The inlay paper industry, or embedded label paper, is projected to be valued at USD 192.1 million in 2025. It is expected to grow at a CAGR of 5.5%, reaching USD 328.13 million by 2035, according to FMI analysis.

In 2024, the embedded label paper industry saw a significant increase in demand, mostly due to increased logistics activity and a greater emphasis on inventory management. Companies were looking to improve their operations actively, and that led to an increase in demand for quality packaging materials, especially in the e-commerce and warehousing industries. The growth of e-commerce websites also added to the increasing demand for embedded label papers since companies needed robust and affordable solutions to support a rising number of shipments.

Retailers and logistics companies viewed inlay papers as a critical component of their packaging strategies, helping ensure safe delivery of goods while maintaining efficient supply chains. Producers compensated by improving their manufacturing process to satisfy the higher demand, focusing on paper quality and endurance enhancements.

Looking to the year 2025, the industry is in line for growth expansion, bolstered by the growth of warehouse infrastructures and logistics. With industries continuing to rationalize operations, there will be a sustained demand for quality embedded label papers.

The development of more long-lasting and affordable paper products will continue to drive industry expansion. With a constant CAGR of 5.5% projected until 2035, industry participants will be in a position to increase their industry share through strategic partnerships, thereby contributing to the overall growth of the embedded label paper industry.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 192.1 million |

| Industry Value (2035F) | USD 328.13 million |

| CAGR (2025 to 2035) | 5.5% |

The industry for embedded label paper is poised for consistent growth as the growth in e-commerce, warehouse, and logistics infrastructure accelerates. Demand will continue to be robust as companies streamline their inventory management and packaging strategies. Manufacturers that are pioneering long-lasting, cost-saving material technologies will be major gainers, as laggards are likely to confront competitive duress.

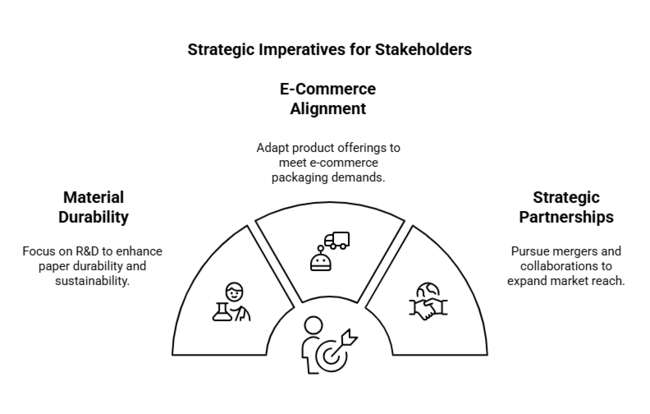

Emphasis on Material Durability Innovation

Executives can invest in research and development to make embedded label papers more durable and sustainable, catering to the increasing need for high-performing packaging solutions in logistics and e-commerce.

Synchronize with E-Commerce Growth

Since e-commerce is growing day by day, companies need to adjust their product offerings according to the particular packaging requirements of e-commerce players. To stay in the supply chain, executives must work with e-commerce platforms.

Enhance Strategic Partnerships and M&A Activities

The executives need to consider possible mergers, acquisitions, and collaborations with warehousing and logistics businesses to increase industry coverage and achieve vertical integration. Such efforts will bring more control of the supply chain and fuel future growth in the embedded label paper industry.

| Risk | Assessment (Probability - Impact) |

|---|---|

| Supply Chain Disruptions | High - High |

| Rising Raw Material Costs | Medium - High |

| Increased Regulatory Scrutiny on Packaging | Low - Medium |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Sustainable Sourcing | Run feasibility on sustainable paper sourcing options. |

| E-commerce Packaging Needs | Initiate strategic discussions with e-commerce platforms on packaging needs. |

| Supply Chain Integration | Launch a pilot for partnerships with logistics companies to enhance supply chain integration. |

To stay ahead, companies must focus on innovation in material strength and sustainability, making their embedded label papers address the changing demands of the e-commerce and logistics industries. Short-term measures must involve establishing strategic alliances with e-commerce platforms and logistics firms, making the business a central figure in the supply chain.

The report identifies a definitive trend in the industry toward more cost-efficient, more resilient packaging solutions, so the company needs to concentrate on R&D and secure long-term alliances with key logistics and retail players. By addressing these requirements, the company will be in an excellent position to gain industry share and achieve consistent growth through to 2035.

Key Priorities of Stakeholders

Regional Difference

New Technologies Implementation

Material Preferences

Regional Variation

Price Sensitivity

Regional Differences

Pain Points in the Value Chain

Future Investment Priorities

Regional Divergence

Conclusion

The study suggests that while there are main concerns worldwide in the embedded label paper industry as a whole, including sustainability and endurance, there is major regional variability impacting stakeholder choice. In the USA, automation and cost savings rank highly; in Western Europe, sustainability is particularly concerning; and in Japan/South Korea, hybrid materials and shrinking down are appealing.

| Countries | Impact of Policies & Government Regulations |

|---|---|

| United States | USA environmental laws, like the Clean Air Act and the Resource Conservation and Recovery Act (RCRA), affect packaging materials, including embedded label paper. Firms have to adhere to sustainability criteria, such as recyclable materials. Manufacturers must also adhere to OSHA (Occupational Safety and Health Administration) safety standards. Certifications such as FSC (Forest Stewardship Council) are widely pursued for sustainable paper procurement. |

| United Kingdom | The UK has strict recycling laws and requirements on sustainable packaging (e.g., Packaging Waste Regulations). Businesses are required to meet Extended Producer Responsibility (EPR) legislation that requires waste management and recycling. Certifications such as FSC and PEFC (Programme for the Endorsement of Forest Certification) are also necessary for green products. The UK government has a strong drive towards plastic waste reduction and circular economy practices. |

| France | France also boasts strong laws covering recycling and managing packaging waste, such as the anti-waste law (AGEC Law) that compels the recycling of packaging materials and the employment of eco-design solutions. The embedded label paper producers should keep themselves up-to-date with the eco-label certificates, e.g., FSC or European Ecolabel, for eco-packaging. Reducing carbon prints in packaging receives incentives from the government. |

| Germany | Germany has strict packaging laws, such as the Packaging Act (VerpackG), that require recycling, reuse, and minimization of packaging waste. All companies dealing with the distribution of packaging have to participate in a dual system of waste management. There is high concern for sustainability in Germany, and companies are required to meet certifications such as FSC and the Blue Angel (Blauer Engel) for eco-friendly packaging. |

| Italy | The European Union's packaging and waste management directive (EU Waste Framework Directive) applies to Italy. Paper packaging collection and recycling are mandatory under Italian regulations. Firms have to comply with EPR policies and achieve certifications like FSC for responsible sourcing. Italy also promotes innovation in eco-design by providing subsidies to firms embracing low-carbon footprint practices. |

| South Korea | South Korea has laws that concentrate on minimizing packaging waste under the Act on Promotion of Resource Recycling. The government promotes the utilization of environmentally friendly materials in packaging, and businesses are required to adhere to particular waste reduction and recycling goals. Businesses that aim for sustainable practices typically mandate certifications like FSC. Packaging programs must be in support of the country's thrust toward zero-waste initiatives. |

| Japan | Japan has rigorous waste management and recycling regulations under the Containers and Packaging Recycling Law, which requires companies to achieve certain recycling rates. Embedded label paper firms are also regulated by eco-design legislation that minimizes environmental effects, with certifications like FSC required for sustainable operations. Japan encourages technological innovation in packaging waste management, with companies required to adhere to certifications that emphasize recyclability and sustainability. |

| China | China has implemented regulations on packaging waste management, such as the Circular Economy Promotion Law, which promotes sustainable packaging. The government is placing greater emphasis on packaging waste reduction, which compels businesses to think about using recyclable and biodegradable packaging. Requirements for certification, such as FSC, are increasingly becoming a need for foreign companies looking to penetrate the Chinese industry. |

| Australia-NZ | Australia and New Zealand are strongly focused on sustainability in packaging, with policies like the National Packaging Targets aiming for 100% recyclable or reusable packaging by 2025. Companies must comply with regulations like the Australian Packaging Covenant, which encourages a shift toward sustainable packaging. Embedded label paper manufacturers are also required to comply with certifications such as FSC for environmental stewardship in packaging production. |

| India | India recently introduced the Plastic Waste Management Rules, which include paper and other packaging materials as well. There is an initiative from the government to use environmentally friendly, recyclable, and biodegradable packaging. Organizations are encouraged to demonstrate sustainability in their materials, although FSC certification is not mandatory. India is also applying Extended Producer Responsibility (EPR) on waste management, which impacts the producers of paper packaging. |

Recycled paper is expected to be the most lucrative material segment in the Inlay Paper Industry during 2025 to 2035, driven primarily by increasing demand for eco-friendly and sustainable packaging solutions. The Recycled Paper segment is forecasted to grow at a CAGR of approximately 5.9% between 2025 and 2035, above the global industry's overall growth rate of 5.5%.

As waste reduction and recycling regulations get stricter globally, firms are increasingly turning to recycled paper to meet environmental objectives and enhance their sustainability credentials. The growing consumer demand for sustainable brands and the rise of the circular economy further reinforce this shift. Furthermore, quality and price advancements in recycled paper are making it an increasingly viable solution for businesses in the transport, retail, and logistics industries.

Wet inlay paper is anticipated to be the most lucrative product type segment in the embedded label paper industry between 2025 and 2035. With technology being directed towards maximizing moisture resistance without impacting the paper's sustainability, wet-embedded label paper is projected to increase at a CAGR of around 6.2% during 2025 to 2035, slightly above the growth rate of the general industry.

As the logistics and e-commerce industries expand, the demand for strong, water-resistant packaging materials will drive the industry for this segment. Wet-embedded label paper offers better protection for goods, especially in conditions where humidity and moisture could compromise the integrity of the packaging. This characteristic makes it particularly valuable for shipping and storing moisture-sensitive goods.

Logistics & Transportation shall be the most lucrative end-use industry for the Inlay Paper Industry during 2025 to 2035. With continuous improvements in material lifespan along with affordability, the Logistics & Transportation vertical is likely to develop at a CAGR of approximately 6.0% from 2025 to 2035, which would be more than the rate of expansion for the total industry.

As the global value chain has become more complex, demand for cheap and reliable packaging material, like embedded label paper, increases in the logistics and transport sectors. Embedded label paper serves a critical role in the security of products in transit and storage, which is of major significance to industries such as e-commerce, retail, and pharmaceuticals. The greater volume of merchandise transported across the globe, coupled with an emphasis on environmentally friendly packaging, places this segment in line for high growth.

In the United States, the inlay paper industry is projected to grow at a CAGR of 6.2% between 2025 and 2035. The US, with its dominance in logistics, warehousing, and e-commerce, is expected to sustain robust growth in embedded label paper adoption. The accelerated development of distribution centers and the growing need for packaging solutions propel the demand.

USA manufacturers are likely to spend heavily on green solutions, with tough recycling regulations compelling firms to adopt sustainable paper options. With the robust economic environment and emphasis on minimizing waste, the USA is likely to continue leading the industry.

In the United Kingdom, the landscape for inlay paper is estimated to expand at a CAGR of 5.5% from 2025 to 2035. The UK's focus on sustainability is expected to play a significant role in this growth, driven by regulations requiring the reduction of packaging waste and increasing the adoption of recyclable materials.

The drive by the government for the circular economy and recycling packaging options will propel demand for embedded label paper. Retailers and logistics operators are placing increased emphasis on cost-effective and sustainable packaging, making the UK a viable industry for embedded label paper producers.

The French sector for inlay paper is anticipated to grow at a CAGR of 5.7% during 2025 to 2035. France is experiencing accelerated growth because of the favorable regulatory system that promotes recyclable and sustainable packaging. The nation has a strong waste management policy, which is fueling demand for green packaging materials such as embedded label paper.

Moreover, the sustained development of e-commerce and the retail industry in France is driving demand for high-quality, sustainable packaging solutions. France's dedication to sustainability will guarantee that the embedded label paper industry will continue to be profitable in the next decade.

Sales in Germany for the inlay paper industry are projected to grow at a CAGR of 6.0% during the period 2025 to 2035. The robust regulatory framework in Germany, such as the Packaging Act (VerpackG), ensures that sustainability is a major driver in the embedded label paper industry.

The country's focus on minimizing packaging waste and maximizing recycling rates will generate high demand for sustainable and high-quality paper products. The expansion of the logistics and e-commerce industries in Germany will persist in driving the demand for embedded label paper, thus making the nation an industry leader in this sector.

The inlay paper sector in Italy is expected to grow at a CAGR of 5.2% during the period 2025 to 2035. Italy's emphasis on sustainability and adherence to European Union packaging laws will contribute significantly to the growth of the embedded label paper industry.

Many industries, particularly in retail and logistics, are increasingly adopting green and recyclable packaging materials. The government backing for innovative packaging solutions will open up opportunities for embedded label paper producers to bring in long-lasting, sustainable, and affordable solutions to satisfy increasing demand.

The South Korean inlay paper landscape is anticipated to grow at a CAGR of 5.3% from 2025 to 2035. South Korea's government has adopted various regulations in a bid to lower packaging waste and enhance recycling rates, creating a favourable environment for sustainable packaging materials such as embedded label paper.

Ongoing growth of the e-commerce and logistics industries in the country will bolster industry growth. Furthermore, the use of environment-friendly materials is promoted by both consumers and the government, presenting a conducive environment for the demand for embedded label paper.

The sector for inlay paper in Japan is projected to grow at a CAGR of 5.0% from 2025 to 2035. Stringent waste management and recycling regulations in the Japanese industry force businesses to adopt sustainable packaging solutions.

As online shopping gains momentum, demand for robust and sustainable packaging materials, such as embedded label paper, is rising. Japan's strong emphasis on reducing carbon emissions and the environmental impact of packaging will drive the growth of the embedded label paper industry. Adoption may progress more slowly compared to Western countries due to higher implementation costs.

The inlay paper industry in China is estimated to grow at a CAGR of 5.8% from 2025 to 2035. The packaging industry in China is likely to increase tremendously with the growth of e-commerce, retail, and logistics industries. The Chinese government's initiative to make the country sustainable, including the reduction of packaging waste and recycling, will stimulate demand for green packaging solutions like embedded label paper.

In addition, the rapid development of the nation's manufacturing sector and the demand for more environmentally friendly supply chain options will render China a significant industry for embedded label paper.

In New Zealand and Australia, the inlay paper sector is predicted to grow at a CAGR of 5.6% from 2025 to 2035. E-commerce and logistics activities are expanding rapidly in both countries, which is propelling demand for packaging material.

Companies are under pressure to use environmentally friendly packaging alternatives, such as embedded label paper, due to strong regulatory frameworks for sustainability and waste management. Australia's emphasis on reducing plastic usage and New Zealand's focus on sustainability will provide a conducive climate for the development of the industry for embedded label paper in this region.

In India, the inlay paper industry is projected to grow at a CAGR of 5.4% from 2025 to 2035. The demand for eco-friendly packaging is increasing due to growing environmental consciousness among consumers and the Indian government's efforts toward better waste management and recycling processes.

The development of the e-commerce and logistics industries in India will also fuel the demand for packaging solutions. Although India’s packaging sector is still maturing, the growing popularity of environment-friendly measures and the move towards the use of recyclable materials will provide immense opportunities for manufacturers of embedded label paper.

The industry for embedded label paper is fragmented, with many regional and international players vying for industry position. Consolidation is growing, though, as major companies grow through acquisitions and alliances. The top players compete on price, innovation, and geographic reach. Leaders such as Schreiner MediPharm, Avery Dennison, and CCL Industries concentrate on RFID-enabled embedded label papers, eco-friendly materials, and smart packaging solutions. Strategic alliances, M&A, and investments in R&D drive growth strategies to boost product offerings.

Industry Share Analysis

Key Developments (2024)

The industry is segmented into synthetic paper and recycled paper.

The industry is segmented into wet inlay paper and dry inlay paper.

The industry is segmented into retail, stationery, banking, logistics & transportation.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, the Middle East & Africa, and Oceania.

The demand for embedded label paper is mainly triggered by the expansion in logistics, e-commerce, and warehousing, where value-added packaging solutions play an important role in inventory management and shipping.

The embedded label paper industry will witness steady expansion, with growth expected to come at a rate of 5.5% CAGR in the period 2025 to 2035, driven by rising logistics activities and technological breakthroughs in package technologies.

Major players are Lahnpaper GmbH, HID Global Corporation, Avery Dennison Corporation, Alien Technology, LLC, Smart Packaging Solutions N.V., Arizon RFID Technology Co., Tageos, Invango Information Technology Co. Ltd., Zebra Technologies Corporation, Shenzhen DTB RFID Co., Ltd., Metalcraft Inc., Paragon Group Limited, Barry-Wehmiller Companies, PPG Industrie Inc., Linxens, Sappi Global, Dipole, D&H Smartid Co., Ltd., and Identiv.

Recycled paper is expected to see considerable growth, spurred by sustainability trends and higher demand for environmentally friendly packaging options.

The inlay paper industry is expected to reach USD 328.13 million by 2035, reflecting a steady growth in sync with rising logistics and warehousing requirements.

Table 01: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 02: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 03: Global Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 04: Global Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 05: Global Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 06: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 07: Global Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 08: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 09: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 36: East Asia Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 44: South Asia Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 46: South Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 48: South Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 52: Oceania Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 54: Oceania Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 56: Oceania Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 57: MEA Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ million) Forecast by Material, 2018 to 2033

Table 60: MEA Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 61: MEA Market Value (US$ million) Forecast by Product Type, 2018 to 2033

Table 62: MEA Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 63: MEA Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 64: MEA Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 65: The USA Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 66: Canada Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 67: Brazil Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 68: Mexico Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 69: Germany Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 70: Italy Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 71: France Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 72: Spain Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 73: The United Kingdom Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 74: Russia Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 75: China Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 76: Japan Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 77: India Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 78: GCC Countries Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Table 79: Australia Market Value (US$ million) Forecast by Material, Packaging, and End-user (2023(E) & 2033(F))

Figure 01: Global Market Value (US$ million) by Material, 2023 to 2033

Figure 02: Global Market Value (US$ million) by Product Type, 2023 to 2033

Figure 03: Global Market Value (US$ million) by End Use, 2023 to 2033

Figure 04: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 05: Global Market Value (US$ million) Analysis by Region, 2018 to 2022

Figure 06: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 07: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 08: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 09: Global Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 10: Global Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Product Type, 2018 to 2022

Figure 14: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by End Use, 2018 to 2022

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by End Use, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Material, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 28: North America Market Value (US$ million) by End Use, 2023 to 2033

Figure 29: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by Country, 2018 to 2022

Figure 31: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 35: North America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 36: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 37: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 38: North America Market Value (US$ million) Analysis by Product Type, 2018 to 2022

Figure 39: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 40: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 41: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 42: North America Market Value (US$ million) Analysis by End Use, 2018 to 2022

Figure 43: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 46: North America Market Attractiveness by Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 48: North America Market Attractiveness by End Use, 2023 to 2033

Figure 49: North America Market Attractiveness by Country, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Material, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by End Use, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 54: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2022

Figure 55: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 56: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 57: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 58: Latin America Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 59: Latin America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 63: Latin America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 64: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 65: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) Analysis by End Use, 2018 to 2022

Figure 67: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 72: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Material, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by End Use, 2023 to 2033

Figure 77: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 78: Europe Market Value (US$ million) Analysis by Country, 2018 to 2022

Figure 79: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 80: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: Europe Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 83: Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 84: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 85: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 86: Europe Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 87: Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 90: Europe Market Value (US$ million) Analysis by End Use, 2018 to 2022

Figure 91: Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 92: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 93: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 94: Europe Market Attractiveness by Material, 2023 to 2033

Figure 95: Europe Market Attractiveness by Material, 2023 to 2033

Figure 96: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 97: Europe Market Attractiveness by Country, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by Material, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by Material, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by End Use, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 102: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2022

Figure 103: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 104: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 105: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 106: East Asia Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 107: East Asia Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 108: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 109: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 110: East Asia Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 111: East Asia Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 114: East Asia Market Value (US$ million) Analysis by End Use, 2018 to 2022

Figure 115: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 116: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 120: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 121: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by Material, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by Product Type, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by End Use, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 126: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2022

Figure 127: South Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 131: South Asia Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 132: South Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 133: South Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 134: South Asia Market Value (US$ million) Analysis by Product Type, 2018 to 2022

Figure 135: South Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: South Asia Market Value (US$ million) Analysis by End Use, 2018 to 2022

Figure 139: South Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Material, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 144: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by Material, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by Product Type, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by End Use, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 150: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2022

Figure 151: Oceania Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 152: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 153: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 154: Oceania Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 155: Oceania Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 156: Oceania Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 157: Oceania Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 158: Oceania Market Value (US$ million) Analysis by Product Type, 2018 to 2022

Figure 159: Oceania Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 162: Oceania Market Value (US$ million) Analysis by End Use, 2018 to 2022

Figure 163: Oceania Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 164: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 165: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Material, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 168: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 169: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 170: MEA Market Value (US$ million) by Material, 2023 to 2033

Figure 171: MEA Market Value (US$ million) by Product Type, 2023 to 2033

Figure 172: MEA Market Value (US$ million) by End Use, 2023 to 2033

Figure 173: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 174: MEA Market Value (US$ million) Analysis by Country, 2018 to 2022

Figure 175: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 176: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 177: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 178: MEA Market Value (US$ million) Analysis by Material, 2018 to 2022

Figure 179: MEA Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 180: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 181: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 182: MEA Market Value (US$ million) Analysis by Product Type, 2018 to 2022

Figure 183: MEA Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 184: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 185: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 186: MEA Market Value (US$ million) Analysis by End Use, 2018 to 2022

Figure 187: MEA Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 190: MEA Market Attractiveness by Material, 2023 to 2033

Figure 191: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 192: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 193: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA