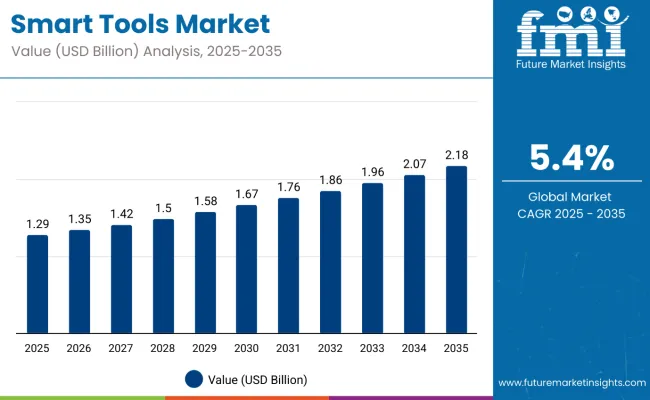

The global smart tools market is projected to grow from USD 1.29 billion in 2025 to approximately USD 2.18 billion by 2035, marking an absolute increase of USD 890 million over the decade. This growth reflects a total expansion of 68.9%, with the market forecast to advance at a compound annual growth rate (CAGR) of 5.4% during the 2025 to 2035 period.

The total market size is expected to grow by nearly 1.7X by the end of the forecast window, supported by the integration of sensor-based diagnostics, predictive analytics, and IoT connectivity in professional-grade and industrial tool applications.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.29 billion |

| Industry Size (2035F) | USD 2.18 billion |

| CAGR 2025 to 2035 | 5.4% |

Between 2025 and 2030, the smart tools market is expected to expand from USD 1.29 billion to USD 1.67 billion, resulting in a value addition of USD 0.38 billion, which accounts for approximately 42.7% of the total decade-long growth.

This phase is likely to be characterized by growing penetration of torque-limiting, calibration-enabled, and digitally programmable tools across automotive service centers, aerospace assembly lines, and precision engineering segments. Investments in connected manufacturing and the adoption of Industry 4.0 protocols are expected to strengthen demand across North America, Germany, Japan, and South Korea.

From 2030 to 2035, the market is projected to increase from USD 1.67 billion to USD 2.18 billion, adding another USD 510 million or 57.3% of total forecast growth. During this second half of the decade, demand is anticipated to accelerate due to widespread implementation of condition-monitoring tools, smart fastening systems, and integrated tool-data platforms in production workflows.

This shift is expected to be reinforced by labor optimization efforts, enhanced worker safety standards, and the expansion of AI-driven tool usage across high-volume manufacturing hubs in China, India, and Mexico.

From 2020 to 2025, the smart tools market expanded from USD 1.03 billion to USD 1.29 billion, reflecting a value increase of USD 260 million. This steady growth was supported by early-stage digitization in industrial tooling systems and a rising focus on productivity and safety within maintenance, repair, and overhaul (MRO) operations. Adoption was led by automotive and aerospace OEMs, where programmable torque tools, electronic wrenches, and battery-powered smart drivers improved error-proofing, reduced rework, and enabled data capture for quality traceability.

Manufacturing sectors in the United States, Germany, and Japan demonstrated early uptake of sensor-integrated tools for assembly and inspection tasks. The deployment of smart torque and angle control tools became prevalent in electronics assembly lines, supported by regulatory emphasis on ESD-safe tools and real-time data validation. Tool manufacturers introduced wireless connectivity, modular attachments, and in-built calibration tracking to align with industry requirements for operational intelligence and predictive maintenance.

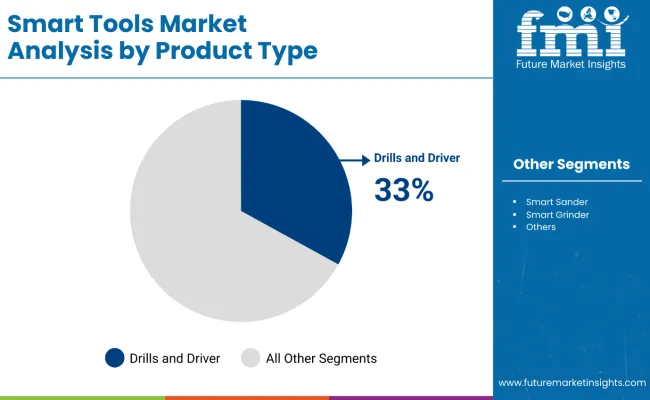

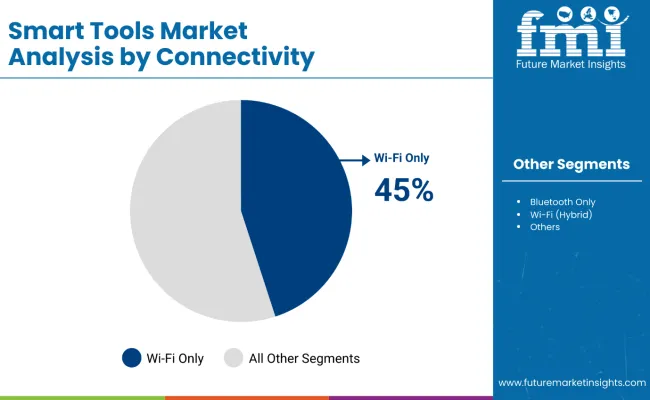

The market is segmented by tool type into drills and drivers, saws, sanders and grinders, outdoor power equipment, and measuring tools, each designed to fulfill distinct operational needs. Based on connectivity and smart capabilities, classifications include Bluetooth-only tools, Wi-Fi-only variants, hybrid models combining both, and tools with app-based control and monitoring functions.

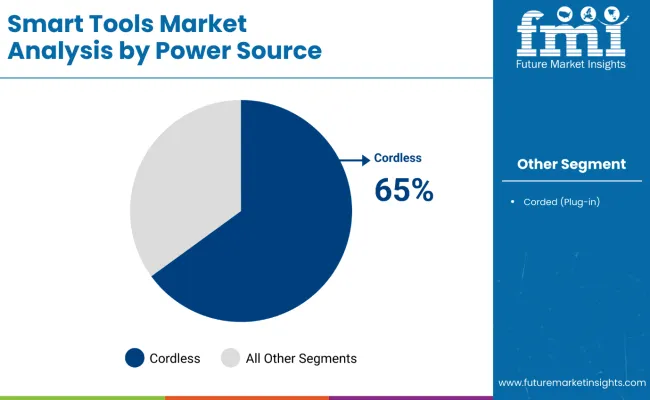

Power source segmentation is divided into cordless battery-powered tools and corded plug-in types. In terms of end-user, the market is distributed across DIY and home users, professional construction teams, infrastructure projects, manufacturing and assembly lines, maintenance and repair operations, as well as the oil and gas, utilities, telecommunications, transportation, and logistics sectors.

Drills and drivers are estimated to hold 33% of the global smart tools market in 2025, supported by their multipurpose use across DIY, industrial, and professional segments. Their integration with smart sensors and torque control features has improved reliability and process automation in fastening and assembly. Cordless compatibility and growing demand for compact toolsets have further reinforced their dominance, especially in environments requiring flexible and mobile power tool solutions.

Wi-Fi-only smart tools are projected to contribute 45% of overall market revenue in 2025, driven by demand for seamless integration with enterprise platforms and cloud-based asset monitoring systems. These tools have gained widespread use in factory floors, utilities, and infrastructure maintenance where high-bandwidth connectivity enables real-time updates, remote diagnostics, and operational analytics.

Cordless, battery-powered tools are expected to account for 65% of total sales in 2025, reflecting user preference for enhanced mobility, minimal setup time, and cable-free operation. Improvements in lithium-ion battery technology, fast charging, and smart battery management systems have increased usage across on-site service, construction, and emergency maintenance applications. Their rising adoption is also supported by ergonomic tool designs and declining battery replacement costs.

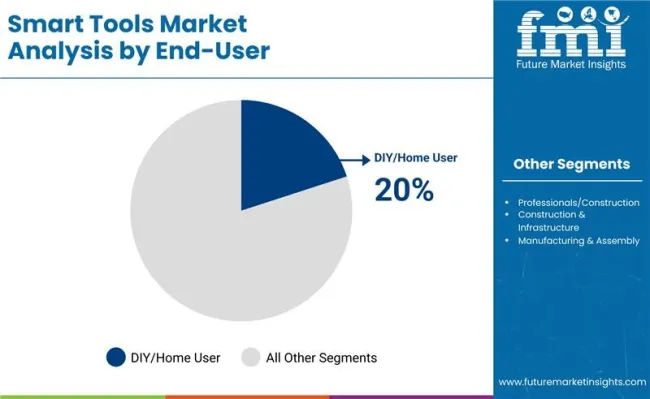

DIY and home users are projected to represent 20% of the market in 2025, reflecting increasing penetration of smart tools in residential applications. Features such as mobile app compatibility, automated control settings, and safety feedback alerts have made smart tools more appealing for home improvement tasks. Online retail channels and bundled tool kits have expanded access for this user group, especially in developed markets where personal ownership of tools is rising.

Growth in the smart tools market is being supported by the convergence of Industry 4.0 deployment, demand for operator safety, and the rising importance of traceable assembly operations. As manufacturing facilities transition toward connected ecosystems, the need for intelligent tools that can provide torque control, usage analytics, and automated calibration alerts has gained traction. These features are enabling better compliance with quality standards in industries such as automotive, electronics, and aerospace.

Labor shortages in skilled trades are also encouraging adoption of programmable tools that reduce operator error and simplify complex procedures. End users are increasingly preferring solutions that integrate directly with MES (Manufacturing Execution Systems) or ERP platforms, allowing production data to be recorded and analyzed in real time. Product development is focusing on integrating wireless communication protocols (Bluetooth, WLAN), ergonomic designs, and embedded diagnostics to support predictive maintenance and fleet-level tool management.

The smart tools market is being driven by automation in industrial workflows, growing need for traceable torque application, and rising compliance with quality management standards across critical sectors. However, adoption is limited by high upfront costs, interoperability challenges with legacy systems, and sensitivity of digital tools in harsh environments.

The lack of skilled operators to handle calibration, diagnostics, and software integration also presents a constraint in mid-scale facilities. Despite these challenges, ongoing advancements in connectivity, miniaturization, and embedded intelligence are shaping next-generation tool platforms.

Connected Assembly Driving Demand for Real-Time Traceability

Tool integration into digital assembly environments is becoming a standard requirement in industries such as automotive, aerospace, and electronics. Smart torque wrenches, angle sensors, and programmable fastening tools are enabling real-time validation, reducing assembly errors, and generating audit trails. This is particularly relevant for high-mix, low-volume production environments where quality and consistency are critical.

Embedded Diagnostics and Predictive Maintenance Expand Industrial Appeal

The ability to track tool usage, predict component wear, and automate calibration alerts is increasing adoption in maintenance-heavy sectors. Predictive maintenance reduces downtime and extends tool life, while also supporting safety protocols by ensuring that tools operate within defined tolerances. These capabilities are being expanded to cover battery management, motor diagnostics, and pressure/load conditions in hand tools and powered systems.

| Country | Value Share 2025 |

|---|---|

| Germany | 25% |

| UK | 18% |

| France | 16% |

| Italy | 11% |

| Spain | 8% |

| BENELUX | 7% |

| Russia | 5% |

| Rest of Europe | 10% |

| Country | Value Share 2035 |

|---|---|

| Germany | 23% |

| UK | 17% |

| France | 17% |

| Italy | 12% |

| Spain | 9% |

| BENELUX | 8% |

| Russia | 4% |

| Rest of Europe | 10% |

Germany is projected to remain the leading market for smart tools in Europe, although its share is expected to decline from 25% in 2025 to 23% by 2035, primarily due to maturing demand and stronger growth in neighboring countries. The United Kingdom will follow with a share moving from 18% to 17%, supported by sustained investment in aerospace and electric vehicle manufacturing, though growth may plateau as local capacity stabilizes.

France is forecast to increase its share slightly from 16% to 17%, driven by factory automation in electronics and defense applications. Italy is projected to grow from 11% to 12%, reflecting rising adoption of smart torque and calibration tools in machinery and automotive components manufacturing. Spain’s market share is expected to improve from 8% to 9%, supported by light industrial expansion and localized electronics assembly.

The BENELUX region is forecast to grow from 7% to 8%, led by precision tool adoption in semiconductor and pharma sectors. Russia is expected to see a drop in share from 5% to 4%, largely due to ongoing import limitations and economic constraints.

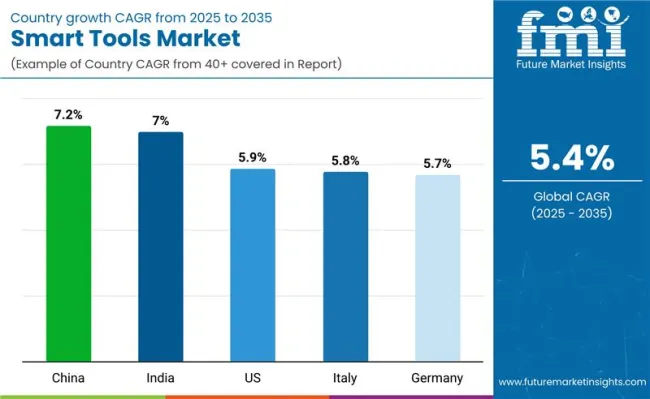

China’s smart tools market is projected to expand at the fastest CAGR of 7.2% between 2025 and 2035. Investments in smart factories and digital assembly lines continue to drive demand for connected, calibrated, and sensor-embedded tools across automotive, electronics, and heavy industry sectors.

India’s smart tools market is forecast to grow at a CAGR of 7.0%, supported by rising awareness and government incentives for industrial digitization. Adoption is strong among small and mid-sized manufacturers involved in electronics, automotive parts, and contract machining.

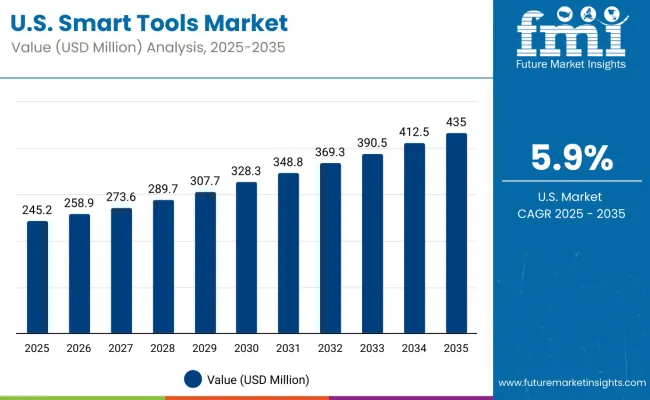

The USA is expected to register a 5.9% CAGR, driven by factory retrofits, aerospace and defense tooling upgrades, and increased adoption of predictive maintenance solutions. Demand is high for tools with integrated telemetry, usage tracking, and remote diagnostics.

Italy’s market is projected to grow at 5.8% CAGR as CNC machining, automotive assembly, and industrial subcontracting shift toward connected tooling. Manufacturers are embedding smart measurement and fastening tools into digitized production environments.

Germany is set to expand at 5.7% CAGR, supported by its emphasis on data-driven quality control and productivity. Precision tooling is increasingly integrated with ERP and MES platforms across manufacturing clusters in the southern and western regions.

In Japan, cordless smart tools are projected to account for 70% of the total market by 2025. Compact industrial setups, ergonomic prioritization, and growing use in confined factory floors have contributed to widespread adoption of battery-powered solutions. Corded tools still retain a 30% share, largely in high-precision assembly lines and applications requiring consistent power supply. This power source distribution aligns with Japan’s emphasis on quiet operation, modular workspaces, and energy-efficient devices.

South Korea’s market shows a preference for tools with Bluetooth-only connectivity, commanding a 40% share in 2025. Hybrid smart tools that combine both Bluetooth and Wi-Fi functionality are projected to account for 25%, offering flexibility across shop floor networks. App-based control and diagnostics tools represent 15% of the market, supporting localized automation in smart factories. Tools relying solely on Wi-Fi connectivity hold a 20% share, primarily used in fixed automation lines or integrated with cloud-based monitoring platforms.

The smart tools market is being shaped by the integration of digital monitoring, connectivity, and predictive maintenance features into power tools. Tools with real-time diagnostics, adaptive performance control, and app-based analytics are being introduced to enhance operational efficiency, safety, and asset management. Wireless connectivity and ecosystem integration are enabling centralized fleet management, usage tracking, and preventive service alerts, particularly in industrial and construction applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.29 Billion (2025) |

| Product Type | Smart Drills, Smart Wrenches, Smart Screwdrivers, Smart Sanders, Smart Grinders |

| Connectivity | Bluetooth Only, Wi-Fi Only, Bluetooth + Wi-Fi (Hybrid), App-based Control & Monitoring |

| Power Source | Cordless (Battery-Powered), Corded (Plug-in) |

| End Use | Automotive, Aerospace, Industrial Machinery, Electronics Assembly, DIY & Professional Repair |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China |

| Key Companies Profiled | Stanley Black & Decker, Hilti Group, Robert Bosch GmbH, Makita Corporation, Snap-on Incorporated, Milwaukee Tool, Techtronic Industries Co. Ltd., Festool GmbH, Metabo HPT, Ingersoll Rand Inc. |

The global smart tools market is expected to be valued at USD 1.29 billion in 2025.

The market is forecast to reach USD 2.18 billion by 2035, expanding at a CAGR of 5.4% over the period.

Cordless, battery-powered smart tools dominate the Japanese market with a 70% share due to demand for mobility and ergonomic convenience.

Bluetooth-only tools lead the South Korean market, though hybrid connectivity tools (Bluetooth + Wi-Fi) are also gaining rapid adoption.

Key sectors include automotive, industrial machinery, aerospace, electronics, and professional repair services.

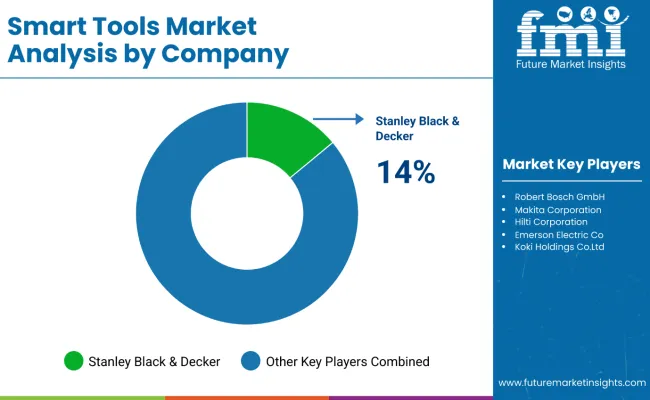

Major players include Stanley Black & Decker, Bosch, Hilti, Makita, Snap-on, and Techtronic Industries.

Growth is supported by the rise of connected manufacturing, increasing demand for productivity monitoring, and adoption of Industry 4.0 automation tools.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA