The global beet sugar market is valued at USD 4.8 billion in 2025 and is projected to reach USD 8.2 billion by 2035, growing at a CAGR of 5.4%. Growth is anticipated to be driven by changing consumer sentiment toward cane sugar alternatives, combined with increasing demand from confectionery and pharmaceutical sectors.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 4.8 billion |

| Projected Industry Value (2035F) | USD 8.2 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

In Europe, average beet yields have crossed 31 tons per hectare in 2024, supported by precision farming and favorable climate cycles. North American cooperatives now supply over half of domestic sugar needs through beet production. Non-GMO and organic beet sugar is gaining traction, especially in clean-label food and beverage segments, with premium variants capturing over 10% of specialty sugar sales in the EU.

Energy-efficient crystallization and water reuse systems have reduced processing costs by around 15%, improving margins for refiners. In Asia, beet sugar imports are rising steadily as urbanization fuels demand for consistent-quality sweeteners in bakery and drink formulations. As buyers look for traceable, climate-resilient sources, beet sugar is emerging as a preferred alternative to cane in both bulk and specialty applications.

As of 2025, the beet sugar market is estimated to hold a steady presence across several global industries. Around 20% of the total global sugar production is contributed by beet sugar, with cultivation concentrated in regions such as Europe and North America. Within the sweeteners market, a share of nearly 18-20% is maintained by beet sugar, supported by its use as a natural alternative to cane and synthetic options.

Approximately 5-7% of the food and beverage ingredients market is occupied by beet sugar, largely due to its application in confectionery, bakery, and soft drinks. In the agricultural commodities market, a contribution of close to 10% is recorded. The processed food market sees beet sugar accounting for nearly 3-4%.

The beet sugar market is witnessing strong momentum across key segments including white sugar, powdered form, bakery applications, and conventional nature. Growth is driven by rising demand for refined sweeteners, processed foods, and premium baked goods.

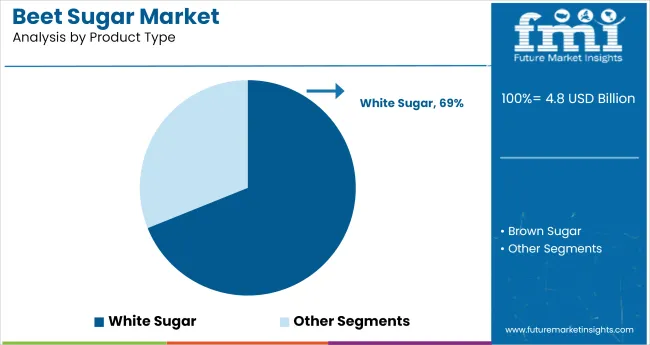

White sugar is projected to account for 68.9% of the total beet sugar market share by 2025. It remains the industry standard for refined sweetness and is widely used in food processing, beverages, and confectionery. Its neutral flavor, long shelf life, and high solubility make it a staple across industrial and domestic applications.

Powdered sugar is forecasted to lead the form segment, holding 29.7% of the global beet sugar market by 2025. Its fine texture and quick solubility make it the go-to ingredient for frostings, icings, and desserts. The segment is gaining traction as demand grows for visually appealing bakery and confectionery products.

Bakery products are expected to dominate the application segment, securing 28% of the global market share by 2025. From commercial bakeries to artisanal brands, beet sugar plays a central role in shaping flavor, structure, and color of baked goods. Demand is bolstered by increased snacking and indulgence behavior worldwide.

Conventional beet sugar is set to lead the nature category, representing 89% of the total market by 2025. Widespread availability, lower costs, and established supply chains ensure its dominance in both food processing and consumer markets. Growth is particularly strong in developing economies seeking affordable sweetener options.

The market is advancing steadily as localized production gains preference over cane imports in temperate regions. In 2024, over 37% of Europe’s total sugar output came from sugar beets, with key producers in France, Germany, and Russia scaling up investments in yield-optimized beet varieties and efficient processing systems.

Increased Production in Europe, Central Asia, and North America

Regional self-sufficiency targets and subsidy-backed beet cultivation are supporting output growth. In the USA, over 56% of domestically produced sugar in 2023 came from beets, with processing plants in Minnesota and North Dakota operating year-round. Uzbekistan and Kazakhstan are also investing in beet sugar plants to reduce cane sugar dependency.

Efficiency Gains in Beet Processing and Co-Product Recovery

Modern extraction lines are yielding more sugar per hectare through energy recovery systems and optimized crystallization stages. In 2024, over 40% of beet sugar mills globally integrated co-product systems to recover molasses, beet pulp, and bioethanol. European producers are leveraging anaerobic digesters to generate biogas from beet waste.

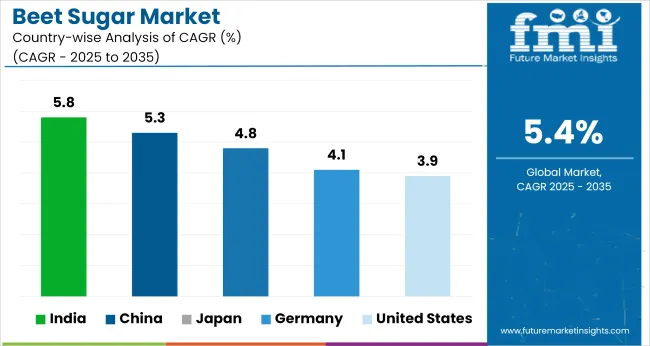

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.8% |

| China | 5.3% |

| Japan | 4.8% |

| Germany | 4.1% |

| USA | 3.9% |

The global market is projected to grow at a 5.4% CAGR between 2025 and 2035, yet growth diverges significantly across BRICS, ASEAN, and OECD economies based on agronomic conditions and processing modernization. India, with a 5.8% CAGR, outpaces the global average as BRICS-aligned states push for water-resilient beet crops over traditional cane.

Hybrid seed deployment and rising private mill investments in Maharashtra are lifting yields beyond 65 tons per hectare. China, growing at 5.3%, remains just below the global pace, with Inner Mongolia and Heilongjiang accounting for nearly 70% of output, supported by subsidies on automated beet harvesters.

Japan posts a 4.8% CAGR, driven by Hokkaido’s precision-farming clusters but constrained by high labor costs. In contrast, OECD leaders like Germany (4.1%) and the USA (3.9%) lag due to rigid sustainability regulations and legacy processing systems. This gap signals market concentration shifting toward Asia’s beet-intensive, yield-efficient zones.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The market in India is projected to expand at a CAGR of 5.8% through 2035. Driven by climate-related risks to cane production, northern states like Punjab and Uttar Pradesh are turning to sugar beet as a water-efficient crop alternative. ISMA-supported pilot programs are demonstrating high-yield varieties with lower input costs. Food processors are sourcing beet sugar for confectionery and bakery applications, especially in tier-1 cities. Investment is increasing in decentralized crushing units designed for flexible crop processing windows.

China is forecast to grow at a CAGR of 5.3% through 2035. The Xinjiang region remains the production hub, contributing over 60% of national beet output. Policy shifts favoring reduced cane sugar imports are encouraging localized beet sugar processing. COFCO and other state-linked processors are upgrading crystallization and filtration systems to meet refined sugar standards. Domestic beverage and instant food manufacturers are incorporating beet sugar as a traceable, non-GMO sweetener option in their product lines.

Japan’s market is projected to grow at a CAGR of 4.8% through 2035. Hokkaido accounts for nearly all domestic production, supported by government subsidies under Japan’s food security program. The processed food sector is adopting beet sugar in response to rising demand for locally sourced, clean-label ingredients. Japanese refiners are offering specialty beet-derived sugars for functional foods and baby nutrition. Growth is also driven by seasonal confectionery and premium beverage blends featuring domestic sweetener sourcing.

Germany is expected to grow at a CAGR of 4.1% during the forecast period. As Europe’s largest beet sugar producer, Germany continues to invest in precision agriculture and automated beet harvesting systems. Südzucker and Nordzucker are optimizing energy efficiency and bioethanol integration at processing facilities. Clean-label food manufacturers in the EU are increasingly sourcing domestically refined beet sugar for organic and sustainable product lines. Beet pulp byproducts are also seeing demand in livestock feed and bioplastics.

The USA market is projected to grow at a CAGR of 3.9% through 2035. North Dakota, Minnesota, and Idaho lead production under cooperative models that ensure grower profitability. Sustainability pressures and GMO scrutiny are encouraging refiners to promote non-GMO beet varieties and eco-certified processing. Food manufacturers are turning to beet sugar as a stable-price sweetener amid cane price volatility. Retailers are also stocking more private-label goods sweetened with USA-sourced beet sugar.

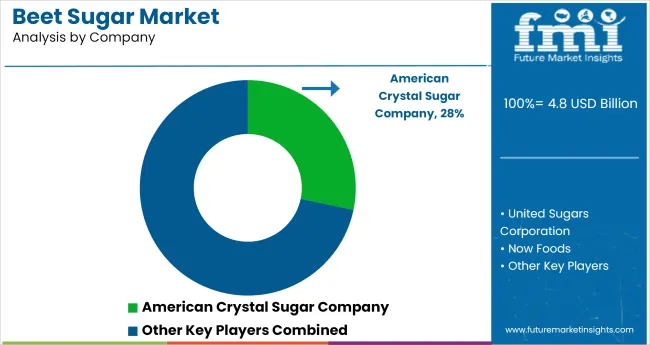

The industry is moderately consolidated, with clear performance differentials among key players. American Crystal Sugar Company dominates the USA with annual production exceeding 3 million tons, backed by 2,800 grower-shareholders and seven factories. United Sugars Corporation, co-owned by Crystal, Cargill, and Minn-Dak, leads in industrial beet sugar distribution, supplying over 25% of the USA market’s ingredient-grade sugar.

In Europe, British Sugar processes over 8 million tons of sugar beet annually and supplies nearly 50% of the UK's sugar needs. Cosun Beet Company emphasizes climate-neutral production by 2030 and leads the EU in sugar beet ethanol integration. Michigan Sugar Company, with its Pioneer® brand, competes in regional markets via retail penetration and processing plant upgrades.

Recent Beet Sugar Industry News

In July 2024, British Sugar and NFU Sugar finalized a flexible contract for the 2025/26 crop priced between £33 and £30.70 per ton. The agreement boosts grower confidence, secures long-term beet supply, and strengthens sourcing strategies amid increasing volatility in European beet sugar production and pricing structures.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.8 billion |

| Projected Market Size (2035) | USD 8.2 billion |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Product Types Analyzed (Segment 1) | White Sugar, Brown Sugar |

| Forms Analyzed (Segment 2) | Granulated Sugar, Powdered Sugar, Liquid Sugar |

| Applications Analyzed (Segment 3) | Dairy Products, Bakery Products, Beverages, Confectionery Products, Dietary Supplements, Snacks, Others (Electrolyte Mixes, Pharmaceuticals) |

| Nature Analyzed (Segment 4) | Organic, Conventional |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | American Crystal Sugar Company, United Sugars Corporation, Now Foods, Domino Sugar, Michigan Sugar Company, Amalgamated Sugar Company, Southern Minnesota Cooperative, Western Sugar Cooperative, Longmont Sugar Company, Cosun Beet Company, British Sugar, Associated British Foods plc (ABF) |

| Additional Attributes | Dollar sales by product and form, rising demand for natural sweeteners, increased use in functional food and beverage categories, and growing availability of organic beet sugar across retail channels. |

This segment is categorized into white sugar and brown sugar.

This segment is categorized into granulated sugar, powdered sugar, and liquid sugar.

This segment is categorized into dairy products, bakery products, beverages, confectionery products, dietary supplements, snacks, and others, which include electrolyte mixes and pharmaceuticals.

This segment is categorized into organic and conventional.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The market is expected to reach USD 8.2 billion by 2035.

The market is anticipated to grow at a CAGR of 5.4% during the forecast period.

White sugar dominates the market with a 68.9% share in 2025.

Powdered sugar is the leading form, accounting for a 29.7% share in 2025.

India is projected to lead with a CAGR of 5.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sugar Beet Pectin Market Growth - Functional Applications & Demand 2025 to 2035

Sugar Beet Juice Extract Market Analysis by Confectionery, Cosmetics & Personal care, Dietary supplements, Sports Nutrition, Biofuel Through 2035

Beetroot Powder Market Size and Share Forecast Outlook 2025 to 2035

Beet Pulp Market Size and Share Forecast Outlook 2025 to 2035

Beetroot Molasses Market

Demand for Beet Pulp in EU Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane Bottle Market Forecast and Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Sugared Egg Yolk Market Size and Share Forecast Outlook 2025 to 2035

Sugar Toppings Market Size, Growth, and Forecast for 2025 to 2035

Sugarcane Fiber Bowls Market – Growth & Demand 2025 to 2035

Sugar-based Excipients Market Analysis by Product, Type, Functionality, Formulation, and Region Through 2035

Sugar-Free Sweets Market Growth - Trends & Consumer Preferences 2025 to 2035

Sugar Substitute Market Trends - Low-Calorie Sweeteners & Demand 2025 to 2035

Sugar-Free Gummy Market Insights - Consumer Trends & Growth 2025 to 2035

Sugar-Free Syrups Market Insights - Innovations & Consumer Demand 2025 to 2035

Sugar-Free White Chocolate Market Trends - Demand & Growth 2025 to 2035

Sugar-Free Cookies Market Insights - Consumer Trends 2025 to 2035

Sugar Alcohol Market Trends - Growth & Sweetener Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA