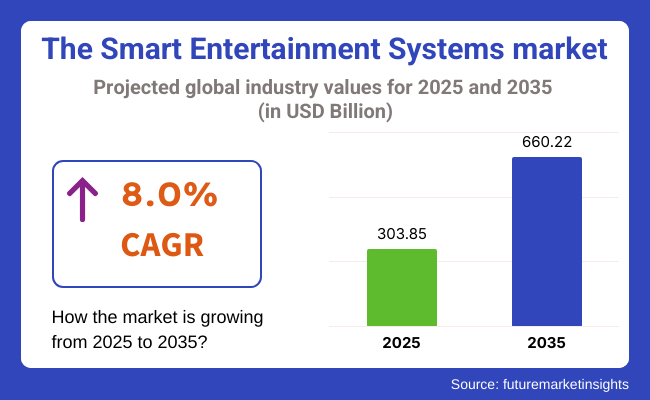

The global smart entertainment systems market is on an upward trajectory, poised for notable growth driven by rapid technological advancements, increasing consumer demand for connected devices, and the seamless integration of artificial intelligence in home entertainment. Worth around USD 303.85 billion in 2025, the industry might grow to a size ofUSD 660.22 billion by 2035 at a strong compound annual growth rate (CAGR) of 8.0% over the forecast period.

With the increased popularity of smart homes, voice-controlled entertainment systems, IoT-enabled, and better content personalization are becoming mainstream in greater numbers. With consumers more and more looking for high-quality, immersive entertainment experiences, there has been a boom in smart TVs, home theaters, AI speakers, streaming devices, and AR/VR platform products. This emerging trend is propelling innovation from manufacturers and tech companies.

The convergence of 5G, edge computing, and cloud-streaming technologies is also transforming user engagement further through real-time high-definition content availability and multi-device synchronization. The evolution of smart assistants, such as Alexa, Google Assistant, and Siri, in entertainment setups, has also brought on a new era of hands-free control and smart interoperability.

Emerging industries will also chart the future of the industry, powered by increasing internet penetration, increasing disposable incomes, and a growing desire for premium digital experiences. At the same time, partnerships between telecommunication providers, content producers, and technology leaders will continue to advance the availability and prices of smart entertainment solutions.

Irrespective of issues ranging from data privacy to heavy capital outlays and interoperability between gear, the industry is holding up. Ongoing R&D spending, better cybersecurity protocols, and government support are opening the door to long-term success.

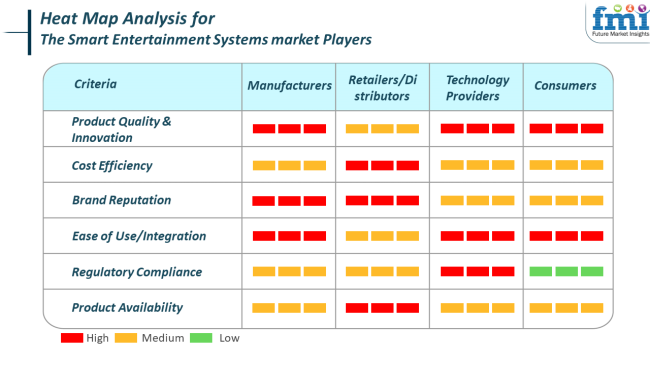

The industry is emerging at a very fast pace due to increasing customer demand for next-generation, converged, and immersive entertainment. Players emphasize product quality, innovation, and seamless connectivity with other smart products to offer cutting-edge technology that sets a new benchmark for user experience.

Stock levels and prices matter to distributors and retailers since they need to have the capacity to respond to demand and be good at managing stocks.

Inventors of technology, including software programmers and hardware designers, are worried about regulation and innovation as a reaction to cross-platform compatibility and data protection requirements.

Ease of use, compatibility with other smart appliances, and product longevity are at the top of consumers' minds since they want their entertainment to be seamless and hassle-free. Price sensitivity exists, but consumers will pay more for quality, long-lasting systems. The growth in the industry arises from the expanding use of connected devices and increased focus on the personalization of entertainment in smart homes.

During 2020 to 2024, the smart entertainment systems market experienced a fast growth rate based on growing consumer demand for connected and interactive entertainment. Technological advancements such as the convergence of the Internet of Things (IoT) and Artificial Intelligence (AI) mainly enhanced user experience through the possibility of delivering more personalized, interactive entertainment.

Smart homes and streaming media saturation also helped increase demand for improved entertainment systems with a focus on smart TVs, smart sound systems, and voice assistant interfaces. With consumers' affection for better-quality entertainment came a growing demand for 4K and 8K resolutions, as well as AI-based personalization capabilities.

Ahead to 2025 to 2035, there will be consistent growth, with even greater emphasis on sustainability and energy efficiency. Smart entertainment systems will more and more be combined with other home automation solutions, enhancing convenience and personalization even further. New AI and augmented reality (AR) developments will further strengthen entertainment experiences as immersive.

At the same time, 5G and beyond (e.g., 6G) will significantly minimize latency, allowing real-time streaming and gaming experiences without buffering. In addition, the growth of VR and AR-driven entertainment will propel new consumer behavior, creating whole new categories of products. Consumer needs for greater interactivity, more personalized experiences, and ease of use with other smart devices will be major drivers of the future.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Technological breakthroughs (AI, IoT), increased demand for smart homes and streaming services | Sustainability-oriented focus, personalization through AI, integration through VR/AR, 5G/6G innovation |

| Smart TVs, voice assistants, streaming devices | AI-powered smart entertainment, content through VR/AR, plug-and-play interoperability with home automatio n |

| Early adopters with tech affinity, subscribers to streaming services, consumers of smart home devices | Diverse demographic profile of tech-inclined folks, gamers, and consumers desiring immersive entertainment |

| Integration with IoT and AI for personaliza tion and smart home connectivity | AR, VR, 5G/6G, AI-led personalization, and energy-friendly devices |

| Early days of green designs and energy-efficient products | Solid emphasis on green manufacturing and energy-efficient products |

| Solid growth in North Americ a, Europe, and Asia-Pacific | Further growth in North America and Europe while expanding into emerging markets such as Latin America and Africa |

| The growing role of influencers in driving take-up of new smart entertainment devices | Further influence of influe ncers and convergence with wider tech and lifestyle trends |

Theindustry is growing at a fast pace, driven by technological advancements and increased consumer demand for integrated, connected home entertainment solutions. Despite the growth outlook, various risks may shape the direction of the market.

The most significant threat is economic sensitivity. Intelligent entertainment systems will be costly and, hence, discretionary consumer products. During economic downturns, such as recessions or times of financial difficulty, consumers will cut spending on non-necessities, such as luxury entertainment systems.

Another risk of special importance is the threat of supply chain disruption. The market for the smart entertainment system is based on a global, intricate supply chain, from the sourcing of components such as semiconductors to the production and delivery of finished products. Disruption in this supply chain-geopolitical conflict, natural disaster, or trade legislation-would translate into delays, higher costs, and lack of availability of essential components, ultimately impacting the production schedule and the price.

Technological obsolescence also confronts market players. Fast technological development is expected in the coming years. Businesses that do not innovate and keep pace with new trends, like innovation in AI, 5G connectivity, and AR, will see their products become outdated rapidly. This may result in declining consumer interest and market share.

The market is also growing more competitive, with most brands fighting for attention in the same space. Big, well-established brands are able to apply price pressure, with small brands fighting to make their products unique. Additionally, market saturation-especially in advanced areas-may cap opportunities for expansion, pushing companies to invest heavily in marketing or product differentiation to be able to compete competitively.

Regulatory issues and compliance are also a major threat. With technology in consumer electronics continuing to advance, data privacy, cybersecurity, and environmental regulations are becoming increasingly stringent. Companies need to be ahead when it comes to regulatory updates so that they do not become victims of fines, lawsuits, and possible reputational losses.

To offset such threats, companies should diversify their product lines so that they address various market segments and are not overly reliant upon a single revenue stream. They should invest in research and development to be ahead of the curve when it comes to technology breakthroughs and maintain their products competitive.

Several sourcing strategies and good inventory control can help offset the interruptions by making the supply chain more resilient. Also, having knowledge of the current regulatory updates and being compliant will be critical in a bid to avoid legal suits. With innovation, customer satisfaction, and sound operations, firms will be well-positioned for success in the smart entertainment systems sector in the future.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 12.4% |

| UK | 10.2% |

| France | 9.6% |

| Germany | 10.5% |

| Italy | 8.9% |

| South Korea | 11.7% |

| Japan | 9.4% |

| China | 13.1% |

| Australia-New Zealand | 9.1% |

The USA will grow at 12.4% CAGR over the study period. There has been good growth in this region with the mounting adoption of smart home technology, high disposable income, and fast-paced digitization of entertainment within households. USA consumers are increasingly looking for sophisticated multimedia systems with the capabilities of embedded features like voice command, hassle-free device connectivity, and AI-driven personalization.

The strong leadership of emerging technology players keeps fueling innovation, leading to product diversity and aggressive pricing. Consumption of entertainment-intensive experiences like augmented and virtual reality applications is gaining traction, increasing the demand for advanced smart entertainment systems.

In addition, high-capacity broadband networks and extensive penetration of 5G enable enhanced performance levels from connected entertainment devices, resulting in seamless streaming and interactive content presentation. The growth of OTT platforms and streaming content has transformed consumer behavior, generating long-term demand for smart TVs, home theaters, and smart sound systems. Continuous smart city planning and energy-efficient home renovations also support the outlook favorably.

The UK will grow at 10.2% CAGR over the study period. The UK demand for smart entertainment systems is fueled by changing consumer lifestyles and the incorporation of smart technologies into everyday living. High penetration of smartphones and a technologically advanced population have provided good circumstances for the large-scale adoption of voice assistants and smart home ecosystems.

Consumers are becoming more predisposed toward complete entertainment configurations with centralized control using mobile apps or voice commands. The growth of remote work and hybrid working patterns has resulted in more investment in home entertainment systems, particularly those that integrate productivity and leisure.

The UK also enjoys robust e-commerce infrastructure, facilitating quicker and more convenient distribution of smart devices. With households going green, energy-efficient systems with automation capabilities are becoming popular. Government initiatives that enable digital innovation and IoT adoption are likely to be a key driver of sustaining industry momentum throughout the forecast period.

France is anticipated to grow at 9.6% CAGR over the study period. The growth path in France is primarily driven by robust digital infrastructure and increasing demand for connected lifestyle solutions. Consumer tastes are changing toward smart TVs, voice assistants, and modular home entertainment systems.

The adoption of 4K and 8K technologies is growing fast, generating new demand for compatible smart entertainment systems. Smart home penetration in France has continued to rise steadily, driven by a technophile urban populace and energy-saving efforts.

Smart entertainment systems with automation and inter-device compatibility are increasingly being adopted in metropolitan areas. Expansion of content streaming services in local and foreign languages has generated further impetus for system upgrades. Moreover, increased investments from both local startups and multinational players are boosting research and development, leading to the launch of user-centric, innovative smart devices.

Germany will grow at 10.5% CAGR throughout the study. With one of the most developed digital economies in Europe, Germany provides a fertile ground for the growth of smart entertainment systems. Smart home adoption, supported by robust economic fundamentals, has fueled demand for integrated entertainment solutions.

Users demand high-performance systems that provide seamless interconnectivity and support an extensive range of streaming services and gaming platforms. Stronger automation and a liking for quality engineering have brought forward more luxurious smart entertainment gadgets.

The increasing need for home-based entertainment in a post-pandemic world, combined with energy-saving systems and compliance in line with environmentally focused aims, continues to affect buying behaviors. The presence of a solid base of manufacture, as well as cooperative innovation, with motor vehicles and the electronic industry, serves to be a beneficial plus factor. Retailers and OEMs are using AI and machine learning to provide personalized experiences.

Italy is set to register an 8.9% CAGR throughout the research study. Italy is accelerating its growth due to urban digitization and increasing interest in connected home environments. Extended availability of smart devices, enhanced affordability, and enhanced consumer awareness are central driving factors for growth. Cultural focus on media viewing, especially cinema and live sports, is being reflected in increasing demand for smart TVs, surround sound equipment, and streaming-compatible devices.

Advancements in broadband infrastructure and 5G deployment are anticipated to enhance device performance and accessibility of content. Manufacturers and retailers emphasize modular and customizable smart entertainment systems to address the diversified needs of Italian homes. While the pace of adoption varies between urban and rural regions, consistent growth in disposable income and ongoing public-private digital initiatives are expected to support long-term growth potential.

South Korea is forecast to grow at 11.7% CAGR through the period of this study. Renowned for fast technology uptake and intense consumer demand for innovation boosts growth. General access to high-speed internet and one of the strongest 5G networks in the world further enriches cloud gaming, real-time streaming, and AI-augmented entertainment experience. Consumer sentiment in South Korea prefers to be an early adopter of new technologies, such as AI-enabled assistants, voice-controlled smart appliances, and interactive display systems.

The success of K-content, such as K-pop and K-dramas, has promoted the use of immersive entertainment configurations at home. Moreover, smart apartments and IoT-enabled homes are becoming increasingly popular, providing rich opportunities for integrated system installations. Local producers have a competitive edge with state-of-the-art innovation and export-focused strategies, further bolstering the domestic outlook. Smart retail experiences and automation in electronics showrooms are also driving higher awareness and adoption levels.

Japan is forecast to grow at 9.4% CAGR over the study period. Japan's heritage of innovation in electronics and digital technology puts it in a strong position for long-term growth. Even with a mature consumer electronics industry, growing consumer demand for enhanced home experiences is opening up new opportunities for growth.

Integration of AI, IoT, and voice recognition technologies into entertainment systems is becoming increasingly prevalent. The nation's population trend, such as a rise in the geriatric population, is driving the usage of easy-to-use, automatic entertainment devices that are more accessible and comfortable.

Smart entertainment systems providing energy efficiency and minimalistic looks harmonize with consumer choices in urban homes. The ongoing improvement in display and audio technology, along with the spread of streaming media, has developed renewed enthusiasm for home refurbishment. Government initiatives for smart living and digital transformation remain driving consumer expenditure trends, underpinning steady growth during the forecast period.

China will grow at 13.1% CAGR over the study period. With one of the fastest-growing middle classes and a highly networked urban population, China offers unparalleled growth opportunities for smart entertainment systems. Urbanization, rising disposable income, and government incentives for digital infrastructure have driven industry adoption. Strong demand for smart TVs, AI-based home assistants, and multifunctional entertainment systems reflects strong consumer demand.

Chinese tech industries contribute significantly to the growth dynamics by combining hardware with indigenous streaming platforms, mobile ecosystems, and IoT platforms. The rising popularity of local content, such as short videos and live streaming, also adds to the dependence on quality entertainment setups.

Competitive pricing, rapid technology refresh cycles, and emphasis on smart living in urban homes provide a conducive setting for industry growth. Innovations specific to family-based experiences and intelligent education are rising trends that will continue to gain strength for the next decade.

The Australia-New Zealand region will have a 9.1% CAGR from the period studied. The nations have good digital literacy, along with rising aspirations for interwoven lifestyle offerings. Intelligent entertainment systems have become more widely used because of robust broadband penetration and extensive utilization of OTT. Urban residents have been spending money on high-definition intelligent televisions, wireless speakers, and artificial intelligence-driven control centers that are efficient and power savviness.

Healthy economic conditions and universal availability of global brands via digital and offline channels complement growth. Interest in home improvement and eco-friendly living trends in the region supports the demand for multifunctional smart entertainment configurations.

Increased real estate constructions that include smart home features also provide new avenues for the installation of integrated entertainment systems. With increasing eco-awareness, the industry is moving towards solutions that save energy while delivering engaging user experiences.

Smart TVs will be the primary driver of the industry in 2025, projected to account for 33% of the total revenue share, and streaming devices will account for a share of 18.5%.

The multifunctionality of smart TVs controls a larger industry share: combining normal TV viewing with streaming programs, internet browsing, and gaming functions. Some major players, such as Samsung, LG, and Sony, in this segment are in the production of smart TV models that include 4K and 8K resolution, OLED display, and voice assistant integration with Alexa, Google Assistant, and Apple's Siri.

The QLED line from Samsung and the LG OLED TVs exhibit how brands are elevating image quality with high smart functionality. The demand for Smart TVs, driven by the growing consumers' preference for streaming services such as Netflix, Amazon Prime, and Disney+, is further enhanced by consumers' quest for convenience and quality content in one device.

While streaming devices like Amazon Fire TV Stick, Roku, and Google Chromecast constitute a smaller share, they provide an essential service to consumers wanting to turn their traditional TVs into smart ones. Streaming devices are cheaper alternatives for mid-range TVs and are gaining popularity among households that already possess one or more standard televisions but want to view online content.

The wide availability and intuitiveness of the Roku platform and the seamless integration of Amazon's Fire TV Stick with Alexa offer great value for consumers. These devices are seeing a surge in popularity due to their easy setup and cost-effective nature as increasing numbers of consumers are cutting the cord and turning to internet entertainment.

In 2025, the industry is anticipated to be primarily driven by Wi-Fi connectivity, commanding about 62% of the total share. Bluetooth connectivity will hold a share of approximately 38%.

Fast data transfer has been the hallmark of Wi-Fi, which has become the de-facto standard for smart entertainment systems, where none are to speak of buffering while streaming high-definition content. Integration with multiple devices shall become seamless with such high data transfer.

Companies like Apple, Google, and Samsung are now investing in Wi-Fi products to enhance user experience in the transfer of large files and streaming 4K or even 8K content. Apple supports streaming content from mobile devices or computers to smart TVs using AirPlay via Wi-Fi, while Chromecast from Google does the same.

This allows high-speed data transfer, ensuring the quality of video remains intact. Wi-Fi connectivity also enables effortless integration with other smart home devices like voice assistants and home automation, which are fast becoming an attractive proposition for consumers looking to complete their smart home ecosystem.

Although Bluetooth remains preferable because of its ease of use, low-power modus operandi, and point-to-point pairing, it finds its application less in bigger technologies than in devices like wireless headphones, speakers, and game controllers.

Manufacturers like Bose and Sony leverage Bluetooth technology to maximize their portability and ease of use by letting the user connect his headphones or portable speakers to a smartphone or smart TV with ease. Therefore, the strongest point of Bluetooth is that it connects two devices without needing a Wi-Fi connection, making it useful in situations where Wi-Fi is unavailable or impractical.

The smart entertainment systems markethas high competition, characterized by the presence of established international players such as Samsung Electronics, Sony Corporation, LG Electronics, and Apple Inc. These companies stand out due to their continuous inventions and applications of newer technologies in smart televisions, audio systems, and home entertainment solutions.

For example, in AI display technology, QLED technology and smart home integration, Samsung Electronics has successfully progressed to being a major player in either premium or mid-range price segments. Conversely, in the high-end segment, Sony Corporation maintains a strong position in the home entertainment business due to its luxury OLED televisions and sophisticated audio systems. Following the demand for advanced image quality and environmentally friendly design, LG Electronics occupies a considerable share of the industry with the leading OLED technology and AI smart TVs.

Apple Inc. provides seamless integration of its entertainment system within a wider ecosystem, using products like the Apple TV and smart home integration via HomeKit. Harman International competes with remarkable audio products, notably through its JBL and AKG brands.

Other companies such as Bose Corporation, Philips Electronics, and Vizio are also putting in competitive products with advanced features while concentrating on different consumer needs, including cost considerations, premium sound and compatibility with the smart home ecosystem.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Samsung Electronics Co., Ltd. | 20-25% |

| Sony Corporation | 18-22% |

| LG Electronics Inc. | 15-20% |

| Apple Inc. | 8-12% |

| Harman International Industries, Inc. | 5-8% |

| Other Key Players (Combined) | 22-28% |

| Company Name | Offerings & Activities |

|---|---|

| Samsung Electronics Co., Ltd. | Leader in smart TVs, QLED as well as AI-powered home entertainment systems. |

| Sony Corporation | Known for high-end smart TVs, soundbars, and home entertainment devices. |

| LG Electronics Inc. | Specializes in OLED TVs and high-quality home theater systems. |

| Apple Inc. | Provides Apple TV and smart home integrat ion with a focus on the ecosystem. |

| Harman International Industries, Inc. | Known for premium audio systems and smart home solutions (JBL, AKG). |

Key Company Insights

Samsung Electronics Co., Ltd. (20-25%)

Samsung continues to lead with innovations in smart TVs and home entertainment systems, especially in the QLED and AI-powered spaces. Their advancements in 8K resolution and home integration via Samsung SmartThings give them a competitive advantage in the premium segment.

Sony Corporation (18-22%)

Sony's strength lies in its premium home entertainment systems, including high-end smart TVs with OLED technology, soundbars, and immersive audio products. They have a continuous focus on combining innovation with entertainment experiences.

LG Electronics Inc. (15-20%)

LG's premium offerings, especially OLED technology and ThinQ AI, position the company as a key player in the high-end entertainment system segment. Their focus on sustainability and smart home integration has allowed LG to remain competitive in the industry.

Apple Inc. (8-12%)

Apple has integrated its smart entertainment systems within its ecosystem, particularly with Apple TV, making it a strong competitor in the home entertainment and smart home segments. Its ability to sync seamlessly with iOS and macOS devices makes it a favored choice for users invested in Apple's ecosystem.

Harman International Industries, Inc. (5-8%)

Known for high-quality audio solutions, Harman, a subsidiary of Samsung, dominates the premium audio space. JBL and AKG, its audio brands, continue to lead the smart entertainment and connected audio product industries.

The segmentation is into Smart TVs, Streaming Devices, Smart Speakers and Soundbars, Home Theater Systems, Gaming Consoles, and Others.

The segmentation is into Bluetooth Connectivity and Wi-Fi Connectivity.

The segmentation is into Commercial and Residential segments.

The segmentation is into Modern Trade, Specialty Stores, Franchise Outlet/Mono Brand Stores, Online Stores (Direct to Consumer, Third Party to Consumer), and Other Sales Channels.

The report covers North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The industry is slated to reach USD 303.85 billion in 2025.

The industry is predicted to reach a size of USD 660.22 billion by 2035.

Key companies include Samsung Electronics Co., Ltd., Sony Corporation, LG Electronics Inc., Panasonic Corporation, Apple Inc., Harman International Industries, Inc., Philips Electronics N.V., Denon Electronics, Yamaha Corporation, Pioneer Corporation, Sharp Corporation, Vizio, Inc., TCL Corporation, and Hisense Co., Ltd.

Which country is slated to observe the fastest growth in the smart entertainment systems industry?

Smart TVs are being widely used.

Table 1: Global Market Value (US$ million) Forecast By Product Type, 2018 to 2033

Table 2: Global Market Volume (‘000 Units) Forecast By Product Type, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast By Technology, 2018 to 2033

Table 4: Global Market Volume (‘000 Units) Forecast By Technology, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast By End User, 2018 to 2033

Table 6: Global Market Volume (‘000 Units) Forecast By End User, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 8: Global Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 9: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 10: Global Market Volume (‘000 Units) Forecast by Region, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast By Product Type, 2018 to 2033

Table 14: North America Market Volume (‘000 Units) Forecast By Product Type, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast By Technology, 2018 to 2033

Table 16: North America Market Volume (‘000 Units) Forecast By Technology, 2018 to 2033

Table 17: North America Market Value (US$ million) Forecast By End User, 2018 to 2033

Table 18: North America Market Volume (‘000 Units) Forecast By End User, 2018 to 2033

Table 19: North America Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 20: North America Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast By Product Type, 2018 to 2033

Table 24: Latin America Market Volume (‘000 Units) Forecast By Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Forecast, By Technology, 2018 to 2033

Table 26: Latin America Market Volume (‘000 Units) Forecast, By Technology, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Forecast, By End User, 2018 to 2033

Table 28: Latin America Market Volume (‘000 Units) Forecast, By End User, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ million) Forecast By Product Type, 2018 to 2033

Table 34: Europe Market Volume (‘000 Units) Forecast By Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ million) Forecast By Technology, 2018 to 2033

Table 36: Europe Market Volume (‘000 Units) Forecast By Technology, 2018 to 2033

Table 37: Europe Market Value (US$ million) Forecast By End User, 2018 to 2033

Table 38: Europe Market Volume (‘000 Units) Forecast By End User, 2018 to 2033

Table 39: Europe Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ million) Forecast By Product Type, 2018 to 2033

Table 44: East Asia Market Volume (‘000 Units) Forecast By Product Type, 2018 to 2033

Table 45: East Asia Market Value (US$ million) Forecast By Technology, 2018 to 2033

Table 46: East Asia Market Volume (‘000 Units) Forecast By Technology, 2018 to 2033

Table 47: East Asia Market Value (US$ million) Forecast By End User, 2018 to 2033

Table 48: East Asia Market Volume (‘000 Units) Forecast By End User, 2018 to 2033

Table 49: East Asia Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 50: East Asia Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 51: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ million) Forecast By Product Type, 2018 to 2033

Table 54: South Asia Market Volume (‘000 Units) Forecast By Product Type, 2018 to 2033

Table 55: South Asia Market Value (US$ million) Forecast By Technology, 2018 to 2033

Table 56: South Asia Market Volume (‘000 Units) Forecast By Technology, 2018 to 2033

Table 57: South Asia Market Value (US$ million) Forecast By End User, 2018 to 2033

Table 58: South Asia Market Volume (‘000 Units) Forecast By End User, 2018 to 2033

Table 59: South Asia Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 60: South Asia Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 61: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ million) Forecast By Product Type, 2018 to 2033

Table 64: Oceania Market Volume (‘000 Units) Forecast By Product Type, 2018 to 2033

Table 65: Oceania Market Value (US$ million) Forecast By Technology, 2018 to 2033

Table 66: Oceania Market Volume (‘000 Units) Forecast By Technology, 2018 to 2033

Table 67: Oceania Market Value (US$ million) Forecast By End User, 2018 to 2033

Table 68: Oceania Market Volume (‘000 Units) Forecast By End User, 2018 to 2033

Table 69: Oceania Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 70: Oceania Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (‘000 Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ million) Forecast By Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (‘000 Units) Forecast By Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ million) Forecast By Technology, 2018 to 2033

Table 76: Middle East and Africa Market Volume (‘000 Units) Forecast By Technology, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ million) Forecast By End User, 2018 to 2033

Table 78: Middle East and Africa Market Volume (‘000 Units) Forecast By End User, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (‘000 Units) Forecast, By Sales Channel, 2018 to 2033

Figure 01: Global Market Value (US$ million) and Volume (‘000 Units) Analysis, 2018 to 2022

Figure 02: Global Market Value (US$ million) and Volume (‘000 Units) Forecast, 2023 to 2033

Figure 03: Global Market Value (US$ million) Analysis, 2018 to 2022

Figure 04: Global Market Value (US$ million) Forecast, 2023 to 2033

Figure 05: Global Market Absolute $ Opportunity Value (US$ million), 2023 to 2033

Figure 06: Global Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 07: Global Market Volume (‘000 Units) Analysis By Product Type, 2018 to 2033

Figure 08: Global Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Global Market Attractiveness By Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis By Technology, 2018 to 2033

Figure 11: Global Market Volume (‘000 Units) Analysis By Technology, 2018 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections, By Technology, 2023 to 2033

Figure 13: Global Market Attractiveness By Technology, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis By End User, 2018 to 2033

Figure 15: Global Market Volume (‘000 Units) Analysis By End User, 2018 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 17: Global Market Attractiveness By End User, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 22: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 23: Global Market Volume (‘000 Units) Analysis by Region, 2018 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 27: North America Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 28: North America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 29: North America Market Attractiveness by Country, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 31: North America Market Volume (‘000 Units) Analysis By Product Type, 2018 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 33: North America Market Attractiveness By Product Type, 2023 to 2033

Figure 34: North America Market Value (US$ million) Analysis By Technology, 2018 to 2033

Figure 35: North America Market Volume (‘000 Units) Analysis By Technology, 2018 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections, By Technology, 2023 to 2033

Figure 37: North America Market Attractiveness By Technology, 2023 to 2033

Figure 38: North America Market Value (US$ million) Analysis By End User, 2018 to 2033

Figure 39: North America Market Volume (‘000 Units) Analysis By End User, 2018 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 41: North America Market Attractiveness By End User, 2023 to 2033

Figure 42: North America Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 46: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 47: Latin America Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 48: Latin America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 49: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 51: Latin America Market Volume (‘000 Units) Analysis By Product Type, 2018 to 2033

Figure 52: Latin America Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness By Product Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ million) Analysis By Technology, 2018 to 2033

Figure 55: Latin America Market Volume (‘000 Units) Analysis By Technology, 2018 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections, By Technology, 2023 to 2033

Figure 57: Latin America Market Attractiveness By Technology, 2023 to 2033

Figure 58: Latin America Market Value (US$ million) Analysis By End User, 2018 to 2033

Figure 59: Latin America Market Volume (‘000 Units) Analysis By End User, 2018 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 61: Latin America Market Attractiveness By End User, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 63: Latin America Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 65: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 66: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 67: Europe Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 68: Europe Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 69: Europe Market Attractiveness by Country, 2023 to 2033

Figure 70: Europe Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 71: Europe Market Volume (‘000 Units) Analysis By Product Type, 2018 to 2033

Figure 72: Europe Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 73: Europe Market Attractiveness By Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ million) Analysis By Technology, 2018 to 2033

Figure 75: Europe Market Volume (‘000 Units) Analysis By Technology, 2018 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections, By Technology, 2023 to 2033

Figure 77: Europe Market Attractiveness By Technology, 2023 to 2033

Figure 78: Europe Market Value (US$ million) Analysis By End User, 2018 to 2033

Figure 79: Europe Market Volume (‘000 Units) Analysis By End User, 2018 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 81: Europe Market Attractiveness By End User, 2023 to 2033

Figure 82: Europe Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Europe Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 85: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 86: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 87: East Asia Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 88: East Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 90: East Asia Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 91: East Asia Market Volume (‘000 Units) Analysis By Product Type, 2018 to 2033

Figure 92: East Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 93: East Asia Market Attractiveness By Product Type, 2023 to 2033

Figure 94: East Asia Market Value (US$ million) Analysis By Technology, 2018 to 2033

Figure 95: East Asia Market Volume (‘000 Units) Analysis By Technology, 2018 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections, By Technology, 2023 to 2033

Figure 97: East Asia Market Attractiveness By Technology, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) Analysis By End User, 2018 to 2033

Figure 99: East Asia Market Volume (‘000 Units) Analysis By End User, 2018 to 2033

Figure 100: East Asia Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 101: East Asia Market Attractiveness By End User, 2023 to 2033

Figure 102: East Asia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 103: East Asia Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 106: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 109: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 110: South Asia Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 111: South Asia Market Volume (‘000 Units) Analysis By Product Type, 2018 to 2033

Figure 112: South Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 113: South Asia Market Attractiveness By Product Type, 2023 to 2033

Figure 114: South Asia Market Value (US$ million) Analysis By Technology, 2018 to 2033

Figure 115: South Asia Market Volume (‘000 Units) Analysis By Technology, 2018 to 2033

Figure 116: South Asia Market Y-o-Y Growth (%) Projections, By Technology, 2023 to 2033

Figure 117: South Asia Market Attractiveness By Technology, 2023 to 2033

Figure 118: South Asia Market Value (US$ million) Analysis By End User, 2018 to 2033

Figure 119: South Asia Market Volume (‘000 Units) Analysis By End User, 2018 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 121: South Asia Market Attractiveness By End User, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 123: South Asia Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 124: South Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 126: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 127: Oceania Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 128: Oceania Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 129: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 130: Oceania Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 131: Oceania Market Volume (‘000 Units) Analysis By Product Type, 2018 to 2033

Figure 132: Oceania Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 133: Oceania Market Attractiveness By Product Type, 2023 to 2033

Figure 134: Oceania Market Value (US$ million) Analysis By Technology, 2018 to 2033

Figure 135: Oceania Market Volume (‘000 Units) Analysis By Technology, 2018 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections, By Technology, 2023 to 2033

Figure 137: Oceania Market Attractiveness By Technology, 2023 to 2033

Figure 138: Oceania Market Value (US$ million) Analysis By End User, 2018 to 2033

Figure 139: Oceania Market Volume (‘000 Units) Analysis By End User, 2018 to 2033

Figure 140: Oceania Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 141: Oceania Market Attractiveness By End User, 2023 to 2033

Figure 142: Oceania Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Oceania Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Oceania Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 145: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 146: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 147: Middle East and Africa Market Volume (‘000 Units) Analysis by Country, 2018 to 2033

Figure 148: Middle East and Africa Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 149: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Figure 150: Middle East and Africa Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 151: Middle East and Africa Market Volume (‘000 Units) Analysis By Product Type, 2018 to 2033

Figure 152: Middle East and Africa Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 153: Middle East and Africa Market Attractiveness By Product Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ million) Analysis By Technology, 2018 to 2033

Figure 155: Middle East and Africa Market Volume (‘000 Units) Analysis By Technology, 2018 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections, By Technology, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness By Technology, 2023 to 2033

Figure 158: Middle East and Africa Market Value (US$ million) Analysis By End User, 2018 to 2033

Figure 159: Middle East and Africa Market Volume (‘000 Units) Analysis By End User, 2018 to 2033

Figure 160: Middle East and Africa Market Y-o-Y Growth (%) Projections, By End User, 2023 to 2033

Figure 161: Middle East and Africa Market Attractiveness By End User, 2023 to 2033

Figure 162: Middle East and Africa Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 163: Middle East and Africa Market Volume (‘000 Units) Analysis by Sales Channel, 2018 to 2033

Figure 164: Middle East and Africa Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 165: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA