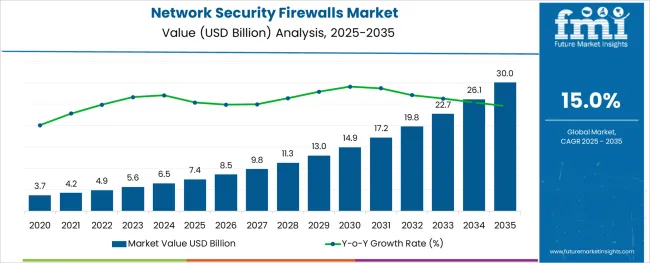

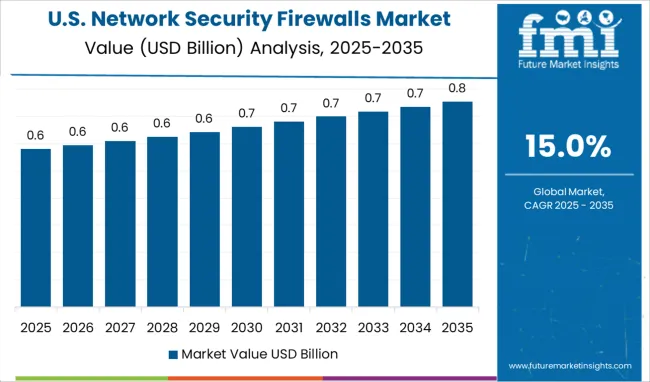

The Network Security Firewalls Market is estimated to be valued at USD 7.4 billion in 2025 and is projected to reach USD 30.0 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

The network security firewalls market is undergoing substantial growth as digital transformation accelerates across telecom, enterprise, and cloud-native infrastructures. Organizations are increasingly prioritizing threat prevention solutions that combine behavioral analytics, deep packet inspection, and real-time anomaly detection.

The widespread shift toward 5G networks and IP-based communications is exposing new vulnerabilities, especially at the signaling layer, prompting a surge in demand for comprehensive firewall frameworks. Regulatory mandates and cross-border data privacy laws are also reinforcing enterprise investment in robust perimeter and internal security protocols.

Network operators and managed security providers are adopting modular firewall architectures capable of addressing evolving attack vectors, especially as multi-access edge computing and hybrid cloud adoption expand. The future growth trajectory is expected to be shaped by the integration of AI-powered threat intelligence, zero-trust architectures, and the rise of security-as-a-service models aimed at real-time traffic control and unified policy enforcement across distributed environments.

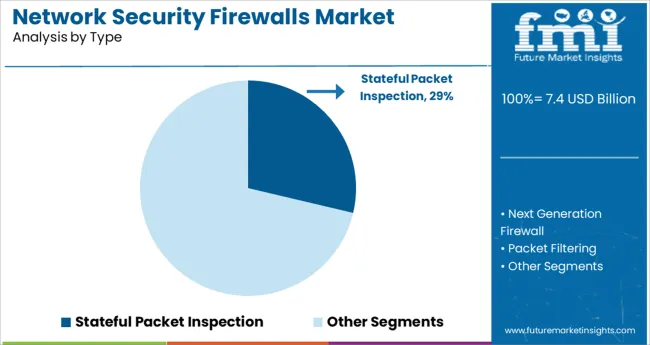

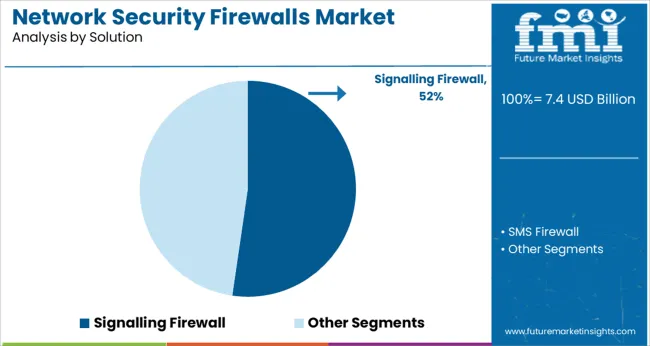

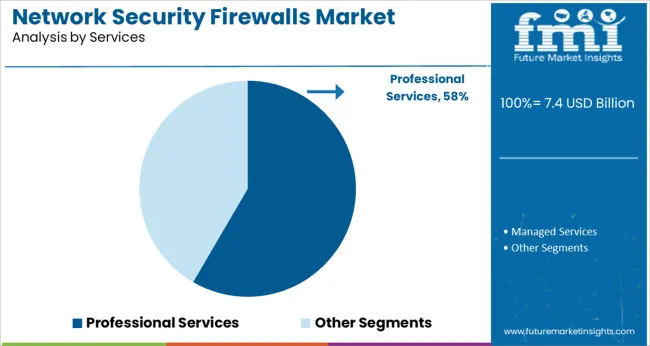

The market is segmented by Type, Solution, Services, and Deployment and region. By Type, the market is divided into Stateful Packet Inspection, Next Generation Firewall, Packet Filtering, and Unified Threat Management. In terms of Solution, the market is classified into Signalling Firewall and SMS Firewall. Based on Services, the market is segmented into Professional Services and Managed Services.

By Deployment, the market is divided into On-premises, Cloud, and Virtualization. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Stateful packet inspection is projected to hold a 28.7% revenue share in 2025 within the type segment, establishing it as the leading protocol-based firewall methodology. This position is being maintained due to its core capability of monitoring active connections and making dynamic traffic decisions based on the state of network sessions.

Stateful firewalls continue to be widely deployed due to their balance of performance and security, especially in enterprise and carrier-grade environments where persistent connections must be authenticated and tracked in real time. Integration with intrusion detection systems and next-generation firewall layers has further elevated the relevance of stateful inspection, allowing for improved visibility without compromising throughput.

As organizations seek dependable protection against mid-level attacks and known threat patterns, stateful inspection remains a foundational element of modern firewall architectures.

The signalling firewall segment is expected to account for 52.3% of the market revenue in 2025 within the solution category, emerging as the dominant offering. The proliferation of 4G and 5G networks, combined with increasing use of SS7, Diameter, and SIP protocols, has escalated the risk of signaling-based cyberattacks such as message spoofing, location tracking, and denial-of-service.

In response, mobile network operators and cloud communication providers have prioritized signaling firewalls as critical infrastructure to protect subscriber data, ensure service integrity, and comply with regional telecom regulations. These solutions provide real-time filtering and behavior-based detection to prevent unauthorized signaling manipulation and fraudulent activities.

Their ability to scale across legacy and next-generation network layers has solidified their role as the backbone of mobile core security and a central component in telecom security modernization strategies.

Professional services are anticipated to contribute 58.4% of the total revenue in 2025 under the services category, positioning them as the leading enabler of firewall deployment and optimization. The complexity of modern network environments and the growing sophistication of cyber threats have driven enterprises to rely heavily on expert-led design, integration, and configuration support.

These services include architecture assessment, rule tuning, threat modeling, and performance benchmarking-delivered by certified consultants to align firewall deployment with organizational security objectives. As compliance standards and security policies become increasingly stringent, demand for hands-on expertise in solution customization, incident response planning, and regulatory audits has intensified.

Furthermore, the rise of hybrid and multi-cloud networks has expanded the scope of firewall service engagements, cementing professional services as a mission-critical segment for effective firewall lifecycle management.

Presently, North American network security firewalls are anticipated to lead the global market during the forecast period. North American network security firewalls market is said to hold 32.8% of the total market share by the end of 2025. Several countries in North America are witnessing a constant growth in cyberattacks, and therefore, venture capital in security reinforcement has assisted North America in gaining the highest market share in the global network security firewalls market.

| Parameters | North America |

|---|---|

| Hold on the Market (2025) | 32.8% |

| Key Driver | Digital transformation in the telecom sector to underpin significant growth. |

| Key Opportunity | Influx of investment brought in the market by venture capitalists. |

Other factors promoting the growth of the market in this region are swift development and privacy concerns in digital transformation in the telecommunication industry are, promoting the incorporation of firewalls. Moreover, the presence of multiple vendors, who provide Distributed Denial of Service (DDoS) protection and well-timed adoption of network security firewall software solutions, are anticipated to propel the North American network security firewalls market during the forecast period.

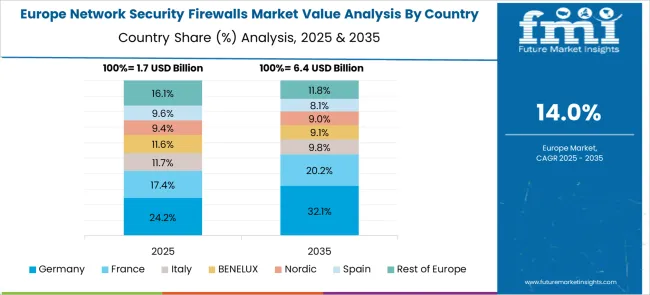

On the other hand, the European regions account for 20.70% of the global market share for the network security firewalls market. European vendors have surfaced as innovators in developing Next Generation Firewalls (NGFW) and UTM (Unified Threat Management). The European Union Agency for Cybersecurity (ENISA) is the dedicated agency to achieve a superior level of cybersecurity across Europe.

| Parameters | Europe |

|---|---|

| Hold on the Market (2025) | 20.70% |

| Key Driver | Government intervention to unlock wide growth channels. |

| Key Opportunity | GDPR norms pertaining to data privacy to unlock vast opportunity. |

ENISA supports EU cyber policy and develops the reliability of ICT products, processes, and services with cybersecurity certification schemes. Businesses in this region go on to use network security solutions to determine and prevent threats at an early stage. This significantly contributes to the network security firewalls market in Europe region.

The network security firewalls industry opens several opportunities for new entrants who focus on segments such as cybersecurity. In April 2025, unified cyber security platform WiJungle received its seed funding at a valuation of USD 22 million from US-based global venture capital firm SOSV. WiJungle decided to be part of the SOSV program from the aspect of global quantifiability and for mentorship to work together on their plans to expand further.

Also, in June 2025, cybersecurity firm Perimeter 81 hit unicorn status with a USD 100 million fundraising. This company offers secure network solutions for the hybrid workforce on its cloud-based platform. The company stated that its backers now value the Israeli cybersecurity company at USD 1 billion.

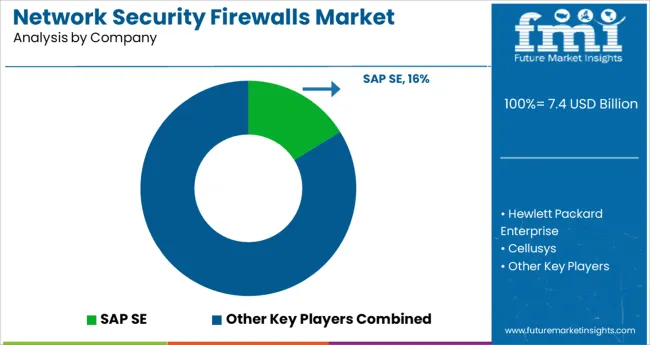

Some of the key players in the network security firewalls market are SAP SE, Hewlett Packard Enterprise, Cellusys, Symsoft, Openmind Networks, Tata Communications, ANAM Technologies, AMD Telecom, Adaptive Mobile, and Infobip.

| Sr. No. | 1 |

|---|---|

| Year | June 2025 |

| Key Player | Hewlett Packard Enterprise |

| Strategy Employed | Hewlett Packard Enterprise stated that it is the primary major server provider to render a new line of cloud-native compute solutions by using processors from Ampere. Also, recently Forrester Researcher, Inc., named SAP a leader among Enterprise Data Fabric Solutions. |

| Sr. No. | 2 |

|---|---|

| Year | November 2024 |

| Key Player | Amazon |

| Strategy Employed | Amazon introduced AWS Network Firewall service that enables easy deployment of key network operations. It is a cloud-based solution that sets up easily using few clicks. In addition to this, the network security firewall can be scaled as per the new requirements surfacing in the future. |

| Sr. No. | 3 |

|---|---|

| Year | April 2025 |

| Key Player | Accenture |

| Strategy Employed | Accenture and Vodacom teamed up to work towards the improvement of cybersecurity 4to curb instances of cyberattacks and cyber threats, which arises on account of the lack of investment. |

| Sr. No. | 4 |

|---|---|

| Year | May 2025 |

| Key Player | Capgemini |

| Strategy Employed | Capgemini announced that it has opened a new office in Spain with a special focus on Cyber Defence Centre, also known as (CDC) as a Cloud Service Center. The new space in Spain will complement the CDC offices present in the UK, France, Poland, India, Paris, the Netherlands, and Australia. |

Most of the players in the niche have an intensified focus on providing a better service in order to gain an edge over their fellow contenders. As a result, the priority has always been on improving the service quality. Cloud deployment of network security firewalls is a game-changing means for the established players to cater to requirements from geographies out of their physical coverage. Additionally, the focus is also on the expansion to new geographies to make the most out of the opportunities present, alongside having less competition to deal with.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 15% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Solution, Services, Deployment, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | SAP SE; Hewlett Packard Enterprise; Cellusys; Symsoft; Openmind Networks; Tata Communications; ANAM Technologies; AMD Telecom; Adaptive Mobile; Infobip |

| Customization | Available Upon Request |

The global network security firewalls market is estimated to be valued at USD 7.4 billion in 2025.

It is projected to reach USD 30.0 billion by 2035.

The market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types are stateful packet inspection, next generation firewall, packet filtering and unified threat management.

signalling firewall segment is expected to dominate with a 52.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Slicing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA