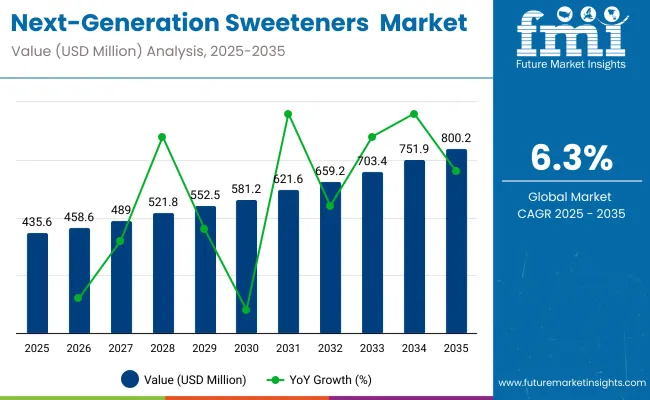

The Next-Generation Sweeteners Market is projected to be valued at USD 435.6 million in 2025 and is forecast to reach USD 800.2 million by 2035. This represents an absolute increase of USD 364.6 million over the decade, equating to a compound annual growth rate (CAGR) of 6.3%. A nearly 2X expansion in market size is expected to be achieved, driven by escalating global demand for metabolically safe, clean-label, and low-calorie sugar alternatives.

| Metric | Value |

|---|---|

| Next-Generation Sweeteners Estimated Value in (2025E) | USD 435.6 million |

| Next-Generation Sweeteners Forecast Value in (2035F) | USD 800.2 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

During the first half of the forecast period (2025 to 2030), the market is expected to grow from USD 435.6 million to approximately USD 591.4 million, accounting for USD 155.8 million in incremental value or nearly 43% of total decade growth.

This initial phase is likely to be shaped by increasing R&D activity, regulatory approvals, and early-stage partnerships across food and beverage manufacturers. Use cases in functional beverages, wellness nutrition, and oral care are anticipated to dominate early adoption curves.

The latter half (2030 to 2035) is forecast to deliver accelerated gains, contributing USD 208.8 million or 57% of the decade’s total expansion-as the market moves from USD 591.4 million to USD 800.2 million. Broader adoption across emerging regions, combined with integration into precision health platforms, is expected to amplify demand. Software-enabled formulation tools and microbiome-neutral innovation are likely to expand competitive differentiation. As personalization in food systems gains prominence, next-generation sweeteners are expected to serve as foundational ingredients in adaptive nutrition ecosystems.

From 2020 to 2024, the Next-Generation Sweeteners Market expanded steadily from~ USD 420.6 million to USD 435.6 million, driven by rising demand for clean-label, zero-calorie, and metabolically safe sugar alternatives. During this phase, plant-derived sweeteners dominated revenue share, while fermentation-derived innovations gained traction through targeted R&D investments.

By 2025, demand is forecast to rise sharply, with peptide-based compounds and mogroside variants leading adoption in functional beverages and diabetic nutrition. Fermentation platforms and synthetic biology tools are being prioritized for scalability and cost-efficiency. Between 2025 and 2035, a noticeable shift is expected in the revenue mix toward AI-optimized formulation platforms, regulatory-compliant ingredient systems, and subscription-based ingredient sourcing partnerships.

Traditional sweetener manufacturers are projected to pivot toward hybrid models that integrate biofunctionality, personalized nutrition, and clean-label alignment. Competitive advantage is forecast to shift from sweetness intensity to sensory precision, clinical validation, and ecosystem partnerships that enable scalable innovation. Emerging players focusing on gut-health compatibility, formulation software, and cloud-based R&D are expected to redefine category leadership.

The growth of the Next-Generation Sweeteners Market is being driven by a confluence of nutritional, regulatory, and technological shifts. Heightened scrutiny of caloric intake and glycemic impact has been observed across health-conscious consumer groups, leading to increased demand for metabolically neutral sweeteners.

Regulatory bodies have progressively endorsed newer sweetener compounds, thereby accelerating formulation adoption across food, beverage, and nutraceutical categories. Functional advantages such as heat stability, taste-masking ability, and microbiome-friendliness are being prioritized by manufacturers seeking to replace legacy sugar substitutes.

Market expansion is also being catalyzed by fermentation-derived and peptide-based innovations, which have allowed for scalable, cost-effective production of rare sweetener proteins. Widespread application across lifestyle-driven product categories such as clean-label beverages, ketogenic foods, and diabetic-friendly formulations has been enabled by improved solubility and organoleptic performance. As industry reformulations align with wellness and personalization trends, next-generation sweeteners are expected to be positioned as critical enablers of long-term nutritional transition.

The Next-Generation Sweeteners Market has been segmented based on sweetener type, source, application, and formulation format. This segmentation framework has enabled a detailed analysis of commercial performance and innovation momentum across the industry.

By sweetener type, the market includes proteins, glycosides, and rare fruit extracts, each offering distinct functional benefits and adoption curves. In terms of source, products are classified into plant-derived, microbial/fermentation-derived, and synthetic-each category carrying unique scalability and regulatory attributes.

Application-wise, use spans beverages, confectionery, supplements, and pharmaceuticals, reflecting diversified end-user integration. These segments are being shaped by health-driven consumption patterns, regional dietary shifts, and food reformulation mandates. Forward-looking strategies are expected to emphasize biotech innovation, regulatory clearance, and cross-category formulation partnerships to expand segment share over the coming decade.

| Protein Source Segment | Market Value Share, 2025 |

|---|---|

| Peptide based sweeteners | 18.0% |

| Mogroside V | 12.0% |

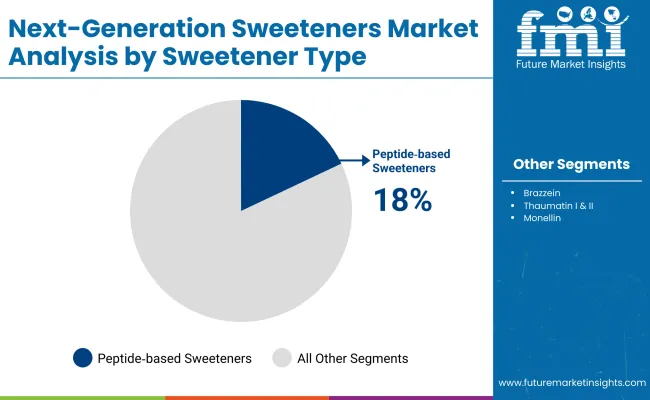

Peptide-based sweeteners are projected to account for the largest share of the market in 2025, contributing 18.0% to total revenue. Their dominance is being attributed to their superior sweetness intensity, heat stability, and clean taste profile, which have made them highly suitable for both food and pharmaceutical applications.

Market growth is being propelled by biotechnological advancements enabling cost-efficient synthesis and large-scale fermentation. Peptide-based solutions are being positioned as the next frontier in zero-calorie sweetening due to their minimal glycemic impact and favorable regulatory profile.

As consumer demand for plant-based, protein-rich, and metabolically safe ingredients continues to rise, the peptide segment is expected to outperform legacy sugar alternatives. Its integration into functional beverages, diet foods, and diabetic formulations will likely secure sustained growth across high-potential regions.

| Plant-Derived | 2025 Share% |

|---|---|

| Plant Derived | 55% |

| Microbial / Fermentation Derived | 35% |

| Synthetic | 10% |

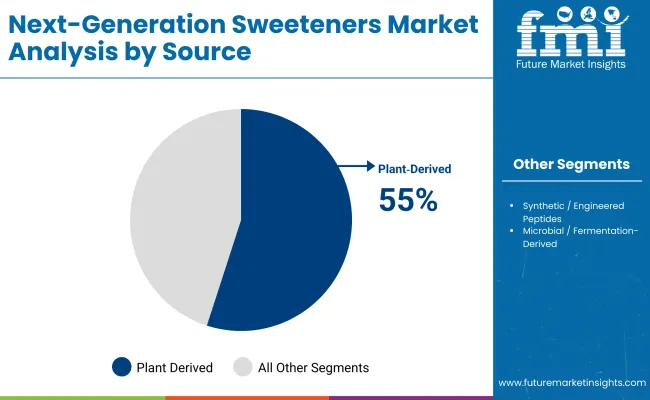

Plant-derived sweeteners are expected to retain the largest share of the global market in 2025, contributing 55.0% of total value. This dominance has been supported by long-standing consumer trust in botanically sourced ingredients, coupled with strong regulatory backing for traditional and naturally occurring sweeteners. Widely recognized extracts such as steviol glycosides, mogroside V, and licorice root derivatives have been adopted across beverages, baked goods, and dietary supplements due to their clean-label positioning and natural origin.

Market demand has been reinforced by rising health consciousness and clean-label product preferences across both developed and emerging regions. As sugar taxes and front-of-pack labeling rules become stricter, food and beverage manufacturers have prioritized plant-derived sweeteners that deliver sweetness without caloric penalties.

| Application | 2025 Share% |

|---|---|

| Beverages | 30% |

| Confectionery & Baked Goods | 20% |

| Nutraceuticals & Supplements | 15% |

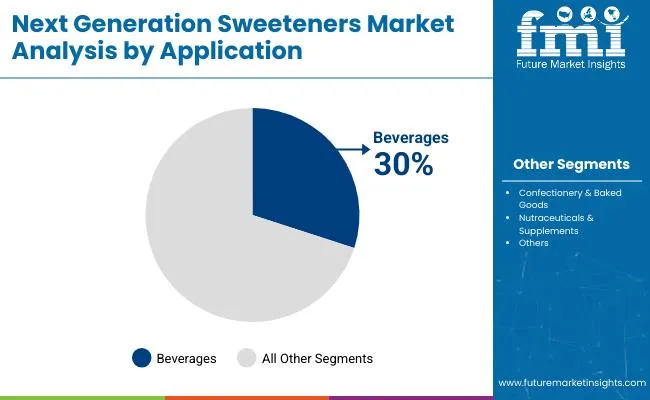

Beverages are expected to remain the dominant application for next-generation sweeteners, accounting for 30.0% of market revenue in 2025. This leadership is being supported by widespread reformulation efforts in the soft drink, flavored water, and functional beverage sectors. Brands are adopting low- and zero-calorie sweeteners to align with evolving dietary preferences and regulatory sugar taxes across North America, Europe, and Asia.

Sweeteners like brazzein and mogroside V are increasingly being integrated due to their compatibility with carbonated and acidic formulations. The segment's growth is further fueled by demand for plant-based and wellness-positioned drinks, which require natural yet scalable sweetening options. As beverage manufacturers pursue clean-label innovation and consumer-centric branding, next-generation sweeteners are expected to remain a central component of R&D pipelines and commercial strategies.

Rising formulation complexity and regional labeling mandates are reshaping the adoption curve for next-generation sweeteners, even as industry demand intensifies across functional nutrition, wellness beverages, and precision diet systems.

Rise of AI-Optimized Formulations for Sensory Precision

Artificial intelligence and computational taste modeling are being used to accelerate sweetener formulation across R&D pipelines. These tools are enabling data-driven optimization of sweetness curves, flavor-masking capabilities, and ingredient synergies, thereby reducing trial-and-error cycles in new product development.

Companies are leveraging sensory prediction models to develop region-specific taste profiles while minimizing off-notes. This shift toward AI-assisted formulation is expected to support scale-up of personalized, microtargeted sweetener applications aligned with digital nutrition platforms and personalized health trends.

Regulatory Alignment with Sugar Reduction Goals

Regulatory frameworks prioritizing sugar reduction and non-nutritive sweetener inclusion are being implemented across North America, Europe, and parts of Asia, accelerating market demand. As public health agencies endorse alternative sweeteners to mitigate obesity, diabetes, and cardiovascular risks, next-generation compounds are being incorporated into approved food codes and GRAS lists.

This alignment is enabling faster commercialization of fermentation- and peptide-derived sweeteners with high-intensity flavor and minimal metabolic disruption. Food manufacturers are responding with reformulations across beverages and functional foods. As sugar taxes expand and clean-label compliance intensifies, next-generation sweeteners are expected to gain preferred status among product developers and formulators.

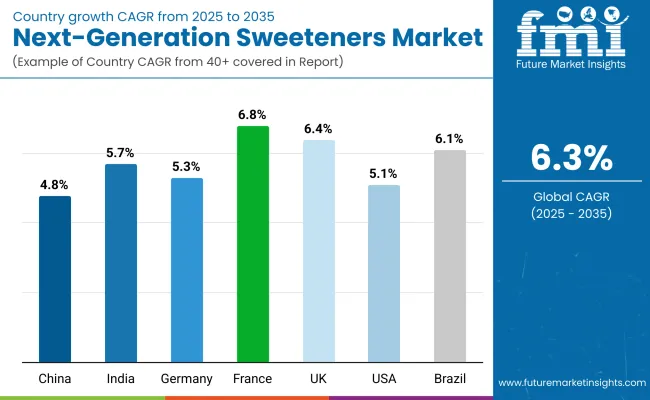

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 4.8% |

| India | 5.7% |

| Germany | 5.3% |

| France | 6.8% |

| UK | 6.4% |

| USA | 5.1% |

| Brazil | 6.1% |

The global Next-Generation Sweeteners Market is expected to display pronounced variation in growth across countries, shaped by dietary health initiatives, innovation readiness, and evolving food regulatory landscapes.

Asia-Pacific is projected to lead the adoption curve, with India expanding at a CAGR of 5.7% and China at 4.8%, driven by public health campaigns focused on reducing sugar consumption and rising demand for clean-label, diabetic-friendly formulations. In India, government-backed nutrition programs and rapid expansion of nutraceuticals are expected to fuel market penetration, especially in urban and tier-II dietary transitions. In China, advancements in biotechnology and strong investment in local production of rare sugar proteins are reinforcing domestic innovation.

In Europe, growth is anticipated to remain robust, led by France (6.8% CAGR), the UK (6.4%), and Germany (5.3%), supported by harmonized food safety regulations, sugar tax policies, and strategic collaborations between food-tech firms and ingredient suppliers. France is witnessing heightened R&D activity around microbiome-friendly sweeteners, while the UK market is being shaped by retailer-led sugar reformulation mandates.

North America, anchored by the USA at a 5.1% CAGR, is experiencing steady growth, with demand increasingly centered on fermentation-derived compounds, wellness-positioned beverages, and personalized nutrition formats. Meanwhile, Brazil (6.1% CAGR) is emerging as a high-potential market, driven by regulatory modernization and the uptake of sweeteners in functional dairy and confectionery exports.

| Year | USA Next-Generation Sweeteners Market (USD Million) |

|---|---|

| 2025 | 104.5 |

| 2026 | 110.7 |

| 2027 | 117.2 |

| 2028 | 124.4 |

| 2029 | 132.0 |

| 2030 | 139.4 |

| 2031 | 149.1 |

| 2032 | 159.4 |

| 2033 | 168.6 |

| 2034 | 178.1 |

| 2035 | 187.4 |

The Next-Generation Sweeteners Market in the United States is projected to expand at a CAGR of 5.9% between 2025 and 2035, underpinned by escalating demand for low-glycemic, clean-label alternatives in packaged food, wellness beverages, and personalized nutrition.

Significant adoption has been observed in diabetic-friendly and ketogenic formulations, particularly within functional beverage and snack categories. Regulatory alignment on sugar reduction, coupled with consumer backlash against artificial sweeteners, has created strong tailwinds for natural and fermentation-derived compounds.

Health-conscious purchasing behavior is being amplified by retailer reformulation mandates and FDA labeling regulations, prompting CPG brands to accelerate sweetener innovation pipelines. Moreover, academic and clinical research institutions are contributing to market growth through studies validating the safety and metabolic neutrality of peptide-based sweeteners.

The UK Next-Generation Sweeteners Market is expected to expand at a CAGR of 6.4%, supported by government-mandated sugar reduction strategies and increased consumer scrutiny over ingredient labels. Clean-label positioning is being prioritized across beverage and bakery categories, where natural and peptide-based sweeteners are being actively integrated into reformulated SKUs.

Regulatory frameworks under Public Health England’s sugar reformulation program have contributed to the growing traction of zero-calorie sweeteners. Retailers are increasingly demanding evidence-backed sweetness enhancers that align with HFSS compliance standards and ESG commitments.

India’s market is projected to grow at a CAGR of 5.7%, driven by surging demand for diabetic-safe and Ayurveda-compatible sugar substitutes. Urban dietary shifts, increasing obesity prevalence, and FSSAI-backed clean-label initiatives have accelerated interest in plant-derived sweeteners such as steviol glycosides and monk fruit blends.

Growth is also being reinforced by domestic manufacturing incentives that aim to reduce reliance on imported artificial sweeteners. Nutraceuticals and dietary supplement brands are actively promoting low-glycemic ingredients, which has supported broader market penetration.

China’s market is forecast to expand at a CAGR of 4.8%, supported by ongoing efforts to combat rising sugar consumption and metabolic health issues. Government-led nutrition programs have endorsed natural and low-calorie sweeteners in school meals, beverages, and mass-market processed foods.

Local biomanufacturing capacity is being scaled to produce fermentation-derived sweeteners such as brazzein and mogroside V, which are favored for their flavor precision and formulation compatibility. Public-private partnerships are increasingly focusing on R&D into sensory optimization and safety testing.

| Countries | 2025 |

|---|---|

| UK | 20.7% |

| Germany | 20.9% |

| Italy | 11.7% |

| France | 14.1% |

| Spain | 11.6% |

| BENELUX | 6.5% |

| Nordic | 5.6% |

| Rest of Europe | 8.9% |

| Countries | 2035 |

|---|---|

| UK | 19.3% |

| Germany | 20.9% |

| Italy | 11.7% |

| France | 12.5% |

| Spain | 9.4% |

| BENELUX | 5.2% |

| Nordic | 5.1% |

| Rest of Europe | 16.0% |

Germany’s market is projected to grow at a CAGR of 5.3%, fueled by food safety regulations, consumer preference for natural ingredients, and reformulation strategies by major food producers. Demand for organic, EU-compliant sweeteners has supported growth in the plant- and fermentation-derived segments.

Key manufacturers are introducing sugar-reduced SKUs in yogurt, cereal, and non-alcoholic beverages, backed by EU health claims. Strong R&D infrastructure and cross-border partnerships have allowed for rapid commercialization of peptide-based and licorice-derived sweeteners with EFSA-approved profiles.

| Sweetener Type | Market Value Share, 2025 |

|---|---|

| Brazzein | 12.0% |

| Thaumatin I & II | 9.0% |

| Monellin | 8.0% |

| Curculin | 6.0% |

| Pentadin | 5.0% |

| Peptide based sweeteners | 15.0% |

| Mogroside V | 14.0% |

| Siraitiflavone based derivatives | 8.0% |

| Licorice root glycyrrhizin derivatives | 7.0% |

| Sweet Chrysanthemum glycosides | 5.0% |

| Oubli fruit extract | 4.0% |

| Others | 7.0% |

The Next-Generation Sweeteners Market in Japan is projected to be valued at USD 68.61 million in 2025, with peptide-based sweeteners leading the segment at 15%, followed closely by Mogroside V (14%) and Brazzein (12%).

This leadership reflects Japan’s emphasis on precision nutrition, clean-label transparency, and zero-calorie innovations within functional food categories. Peptide-based compounds have gained traction due to their ability to mimic natural sweetness without altering metabolic responses critical for Japan’s aging population and diabetes-prevention policies.

Consumer preference for subtle sweetness and traditional flavor harmony has driven interest in Mogroside V and Brazzein, both of which blend well with Japanese tea-based and fermented beverages. Moreover, local R&D efforts have prioritized the development of fermentation-derived sweeteners to enhance scalability and sustainability.

The adoption outlook is expected to be shaped by increasing demand for gut-friendly sweeteners, high heat stability for baked goods, and clean sensory profiles suited to umami-rich culinary applications.

| Source | Market Value Share, 2025 |

|---|---|

| Plant Derived | 54.0% |

| Microbial / Fermentation Derived | 36.0% |

| Synthetic | 10.0% |

The Next-Generation Sweeteners Market in South Korea is projected to reach USD 39.2 million in 2025, with plant-derived sweeteners accounting for the largest share at 54%, followed by fermentation-derived at 36%, and synthetic variants contributing the remaining 10%. This distribution reflects South Korea’s long-standing preference for natural health ingredients, supported by strong public trust in botanically sourced functional foods.

However, growth within the fermentation-derived segment projected to expand at the highest CAGR of 9.4% is expected to outpace others due to the nation’s biotech-forward food industry. Next-gen solutions such as brazzein, thaumatin, and precision-fermented proteins are being increasingly adopted in wellness beverages, diabetic nutrition, and low-calorie snacks.

South Korean food tech companies are actively investing in scalable bioprocesses that support ingredient transparency and sustainability two pillars central to consumer loyalty. Regulatory frameworks that prioritize food safety and digital traceability have further supported the commercial launch of next-generation alternatives across domestic and export-focused product lines.

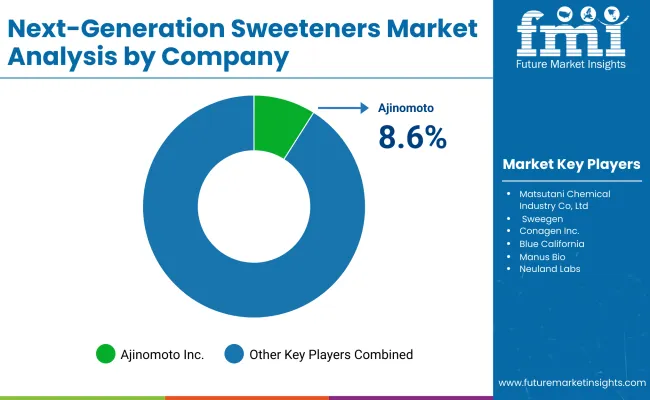

The Next-Generation Sweeteners Market is moderately fragmented, with global conglomerates, biotech-driven innovators, and formulation-focused specialists competing across nutritional, pharmaceutical, and food-tech domains. Leading players such as Ajinomoto Co., Inc., Roquette (via BRAIN AG JV), and Samyang Corporation have been observed to command significant influence through proprietary ingredient platforms, established distribution, and long-standing regulatory alignment. Their strategies are increasingly centered on scalable peptide production, global regulatory access, and integration with metabolic wellness trends.

Mid-sized innovators like Sweegen Inc., Conagen Inc., and Bonumose Inc. are reshaping competition through bioprocess optimization, synthetic biology, and fermentation-based sweetener development. Their technologies are being positioned to offer high-intensity sweetness with minimal off-notes, microbiome neutrality, and high thermal stability-qualities sought by CPG brands undergoing rapid reformulation.

Specialist ventures such as Oobli (formerly Joywell), Avansya (Cargill + DSM JV), Bestzyme Biotech, and Manus Bio are focusing on rare protein sweeteners, AI-guided molecular design, and sugar reduction partnerships with functional food brands. These firms are gaining traction through agility, IP ownership, and ingredient customization.

Competitive differentiation is expected to shift toward biosynthetic scalability, clean-label compliance, and multi-application versatility-with success defined not by sweetness intensity alone but by metabolic integrity, taste precision, and formulation compatibility.

Key Developments in Next-Generation Sweeteners

| Item | Value |

|---|---|

| Quantitative Units | USD 435.6 million |

| Sweetener Type | Brazzein, Thaumatin I & II, Monellin, Curculin, Pentadin, Peptide-based Sweeteners, Mogroside V, Siraitiflavone-based Derivatives, Licorice Root Glycyrrhizin Derivatives, Sweet Chrysanthemum Glycosides, Oubli Fruit Extract, Others |

| Source | Plant-Derived, Microbial / Fermentation-Derived, Synthetic |

| Application | Beverages, Confectionery & Baked Goods, Dairy & Frozen Desserts, Nutraceuticals & Supplements, Pharmaceuticals, Tabletop Sweeteners |

| Formulation Type | Powder, Liquid, Tablets, Sachets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ajinomoto Co., Inc., Sweegen Inc., Conagen Inc., Roquette (via BRAIN AG JV), Avansya (Cargill + DSM JV), Bonumose Inc., Bestzyme Biotech, Samyang Corporation, Oobli (formerly Joywell), Manus Bio |

| Additional Attributes | Market size by sweetener type, application, and source; R&D investment in fermentation and synthetic biology; rising adoption in diabetic and keto nutrition; regulatory support across EU, USA, and Asia; increased use in clean-label and functional products; partnerships with CPG and beverage majors; technology transfer and licensing trends; impact of sugar taxes and front-of-pack labeling policies |

The global Next-Generation Sweeteners is estimated to be valued at USD 435.6 million in 2025.

The market size for the Next-Generation Sweeteners is projected to reach USD 800.2 million by 2035.

The Next-Generation Sweeteners is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key sweetener type in the Next-Generation Sweeteners Market are The key sweetener types in the market include Peptide-Based Sweeteners, Mogroside V, Brazzein, Thaumatin I & II, and Monellin, among others.

In terms of source, the plant-derived segment is projected to command the largest share at 55% in the Next-Generation Sweeteners Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Next-Gen Digital Cockpit Solution Market Size and Share Forecast Outlook 2025 to 2035

Next-gen Military Avionics Market Size and Share Forecast Outlook 2025 to 2035

Next-Gen Firewall Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Mass Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Wireless Network Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Next Generation Immunotherapies Market - Innovations & Growth 2025 to 2035

Next-Generation Biomanufacturing Market - Trends, Innovations & Forecast 2025 to 2035

Market Leaders & Share in the Next Generation Packaging Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA