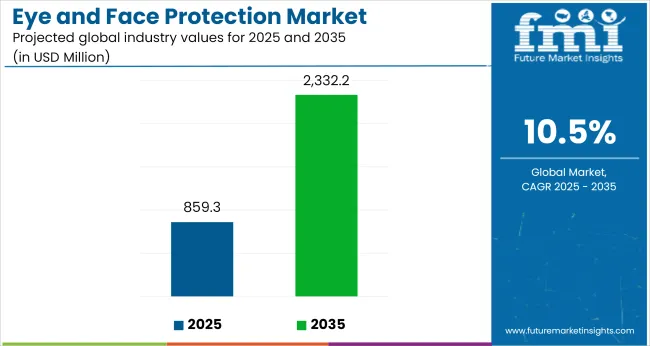

The global Eye and Face Protection Market is estimated to be valued at USD 859.3 million in 2025 and is projected to reach USD 2,332.2 million by 2035, registering a compound annual growth rate of 10.5% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 859.3 million |

| Industry Value (2035F) | USD 2,332.2 million |

| CAGR (2025 to 2035) | 10.5% |

The Eye and Face Protection market is undergoing a critical shift driven by rising workplace safety awareness and increasingly stringent occupational health regulations. Industries such as construction, manufacturing, and healthcare are under mounting pressure to ensure worker safety, prompting a surge in demand for advanced protective gear.

Companies are investing in innovation to enhance product comfort, durability, and compliance with global safety standards. Additionally, the integration of smart technologies into PPE is enabling real-time monitoring and risk detection. As industrial expansion continues across emerging markets and regulatory enforcement strengthens globally, the market is expected to witness consistent growth. Future opportunities lie in sustainable materials and intelligent protective solutions tailored for dynamic, high-risk work environments.

The dominance of general safety glasses in the Eye and Face Protection market, accounting for 70.10% of revenue share in 2025, can be attributed to their wide applicability across diverse industrial verticals. These glasses are considered the baseline requirement for personal protective equipment (PPE) protocols across manufacturing, construction, healthcare, and laboratory settings.

Their cost-effectiveness and ease of use have positioned them as the first line of defense in occupational safety programs. This segment has been favored due to compliance mandates from regulatory agencies like OSHA and ANSI, which have made basic eye protection compulsory in numerous high-risk job roles.

The product’s lightweight design, anti-scratch coatings, and compatibility with prescription lenses have further increased user compliance and operational convenience. Innovations such as anti-fog technology and UV protection have also enhanced the usability of general safety glasses in both indoor and outdoor environments. As industrial safety awareness continues to expand, the demand for this essential protective gear is expected to remain strong.

The manufacturing sector is anticipated to dominate the Eye and Face Protection market by application in 2025, contributing 35.5% to overall revenue. This leadership position has been reinforced by the elevated risk of occupational eye injuries prevalent in metalworking, fabrication, machinery operation, and chemical handling within the sector.

The necessity to adhere to rigorous health and safety standards enforced by national and international regulatory bodies has prompted widespread adoption of safety eyewear among manufacturing enterprises. Compliance requirements from agencies such as OSHA, along with internal corporate safety audits, have increased investment in basic and specialized eye protection solutions.

Moreover, the presence of complex mechanical operations, high-temperature processes, and exposure to flying particles has created a non-negotiable need for effective eye safety gear. Manufacturing facilities globally have also embraced PPE training and hazard assessments, further supporting the segment’s stronghold.

User Comfort, PPE Fatigue, and Cost Constraints

Especially in tropical climates, it is common for workers to report discomfort from the heat build-up, restricted vision, or the overall weight of the full-face unit during long shifts. PPE fatigue from prolonged wear can also reduce adherence. Price sensitivity in developing economies and patchy implementation of safety policies are also keeping it from taking off especially within small- and medium-sized enterprises (SMEs).

Smart PPE, Custom Fit Technologies, and Pandemic-Resilient Supply Chains

Advancements in smart eye and face protection technology, like embedded thermal sensors, real-time alerts, and connectivity with hazard detection systems, are changing the landscape-creating high-value segments.

3D-scanned and personalized PPE fittings, eco-friendly reusable materials, and pandemic-resilient Manufacturing (i.e. closer to home) will change the sourcing model. Emergent sectors such as hydrogen fuel infrastructure, bio manufacturing, and battery reclamation represent new frontiers for targeted face and eye safety systems.

The USA eye and face protection industry is experiencing substantial growth, propelled by rigorous workplace health and safety regulations, heightened concern for worker safety, and significant market demand in construction, manufacturing, and healthcare industries. Safety goggles, face shields, and welding helmets that meet ANSI compliance are gaining more acceptance in industries and laboratories.

Innovations like anti-fog coatings, impact-resistant polycarbonate lenses, and auto-darkening visors are helping users stay more comfortable and protected. Market growth remain supported by mounting demand for PPE kits in emergency response and medical establishments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.7% |

In UK, the eye and face PPE market is growing lunch and groomed with increasing responsibilities around occupational health and safety and growing adoption of personal protective equipment (PPE) by end-use industries such as construction, energy, and healthcare.

There is good demand for CE certified eye protection products with superior optical clarity, UV resistance properties and ergonomic fitting. Adoption is driven by public sector procurement programs and compliance with safety across SMEs. The market is shifting toward potentially reusable, sustainable protective gear that has added comfort features.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.2% |

The eye and face protection market in EU accounted for the largest share in the value driven by the high worker protection laws in place, the active status of the industrial sector, and an increase in investment towards high-risk infrastructure projects, with leading contributions from Germany, France, and The Netherlands.

Manufacturers across the EU are getting creative, producing lightweight face shields that can be customized, eye shields that serve a dual purpose and even integrated communication systems. Strong demand in metallurgy, chemical handling and precision engineering drives the market EU safety standards still influence product development and the potential to export.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 10.4% |

Japan is also gradually enhancing its eye and face protection market owing to rising automation in manufacturing, robust work environment safety norms, and high-quality PPE standards. Yes, the automotive, pharmaceutical, and electronics segment where cleanroom, lasers, and chemicals eye protection is mandatory has steady demand.

In line with users preference and feedback, Japanese manufacturers focused on ergonomic design, anti-fog capability, and smaller face protection systems. The ageing workforce trends are also driving demand for light weight and adjustable gear for long-duration use.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.9% |

The eye and face protection market in South Korea is booming, driven by increased awareness of industrial safety, government-backed health standards, and the growth of high-technology manufacturing. Smart-enhanced protective eyewear with the likes of heads-up displays, customized data overlay and integrated safety alerts are experiencing rapid adoption.

Construction, semiconductor fabrication, and heavy industries all have strong demand. Local suppliers are honing in on high-performance materials and clean, modern aesthetics to attract both industrial clients and the consumer PPE market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.8% |

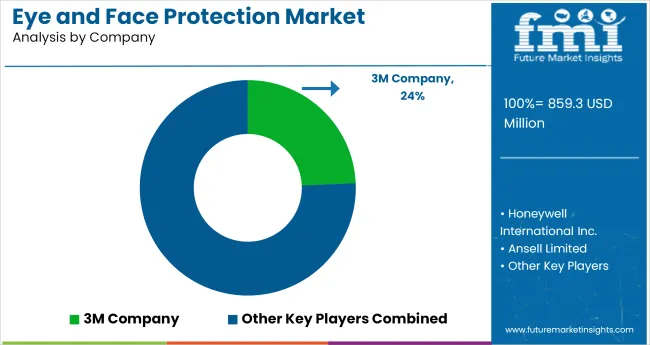

The Eye and Face Protection market is marked by intense competition, driven by continuous innovation, regulatory compliance pressures, and evolving end-user requirements. Market players are actively investing in R&D to develop advanced protective solutions that combine safety with comfort, durability, and ergonomic design. Strategic collaborations with industrial safety authorities and expansion into emerging markets are being prioritized to strengthen global footprints.

A clear shift toward eco-friendly materials and smart protective gear integrated with sensors and real-time monitoring capabilities is reshaping product offerings. Competitive pricing strategies, vertical integration, and customization based on application-specific needs are also being employed to retain and expand market share. Additionally, players are enhancing distribution networks and leveraging digital channels to meet growing demand swiftly.

Key Development

The overall market size for the eye and face protection market was USD 859.3 million in 2025.

The eye and face protection market is expected to reach USD 2,332.2 million in 2035.

The demand for eye and face protection will be driven by rising workplace safety regulations, increasing adoption of personal protective equipment (PPE) in construction, manufacturing, and healthcare sectors, growing awareness about occupational hazards, and advancements in anti-fog, impact-resistant, and ergonomic designs.

The top 5 countries driving the development of the eye and face protection market are the USA, China, Germany, India, and the UK.

The protective goggles segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eye Tracking System Market Forecast and Outlook 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Eye Health Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Eye Shadow Stick Market Analysis - Size, Share, and Forecast 2025 to 2035

Eye Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Global Eye Infections Treatment Market Report - Trends & Forecast 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Eye Shadow Market Insights – Size, Trends & Forecast 2025 to 2035

Eye Care Supplement Analysis by Ingredients, Dosage Form, Route of Administration, Indication, Distribution channel and Region 2025 to 2035

Eyewear Market Analysis by Product Type, End Use, Sales Channel, Material Type, and Region

Key Companies & Market Share in the Eye Shadow Stick Sector

Competitive Overview of Eyewear Packaging Companies

Market Share Insights of Eye Cosmetic Packaging Providers

Eyewear Packaging Market by Material Type from 2024 to 2034

Eyeliner Pen Market

Eye Tracking Solutions Market

Eye Wash Stations Market

Eye Socket Implants Market

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA