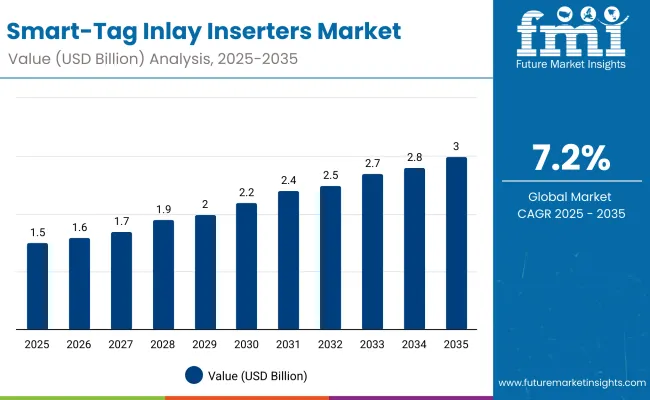

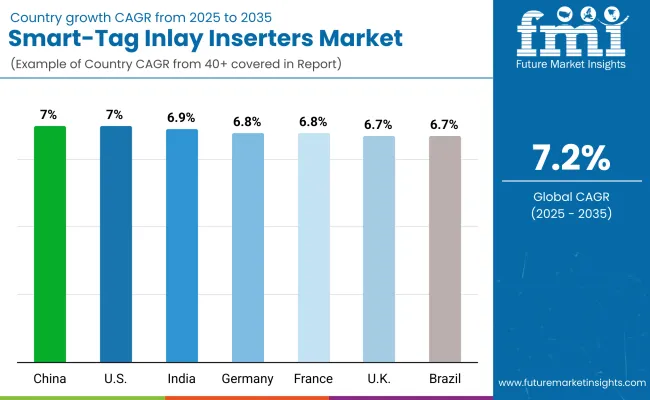

The Smart-Tag Inlay Inserters Market will expand from USD 1.5 billion in 2025 to USD 3.0 billion by 2035 at a CAGR of 7.2%. Increasing demand for RFID and NFC tagging in retail and supply-chain applications is boosting adoption of high-speed inlay insertion equipment. Fully automatic inserters enable precise tag placement for smart packaging authentication and real-time inventory management. Between 2025 and 2030, integration of AI-based positioning and vision systems will enhance accuracy and throughput. Asia-Pacific is poised to lead due to strong manufacturing capability and smart logistics infrastructure growth.

From 2020 to 2024, the rise of digital retail and global traceability requirements accelerated smart tagging automation. Early RFID systems evolved into multi-frequency platforms with BLE and QR integration. By 2035, the market is projected to reach USD 3.0 billion, driven by IoT-enabled track-and-trace solutions across manufacturing and e-commerce. Asia-Pacific will remain dominant in production, while Europe leads in machine design innovation and North America drives data-analytics-based supply visibility.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 3.0 billion |

| CAGR (2025 to 2035) | 7.2% |

Growth is propelled by rising demand for automated product identification and authentication systems in logistics and retail. Smart inlay inserters enable precise embedding of RFID and NFC chips within packaging materials, enhancing inventory transparency and anti-counterfeiting measures. The integration of BLE and IoT technologies for real-time monitoring further stimulates equipment investments.

The market is segmented by technology, machine type, application, end-use industry, and region. Technologies include RFID, NFC, BLE, and QR/barcode inlay inserters. Machine types cover fully automatic, semi-automatic, and robotic systems. Applications span smart labels and tags, packaging authentication, inventory management, and supply-chain visibility. End-use industries comprise logistics and supply chain, retail and e-commerce, pharmaceuticals and healthcare, and food and beverages.

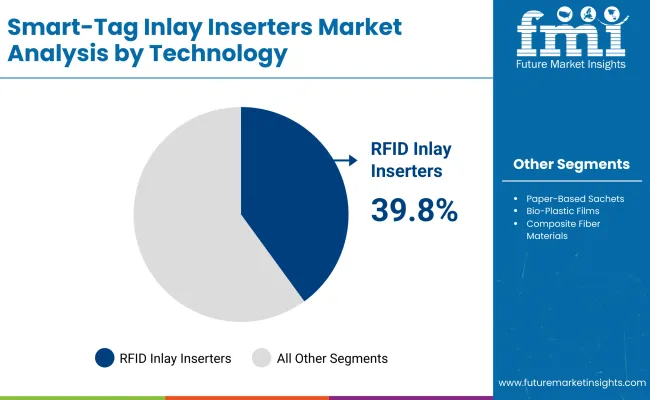

RFID inlay inserters are projected to hold 39.8% of the market in 2025, driven by their pivotal role in global logistics, asset management, and retail automation. These systems ensure high-speed, precise insertion of RFID tags, supporting traceability and data synchronization across complex supply chains.

Their superior tag readability and compatibility with various substrates enhance production efficiency and scalability. As industries accelerate digital transformation, RFID inserters underpin the expansion of connected packaging and real-time inventory visibility, securing their leadership in insertion technology.

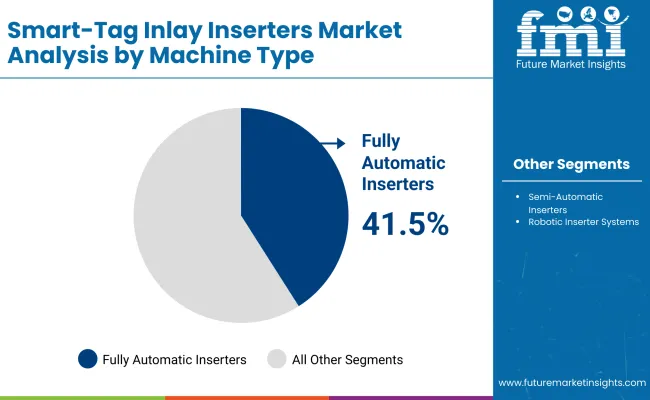

Fully automatic inserters are expected to capture 41.5% of the market in 2025, supported by increasing demand for error-free, high-volume operations. These systems combine robotics, vision alignment, and data-driven control for precise tag placement and reduced downtime.

Automation enhances quality assurance and operational consistency across large-scale manufacturing environments. Integration with AI-based diagnostics and cloud connectivity further improves system uptime. As manufacturers modernize smart label production, fully automatic inserters continue to lead adoption.

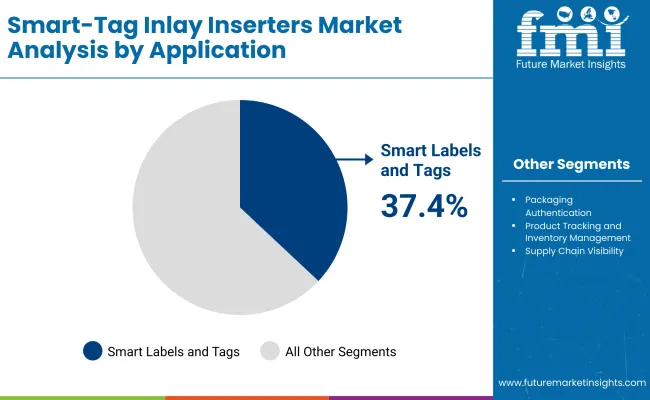

Smart labels and tags are forecast to represent 37.4% of the market in 2025, reflecting the growing use of embedded identification in logistics, retail, and healthcare. They enable traceability, anti-counterfeiting, and temperature monitoring functions within connected packaging ecosystems.

Manufacturers favor these solutions for supporting transparency and consumer engagement through contactless interactions. With expanding cold-chain and authentication needs, smart labeling continues to dominate the application segment, aligning with global IoT packaging initiatives.

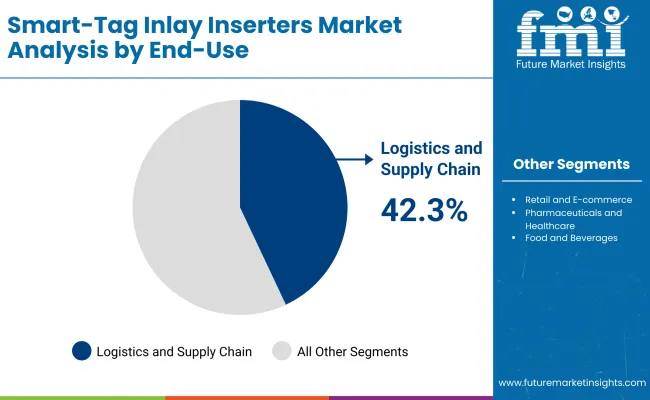

The logistics and supply-chain segment is projected to hold 42.3% of the market in 2025, fueled by widespread RFID integration in warehouses and fulfillment centers. Automated inlay insertion supports efficient item-level tracking, reducing inventory discrepancies and improving throughput.

Adoption is reinforced by the need for real-time data analytics and smart distribution systems. RFID-enabled infrastructure enhances operational transparency and reduces waste. As global logistics networks digitize, this sector remains the cornerstone of market expansion for smart-tag inserters.

The market is driven by growing e-commerce volumes and stricter traceability mandates, fueling adoption of smart label automation for efficient logistics and compliance. However, high initial investment in inlay equipment and integration complexities hinder adoption among SMEs. Opportunities emerge with eco-RFID inlays and AI-driven positioning systems creating new revenue pathways. Key trends include robotic tagging cells, modular retrofitting, and hybrid RFID/BLE solutions enhancing connectivity and operational agility.

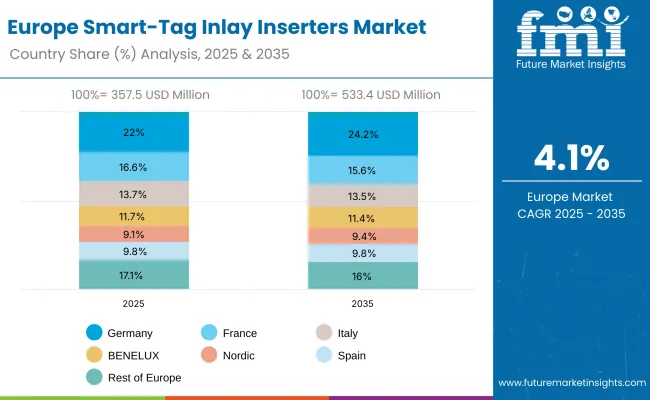

The global smart-tag inlay inserters market is witnessing strong momentum as automation, RFID analytics, and sustainable data-tracking technologies converge. Asia-Pacific leads due to its manufacturing scale and widespread smart factory deployment, while North America is advancing through RFID-driven logistics optimization and IoT integration. Europe emphasizes sustainability, data security, and traceability compliance in tagging systems. Growing adoption across retail, pharmaceuticals, automotive, and consumer electronics is reshaping global supply-chain visibility and operational efficiency.

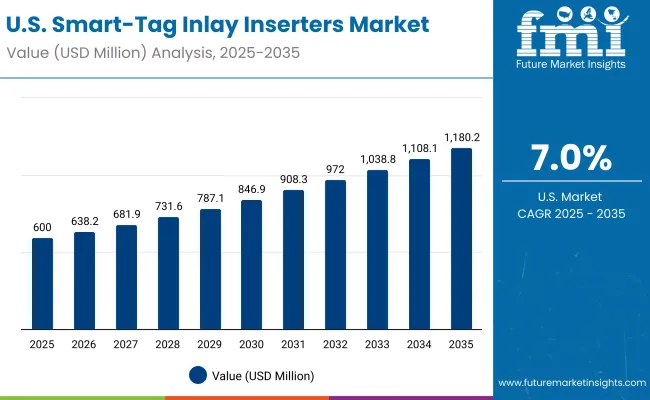

The USA will grow at 7.0% CAGR, driven by retail inventory automation and warehouse optimization initiatives. Adoption of contactless authentication, RFID, and IoT technologies is reshaping supply chain transparency. Collaboration between OEMs and digital analytics platforms supports precision tagging and real-time product tracking. The demand for sustainable RFID solutions is also driving innovation across logistics operations.

Germany will expand at 6.8% CAGR, supported by automation upgrades in industrial packaging and logistics. Energy-efficient and sustainable inlay integration systems are aligning with EU green technology mandates. Increased adoption in automotive traceability and manufacturing optimization reinforces demand for advanced RFID-enabled machinery.

The UK will grow at 6.9% CAGR, led by e-commerce automation and regulatory digital compliance in labeling. Retailers and logistics providers are investing in smart RFID infrastructure to enhance fulfillment accuracy. Pharma sector adoption of NFC and smart-tag tracking supports serialization and safety compliance.

China will grow at 7.0% CAGR, underpinned by large-scale RFID manufacturing and logistics digitalization. Expanding production of industrial grade tagging systems supports rapid deployment in asset management and inventory control. Government-led digital supply chain initiatives continue to strengthen local competitiveness in RFID equipment exports.

India will grow at 6.9% CAGR, supported by the digitization of supply chains across retail, healthcare, and pharmaceuticals. Local production of cost-effective inlays is enhancing accessibility for domestic manufacturers. Automation in export-oriented packaging and logistics sectors is further accelerating smart-tag adoption nationwide.

Japan will grow at 7.6% CAGR, driven by high-end NFC, BLE, and robotic tagging technologies. Advanced micro-precision insertion systems are being integrated into consumer electronics and packaging applications. Continued miniaturization and intelligent data-linking enhance efficiency in RFID tagging across multiple industrial verticals.

South Korea will lead with 7.7% CAGR, propelled by AI-linked RFID systems and IoT-based logistics automation. Smart factory initiatives and government-backed digital transformation programs strengthen local innovation. Integration of cloud analytics in inlay operations enhances production efficiency and sustainability.

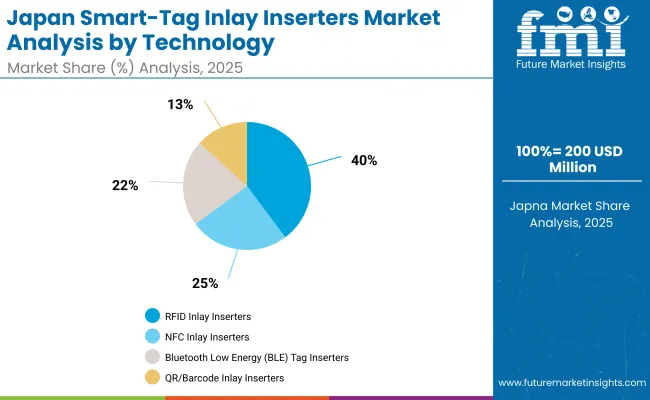

Japan’s smart-tag inlay inserters market, valued at USD 200.0 million in 2025, is dominated by RFID inlay inserters, holding a 41.6% share due to widespread use in logistics, apparel, and consumer goods packaging. NFC inlay inserters are advancing contactless retail tracking, while BLE tag inserters enhance real-time asset monitoring. QR/barcode inserters remain key for cost-effective labeling in mass packaging.

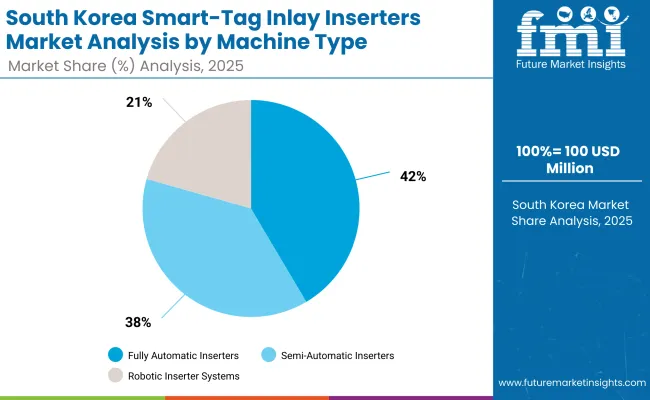

South Korea’s smart-tag inlay inserters market, worth USD 100.0 million in 2025, is led by fully automatic inserters, accounting for 40.6% share owing to faster throughput and reduced human error. Semi-automatic inserters cater to mid-scale operations, while robotic inserter systems gain traction for precision placement in flexible electronics, security tagging, and IoT-enabled packaging applications.

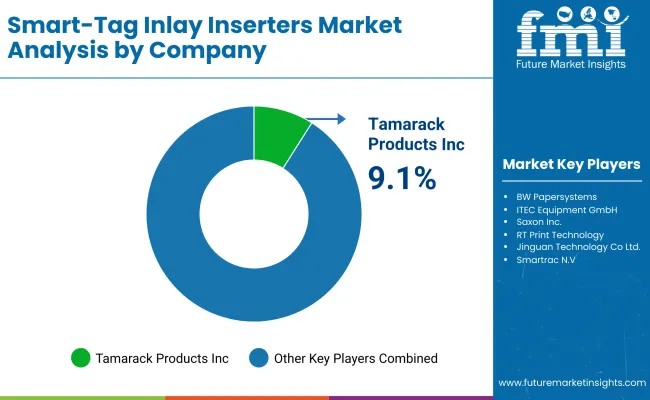

The market is moderately consolidated with major players including Tamarack Products Inc., BW Papersystems, ITEC Equipment GmbH, Saxon Inc., RT Print Technology, Jinguan Technology Co. Ltd, ZBTECH Co. Ltd, Smartrac N.V., Tageos SAS, and ID Smart Card Solutions. Companies focus on high-precision automation, energy-efficient systems, and integrated data management software.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion (2025 baseline) |

| By Technology | RFID, NFC, BLE, QR/Barcode Inlay Inserters |

| By Machine Type | Fully Automatic, Semi-Automatic, Robotic Inserters |

| By Application | Smart Labels & Tags, Authentication, Inventory Tracking, Supply Visibility |

| By End-Use Industry | Logistics & Supply Chain, Retail & E-commerce, Pharma & Healthcare, Food & Beverages |

| Key Companies Profiled | Tamarack Products Inc., BW Papersystems, ITEC Equipment GmbH, Smartrac N.V., Tageos SAS, ID Smart Card Solutions |

| Additional Attributes | Market driven by IoT-enabled automation and eco-RFID adoption |

The Smart-Tag Inlay Inserters Market is valued at USD 1.5 billion in 2025.

The market is projected to reach USD 3.0 billion by 2035.

The market will grow at a CAGR of 7.2 % during the forecast period.

RFID Inlay Inserters lead with a 39.8 % share in 2025, driven by high-speed tracking capabilities and supply-chain automation.

Key companies include Tamarack Products Inc., BW Papersystems, ITEC Equipment GmbH, Smartrac N.V., Tageos SAS, and ID Smart Card Solutions, all focusing on automation and eco-RFID integration.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inlay Paper Market Growth – Demand, Innovations & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA