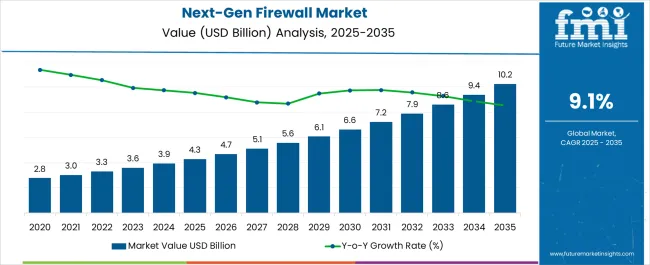

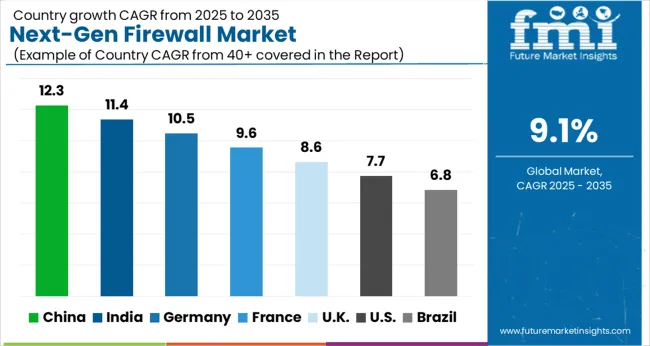

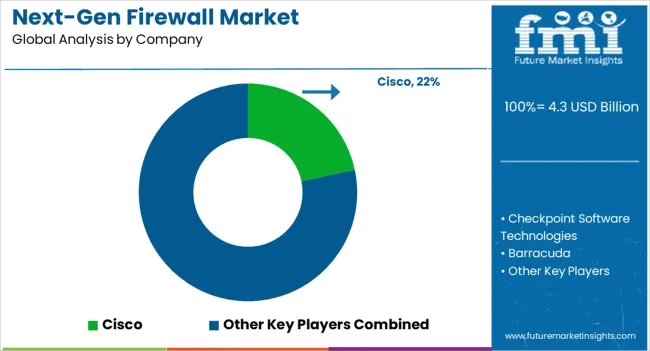

The next-gen firewall market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

The market operates within enterprise cybersecurity environments where threat detection sophistication and network performance requirements create coordination challenges between information security teams and network operations departments. Corporate IT organizations experience operational complexity as NGFW deployment requires coordination between network architecture planning, security policy configuration, and application performance monitoring while managing threat intelligence integration, intrusion prevention tuning, and compliance reporting that affects both security posture and network functionality across diverse business applications and user access patterns.

Network security operations encounter implementation challenges as advanced firewall systems require coordination between traditional network filtering, deep packet inspection, and application-aware security policies while managing rule optimization, performance tuning, and incident response procedures. Security analysts work with network engineers to establish traffic inspection parameters while coordinating with system administrators about bandwidth allocation and latency management that balances security effectiveness against network performance requirements.

Cross-functional coordination between cybersecurity teams and business operations creates ongoing dialogue about security policy enforcement versus user productivity and application functionality requirements. Security managers work with business unit leaders to evaluate access control policies while coordinating with help desk operations about user support procedures and application troubleshooting that addresses both security compliance and operational efficiency across different departmental needs.

Data center operations experience integration complexity as next-generation firewalls must coordinate with existing network infrastructure, virtualization platforms, and cloud connectivity while maintaining high availability and disaster recovery capabilities. Network architects coordinate with security specialists to establish segmentation strategies while working with operations teams about equipment placement, power requirements, and cooling considerations that support both security objectives and infrastructure reliability.

Managed security service providers encounter service delivery challenges as NGFW management requires coordination between remote monitoring capabilities, customer policy customization, and threat response procedures while managing multi-tenant configurations and service level agreement compliance. Technical operations teams coordinate with customer security personnel to establish monitoring parameters while working with incident response specialists about escalation procedures and remediation coordination across diverse client environments.

Cloud migration operations introduce architectural complexity as hybrid security models require coordination between on-premises firewall policies and cloud-native security controls while managing traffic routing, identity integration, and policy consistency across multiple deployment environments. Cloud security architects coordinate with network teams to establish connectivity procedures while working with compliance specialists about regulatory requirements and audit trail management.

| Metric | Value |

|---|---|

| Next-Gen Firewall Market Estimated Value in (2025 E) | USD 4.3 billion |

| Next-Gen Firewall Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The next generation firewall market is witnessing robust expansion due to escalating cyber threats, regulatory compliance requirements, and the growing complexity of enterprise networks. Organizations are increasingly prioritizing advanced security frameworks capable of integrating intrusion prevention, application control, and deep packet inspection within a single system.

The rapid growth of cloud computing, remote working models, and Internet of Things deployments has amplified demand for advanced firewall solutions that ensure both scalability and adaptability. Enterprises are focusing on reducing vulnerabilities while enhancing network visibility and operational resilience.

Investments in AI enabled threat detection and automation are further supporting the adoption of next generation firewalls across industries. The outlook remains positive as businesses and government institutions continue to emphasize proactive defense strategies, scalable infrastructure, and advanced risk management capabilities to secure their digital environments.

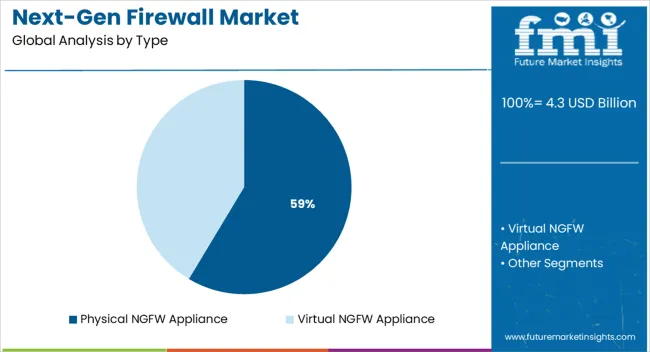

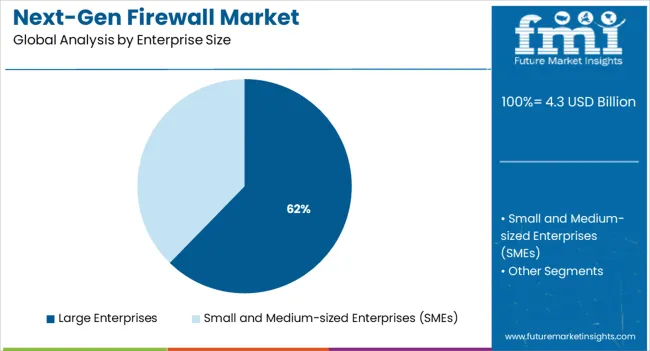

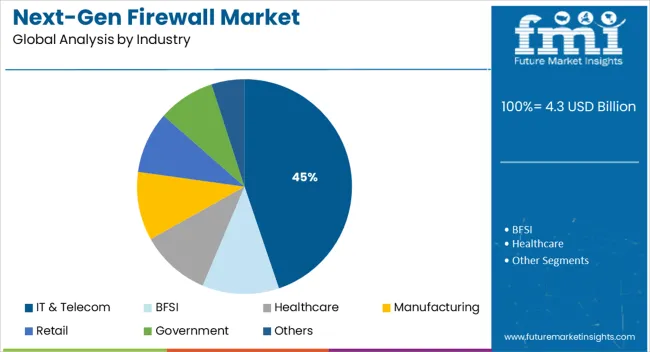

The market is segmented by Type, Enterprise Size, and Industry and region. By Type, the market is divided into Physical NGFW Appliance and Virtual NGFW Appliance. In terms of Enterprise Size, the market is classified into Large Enterprises and Small and Medium-sized Enterprises (SMEs). Based on Industry, the market is segmented into IT & Telecom, BFSI, Healthcare, Manufacturing, Retail, Government, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The physical NGFW appliance segment is projected to contribute 58.60% of total market revenue by 2025 within the type category, establishing its position as the leading segment. This dominance is driven by its robust performance, ability to handle high traffic volumes, and integration of multi layer security features.

Enterprises continue to rely on physical appliances due to their proven reliability in mission critical operations and enhanced protection for on premise data centers. Their scalability and adaptability for hybrid networks have reinforced adoption across diverse industries.

Additionally, strong investment in hardware based innovations and the ability to support advanced threat intelligence have further strengthened their leadership in the type segment.

The large enterprises segment is expected to hold 62.30% of total market revenue by 2025, making it the most prominent category under enterprise size. This growth is being fueled by the need for high performance network protection, regulatory compliance, and complex IT infrastructure management.

Large organizations have greater resources to deploy comprehensive firewall solutions with integrated features such as sandboxing, deep packet inspection, and application level control. The segment has also benefited from growing emphasis on security governance and data protection policies.

The ability to scale firewall deployments across multiple locations while ensuring centralized monitoring has made large enterprises the dominant contributors to market revenue.

The IT and telecom industry segment is projected to represent 44.80% of total revenue by 2025 within the industry category, positioning it as the leading vertical. This growth is being propelled by the sector’s requirement for continuous connectivity, data intensive applications, and heightened exposure to cyberattacks.

The integration of 5G networks, cloud services, and edge computing has increased the need for resilient, high capacity firewalls capable of addressing dynamic security challenges. Telecom operators and IT service providers are leveraging next generation firewalls to ensure data integrity, minimize downtime, and safeguard customer information.

This industry’s role as the backbone of digital transformation has reinforced its priority in adopting advanced firewall solutions, cementing IT and telecom as the most influential segment driving the overall market.

The next-gen firewall demand is estimated to grow at 9.1% CAGR between 2025 and 2035 in comparison to 7.0% CAGR recorded during historic period of 2020 to 2025. Growth is underpinned with the adoption of advanced firewall over traditional firewall.

Traditional firewalls were limited to data link layer and transport layer in OSI model. In addition to this, traditional firewall typically blocks common application ports or service on a network for controlling application access and monitor specific network security threats.

With complex network connectivity and multiple ports usage for various applications it is difficult for traditional firewalls to identify the targeted port. To overcome this challenge, the adoption of next-gen firewall is increasing as it includes intrusion detection system and protection system for improved packet-content filtering of network traffic.

Physical NGFW appliance segment in global next-gen firewall market is estimated to have dominating market share of 66.7% in 2025. Regionally, North America is currently dominating the global market owing to high adoption of network security solutions among enterprises.

The adoption of security solutions for the next generation helps to improve the company’s product and operational efficiencies. Next-generation endpoint security uses machine learning, artificial intelligence (AI), and tighter integration of networks to offer more comprehensive and adaptive protection.

Next-gen security solutions incorporate real-time analysis of user and system behavior to analyse executables. Existing security technologies moving in the direction of context-aware computing technology, allows companies to identify advanced threats.

System failures in IT infrastructure can cause a payment failure that interrupts global business, while network connection loss affects government services like law enforcement. This factor is expected to create potential opportunities for next-gen firewall vendors over the forecast period.

Internet-based cybersecurity tools can be accessed and are widely used for protecting cloud-based applications. More usage of the internet increases the possibility of data breaches and simple manipulation of data, which is not possible in the internal security system.

As a result, businesses are not adopting internet-based security solutions or disclosing internet tools for firewall management. Clear and multifactor safety solutions are offered by providers for an adequate level of protection.

It is also necessary for businesses to consider future DoS (Denial-of-Service) attacks. However, without proper protective measures and solutions, it is relatively difficult to identify these attacks by security analytics solutions.

Hence, demand for next-gen firewall systems is expected to increase to maintain robust and efficient security systems.

Burgeoning Need for Defense Against Cyber-Attacks to Boost Next-Gen Firewall System Demand

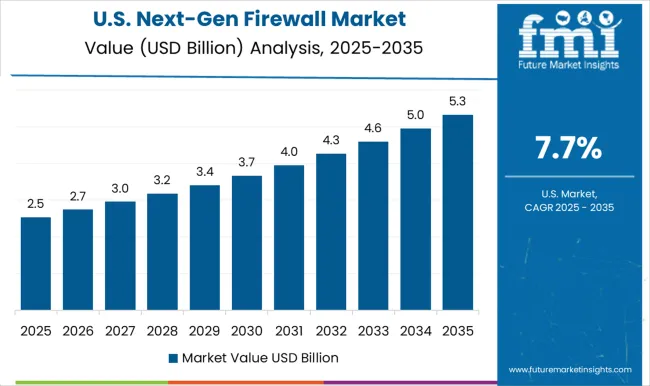

The next-gen firewall demand in the USA is expected to account for nearly 78.6% of North America market share through 2035. In the USA, next-gen firewall providers are focusing on offering intrusion detection and prevention system for identifying and analysing irregular deviation from cyber-attacks.

These players are focusing on small and medium organizations for securing their applications on the cloud at a considerably low cost. These players also offer network security solutions and various strong authentication systems.

They are also offering integration services for existing platforms for managing and centralizing data related to emails, access and other business assets.

Next-Gen Firewall Providers Offers Security Compliance Solutions to Enterprises to Gain Revenue

Europe is predicted to remain one of the most attractive markets during the forecast period. According to the study, the United Kingdom is estimated to grow by 3.2X during the forecast period.

Countries in Europe are aggressively adopting security solutions in order to ensure the safety and integrity of critical information related to citizens. In the United Kingdom enterprises are implementing encryption solutions along with the adoption of security compliance to reduce potential data breaches with regard to emails.

Moreover, companies are regularly updating security solutions such as network security, data loss prevention, and other security measures to improve data integrity over the cloud.

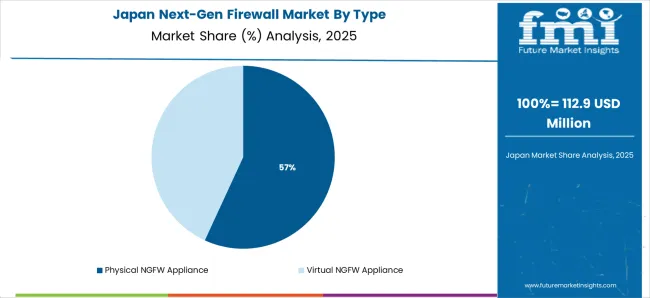

Booming IT Sector in Japan to Create Conducive Environment for Next-Gen Firewall Market

Sales in Japan are estimated to grow at an impressive rate of around 12.4% CAGR between 2025 and 2035. In Japan, the adoption of network security solutions is growing at a high rate. Dependence on networks is rising and this has led to a surge in adoption of network security solutions.

Due to businesses growing at a robust pace, complexity in IT infrastructure is also increasing. Hence, companies are unable to manage and control. As a result, large and small & medium enterprises in the Japan are adopting network security solutions to combat cyber threats.

| Countries | BPS Change (H2'22 (O) - H2'22 (P)) |

|---|---|

| India | (+)26 |

| Singapore | (+)25 |

| France | (+)23 |

| UAE | (+)21 |

| Germany | (+)19 |

The rapidly increasing adoption of cloud services in India drove the BPS change of (+)26 BPS units for H2’22(O)-H2’22(P). Singapore saw a BPS change of (+)25 units because as cyber threats continue to evolve, organizations in Singapore are investing in NGFWs to protect their networks and data from cyber attacks

France witnessed a BPS change of (+)23 units because of the increasing need for advanced network security, regulatory compliance, and the growth of cloud computing and Internet of Things (IoT) deployments.

As UAE has made significant investments in cybersecurity in recent years due to the increasing number of cyber-attacks targeting the region allowed the market to witness a BPS change of (+)21 units.

The strict data privacy regulations such as the General Data Protection Regulation (GDPR) in Europe drove the BPS change of (+)19 market in Germany.

Virtual Next-Gen Firewall Appliance to Remain Highly Sought-After

In terms of type, the virtual NGFW appliance segment is expected to showcase a higher market share in the coming years. This segment is predicted to create an absolute $ opportunity of USD 1,717.0 billion by the end of 2035.

The adoption of virtual appliances is witnessing high growth in private and public cloud deployments due to their scalability, automated provisioning, and security policy management in private clouds.

Virtual appliance inspects traffic and security enforcement for all traffic within the cloud environment. Hence, these factors will drive the demand for virtual appliances during the forecast period.

Limited Budget in SMEs to Push the Adoption of Next-Gen Firewall Systems due to its Cost-Effectiveness

The small and medium-sized enterprises (SMEs) segment is expected to grow by 3.0X during the forecast period. As per FMI, the segment is expected to showcase a strong CAGR growth over the upcoming years owing to rapid digitization.

SMEs are adopting network security solutions as these companies have a limited budget to manage business applications and other business activities. Hence, small companies generally use cloud-based applications for their businesses.

These cloud-based applications are sometimes prone to risk due to a lack of authentication. This encourages small and medium enterprises to use network security solutions for securing their cloud-based identities.

Growing Rate of Cyber-Attacks in Healthcare Sector to Propel the Demand for Next-Gen Firewall Systems

The healthcare industry is estimated to grow at the highest CAGR of 11.5% during the forecast period. The healthcare industry is the top most targeted industry among others by cyber-attacker due to the availability of personal and confidential data related to patients.

Information stolen includes data medical history data of patients, bills, and other important documents. These can be used by cybercriminals for creating fake IDs to claim insurance or gain other benefits.

Moreover, due to the rising trend of BYOD in the healthcare industry, employees or staff are making use of their own devices for performing a task and saving data on cloud-based applications. As these applications are less secure and more prone to cyber threats and viruses, demand for next-gen firewall systems is increasing.

The next-generation firewall (NGFW) market is highly competitive. Key players focus on continuous innovation, threat intelligence integration, and network automation to address evolving cybersecurity challenges. Cisco Systems Inc., Fortinet Inc., and Palo Alto Networks Inc. lead the market through advanced firewall architectures, combining AI-driven threat detection and cloud-native security for hybrid enterprise environments.

Check Point Software Technologies Ltd., Sophos Ltd., and Juniper Networks Inc. strengthen their positions with scalable network protection, endpoint integration, and zero-trust frameworks. These firms emphasize machine learning-based analytics to enhance visibility and reduce security breaches.

Cloudflare Inc. and Zscaler Inc. are expanding in cloud-first and SASE segments, providing firewall-as-a-service (FWaaS) solutions optimized for distributed and remote networks. Barracuda Networks Inc. and Hillstone Networks address mid-sized enterprise needs, offering cost-effective, unified security solutions.

Market strategies focus on R&D investment, strategic partnerships, and acquisitions to strengthen product ecosystems. Growth depends on cloud integration, real-time threat prevention, and the ability to deliver flexible, subscription-based security models that align with digital transformation trends across industries.

| Attribute | Details |

|---|---|

| Market value in 2025 | USD 4.3 billion |

| Market CAGR 2025 to 2035 | 9.1% |

| Share of top 5 players | Around 35% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, North Africa and South Africa |

| Key Segments Covered | Type, Enterprise Size, Industry and Region |

| Key Companies Profiled |

Cisco Systems Inc., Fortinet Inc., Palo Alto Networks Inc., Check Point Software Technologies Ltd., Sophos Ltd., Juniper Networks Inc., Cloudflare Inc., Barracuda Networks Inc., Hillstone Networks, Zscaler Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global next-gen firewall market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the next-gen firewall market is projected to reach USD 10.2 billion by 2035.

The next-gen firewall market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in next-gen firewall market are physical ngfw appliance and virtual ngfw appliance.

In terms of enterprise size, large enterprises segment to command 62.3% share in the next-gen firewall market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firewall as a Service Market

SMS Firewall Market Size and Share Forecast Outlook 2025 to 2035

Cloud Firewalls Market Size and Share Forecast Outlook 2025 to 2035

Industrial Firewall Device Market Size and Share Forecast Outlook 2025 to 2035

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Network Security Firewalls Market Size and Share Forecast Outlook 2025 to 2035

Domain Name System (DNS) Firewall Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA