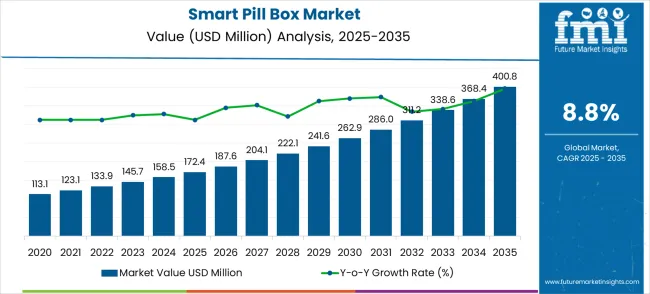

The smart pill box market is anticipated to expand from USD 172.4 million in 2025 to USD 400.8 million by 2035, at a CAGR of 8.8%. In the initial phase, from 2025 to 2030, the market experiences steady growth, increasing from USD 113.1 million in 2025 to USD 172.4 million in 2030. This growth is largely driven by the increasing need for medication adherence solutions, especially among aging populations and those with chronic conditions. The market sees consistent growth each year, with values progressing from USD 123.1 million in 2026 to USD 145.7 million in 2029. Technological advancements in smart pill box features, such as connectivity with mobile apps, help facilitate adoption during this period.

Between 2030 and 2035, the smart pill box market experiences an accelerated growth phase, moving from USD 172.4 million in 2030 to USD 400.8 million by 2035. In this period, market growth becomes more pronounced, with values increasing from USD 187.6 million in 2031 to USD 368.4 million in 2034. The rise in adoption is driven by the growing emphasis on medication management, especially with features like real-time tracking and alerts. The integration of smart pill boxes with healthcare systems ensures better monitoring of patient adherence. By 2035, the market will reach USD 400.8 million, driven by expanding demand in both individual and healthcare settings.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 172.4 million |

| Forecast Value in (2035F) | USD 400.8 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

The smart pill box market is a rapidly growing segment driven by the increasing need for medication adherence, especially among elderly patients and individuals with chronic conditions. In the healthcare market, smart pill boxes account for around 3-5% of the total share, as they are becoming essential tools for improving medication adherence and patient outcomes. With features like alarms, reminders, and tracking systems, these devices help users remember to take their medications on time, reducing the risk of missed doses. The demand for smart pill boxes is particularly strong in chronic disease management and home healthcare, as they allow caregivers and healthcare providers to monitor medication compliance remotely.

In the medical devices market, smart pill boxes represent approximately 4-6% of the market share, driven by the growing integration of advanced features such as mobile app connectivity and real-time data sharing. These devices are playing an increasingly important role in managing patient health, particularly for individuals on multiple medications. In the elderly care market, smart pill boxes contribute around 6-8%, as they offer an efficient solution for elderly individuals who may struggle with remembering their medication schedules. By improving adherence, these devices help patients maintain their health and reduce the risk of complications from missed doses. In the telemedicine market, smart pill boxes make up about 2-4%, supporting remote monitoring and telehealth services.

Market expansion is being supported by the critical healthcare challenge of medication non-adherence and the corresponding demand for technology solutions that can improve patient compliance and clinical outcomes. Modern healthcare systems are increasingly focused on preventive care approaches that can reduce hospital readmissions and support chronic disease management through consistent medication adherence. The proven capability of smart pill boxes to provide automated reminders, adherence tracking, and caregiver notifications makes them essential components of comprehensive medication management programs.

The growing emphasis on aging in place and home-based healthcare delivery is driving demand for remote monitoring technologies that can support independent living while ensuring medication safety. Healthcare preference for solutions that can integrate with existing care workflows while providing real-time adherence data is creating opportunities for advanced smart pill box development. The rising influence of value-based care models and quality metrics focused on medication adherence is also contributing to increased adoption of digital medication management solutions across different healthcare settings and patient populations.

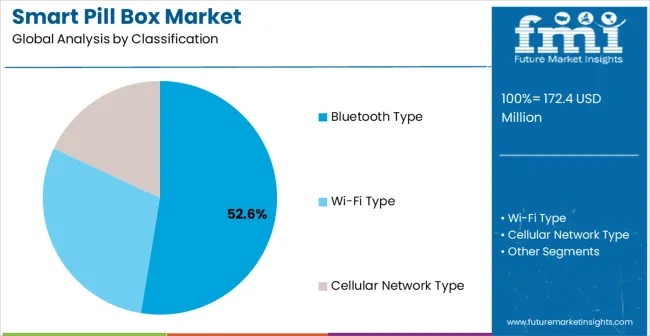

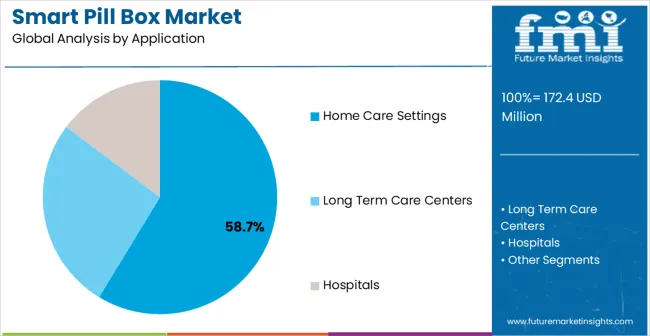

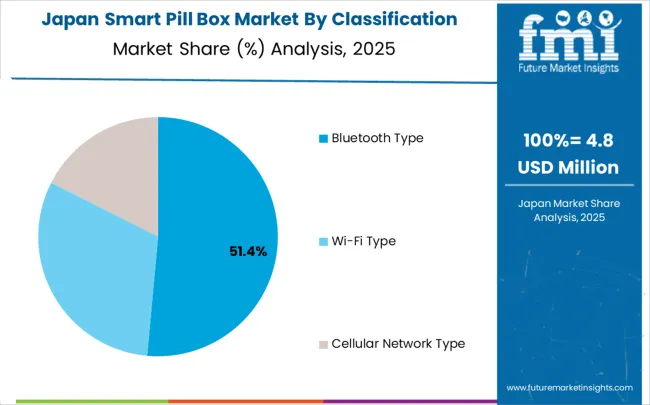

The market is segmented by classification, application, and region. By classification, the market is divided into Bluetooth type, Wi-Fi type, cellular network type, and others. Based on application, the market is categorized into home care settings, long term care centers, hospitals, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The Bluetooth type classification is projected to account for 52.6% of the smart pill box market in 2025, reaffirming its position as the category's dominant connectivity technology. Healthcare technology developers increasingly recognize the optimal balance of connectivity reliability, power efficiency, and smartphone integration provided by Bluetooth-enabled smart pill box systems. This classification addresses the majority of current medication management requirements while providing essential wireless connectivity and mobile app integration.

This classification forms the foundation of most consumer-focused smart pill box solutions, as it represents the most accessible and user-friendly approach for medication management technology. Technology development and user interface optimization continue to strengthen confidence in Bluetooth-based medication management systems. With increasing recognition of the importance of seamless smartphone integration and ease of use, Bluetooth connectivity aligns with both current user preferences and established mobile health ecosystems. Their broad compatibility with existing mobile devices ensures sustained market dominance, making them the central growth driver of smart pill box adoption.

Home care settings are projected to represent 58.7% of smart pill box demand in 2025, underscoring their role as the primary application driving market development. Healthcare providers and patients recognize that home-based medication management requires the most accessible and user-friendly solutions to support independent living and chronic disease management. Home care applications demand exceptional ease of use and reliability that smart pill box technologies are uniquely positioned to deliver.

The segment is supported by the continuous growth of aging in place preferences requiring comprehensive home health support and the increasing deployment of remote patient monitoring across healthcare systems. Home care is increasingly adopting connected health technologies that can provide peace of mind for patients and caregivers while supporting clinical oversight. As understanding of home-based healthcare needs advances, home care applications will continue to serve as the primary commercial driver, reinforcing their essential position within the medication management technology market.

The smart pill box market is advancing rapidly due to increasing awareness of medication adherence importance and growing adoption of digital health technologies. The market faces challenges including technology adoption barriers among elderly users, privacy and data security concerns, and varying reimbursement coverage policies. Innovation in user interface design and healthcare system integration continue to influence product development and market expansion patterns.

The growing adoption of telehealth services is creating enhanced opportunities for smart pill box integration with comprehensive remote monitoring systems. Advanced telehealth platforms offer integrated medication management capabilities, including real-time adherence tracking and clinical intervention triggers, that are particularly important for chronic disease management. Remote monitoring systems provide healthcare providers with continuous visibility into patient medication behavior and intervention opportunities.

Modern healthcare technology companies are incorporating AI-powered adherence prediction, personalized reminder algorithms, and clinical decision support to enhance smart pill box effectiveness and patient outcomes. These technologies improve adherence prediction accuracy, enable customized intervention strategies, and provide enhanced clinical insights throughout treatment programs. Advanced AI integration also enables optimized caregiver communication and improved healthcare provider workflow integration.

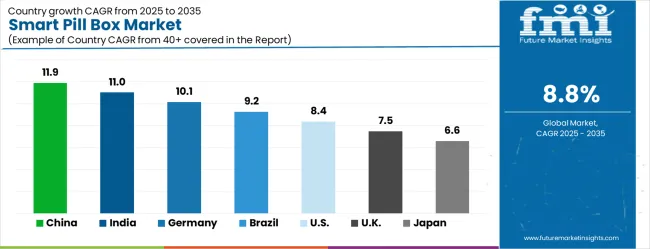

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| Brazil | 9.2% |

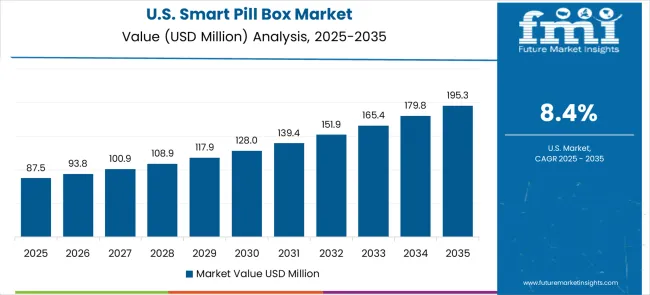

| USA | 8.4% |

| UK | 7.5% |

| Japan | 6.6% |

The smart pill box market is experiencing strong growth globally, with China leading at an 11.9% CAGR through 2035, driven by rapidly aging population, increasing healthcare digitalization initiatives, and growing adoption of connected health technologies. India follows at 11.0%, supported by expanding healthcare accessibility, rising chronic disease prevalence, and increasing smartphone penetration enabling digital health adoption. Germany shows growth at 10.1%, emphasizing comprehensive healthcare system integration and aging population support programs. Brazil records 9.2% growth, focusing on expanding healthcare technology access and growing awareness of medication management importance. The USA shows 8.4% growth, representing mature market dynamics with continued innovation in digital health solutions.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

The smart pill box market in China is projected to exhibit outstanding growth with a CAGR of 11.9% through 2035, driven by rapidly aging population demographics and comprehensive government support for healthcare digitalization and smart health initiatives. The country's massive healthcare market and increasing adoption of digital health technologies are creating substantial opportunities for medication management solutions. Major domestic and international healthcare technology companies are establishing comprehensive distribution and service networks to serve the expanding digital health market.

Revenue from smart pill boxes in India is expanding at a CAGR of 11.0%, supported by growing healthcare accessibility initiatives, increasing prevalence of chronic diseases, and expanding digital health technology adoption. The country's large population base and commitment to healthcare improvement are driving demand for accessible medication management solutions. International healthcare technology companies and domestic manufacturers are establishing partnerships to serve the growing demand for digital health solutions.

Sale of smart pill boxes in Germany is growing at a CAGR of 10.1%, supported by the country's comprehensive healthcare system and established aging population support programs. German healthcare providers and patients consistently adopt advanced digital health technologies through systematic clinical protocols and established reimbursement frameworks. The market is characterized by healthcare excellence, comprehensive patient care, and established relationships between healthcare providers and technology suppliers.

Demand for smart pill boxes in Brazil is projected to expand at a CAGR of 9.2% through 2035, driven by expanding healthcare technology access, increasing awareness of chronic disease management, and growing adoption of digital health solutions. Brazilian healthcare providers and patients are increasingly recognizing the importance of medication adherence in achieving optimal health outcomes and reducing healthcare costs.

The smart pill box market in the USA is anticipated to grow at a CAGR of 8.4%, supported by established digital health infrastructure, continued innovation in medication management technologies, and comprehensive healthcare technology adoption. American healthcare providers and patients maintain consistent utilization of smart health devices through established clinical workflows and technology integration programs.

Revenue from smart pill boxes in the UK is forecated to grow at a CAGR of 7.5% through 2035, supported by National Health Service digital health initiatives and comprehensive medication management programs. British healthcare providers emphasize evidence-based medication adherence solutions within integrated care frameworks that prioritize patient outcomes and cost-effectiveness.

The smart pill box market in Japan is projected to expand at a CAGR of 6.6% through 2035, supported by the country's advanced aging society and comprehensive approach to elderly care technology solutions. Japanese healthcare providers and technology companies emphasize innovation-driven development of medication management systems within established frameworks that prioritize user accessibility and clinical effectiveness.

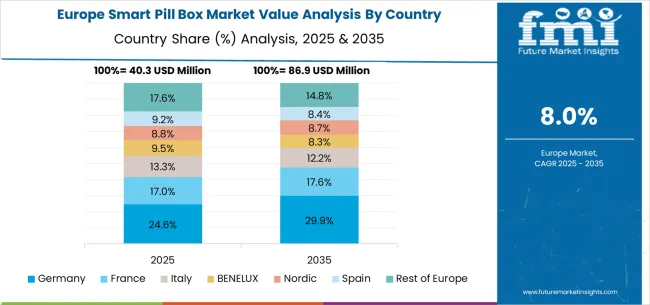

The smart pill box market in Europe is projected to expand steadily through 2035, supported by aging population demographics, established healthcare systems, and ongoing integration of digital health technologies. Germany will continue to lead the regional market, accounting for 29.1% in 2025 and rising to 29.8% by 2035, supported by comprehensive healthcare coverage, advanced aging population support programs, and established digital health integration. The United Kingdom follows with 18.6% in 2025, increasing to 18.9% by 2035, driven by NHS digital health initiatives, medication management programs, and systematic healthcare technology adoption.

France holds 16.2% in 2025, edging up to 16.5% by 2035 as healthcare providers expand digital health capabilities and demand grows for medication management solutions. Italy contributes 12.7% in 2025, remaining stable at 12.9% by 2035, supported by aging population needs and growing healthcare technology adoption. Spain represents 9.8% in 2025, moving upward to 10.0% by 2035, underpinned by expanding healthcare digitalization and increasing investment in aging population support.

Nordic countries together account for 8.2% in 2025, maintaining their position at 8.3% by 2035, supported by advanced healthcare systems and early adoption of innovative digital health technologies. The Rest of Europe represents 5.4% in 2025, declining slightly to 3.6% by 2035, as larger markets capture greater investment focus and established healthcare infrastructure advantages.

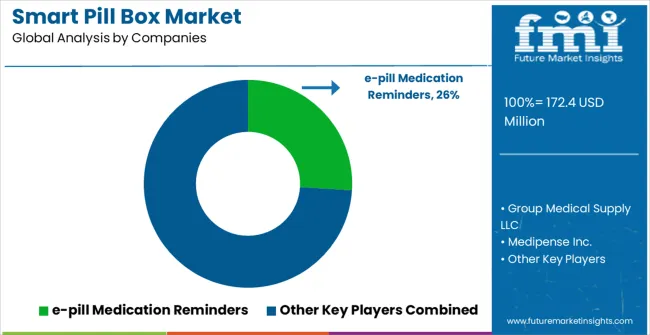

The smart pill box market is characterized by competition among specialized medication management companies, established healthcare technology firms, and innovative digital health startups. Companies are investing in user experience design, connectivity enhancement, strategic partnerships, and clinical validation to deliver user-friendly, reliable, and clinically effective medication management solutions. Technology development, regulatory compliance, and healthcare system integration strategies are central to strengthening competitive advantages and market presence.

e-pill Medication Reminders leads the market with significant expertise in medication adherence solutions, offering comprehensive smart pill box technologies with focus on user accessibility and reliability optimization. Group Medical Supply LLC provides established healthcare supply capabilities with emphasis on medical device distribution and customer support. Medipense Inc. focuses on innovative medication management technologies with comprehensive smartphone integration and user experience design. Medminder Inc delivers advanced pill dispensing solutions with strong focus on caregiver connectivity and clinical monitoring.

MedReady operates with focus on automated medication dispensing and comprehensive medication management systems. PillDrill Inc. provides innovative medication tracking technologies with emphasis on family caregiver integration and adherence analytics. Pillo Inc. specializes in AI-powered medication management with comprehensive voice interaction and health monitoring capabilities. Koninklijke Philips NV leverages comprehensive healthcare technology expertise to provide integrated medication management solutions within broader health monitoring platforms.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 172.4 million |

| Classification | Bluetooth Type, Wi-Fi Type, Cellular Network Type, Others |

| Application | Home Care Settings, Long Term Care Centers, Hospitals, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | e-pill Medication Reminders, Group Medical Supply LLC, Medipense Inc., Medminder Inc, MedReady, PillDrill Inc., Pillo Inc., Koninklijke Philips NV |

| Additional Attributes | Dollar sales by connectivity type and application, regional adoption trends, competitive landscape, healthcare provider partnerships, integration with digital health platforms, innovations in user interface and adherence tracking, clinical outcome analysis, and medication management optimization strategies |

The global smart pill box market is estimated to be valued at USD 172.4 million in 2025.

The market size for the smart pill box market is projected to reach USD 400.8 million by 2035.

The smart pill box market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in smart pill box market are bluetooth type, wi-fi type and cellular network type.

In terms of application, home care settings segment to command 58.7% share in the smart pill box market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Pill Boxes & Bottles Market Size, Growth, and Forecast for 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA