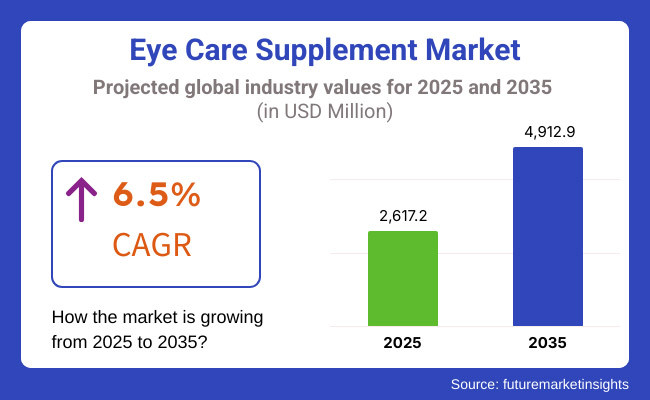

The global eye care supplement industry is expanding as more people prioritize vision health. Valued at USD 2,617.2 million in 2025, it is projected to reach USD 4,912.9 million by 2035, growing at a CAGR of 6.5%.

With increasing screen exposure and aging populations, demand for supplements rich in lutein, zeaxanthin, and other antioxidants is rising. This growth presents opportunities for innovation in eye health and wellness.

| Key Drivers | Key Restraints |

|---|---|

| Rising Screen Time: Increased digital exposure is leading to more eye strain and vision issues. | High Product Cost: Premium supplements can be expensive, limiting accessibility. |

| Aging Population: Growing elderly demographics drive demand for age-related vision support. | Lack of Awareness: Many consumers are unaware of the benefits of eye supplements. |

| Increasing Health Consciousness: More people are proactively investing in eye health. | Regulatory Challenges: Strict guidelines and approvals can slow product launches. |

| Innovation & Research: New formulations with clinically proven ingredients boost market growth. | Availability of Alternatives: Dietary sources and prescription treatments compete with supplements. |

| E-commerce Growth: Online retail expands accessibility and consumer reach. | Skepticism & Misinformation: Doubts over supplement effectiveness may impact sales. |

Impact Assessment of Key Drivers

| Key Drivers | Impact |

|---|---|

| Rising Screen Time | High |

| Aging Population | High |

| Increasing Health Consciousness | Medium |

| Innovation & Research | High |

| E-commerce Growth | Medium |

Impact Assessment of Key Restraints

| Key Restraints | Impact |

|---|---|

| High Product Cost | Medium |

| Lack of Awareness | High |

| Regulatory Challenges | Medium |

| Availability of Alternatives | Medium |

| Skepticism & Misinformation | High |

Retail pharmacies will remain dominant, offering easy access to eye health supplements and expert recommendations. Specialist products or compounded products prescribed by healthcare professionals will be supplied through a hospital pharmacy.

Online pharmacies will continue to grow significantly, providing ease of use, discounts, and subscribing models to a wider audience. Ophthalmic store will always serve specific market for patients who are looking for an expert guidance or quality eye health formulations.

Awareness for eye health will drive the market growth in different indications. The demand for preventive and therapeutic solutions will be fuelled by age-related macular degeneration, especially in aging populations. Expect cataract-related supplements and treatments to be in vogue, as others seek alternatives to surgery.

Dry eye syndrome will also remain an impetus for innovation, and new formulations will provide long-lasting hydration and relief. There will be more emphasis on glaucoma management with nutraceutical innovations to support optic nerve health. Industry growth resulting from the active effort from consumers to take better care of their eye health will include other indications like diabetic retinopathy and general vision enhancement.

As different routes of administration meet different consumer needs, the market will grow. The few ways of orally administration will still be the most widely accepted and most advantageous over time. Targeted relief for user-originated issues, such as eye strain, irritation, and dryness, will lead to topical applications becoming more prominent.

The administration of parenteral route is not as frequent as topical, but will be an essential aspect in clinical settings in life-threatening eye conditions that require immediate intervention.

Over the forecast period, different dosage forms are expected to show their presence constantly in the industry. Tablets will also lead such as their easy storage and a consumer’s choice. Capsules will have their moment as an easy-to-swallow alternative with better bioavailability.

Gels will be preferred because they provide fast relief and targeted application. Consumers seeking faster absorption and enhanced effectiveness will gravitate toward liquid formulations. Gummies will remain the most popular form for eye health supplement drivers, especially among younger consumers and those who prefer a more enjoyable delivery method.

The market for eye care supplements in the USA is expected to grow at a moderate pace owing to high consumer awareness and the aging population. Also, the soaring incidence of digital eye strain resulting from extended daily screen time will continue to drive demand.

With an eye to science, consumers will gravitate toward clinically validated ingredients in product formulations, including lutein, zeaxanthin, and omega-3 fatty acids. Distribution will be predominantly by e-commerce, with subscription models on the rise.

Regulatory review will become more stringent, and the need for high-quality, transparent formulations will drive companies to invest. These trends in preventive healthcare will bring more Americans comprehensive eye care supplements in their daily wellness routines.

This situation will convince more consumers to invest in eye care to avoid problems. An increase in the use of digital devices will boost demand for formulations designed to relieve digital eye strain and dry eye syndrome.

As consumers look for clean-label products, natural and organic supplements will garner growth. Regulatory agencies will focus on product transparency and efficacy leading the companies to conduct clinical studies.

The growth of e-commerce and development of online pharmacies will increase access for consumers to specialized eye health products. This will drive growth for vegan and sustainably sourced supplements too, given Canada’s particular focus on sustainability.

The rising prevalence of age-related macular degeneration and cataracts in the UK will create a demand for eye care supplements. Consumer will focus on high-quality and clinically validated supplement and companies will focus on research backed formulations.

Distribution will be dominated by online retail and pharmacy chains that offer subscription models and personalized recommendations. Consumer preferences will be driven by sustainability with a greater demand for plant-based and ethical products.

More stringent guidelines imposed by regulatory authorities will ensure that the mesh/devices are safe and efficacious. Anticipating the increasing awareness of blue light exposure, especially among professionals and their students, is expected to fuel the demand for supplements formulated to protect the eyes against the effects of digital eye strain.

In France, sales will grow in response to the rising adoption of preventive healthcare practices. And consumers will look towards scientifically backed solutions, and lutein, zeaxanthin, and astaxanthin will be household names.

Products will reflect the growing interest in organic and natural ingredients, and companies will invest in portions which are sustainably harvested. Pharmacy chains will continue to be the mainstay distribution channel, but e-commerce will increase dramatically as they are more convenient and have better access to products.

Government regulations will lead to more transparency and push for clinical validation as well, which will have implications for brand credibility. Increasing screen exposure towards a broader population of professionals and students will continue to drive the demand for blue-light protective supplements.

The German eye care supplements sector will be favored by a health-conscious population and a robust pharmaceutical industry. Consumers will find high-quality, clinically tested formulations a must-use, leading to more innovation driven by bioavailable ingredients.

Strict quality standards will be maintained by regulatory bodies to ensure that products are safe and effective. Sales will also be boosted by online and retail pharmacies, along with a growing reliance among consumers on expert advice.

The growing population will also fuel ongoing demand for supplements for age-related macular degeneration and cataracts. Germany is characterized by environmentally conscious and ethical consumerism, which will likely position sustainable and vegan supplements in a stronger field.

With a digitally exposed and technologically proficient population, South Korea will see the fastest growth in the eye care supplement industry. Consumers are likely to look for supplements specifically designed to target digital eye strain, dryness, and fatigue.

The report also points towards the innovation of functional foods & beauty-nutraceuticals, which in turn will drive eye care products formulated with antioxidants & herbal extracts. E-commerce will also lead to distribution, allowing brands to use social media and online platforms to sell individualized solutions. As such, the need for premium and scientifically validated supplements will grow, prompting firms to partner with research institutions to create tomorrow’s generation of eye health products.

Japan’s growing geriatric population, coupled with its aversion to preventive healthcare, will augment the eye care supplement market in the country. Manufacturers will produce high-quality, clinically backed supplements that contain lutein, astaxanthin, and omega-3 fatty acids, which will be at the demand of consumers.

You will still be seeing traditional ingredients like herbal extracts make their way into modern formulations. Distribution will be led by convenience stores, pharmacies and e-commerce, with online sales becoming increasingly important.

As for older adults, the government will keep pushing proactive eye health, including introducing supplements for macular degeneration and other vision-related ailments. The increasing penetration of functional foods, which focus on infusing eye health benefits into everyday nutrition, will also drive the growth of the market.

The eye care supplements in China will grow rapidly. Consumers will become increasingly health conscious, which will create demand for preventive solutions against digital eye strain, dry eye syndrome, and myopia. International players will also enter to meet growing demand, in addition to expansion of domestic brands. Distribution will consolidate in e-commerce. Alibaba, JD. com are key sales channels. Standards and regulatory compliance will be a focus for the government that will ensure consumer confidence in the safety and efficacy of products.

Driven by growing awareness for vision health and a rising middle-class segment, India’s eye care supplement market will expand rapidly. Digital eye strain will be prevalent, thus increasing the need for supplements that can counter the effects of blue light exposure. Products that are both affordable and effective will be in great demand in the market with brands both local and foreign vying for market share.

The product will be widely available through retail pharmacies and e-commerce platforms as the primary distribution channels. Consumers will lean towards herbal and Ayurvedic formulations in demand for natural replacements. Such factors, in turn, will bolster its market expansion plans, particularly with the government encouraging preventive healthcare.

The eye care supplement industry is consolidated globally, wherein Tier 1 players account for 90% of the total market share. European countries also account for some of the major market players, including the leading pharma and nutraceutical companies, who drive the industry through strong branding, wide-ranging distribution networks, and ongoing product development to meet diverse consumer needs.

Their capital muscle and knowledge of regulatory environment make it difficult for new entrants, resulting in a concentrated market that’s dominated by a few big players.

However, niche opportunities persist for smaller and emerging firms with well-defined targeting, special formulations, or naturally derived ingredients, and region-focused consumers. A rising focus on eye health, growing awareness of the usefulness of personalised user-specific supplements, technological readiness and increasing e-commerce platforms are fueling markets for new entrants.

The eye care supplement landscape has already seen the advent of key manufacturers with new product developments and clever expansion strategies. Some companies, like Bausch + Lomb, launched supplements like Blink NutriTears, which is infused with lutein, zeaxanthin, curcumin and vitamin D, that claim to assist dry eyes and enhance tear production.

HealthyCell also debuted Eye Health MicroGel, a highly bioavailable supplement filled with nutrients, including astaxanthin and lycopene to support vision and retinal health. These brands are harnessing such new research to deliver far better solutions for consumers whose focus on eye health is growing.

Startups are changing the game with specialized products and unique approaches. Wellbeing Nutrition hit the headlines with Melts Eye Care, the world’s first natural eye vitamin that rather than consume through the digestive system applies nanotechnology to allow for better absorption.

Enabling that type of innovation is helping smaller brands stake a claim in a industry that has been historically dominated by big names.” Most of these startups are around natural ingredients and innovative delivery methods, aiming at a growing consumer segment that wants clean-label, scientifically supported supplements.

And that goes beyond only new products; both big companies and startups are also delving into personalized nutrition and digital health tools. A few brands are incorporating telehealth consultations for personalized diets and eye care supplements, while others are working on AI products to automatically monitor and optimize eye health. As individuals take a more active approach towards their well-being, the future of eye care supplements is moving towards more customized, tech-enabled and personalized options that suit personal lifestyles.

Key factors driving demand include increased screen time, aging populations and rising eye health awareness.

These are commonly used (Lutein, zeaxanthin, omega-3 fatty acids, and antioxidants) for vision support.

They can be found in retail and hospital pharmacies, in online retailers and in specialized ophthalmic stores.

Growing awareness and investments in health care led to the fastest growth of East Asia and South Asia.

Table 01: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Ingredients

Table 02: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Dosage Form

Table 03: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Route of Administration

Table 04: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Indication

Table 05: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 06: Global Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Region

Table 07: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 08: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Ingredients

Table 09: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Dosage Form

Table 10: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Route of Administration

Table 11: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Indication

Table 12: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 13: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 14: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Ingredients

Table 15: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Dosage Form

Table 16: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Route of Administration

Table 17: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Indication

Table 18: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 19: Europe Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 20: Europe Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Ingredients

Table 21: Europe Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Dosage Form

Table 22: Europe Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Route of Administration

Table 23: Europe Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Indication

Table 24: Europe Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 25: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 26: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Ingredients

Table 27: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Dosage Form

Table 28: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Route of Administration

Table 29: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Indication

Table 30: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 31: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 32: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Ingredients

Table 33: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Dosage Form

Table 34: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Route of Administration

Table 35: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Indication

Table 36: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 37: Oceania Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 38: Oceania Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Ingredients

Table 39: Oceania Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Dosage Form

Table 40: Oceania Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Route of Administration

Table 41: Oceania Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Indication

Table 42: Oceania Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Table 43: Middle East & Africa Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 44: Middle East & Africa Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Ingredients

Table 45: Middle East & Africa Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Dosage Form

Table 46: Middle East & Africa Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Route of Administration

Table 47: Middle East & Africa Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Indication

Table 48: Middle East & Africa Market Analysis 2019 to 2023 and Forecast 2024 to 2034, by Distribution Channel

Figure 01: Global Market Value (US$ Million) Analysis, 2019 to 2023

Figure 02: Global Market Forecast & Y-o-Y Growth, 2024 to 2034

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2024 to 2034

Figure 04: Global Market Value Share (%) Analysis 2024 and 2034, by Ingredients

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Ingredients

Figure 06: Global Market Attractiveness Analysis 2024 to 2034, by Ingredients

Figure 07: Global Market Value Share (%) Analysis 2024 and 2034, by Dosage Form

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Dosage Form

Figure 09: Global Market Attractiveness Analysis 2024 to 2034, by Dosage Form

Figure 10: Global Market Value Share (%) Analysis 2024 and 2034, by Route of Administration

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Route of Administration

Figure 12: Global Market Attractiveness Analysis 2024 to 2034, by Route of Administration

Figure 13: Global Market Value Share (%) Analysis 2024 and 2034, by Indication

Figure 14: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Indication

Figure 15: Global Market Attractiveness Analysis 2024 to 2034, by Indication

Figure 16: Global Market Value Share (%) Analysis 2024 and 2034, by Distribution Channel

Figure 17: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Distribution Channel

Figure 18: Global Market Attractiveness Analysis 2024 to 2034, by Distribution Channel

Figure 19: Global Market Value Share (%) Analysis 2024 and 2034, by Region

Figure 20: Global Market Y-o-Y Growth (%) Analysis 2024 to 2034, by Region

Figure 21: Global Market Attractiveness Analysis 2024 to 2034, by Region

Figure 22: North America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 23: North America Market Value (US$ Million) Forecast, 2024 to 2034

Figure 24: North America Market Value Share, by Ingredients (2024 E)

Figure 25: North America Market Value Share, by Dosage Form (2024 E)

Figure 26: North America Market Value Share, by Route of Administration (2024 E)

Figure 27: North America Market Value Share, by Indication (2024 E)

Figure 28: North America Market Value Share, by Distribution Channel (2024 E)

Figure 29: North America Market Value Share, by Country (2024 E)

Figure 30: North America Market Attractiveness Analysis by Ingredients, 2024 to 2034

Figure 31: North America Market Attractiveness Analysis by Dosage Form, 2024 to 2034

Figure 32: North America Market Attractiveness Analysis by Route of Administration, 2024 to 2034

Figure 33: North America Market Attractiveness Analysis by Indication, 2024 to 2034

Figure 34: North America Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 35: North America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 36: USA Market Value Proportion Analysis, 2023

Figure 37: Global Vs. USA Growth Comparison

Figure 38: USA Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 39: USA Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 40: USA Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 41: USA Market Share Analysis (%) by Indication, 2024 & 2034

Figure 42: USA Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 43: Canada Market Value Proportion Analysis, 2023

Figure 44: Global Vs. Canada. Growth Comparison

Figure 45: Canada Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 46: Canada Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 47: Canada Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 48: Canada Market Share Analysis (%) by Indication, 2024 & 2034

Figure 49: Canada Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 50: Latin America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 51: Latin America Market Value (US$ Million) Forecast, 2024 to 2034

Figure 52: Latin America Market Value Share, by Ingredients (2024 E)

Figure 53: Latin America Market Value Share, by Dosage Form (2024 E)

Figure 54: Latin America Market Value Share, by Route of Administration (2024 E)

Figure 55: Latin America Market Value Share, by Indication (2024 E)

Figure 56: Latin America Market Value Share, by Distribution Channel (2024 E)

Figure 57: Latin America Market Value Share, by Country (2024 E)

Figure 58: Latin America Market Attractiveness Analysis by Ingredients, 2024 to 2034

Figure 59: Latin America Market Attractiveness Analysis by Dosage Form, 2024 to 2034

Figure 60: Latin America Market Attractiveness Analysis by Route of Administration, 2024 to 2034

Figure 61: Latin America Market Attractiveness Analysis by Indication, 2024 to 2034

Figure 62: Latin America Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 63: Latin America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 64: Mexico Market Value Proportion Analysis, 2023

Figure 65: Global Vs Mexico Growth Comparison

Figure 66: Mexico Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 67: Mexico Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 68: Mexico Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 69: Mexico Market Share Analysis (%) by Indication, 2024 & 2034

Figure 70: Mexico Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 71: Brazil Market Value Proportion Analysis, 2023

Figure 72: Global Vs. Brazil. Growth Comparison

Figure 73: Brazil Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 74: Brazil Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 75: Brazil Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 76: Brazil Market Share Analysis (%) by Indication, 2024 & 2034

Figure 77: Brazil Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 78: Argentina Market Value Proportion Analysis, 2023

Figure 79: Global Vs Argentina Growth Comparison

Figure 80: Argentina Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 81: Argentina Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 82: Argentina Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 83: Argentina Market Share Analysis (%) by Indication, 2024 & 2034

Figure 84: Argentina Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 85: Europe Market Value (US$ Million) Analysis, 2019 to 2023

Figure 86: Europe Market Value (US$ Million) Forecast, 2024 to 2034

Figure 87: Europe Market Value Share, by Ingredients (2024 E)

Figure 88: Europe Market Value Share, by Dosage Form (2024 E)

Figure 89: Europe Market Value Share, by Route of Administration (2024 E)

Figure 90: Europe Market Value Share, by Indication(2024 E)

Figure 91: Europe Market Value Share, by Distribution Channel (2024 E)

Figure 92: Europe Market Value Share, by Country (2024 E)

Figure 93: Europe Market Attractiveness Analysis by Ingredients, 2024 to 2034

Figure 94: Europe Market Attractiveness Analysis by Dosage Form, 2024 to 2034

Figure 95: Europe Market Attractiveness Analysis by Route of Administration, 2024 to 2034

Figure 96: Europe Market Attractiveness Analysis by Indication, 2024 to 2034

Figure 97: Europe Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 98: Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 99: UK Market Value Proportion Analysis, 2023

Figure 100: Global Vs. UK Growth Comparison

Figure 101: UK Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 102: UK Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 103: UK Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 104: UK Market Share Analysis (%) by Indication, 2024 & 2034

Figure 105: UK Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 106: Germany Market Value Proportion Analysis, 2023

Figure 107: Global Vs. Germany Growth Comparison

Figure 108: Germany Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 109: Germany Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 110: Germany Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 111: Germany Market Share Analysis (%) by Indication, 2024 & 2034

Figure 112: Germany Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 113: Italy Market Value Proportion Analysis, 2023

Figure 114: Global Vs. Italy Growth Comparison

Figure 115: Italy Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 116: Italy Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 117: Italy Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 118: Italy Market Share Analysis (%) by Indication, 2024 & 2034

Figure 119: Italy Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 120: France Market Value Proportion Analysis, 2023

Figure 121: Global Vs France Growth Comparison

Figure 122: France Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 123: France Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 124: France Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 125: France Market Share Analysis (%) by Indication, 2024 & 2034

Figure 126: France Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 127: Spain Market Value Proportion Analysis, 2023

Figure 128: Global Vs Spain Growth Comparison

Figure 129: Spain Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 130: Spain Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 131: Spain Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 132: Spain Market Share Analysis (%) by Indication, 2024 & 2034

Figure 133: Spain Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 134: Russia Market Value Proportion Analysis, 2023

Figure 135: Global Vs Russia Growth Comparison

Figure 136: Russia Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 137: Russia Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 138: Russia Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 139: Russia Market Share Analysis (%) by Indication, 2024 & 2034

Figure 140: Russia Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 141: BENELUX Market Value Proportion Analysis, 2023

Figure 142: Global Vs BENELUX Growth Comparison

Figure 143: BENELUX Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 144: BENELUX Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 145: BENELUX Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 146: BENELUX Market Share Analysis (%) by Indication, 2024 & 2034

Figure 147: BENELUX Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 148: East Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 149: East Asia Market Value (US$ Million) Forecast, 2024 to 2034

Figure 150: East Asia Market Value Share, by Ingredients (2024 E)

Figure 151: East Asia Market Value Share, by Dosage Form (2024 E)

Figure 152: East Asia Market Value Share, by Route of Administration (2024 E)

Figure 153: East Asia Market Value Share, by Indication(2024 E)

Figure 154: East Asia Market Value Share, by Distribution Channel (2024 E)

Figure 155: East Asia Market Value Share, by Country (2024 E)

Figure 156: East Asia Market Attractiveness Analysis by Ingredients, 2024 to 2034

Figure 157: East Asia Market Attractiveness Analysis by Dosage Form, 2024 to 2034

Figure 158: East Asia Market Attractiveness Analysis by Route of Administration, 2024 to 2034

Figure 159: East Asia Market Attractiveness Analysis by Indication, 2024 to 2034

Figure 160: East Asia Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 161: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 162: China Market Value Proportion Analysis, 2023

Figure 163: Global Vs. China Growth Comparison

Figure 164: China Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 165: China Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 166: China Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 167: China Market Share Analysis (%) by Indication, 2024 & 2034

Figure 168: China Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 169: Japan Market Value Proportion Analysis, 2023

Figure 170: Global Vs. Japan Growth Comparison

Figure 171: Japan Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 172: Japan Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 173: Japan Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 174: Japan Market Share Analysis (%) by Indication, 2024 & 2034

Figure 175: Japan Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 176: South Korea Market Value Proportion Analysis, 2023

Figure 177: Global Vs South Korea Growth Comparison

Figure 178: South Korea Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 179: South Korea Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 180: South Korea Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 181: South Korea Market Share Analysis (%) by Indication, 2024 & 2034

Figure 182: South Korea Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 183: South Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 184: South Asia Market Value (US$ Million) Forecast, 2024 to 2034

Figure 185: South Asia Market Value Share, by Ingredients (2024 E)

Figure 186: South Asia Market Value Share, by Dosage Form (2024 E)

Figure 187: South Asia Market Value Share, by Route of Administration (2024 E)

Figure 188: South Asia Market Value Share, by Indication(2024 E)

Figure 189: South Asia Market Value Share, by Distribution Channel (2024 E)

Figure 190: South Asia Market Value Share, by Country (2024 E)

Figure 191: South Asia Market Attractiveness Analysis by Ingredients, 2024 to 2034

Figure 192: South Asia Market Attractiveness Analysis by Dosage Form, 2024 to 2034

Figure 193: South Asia Market Attractiveness Analysis by Route of Administration, 2024 to 2034

Figure 194: South Asia Market Attractiveness Analysis by Indication, 2024 to 2034

Figure 195: South Asia Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 196: South Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 197: India Market Value Proportion Analysis, 2023

Figure 198: Global Vs. India Growth Comparison

Figure 199: India Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 200: India Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 201: India Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 202: India Market Share Analysis (%) by Indication, 2024 & 2034

Figure 203: India Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 204: Indonesia Market Value Proportion Analysis, 2023

Figure 205: Global Vs. Indonesia Growth Comparison

Figure 206: Indonesia Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 207: Indonesia Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 208: Indonesia Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 209: Indonesia Market Share Analysis (%) by Indication, 2024 & 2034

Figure 210: Indonesia Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 211: Malaysia Market Value Proportion Analysis, 2023

Figure 212: Global Vs. Malaysia Growth Comparison

Figure 213: Malaysia Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 214: Malaysia Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 215: Malaysia Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 216: Malaysia Market Share Analysis (%) by Indication, 2024 & 2034

Figure 217: Malaysia Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 218: Thailand Market Value Proportion Analysis, 2023

Figure 219: Global Vs. Thailand Growth Comparison

Figure 220: Thailand Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 221: Thailand Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 222: Thailand Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 223: Thailand Market Share Analysis (%) by Indication, 2024 & 2034

Figure 224: Thailand Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 225: Oceania Market Value (US$ Million) Analysis, 2019 to 2023

Figure 226: Oceania Market Value (US$ Million) Forecast, 2024 to 2034

Figure 227: Oceania Market Value Share, by Ingredients (2024 E)

Figure 228: Oceania Market Value Share, by Dosage Form (2024 E)

Figure 229: Oceania Market Value Share, by Route of Administration (2024 E)

Figure 230: Oceania Market Value Share, by Indication(2024 E)

Figure 231: Oceania Market Value Share, by Distribution Channel (2024 E)

Figure 232: Oceania Market Value Share, by Country (2024 E)

Figure 233: Oceania Market Attractiveness Analysis by Ingredients, 2024 to 2034

Figure 234: Oceania Market Attractiveness Analysis by Dosage Form, 2024 to 2034

Figure 235: Oceania Market Attractiveness Analysis by Route of Administration, 2024 to 2034

Figure 236: Oceania Market Attractiveness Analysis by Indication, 2024 to 2034

Figure 237: Oceania Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 238: Oceania Market Attractiveness Analysis by Country, 2024 to 2034

Figure 239: Australia Market Value Proportion Analysis, 2023

Figure 240: Global Vs. Australia Growth Comparison

Figure 241: Australia Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 242: Australia Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 243: Australia Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 244: Australia Market Share Analysis (%) by Indication, 2024 & 2034

Figure 245: Australia Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 246: New Zealand Market Value Proportion Analysis, 2023

Figure 247: Global Vs New Zealand Growth Comparison

Figure 248: New Zealand Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 249: New Zealand Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 250: New Zealand Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 251: New Zealand Market Share Analysis (%) by Indication, 2024 & 2034

Figure 252: New Zealand Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 253: Middle East & Africa Market Value (US$ Million) Analysis, 2019 to 2023

Figure 254: Middle East & Africa Market Value (US$ Million) Forecast, 2024 to 2034

Figure 255: Middle East & Africa Market Value Share, by Ingredients (2024 E)

Figure 256: Middle East & Africa Market Value Share, by Dosage Form (2024 E)

Figure 257: Middle East & Africa Market Value Share, by Route of Administration (2024 E)

Figure 258: Middle East & Africa Market Value Share, by Indication(2024 E)

Figure 259: Middle East & Africa Market Value Share, by Distribution Channel (2024 E)

Figure 260: Middle East & Africa Market Value Share, by Country (2024 E)

Figure 261: Middle East & Africa Market Attractiveness Analysis by Ingredients, 2024 to 2034

Figure 262: Middle East & Africa Market Attractiveness Analysis by Dosage Form, 2024 to 2034

Figure 263: Middle East & Africa Market Attractiveness Analysis by Route of Administration, 2024 to 2034

Figure 264: Middle East & Africa Market Attractiveness Analysis by Indication, 2024 to 2034

Figure 265: Middle East & Africa Market Attractiveness Analysis by Distribution Channel, 2024 to 2034

Figure 266: Middle East & Africa Market Attractiveness Analysis by Country, 2024 to 2034

Figure 267: GCC Countries Market Value Proportion Analysis, 2023

Figure 268: Global Vs GCC Countries Growth Comparison

Figure 269: GCC Countries Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 270: GCC Countries Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 271: GCC Countries Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 272: GCC Countries Market Share Analysis (%) by Indication, 2024 & 2034

Figure 273: GCC Countries Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 274: Türkiye Market Value Proportion Analysis, 2023

Figure 275: Global Vs. Türkiye Growth Comparison

Figure 276: Türkiye Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 277: Türkiye Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 278: Türkiye Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 279: Türkiye Market Share Analysis (%) by Indication, 2024 & 2034

Figure 280: Türkiye Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 281: South Africa Market Value Proportion Analysis, 2023

Figure 282: Global Vs. South Africa Growth Comparison

Figure 283: South Africa Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 284: South Africa Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 285: South Africa Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 286: South Africa Market Share Analysis (%) by Indication, 2024 & 2034

Figure 287: South Africa Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Figure 288: North Africa Market Value Proportion Analysis, 2023

Figure 289: Global Vs North Africa Growth Comparison

Figure 290: North Africa Market Share Analysis (%) by Ingredients, 2024 & 2034

Figure 291: North Africa Market Share Analysis (%) by Dosage Form, 2024 & 2034

Figure 292: North Africa Market Share Analysis (%) by Route of Administration, 2024 & 2034

Figure 293: North Africa Market Share Analysis (%) by Indication, 2024 & 2034

Figure 294: North Africa Market Share Analysis (%) by Distribution Channel, 2024 & 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Thyroid Care Supplements Market – Growth, Demand & Hormonal Health

Veterinary Eye Care Market Size and Share Forecast Outlook 2025 to 2035

Eyebrow Makeup Market Size and Share Forecast Outlook 2025 to 2035

Eye Tracking System Market Forecast and Outlook 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Eye Health Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Eye Shadow Stick Market Analysis - Size, Share, and Forecast 2025 to 2035

Eye Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Eye and Face Protection Market Growth - 2025 to 2035

Global Eye Infections Treatment Market Report - Trends & Forecast 2025 to 2035

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Eye Shadow Market Insights – Size, Trends & Forecast 2025 to 2035

Eyewear Market Analysis by Product Type, End Use, Sales Channel, Material Type, and Region

Evaluating Eyeliner and Kajal Sculpting Pencil Packaging Market Share & Provider Insights

Key Companies & Market Share in the Eye Shadow Stick Sector

Competitive Overview of Eyewear Packaging Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA