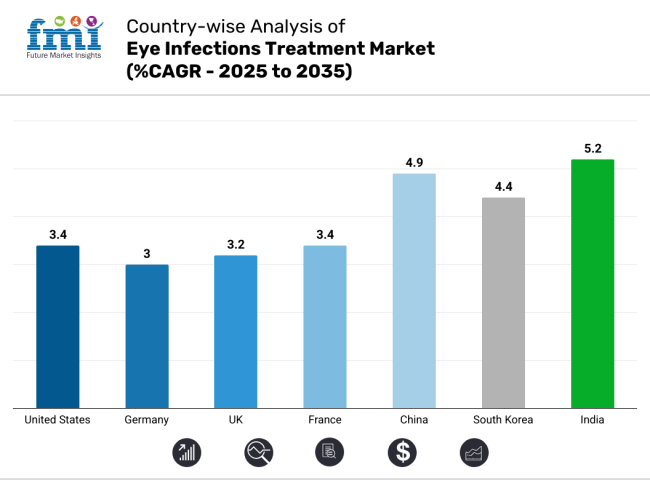

The market analysis for eye infections treatment in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 86.7%. By 2035, China is expected to experience a CAGR of 4.9% in the Asia-Pacific region.

Germany’s eye infections treatment market is poised to exhibit a CAGR of 3.0% between 2025 and 2035. The Germany holds highest market share in European market.

Germany has the biggest population aged people in Europe. Since aging makes most people susceptible to many types of eye problems such as cataracts and AMD, an elderly population creates high demand for treatment of eye infections. Cataract is an opaque area that encroaches in the lens inside the eye making it unable to focus on anything clearly; sometimes surgery has to be undertaken.

Post-operative complications such as infections can include endophthalmitis, thereby raising the need for infection treatments. Similarly, AMD is one of the major causes of vision loss in the aged, causing damage to the retina, thus leaving the eye prone to infections and inflammation.

The elderly often become less responsive to the immune system. Dry eye syndrome is also very common among the elderly and tends to increase the risk of eye infections since the natural defense mechanisms of the eye are poor. As the number of older people in Germany increases, so does the prevalence of these conditions and the resultant demand for appropriate treatments for eye infections. This trend propels market growth since healthcare providers have been targeting aged populations with chronic or post-surgical eye conditions for infection management.

United States is anticipated to show a CAGR of 3.4% between 2025 and 2035.

Growing demand for contact lens in the United States, particularly among its younger population, is an imperative driver of this eye infections treatment market. In fact, since more and more are turning to these lenses to correct vision problems, the danger of eye infections-keratitis and conjunctivitis- increases among them. These also include poor hygiene, extended use, and ignoring the cleaning processes. These habits significantly raise bacterial, viral, or fungal infection chances.

This is the same case for most forms of contact lenses. One common complication with its use is that of bacterial keratitis. Without prompt treatment, bacterial keratitis is a significant reason for serious impairments to a person's eyesight. As the use of contact lenses increases, and especially in the USA, the demand to treat and prevent infection grows.

Consumers become aware of the dangerous implications due to contact lens usage, which fuels the market for both prophylactic treatments and therapeutic solutions. Besides this, the health care professionals are focusing towards educating their users about proper lens care and the significance of regular eye examinations that propel the market for eye infection treatment. This creates a rising need for the effective and accessible treatments in the USA

China is anticipated to show a CAGR of 4.9% between 2025 and 2035.

In China, initiatives by the government and non-government organizations related to vision health and prevention of blindness are working as a great driving force in the eye infections treatment market. The Chinese government has realized that the burden of eye diseases is increasing and has thus launched several national health campaigns on improving eye care awareness and prevention of vision loss. These initiatives mainly focus on regular eye tests, public enlightenment about eye care, and proper treatment of an eye infection if caught early.

Apart from governmental efforts, various non-government organizations are coming forward to enhance awareness about the eye health system in rural areas where healthcare access is limited. The programs, therefore, by these organizations provide free eye screenings and distribute eye care information, giving treatments for the most common infections affecting the eye.

These not only prevent serious eye conditions but also encourage early treatment of problems that might not lead to any complications if dealt with promptly, hence creating a demand for efficient treatments.

With such expansions, treatment of eye infections will increase adoption in the market because people will look for their eyes to be safe and be treated promptly.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. These involve product innovation to create advanced therapies like combination treatments, biologics, and new drug delivery systems to ensure greater efficacy and compliance from the patient.

Strategic partnerships and collaborations with research institutions and healthcare providers are being utilized to broaden their product portfolio. Geographical expansion into the emerging markets, particularly China and India, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong. Companies also have been spending money on the campaigns and educational programs for raising early diagnosis and the treatment uptake.

Recent Industry Developments in Eye Infections Treatment Industry Outlook

In terms of drug class, the industry is divided into antibiotics, antivirals, antifungals, antihistamines, corticosteroids and glucocorticoids.

In terms of indication, the industry is segregated into conjunctivitis, keratitis, endophthalmitis, blepharitis, stye or sty, uveitis, cellulitis and ocular herpes

In terms of dosage form, the industry is divided into tablet, capsule, ophthalmic ointment, eye drops and others.

In causative agents, the industry is segregated into virus, bacteria, fungus, and allergens

In terms of mode of purchase, the industry is divided into prescription drugs and over-the-counter (OTC) drugs.

In terms of distribution channel, the industry is divided into hospital pharmacies, retail pharmacies and online pharmacies.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global eye infections treatment industry is projected to witness CAGR of 4.7% between 2025 and 2035.

The global eye infections treatment industry stood at USD 7,860.1 million in 2024.

The global eye infections treatment industry is anticipated to reach USD 11,400.7 million by 2035 end.

China is expected to show a CAGR of 4.9% in the assessment period.

The key players operating in the global eye infections treatment industry AbbVie, Alcon Laboratories Inc., Bausch + Lomb, Pfizer Inc., Johnson & Johnson Services Inc., Sanofi S.A., GlaxoSmithKline plc, Akron Pharma Inc., Intas Pharmaceuticals Ltd, Macleods Pharmaceuticals Ltd. and others

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Under-Eye Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Coxsackievirus Infections Treatment Market – Growth & Drug Innovations 2025 to 2035

Helicobacter Pylori Infections Treatment Market Size and Share Forecast Outlook 2025 to 2035

Global Antibiotic-Resistant Infections Treatment Market Analysis – Size, Share & Forecast 2024-2034

Complicated Urinary Tract Infections Treatment Market - Trends & Outlook 2025 to 2035

Catheter Associated Urinary Tract Infections (UTI) Treatment Market - Demand & Forecast 2025 to 2035

Eyebrow Makeup Market Size and Share Forecast Outlook 2025 to 2035

Eye Tracking System Market Forecast and Outlook 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Eye Health Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Eye Shadow Stick Market Analysis - Size, Share, and Forecast 2025 to 2035

Eye Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Eye and Face Protection Market Growth - 2025 to 2035

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA