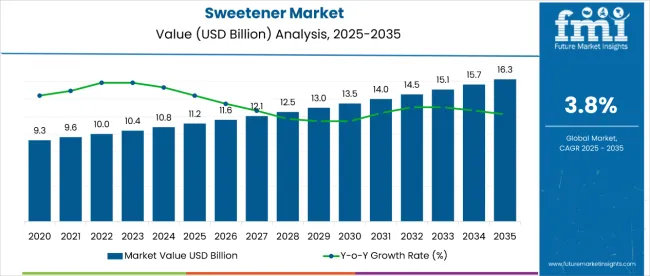

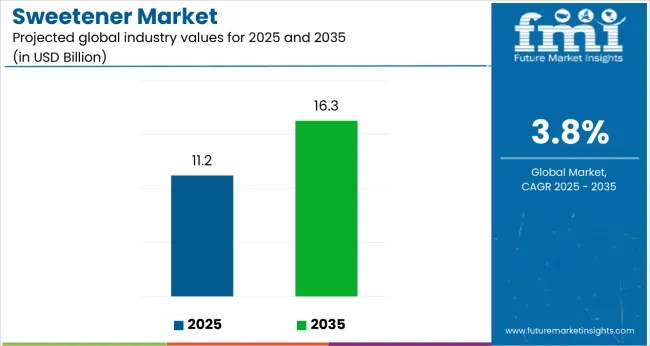

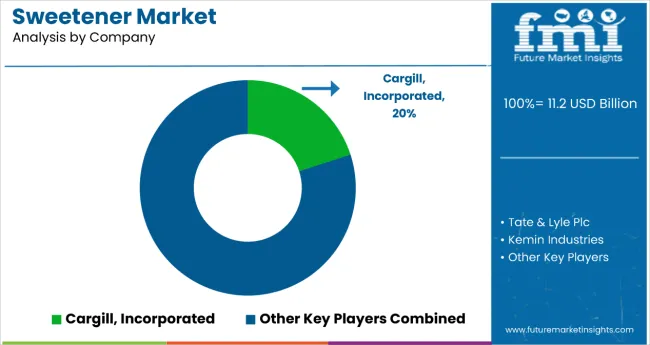

The sweetener market is estimated to be valued at USD 11.2 billion in 2025 and is projected to reach USD 16.3 billion by 2035, registering a CAGR of 3.8% over the forecast period. The market is expected to add an absolute dollar opportunity of USD 5.1 billion during this period. This reflects a 1.45 times growth at a CAGR of 3.8%. The market evolution is expected to be shaped by increasing consumer demand for low-calorie and natural sweeteners, rising health awareness, and expansion in the processed food and beverage sectors.

By 2030, the market is projected to reach USD 13.5 billion, with an incremental gain of USD 2.3 billion in the first half of the decade. Between 2030 and 2035, an additional USD 3.5 billion is expected, highlighting steady growth supported by the proliferation of functional foods, innovative sugar alternatives, and favorable regulations in North America and Europe.

Companies, such as Tate & Lyle Plc, Kemin Industries, DuPont, Cargill, Ajinomoto Co., Archer Daniels Midland, Nestlé S.A., Wilmar International, Ingredion, Roquette Freres, JK Sucralose, Hermes Sweeteners, McNeil Nutritionals, Beijing Vitasweet, and Madhava Sweeteners, are strengthening market presence through product innovations, capacity expansions, and strategic partnerships. Sustainability, regulatory compliance, and clean-label trends are expected to remain central to market growth.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 11.2 billion |

| Projected Value (2035F) | USD 16.3 billion |

| CAGR (2025 to 2035) | 3.8% |

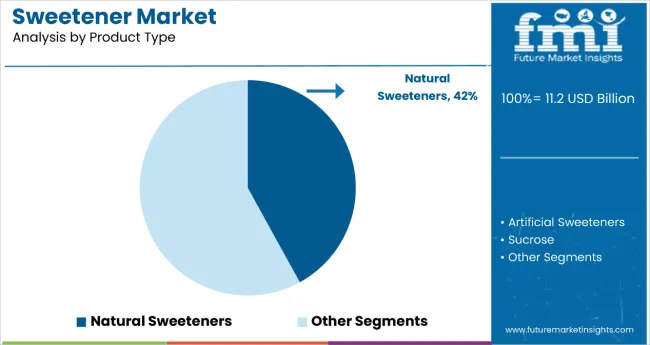

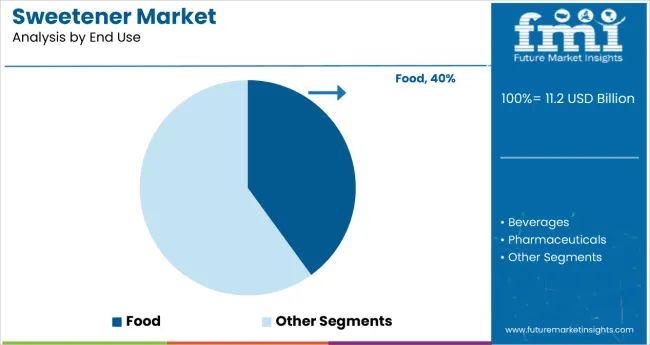

The market holds a strong position across its parent industries, reflecting its rising adoption in food and beverage, pharmaceuticals, and personal care sectors. Within the food and beverage category, natural sweeteners contribute significantly, accounting for about 42% of the market, driven by demand for low-calorie and clean-label products. In pharmaceuticals, sweeteners account for nearly 12% of the market, primarily used in syrups, chewable tablets, and nutraceuticals for taste-masking purposes. In personal care and cosmetics, sweeteners contribute an estimated 6%, fueled by applications in oral care, skincare, and health supplements. Overall, sweeteners hold close to 40% of the broader sugar substitute market, underlining their critical role in industrial and consumer applications.

The market is being driven by expanding demand in food and beverage industries, where sweeteners enhance product appeal, shelf-life, and nutritional positioning. Rising adoption in pharmaceutical formulations and functional foods is further boosting consumption. Innovations are being observed in natural, plant-based, and low-glycemic alternatives, aligning with health trends and regulatory standards. Developments include capacity expansions in Asia-Pacific, particularly in China, India, and Southeast Asia, to meet growing demand from manufacturing hubs and retail markets. Trends show a gradual shift toward sustainable, clean-label, and non-GMO sweeteners, though conventional and natural sweeteners continue to dominate due to their versatility, performance efficiency, and cost-effectiveness. Increasing regulatory emphasis on health, safety, and environmental compliance is shaping R&D strategies and influencing global competition among leading manufacturers.

Sweeteners unique ability to provide sweetness, functionality, and calorie management across diverse industries is driving their adoption. Their versatile properties make them indispensable in food and beverages, pharmaceuticals, and personal care products, where taste, product stability, and consumer health are critical.

Rising demand in the food and beverage sector, where sweeteners improve flavor, shelf-life, and nutritional appeal, is a key growth driver. Growth is further supported by expanding use in pharmaceutical syrups, chewable tablets, and nutraceuticals for taste masking, as well as in personal care products like oral care and health supplements. Technological innovations in natural, plant-based, low-glycemic, and clean-label sweeteners are enhancing both safety and health benefits, aligning with global regulatory trends and consumer preferences.

Increasing industrialization and rising middle-class consumption in Asia-Pacific, along with regulatory emphasis on sugar reduction, health-conscious formulations, and clean-label products in Europe and North America, are strengthening market prospects. As industries prioritize product quality, cost-effectiveness, and sustainability, sweeteners continue to gain traction. With leading manufacturers focusing on natural and functional innovations, strategic partnerships, and capacity expansion, the market is expected to witness steady and long-term growth across its parent industries.

The market is segmented by product type, form, category, nature, end use, sales channel, and region. By product type, the market is categorized into natural sweeteners, artificial sweeteners, sucrose, novel sweeteners, and sugar alcohols. Based on form, the market is segmented into powder, liquid, and crystals. In terms of category, the market is bifurcated into high-intensity sweeteners and low-intensity sweeteners. By nature, the market is divided into organic and conventional sweeteners.

Based on end use, the market is segmented into food, beverages, pharmaceuticals, personal care, and other applications. By sales channel, the market is categorized into hypermarkets/supermarkets, convenience stores, specialty retail stores, traditional grocery retailers, online retailers, and other channels. Regionally, the market spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural sweeteners segment dominates the product type category with a 42% market share, supported by its widespread use as a healthier and clean-label alternative in food, beverages, and pharmaceutical applications. Its functional properties, including low-calorie content, natural origin, and compatibility with diverse formulations, make it indispensable for large-scale bakery, confectionery, and beverage production.

Natural sweeteners are extensively used in sugar-reduced and functional foods, soft drinks, dairy products, and nutraceuticals, owing to their ability to enhance taste, shelf-life, and nutritional value. The rising demand for health-conscious, low-glycemic, and clean-label products in both developed and emerging markets has positioned this segment as the primary growth driver.

Increasing investments in plant-based, organic, and non-GMO formulations, coupled with expanding production capacity in Asia-Pacific, North America, and Europe, are further strengthening demand. Manufacturers are focusing on sustainable and regulatory-compliant production to meet consumer and safety standards. With growing adoption in processed foods, beverages, and health-focused applications, the natural sweeteners segment is expected to remain the cornerstone of sweetener consumption in the coming decade.

The food applications segment dominates the end-use category with a 40% market share, driven by high consumption of sweeteners in bakery, confectionery, dairy, snacks, and processed foods. These products form the backbone of the global food industry, where taste, texture, and nutritional appeal are critical.

Sweeteners are widely used to enhance flavor, reduce sugar content, and improve product shelf-life in both conventional and health-focused foods. The rising demand for healthier, low-calorie, and natural products in developed and emerging markets has positioned this segment as the primary growth driver.

Increasing industrial production, particularly in Asia-Pacific, North America, and Europe, coupled with growing consumer awareness and regulatory encouragement for sugar reduction, is further strengthening demand. Manufacturers are focusing on innovative, high-purity, and clean-label sweetener solutions to meet industrial, nutritional, and environmental requirements. With expanding applications in bakery, beverages, snacks, and dairy, the food applications segment is expected to remain the cornerstone of sweetener consumption in the coming decade.

In 2025, global sweetener demand is estimated at USD 11.2 billion, with Asia-Pacific accounting for nearly 35 to 40% of total consumption. Applications include food, beverages, pharmaceuticals, personal care, and other specialty products. Manufacturers are focusing on natural, organic, plant-based, and clean-label formulations to meet regulatory compliance and consumer demand. Cost-effectiveness, functional versatility, and ability to provide low-calorie and sugar-reduction benefits across multiple industries continue to support market penetration. Specialty and sustainable sweeteners are increasingly being deployed in nutraceuticals, functional foods, and health-oriented beverages, further supporting adoption.

Growing Food and Beverage Demand Drives Sweetener Adoption

The food and beverage sector is the largest consumer of sweeteners, leveraging their flavor-enhancing, sugar-reduction, and shelf-life-extending properties. With global industrial output and processed food production on the rise, sweeteners are witnessing expanded demand. Natural sweeteners, in particular, account for a significant share of applications due to their health benefits, clean-label appeal, and versatility. The ability of sweeteners to improve taste, texture, and nutritional value continues to anchor their adoption. Expanding bakery, confectionery, beverage, and dairy manufacturing in Asia-Pacific, North America, and Europe further strengthens growth prospects.

Regulatory and Health Factors Restrain Expansion

Growth faces limitations due to increasing health and safety regulations, sugar-reduction guidelines, and volatility in raw material prices. Compliance with labeling, food safety, and organic certification standards requires additional investment in production and quality control. Consumer concerns over artificial sweeteners and synthetic additives in certain regions have led to stricter regulations, particularly in Europe and North America. Additionally, dependency on raw materials such as sugar alcohols, stevia extracts, and high-intensity sweeteners presents supply chain challenges. These restraints are encouraging manufacturers to develop clean-label, natural, and eco-friendly formulations while balancing cost-effectiveness and industrial performance.

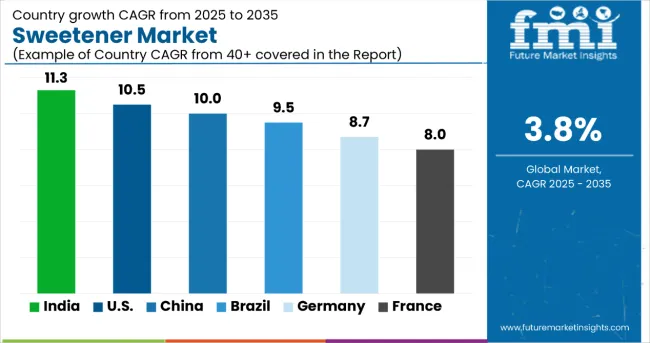

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 11.3% |

| USA | 10.5% |

| China | 10.0% |

| Brazil | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

The sweetener market shows varied growth trajectories across the top six countries. India leads with the highest projected CAGR of 11.3% from 2025 to 2035, supported by rising demand for processed foods, beverages, and natural sweeteners. The USA follows at 10.5%, driven by health-conscious consumer trends, sugar-reduction initiatives, and clean-label adoption. China maintains strong growth at 10.0%, fueled by increasing consumption in bakery, confectionery, and beverage industries. Meanwhile, Brazil (9.5%), Germany (8.7%), and France (8.0%) experience steady growth, reflecting established markets, regulatory support for low-calorie products, and rising adoption of organic and natural alternatives.

The report covers an in-depth analysis of 40+ countries; six top-performing markets are highlighted below.

The sweetener market in India is projected to expand at a CAGR of 11.3% from 2025 to 2035, fueled by rapid growth in food and beverage manufacturing, functional foods, and health-oriented product lines. Manufacturers are investing in natural, plant-based, and organic sweeteners to meet rising consumer demand and regulatory standards. The country’s expanding bakery, dairy, beverage, and nutraceutical industries are driving adoption of low-calorie and clean-label alternatives, while exports of processed foods further strengthen market growth.

Key Statistics:

Sales of sweeteners in the USA are expected to grow at a CAGR of 10.5% from 2025 to 2035, supported by increasing demand for sugar-reduced and functional foods and beverages. Adoption of low-calorie, natural, and clean-label sweeteners is rising to comply with FDA guidelines and consumer preferences. Strong demand in confectionery, dairy, beverages, and nutraceuticals is driving investments in advanced production technologies, while innovation in high-intensity and sugar alcohol sweeteners enhances market growth.

Key Statistics:

Revenue from sweeteners in China is projected to grow at a CAGR of 10.0% from 2025 to 2035, fueled by rising demand in processed foods, beverages, and pharmaceutical syrups. Manufacturers are focusing on organic, natural, and high-purity formulations to meet domestic standards and export requirements. The country’s expanding bakery, confectionery, and beverage industries, along with growing health-conscious consumer trends, are driving adoption of low-calorie sweeteners.

Key Statistics:

Sales of sweeteners in Brazil are expected to grow at a CAGR of 9.5% from 2025 to 2035, supported by expanding food and beverage industries and rising adoption of sugar alternatives in processed foods. Increasing awareness of obesity and diabetes is driving demand for low-calorie and natural sweeteners, while manufacturers invest in plant-based, clean-label, and organic products to meet regulatory and consumer expectations.

Key Statistics:

The sweetener market in Germany is projected to expand at a CAGR of 8.7% from 2025 to 2035, driven by consumer demand for low-calorie, organic, and clean-label products. Manufacturers focus on natural, high-intensity, and plant-based sweeteners to comply with strict EU regulations and meet industrial needs. Expanding applications in bakery, beverages, and functional foods strengthen market adoption, while innovation in sustainable production supports competitive positioning.

Key Statistics:

Demand for sweeteners in France is projected to grow at a CAGR of 8.0% from 2025 to 2035, supported by expanding processed food, beverage, and nutraceutical industries. Manufacturers emphasize organic, natural, and low-calorie sweeteners to meet consumer preferences and regulatory requirements. Growing functional food and beverage consumption, along with export opportunities in Europe, are strengthening market growth.

Key Statistics:

The market is moderately consolidated, comprising multinational food and ingredient corporations, regional producers, and specialized sweetener manufacturers. Key players include Tate & Lyle Plc, Kemin Industries, DuPont, Cargill, Incorporated, Ajinomoto Co., Inc., Archer Daniels Midland Company, Nestlé S.A., Wilmar International Limited, Ingredion Incorporated, Roquette Freres, JK Sucralose, Hermes Sweeteners Ltd., McNeil Nutritionals, Beijing Vitasweet Co. Ltd., and Madhava Sweeteners. These companies leverage advanced production technologies, extensive R&D capabilities, and wide distribution networks to serve applications across food, beverages, pharmaceuticals, personal care, and functional foods.

The market is characterized by a significant share of natural, organic, and high-intensity sweeteners, which accounted for over 60% of total consumption in 2025. These grades are preferred due to their health benefits, clean-label appeal, and regulatory compliance. Conventional and artificial sweeteners remain widely used in beverages, confectionery, and processed foods, while natural and specialty grades are increasingly adopted in nutraceuticals, functional foods, and low-calorie products.

Strategic initiatives such as mergers and acquisitions, joint ventures, regional expansions, and product innovation are common among market participants aiming to strengthen their global footprint. Additionally, companies are investing in sustainable production processes, eco-friendly formulations, and high-purity natural sweeteners to meet evolving regulatory standards and consumer demand. Overall, the sweetener market continues to evolve as established and emerging players focus on technological innovation, clean-label solutions, and expansion into high-growth segments, shaping the competitive landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 11.2 billion |

| Product Type | Natural Sweeteners, Artificial Sweeteners, Sucrose, Novel Sweeteners, and Sugar Alcohol |

| Form | Powder, Liquid, and Crystals |

| Category | High-Intensity Sweeteners and Low-Intensity Sweeteners |

| Nature | Organic and Conventional |

| End Use | Food, Beverages, Pharmaceuticals, Personal Care, and Other Applications |

| Sales Channel | Hypermarkets / Supermarkets, Convenience Stores, Specialty Retail Stores, Traditional Grocery Retailers, Online Retailers, and Other Channels |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Tate & Lyle Plc, Kemin Industries, DuPont, Cargill, Incorporated, Ajinomoto Co., Inc., Archer Daniels Midland Company, Nestlé S.A., Wilmar International Limited, Ingredion Incorporated, Roquette Freres, JK Sucralose, Hermes Sweeteners Ltd., McNeil Nutritionals, Beijing Vitasweet Co. Ltd., and Madhava Sweeteners |

| Additional Attributes | Dollar sales by product type, form, and application; regional demand trends; competitive landscape; consumer preferences for natural versus artificial sweeteners; integration with clean-label and sustainable production practices; innovations in high-purity, organic, and functional sweeteners; quality standardization across food, beverage, pharmaceutical, and personal care applications |

The global sweetener market is estimated to be valued at USD 11.2 billion in 2025.

The market size for sweetener is projected to reach USD 16.3 billion by 2035.

The sweetener market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The natural sweeteners segment is projected to lead in the sweetener market with 42% market share in 2025.

In terms of end use, the food segment is projected to command 40% share in the sweetener market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Sweetener Market Share & Industry Dynamics

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

USA Sweetener Market Report – Trends, Demand & Industry Forecast 2025–2035

Analysis and Growth Projections for Dry Sweeteners Market

Corn Sweeteners Market Outlook - Growth, Demand & Forecast 2025 to 2035

ASEAN Sweetener Market Growth – Trends, Demand & Innovations 2025–2035

Novel Sweeteners Market Analysis by Product Type, End Use, Application and Region from 2025 to 2035

Polyol Sweeteners Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Europe Sweetener Market Outlook – Share, Growth & Forecast 2025–2035

Nutritive Sweetener Market Size and Share Forecast Outlook 2025 to 2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Intensive Sweeteners Market Analysis by Nature, Type, Application, Sales Channel and Region through 2035

Fermented Sweeteners Market

Analysis and Growth Projections for Artificial Sweetener Business

Low-calorie Sweeteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Sweetener Market – Growth, Innovations & Market Demand

Natural Malt Sweeteners Market

Peptide-based Sweetener Size and Share Forecast Outlook 2025 to 2035

Low Intensity Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

Latin America Sweetener Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA