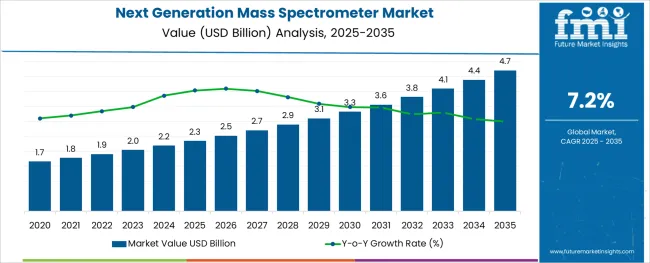

The Next Generation Mass Spectrometer Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

The next generation mass spectrometer market is undergoing a transformation fueled by the convergence of digital analytics, precision instrumentation, and demand for advanced molecular diagnostics. Innovations in ionization techniques, resolution enhancement, and data processing algorithms are enabling researchers and industry professionals to perform complex compound identification with higher speed and accuracy.

Regulatory pressure for trace-level detection, especially in pharmaceuticals and environmental sciences, is encouraging the adoption of next-gen mass spectrometry systems with improved sensitivity and automation capabilities. Additionally, the integration of mass spectrometers with lab informatics platforms and AI-driven data interpretation tools is enhancing productivity in research and quality control settings.

Investment in proteomics, metabolomics, and biomarker discovery driven by precision medicine and drug development pipelines—is expected to further propel the market. As academic and commercial institutions shift toward multi-omics and high-throughput platforms, next generation systems are becoming central to enabling comprehensive and real-time molecular insights.

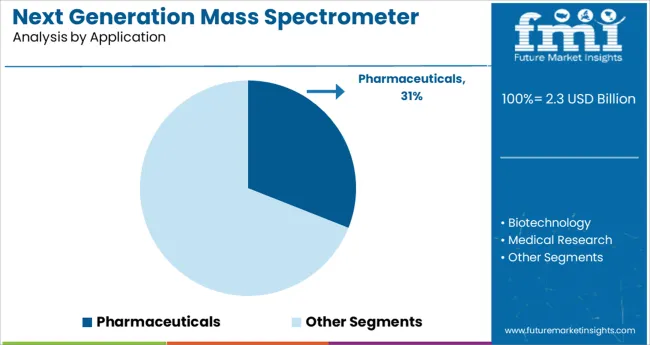

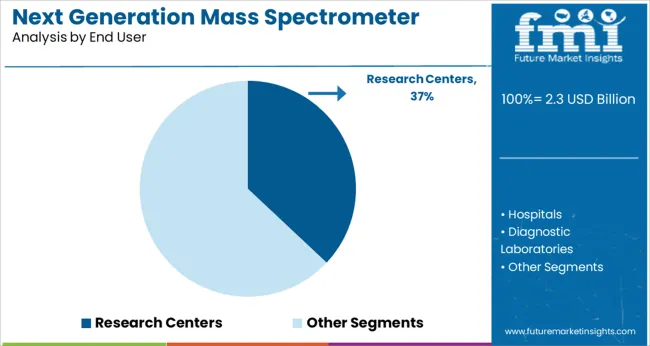

The market is segmented by Application and End User and region. By Application, the market is divided into Pharmaceuticals, Biotechnology, Medical Research, Food and Beverage Testing, and Others. In terms of End User, the market is classified into Research Centers, Hospitals, and Diagnostic Laboratories. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceuticals segment is expected to account for 31.0% of the total revenue in the next generation mass spectrometer market in 2025, making it a key application area. This leadership is being reinforced by the industry's growing reliance on high-resolution analytical tools for drug development, quality assurance, and regulatory compliance.

Next generation mass spectrometers are increasingly being deployed to support the identification of impurities, pharmacokinetic studies, and formulation stability testing. Their ability to detect trace elements and provide quantitative analysis at molecular levels aligns with the stringent standards set by regulatory agencies for drug approval processes.

Additionally, the expansion of biologics and biosimilars has created new analytical demands that are being addressed through advanced mass spectrometry platforms. The adoption of these systems within pharmaceutical manufacturing and R&D facilities is further driven by their integration with automated sample preparation and data management solutions, which together improve operational efficiency and data integrity.

Research centers are projected to lead the market with a 37.0% revenue share in 2025, emerging as the dominant end-user segment. This growth is being driven by the increasing scope of life sciences research, academic collaborations, and government funding directed toward proteomics, genomics, and metabolomics studies.

Next generation mass spectrometers are enabling researchers to explore cellular processes, disease mechanisms, and biomolecular interactions with unprecedented accuracy and depth. Their enhanced sensitivity and resolution are critical in exploring low-abundance biomarkers, drug metabolites, and environmental contaminants. Research institutions are also leveraging mass spectrometry for interdisciplinary projects that span materials science, forensics, and food safety.

The growing emphasis on reproducible, high-throughput analytical workflows is encouraging laboratories to invest in scalable, next-gen platforms with cloud connectivity and AI-powered analytics. As scientific inquiry expands toward multi-omics integration, mass spectrometry continues to serve as a foundational tool in unlocking complex biological and chemical insights.

The major factor for the growth of the next generation mass spectrometer market is a rise in government spending on life sciences and pharmaceutical study and development.

Furthermore, rising food concerns, clamor in agriculture and medical research, enabling innovative diagnosis, new drug development for diseases, and competitive post-sale and technical assistance, all contributed to a rise in the adaptation of next-generation mass spectrometers.

However, the significantly high cost of the device and a lack of skilled personnel to operate next generation mass spectrometers are some of the key restraints in the market.

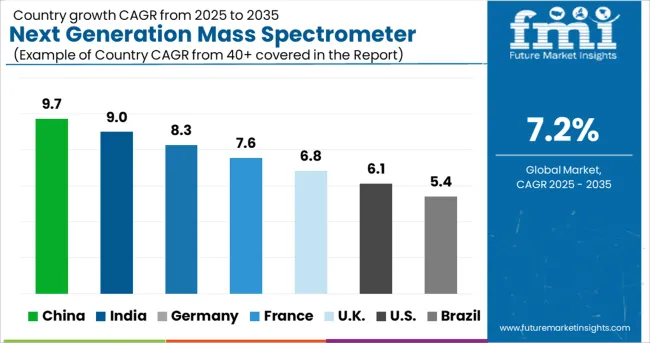

Because of increased government investment opportunities in biomedical and biotechnology areas, North America is anticipated to dominate the global next generation mass spectrometer market.

In North America, the key markets for next generation mass spectrometers are the United States and Canada. The market in this region will grow more rapidly than the markets in Europe, Asia Pacific, and South America. Several pharmaceutical companies' greater emphasis on drug research and development will aid the growth of the next generation mass spectrometer market in North America over the forecast timeframe. North America is accounting for a market share of 33% of the global Next generation mass spectrometer market.

Furthermore, increased research in the pharmaceutical and medical fields is promoting the growth of global next generation mass spectrometers in the region. Similarly, the huge number of conferences, production, and research facilities of industries in the Asia-Pacific excluding Japan market is expected to drive the growth of the next generation mass spectrometer market throughout the forecast period.

Tandem mass spectrometry devices are in high demand in Europe right now. Diagnostic and therapeutic chemistry and immunoassay techniques are employed in traditional hospital diagnostic assays, which entail analyte-specific reagents and antibodies.

The integration of liquid chromatography and tandem mass spectrometry allows for the unambiguous identification of antibiotic and antibacterial representative traces in complex biological matrices. Elevated research in genetics, particularly proteomics, and the use of alongside next generation mass spectrometers for the same are cruising market growth in Europe. Europe is accounting for a market share of 25.9% of the global Next generation mass spectrometer market.

The market is divided into applications such as pharmaceuticals, biotechnology, medical research, food and beverage testing, and others. Pharmaceutical industries, for example, have a broad scope of the next generation mass spectrometer due to a rise in cases of adulterated food, drug safety, and new drug advancement for diseases.

Furthermore, medical research has bolstered the global next generation mass spectrometer market. The market is divided into three segments based on end-users: hospitals, research centers, and diagnostic laboratories. Globally, next-generation mass spectrometers are most commonly used in experiments and diagnostic laboratory facilities.

Manufacturers are adopting various marketing strategies such as new product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential buyers and create a larger customer base. For instance,

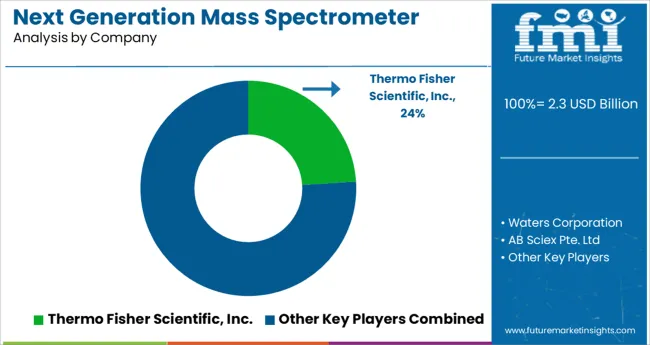

Some of the leading next generation mass spectrometer manufacturers include

Waters Corporation, Thermo Fisher Scientific, Inc., AB Sciex Pte. Ltd., Bruker Corporation, Shimadzu Corporation, anaher Corporation, PerkinElmer, Rigaku, Bio-Rad Laboratories, Jeol Ltd, and Agilent Technologies.

These key next generation mass spectrometer providers are adopting various strategies such as new product launches and approvals, partnerships, collaborations, acquisitions, mergers, etc. to increase their sales and gain a competitive edge in the global Next generation mass spectrometer market. For instance,

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.2% from 2025 to 2035 |

| Market Value in 2025 | USD 2.3 billion |

| Market Value in 2035 | USD 4.7 billion |

| Base Year for Estimates | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | End User, Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Waters Corporation,; Thermo Fisher Scientific, Inc.; AB Sciex Pte. Ltd.; Bruker Corporation; Shimadzu Corporation; Danaher Corporation; PerkinElmer; Rigaku; Bio-Rad Laboratories; Jeol Ltd; Agilent Technologies |

| Report Customization & Pricing | Available upon Request |

The global next generation mass spectrometer market is estimated to be valued at USD 2.3 billion in 2025.

It is projected to reach USD 4.7 billion by 2035.

The market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types are pharmaceuticals, biotechnology, medical research, food and beverage testing and others.

research centers segment is expected to dominate with a 37.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Wireless Network Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Next Generation Immunotherapies Market - Innovations & Growth 2025 to 2035

Next-Generation Biomanufacturing Market - Trends, Innovations & Forecast 2025 to 2035

Market Leaders & Share in the Next Generation Packaging Industry

Next-generation Titrator Market Growth – Industry Trends & Forecast 2024-2034

Next Generation Ultrasound Systems Market

Next Generation Blood Gas Monitors System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA