The smart card IC market is experiencing robust expansion driven by increasing adoption of digital payment systems, growing demand for secure identity management, and advancements in contactless technology. Rising data security concerns, regulatory mandates for authentication, and the proliferation of smart devices are strengthening market development.

The current scenario reflects rapid modernization of payment infrastructure and growing implementation of smart cards across banking, telecommunications, and government sectors. Future growth is expected to be propelled by innovations in semiconductor design, enhanced processing capabilities, and integration of AI and cryptographic technologies for improved data protection.

The market is also benefiting from global initiatives promoting cashless transactions and secure digital ecosystems Growth rationale lies in the continued shift toward secure, multi-functional smart card applications that enhance user convenience while ensuring compliance with global security standards, thereby supporting sustained adoption across financial, public, and enterprise domains.

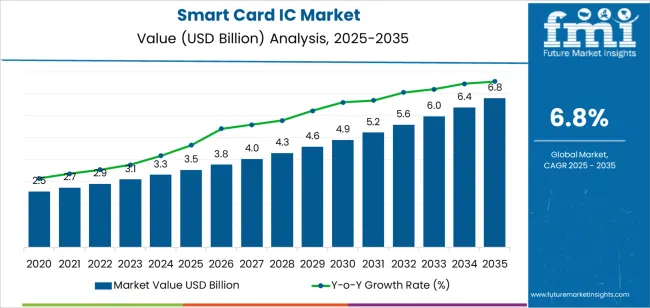

| Metric | Value |

|---|---|

| Smart Card IC Market Estimated Value in (2025 E) | USD 3.5 billion |

| Smart Card IC Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

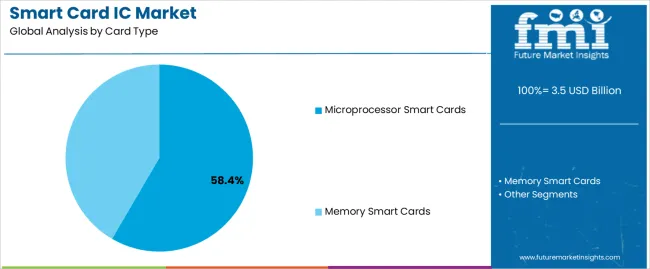

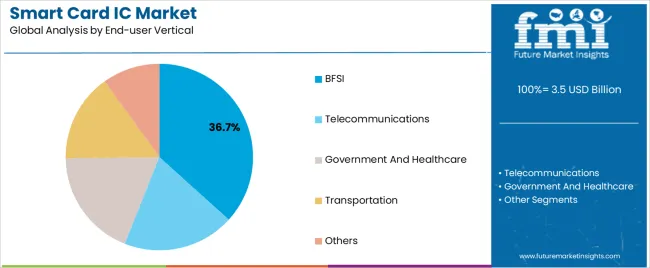

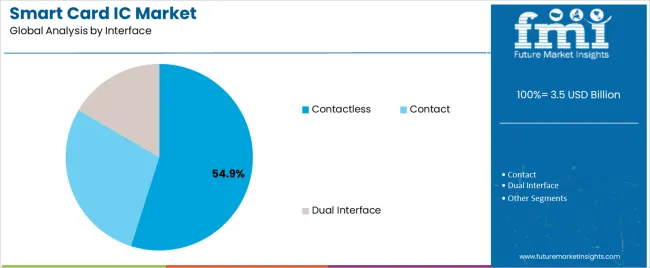

The market is segmented by Card Type, End-user Vertical, and Interface and region. By Card Type, the market is divided into Microprocessor Smart Cards and Memory Smart Cards. In terms of End-user Vertical, the market is classified into BFSI, Telecommunications, Government And Healthcare, Transportation, and Others. Based on Interface, the market is segmented into Contactless, Contact, and Dual Interface. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

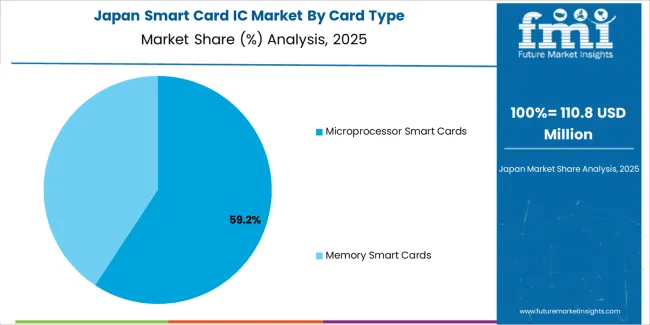

The microprocessor smart cards segment, holding 58.40% of the card type category, dominates the market due to its superior processing power, memory capacity, and security architecture. Demand has been reinforced by its extensive use in banking, telecommunications, and government identification programs where high data security and authentication reliability are critical.

Continuous technological enhancements, including integration of advanced encryption and embedded operating systems, have improved performance and versatility. Adoption has been driven by global digital transformation initiatives and the need for efficient data handling and secure user authentication.

The segment’s dominance is expected to persist as microprocessor-based cards continue to replace magnetic and simple memory cards in high-security applications, ensuring stable growth and widespread market acceptance.

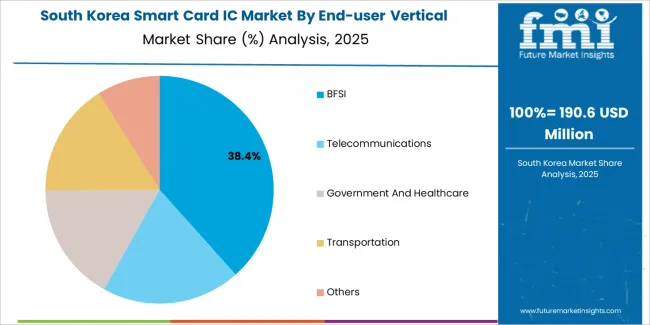

The BFSI segment, accounting for 36.70% of the end-user vertical category, has been leading the market due to the rapid digitalization of financial services and increasing reliance on secure payment methods. The transition toward EMV-compliant cards and contactless payment systems has significantly boosted adoption within banks and financial institutions.

Rising incidences of fraud have intensified the need for robust authentication mechanisms, further supporting smart card IC integration. Continuous investment in secure transaction infrastructure and modernization of ATM and POS systems have reinforced market growth.

As digital banking and mobile wallet ecosystems expand globally, the BFSI segment is expected to maintain its leadership through sustained deployment of secure, scalable, and efficient smart card-based solutions.

The contactless segment, representing 54.90% of the interface category, has emerged as the leading interface due to rising preference for frictionless and hygienic transaction modes. Growth has been driven by consumer inclination toward convenience, faster processing speeds, and minimal physical interaction.

The integration of NFC and RFID technologies has further accelerated adoption across retail, transportation, and banking applications. Regulatory encouragement for secure contactless payments and the ongoing transition to digital identity systems have strengthened market penetration.

Enhanced chip performance and reliability have improved user experience and expanded usage in public services and corporate environments With continued urbanization, digital transformation, and focus on transaction efficiency, the contactless segment is expected to retain its dominant share and drive overall market evolution.

| Attributes | Details |

|---|---|

| Card Type | Memory Smart Cards |

| Market CAGR from 2025 to 2035 | 6.5% |

| Attributes | Details |

|---|---|

| End Use Vertical | Telecommunication |

| Market CAGR from 2025 to 2035 | 6.2% |

| Countries | Forecasted CAGR from 2025 to 2035 |

|---|---|

| United States | 6.9% |

| United Kingdom | 8.1% |

| China | 7.5% |

| Japan | 7.7% |

| South Korea | 9.2% |

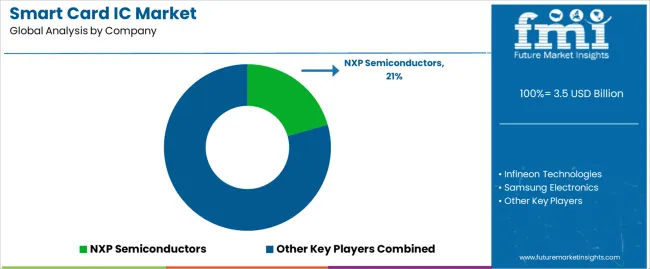

The smart card IC market is highly fragmented, with the presence of several players, both big and small. Competition in the market stems from the increasing demand for smart cards across various applications such as banking, transportation, healthcare, and government.

As a result, companies are investing heavily in research and development to develop innovative and advanced smart card ICs to cater to the diverse needs of the market.

Additionally, the market is witnessing a trend toward consolidation, with many companies looking to acquire smaller players to expand their product portfolio and strengthen their market position. This trend is expected to continue in the future as companies seek to gain a competitive edge in the market.

Recent Development

The global smart card ic market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the smart card ic market is projected to reach USD 6.8 billion by 2035.

The smart card ic market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in smart card ic market are microprocessor smart cards and memory smart cards.

In terms of end-user vertical, bfsi segment to command 36.7% share in the smart card ic market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Card Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Card in Government Market by Card Type , by Application, by End User & Region Forecast till 2025 to 2035

Smart Dictation Systems Market Size and Share Forecast Outlook 2025 to 2035

Smart Ticketing Market Size and Share Forecast Outlook 2025 to 2035

Pericarditis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart Medical Mattress Market Size and Share Forecast Outlook 2025 to 2035

Smart Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Smart Medication Adherence Sensors Market Size and Share Forecast Outlook 2025 to 2035

Cardiogenic Shock Treatment Market Analysis & Forecast for 2025 to 2035

Smart Agriculture Solution Market Analysis by Component Type, Application, and Region Through 2035

CARD9 Deficiency Treatment Market

Smart Musical Instrument Market

Smart Office Market

Smart Medication Packaging Market

Smart Fabric Market Size and Share Forecast Outlook 2025 to 2035

Medical Smart Drug Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Medical Device Market

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA