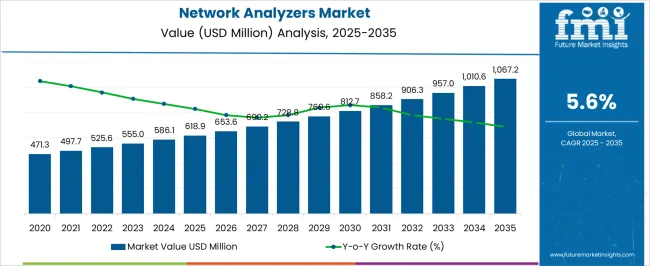

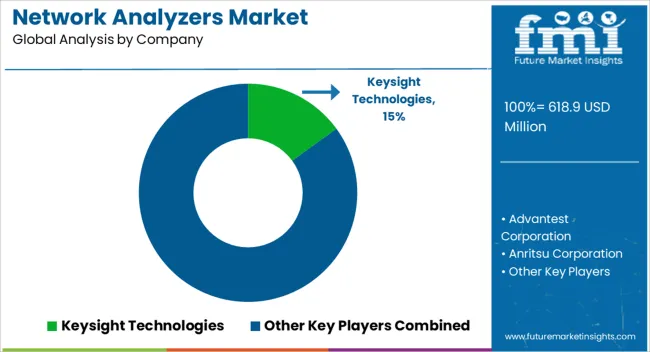

The network analyzers market is projected at USD 618.9 million in 2025 and anticipated to reach USD 1,067.2 million by 2035, registering growth at a CAGR of 5.6%. Market share erosion and gain patterns across this timeline highlight a competitive transition as manufacturers, service providers, and regional suppliers respond to technology shifts and customer preferences. In the early phase, stronger adoption is seen in telecom, aerospace, and defense sectors, where network analyzers are increasingly deployed to validate complex systems. This concentration of usage is expected to give established players higher share, yet it also opens space for niche manufacturers specializing in portable and mid-range devices. By 2030, market expansion in Asia-Pacific is projected to redistribute global share, as local suppliers gain momentum through cost-effective offerings.

Toward 2035, share erosion is anticipated for traditional bench-top devices, as portable, modular, and software-driven analyzers gain wider acceptance in automotive electronics and IoT testing. In my opinion, share dynamics suggest that those relying only on high-end, capital-intensive instruments may lose ground, while agile competitors investing in multi-functionality, user-friendly interfaces, and cloud-linked solutions are likely to secure incremental share. This blend of erosion and gain indicates a shifting balance favoring adaptability and accessibility.

| Metric | Value |

|---|---|

| Network Analyzers Market Estimated Value in (2025 E) | USD 618.9 million |

| Network Analyzers Market Forecast Value in (2035 F) | USD 1067.2 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The network analyzers market is influenced by several interconnected application segments, each shaping demand and overall growth differently. The telecommunications segment holds the largest share at 38%, as network analyzers are heavily deployed to ensure accuracy, efficiency, and performance in 5G rollouts, fiber networks, and wireless communication systems. The aerospace and defense sector contributes 25%, where precision testing of radar, satellite, and electronic warfare systems requires advanced analyzers with high-frequency capabilities.

The electronics and semiconductor segment accounts for 20%, with analyzers integrated into R&D labs and production facilities to validate components, circuits, and devices for quality assurance. The automotive and industrial electronics sector makes up 10%, driven by increasing reliance on analyzers for testing vehicle connectivity, electric powertrains, and smart factory systems. The education and research segment represents 7%, where universities and institutes use analyzers for teaching, prototyping, and experimental validation.

The market is experiencing robust growth driven by the increasing demand for high-frequency testing and measurement solutions across telecommunications, aerospace, defense, and electronics manufacturing industries. The current market landscape is shaped by rapid advancements in 5G technology, which require precise and reliable network testing tools to ensure optimal signal integrity and performance.

The growing complexity of electronic devices and systems has also heightened the need for sophisticated analyzers capable of handling a broad spectrum of frequencies. Investments in research and development to enhance analyzer accuracy, speed, and user interface are supporting market expansion.

Additionally, the rising adoption of automated testing in manufacturing and quality control processes is accelerating demand. Future growth prospects are tied to the continuous evolution of wireless communication standards and the expansion of IoT ecosystems, which necessitate advanced network characterization and analysis capabilities.

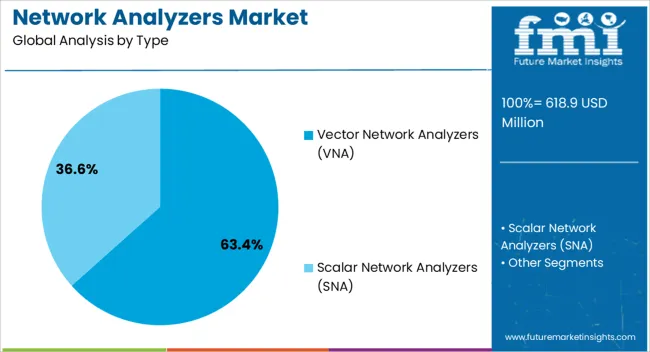

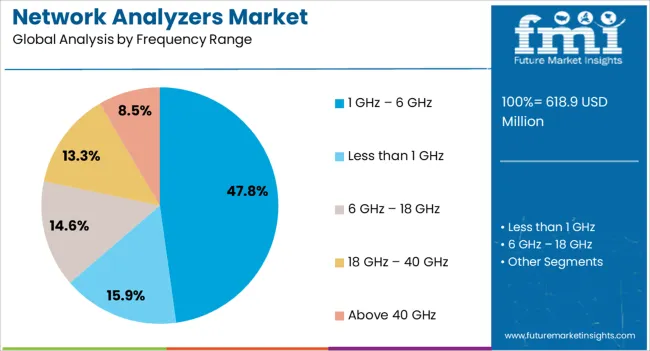

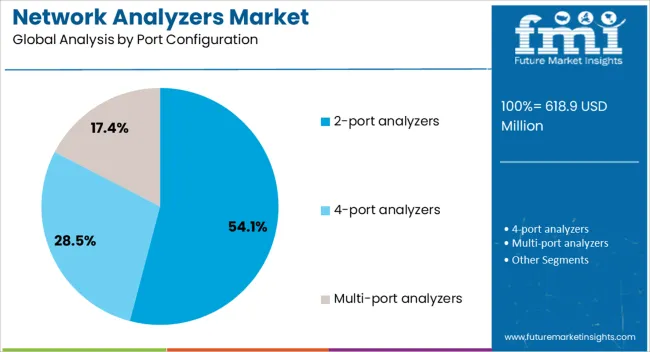

The network analyzers market is segmented by type, frequency range, port configuration, technology, application, end-user, and geographic regions. By type, network analyzers market is divided into Vector Network Analyzers (VNA) and Scalar Network Analyzers (SNA). In terms of frequency range, network analyzers market is classified into 1 GHz – 6 GHz, Less than 1 GHz, 6 GHz – 18 GHz, 18 GHz – 40 GHz, and Above 40 GHz. Based on port configuration, network analyzers market is segmented into 2-port analyzers, 4-port analyzers, and Multi-port analyzers.

By technology, network analyzers market is segmented into Benchtop network analyzers and Portable/handheld network analyzers. By application, network analyzers market is segmented into Design and manufacturing, Network verification and maintenance, Signal integrity testing, Component testing, Radar system testing, Wireless network testing, 5G testing, and Others. By end-user, network analyzers market is segmented into Telecommunications, Aerospace & defense, Automotive, Electronics & semiconductors, Healthcare, IT and networking, Research & development institutes, Manufacturing industry, Energy and utilities, and Others. Regionally, the network analyzers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Vector Network Analyzers segment is projected to hold 63.4% of the Network Analyzers market revenue share in 2025, marking it as the leading type in the market. This prominence is attributed to the segment’s capability to measure both amplitude and phase across multiple ports, making it essential for characterizing complex RF and microwave components.

The segment’s growth has been propelled by its critical role in the development and testing of high-frequency communication systems, including 5G infrastructure and satellite communications. The precision and reliability offered by vector analyzers have made them the preferred choice for research laboratories and manufacturing test environments.

Furthermore, advances in miniaturization and software integration have enhanced their usability, enabling comprehensive network characterization with faster and more accurate results. As electronic systems become more sophisticated, the demand for vector analyzers is expected to maintain its leading position in the market.

The 1 GHz to 6 GHz frequency range segment is anticipated to command 47.8% of the Network Analyzers market revenue share in 2025, establishing it as the dominant frequency range category. This segment’s growth is largely driven by the widespread use of this frequency band in cellular communications, Wi-Fi technologies, and radar systems.

The expanding deployment of 5G networks, which operate significantly within this range, has underscored the necessity for network analyzers capable of precise measurement in these bands. Testing devices optimized for this frequency range allow engineers to perform critical evaluations of signal integrity and component performance relevant to consumer electronics and communication infrastructure.

The increasing complexity of multi-band devices and the push for higher data transmission rates are expected to sustain strong demand for analyzers operating within the 1 GHz to 6 GHz frequency range.

The 2-port analyzers segment is expected to represent 54.1% of the Network Analyzers market revenue share in 2025, positioning it as the leading port configuration category. This segment’s growth can be attributed to its broad applicability in measuring transmission and reflection parameters of two-port networks, which are common in many RF and microwave components such as filters, amplifiers, and antennas.

The relative simplicity, cost-effectiveness, and reliability of 2-port analyzers have driven their preference in both design verification and manufacturing test processes. Additionally, their ability to deliver precise measurements while maintaining manageable complexity makes them suitable for a wide range of applications, from academic research to commercial product development.

As testing requirements evolve with the advancement of wireless technologies, 2-port analyzers are expected to continue dominating the market due to their balance of performance and operational efficiency.

Network analyzers gain momentum from telecom, aerospace, semiconductors, and automotive adoption. Strong reliance on precision and reliability secures consistent growth while diversification into new industries ensures future stability.

Telecommunications expansion has become a critical growth driver for network analyzers, especially with the global transition toward 5G infrastructure. These devices are deployed to validate high-frequency performance, optimize signal transmission, and maintain network reliability. Telecom operators increasingly depend on portable and modular analyzers to streamline field testing and improve cost efficiency. Growth is also linked to fiber-optic deployment, where analyzers verify bandwidth performance and detect faults in real-time. As telecom traffic surges from video streaming, cloud computing, and IoT integration, network reliability becomes non-negotiable, reinforcing demand for precision tools. In my opinion, the dependence of 5G and fiber networks on reliable analyzers ensures long-term demand across both emerging and developed markets.

Aerospace and defense applications strongly influence the network analyzer market, as these sectors require ultra-high-frequency and highly accurate testing for radar, satellite, and advanced communication systems. Equipment reliability in mission-critical operations demands analyzers with exceptional accuracy and durability.

Growth in global defense budgets, satellite launches, and electronic warfare systems further expands the scope of adoption. Analyzers also play a role in standard compliance, ensuring that equipment meets strict military communication protocols. In my view, aerospace and defense remain premium end-users, driving consistent investments in high-value analyzers. Their demand ensures suppliers focus on innovation, calibration accuracy, and extended service models to secure competitive positioning in this specialized segment.

Electronics and semiconductor industries are projected to drive significant adoption of network analyzers, particularly as component complexity rises. Validation of circuits, microchips, and high-frequency devices requires precision testing during design and production. Semiconductor manufacturing hubs in Asia-Pacific are increasingly integrating analyzers to maintain quality assurance and accelerate product launches. Portable and modular analyzers are gaining acceptance in production lines due to their flexibility and cost-effectiveness. As demand for consumer electronics and computing devices intensifies, suppliers of analyzers are benefiting from strong downstream demand. The semiconductor sector represents a growth anchor for the market, offering stability and consistent investment opportunities for manufacturers of high-performance testing equipment.

The automotive industry, especially electric vehicles, has started to rely more on network analyzers for testing vehicle connectivity, infotainment systems, and battery management electronics. Industrial adoption is also strengthening, where smart factory systems and industrial IoT devices require reliable testing protocols. Growth in automation across production environments reinforces demand for compact and versatile analyzers. While smaller in overall share, these sectors bring fresh opportunities for equipment suppliers, expanding beyond traditional telecom and aerospace reliance. Automotive and industrial electronics act as growth catalysts, providing diversification that sustains long-term market resilience. This creates a balanced outlook, where both mature and emerging industries contribute to adoption.

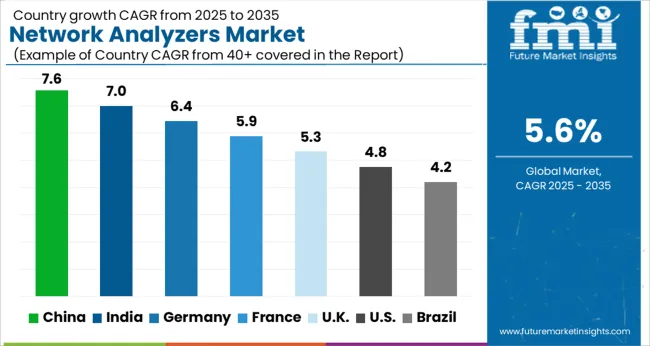

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

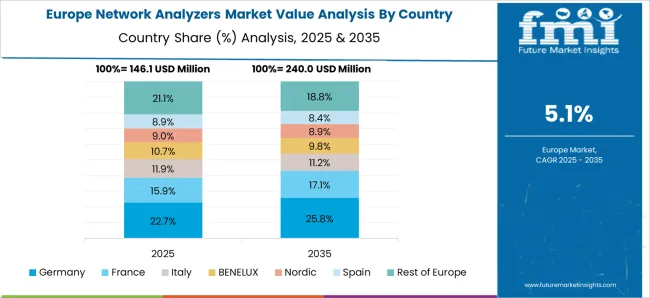

The global network analyzers market is projected to grow at a CAGR of 5.6% from 2025 to 2035. China leads at 7.6%, followed by India at 7.0% and Germany at 6.4%, while France records 5.9%, the UK 5.3%, and the USA 4.8%. Expansion in China and India is propelled by telecom infrastructure buildouts, 5G deployment, and rising electronics manufacturing, creating sustained momentum. Germany and France emphasize aerospace, defense, and industrial electronics testing, with adoption supported by regulatory compliance and high-value R&D activity. The UK demonstrates steady reliance on telecom and automotive electronics testing, while the USA market grows at a moderate pace, focusing on mature sectors like aerospace, defense, and advanced computing. Dollar sales and share dynamics indicate Asia-Pacific as the fastest-growing contributor, while Europe and North America remain steady with premium adoption. The analysis spans over 40 countries, with the above leaders shaping global performance.

The network analyzers market in China is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by the country’s leadership in electronics manufacturing, telecommunications, and 5G rollout. Strong domestic demand from telecom operators and semiconductor companies is pushing manufacturers to adopt high-frequency, modular, and portable analyzers for field and laboratory applications. China’s defense and aerospace investments also contribute significantly, as precision testing becomes critical for radar, satellite, and electronic systems. Regional hubs such as Shenzhen and Shanghai are strengthening R&D and production activities, with both local and international companies competing for share. Dollar sales and share data indicate that China dominates in Asia-Pacific, not only as a consumer but also as a global supplier of analyzers. In my opinion, China’s growth trajectory reflects its capacity to scale production, enhance export competitiveness, and maintain a central role in technology-driven industries worldwide.

The network analyzers market in India is expected to expand at a CAGR of 7.0% from 2025 to 2035, supported by rising telecom investments, digital connectivity initiatives, and the rapid expansion of electronics manufacturing. Government programs promoting 5G adoption and Make in India policies are attracting global companies to invest in local R&D and production facilities. Universities and research institutions are also increasing adoption for training and prototyping, contributing to consistent demand. Dollar sales and share growth are concentrated in portable and mid-range analyzers, as affordability remains a key factor in adoption across small enterprises and academic sectors. In my opinion, India’s mix of large-scale telecom expansion and growing domestic electronics production creates balanced opportunities for both global suppliers and local entrants.

The network analyzers market in Germany is projected to grow at a CAGR of 6.4% from 2025 to 2035, anchored by the country’s role as Europe’s hub for automotive electronics, aerospace, and industrial automation. German manufacturers and research institutions rely on network analyzers for high-frequency testing, compliance validation, and advanced R&D. Automotive innovations, particularly in electric vehicles and connectivity systems, are fueling new demand streams. Aerospace and defense applications, including radar and satellite systems, require high-precision analyzers, reinforcing Germany’s premium market position. Dollar sales and share reflect dominance in high-value, bench-top equipment, complemented by modular analyzers for industrial labs. In my opinion, Germany’s strength lies in its engineering expertise and compliance-driven demand, positioning it as one of the most stable European markets.

The network analyzers market in the UK is expected to grow at a CAGR of 5.3% from 2025 to 2035, sustained by telecom infrastructure upgrades, aerospace industry needs, and academic research adoption. London and other technology hubs are investing in high-speed broadband and 5G networks, where analyzers play a critical role in validation and performance testing. Aerospace firms also use analyzers for high-frequency systems, contributing to steady demand. Universities and training centers represent an important customer group, supporting education and innovation. Dollar sales and share show a preference for modular and compact analyzers, fitting the UK’s demand for cost-efficient solutions. In my opinion, while smaller in scale than Germany, the UK offers consistent growth driven by its strong academic and telecom ecosystem.

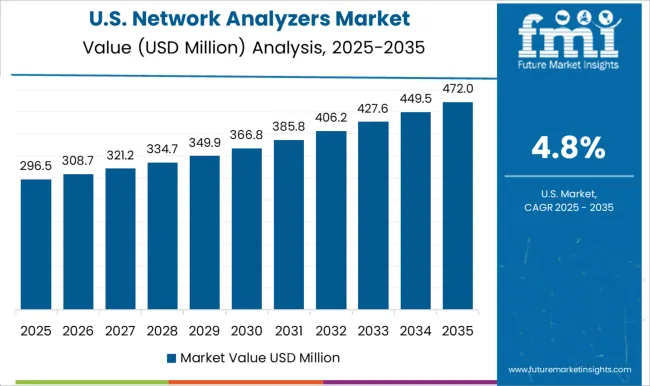

The network analyzers market in the USA is projected to expand at a CAGR of 4.8% from 2025 to 2035, reflecting slower but stable growth compared to emerging regions. Demand is anchored by aerospace, defense, and advanced computing industries, which require high-performance analyzers for compliance, radar, and satellite communication systems. Telecom demand remains steady, though growth is less pronounced due to mature infrastructure. Universities, semiconductor R&D labs, and automotive manufacturers contribute additional adoption. Dollar sales and share figures reveal dominance of high-end analyzers, with companies like Keysight Technologies playing a central role. In my opinion, while the USA shows moderate growth, its market remains critical due to its high-value customer base and emphasis on advanced applications.

Competition in the network analyzers market is driven by precision, frequency range, modularity, and application-specific adaptability. Keysight Technologies leads with a comprehensive range of high-performance analyzers, dominating telecom, aerospace, and defense applications through advanced R&D, calibration services, and global distribution reach. Advantest Corporation and Anritsu Corporation compete with strong portfolios targeting semiconductor, 5G, and wireless testing, emphasizing high-frequency analyzers and portable solutions for field use. B&K Precision Corporation and Boonton Electronics differentiate with affordable, mid-range analyzers designed for academic, industrial, and smaller R&D labs, focusing on accessibility and user-friendly design. Copper Mountain Technologies and its LLC unit emphasize modular USB-driven analyzers, catering to cost-sensitive markets while maintaining flexibility for industrial and academic research applications. GW Instek and HUBER+SUHNER strengthen their positions with diversified instrumentation and RF connectivity solutions, providing niche advantages in high-precision testing and custom industrial applications. National Instruments Corporation focuses on software-defined, modular platforms that integrate network analyzers into broader testing ecosystems, appealing to R&D and educational institutions. Nanjing PNA Instruments Co. Ltd. builds regional competitiveness by offering cost-efficient solutions tailored to emerging Asian markets, gaining traction through localized support and adaptability. Strategies across competitors emphasize R&D investments in higher frequency ranges, expansion into portable and modular devices, and integration with software-based platforms for advanced analytics. Partnerships with telecom operators, semiconductor manufacturers, aerospace companies, and academic institutions enhance market penetration. Dollar sales and share analyses highlight the dominance of premium players like Keysight, Anritsu, and Advantest, while modular specialists and regional firms secure incremental growth opportunities. The market emphasizes performance accuracy, modular innovation, and application-driven solutions to sustain long-term competitiveness globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 618.9 Million |

| Type | Vector Network Analyzers (VNA) and Scalar Network Analyzers (SNA) |

| Frequency Range | 1 GHz – 6 GHz, Less than 1 GHz, 6 GHz – 18 GHz, 18 GHz – 40 GHz, and Above 40 GHz |

| Port Configuration | 2-port analyzers, 4-port analyzers, and Multi-port analyzers |

| Technology | Benchtop network analyzers and Portable/handheld network analyzers |

| Application | Design and manufacturing, Network verification and maintenance, Signal integrity testing, Component testing, Radar system testing, Wireless network testing, 5G testing, and Others |

| End-user | Telecommunications, Aerospace & defense, Automotive, Electronics & semiconductors, Healthcare, IT and networking, Research & development institutes, Manufacturing industry, Energy and utilities, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Keysight Technologies, Advantest Corporation, Anritsu Corporation, Anritsu, B&K Precision Corporation, Boonton Electronics, Copper Mountain Technologies, Copper Mountain Technologies, LLC, GW Instek, HUBER+SUHNER, National Instruments Corporation, and Nanjing PNA Instruments Co. Ltd. |

| Additional Attributes | Dollar sales, share, regional adoption trends, telecom and 5G demand, semiconductor and aerospace applications, competitor positioning, product segmentation, and modular vs. portable equipment growth. |

The global network analyzers market is estimated to be valued at USD 618.9 million in 2025.

The market size for the network analyzers market is projected to reach USD 1,067.2 million by 2035.

The network analyzers market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in network analyzers market are vector network analyzers (vna) and scalar network analyzers (sna).

In terms of frequency range, 1 ghz – 6 ghz segment to command 47.8% share in the network analyzers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Slicing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA