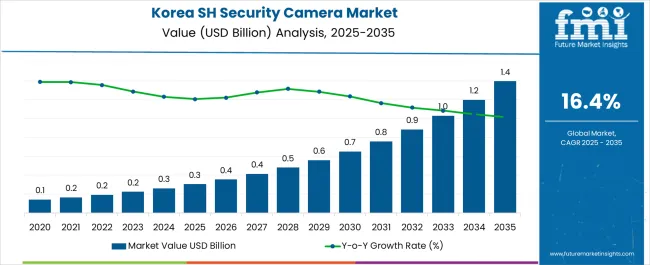

The Korea Smart Home Security Camera Market is estimated to be valued at USD 0.3 billion in 2025 and is projected to reach USD 1.4 billion by 2035, registering a compound annual growth rate (CAGR) of 16.4% over the forecast period.

| Metric | Value |

|---|---|

| Korea Smart Home Security Camera Market Estimated Value in (2025 E) | USD 0.3 billion |

| Korea Smart Home Security Camera Market Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 16.4% |

The Korea smart home security camera market is expanding rapidly, supported by rising urbanization, increasing consumer focus on residential safety, and the adoption of smart technologies integrated with home automation systems. Growth is being driven by higher internet penetration, widespread use of smartphones, and advancements in wireless connectivity that allow seamless monitoring and control.

Current dynamics reflect strong demand for real-time surveillance solutions and increasing reliance on AI-enabled features such as motion detection, facial recognition, and cloud storage. Regulatory emphasis on residential safety standards and growing awareness of home security risks are further strengthening market adoption.

The future outlook remains promising, with continuous product innovation, falling device costs, and integration with broader IoT ecosystems fueling penetration Growth rationale is also underpinned by the rising influence of e-commerce platforms and retail channels that improve product accessibility, combined with the willingness of consumers to invest in premium home security solutions, which ensures consistent market expansion across both urban and suburban households.

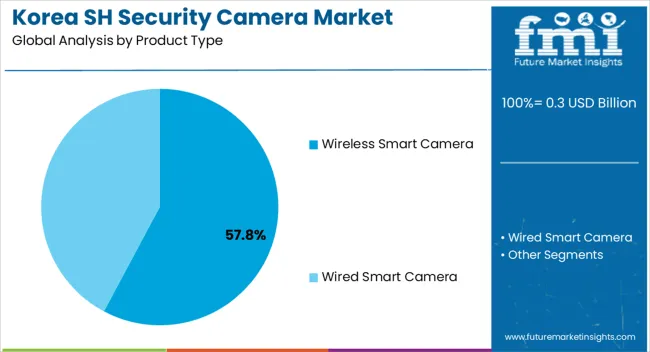

The wireless smart camera segment, holding 57.80% of the product type category, has been driving the market due to its convenience, flexibility, and ease of installation compared to wired alternatives. Its leadership has been supported by enhanced features such as mobile app connectivity, Wi-Fi compatibility, and remote monitoring capabilities that align with modern consumer expectations.

Adoption has been strengthened by affordability improvements and the ability to integrate seamlessly with other smart home devices. Demand has also been boosted by increasing consumer preference for devices with minimal maintenance requirements and higher portability.

Continuous technological upgrades in image resolution, night vision, and AI-driven analytics have reinforced the value proposition of wireless solutions With the ongoing expansion of 5G networks and IoT-enabled infrastructure in Korea, the wireless smart camera segment is expected to sustain its market leadership and capture further growth opportunities.

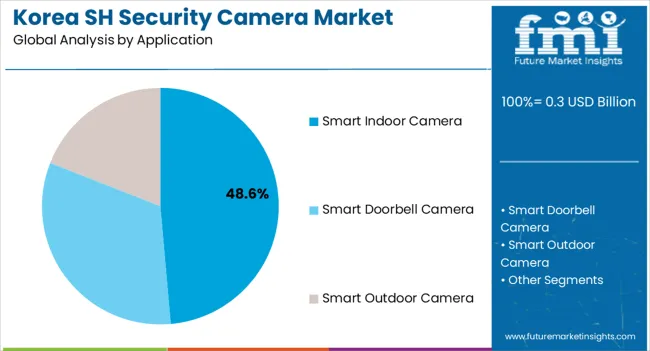

The smart indoor camera segment, representing 48.60% of the application category, has established dominance due to heightened consumer demand for in-home monitoring and family safety solutions. Its growth has been supported by rising adoption among dual-income households and elderly care applications, where real-time surveillance enhances reassurance and convenience.

Market expansion has been reinforced by the ability of indoor cameras to integrate with voice assistants, smart locks, and home automation systems, creating a connected living environment. Product affordability, combined with availability across both online and offline channels, has widened accessibility and fueled adoption.

Enhanced AI functionalities, including intrusion alerts, child and pet monitoring, and customized recording settings, have strengthened consumer value perception With increasing awareness of home safety and continuous innovations tailored to user-specific needs, the smart indoor camera segment is expected to maintain its strong position and remain a critical growth driver in the Korean smart home security camera market.

| Leading Connectivity for Smart Home Security Camera in Korea | Wired Smart Camera |

|---|---|

| Total Value Share (2025) | 71.10% |

Wired connections are typically considered more secure than wireless connections because they are less susceptible to hacking or signal interference. The perceived security advantage of wired connections can be a key selling feature in an industry where data security and privacy are crucial. Korea is well-known for its sophisticated internet infrastructure, which includes high-speed broadband and ubiquitous fiber optic access.

This deployment of wired smart camera is supported by this robust infrastructure, allowing for high-definition video streaming and continuous surveillance without the risk of signal losses or latency difficulties. The rapid growth of infrastructure is expected to boost demand for connected smart home security camera in the future years.

| Leading Sales Channel for Smart Home Security Camera in Korea | Physical Stores |

|---|---|

| Total Value Share (2025) | 69.10% |

For the younger generation in Korea, the future of brick-and-mortar shops appears secure, at least in the short term. In 2024, more than 65% of Koreans favored offline shopping, citing the ability to personally inspect products, and buying a smart home security camera is no exception. Traditional and independent markets coexist with chain businesses, such as department stores and hypermarkets, in the Korean retail scene.

Physical stores are preferred in Korea due to social and cultural reasons. In addition to the value of human relationships, the tactile sensation of physically examining items is important. Koreans place a high emphasis on in-person conversations with vendors, asking for tailored advice, and developing a relationship of trust. The comfort and familiarity of conventional retail locations, together with a need for instant satisfaction, continue to fuel the appeal of physical stores, even while eCommerce is rising.

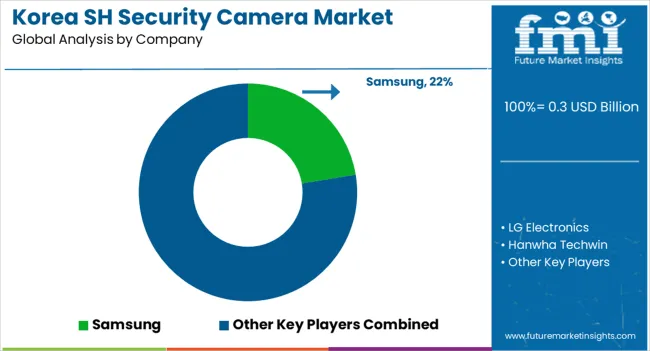

The smart home security camera industry in Korea features an evolving competitive landscape with a mix of domestic and foreign competitors striving for a competitive edge. Growing security concerns and the emergence of smart home ecosystems drive healthy industry growth.

Domestic firms like Samsung and LG are fierce competitors, utilizing their established presence and brand image to offer complete security solutions integrated into their larger product ranges. These firms concentrate on developing synergies within their product ecosystems to deliver end-to-end smart home solutions, thereby increasing their competitive position.

International firms, such as Google's Nest and Amazon's Ring, are also making strides in the Korean industry. These firms bring their worldwide expertise and technical advancements to the forefront to seize a portion of the rising demand for smart home security camera. Their focus on cloud-based solutions and AI-powered features has piqued the interest of tech-savvy Korean customers.

Strategies for Key Players to Tap into Potential Growth Opportunities

Recent Development Observed in Smart Home Security Camera in Korea

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 0.3 billion |

| Projected Industry Size in 2035 | USD 1.4 billion |

| Anticipated CAGR between 2025 to 2035 | 16.4% CAGR |

| Historical Analysis of Demand for Smart Home Security Camera in Korea | 2020 to 2025 |

| Demand Forecast for Smart Home Security Camera in Korea | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Smart Home Security Camera Adoption in Korea, Insights on Global Players and their Industry Strategy in Korea, Ecosystem Analysis of Local and Regional Korean Manufacturers |

| Key Cities Analyzed While Studying Opportunities in Smart Home Security Camera in Korea | South Gyeongsang, North Jeolla, South Jeolla, Jeju |

| Key Companies Profiled | Samsung; LG Electronics; Hanwha Techwin; ADT Caps; KT Corporation; SK Telecom; Cubie; Goscam; DLink Korea; Withus Technology |

The global Korea smart home security camera market is estimated to be valued at USD 0.3 billion in 2025.

The market size for the Korea smart home security camera market is projected to reach USD 1.4 billion by 2035.

The Korea smart home security camera market is expected to grow at a 16.4% CAGR between 2025 and 2035.

The key product types in Korea smart home security camera market are wireless smart camera and wired smart camera.

In terms of application, smart indoor camera segment to command 48.6% share in the Korea smart home security camera market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Home Security Camera Market Analysis - Size, Share, and Forecast 2025 to 2035

Demand and Trends Analysis of Smart Home Security Camera in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Smart Home Security Camera in Japan Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Home Security Drone Market Size and Share Forecast Outlook 2025 to 2035

Home Security Sensors Market Analysis by Application, Product, and Region through 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Service Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Automation Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Market Size and Share Forecast Outlook 2025 to 2035

Smart Home-Based Beverage Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Payments Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Automation Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Smart Home Appliances Market Growth – Trends & Forecast 2025 to 2035

Smart Home Water Sensors & Controllers Market Trends & Forecast 2025 to 2035

Smart Camera Market Analysis – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA