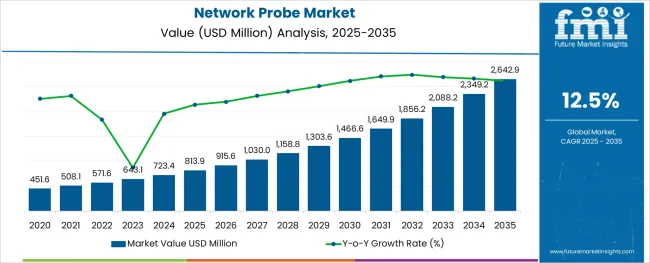

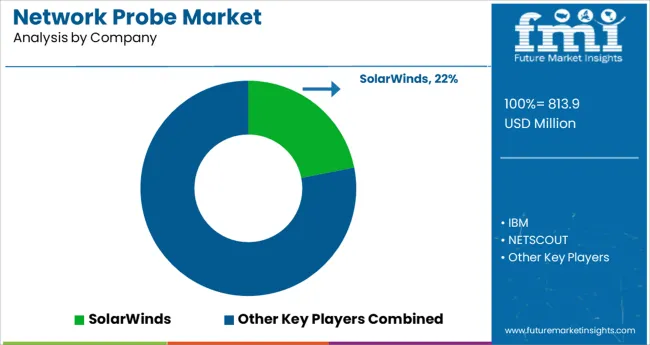

The Network Probe Market is estimated to be valued at USD 813.9 million in 2025 and is projected to reach USD 2642.9 million by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period.

The network probe market is experiencing consistent momentum, driven by the escalating complexities of modern network infrastructures and the mounting demand for advanced network performance management tools. With increasing volumes of data traffic, cloud service adoption, and the proliferation of remote work environments, enterprises and service providers are prioritizing solutions capable of offering real-time network visibility, anomaly detection, and traffic analysis.

The market has seen heightened investment in scalable, AI-driven, and cloud-native probe technologies, designed to support hybrid and multi-cloud ecosystems. As cybersecurity threats become more sophisticated and regulatory mandates on data governance intensify, network probes are gaining strategic importance for both operational performance assurance and security incident detection.

Over the next few years, the market is anticipated to witness accelerated adoption across large enterprises and telecommunication sectors, while newer opportunities emerge in government and industrial networks seeking robust monitoring frameworks. Continuous advancements in AI-powered analytics, packet capture solutions, and integration capabilities with existing IT service management tools are poised to reinforce the market’s growth trajectory on a global scale.

The market is segmented by Organization Size, Component, End User, and Deployment Mode and region. By Organization Size, the market is divided into Large Enterprises and SMEs. In terms of Component, the market is classified into Solution and Services. Based on End User, the market is segmented into Service Providers and Enterprises. By Deployment Mode, the market is divided into Cloud and On-premise. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

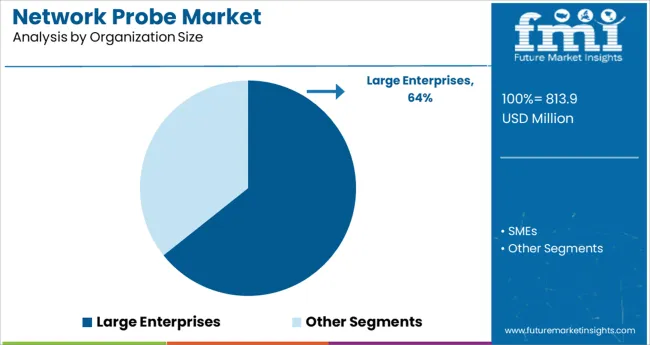

The large enterprises segment held a commanding 64.3% market share within the network probe market, supported by the segment’s inherent need for advanced network visibility tools capable of managing expansive and intricate IT infrastructures. The increasing dependency on cloud services, SaaS applications, and geographically dispersed operations has necessitated the deployment of sophisticated probes capable of offering granular performance metrics and traffic analysis across multiple environments.

Large enterprises consistently prioritize network security, compliance, and operational resilience, making real-time monitoring solutions indispensable for uninterrupted service delivery and risk mitigation. Additionally, the capacity to integrate network probes with existing cybersecurity and incident management platforms has amplified their relevance within enterprise IT ecosystems.

As digital transformation initiatives expand, this segment’s demand for scalable and AI-enhanced network probes is expected to rise further, with a focus on enhancing network troubleshooting, optimizing bandwidth utilization, and securing sensitive corporate data against advanced persistent threats.

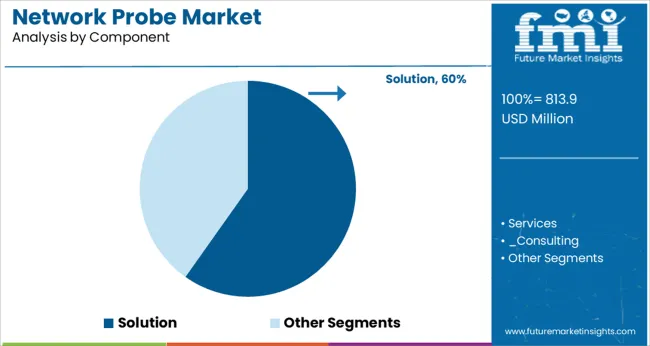

The solution segment dominated the component category with a 59.8% market share, primarily driven by the rising requirement for sophisticated network performance management and monitoring capabilities across diverse industries. Network probe solutions, which encompass hardware and software tools for traffic monitoring, packet capture, and deep packet inspection, have remained critical for ensuring optimal network health and service delivery.

The ability of these solutions to detect anomalies, monitor application performance, and identify potential security breaches in real time has reinforced their adoption, particularly in high-traffic network environments. Continuous innovation in AI-driven traffic analysis and automated response mechanisms has further enhanced the functional value proposition of network probe solutions.

Moreover, as network architectures evolve toward multi-cloud and hybrid deployments, the demand for flexible, scalable, and cloud-native probe solutions is expected to intensify, ensuring this segment maintains a dominant position in the market’s growth narrative over the foreseeable future.

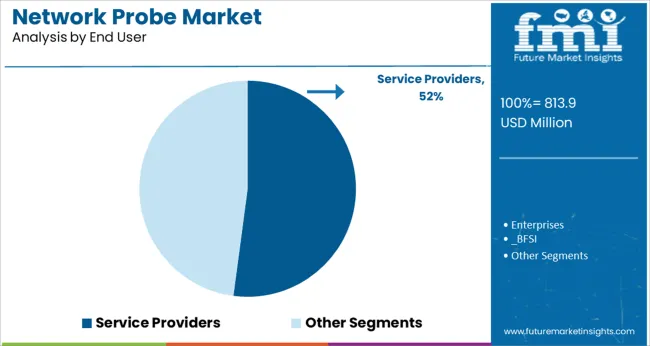

Among end users, the service providers segment secured a leading 52.1% market share, attributed to the critical role network probes play in managing high-volume, high-speed, and mission-critical network infrastructures. Telecommunication companies, internet service providers, and managed service operators rely extensively on network probes to monitor traffic flows, identify service degradations, and swiftly resolve network anomalies to maintain stringent service-level agreements.

The growing adoption of 5G networks, IoT ecosystems, and bandwidth-intensive applications has intensified the operational demands placed on service providers, making real-time network performance management solutions indispensable. Additionally, network probes support service providers in ensuring network security, mitigating DDoS attacks, and achieving regulatory compliance in data-sensitive regions.

The strategic importance of network probes in reducing operational downtime, optimizing infrastructure utilization, and delivering seamless user experiences is expected to sustain high adoption rates within this segment, as providers increasingly invest in advanced, AI-enabled, and scalable network management platforms.

As per the network probe market analysis, device interconnection and virtualization technology have grown rapidly as a result of the increased usage of modern technologies. As a result, the rate of cyber and unauthorized access has skyrocketed, prompting the creation of a comprehensive network efficiency and security evaluation system.

Companies are starting to deploy network probes to comprehend their network design. Network probe solutions safeguard both wired and wireless networks, as well as the core system, reducing the danger of cyberattacks. The demand for network probes is on a steady rise owing to the changing global requirements.

Despite a global rise in the demand for network probes, there are still a few restrictions that continue to hamper the growth of the network probe market share. Network probes aren't designed to provide a high level of visibility and control. The network probing tools are unable to access certain blind areas in the network. If there were any network challenges, it would be a costly process.

The network probe market's growth is projected to be hampered by high initial investment and a lack of awareness. The market is constrained because small and medium-sized organizations have smaller resources and cannot finance substantial capital outlay in outsourced network probing technologies. The adoption of network probes is still limited due to this factor.

The network probe market size's growth is also projected to be hampered by a lack of understanding about the benefits of network probing tools among small and medium businesses. This lack of awareness about the network probe market needs to be dealt with to increase the growth of the industry.

Major driving factors of the rising demand for network probes include the introduction of analytics and cloud technology, as well as the rising demand for proactive monitoring solutions. With the growing requirement for cybersecurity management, the network probe market is expected to grow significantly in the future. Improved cloud computing capabilities and an increase in the number of cloud-based infrastructures throughout the world are driving up network probe market share.

The expanding adoption of cloud and IoT, as well as growing network complexities and security issues, support the need for the adoption of network probes. On the other hand, a lack of technical expertise stifles the network probe market expansion. Nonetheless, the growing demand for network monitoring tools among SMEs is expected to support market growth, providing lucrative growth opportunities for network probe market participants.

The Internet is used by all major industries for day-to-day business activities, which has a favourable impact on the network probe market size. Furthermore, the increasing adoption of network probe capabilities in emerging enterprises is accelerating the network probe market share.

In 2024, the on-premise segment led the network probe market, accounting for more than 61.0 percent of worldwide revenue. When opposed to cloud-based solutions, on-premise network monitoring gives you more control over your network. This sort of deployment is preferred by IT experts because it allows them to customize solutions to match their specific needs.

One of the primary drivers driving the adoption of network probes is the benefits provided by this deployment, such as performance reliability to service providers.

Over the projected period, the cloud segment of the network probe market is expected to increase at the fastest rate. The increased adoption of cloud-based software by enterprises to avoid the burden and expense of administering a system can be contributed to the segment's growth. Cloud-based software's smooth integration capability is contributing to its rising demand.

In 2024, the large companies segment led the network probe market, accounting for more than 53.0 percent of global revenue. Large organizations working in situations like geographically dispersed locations, cloud as a service architecture, and others are vulnerable to threats like cyber-attacks, necessitating the use of network monitoring software.

The growing investments made by large corporations to address cyber-attack worries are adding to the network probe market segment's growth.

Over the projected period, the small and medium enterprise segment is expected to increase the most. To stay competitive in the market, many small and medium enterprises are adopting the bring your own device and Internet of Things trends.

There is a growing demand for IT infrastructure to accommodate enterprises' increasing network traffic. As a result, the network probe market size is rising due to increased network traffic in small business activities.

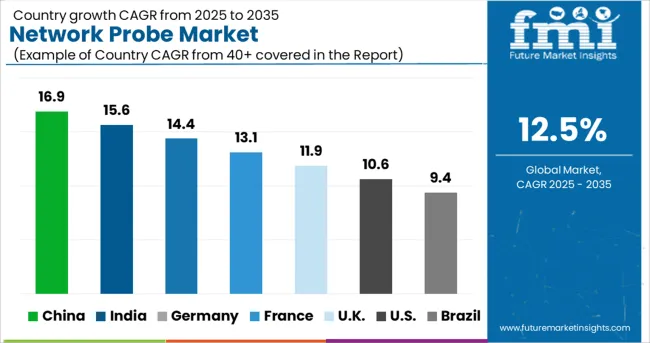

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States | USD 597.8 Million |

| United Kingdom | USD 82.3 Million |

| China | USD 132.4 Million |

| Japan | USD 110.8 Million |

| South Korea | USD 69.9 Million |

The greatest market for network probe technology is in North America. The network probe market's growth is fuelled by the existence of important industry players such as SolarWinds, NETSCOUT, and Broadcom, as well as significant technological advancements.

In addition, the region's network probe market size is boosted by increasing demand and early acceptance of cloud-based platforms, as well as well-established IT and telecom industries.

The regional demand for network probes is bolstered by the expanding use of innovative solutions and the growing number of SMEs in the region. The market is rising due to a growing focus on innovation, significant Research and Development investments, and an increase in the number of IT firms in the region.

The emerging trends in the network probe market are influenced by the increased need for technology and services for web applications, mobile applications, API monitoring, and SaaS application monitoring.

The APAC network probe market is expected to grow rapidly in the next few years. APAC is one of the world's fastest-growing regions. With the ongoing advancement of technology, the volume of data flow within corporate networks is steadily increasing.

As a result, the number of cyber-attacks such as malware, virus, and denial-of-service (DoS) on enterprise networks has increased, driving up demand for network probing solutions among businesses in the area, particularly in fast-growing countries like China, Japan, and India.

This network probe market appears to be extremely competitive and fragmented, with a competitive landscape formed by multiple mature firms. Mergers and acquisitions, collaborations, expansion, and product/technology development are all examples of strategic tactics taken by these players. They invest much in product development and growing their global footprints.

Some of the recent developments in the network probe market are:

SolarWinds and DNSFilter announced a collaboration in April 2024 to help MSPs defend their customers from internet security risks using advanced DNS technology. DNSFilter's cloud-based security solution would be integrated with N-Central to deliver threat protection and content filtering to MSPs.

Broadcom and Google established a partnership in April 2024 to accelerate innovation and increase cloud services integration. Broadcom will be able to provide its suites on the Google Cloud Platform as a result of the partnership.

Nokia teamed with Tele2 in January 2024 to speed its digitalization using a distributed cloud core. Nokia will deliver the NetAct Network Management System as part of the agreement to help protect, automate, and scale network management operations.

North America

The global network probe market is estimated to be valued at USD 813.9 million in 2025.

It is projected to reach USD 2,642.9 million by 2035.

The market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types are large enterprises and smes.

solution segment is expected to dominate with a 59.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Slicing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA