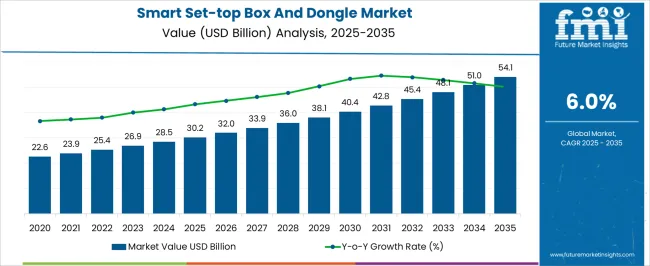

The Smart Set-top Box And Dongle Market is estimated to be valued at USD 30.2 billion in 2025 and is projected to reach USD 54.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Smart Set-top Box And Dongle Market Estimated Value in (2025 E) | USD 30.2 billion |

| Smart Set-top Box And Dongle Market Forecast Value in (2035 F) | USD 54.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The smart set-top box and dongle market is expanding rapidly as consumers seek enriched content experiences, seamless streaming, and greater control over digital media. This momentum is being driven by the convergence of internet accessibility, smart home adoption, and rising demand for over-the-top services across both developed and emerging economies.

Manufacturers are investing in compact, user-friendly devices equipped with advanced processing capabilities and integrated app ecosystems. Growth is further supported by shifts in viewing behavior from linear TV to on-demand content consumption.

Global telecommunications advancements and affordable high-speed connectivity have made smart devices more accessible to mass markets. The market outlook remains strong as consumers continue to value portability, resolution quality, and interoperability with existing smart home environments, encouraging continuous innovation in product design and software ecosystems.

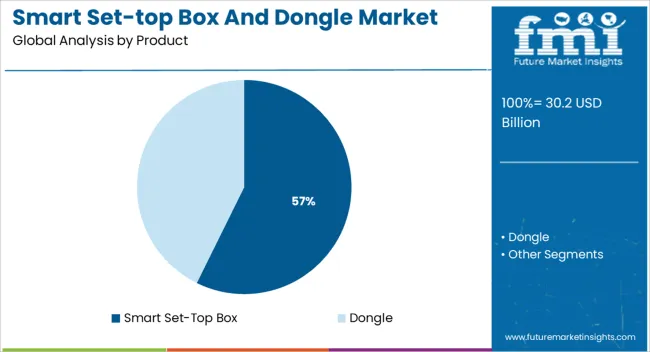

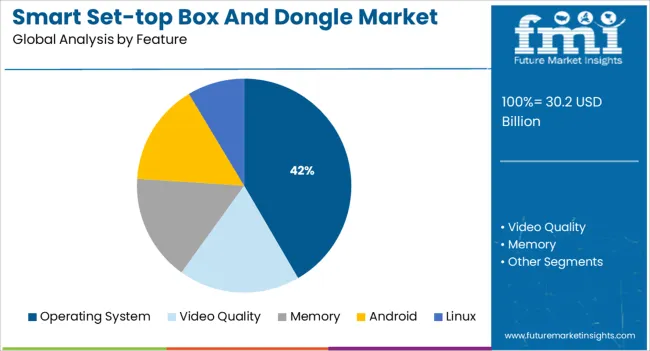

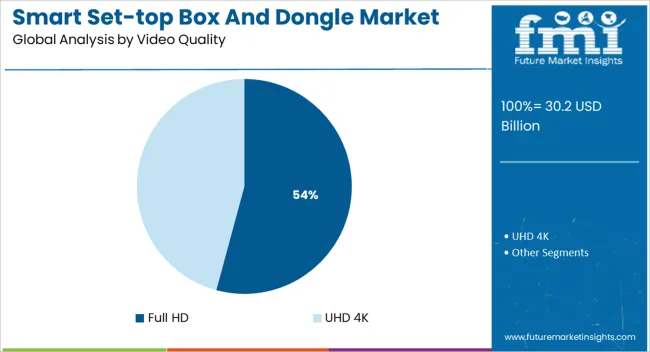

The market is segmented by Product, Feature, and Video Quality and region. By Product, the market is divided into Smart Set-Top Box and Dongle. In terms of Feature, the market is classified into Operating System, Video Quality, Memory, Android, and Linux. Based on Video Quality, the market is segmented into Full HD and UHD 4K. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The smart set-top box segment is expected to contribute 57.30% of total market revenue by 2025 within the product category, positioning it as the dominant segment. This lead is attributed to its extensive compatibility with broadcast and streaming platforms, enhanced processing power, and the ability to deliver a hybrid viewing experience.

These devices are favored for their capacity to support gaming, voice integration, and content aggregation, making them central to modern living room ecosystems. Unlike basic dongles, smart set-top boxes offer expandable storage, better connectivity options, and support for multiple users, further reinforcing their adoption among households.

Their functionality in managing content from diverse providers has driven sustained consumer preference, securing their leadership in the product segment.

The operating system feature segment accounts for 41.60% of total revenue in 2025 within the feature category, making it the most significant segment. Its dominance stems from the growing importance of user interface flexibility, frequent software updates, and app compatibility in delivering a superior user experience.

Devices embedded with proprietary or open-source operating systems allow users to access app stores, customize content, and integrate with voice assistants and smart devices. Manufacturers increasingly emphasize operating system capabilities to differentiate products and support long-term device relevance.

As consumers prioritize personalized content environments and seamless navigation, the operating system has emerged as the core feature driving engagement, retention, and satisfaction.

The full HD segment is projected to contribute 54.20% of total market revenue in 2025 under the video quality category, securing its position as the leading resolution tier. This is largely due to its optimal balance between affordability and visual performance, making it the preferred standard for most streaming applications and home entertainment setups.

Full HD provides clear and vibrant visuals suitable for medium to large displays, satisfying a wide range of consumer expectations without requiring the bandwidth and hardware upgrades demanded by 4K content. Its widespread compatibility with existing televisions and content platforms has reinforced its popularity.

As streaming becomes mainstream across middle-income households, full HD continues to dominate due to its accessibility, visual quality, and overall cost efficiency.

Apart from set box, dongle can be directly plugged into TV to enable the content access from internet.

Increase in the number of smart homes, growth in adoption rate of smart technologies, and rise in demand for video on demand services & video recording are the major drivers for smart set-top box & dongle market.

Smart TV manufacturers are deploying different types of interface and software in their products, as there is lack of standard for software, operating system and interface implementation in TV. Most of the TV’s are supporting popular services that includes Netflix, Hulu, Amazon video and Pandora, where as some manufacturers are supporting only some of the most popular apps such as Facebook.

The absence of standard operating system and interface to run the online content on TV, are the major challenges for smart set-top box and dongle market.

In 2020, North America was dominating the overall smart set-top box & dongle market in terms of consumption. USA was the leading market in the region as, major companies including Apple and Roku were launching the new generation devices in order to take maximum advantage of poor performance by Pay TV in the region.

India and China were leading markets in Asia Pacific region. In 2020, Growth in china was driven by IPTV, where telecommunication companies were creating trend by pushing IPTV services in order to generate return on their investment in fibre to home.

Europe was the emerging region for smart set-top box and dongle market as, the subscription of video on demand services had grown with the significant rate by end of 2014.

Apple Inc. (USA), Google Inc. (USA), Roku Inc.(USA), Netflix (USA), Amazon.com Inc.(USA), Cisco Systems Inc. (US),NVIDIA Corporation (USA), LG Corporation (South Korea), D-Link Corporation (Taiwan), Plex Inc. (USA).

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Smart set-top box & dongle market can be segmented on the basis of product and feature.

The global smart set-top box and dongle market is estimated to be valued at USD 30.2 billion in 2025.

The market size for the smart set-top box and dongle market is projected to reach USD 54.1 billion by 2035.

The smart set-top box and dongle market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in smart set-top box and dongle market are smart set-top box and dongle.

In terms of feature, operating system segment to command 41.6% share in the smart set-top box and dongle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA