The smart wheelchair market is experiencing robust expansion driven by technological innovation, growing demand for assistive mobility solutions, and increasing prevalence of mobility impairments across aging populations. Current market growth is being supported by integration of artificial intelligence, IoT, and sensor-based navigation systems that enhance safety, comfort, and autonomy for users. Manufacturers are emphasizing product customization, connectivity, and ergonomic design to cater to both personal and institutional use cases.

Expanding healthcare infrastructure and rising government initiatives promoting accessibility are further strengthening adoption. Cost reduction in electronic components and battery technologies is improving affordability and operational efficiency.

The future outlook remains optimistic as smart mobility devices become integral to rehabilitation and long-term care frameworks Continued advancements in connectivity, remote diagnostics, and predictive maintenance are expected to sustain market growth, ensuring greater convenience, safety, and independence for users while enhancing efficiency in healthcare and homecare environments.

| Metric | Value |

|---|---|

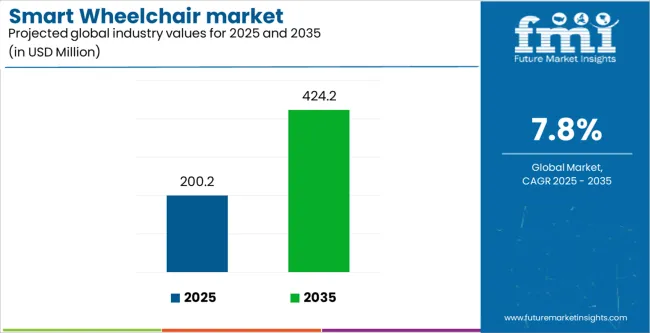

| Smart Wheelchair market Estimated Value in (2025 E) | USD 200.2 million |

| Smart Wheelchair market Forecast Value in (2035 F) | USD 424.2 million |

| Forecast CAGR (2025 to 2035) | 7.8% |

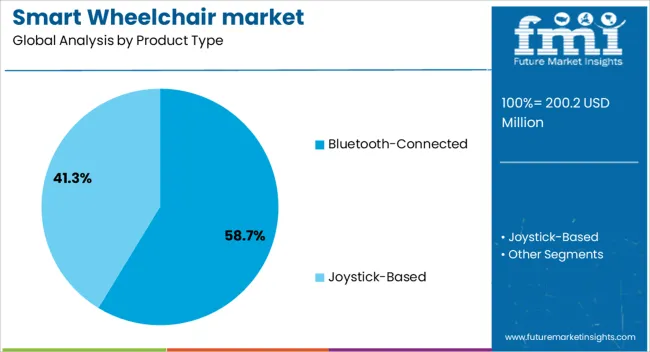

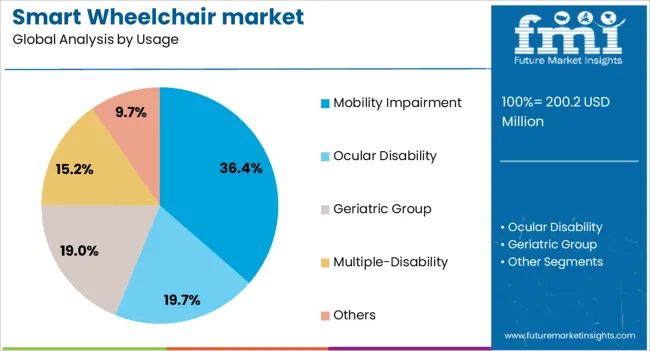

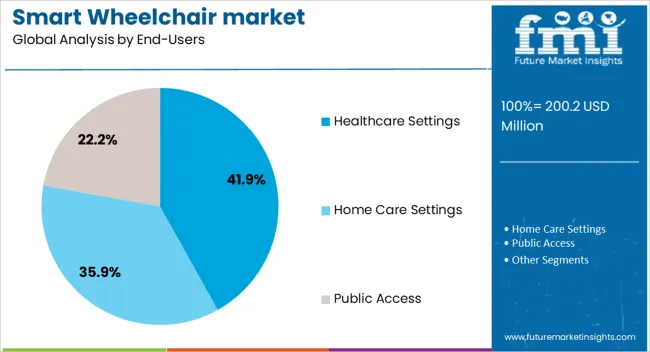

The market is segmented by Product Type, Usage, and End-Users and region. By Product Type, the market is divided into Bluetooth-Connected and Joystick-Based. In terms of Usage, the market is classified into Mobility Impairment, Ocular Disability, Geriatric Group, Multiple-Disability, and Others. Based on End-Users, the market is segmented into Healthcare Settings, Home Care Settings, and Public Access. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Bluetooth-connected segment, accounting for 58.70% of the product type category, is leading the market due to its advanced control capabilities, seamless device integration, and enhanced user experience. Its dominance has been driven by rising adoption among tech-enabled healthcare providers and individuals seeking intuitive mobility support.

Integration with smartphones and wearable devices allows users to operate wheelchairs remotely, improving accessibility and customization. Manufacturers are focusing on software upgrades and data security to ensure performance reliability.

The segment’s growth has also been supported by expanding applications in rehabilitation centers and assisted living facilities Continuous innovation in connectivity protocols and sensor optimization is expected to sustain the segment’s leading position and expand its role in personalized patient mobility management.

The mobility impairment segment, holding 36.40% of the usage category, has maintained a leading share due to the increasing number of patients with chronic movement disorders, spinal injuries, and age-related disabilities. Adoption has been driven by the growing need for assistive solutions that combine safety, comfort, and intelligent control systems.

Technological integration, such as collision avoidance and automated navigation, has significantly improved user independence. Healthcare programs supporting accessibility and insurance reimbursements for mobility aids have further strengthened this segment’s position.

Continuous innovation in wheelchair design and customization for diverse impairment levels is expected to reinforce sustained demand, making mobility impairment the primary usage driver in the global smart wheelchair market.

The healthcare settings segment, representing 41.90% of the end-user category, has emerged as the dominant channel due to rising deployment of smart wheelchairs in hospitals, rehabilitation centers, and long-term care facilities. Demand has been fueled by increasing focus on patient mobility management and efficient recovery processes.

Integration of smart wheelchairs into healthcare systems enables better monitoring, safety tracking, and remote control, improving overall patient outcomes. Institutions are adopting these solutions to reduce caregiver workload and improve rehabilitation effectiveness.

Investments in advanced assistive technologies and expanding hospital infrastructure in emerging economies are further supporting segment growth Over the forecast period, the healthcare settings segment is expected to retain its leadership as smart mobility devices become essential in clinical and rehabilitative environments.

Neurodegenerative Disorders Fuel the Sales of Smart Wheelchairs

Neurodegenerative disorders like Amyotrophic Lateral Sclerosis (ALS) affect vast populations. For instance, the ALS Society of Canada approximated that over 1,000 people are typically diagnosed with this disease in Canada annually.

Apart from this, 3,000 people with ALS are living in the country at any given time. This is a consistent driver for assistive equipment like intelligent wheelchairs. Wheelchairs, equipped with numerous functions including tilting, reclining, and standing, are in demand for improved care and mobility.

Favorable Government Policies Impel More Sales of Smart Wheelchairs

Government policies and regulations are set in place to improve accessibility for people with disabilities. Regulations as such encourage public spaces and transportation to make arrangement for wheelchair-accessibility.

Thus, boosting the product demand. Moreover, the insurance coverage and healthcare reimbursement for intelligent wheelchairs is expected to make this equipment affordable for people with disabilities. Consequently, raising the product’s demand.

Restrictive Factors that Pose Challenges for Manufacturers

Such wheelchairs are a luxury for patients. For people already incurring medical expenses for hospital visits, medicines, traveling expenses to healthcare, etc., the added and high cost of these intelligent wheelchairs doesn’t seem feasible. Additionally, alternative options like manual wheelchairs, whose maintenance costs are reasonable, are further prohibiting its adoption.

Extreme comfort linked with the use of manual wheelchairs, so much so that the patient considers it as an extended limb, is also impeding the industry's growth. To further realize the potential of smart wheelchairs, they would require interaction with smart city infrastructure.

This would necessitate seamless navigation with automatic doors, accessible ramps, and elevator call systems. Nonetheless, it’s a complex task, one which would take several years to fully develop.

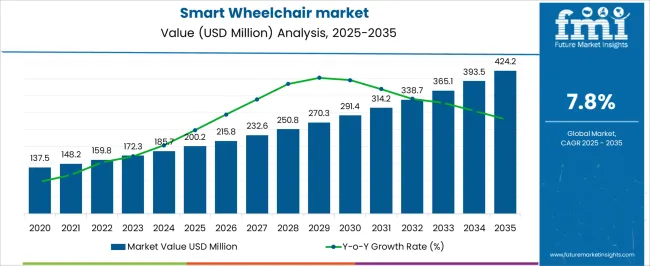

Global smart wheelchair sales rose at a CAGR of 6.7% from 2020 to 2025. The corresponding market values for 2020 and 2025 were assessed at USD 125.1 million and USD 172.7 million, respectively.

The moderate sales of such wheelchairs during the historical period are attributed to rising incidences of physical disabilities, deemed temporary or permanent. Surging cases of road traffic-related accidents, that induce limited mobility, are another impetus for intelligent wheelchair demand.

The expanding geriatric population is also susceptible to restricted mobility conditions. Knee injuries, paralysis, strokes, and obesity are certain pervasive mobility-related issues that have been detected among people over 65 years. Thus, players are targeting their efforts on this group to boost their sales.

Technological progress in the field of home care, assisted living, patient care, and elder care products and services to improve patient management is taking precedence. As a result, innovations in the field of intelligent wheelchairs are welcomed by end users.

New and improved assistive technology designs are being developed with sensor and wireless technologies. Additionally, players are creating customized solutions with the assistance of Information and Communication Technologies (ICT) tools. People with severe disabilities are adopting such assistive technologies to interact with electric devices like tablets, laptops, radios, and televisions.

Over the forecast period, the industry is projected to expand at a promising 7.8% CAGR, given the continuous technological advancements in the industry.

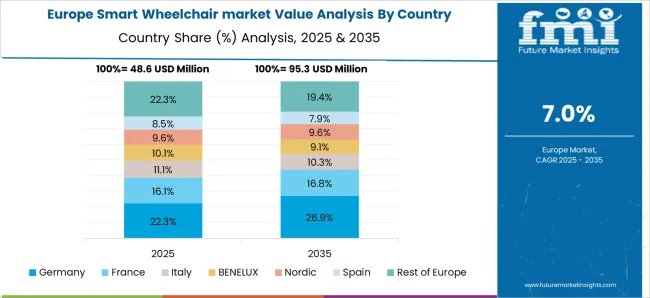

Adoption patterns of smart wheelchairs in developed countries like the United States and Germany are expected to be promising. Sales are predicted to be driven by research funding and the availability of smart equipment in such areas.

Demand in China and India is projected to be fueled by the expansive patient base of physically impaired individuals and improving income levels.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 8.3% |

| Germany | 7.4% |

| China | 11.1% |

| India | 11.4% |

| Australia | 7.5% |

The United States enjoys a leading position in North America when it comes to smart wheelchair market. The country is estimated to attain a CAGR of 8.3% over the forecast period. The country is populated with a massive population of people suffering from physical disabilities. This is creating a potential for surged sales across the country.

The country’s federal reimbursement plans and the existence of disability criteria within the healthcare structure are prompting intelligent wheelchairs sales. In conjunction, the Americans with Disabilities Act has many reimbursements for assistive mobility tools and aids. Such policies are pushing the adoption and management of assistive devices like intelligent wheelchairs across the United States.

The smart wheelchair industry in Germany is expected to expand at a 7.4% CAGR over the forecast period. Continuous research to develop advanced versions of wheelchairs is expected to meet or surpass patients’ expectations.

For instance, in September 2024, the German federal government-funded research on intelligent wheelchair seats to create smart seats for young wheelchair users. Digitalization and customization are the focus areas of the project, to give young users reliable sitting support.

Recently, a leading provider of intelligent wheelchairs has developed a system that can be controlled with head gestures. Thereby, empowering those with extreme muscle diseases with more independence and mobility.

India is expected to pace at a CAGR of 11.4% over the next decade in the smart wheelchair market. Key factors contributing to the expansive market for such wheelchairs include a rapidly growing geriatric population and robust adoption of automated systems. The rising integration of technologies like autonomous navigation systems for real-time navigation of intelligent wheelchairs is further enhancing the market scope.

Players are also developing assistive devices with terrain perception to reduce fall risks among elderly users of intelligent wheelchairs.

This section mentions the top performers of the smart wheelchair market in detail. Presently, joystick-based smart wheelchairs enjoy a high preference among patients with mobility issues, registering a share of 85% in 2025. Under the usage category, the mobility impairment segment is expected to assume prominence over the estimated period. In 2025, this segment is predicted to obtain a 45% share.

| Segment | Joystick-based Smart Wheelchairs (Product) |

|---|---|

| Value Share (2025) | 85% |

Joystick-based smart wheelchairs are expected to acquire a dominant share of the industry. This segment growth is driven by continuous advancements aimed at improving patient mobility. For example, several patients suffering from cerebral palsy are not quite adaptive to the navigation assistance offered by conventional joystick-based wheelchairs.

As a result, advances are being made in joystick-based intelligent wheelchairs like simultaneous deployment of AI for assistive mobility. Rising traction for joystick-based intelligent wheelchairs is expected to further expand the segment’s value.

| Segment | Mobility Impairment (Usage) |

|---|---|

| Value Share (2025) | 45% |

Smart wheelchairs are typically and widely used to accommodate people with mobility impairment. The patients adopt wheelchairs to perform daily functions. Integration of the Internet of Medical Things (IoMT) in smart wheelchairs for expansive data monitoring and patient assessment is expected to increase the appeal of this equipment among physically impaired individuals.

Players are developing smart wheelchairs that can be controlled via voice commands, which can be helpful for people with limited upper-body mobility. Additionally, navigation systems like GPS and other navigation systems are being integrated into smart wheelchairs to get the user to their destination efficiently and safely. Thereby, increasing their use for mobility impairment.

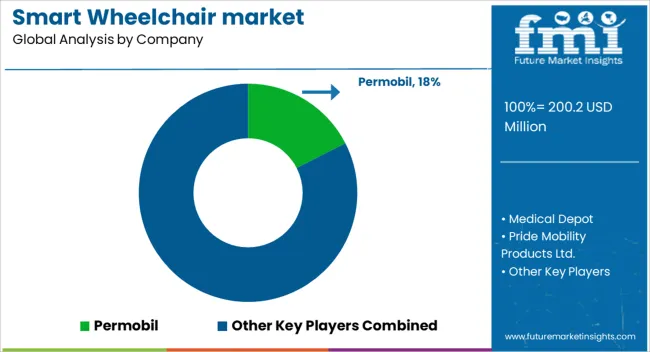

Key players in the smart wheelchair market are focusing on innovation in their latest developments. Companies are integrating AI-powered navigation systems, remote monitoring, and emergency alert systems, in electric wheelchairs to enhance their portfolio. Additionally, efforts are being made to improve the battery life and charging capabilities to increase patients’ convenience.

Players are also innovating foldable and lightweight smart wheelchairs to increase their penetration in the smart wheelchair market. Playersmark are sensing the demand for customizable options to meet the various needs and abilities of patients. Predominantly, opportunities for key players lie in developing smart wheelchairs to cater to the expanding pediatric and geriatric population.

Industry Updates

Based on product type, the sector is divided into joystick-based and Bluetooth-connected.

By usage, the industry is segmented into mobility impairment, ocular disability, geriatric group, and multiple-disability, among others.

End-users of intelligent wheelchairs include healthcare settings, home care settings, and public access.

A regional industry analysis is conducted across North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The global smart wheelchair market is estimated to be valued at USD 200.2 million in 2025.

The market size for the smart wheelchair market is projected to reach USD 424.2 million by 2035.

The smart wheelchair market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in smart wheelchair market are bluetooth-connected and joystick-based.

In terms of usage, mobility impairment segment to command 36.4% share in the smart wheelchair market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Home Automation in India – IoT & AI-Driven Growth

Smart Space Market Growth – Trends & Forecast 2024-2034

Smart TV Market Forecast and Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Bed Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Market Size and Share Forecast Outlook 2025 to 2035

Smart Crib Market Size and Share Forecast Outlook 2025 to 2035

Smart Vase Market Analysis – Trends, Growth & Forecast 2025 to 2035

Smart Pump Market Growth – Trends & Forecast 2025 to 2035

Key Players & Market Share in the Smart Lock Sector

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Meter Market Size and Share Forecast Outlook 2025 to 2035

Smart Rings Market Size and Share Forecast Outlook 2025 to 2035

Smart Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Space Market Analysis – Growth, Applications & Outlook 2025–2035

Smart Shoes Market - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Smart Label Providers

Smart Solar Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA