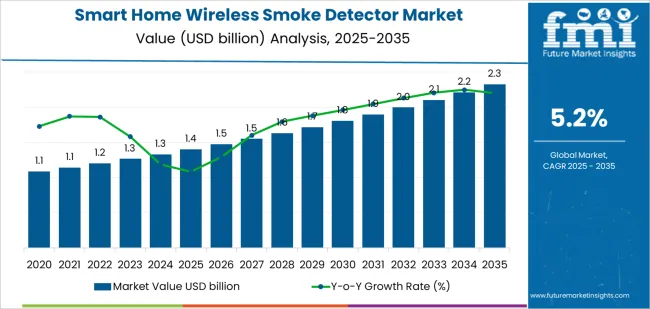

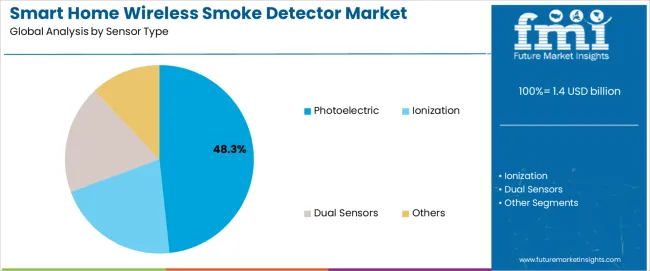

The global smart home wireless smoke detector market is projected to grow from USD 1.4 billion in 2025 to approximately USD 2.3 billion by 2035, recording an absolute increase of USD 908.7 million over the forecast period. This translates into a total growth of 66.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.2% between 2025 and 2035. Segment analysis reveals a clear hierarchy across sensor type and application categories, with technology preference and building type driving adoption trends across both developed and emerging regions. By sensor type, the photoelectric segment dominates with a 48.3% share in 2025, projected to maintain its lead through 2035 due to superior sensitivity in detecting smoldering fires, reliability under residential conditions, and regulatory preference across Europe and North America. Its advantage in avoiding false alarms from cooking smoke or steam enhances consumer confidence, driving the replacement of legacy ionization units. The dual-sensor segment, combining photoelectric and ionization technologies, is forecast to grow rapidly in premium markets where homeowners and commercial operators seek comprehensive multi-hazard coverage, contributing the highest revenue acceleration within the segment structure. Ionization detectors retain niche applications for fast-flaming fire detection, though share erosion continues due to radioactive material restrictions and disposal concerns. Emerging technologies, such as AI-based optical, aspirating, and thermal detection systems, are gaining traction in specialized industrial and heritage property protection scenarios.

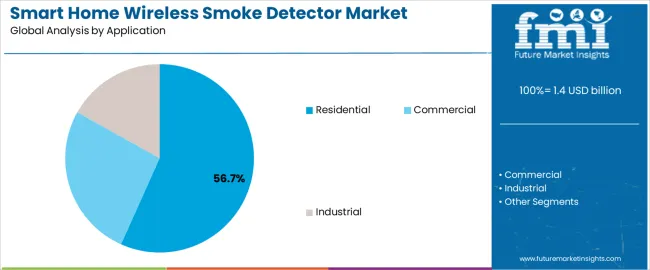

By application, the residential category leads with 56.7% market share, driven by smart home adoption, insurance incentives, and new building regulations mandating interconnected detection systems. Homeowners are favoring detectors with smartphone notifications, self-testing functions, and integration with home ecosystems such as Google Home, Alexa, and Apple HomeKit. The commercial segment follows, supported by building management system integration across offices, retail outlets, and hospitality spaces, emphasizing real-time monitoring and regulatory compliance. Industrial applications, while smaller in share, represent a growing niche focused on ruggedized designs and wireless connectivity in harsh environments such as warehouses and logistics hubs.

Regulatory mandates for smoke detector installation in residential and commercial properties, combined with insurance incentives for smart safety systems, are creating sustained demand for connected detection solutions. The market is characterized by convergence of fire safety technology, wireless communication protocols, and cloud-based monitoring platforms, with manufacturers developing products that balance sophisticated features with user-friendly installation, reliable battery life, and false alarm reduction through intelligent sensing algorithms that distinguish between actual fire events and cooking smoke or steam.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.4 billion |

| Market Forecast Value (2035) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

| SMART HOME INTEGRATION TRENDS | TECHNOLOGY & SAFETY ADVANCEMENT | REGULATORY & INSURANCE DRIVERS |

|---|---|---|

| IoT Ecosystem Expansion Continuous growth of connected home devices and smart home platforms creating foundation for integrated safety systems with remote monitoring and control capabilities. Voice Assistant Integration Growing adoption of voice-activated smart home systems enabling seamless integration of smoke detectors with Amazon Alexa, Google Assistant, and Apple HomeKit platforms. Remote Monitoring Demand Increasing consumer desire for real-time alerts and remote property monitoring enabling homeowners to receive instant notifications and verify emergency situations from any location. |

Wireless Technology Maturation Development of reliable wireless communication protocols including Wi-Fi, Zigbee, and Z-Wave enabling stable connectivity and eliminating complex wiring requirements during installation. False Alarm Reduction Advanced sensing algorithms and multi-criteria detection capabilities distinguishing between actual fire conditions and benign sources like cooking smoke or steam. Battery Technology Improvement Extended battery life spanning 5-10 years and low-battery warnings eliminating maintenance concerns and ensuring continuous protection without frequent replacements. |

Building Code Requirements Mandatory smoke detector installation regulations in residential and commercial buildings creating baseline demand with growing preference for smart-enabled solutions. Insurance Incentives Premium reductions and favorable coverage terms offered by insurance companies for properties equipped with monitored smart fire detection systems. Fire Safety Standards Evolving safety standards emphasizing early detection, interconnected alarm systems, and notification capabilities driving adoption of wireless networked solutions over standalone devices. |

| Category | Segments Covered |

|---|---|

| By Sensor Type | Photoelectric, Ionization, Dual Sensors, Others |

| By Application | Commercial, Industrial, Residential |

| By Region | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Photoelectric |

|

| Ionization |

|

| Dual Sensors |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Residential |

|

| Commercial |

|

| Industrial |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Region | Market Value 2025 (USD Million) | Market Value 2035 (USD Million) | CAGR (2025 to 2035) |

|---|---|---|---|

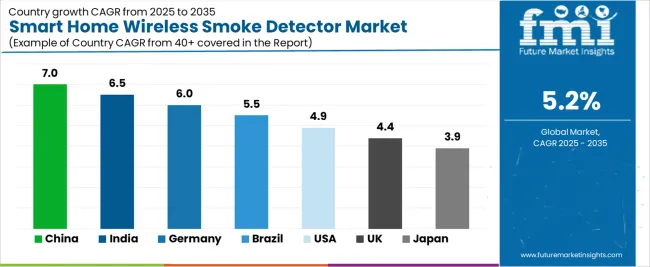

| China | 503.2 | 1,123.8 | 7.0% |

| India | 44.5 | 68.0 | 6.5% |

| Germany | 1,068.3 | 1,773.5 | 6.0% |

| Brazil | 1,182.3 | 1,962.8 | 5.5% |

| United States | 1,243.8 | 2,064.9 | 4.9% |

| United Kingdom | 1,308.4 | 2,172.2 | 4.4% |

| Japan | 1,448.0 | 2,285.2 | 3.9% |

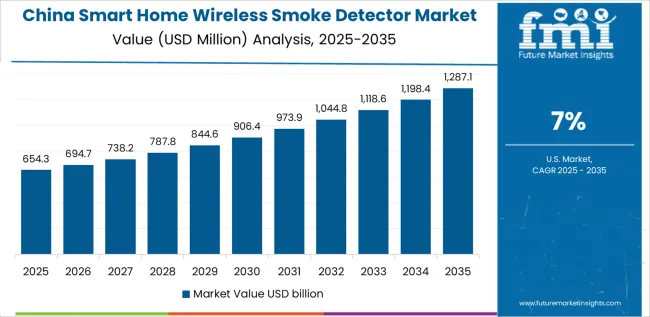

Revenue from smart home wireless smoke detectors in China is projected to reach USD 1.1 billion by 2035, driven by rapid smart home adoption and government initiatives promoting fire safety in residential and commercial buildings creating substantial opportunities for connected safety device manufacturers. The country's massive construction activity and urbanization are generating demand for modern fire detection solutions integrated with smart building systems and home automation platforms. National fire safety campaigns and regulatory requirements for smoke detector installation in residential properties are accelerating market development, with consumers increasingly selecting wireless smart-enabled devices over traditional standalone units. Major technology companies and appliance manufacturers including Xiaomi, Haier, and Midea are incorporating smoke detectors into comprehensive smart home ecosystems, leveraging existing customer relationships and distribution networks. The integration with popular Chinese smart home platforms including Xiaomi Mi Home and Alibaba Tmall Genie is driving consumer adoption through seamless setup experiences and unified device management. Domestic manufacturers are developing cost-competitive products tailored to Chinese market preferences including WeChat integration, local cloud services, and compatibility with domestic wireless protocols.

Revenue from smart home wireless smoke detectors in India is expanding to reach USD 68.0 million by 2035, supported by rapid urbanization and growing awareness of fire safety in high-rise residential buildings creating emerging demand for modern detection solutions. The country's expanding middle class and increasing construction of premium apartment complexes are driving adoption of smart home technologies including connected safety devices. High-profile fire incidents in residential and commercial buildings are raising public awareness and creating demand for reliable early warning systems. Smart home ecosystem development by companies including Amazon India and Xiaomi is facilitating market entry, with smoke detectors positioned as accessible entry points into broader home automation adoption. Price sensitivity remains significant with emphasis on demonstrating value proposition through features including smartphone alerts, battery life indicators, and false alarm reduction. E-commerce platforms are playing crucial roles in market development, providing access to international and domestic brands while offering customer education through product reviews and comparison tools. Regulatory environment is evolving with increasing emphasis on fire safety in building codes, particularly for high-rise residential and commercial structures in major metropolitan areas.

Demand for smart home wireless smoke detectors in Germany is projected to reach USD 1.8 billion by 2035, supported by stringent fire safety regulations and comprehensive smoke detector installation mandates across all residential properties creating sustained market foundation. German building codes require smoke detectors in bedrooms, children's rooms, and hallways, with enforcement driving universal adoption. The market is characterized by emphasis on product quality, reliability, and compliance with DIN EN 14604 standard and VdS certification requirements. German consumers prioritize long-term reliability and low maintenance, favoring detectors with 10-year sealed batteries and proven track records. Smart home adoption is accelerating with growing acceptance of connected devices, creating opportunities for wireless smoke detectors integrated with platforms including Bosch Smart Home, Homematic IP, and international systems. Privacy considerations influence market dynamics with preference for local data processing and European cloud infrastructure over systems requiring data transmission to overseas servers. Insurance industry actively promotes smart smoke detectors through premium discounts and risk reduction programs, creating economic incentives for adoption. Replacement market is significant as older detectors reach end-of-life and homeowners upgrade to smart-enabled solutions offering enhanced features and connectivity.

Revenue from smart home wireless smoke detectors in Brazil is growing to reach USD 2 billion by 2035, driven by increasing construction activity and growing middle-class adoption of home security systems creating opportunities for integrated fire detection solutions. The country's expanding awareness of fire safety, particularly following high-profile incidents, is driving regulatory evolution and consumer demand for reliable detection systems. Urban apartment construction is creating natural market for wireless solutions eliminating installation complexity in retrofit scenarios. Smart home ecosystem development by international and regional technology companies is facilitating product availability and consumer education. Integration with home security systems offered by monitoring companies provides channel for smoke detector adoption as part of comprehensive safety packages. Economic considerations favor products offering clear value propositions including remote monitoring, alert verification, and potential insurance benefits. Technical support and Portuguese-language applications are important factors for consumer adoption and satisfaction. Market development faces challenges including price sensitivity, limited awareness of smart detector benefits compared to basic models, and preference for professionally installed systems in premium segments.

Revenue from smart home wireless smoke detectors in United States is projected to reach USD 2.1 billion by 2035, supported by mature smart home market and strong fire safety culture creating sustained demand for connected detection solutions. The country's established smoke detector penetration provides substantial replacement market as consumers upgrade to smart-enabled devices offering enhanced features and connectivity. Integration with dominant smart home platforms including Amazon Alexa, Google Home, and Apple HomeKit is driving adoption through simplified setup and unified device control. National Fire Protection Association standards and local building codes mandate smoke detector installation with periodic replacement, creating predictable demand cycles. Insurance industry promotes smart detectors through monitoring service discounts and premium reductions for properties with connected safety systems. Retail distribution through home improvement stores, mass merchants, and online channels provides extensive product availability and consumer choice. Technology leadership positions U.S. market as testing ground for innovative features including AI-powered detection algorithms, predictive maintenance capabilities, and integration with emergency response services. Consumer expectations for reliable performance, extended battery life, and effective false alarm prevention drive continuous product improvement and competitive differentiation.

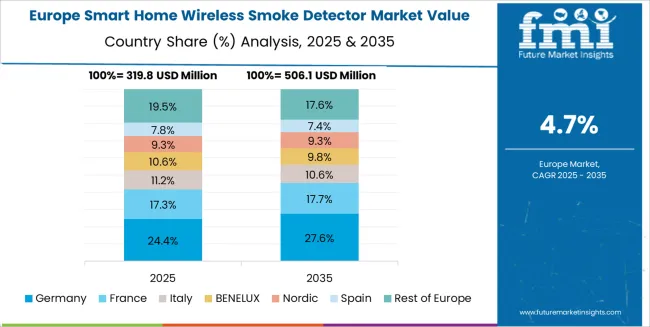

The smart home wireless smoke detector market in Europe is projected to grow from USD 1.3 billion in 2025 to USD 2 billion by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 32.6% market share in 2025, projected to expand to 33.4% by 2035, supported by comprehensive smoke detector mandates and strong smart home adoption across residential properties. The United Kingdom follows with a 26.8% share in 2025, anticipated to reach 27.1% by 2035, driven by regulatory requirements and growing integration with home security systems. France holds a 18.9% share, while Netherlands accounts for 13.4% in 2025, reflecting active fire safety programs and high smart home penetration. The Rest of Europe region is projected to maintain approximately 8.3% collectively through 2035, with Nordic countries, Belgium, and Southern European nations implementing smoke detector regulations and experiencing growing smart home adoption creating demand for wireless connected solutions.

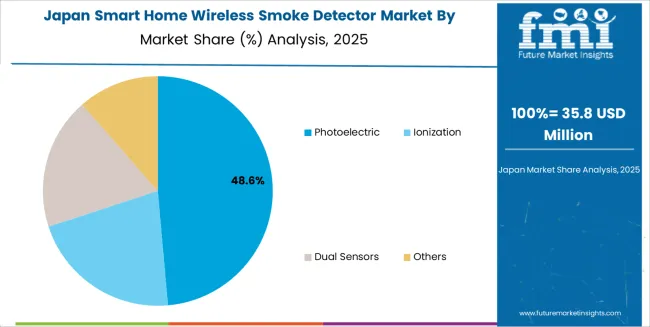

Japanese smart home wireless smoke detector operations reflect the country's emphasis on product quality and comprehensive safety standards. Fire defense regulations require smoke detector installation in residential properties with strict compliance oversight and periodic inspection requirements. Japanese consumers prioritize reliability and longevity, favoring products from established brands with proven track records and comprehensive after-sales support. The market demonstrates unique requirements for integration with Japanese smart home ecosystems including local platforms and voice assistants, with product localization including Japanese-language interfaces, metric measurements, and compatibility with domestic wireless standards. Regulatory oversight through the Fire Defense Agency establishes performance standards and certification requirements that create high barriers for international products lacking proper approvals. Japanese fire safety culture emphasizes prevention and preparedness, supporting willingness to invest in premium detection solutions offering advanced features and reliability. Technical preferences include preference for compact designs suitable for Japanese residential architecture, low false alarm rates important in compact living spaces, and compatibility with existing home automation systems. Distribution channels emphasize specialized fire safety retailers, home improvement stores, and electronics retailers providing expert product guidance and installation support. Market maturity creates stable replacement cycles with consumers upgrading detectors every 8-10 years in alignment with manufacturer recommendations and regulatory guidance.

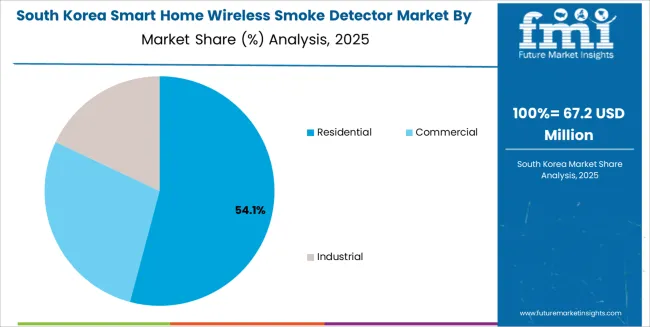

South Korean smart home wireless smoke detector operations reflect the country's technology leadership and government initiatives promoting smart city development. Fire safety regulations require smoke detector installation in residential properties with enforcement creating universal adoption. Korean consumers demonstrate high technology adoption rates, creating favorable environment for smart-enabled fire detection solutions integrated with comprehensive home automation systems. Major electronics manufacturers including Samsung and LG maintain strong market positions leveraging brand recognition, extensive distribution networks, and integration with proprietary smart home platforms. The market demonstrates particular strength in apartment buildings where building-wide fire safety systems increasingly incorporate individual unit monitoring through wireless detectors connected to central management platforms. Regulatory framework through the National Fire Agency establishes performance standards and certification requirements while promoting adoption of advanced detection technologies. Consumer preferences emphasize sleek designs, intuitive smartphone applications, and integration with popular Korean messaging platforms for alert delivery. Technical innovation focus includes development of AI-powered detection algorithms, integration with building management systems, and incorporation of additional sensors for comprehensive environmental monitoring. Market characteristics include preference for products from recognized brands, willingness to pay premiums for advanced features, and expectations for seamless integration with existing smart home devices and security systems.

The smart home wireless smoke detector market demonstrates consolidation among established fire safety manufacturers and technology companies entering from adjacent smart home categories. Profit concentration occurs in premium segments where brands command pricing power through established reputations, comprehensive features, and ecosystem integration. Value migration favors companies offering seamless smart home integration, reliable performance with low false alarm rates, and strong brand recognition in fire safety or technology sectors. Several competitive archetypes shape market dynamics: traditional fire safety companies extending product portfolios into smart-enabled devices leveraging established distribution and regulatory expertise; technology companies entering fire safety from smart home platforms emphasizing connectivity and user experience; home security system providers bundling smoke detection with comprehensive monitoring services; and specialized smart home device manufacturers focusing on design and integration capabilities. Market differentiation centers on detection technology sophistication, wireless protocol support, battery longevity, smartphone application quality, and integration breadth with smart home ecosystems. Switching costs remain moderate with primary barriers including learning curves for new applications, ecosystem lock-in effects favoring devices compatible with existing smart home platforms, and installation effort despite wireless simplicity.

Competition intensifies around false alarm reduction through advanced sensing algorithms, recognizing that nuisance alarms drive detector disconnection undermining safety objectives. Distribution strategy proves critical with successful companies maintaining presence across professional installation channels, retail stores, online marketplaces, and direct-to-consumer platforms. Partnerships with insurance companies, home builders, and property management firms create channels for volume adoption and recurring revenue through monitoring services. Market maturity varies by geography with developed markets emphasizing replacement cycles and feature upgrades while emerging markets focus on initial adoption and awareness building. Regulatory compliance and certification requirements create barriers favoring established manufacturers with testing infrastructure and regulatory expertise, though standardization enables new entrants meeting baseline requirements. Innovation focus includes extending battery life toward true 10-year sealed designs, improving wireless reliability through multiple protocol support, incorporating additional sensors for comprehensive environmental monitoring, and developing AI capabilities distinguishing fire conditions from benign events.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Sensor Type | Photoelectric, Ionization, Dual Sensors, Others |

| Application | Commercial, Industrial, Residential |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

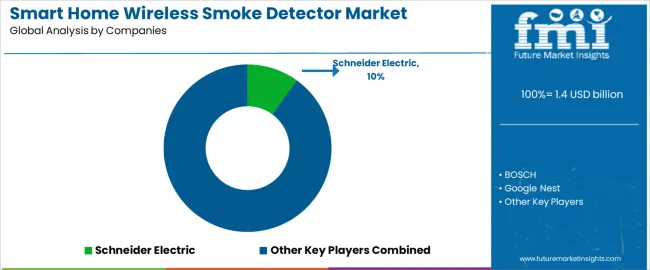

| Key Companies Profiled | Schneider Electric, BOSCH, Google Nest, X-Sense, First Alert (Resideo Technologies), Netatmo, Kidde, FireAngel, Aqara, ORVIBO, Heiman Technology, Honeywell, Ei Electronics, Johnson Controls, Swiss Securitas Group, WAGNER Group, Busch-jaeger (ABB), Halma, Siemens, Legrand, Smartwares, ABUS, Panasonic Fire & Security, OUTESS, SHANGHAI NOHMI, SECOM, SITERWELL, JADE BIRD FIRE, Leader Group, Tanda, HTI Sanjiang Electronics |

| Additional Attributes | Dollar sales by sensor type and application, regional demand across key markets, competitive landscape, smart home integration patterns, wireless technology adoption, and IoT infrastructure development driving fire safety enhancement, remote monitoring capabilities, and connected home security ecosystems |

The global smart home wireless smoke detector market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the smart home wireless smoke detector market is projected to reach USD 2.3 billion by 2035.

The smart home wireless smoke detector market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in smart home wireless smoke detector market are photoelectric, ionization, dual sensors and others.

In terms of application, residential segment to command 56.7% share in the smart home wireless smoke detector market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA