Growing sustainability, luxury appeal, and protected functionality in eyewear packaging are stimulating market growth. As demand rises for premium eyewear brands and optical retailers, e-commerce avenues bring innovation in pack-making using recyclable, biodegradable and high-end custom packaging solutions. Eco-friendly materials integrated into magnetic closures and anti-scratch coatings establish brand value in durability.

In addition to automation for box production and digitization for personalized branding, AI-driven techniques for quality control are also emerging in the manufacture of eyewear cases. Nowadays, many lightweight and impact-resistant tamper-proof seals are added by manufacturers for secure and smart tracking features.

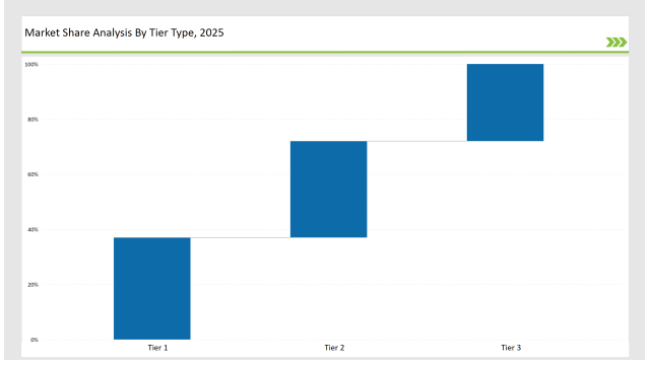

A leading part of 37% of the market is held by Tier 1 players, which include Luxottica Group, Essilor International, and Marcolin Group. Their dominance lies in premium and sustainable eyewear packaging solutions, global distribution networks, and innovative cutting-edge designs.

35% of the market is covered by Tier-2 players like Safilo Group, De Rigo Vision, and WestRock by catering to equally cost-effective and strong packaging options that are salvaged for the mid-range and mass-market eyewear brands.

The tier 3- regional and niche players constitute 28% of the market and comprise eco-conscious, luxury, and smart eyewear packaging. As a result, production is localized with innovative packaging while being driven by sustainability in design.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Luxottica Group, Essilor International, Marcolin Group) | 17% |

| Rest of Top 5 (Safilo Group, De Rigo Vision) | 12% |

| Next 5 of Top 10 (WestRock, HCP Packaging, Pivaudran, Fenton Packaging, Progress Packaging) | 8% |

The eyewear packaging industry serves multiple sectors where branding, sustainability, and product protection are essential. Companies are investing in premium packaging solutions to enhance customer experience and reinforce brand identity.

Manufacturers are optimizing eyewear packaging with sustainable materials, premium finishes, and smart tracking solutions. They are incorporating anti-scratch coatings to enhance durability and maintain product aesthetics. Additionally, companies are developing shock-absorbent interior linings to provide extra protection for delicate lenses. Businesses are also integrating biodegradable adhesives to support eco-friendly packaging initiatives.

The packaging industry is evolving towards sustainability and digital transformation in the eyewear packaging. Companies are installing AI-driven defect detection in their production process, premium embossed branding, and lightweight packaging solutions to make sure durability. Businesses are now moving towards an increasingly recycled paper-based insert instead of foam padding. Manufacturers are developing temperature-resistant coatings to protect the products in harsh situations; these harms are often extreme. Similarly, NFC-enabled packaging solutions offer possibilities for interactive consumer engagement and authentication.

Technology suppliers should focus on automation, digital branding, and smart packaging advancements to support the evolving eyewear packaging market. Partnering with luxury brands, optical retailers, and e-commerce platforms will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Luxottica Group, Essilor International, Marcolin Group |

| Tier 2 | Safilo Group, De Rigo Vision, WestRock |

| Tier 3 | HCP Packaging, Pivaudran, Fenton Packaging, Progress Packaging |

Leading manufacturers are advancing eyewear packaging technology with AI-powered quality control, digital branding, and sustainable materials. They are integrating high-precision laser cutting to improve packaging aesthetics and reduce waste. Additionally, companies are developing temperature-resistant packaging to protect eyewear in extreme climate conditions. Manufacturers are also adopting smart sensors to enable real-time tracking and authentication of eyewear products.

| Manufacturer | Latest Developments |

|---|---|

| Luxottica Group | Launched biodegradable luxury eyewear cases in March 2024. |

| Essilor Intl. | Developed lightweight foldable packaging for optical retailers in April 2024. |

| Marcolin Group | Expanded smart packaging solutions with QR authentication in May 2024. |

| Safilo Group | Released premium rigid boxes with magnetic closures in June 2024. |

| De Rigo Vision | Strengthened moisture-resistant eyewear cases in July 2024. |

| WestRock | Introduced digitally printed eco-friendly eyewear boxes in August 2024. |

| HCP Packaging | Pioneered ultra-light travel-friendly packaging in September 2024. |

The eyewear packaging market is evolving as companies invest in premium finishes, AI-driven defect detection, and interactive smart packaging. They are enhancing protective coatings to prevent scratches and maintain pristine presentation. Additionally, businesses are incorporating tamper-evident features to improve security and ensure product authenticity. Manufacturers are also optimizing material composition to develop ultra-light yet highly durable packaging solutions.

The manufacturers will proceed with the integration of AI-driven quality control, biodegradable materials, and smart packaging solutions. Slim and durable design will continue to be explored by companies for an effective protective lightweight that also minimizes waste. Firms will extend NFC-supported authentication to beef up anti-counterfeiting actions. Digital Printing and custom embossing will escalate premium branding. Lines streamlining production by invalidating waste and creating consistency will feature AI-based defect detection. Moreover, high-speed automation will be adopted by firms to serve the ever-increasing global demands more efficiently.

Leading players include Luxottica Group, Essilor International, Marcolin Group, Safilo Group, De Rigo Vision, WestRock, and HCP Packaging.

The top 3 players collectively control 17% of the global market.

Key drivers include sustainability, smart packaging, digital printing, and automation.

Key drivers include sustainability, smart packaging, digital printing, and automation.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eyewear Market Analysis by Product Type, End Use, Sales Channel, Material Type, and Region

Eyewear Packaging Market by Material Type from 2024 to 2034

Smart Eyewear Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Eyewear Market Report – Trends & Forecast 2024-2034

Safety Eyewear Market Analysis - Size, Share, and Forecast 2025 to 2035

Key Companies & Market Share in the Safety Eyewear Sector

MEA Safety Eyewear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Protective Eyewear Market Trends – Industry Growth & Forecast 2025 to 2035

Europe Safety Eyewear Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA