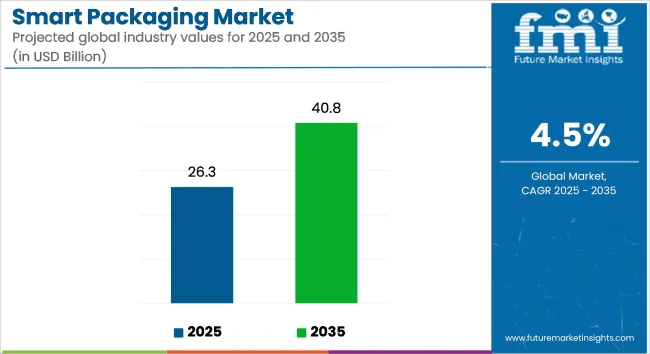

The smart packaging market is projected to grow from USD 26.3 billion in 2025 to USD 40.8 billion by 2035, registering a CAGR of 4.5% during the forecast period. Market growth is being supported by increased adoption of RFID tags, temperature-sensitive labels, and IoT-based packaging to improve traceability and real-time monitoring in sectors like pharmaceuticals and food.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 26.3 billion |

| Projected Market Value (2035F) | USD 40.8 billion |

| Value-based CAGR (2025 to 2035) | 4.5% |

These solutions are being increasingly deployed by brands aiming to curb counterfeiting, reduce spoilage, and increase consumer engagement. Additionally, rising demand for compliance with evolving safety regulations has further accelerated the integration of smart packaging formats across global supply chains.

Sealed Air today announced the introduction of prismiq™ a digital packaging brand with a portfolio of solutions for design services, digital printing, and smart packaging. “The future of digital packaging and graphics is here prismiq™, powered by our state-of-the-art digital printing technology, is creating game-changing value for customers, enabling touchless automation both in our facilities and our customers’ operations, and making sustainability for packaging real,” said Ted Doheny, President & CEO of SEE. Smart Packaging prismiq™ eliminates waste and excess packaging while enhancing products and customer engagement.

Technology integration in packaging has been driven by advancements in printed electronics, NFC chips, and digital sensors. Smart packaging formats are now being designed to minimize environmental waste by improving logistics efficiency and reducing returns due to spoilage or damage.

Moreover, sustainability initiatives have been aligned with traceability innovations, where companies aim to measure and offset carbon footprints via digital tracking. The intersection of smart packaging with block chain-based data verification is also facilitating greater transparency across the product lifecycle. These innovations are expected to enable smarter inventory management and sustainability reporting over time.

The outlook for smart packaging remains promising, with increased demand projected from sectors such as pharmaceuticals, beverages, and personal care. By 2035, an estimated additional USD 14.5 billion in opportunity is expected to emerge, supported by strong regulatory alignment and smart infrastructure adoption in logistics and retail.

Future advancements are likely to revolve around AI-powered diagnostic packaging, connected ecosystems for inventory control, and cost optimization in embedded electronics. As competition rises, firms will be prompted to innovate in areas like flexible hybrid electronics and multifunctional label design. Strategic collaboration with tech startups will remain a key success lever across markets.

The market is segmented based on technology type, packaging format, end-use industry, and region. By technology type, categories include active packaging, intelligent packaging, modified atmosphere packaging, and connected packaging, each contributing to extended shelf life, traceability, and real-time monitoring across supply chains.

Packaging formats consist of labels and tags, films & wraps, bottles & containers, boxes & cartons, and blister & strip packs, selected for compatibility with both analog and digital smart features. End-use industries include food and beverage, pharmaceuticals, cosmetics and personal care, electronics, logistics & supply chain, and automotive components, where performance and security are critical. Regional segmentation covers North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Active packaging is expected to lead the smart packaging market with a projected market share of 39.8% in 2025. It has been adopted widely due to its ability to maintain freshness, delay oxidation, and regulate moisture. Technologies such as oxygen scavengers, moisture absorbers, and antimicrobial layers have been integrated into the packaging design.

Regulatory bodies have supported its use, particularly in food safety-sensitive applications. Active packaging has been implemented prominently in food-grade films, cartons, and pouches across perishables and ready-to-eat meals. Functional attributes such as ethylene control in produce packaging have improved shelf stability across long-distance shipping formats.

Packaging converters have collaborated with material scientists to introduce shelf-life sensors and freshness indicators. This segment’s growth has been bolstered by rising consumer demand for quality assurance and supply-chain traceability.

The segment’s performance has been enhanced by cost-efficient scalable deployment across paperboard, flexible plastic, and multilayer formats. Integration into smart labels and compostable films has allowed alignment with broader sustainability goals. As logistics and traceability become more central, active packaging has been favored by CPGs and retailers.

It has been deployed across grocery, online retail, and fresh food packaging with growing preference for sensor-enabled formats. As e-commerce and cross-border food shipping rise, active packaging has been implemented to reduce spoilage and preserve texture.

The technology has been endorsed in the form of embedded additives and multilayer film laminates. Use cases in meat, seafood, and dairy products have gained prominence due to perishability concerns. As innovations in nanomaterials and bio-based active agents emerge, its utility is expected to increase further.

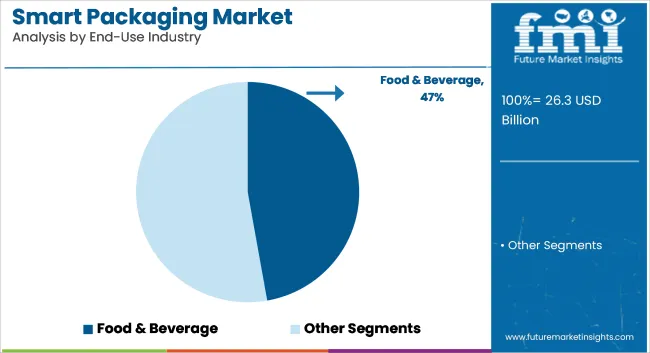

The food and beverage industry is projected to dominate the smart packaging market in 2025, accounting for an estimated 47.2% share. Adoption has been accelerated by the need for real-time freshness monitoring, supply chain transparency, and compliance with safety standards. Smart packaging solutions have been embedded into trays, films, and cartons for packaged meals, dairy, and frozen goods.

This has been driven by consumer preference for visible shelf-life information. Smart labels and thermochroic indicators have been integrated across premium and perishable food categories. Intelligent features have allowed temperature tracking during transit and storage, especially under cold chain logistics. Leading food retailers and QSR chains have adopted tamper-evident and time-temperature indicators in on-the-go and meal kit segments. These deployments have enhanced product authenticity, waste reduction, and user experience.

Food processors have adopted modified atmosphere packaging, oxygen absorbers, and antimicrobial sheets across vacuum-packed and microwaveable items. The technology has supported long-distance exports and safety verification. Regulatory alignment and serialization initiatives across Europe and North America have contributed to wider adoption.

Moreover, consumer engagement tools such as QR code tracking have further driven adoption. The growth of online grocery, meal delivery services, and smart vending formats has expanded the use of interactive packaging. Brands have added NFC tags and freshness trackers to enhance consumer confidence and optimize inventory.

With sustainability mandates tightening, biodegradable smart packaging has been explored for organic and ready-to-consume meals. This sector is expected to remain the leading adopter of smart packaging technologies in the coming years.

Technological Advancements

The rapid development of technology is one of the primary drivers of the smart packaging market's expansion. With the development of new materials and smart gadgets, packaging is becoming more interactive. For instance, sensors can be used to measure humidity and temperature. This will guarantee that the products are kept in the proper storage environment. Businesses find this technology appealing because it lowers waste and enhances product quality.

Consumer Demand for Safety

Consumers today care more about the safety and quality of the products they buy. Smart packaging helps by offering features like tamper-proof seals and freshness indicators. These features give consumers peace of mind, knowing the products they buy are safe. As people become more aware of food safety and health, more companies are using smart packaging to meet consumers' expectations.

Environmental Concerns

Smart packaging is also growing because people are more concerned about the environment. It helps cut down on waste by improving product tracking and making supply chains work better. For example, it can help businesses manage their stock, so there's less spoilage. This helps the environment and saves companies’ money, making smart packaging a win for everyone.

High Costs Creates Challenges

One of the challenges facing the smart packaging market is the high cost of bringing new technologies into action. It may be difficult for many small and medium-sized businesses to invest in smart packaging solutions. The initial costs for research, development, and production can be high as well, which may stop some companies from adopting these innovations.

Regulatory Challenges

Another deterrent is the complicated regulatory framework governing packaging technology and materials. Regulations governing the use of smart packaging vary by location, which can present challenges for businesses trying to enter the industry. Some companies choose to completely ignore smart packaging because complying with these rules can be expensive and time-consuming.

Consumers are looking for products that give them more information and are easier to use. Smart packaging meets this need by adding features like QR codes. With these technologies, people can scan the packaging with their phones to learn more about the product, like where it came from, what's inside, and how to use it. This shows that consumers want more transparency and remain updated with what they're buying.

They also want to make informed choices about the products they buy, especially when it comes to health and safety. Smart packaging will become more popular as people get better with technology. Consumers are also interested in products that offer extra value, like special offers or loyalty rewards through smart packaging, making it even more appealing.

One big trend in smart packaging is using eco-friendly materials. Companies are more aware of how their packaging affects the environment and are choosing better options, like biodegradable materials and recycled plastics. This helps reduce waste and also appeals to customers who care about the environment. As more people care about sustainability, businesses using eco-friendly packaging may stand out.

Using the internet to track products during shipment is another trend in smart packaging. During shipping, for instance, sensors can monitor location, temperature, and humidity. This lowers waste by assisting businesses in ensuring that goods are transported and stored appropriately.

Customers' shopping experiences are enhanced by the ease with which they may get product information on their phones in such packaging. Lastly, personalization is becoming more important. Smart packaging lets companies create special experiences, like custom messages or offers for customers. This helps build loyalty and encourages people to buy again.

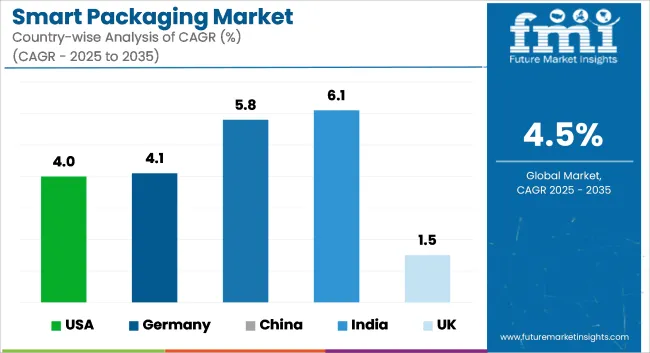

| Countries | CAGR |

|---|---|

| USA | 4.0% |

| Germany | 4.1% |

| China | 5.8% |

| India | 6.1% |

| UK | 1.5% |

The USA is expected to grow at a CAGR of 4.0% over the forecast period. The USA has a strong focus on innovation and technology. Many companies are investing in smart packaging to improve product safety and freshness. Consumers are also very aware of food quality and safety, which drives demand for packaging that offers more information and protection. Additionally, the trend toward sustainability encourages businesses to adopt eco-friendly packaging solutions.

Germany is expected to grow at a CAGR of 4.1% over the forecast period. The manufacturing and engineering industries are working well in Germany. The German companies are focused on quality and sustainability, making smart packaging an appealing choice. The country also has strict regulations regarding food safety, which encourages the use of advanced packaging solutions. Consumers in Germany value transparency, and smart packaging provides a detailed product information.

China is expected to grow at a CAGR of 5.8% over the forecast period. China has a large growing consumer market. As people become more health-conscious, they demand better quality food and drinks. Smart packaging takes care of freshness and safety, because of this, it becomes attractive to both consumers and manufacturers. The rapid growth of e-commerce in China also boosts the need for smart packaging to track products during delivery, enhancing customer confidence.

India is expected to grow at a CAGR of 6.1% over the forecast period. In India, the food and beverage sector is expanding quickly. As urbanization increases, more people are looking for convenient and safe food options. Smart packaging can provide solutions like extended shelf life and freshness indicators. Additionally, the rising middle class in India is willing to spend more on quality products, supporting smart packaging growth.

In the UK, the market is expected to reach a CAGR of 1.5% over the forecast period driven by a growing concern about food waste and sustainability. Smart packaging helps reduce waste by keeping products fresh for longer. Consumers are also interested in technology that enhances their shopping experience. As awareness of environmental issues increases, the demand for smart and eco-friendly packaging solutions is likely to rise.

The smart packaging market is becoming increasingly competitive, with many players entering the field. Packaging companies that are grown to a good level, are putting money in new technologies to enhance their offerings. Startups are also emerging, bringing innovative solutions to the market.

Collaboration between technology firms and packaging manufacturers is common, as both seek to create smarter, more efficient packaging solutions. Companies that can adjust themselves quickly to changing consumer demands and technological advancements are likely to succeed in this evolving landscape.

Companies should focus on innovation and sustainability to succeed in the smart packaging market. Investing in research and development will help create new packaging solutions with advanced features, like sensors for freshness. At the same time, using eco-friendly materials can attract environmentally conscious consumers. Companies can also form work together with technology firms to improve their products and collaborate with suppliers to strengthen their supply chains.

Another strategy is to make consumers aware about the benefits of smart packaging. The horizon of social media has widened, and companies can explain how smart packaging improves product safety and quality. Offering customization options can also help brands stand out in a competitive market. As there will be a growth in the e-commerce industries, smart packaging companies can work on packaging products that are good for online shopping. This will benefit the e-commerce companies, as well as customers.

The smart packaging market is segmented into type, end-user, material, and region.

By type, the market is sub-segmented into active packaging, intelligent packaging, and modified atmosphere packaging.

By end-user, the market is sub-segmented into food & beverage, personal care, healthcare, automotive, and others.

By material, the market is sub-divided into solid, and liquid.

By region, the market is sub-segmented into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The market was valued at USD 26.3 billion in 2025.

The market is predicted to reach a size of USD 40.8 billion by 2035.

Some of the key companies manufacturing smart packaging include 3M, BASF SE, Crown, Avery Dennison Corporation, and others.

China is a prominent hub for smart packaging manufacturers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Smart Tag Packaging Industry

Smart Tag Packaging Market

Smart Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smart Conveyor Packaging Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Smart Medication Packaging Market

Smart Plant Based Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Active, Smart, and Intelligent Packaging Manufacturers

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA