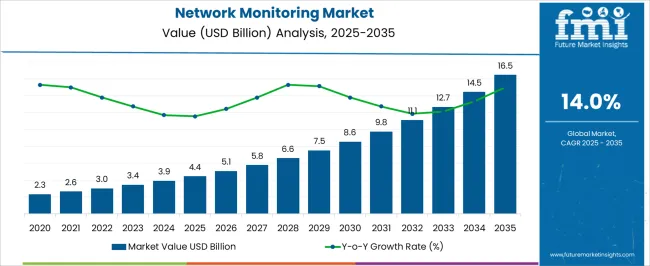

The network monitoring market is projected to grow from USD 4.4 billion in 2025 to USD 16.5 billion by 2035, reflecting strong expansion over the forecast period. The rapid adoption of cloud services, the proliferation of Internet of Things (IoT) devices, and the need for advanced cybersecurity solutions are key drivers of market growth.

The growing importance of network automation, AI-driven analytics, and predictive capabilities in network management also contributes to market expansion. The rise in remote work, digital transformation, and the ever-expanding demand for secure, high-performance networks will continue to drive innovation and growth. Overall, the network monitoring market is set for sustained, robust growth, driven by technological advancements, rising cybersecurity threats, and increasing demands for network reliability and optimization.

| Metric | Value |

|---|---|

| Network Monitoring Market Estimated Value in (2025 E) | USD 4.4 billion |

| Network Monitoring Market Forecast Value in (2035 F) | USD 16.5 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The network monitoring market is undergoing significant expansion, driven by rising data traffic, increasing complexity of IT infrastructures, and the shift toward cloud-native and hybrid environments. Enterprises are adopting intelligent monitoring systems to ensure uptime, manage bandwidth, and mitigate threats in real time.

The growing prevalence of cyberattacks, coupled with compliance pressures across regulated industries, has accelerated demand for proactive, scalable monitoring solutions. Technological developments such as the deployment of 5G, edge computing, and software-defined networking have intensified the need for deep visibility across multi-layered network ecosystems.

As organizations prioritize performance, availability, and security of business-critical applications, investment in high-speed, automation-ready monitoring infrastructure is expected to remain a key strategic focus. Additionally, large-scale digital transformation initiatives and increased integration of AI/ML analytics are reshaping how network data is captured, analyzed, and acted upon across enterprise and telecom segments.

The network monitoring market is shaped by increasing cybersecurity threats, remote work demands, regulatory requirements, and the shift to cloud-based solutions. These factors are driving the widespread adoption of network monitoring tools across industries.

The rise in cybersecurity threats is one of the major dynamics driving the demand for network monitoring solutions. With the growing number of cyberattacks, organizations are prioritizing proactive network monitoring to detect vulnerabilities and mitigate risks. Cybersecurity breaches often lead to significant financial and reputational losses, prompting enterprises to invest in solutions that can provide real-time alerts and issue warnings about potential threats. Network monitoring tools are instrumental in identifying anomalies and suspicious activities, enabling faster response times and minimizing damage. As cybercriminals continue to evolve their tactics, businesses are recognizing the need for continuous network surveillance to protect sensitive data and ensure operational continuity.

The global shift towards remote work has placed additional pressure on organizations to monitor networks effectively. As employees work from multiple locations, the corporate network becomes more distributed, increasing the complexity of managing and securing it. The demand for network monitoring solutions has surged as businesses need to ensure that remote workers can access network resources securely and efficiently. These solutions offer real-time visibility into network traffic, helping businesses detect and resolve issues quickly, thus minimizing disruptions. This shift in work culture has made network monitoring an essential part of managing an organization's IT infrastructure, especially with the rise of cloud computing and mobile access.

Increasing regulatory requirements in industries such as finance, healthcare, and telecommunications have been a driving force for the network monitoring market. Governments and industry bodies are mandating higher standards for data protection and network security, compelling organizations to adopt network monitoring solutions that comply with these regulations. Compliance mandates such as GDPR and HIPAA require businesses to ensure data privacy, monitor network traffic, and conduct regular audits. As penalties for non-compliance grow more stringent, companies are investing in network monitoring tools to track, analyze, and report on network activity to meet legal and regulatory obligations. This trend has made network monitoring a vital component for compliance-driven industries.

The migration towards cloud-based services has reshaped the network monitoring landscape. Businesses are increasingly adopting cloud-based network monitoring solutions due to their scalability, flexibility, and reduced overhead costs compared to traditional on-premise systems. Cloud-based solutions offer centralized monitoring and management of multiple networks, regardless of location, enabling businesses to manage their IT infrastructure more efficiently. This shift has been accelerated by the growing trend of hybrid IT environments, where businesses rely on both on-premise and cloud-based resources. The ability to monitor networks remotely from any location has become a key advantage, especially for organizations with global operations, fostering a more streamlined and accessible approach to network monitoring.

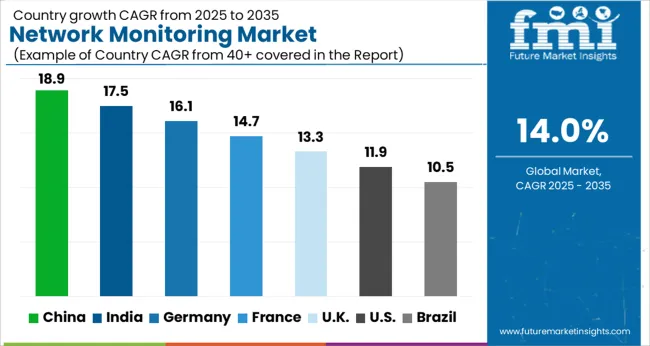

The network monitoring market is projected to grow globally at a CAGR of 14.0% from 2025 to 2035, driven by increasing demand for real-time network performance monitoring, security management, and traffic analysis across multiple industries. China leads with a CAGR of 18.9%, supported by rapid digital transformation, smart city initiatives, and widespread industrial adoption of connected systems. India follows at 17.5%, propelled by the expansion of IT infrastructure, telecommunications networks, and government-driven digital initiatives. France records 14.7%, reflecting robust growth in sectors like banking, healthcare, and manufacturing, which require advanced network monitoring systems.

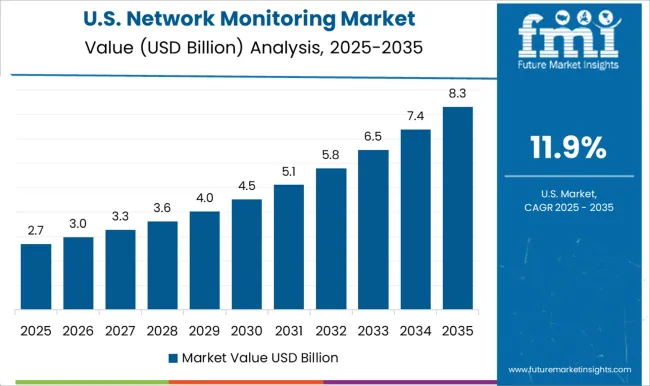

The United Kingdom grows at 13.3%, fueled by rising cybersecurity demands, remote work infrastructure, and critical national infrastructure monitoring needs. The United States achieves 11.9%, reflecting steady growth driven by increasing regulatory compliance, corporate cybersecurity efforts, and demand for data-driven network management solutions. This growth outlook underscores Asia's dominance in driving network monitoring adoption, while Europe and North America maintain consistent demand due to regulatory requirements and the need for enhanced network security.

The CAGR for the network monitoring market in the United Kingdom was assessed at 8.7% during 2020–2024 and advanced to 13.3% for 2025–2035, indicating a stronger cycle of adoption across carriers, enterprises, and public services. Early momentum was tempered by legacy tool overlap, budget deferrals, and fragmented observability stacks across multicloud estates. Growth improved as zero trust programs, encrypted traffic analytics, and full-stack observability were prioritized in procurement scorecards. Spending tilted toward AI-assisted anomaly detection, NDR integration, and real user monitoring for critical services. Partner ecosystems with MSSPs were expanded to meet 24x7 requirements, while compliance reporting needs raised platform consolidation.

China’s CAGR for the network monitoring market stood at 12.4% during 2020–2024 and surged to 18.9% in 2025–2035, signaling heightened demand from hyperscale data centers and industrial networks. The first phase emphasized foundational SNMP and flow-based tools as enterprises stabilized hybrid WAN and edge rollouts. The next wave favored packet capture at scale, intent-based analytics, and automated incident triage for nationwide platforms. Domestic vendors strengthened hardware acceleration for high-throughput inspection, while large operators invested in telemetry pipelines for 5G core and MEC nodes. Procurement favored integrated stacks that combine performance monitoring with east-west threat detection.

India’s CAGR for the network monitoring market was 11.8% during 2020–2024 and elevated to 17.5% for 2025–2035, supported by rapid expansion of telecom, fintech, and shared services hubs. Early gains were recorded from ISP upgrades and SD-WAN rollouts, although tool sprawl and skills gaps limited deeper instrumentation. A clearer upswing followed as digital public infrastructure, UPI traffic growth, and cloud migrations required continuous telemetry with low MTTR. Vendors gained share through managed offerings, API-first integrations, and affordable sensor footprints for distributed branches. Government networks pursued centralized visibility to support e-governance uptime and audit trails.

France’s network monitoring CAGR measured 9.9% in 2020–2024 and improved to 14.7% during 2025–2035, with momentum centered on regulated industries and cloud-first modernization. Initial activity concentrated on performance baselining for data center consolidation and SDN transitions. A steeper climb followed as SOCs integrated NDR with performance telemetry, giving teams shared context for outage and breach containment. Procurement emphasized encrypted traffic visibility, synthetic testing for customer-facing apps, and SLA enforcement across multicloud platforms. Regional hosting and data-residency needs favored vendors offering in-country processing and audit-ready reporting.

The CAGR for the USA network monitoring market was 8.1% from 2020–2024 and climbed to 11.9% for 2025–2035, aided by platform consolidation and security-performance convergence. Early years focused on incremental tool refresh within data centers, with limited end-to-end visibility for SaaS and remote users. Growth strengthened as large enterprises unified AIOps, DEM, and NDR under single observability contracts to reduce MTTR and tool costs. Cloud providers and content networks adopted high-fidelity telemetry to manage east-west traffic and API reliability. Federal and critical infrastructure programs required deeper packet inspection and zero trust metrics, pushing standardized monitoring baselines.

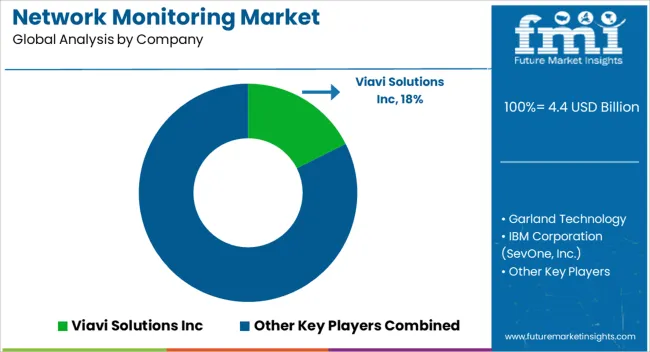

The network monitoring market is highly competitive, comprising a mix of global technology leaders and specialized network performance management providers. Viavi Solutions Inc. offers advanced visibility and analytics solutions for network performance, focusing on service providers and enterprises seeking actionable intelligence.

Arista Networks, Inc. leverages its expertise in high-performance networking hardware and software-defined capabilities to deliver telemetry-driven visibility. Juniper Networks Inc. integrates AI-based insights and automation into its monitoring solutions for data center, campus, and WAN networks. SolarWinds Worldwide LLC remains a key player with its widely adopted Orion platform, offering comprehensive monitoring for on-premises, cloud, and hybrid environments.

Key competitive strategies include expanding AI and machine learning integration for predictive performance analysis, enhancing visibility across hybrid and multicloud environments, and developing end-to-end monitoring platforms that unify performance, security, and compliance data.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Component | Monitoring Equipment, Network Monitoring Switch, Network Terminal Access Point (TAP), Software Platform, Service, Professional Services, and Managed Services |

| Enterprise Size | Large Enterprises and SME |

| Network Speed | 100 Gbps, 1 and 10 Gbps, 40 Gbps, and 400 Gbps |

| Application | IT & Telecom, BFSI, Healthcare, Energy & Utility, Government, Retail, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Viavi Solutions Inc, Garland Technology, IBM Corporation (SevOne, Inc.), LiveAction, Inc, Garland Technology LLC, Riverbed Technology Inc, Arista Networks, Inc, Juniper Networks Inc, and SolarWinds Worldwide LLC |

| Additional Attributes | Dollar sales projections, market share by region and segment, growth rate by deployment model, competitive positioning, key vertical demand, pricing trends, emerging tech adoption, and regulatory or compliance impacts driving procurement. |

The global network monitoring market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the network monitoring market is projected to reach USD 16.5 billion by 2035.

The network monitoring market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in network monitoring market are monitoring equipment, network monitoring switch, network terminal access point (tap), software platform, service, professional services and managed services.

In terms of enterprise size, large enterprises segment to command 61.4% share in the network monitoring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Fault Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Cloud Network Monitoring Market Trends – Growth & Forecast 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA