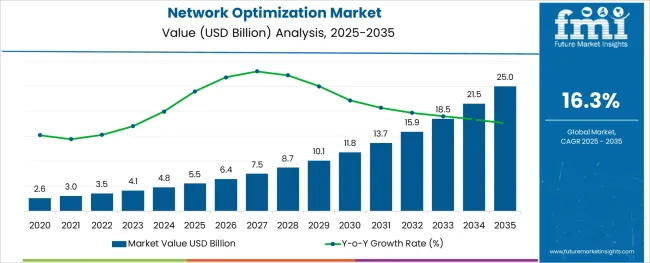

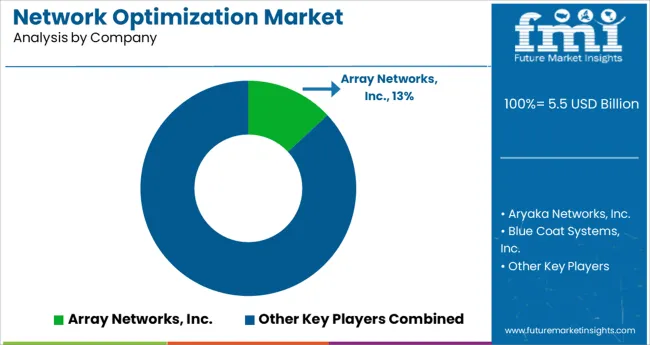

The Network Optimization Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 25.0 billion by 2035, registering a compound annual growth rate (CAGR) of 16.3% over the forecast period.

The network optimization market is currently advancing rapidly, supported by the rising complexity of enterprise network environments and the surge in data traffic from cloud computing, video streaming, and IoT connectivity. As organizations face growing pressure to maintain low latency, high uptime, and secure data flows, investment in intelligent traffic routing, WAN acceleration, and dynamic load balancing tools is intensifying.

Many enterprises are also upgrading infrastructure to meet the demands of hybrid workforces, requiring optimized application delivery across distributed endpoints. Cybersecurity and compliance mandates are further pushing adoption of solutions that not only boost performance but also enhance visibility and control.

Key players are focusing on AI-enhanced analytics, predictive congestion management, and multi-cloud integration capabilities to strengthen value propositions. With emerging markets scaling digital infrastructure and developed markets pushing toward zero-trust architecture and intelligent edge computing, network optimization solutions are expected to remain critical in enterprise IT strategy over the coming years.

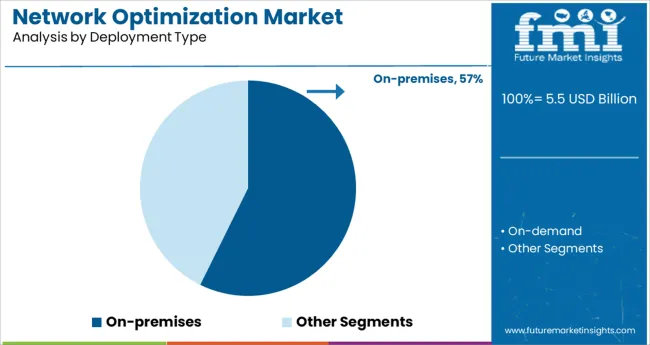

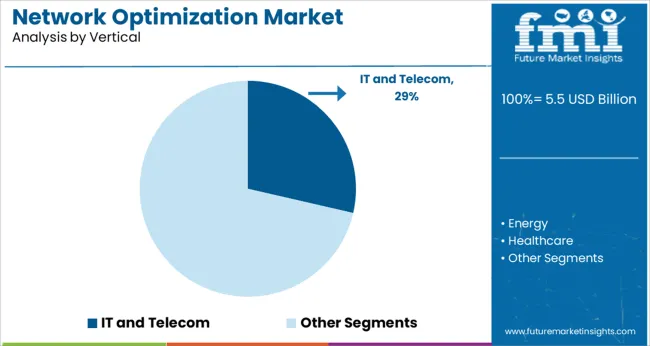

The market is segmented by Deployment Type and Vertical and region. By Deployment Type, the market is divided into On-premises and On-demand. In terms of Vertical, the market is classified into IT and Telecom, Energy, Healthcare, Manufacturing, Retail, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on-premises segment is anticipated to lead the deployment type category with a 57.30% revenue share in 2025, maintaining its stronghold across industries where control, customization, and data security remain top priorities. Organizations handling sensitive data and operating under stringent regulatory frameworks have favored on-premises deployments due to their ability to ensure data residency and mitigate risks associated with third-party hosting.

Enterprises have also preferred this model for optimizing internal networks and maintaining real-time control over traffic management tools and application performance. Customizability and integration flexibility have allowed tailored deployment within existing IT ecosystems, a key driver in sectors like healthcare, finance, and manufacturing.

The segment’s resilience is further supported by investments in edge appliances and next-generation infrastructure components that enable high-performance optimization within internal data centers, reinforcing the dominance of on-premises models even in a cloud-forward era.

The IT and telecom vertical is expected to command a 28.60% revenue share in 2025, making it the largest contributor by industry. This leadership is being propelled by the sector’s inherent need to manage vast data volumes, deliver consistent service levels, and enable seamless connectivity across global networks.

With cloud adoption, 5G rollout, and edge computing on the rise, IT and telecom enterprises are increasingly deploying network optimization tools to ensure application availability and reduce latency across high-bandwidth environments. These organizations rely on robust optimization frameworks to manage real-time traffic for voice, video, and enterprise-grade applications while also meeting SLAs.

Strategic upgrades in core and access networks, along with investments in AI-powered traffic analysis and intent-based networking, are further strengthening the segment’s adoption curve. As service providers and IT vendors expand global operations and support complex multi-cloud ecosystems, the demand for scalable, reliable optimization solutions within this vertical is projected to sustain strong growth.

The primary factor driving the global network optimization market is fast growth in IP and Ethernet services. Consequently, the rising number of users coupled with restricted bandwidth, and availability of organizations, might experience problems in bulk data transfer over the internet.

Furthermore, in recent years all organizations are majorly concerned regarding the transfer of data and are thus shifting to web-based versions for easily accessing remote employees and expanding data transfer security. However, this shift to web-based versions leads to a heavy load on the network, and this results in lower performance output on an occasional basis.

Many service providers are advancing towards global and regional growth by making use of software-as-a-service (SaaS) technology. These technologies assist in enhancing the markets by rendering solutions which are playing a significant role in uplifting the revenue development of the network optimization services market.

The increasing demand for VoIP (Voice over Internet Protocol) services across enterprises is promoting the network optimization market growth. With the increasing need for VoIP services demanding a huge amount of high-speed internet connectivity, enterprises have a considerable impact on the need for optimizing their network to enhance functional efficiency.

By implementing technology, businesses can enjoy seamless transmission of data. Moreover, network optimization can deal with real-time applications, which include pre-population of on-demand video, Voice over Internet Protocol (VoIP), and streamlining of video, among other features. These factors assist in advantages rendered by network optimization technology and, therefore, the need of the hour for all businesses regardless of their functional field.

Given the number of prominent drivers, the network optimization market is likely to thrive significantly during the forecast period.

The growth momentum of the network optimization market is not without any roadblock.

There is a significant lack of awareness pertaining to the advantages offered, especially in the developing region, regarding the network optimization service. As a result, it could cause a hindrance in the global network optimization market. In developing countries, many companies do not comprehend the advantages of network and optimizing services. Network optimization services can assist in faster transfer of data, disaster recovery, transfer of massive data, and response to time restrictions of various interactive applications like database and software applications.

A crucial leap in RAN and WAN optimization technology offers several opportunities in the network optimization market. Developments in technologies for RAN and WAN optimization assist in the transmission of ample data and solutions for data traffic. This helps in the market growth of network optimization across the world and renders opportunities for growth of the market during the forecast period. Lastly, a shortage of awareness pertaining to network optimization and high initial investments are the primary reasons which have negatively affected the growth of the global network optimization market.

Outcome Forecast: All-in-all, the network optimization market is likely to have a healthy growth rate during the forecast period, as the influence of the driver is prominently observed over the restraints.

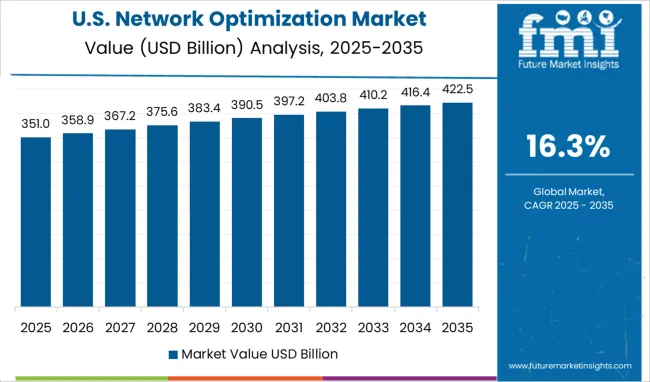

North America is anticipated to experience a remarkable growth during the forecast period. North America is responsible for holding a 35.20% share of the global network optimization market by the end of 2025. The key factor accountable for this growth is the increasing adoption of novel technologies such as cloud-based platforms and smartphones.

Moreover, the positioning of cloud-based systems and solutions and services are delivered via online mode. These are responsible for the growth of the North American network optimization market. To strengthen their position and support in the global network optimization services market, many key market players in this region are adopting some inert strategies.

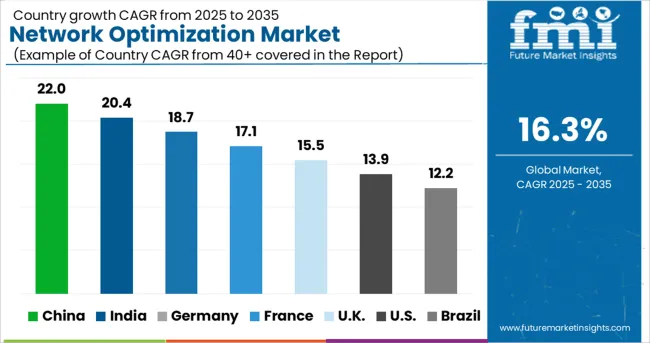

Asia Pacific is said to garner the highest CAGR during the forecast period. This region is presently one of the swiftest growing network optimization markets. In the Asia Pacific, countries such as Japan, India, China, and Australia are four of the most significant contributors to the lucrative growth of the Asia Pacific network optimization market.

To enhance performance in a specific area, a network optimization technique is used. Network optimization is the primary factor that contributes to the efficient and effective management of information systems. Technology plays a significant role in and constantly evolves at an exponential rate.

The network optimization industry opens numerous opportunities for new entrants who focus on segments such as cybersecurity. In April 2025, AMD declared that it would be acquiring data centre optimization start-up, Pensando, for approximately D1.9 billion.

In April 2025, Intel announced that it would reportedly buy cloud optimization start-up Granulate for D4.8 million. In October 2024, Deci, an AI model optimization start-up based in Tel Aviv, Israel, announced that it raised D21 million, which will be utilized to encourage the growth of the company by expanding marketing, sales, and service operations.

Some of the key players in the network optimization market are Array Networks, Inc., Aryaka Networks, Inc., Blue Coat Systems, Inc., CISCO Systems Inc., Circadence Corporation, Citrix Systems, Inc., Exinda, Ipanema Technologies, InfoVista, and Riverbed Technology and Silver Peak, Inc.

High Investment in R&D and continuous technological innovations to eliminate network issues pertaining to data transfer is the key strategy followed by major market vendors to gain a competitive edge. In April 2024, Cisco Systems, Inc. had a strategic partnership with Circadence Corporation to help expand global deployments of 5G IP transport networks. Besides, in October 2024, InfoVista had a collaboration with Rakuten Mobile to assist in delivering cloud-based network planning services to deploy 5G.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 16.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Deployment Type, Verticals, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Array Networks, Inc.; Aryaka Networks, Inc.; Blue Coat Systems, Inc.; CISCO Systems Inc.; Circadence Corporation; Citrix Systems, Inc.; Exinda; Ipanema Technologies; Riverbed Technology and Silver Peak, Inc.; InfoVista |

| Customization | Available Upon Request |

The global network optimization market is estimated to be valued at USD 5.5 billion in 2025.

It is projected to reach USD 25.0 billion by 2035.

The market is expected to grow at a 16.3% CAGR between 2025 and 2035.

The key product types are on-premises and on-demand.

it and telecom segment is expected to dominate with a 28.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA