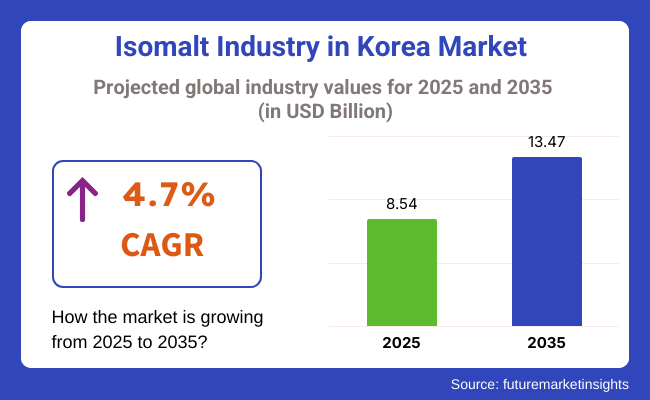

The Isomalt Industry Analysis in Korea will grow to USD 8.54 million by 2025 and will continue to grow at a CAGR of 4.7% from 2025 to 2035, with market valuations reaching USD 13.47 million by 2035. Increased health awareness is expected to unleash demand for healthier alternatives in food segments, such as confectionery and bakery, where this sweetener is increasingly being put to use as a sugar substitute. It offers several advantages, such as a low glycemic index, fewer calories, and dent-friendly properties, which make it attractive to health-oriented consumers and food manufacturers.

Increasing awareness about the dangers of excess sugar consumption resulting in obesity, diabetes, and other lifestyle diseases has led to a dramatic change in the South Korean taste preference towards low-calorie, sugar-free, or functional food products replicating the same taste and texture of sugar items without bad health effects.

This ingredient fits exactly into this demand as it sweetens and bulks like sugar but cuts calories in sugar-free or reduced-sugar products. Hence, this sweetener is a common ingredient in many products, including candies, gums, chocolates, baked goods, and beverages.

Adding the sweetener's ability to establish clean-label products complements the growing demand. South Korean consumers are continuing to develop their interest in transparency in food labeling. Natural sugar alternatives are considered healthier than typical granulated sugar. It is versatile in various formulations and applications, making it ideal for manufacturers that want to meet the growing demand for healthier yet satisfying products.

Interest in well-being and health has propelled the consumption of functional food ingredients in South Korea. As the country has focused on preventing and managing conditions such as obesity, diabetes, and cardiovascular diseases, consumers now look forward to foods and beverages that would contribute health credentials to items beyond basic nutrition. The players position themselves for the tide of consumers preferring functional foods and drinks whose consumption would contribute to one's overall well-being.

The isomalt market in South Korea is expected to be dominantly conventional isomalt, having an estimated share of about 91.3% in 2025. In contrast, organic isomalt amounts to 8.7%, during which period it is in less volume.

Conventional isomalt holds the largest share in South Korea due to its availability, cost-effective use, and versatile applications in many food and confectionery products. It is most used in sugar-free confectionery products, chewing gums, and baked products, for instance, by large-scale manufacturers.

Companies such as Lotte Confectionery and Orion Corporation bring out their sugar-free or reduced-sugar snack products by including conventional isomalt as an ingredient since it employs the features of texture and sweetness of sugar without the taste and dental effects.

CJ CheilJedang has also produced conventional isomalt for use in its health-related snack and beverage products. The main advantage of conductional isomalt is that it is highly affordable, easy to make, and caters to mass requirements for mainstream food manufacturers.

Organic isomalt has a small but growing revenue share since health-driven consumers increasingly demand clean-label, natural, and added ingredient-free products. Many premium brands now use organic isomalt for functional foods, health supplements, and organic-certified products. In this way, Amorepacific's organic isomalt is used through its health food department to produce premium sugar-free snacks and beverages targeted toward wellness-minded consumers.

Lastly, organic isomalt is also used by smaller organic and allergen-free brands like Happy Whole Foods and Green Juice to create artisanal sugar-free confections. The organic segment may be small in terms of share. Still, it is gradually growing as consumers are keen on organic certification and natural alternatives in their food and wellness choices.

By form, the industry will be led by the Powder form, which will account for 77.6% of the entire revenue share, while the Syrup form will represent 22.4%.

The powdered form dominates South Korea due to its freedom of usage, easy handling, and diversity in dry food products. It is most commonly used in confectionery manufacturing, especially in the production of sugarless candies, gums, and baked products. Well-known food manufacturers such as Lotte and Orion use the powdered form in their sugar-free and reduced-sugar snacks.

The powdered isomalt is also an ingredient for CJ CheilJedang in health-focused baked goods and snack bars, where the powdered form provides consistency in texture and stability. The powder form is the best choice for high-volume applications as it makes long shelf life possible, easy storage, and cost-effectiveness for large-scale manufacturing processes possible.

The syrup form is a small segment but important for those applications where mixing and solubility are required; examples are beverages, liquid sweeteners, and functional foods. The syrup form has applications in the premium health-conscious goods product category, where the consumer accepts it on the basis of taste and texture.

Amore Pacific and Samyang Foods include isomalt syrup in low-calorie and sugar-free beverage lines, as well as functional syrup and ready-to-drink health supplement lines. In the HORECA sectors, syrup is a competitive advantage in gourmet products like premium sauces, dressings, and desserts. It is mentioned to be thin enough to dissolve in liquids yet impart sweetness and texture to finished products.

The South Korean industry has been developing because of increased consumer preference for healthier, sugar-free alternatives. Isomalt, a sugar alcohol from beet sugar, is mainly used in the food industry for confectionery and bakery purposes.

Health consciousness, on the rise due to an increase in the cases of diabetes and obesity, has led to a demand for low-calorie, sugar-free products. The large food manufacturing sector in South Korea and the increasing popularity of clean-label foods are prominent contributing factors leading to the growth of the industry.

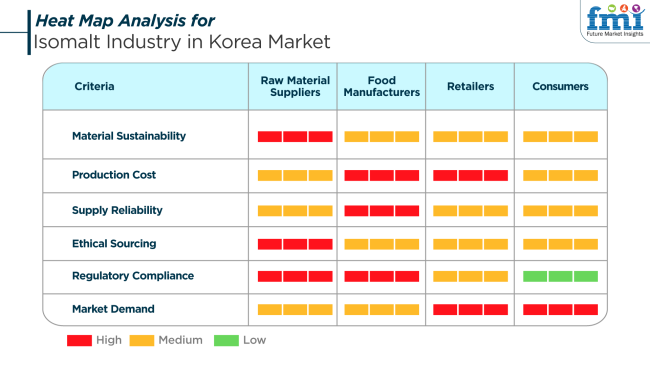

The raw material suppliers maintain continuity in the supply and sustainable sourcing. Their demand for sustainable and ethically sourced materials is increasing. It is driven by increased consumer awareness of environmental and health concerns. The production cost for raw materials is kept moderate thanks to the renewable source of beet sugar. At the same time, the reliability of the supply is of medium concern due to the unpredictability of agricultural production.

(Stakeholders: Raw Material Suppliers, Food Manufacturers, Retailers, Consumers)

Food manufacturers have to deal with high production costs mainly due to the complexity of the conversion of beet sugar to isomalt. They typically focus on producing at lower costs while adhering to food safety regulations and quality standards. When it comes to regulatory compliance, manufacturers face a tougher challenge in South Korea.

The manufacturers need to comply with these regulations, ensuring the products meet local requirements concerning the admissible sugar-alcohol content and the health warnings, both of which are highly regulated by South Korean authorities.

Retailers have started to stock sugar-free and low-calorie product lines to keep up with rising consumer demand for health-oriented food options. Manifold demand remains a huge concern for its retailers, who focus on providing products that serve consumers looking for healthier alternatives, particularly for people with diabetes and those conscious about weight. However, supply reliability and production cost will also be major considerations as they address demand while being profitable.

In South Korea, consumers are health-conscious, and this sweetener is predominantly gaining demand due to concerns about sugar use and the prevalence of diabetes and obesity. Consumers prefer low-calorie, sugar-free options in confectionery products, baked goods, and beverages. All these segments are undergoing an increase in demand. Ethical sourcing and sustainability are important to this group of consumers, while regulatory compliance is not. Consumers trust that the products available comply with all the safety standards needed.

From 2020 to 2024, the South Korean isomalt market experienced a gradual but promising growth owing to the growing health-conscious South Korean population. With a decline in sugar consumption, isomalt gained attention as a functional, low-calorie confectionery, pharmaceutical, and nutraceutical solution. Its tooth-friendliness and low glycemic index helped gain consumer attention, particularly with rising awareness for metabolic health issues. The industry was also limited in terms of low manufacturer and consumer awareness, and competition from other natural sweeteners.

With years approaching 2025 to 2035, South Korea's isomalt market will progress through innovation and increasing use. As the food industry gravitates toward functional, clean-label foods, the sweetener will be used in health-focused snacks, beverages, and supplement blends.

Greater government and industry initiatives toward sugar reformulation and sustainable food processing will fuel the shift. Enhanced product innovation, enhanced flavor profile, and consumers' expectations for customized nutrition will drive the isomalt market forward, and it will become a central point of South Korea's changing health-food industry.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Healthy consumers who demand sugar-free, lower-calorie foods | Clean-label, functional, and personalized nutrition needs |

| Sugar-free gum, sweets, and tablets | Functional foods, beverages, and nutraceuticals |

| Simple labeling and food safety compliance | Deeper emphasis on sugar reformulation and clear labeling |

| Lifestyle-associated conditions, low-sugar consumption trends | Wellness lifestyle, need for sustainable sweeteners |

| Gross formulation improvements and clean-label popularity | Science-driven flavor enhancement, varied uses and sustainability |

The industry has several risks that would impede its sustained success. One major issue remains the low consumer awareness. Although they are increasingly shifting toward low-calorie and sugar-free alternatives, many people in South Korea need more exposure to the product. There is a slower adoption, given that customers would not be aware of many of the advantages of isomalt over others.

So, manufacturers have to significantly invest in consumer education and product marketing to address the gap and create brand awareness. Another risk is the long-standing preference for sweeteners in a traditional sense. Many South Korean consumers have their old practices of using natural sugars and honey in most of their food products.

Thus, the resistance toward using new sugar substitutes might slow growth for food and beverage categories that significantly rely on sweeteners. Hence, it becomes imperative that companies strive to redefine isomalt's appeal to include the tastes and preferences of locational attributes.

The other major risk is the regulatory framework. Standards and guidelines regarding functional food, which include sweeteners, within the country's boundaries, are not static. Such variation could introduce ambiguity in the whole system, largely affecting the industry, as it could entail new classification requirements and change allowed health claims on product labeling. Companies must stay vigilant and monitor changes to these public regulations while trying to ensure that their products comply with the strictures or adapt to these new standards.

The production of isomalt is very costly and is rarely available. This means that manufacturers and consumers will both face enormous logistical and financial challenges to access it. The difficult process involved in producing isomalt leads to higher prices than all other sugar alternatives, making it less available to price-sensitive consumers. The relatively limited supply chain could restrict adoption in more cost-conscious industry segments.

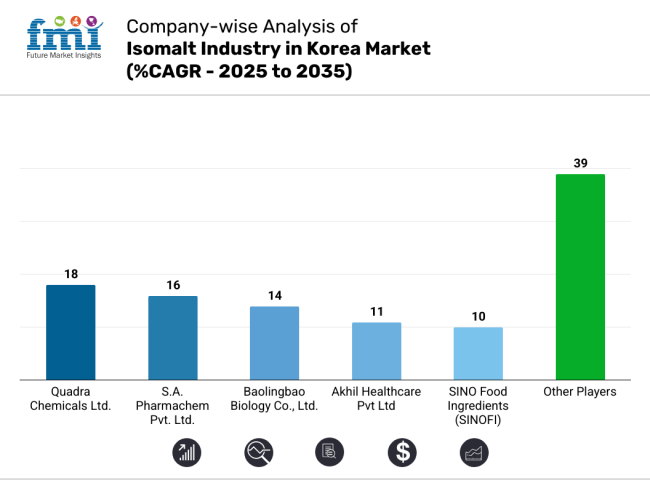

The isomalt industry in Korea is characterized by a diverse range of players, from large multinational corporations to specialized regional suppliers, offering a variety of products tailored to the growing demand for low-calorie sweeteners.

The industry is primarily driven by the rising health consciousness among consumers, particularly those seeking sugar substitutes for weight management, diabetic diets, and gluten-free options. Leading players such as Quadra Chemicals Ltd., S.A. Pharmachem Pvt. Ltd., and Baolingbao Biology Co., Ltd. have established a strong foothold by offering a wide array of products for both food and pharmaceutical applications.

Quadra Chemicals Ltd. is one of the top competitors in Korea, leveraging its extensive distribution networks and a long-standing reputation for producing high-quality products. Baolingbao Biology Co., Ltd., a key player in Asia, strengthens its position by diversifying its offerings, including both food-grade and pharmaceutical-grade Isomalt.

Regional players like Akhil Healthcare Pvt. Ltd. and SINO Food Ingredients (SINOFI) offer targeted solutions for specific customer needs, such as customized sweetener blends for confectionery and baked goods. Meanwhile, Wako Pure Chemical Industries, Ltd. and FUJIFILM Wako bring advanced technology and research into production, driving innovation in product purity as well as functionality.

The competitive landscape is also shaped by Wilmar Bio Ethanol and KF Specialty Ingredients, which focus on increasing revenue share by leveraging cost-effective production methods and catering to the growing demand for natural, clean-label sweeteners. The industry continues to see increasing investment in R&D to improve the properties of this sweetener, such as solubility and sweetness profile, to match evolving consumer preferences.

Market Share Analysis by Company

Key Company Insights

Quadra Chemicals Ltd. dominates with a considerable share of 14-18%. The company is best known for its extensive product portfolio and an impressive rapport with its customers, which has allowed it to have a firm grip in the food segment as well as in pharmaceuticals. Quadra invests in R&D, introducing innovations in sweetener solutions with the intention of capturing changing consumer preferences toward healthier sweetener alternatives.

It also doubles its competition with S.A. Pharmachem Pvt. Ltd., having a share between 12% and 16%. One of the strongholds of S.A. Pharmachem is its manufacturing setup combined with global supply chains. The government mandates that the quality meets specifications for food and pharmaceutical products. This focus helped it acquire a significant revenue share in Korea. The company is expected to expand through more distribution networks and the development of brand recognition.

Baolingbao Biology Co., Ltd. captures about 10-14% of the share, which is enhanced due to its capability to produce Isomalt products at both food and pharmaceutical grades. Customized solutions specifically for the needs of confectionery producers have secured the stronghold for the company, especially focusing on natural sweeteners for the health-conscious consumer. Akhil Healthcare Pvt Ltd occupies 8-11% of the revenue.

The company differentiates itself with a wide range of specialized sweeteners with an emphasis on diabetic diets and other health-conscious segments. Its success in niche markets helps Akhil Healthcare consistently grow in the region. SINO Food Ingredients (SINOFI) is in the 7-10% range and continues to strengthen its presence in Korea through studies on the increasing demand for natural and clean-label ingredients. The low-cost yet effective quality of products has helped the company expand its revenue share, especially in the bakery and confectionery segment.

By nature, the industry is segmented into organic and conventional.

By form, the industry is segmented intopowder and syrup.

The segmentation is into Confectionary, Sugar Confectionary, Bakery Products, Breakfast Cereals and Bars, Dairy Products, Frozen Desserts, Beverages, Sports Drink, Meat and Fish Products, Infant Formula, Pharmaceuticals, and Others.

The regions covered include South Korea, including South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the Rest of Korea.

The isomalt market in South Korea is expected to reach USD 8.54 million in 2025.

The market is projected to grow to USD 13.47 million by 2035.

The market is expected to grow at a CAGR of approximately 4.7% during the forecast period.

Conventional isomalt represents a key segment in the South Korean market.

Key players include Quadra Chemicals Ltd., S.A. Pharmachem Pvt. Ltd., Baolingbao Biology Co., Ltd., Akhil Healthcare Pvt Ltd, SINO Food Ingredients (SINOFI), Wako Pure Chemical Industries, Ltd, FUJIFILM Wako, Deiman SA de CV, Wilmar BioEthanol, and KF Specialty Ingredients.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 15: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 17: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 21: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 22: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 23: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 25: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 26: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 27: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 29: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 10: Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 14: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 22: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 23: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 26: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 27: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 28: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 29: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 30: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 31: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 33: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 34: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 35: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 36: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 37: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 38: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 39: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 40: South Gyeongsang Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 41: South Gyeongsang Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 42: South Gyeongsang Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 43: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 44: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 45: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 46: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 47: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 48: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 49: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 50: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 51: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 52: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 53: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 54: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 55: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 56: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: North Jeolla Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 59: North Jeolla Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 60: North Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 61: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 62: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 63: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 64: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 65: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 66: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 67: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 68: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 69: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 70: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 71: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 72: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 73: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 74: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 75: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 76: South Jeolla Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 77: South Jeolla Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 78: South Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 79: Jeju Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 80: Jeju Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 81: Jeju Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 82: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 83: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 84: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 85: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 86: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 87: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 88: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 89: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 90: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 91: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 92: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 93: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 94: Jeju Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 95: Jeju Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 96: Jeju Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 97: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 98: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 99: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 102: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 106: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 110: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 113: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 114: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Korea On-shelf Availability Solution Market – Demand & Forecast 2025 to 2035

Korea Customized Premix Market Analysis – Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA