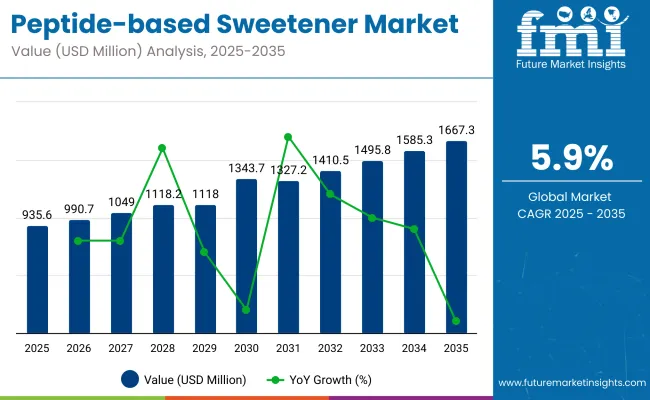

The peptide-based sweeteners market is expected to be valued at USD 935.6 million in 2025 and reach a valuation of USD 1,667.3 million by 2035. An absolute increase of USD 731.7 million is anticipated over the decade, representing a total growth of approximately 78.2%. This expansion reflects a compound annual growth rate (CAGR) of 5.9%, signaling steady yet resilient momentum across functional and clean-label ingredient categories.

| Metric | Value |

|---|---|

| Peptide-based Sweetener Estimated Value in (2025E) | USD 935.6 million |

| Peptide-based Sweetener Forecast Value in (2035F) | USD 1,667.3 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

During the first half of the forecast period from 2025 to 2030 the market is projected to expand from USD 935.6 million to approximately USD 1,243.7 million, contributing nearly USD 308.1 million, or 42% of total decade growth. This phase is expected to be shaped by rising demand for plant-based and fermentation-derived peptides that align with metabolic health trends and sugar reduction mandates.

“Sweet-tasting peptides and natural peptide-based sweeteners are expected to gain traction in functional beverages and diabetic-friendly formulations, as evidenced by Sweegen’s 2024 launches in North America and Ajinomoto’s clinical trials in metabolic beverages (Company Reports, 2024).”

The second half of the decade from 2030 to 2035 is forecasted to add USD 423.6 million, accounting for the remaining 58% of decade growth, as the market is propelled by rapid advances in synthetic biology and precision peptide engineering. During this phase, synthetic and engineered Peptide-based Sweeteners are projected to witness broader regulatory clearance and commercialization. Enhanced solubility, thermal stability, and compatibility with reformulated consumer health products are expected to accelerate penetration across mainstream food and nutraceutical applications.

From 2020 to 2024, the peptide-based sweeteners market grew steadily from an emerging niche to a recognized functional ingredient category, supported by demand in beverages, nutraceuticals, and diabetic-friendly food applications. During this period, fermentation-derived peptide producers held a dominant position, accounting for over 35% of total volume share. Leading players such as Ajinomoto and Sweegen expanded their capabilities through partnerships and synthetic biology platforms to meet the rising demand for clean-label sweeteners.

By 2025, demand is expected to reach USD 935.6 million, with the market transitioning toward digital-first formulation platforms and AI-assisted peptide design. Recurring revenue streams from D2C formulations and ingredient licensing models are expected to surpass 20% share. Competitive advantage is projected to shift from volume-based supply chains toward regulatory flexibility and digital formulation tools, as seen in Conagen’s AI-based peptide screening and Blue California’s proprietary formulation platforms (Ingredient Insights, Q1 2025).

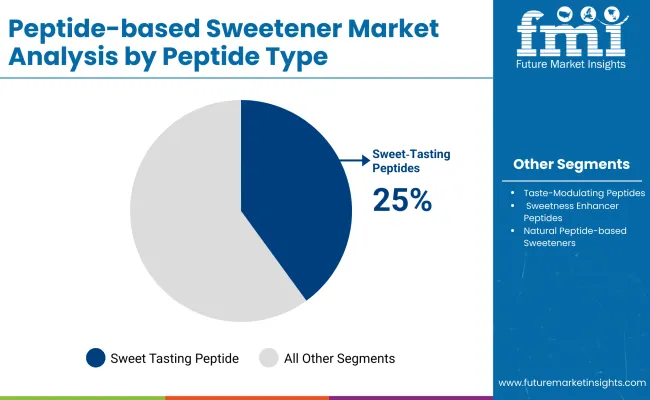

Significant momentum within the peptide-based sweeteners market is being driven by a combination of high-growth peptide types, sustainable sourcing pathways, and functional end-use applications. Among peptide types, natural Peptide-based Sweeteners and sweet-tasting peptides are expected to lead, supported by CAGRs of 9.5% and 9.2% respectively. These segments are being increasingly preferred due to their clean-label appeal and regulatory compatibility in both food and health applications.

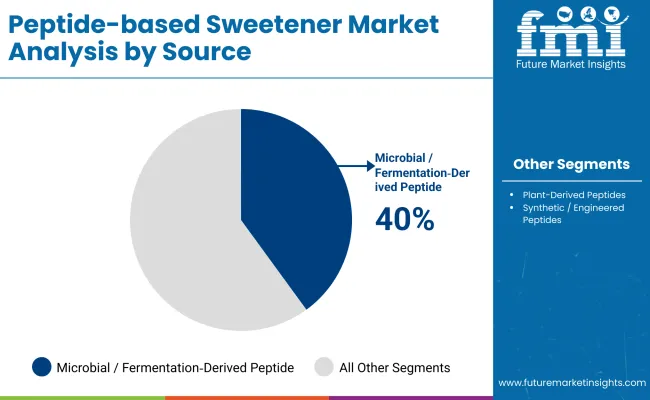

By source, microbial and fermentation-derived peptides are projected to dominate growth with a 9.6% CAGR, aided by precision fermentation advances and favorable consumer perception of “bio-native” ingredients. Plant-derived peptides, contributing 30% of 2025 value share, are also gaining ground owing to their sustainable sourcing and ease of formulation integration.

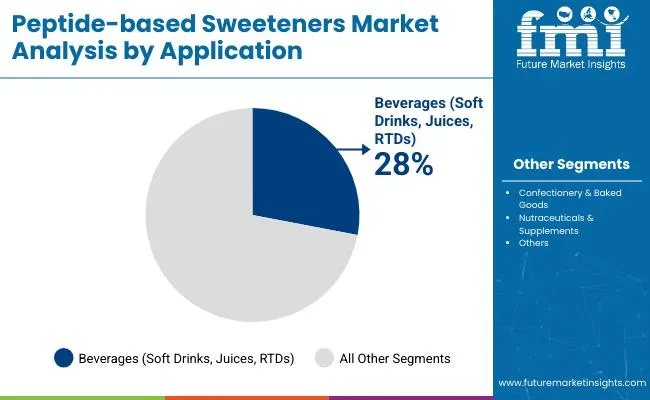

On the application front, beverages are forecasted to contribute the highest growth, driven by their 28% market share and 9.5% CAGR, as Peptide-based Sweeteners are being rapidly adopted in functional drinks and reformulated soft beverages. Tabletop sweeteners and confectionery segments are also emerging as high-opportunity areas due to shifting consumer preferences for low-calorie indulgence products.

The peptide-based sweeteners market has been segmented across Peptide Type, Source, and Application to provide a comprehensive understanding of growth patterns and innovation pathways. Each segment has been defined based on its molecular profile, production origin, and use-case alignment, allowing targeted strategy development across stakeholders.

Peptide Type segmentation includes sweet-tasting peptides, taste-modulating peptides, sweetness enhancer peptides, natural Peptide-based Sweeteners, and synthetic Peptide-based Sweeteners. These classifications reflect how peptides interact with sweetness receptors and metabolic pathways, offering differentiated value propositions across applications.

Source segmentation spans plant-derived, animal-derived, microbial/fermentation-derived, and synthetic/engineered peptides. Source selection plays a key role in regulatory acceptance, scalability, and clean-label positioning.

Application segmentation includes beverages, confectionery & baked goods, dairy products, nutraceuticals, pharmaceuticals, and tabletop sweeteners. These categories are being shaped by shifting dietary patterns, functional product innovation, and sugar replacement mandates.

| Peptide Type Segment | Market Value Share, 2025 |

|---|---|

| Sweet Tasting Peptides | 25.0% |

| Taste Modulating Peptides | 20.0% |

The peptide type segment is expected to be led by natural Peptide-based Sweeteners and sweet-tasting peptides, each contributing 25% of market value in 2025. Demand for natural peptides has been reinforced by clean-label imperatives, while sweet-tasting peptides are being favored for their palatability and compatibility across categories.

Growth rates above 9% are forecasted across all types, signaling broad-based adoption. Formulation flexibility, regulatory clarity, and health-aligned marketing are expected to further strengthen these sub segments. Synthetic peptides, while contributing less, are anticipated to gain traction as bioengineering advances enable high-performance sweetness profiles.

| Source | 2025 Share% |

|---|---|

| Microbial / Fermentation Derived Peptides | 40.0% |

| Plant Derived Peptides | 30.0% |

| Animal Derived Peptides | 15.0% |

Microbial and fermentation-derived peptides are forecasted to contribute the largest share at 40% of the market in 2025, supported by strong CAGR of 9.6%. This dominance is being reinforced by scalability, sustainability, and strong consumer acceptance of fermentation-based “bio-native” solutions.

Plant-derived peptides, with a 30% share, are also gaining ground through alignment with vegan and allergen-free formulation needs. Synthetic/engineered peptides are expected to see innovation-led growth through synthetic biology platforms that enhance sweetness intensity and thermal stability. Animal-derived peptides remain niche but are being explored for pharmaceutical-grade applications.

| Application | 2025 Share% |

|---|---|

| Beverages (Soft Drinks, Juices, RTDs) | 28.0% |

| Confectionery & Baked Goods | 20.0% |

| Nutraceuticals & Supplements | 15.0% |

The beverage segment is projected to account for 28% of market value in 2025, driven by the rapid adoption of peptide-based sweeteners in functional beverages, soft drinks, and reformulated juices. Peptides are being selected for their low glycemic impact and flavor-enhancing properties, making them ideal for health-oriented beverages.

Confectionery and baked goods, together with tabletop sweeteners, are also expected to record strong growth as sugar-reduction trends gain policy and consumer backing. Applications in nutraceuticals and pharmaceuticals are forecasted to expand, especially where peptides double as bioactive agents offering therapeutic value beyond sweetness.

Health-driven reformulations and regulatory sugar mandates, including the UK’s Soft Drinks Industry Levy and India’s FSSAI reformulation program, are accelerating the adoption of peptide-based sweeteners across mainstream beverage categories.

Regulatory Pressure for Sugar Reduction and Metabolic Health

The peptide-based sweeteners market is being significantly driven by escalating global regulatory mandates targeting sugar reduction in processed foods and beverages. Policies such as sugar taxes, front-of-pack labeling, and WHO dietary guidelines have reinforced the shift toward alternative sweetening solutions that offer both safety and efficacy.

Peptide-based sweeteners, especially those derived from natural or fermentation processes, have been increasingly favored due to their metabolic neutrality and minimal caloric impact. As non-communicable disease burdens intensify globally, particularly diabetes and obesity, public health agencies are expected to expand reformulation frameworks. In this context, peptide-based solutions are being positioned not only as sugar substitutes but as functional metabolic agents aligned with long-term health goals.

Precision Fermentation Unlocking Cost-Effective Sweetener Innovation

A pivotal trend reshaping the peptide-based sweeteners landscape is the advancement of precision fermentation technologies. These platforms are enabling cost-effective, scalable, and customizable production of sweet peptide molecules that were previously limited by extraction inefficiencies or high biosynthesis costs.

Through microbial chassis optimization and protein structure engineering, peptides can now be designed for targeted sensory profiles, improved solubility, and greater shelf stability. As bio foundry models and synthetic biology collaborations expand, the time-to-market for novel Peptide-based Sweeteners is expected to shrink considerably. This technological shift is positioning peptide-based sweeteners as commercially viable for mainstream CPG brands seeking clean-label, next-gen sweetening agents.

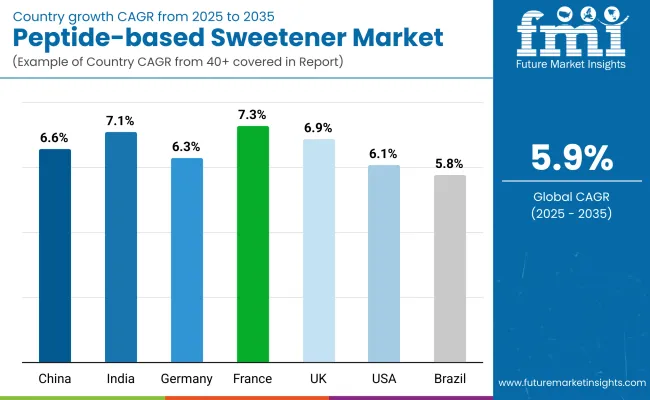

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.6% |

| India | 7.1% |

| Germany | 6.3% |

| France | 7.3% |

| UK | 6.9% |

| USA | 6.1% |

| Brazil | 5.8% |

The global peptide-based sweeteners market is expected to experience uneven geographic expansion, shaped by regulatory intensity, food reformulation mandates, and biomanufacturing investments. Countries such as France, India, and the UK are forecasted to lead growth, with CAGRs of 7.3%, 7.1%, and 6.9%, respectively, as clean-label dietary frameworks and sugar reduction policies are being institutionalized. In France, peptide-based sweeteners are being increasingly incorporated into health-positioned beverages and functional dairy alternatives, supported by strong innovation ecosystems and EU health regulations.

In India, market acceleration is being driven by rising middle-class health awareness and government support for nutraceutical innovation. Local food and beverage manufacturers are expected to integrate fermentation-derived peptides into diabetic-friendly and sports nutrition formats. Meanwhile, China, at 6.6% CAGR, is projected to maintain steady adoption, bolstered by investments in synthetic biology platforms and precision fermentation hubs.

Germany and the USA, with CAGRs of 6.3% and 6.1% respectively, are witnessing moderate growth, where adoption is being led by institutional foodservice, pharmaceutical applications, and early integration of Peptide-based Sweeteners in clinical nutrition. In Brazil, although growth is slower at 5.8%, demand is expected to rise as health taxes on sugar are expanded and wellness-positioned product portfolios diversify across regional brands.

| Year | USA Peptide-based Sweetener(USD million) |

|---|---|

| 2025 | 224.5 |

| 2026 | 237.9 |

| 2027 | 251.2 |

| 2028 | 265.3 |

| 2029 | 281.4 |

| 2030 | 295.6 |

| 2031 | 313.5 |

| 2032 | 329.5 |

| 2033 | 351.8 |

| 2034 | 373.0 |

| 2035 | 397.7 |

The peptide-based sweeteners market in the United States is projected to grow from USD 224.5 million in 2025 to USD 397.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.8%. Growth is being propelled by aggressive reformulation initiatives among food and beverage manufacturers responding to FDA guidelines and evolving consumer expectations for low-glycemic, clean-label products.

Peptide-based Sweeteners have been increasingly adopted in functional beverages and sugar-free dairy alternatives, with preference being shown for fermentation-derived and plant-based peptide sources. Steady demand has also been observed in the nutraceuticals and dietary supplements segment, where sweeteners with metabolic neutrality are favored.

Digital retail platforms and D2C wellness brands have been instrumental in mainstreaming awareness around peptide-based alternatives. Software-led nutritional scoring tools and label transparency initiatives are creating favorable market conditions for peptides over artificial or synthetic counterparts.

The peptide-based sweeteners market in the United Kingdom is forecasted to witness steady expansion through 2035, supported by a CAGR of 6.9%. Regulatory momentum under the UK Soft Drinks Industry Levy has been intensifying pressure on manufacturers to reduce added sugar, leading to increased adoption of peptide-based alternatives.

Health-oriented consumer preferences are being shaped by NHS-backed public health campaigns, further elevating demand for low-glycemic sweeteners in ready-to-drink products. Clean-label peptides derived from plant and fermentation sources are being prioritized in bakery, dairy, and adult nutrition categories. Regulatory clarity post-Brexit has allowed new ingredient approvals to be fast-tracked under UK-specific food safety policies.

In India, the peptide-based sweeteners market is projected to grow at a robust 7.1% CAGR through 2035, driven by heightened urban health consciousness and rising demand for diabetic-friendly food solutions. Government-led initiatives promoting sugar reduction, such as FSSAI's Eat Right India movement, have encouraged both domestic and multinational brands to invest in peptide-based alternatives.

Nutraceuticals and ayurvedic supplement sectors are witnessing peptide integration, particularly in herbal formulations requiring palatable sweetness without compromising efficacy. Demand is also being propelled by growing e-commerce penetration and startup-led innovation in functional beverages and snacks.

The peptide-based sweeteners market in China is expected to grow steadily at a 6.6% CAGR, supported by strong investments in synthetic biology and food innovation infrastructure. National sugar-reduction policies and alignment with global dietary guidelines have stimulated industry interest in fermentation-derived and engineered Peptide-based Sweeteners.

The beverage sector-particularly functional tea, yogurt drinks, and meal replacements is being prioritized for reformulation using heat-stable, high-intensity peptide options. Consumer acceptance has been facilitated by widespread health tracking apps and increased awareness of glycemic response in diet.

| Countries | 2025 |

|---|---|

| UK | 20.4% |

| Germany | 21.8% |

| Italy | 9.0% |

| France | 12.9% |

| Spain | 11.4% |

| BENELUX | 6.9% |

| Nordic | 5.1% |

| Rest of Europe | 12.4% |

| Countries | 2035 |

|---|---|

| UK | 20.1% |

| Germany | 21.3% |

| Italy | 10.5% |

| France | 13.6% |

| Spain | 11.4% |

| BENELUX | 5.5% |

| Nordic | 5.9% |

| Rest of Europe | 11.8% |

Germany’s peptide-based sweeteners market is forecasted to expand at a 6.3% CAGR, fueled by its leadership in clean-label innovation and functional food engineering. Sugar taxes and EU labeling laws have prompted proactive reformulation strategies across the food and beverage value chain.

Peptide-based Sweeteners are being increasingly adopted in plant-based dairy alternatives, energy bars, and pharmaceutical syrups where low-glycemic performance and thermal resilience are critical. Sustainability narratives have favored fermentation- and plant-derived peptides over chemically synthesized sweeteners.

| Peptide Type | Market Value Share, 2025 |

|---|---|

| Sweet Tasting Peptides | 26.0% |

| Taste Modulating Peptides | 21.0% |

| Sweetness Enhancer Peptides | 14.0% |

| Natural Peptide-based Sweetener s | 24.0% |

| Synthetic Peptide-based Sweetener s | 15.0% |

The peptide-based sweeteners market in Japan is projected to achieve steady growth through 2035, driven by heightened consumer health awareness and national policies targeting sugar intake reduction. In 2025, sweet-tasting peptides are expected to lead with 26% share, followed closely by natural Peptide-based Sweeteners at 24%, highlighting Japan’s strong preference for functional and clean-label food ingredients.

This distribution reflects a nuanced shift toward metabolically safe sweetness enhancers that align with the country's rising aging population and their dietary needs. Sweetness enhancer peptides, though contributing a smaller share of 14%, are forecasted to grow rapidly due to their integration in wellness-positioned beverages and low-calorie supplements.

Product innovation has been largely supported by Japanese manufacturers’ emphasis on bioactive functionality, precise flavor calibration, and synergy with traditional dietary formats. Regulatory approval processes have remained robust yet favorable, allowing rapid commercialization of fermentation-derived peptides.

| Source | Market Value Share, 2025 |

|---|---|

| Plant Derived Peptides | 31.0% |

| Animal Derived Peptides | 14.0% |

| Microbial / Fermentation Derived Peptides | 40.0% |

| Synthetic / Engineered Peptides | 15.0% |

The peptide-based sweeteners market in South Korea is projected to expand steadily through 2035, driven by a national emphasis on functional health foods and clean-label innovation. In 2025, microbial and fermentation-derived peptides are expected to dominate with a 40% market share, reflecting the country’s strategic investments in precision fermentation and bio manufacturing infrastructure.

Plant-derived peptides, contributing 31%, are being increasingly incorporated into low-glycemic traditional foods and K-beauty-inspired functional beverages. South Korea’s regulatory framework has enabled the early adoption of naturally sourced bioactive ingredients, which has favored both local R&D and global brand entry.

Synthetic/engineered and animal-derived peptides together make up 29%, with growth being seen in pharmaceutical and clinical nutrition channels. As urban consumers seek sugar alternatives that align with metabolic health, digestive wellness, and sustainability, the market is expected to continue evolving toward biologically derived solutions.

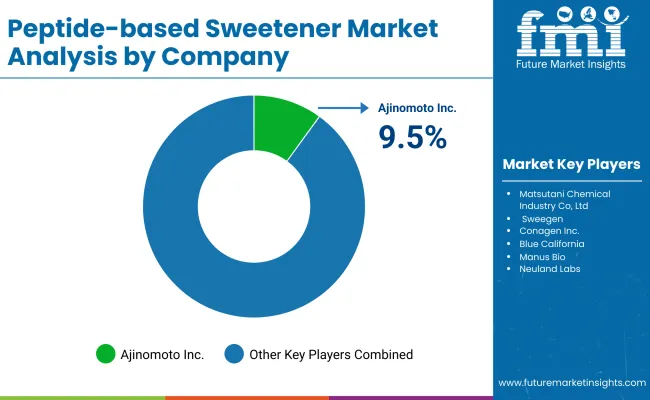

| Company | Global Value Share 2025 |

|---|---|

| Ajinomoto, Inc. | 9.5% |

| Others | 90.5% |

The peptide-based sweeteners market is moderately fragmented, with global leaders, mid-sized innovators, and bio-specialists competing across diverse formulation and application domains. Industry pioneers such as Ajinomoto Co., Inc., Matsutani Chemical Industry Co., Ltd., and Sweegen are recognized for their extensive R&D pipelines, large-scale fermentation infrastructure, and regulatory agility across major markets. These players have been prioritizing precision fermentation, IP-protected peptide variants, and strategic partnerships to accelerate global reach in the functional foods and nutraceutical space.

“Mid-sized innovators such as Blue California, Conagen Inc., and Manus Bio have focused on synthetic biology-driven customization, evidenced by their participation in the 2025 Clean Label Expo and patent filings related to enzyme-based peptide modification (USPTO, Jan 2025), enabling the production of high-intensity Peptide-based Sweeteners tailored to specific glycemic profiles and stability requirements. These firms are advancing adoption through D2C collaborations and ingredient-as-a-service models in the clean-label reformulation sector.

Specialist firms like Nerudia, Neuland Laboratories Ltd., and Zhongke New Life Biotechnology are being positioned for niche applications in pharmaceutical-grade formulations and traditional wellness formats. Custom peptide engineering and integration into therapeutic nutrition pipelines are being used as differentiation levers.

Competitive advantage is shifting from peptide origin alone to full-stack capabilities spanning metabolic pathway design, regulatory strategy, and taste optimization algorithms. Ecosystem integration, sustainability credentials, and digital formulation tools are expected to define leadership over the coming decade.

Key Developments in Peptide-based Sweetener

| Item | Value |

|---|---|

| Quantitative Units | USD 935.6 million |

| Peptide Type | Sweet-Tasting Peptides, Taste-Modulating Peptides, Sweetness Enhancer Peptides, Natural Peptide-based Sweeteners, Synthetic Peptide-based Sweeteners |

| Source | Plant-Derived Peptides, Animal-Derived Peptides, Microbial / Fermentation-Derived Peptides, Synthetic / Engineered Peptides |

| Formulation Type | Powder, Liquid, Tablets, Sachets |

| Application | Beverages (Soft Drinks, Juices, RTDs), Confectionery & Baked Goods, Dairy Products, Nutraceuticals, Pharmaceuticals, Tabletop Sweeteners |

| End User | Food & Beverage Ingredients, Animal Feed & Aquafeed, Nutraceuticals & Dietary Supplements, Cosmetics & Personal Care, Industrial Uses |

| Sales Channel | Food & Beverage Manufacturers (B2B), Nutraceutical & Pharmaceutical Companies, Direct-to-Consumer (D2C), Online Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ajinomoto Co., Inc., Matsutani Chemical Industry Co., Ltd., Sweegen, Conagen Inc., Blue California, Manus Bio, Neuland Labs, Bachem, Nerudia |

| Additional Attributes | Dollar sales by peptide type and application, growth in natural and fermentation-derived peptides, integration into clean-label food and beverages, synthetic biology breakthroughs in peptide design, rising demand in diabetic and wellness segments, regional regulatory impact, and D2C expansion of peptide-based formulations. |

The global Peptide-based Sweetener is estimated to be valued at USD 935.6 million in 2025.

The market size for the Peptide-based Sweetener is projected to reach USD 1,667.3 million by 2035.

The Peptide-based Sweetener is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key peptide types in the market include sweet-tasting peptides, taste-modulating peptides, sweetness enhancer peptides, natural Peptide-based Sweeteners, and synthetic Peptide-based Sweeteners.

In terms of peptide source, the “Microbial and fermentation-derived peptides are forecasted to contribute 40% of market share in 2025, driven by lower production cost, high purity, and strategic investments by firms like Conagen and Ajinomoto in Asia-Pacific biomanufacturing hubs (Sweegen 2024 Corporate Report).

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Dry Sweeteners Market

Corn Sweeteners Market Outlook - Growth, Demand & Forecast 2025 to 2035

Novel Sweeteners Market Analysis by Product Type, End Use, Application and Region from 2025 to 2035

Intensive Sweeteners Market Analysis by Nature, Type, Application, Sales Channel and Region through 2035

Fermented Sweeteners Market

Low-calorie Sweeteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Natural Malt Sweeteners Market

Low Intensity Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

High-intensity Artificial Sweeteners Market Analysis by Product Type, Form, Application Distribution Channel, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA