The Smart Water Management Market is estimated to be valued at USD 20.7 billion in 2025 and is projected to reach USD 68.3 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period.

| Metric | Value |

|---|---|

| Smart Water Management Market Estimated Value in (2025 E) | USD 20.7 billion |

| Smart Water Management Market Forecast Value in (2035 F) | USD 68.3 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

The Smart Water Management market is witnessing strong growth, driven by the increasing need for efficient water monitoring, distribution, and conservation across municipal and industrial sectors. Rising concerns about water scarcity, aging infrastructure, and regulatory compliance are compelling utilities and organizations to adopt advanced technologies for real-time water management. Integration of smart meters, SCADA systems, and analytics platforms enables continuous monitoring of consumption patterns, leak detection, and predictive maintenance, resulting in optimized water distribution and reduced operational costs.

Investments in IoT-enabled solutions, cloud computing, and AI-driven analytics are enhancing decision-making capabilities and operational efficiency. Government initiatives promoting sustainable water management and urban infrastructure modernization are further accelerating market adoption.

The growing emphasis on environmental sustainability, resource efficiency, and data-driven water governance is shaping market dynamics As organizations continue to seek scalable and intelligent water management solutions, the market is expected to experience sustained expansion, with technological innovation and service integration driving efficiency, reliability, and overall system performance.

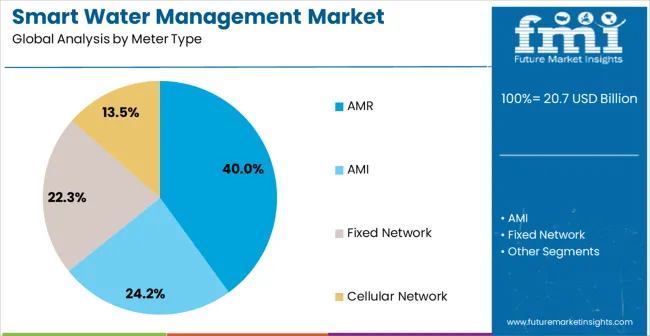

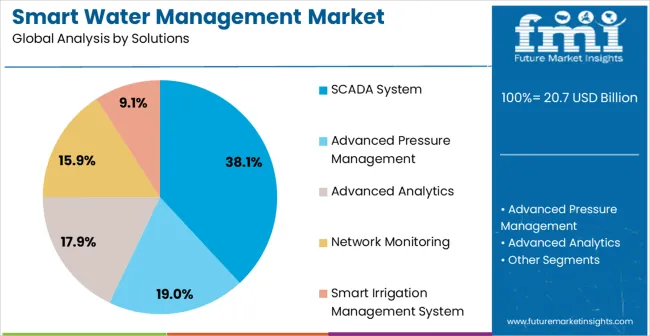

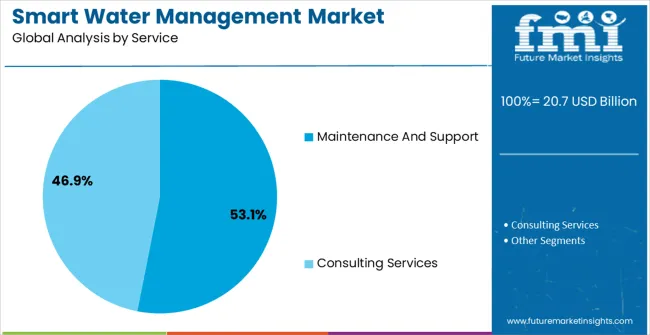

The smart water management market is segmented by meter type, solutions, service, and geographic regions. By meter type, smart water management market is divided into AMR, AMI, Fixed Network, and Cellular Network. In terms of solutions, smart water management market is classified into SCADA System, Advanced Pressure Management, Advanced Analytics, Network Monitoring, and Smart Irrigation Management System. Based on service, smart water management market is segmented into Maintenance And Support and Consulting Services. Regionally, the smart water management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AMR meter type segment is projected to hold 40.0% of the market revenue in 2025, establishing it as the leading meter category. Its dominance is being driven by the ability to automate water usage data collection and transmit it in real time, eliminating the need for manual readings and reducing errors. AMR meters enable utilities to identify consumption trends, detect leakages, and optimize billing processes efficiently.

Integration with SCADA systems and IoT platforms further enhances data visibility, operational efficiency, and decision-making capabilities. The scalability and adaptability of AMR meters allow deployment across residential, commercial, and industrial applications, strengthening market adoption.

Technological advancements, including wireless communication, smart data analytics, and cloud integration, have improved performance and reliability, making AMR meters the preferred choice for modern water management systems As the demand for precise, real-time monitoring and efficient resource allocation grows, the AMR meter type segment is expected to maintain its leadership position, supported by regulatory encouragement and the need for sustainable water management practices.

The SCADA system solutions segment is expected to account for 38.1% of the market revenue in 2025, making it the leading solutions category. Growth in this segment is being driven by the increasing adoption of centralized monitoring and control systems for water distribution networks. SCADA solutions enable real-time data acquisition, process automation, and predictive analytics, allowing for rapid response to operational anomalies, system failures, and leakage events.

Integration with smart meters, IoT devices, and cloud-based platforms improves efficiency, reduces operational costs, and supports regulatory compliance. Utilities and industrial users are leveraging SCADA systems for optimized water management, energy savings, and improved service quality.

Advanced features, including remote monitoring, alert generation, and performance reporting, further strengthen their value proposition As the demand for intelligent and sustainable water infrastructure grows, SCADA system solutions are expected to remain the primary driver of growth, supported by continuous technological advancements and the need for efficient, automated water management processes.

The maintenance and support service segment is projected to hold 53.1% of the market revenue in 2025, establishing it as the leading service category. Its growth is driven by the need to ensure the uninterrupted operation of smart water management infrastructure, including meters, SCADA systems, and other connected devices. Timely maintenance, technical support, and system calibration are critical for sustaining operational efficiency, data accuracy, and compliance with regulatory requirements.

Service providers offer preventive maintenance programs, software updates, and troubleshooting assistance, which reduce downtime and extend the lifespan of installed equipment. Organizations are increasingly outsourcing maintenance and support to specialized providers to enhance reliability and cost efficiency.

As smart water management systems become more complex and integrated, demand for dedicated maintenance and support services is expected to rise Continuous monitoring, rapid issue resolution, and proactive system upgrades are strengthening the adoption of this segment, ensuring that utilities and industrial users can achieve optimal performance and sustainable water management outcomes.

Smart water management is the next big thing due to rising water paucity and rising need of water conservation around the world. Smart water management solution providers are proactively offering smart water technologies that can help users to productively manage chronic shortage of water.

Smart water management is being adopted mainly by manufacturing firms and chemical based companies to reduce water wastage and for efficient use of their resources. Smart water management technology helps organizations for identification of network problem, enhances customer engagement in water conservation and most prominently used to reduce non-revenue water losses due to damage of infrastructure.

The three main components of smart water management system are hardware, solutions and services. Smart water management can be categorized into two sub segment as meter type and meter read technology.

Smart water meter can be used for the purpose of non-revenue water problem detection and identifying leakage in infrastructure. Moreover, automated meter reading technology provide solutions and services such as advanced analytics and network monitoring. It also helps to identify problematic areas within the water management system.

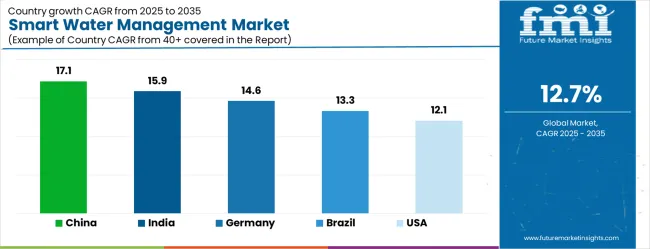

| Country | CAGR |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| Brazil | 13.3% |

| USA | 12.1% |

| UK | 10.8% |

| Japan | 9.5% |

The Smart Water Management Market is expected to register a CAGR of 12.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 17.1%, followed by India at 15.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 9.5%, yet still underscores a broadly positive trajectory for the global Smart Water Management Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.6%. The USA Smart Water Management Market is estimated to be valued at USD 7.2 billion in 2025 and is anticipated to reach a valuation of USD 7.2 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 997.9 million and USD 699.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.7 Billion |

| Meter Type | AMR, AMI, Fixed Network, and Cellular Network |

| Solutions | SCADA System, Advanced Pressure Management, Advanced Analytics, Network Monitoring, and Smart Irrigation Management System |

| Service | Maintenance And Support and Consulting Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

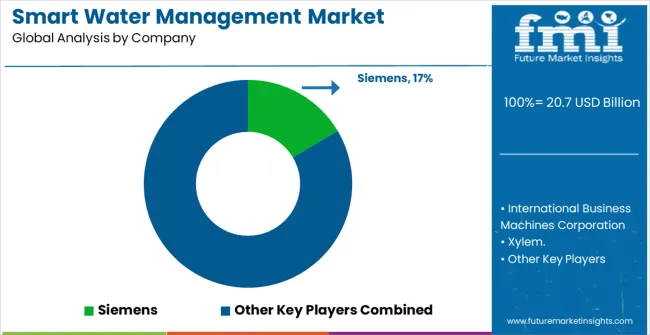

| Key Companies Profiled | Siemens, International Business Machines Corporation, Xylem., Honeywell International Inc, Schneider Electric, Itron Inc., SUEZ, Oracle, Landis+Gyr, and Trimble Inc. |

The global smart water management market is estimated to be valued at USD 20.7 billion in 2025.

The market size for the smart water management market is projected to reach USD 68.3 billion by 2035.

The smart water management market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in smart water management market are amr, ami, fixed network and cellular network.

In terms of solutions, scada system segment to command 38.1% share in the smart water management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Behind-The-Ear Hearing Aid Market Size and Share Forecast Outlook 2025 to 2035

Smart Pill Box Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA