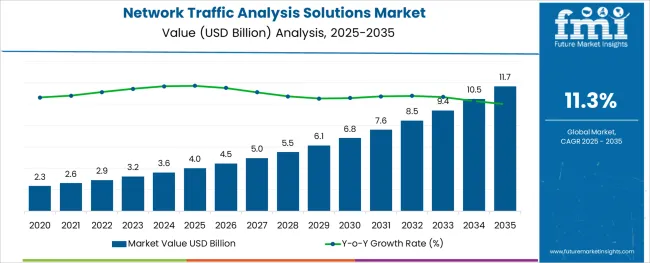

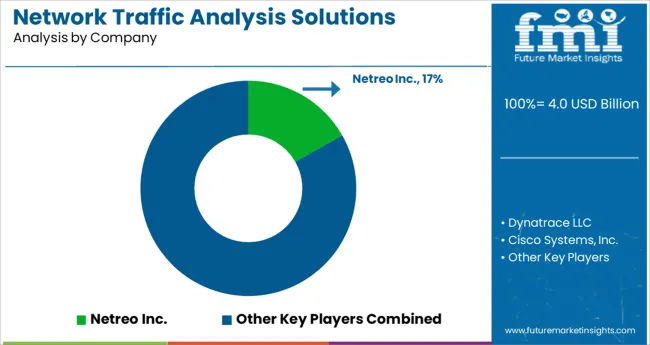

The Network Traffic Analysis Solutions Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

The network traffic analysis (NTA) solutions market is witnessing consistent growth momentum, driven by the escalating frequency of sophisticated cyber threats and the increased adoption of digital infrastructure across industries. As organizations expand their reliance on cloud-based applications, remote work models, and interconnected operational ecosystems, the need for advanced network monitoring and real-time traffic visibility tools has intensified.

Market growth is further reinforced by regulatory mandates and compliance frameworks demanding proactive threat detection and response mechanisms. In the near term, heightened investments in cloud security, edge computing, and artificial intelligence-integrated analytics platforms are expected to fuel demand for scalable, automated traffic analysis solutions.

Enterprise IT leaders continue to prioritize unified security architectures capable of providing deep network insights and early anomaly detection capabilities. Additionally, the growing complexity of multi-cloud and hybrid environments is compelling enterprises to deploy robust NTA systems that ensure operational resilience and data security. The market outlook remains optimistic, with continuous product enhancements and vendor partnerships anticipated to extend solution availability to untapped regions and industry verticals.

The market is segmented by Deployment Type, User Type, and Industry Vertical and region. By Deployment Type, the market is divided into Cloud and On-Premises. In terms of User Type, the market is classified into Small and Medium Enterprise (SME) and Large Enterprise. Based on Industry Vertical, the market is segmented into Banking, Financial Services, and Insurance (BFSI), Government, Healthcare, Energy and Utilities, Education, Telecom and IT, Manufacturing, Retail, and Others (Media & Entertainment, Aerospace & Defense, and Hospitality).

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

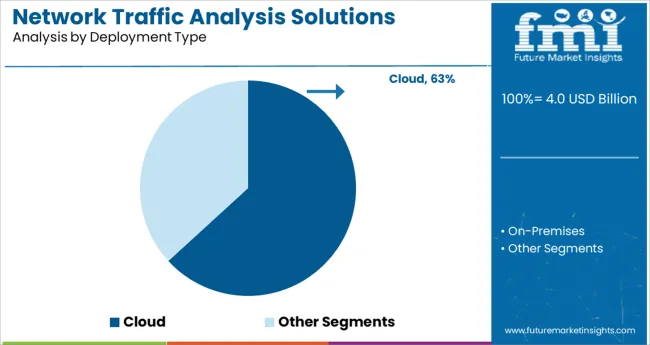

The cloud deployment type segment accounted for approximately 63.2% of the total network traffic analysis solutions market share, establishing its clear dominance within the deployment category. This leadership position has been primarily driven by the rapid enterprise migration to cloud-native architectures and the widespread adoption of software-as-a-service (SaaS) applications across business functions.

Cloud-based NTA solutions offer enhanced scalability, simplified management, and cost-efficiency, making them particularly attractive to enterprises operating in dynamic, distributed environments. The segment's sustained growth has been supported by the rise in remote working models and the proliferation of multi-cloud strategies, which necessitate agile, centrally managed network security tools.

Cloud-based solutions are favored for their ability to deliver continuous network visibility, real-time threat detection, and seamless integration with existing cloud infrastructure security stacks. Future growth is expected to be propelled by ongoing vendor innovations in AI-driven anomaly detection, automated response capabilities, and cloud-native traffic analytics modules tailored for industry-specific compliance requirements.

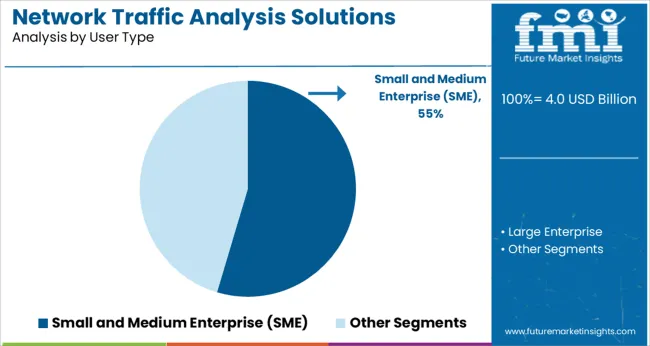

Within the user type category, the small and medium enterprise (SME) segment secured a 54.6% market share, reflecting the increasing prioritization of network security by this traditionally underserved sector. As SMEs adopt cloud services, IoT applications, and digital transaction platforms, their exposure to cyber risks has expanded considerably, prompting a noticeable shift toward deploying advanced traffic monitoring and incident response solutions.

The affordability, ease of deployment, and subscription-based models of modern NTA solutions have further encouraged adoption among SMEs with limited in-house security resources. This segment’s growth is reinforced by regulatory compliance pressures and growing awareness about the financial and reputational consequences of data breaches.

Vendors are increasingly offering tailored, scalable NTA packages specifically designed for small business networks, including features like simplified dashboards, automated reporting, and pre-configured threat detection policies. Continued emphasis on affordable cybersecurity infrastructure and increasing managed security service partnerships are expected to sustain robust growth within this segment over the forecast period.

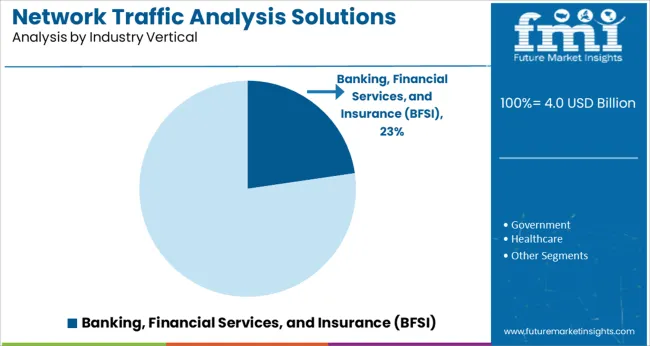

In terms of industry verticals, the banking, financial services, and insurance (BFSI) segment led with a 22.7% market share, underscoring its strategic emphasis on proactive cybersecurity infrastructure. The BFSI sector has long been a prime target for cyberattacks due to the sensitive financial and personal data it manages, necessitating comprehensive network monitoring frameworks capable of detecting anomalous activity and securing transactional environments.

The segment’s strong market share is driven by stringent regulatory compliance mandates, including real-time breach reporting requirements and network segmentation policies. Financial institutions continue to prioritize investments in advanced network traffic analysis solutions that integrate seamlessly with existing security information and event management (SIEM) systems and enable rapid incident containment.

Furthermore, the sector’s gradual adoption of open banking APIs, mobile-first financial services, and cloud-hosted core systems has intensified demand for scalable, cloud-compatible NTA platforms. Moving forward, BFSI organizations are expected to enhance their security posture through AI-driven traffic analytics, behavioral anomaly detection, and multi-cloud network visibility capabilities.

The paradigm shift from normal text messaging to social media messaging apps along with big capital investments by e-commerce giants increases their control over the network and enhances the security of a company’s valuable data.

Network traffic analysis solutions market demand analysis explain the driving factors for the market as proliferating traffic, high consumption of the internet with 5G deployment, advanced attacks on business data, and enhanced control over information.

The high demand for network traffic analysis solutions is attributed to its accessible method for decrypting security professionals while not getting their hands on data privacy implications. In the changing corporate dynamics, data security is an important component of any business, and network analysis helps the end user analyze the threats.

The rapid growth of e-commerce giants like Amazon and Flipkart (Walmart) is expanding the retail space traffic. This allows the expansion of the network traffic analysis solutions market size. Multiple sale events like Flipkart’s big billion-day sale gain a lot of traction from Indian end users. E-commerce platforms adopt traffic analysis solutions to monitor network activities so that the website’s server doesn’t go down because of the high-end user traffic.

This includes providing the end user an enhanced, amazing experience, easing the navigation for them, and resolving all their queries. NTA solutions improve network differentiation in order to allow users to browse through the website conveniently.

Recent developments in the network traffic analysis solutions market explain evolving attacks on network-based communication systems such as phishing attacks or data theft, hackers using new technology to penetrate into security layers of businesses are creating an uneasy situation for corporations. Increased use of cloud technology and cloud traffic has also led to the expansion of network traffic analysis solutions.

It helps the cloud systems secure the important data and information of the company. NTA solutions help businesses analyze the threat and then manage it accordingly. Cutting-edge monitoring tools are also helping end-user businesses in keeping an eye on multiple components to enhance productivity, involving the management of distributed Denial-of-service (DDoS) attacks while maintaining the quality of experience (QoE), increasing the sales of network traffic analysis solutions.

As 5G deployment plays an important part in the growth of the network traffic analysis solutions market, covid-19, and its spread has put a hold on the deployment of 5G deployment around the countries, restraining the growth of the market. Even though the spread of covid-19 has been fruitful to the market, this one factor restrained the growth of the market.

The network traffic analysis solutions market is categorized by deployment type, user type, and industry vertical. These categories are further divided into small segments that expand their channels in multiple market spaces. These segments perform differently in multiple markets as they have a stronghold in multiple regions.

The deployment category is segmented into cloud and on-premises, while the user type category is segmented into small and medium enterprises (SME) and large enterprises. The last category is a vertical industry divided into banking, financial services, insurance, government, healthcare, energy and utilities, education, telecom, IT, manufacturing, and retail.

By deployment type, the network traffic analysis solutions market analysis finds that the On-premises segment is the biggest and is expected to hold the major chunk of the market in the forecast period, thriving at a CAGR of 9.1%.

The factors behind this segment's sales are reliability, easy implementation, and high consumption of on-premises solutions while security concerns arise. Another factor that drives the segment's growth is its increased use of social media monitoring.

By industrial vertical, the banking, financial services, and insurance (BFSI) segment is the biggest segment in the network traffic analysis solutions market. It is expected to hold the largest portion in the forecast period.

The segment is thriving at a strong CAGR of 11.6%. The factors behind the growth of this segment are rising technological advancements in the banking sector and improving security and monitoring levels. Aggressive pricing, growing analysis, and monitoring need to expand the market size of the network traffic analysis solutions.

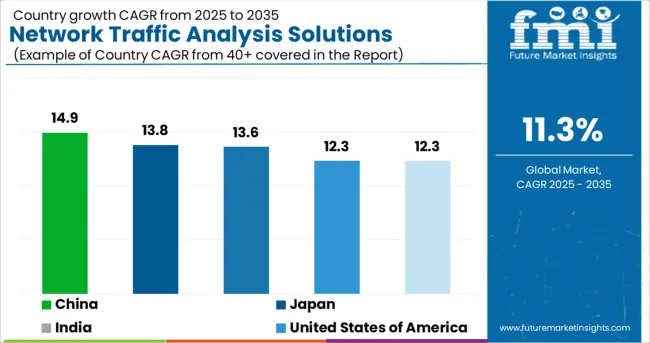

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States of America | 12.3% |

| United Kingdom | 12.3% |

| China | 14.9% |

| Japan | 13.8% |

| India | 13.6% |

The network traffic analysis solutions market report explains that the market is divided into regions; North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe. The biggest market is the USA, growing at a CAGR of 12.3% between 2025 and 2035.

The region is expected to hold a market revenue of USD 11.7 Billion by the end of 2035. Factors behind the high sales of NTA solutions are increasing traffic in the region, rising cyberattacks, and rapid 5G deployments.

Apart from this, China is the highest-growing market for network traffic analysis market, thriving at a CAGR of 14.9% and will hold the second-highest value of USD 1.6 Billion by 2035, while the Japan region is the highest growth potential with a CAGR of 13.8% between 2025 to 2035, generating a revenue of USD 479.6 Million. The UK also grows along with Japan, with the forecasted value of USD 681.2 Million (2035) at a CAGR of 12.3% between 2025 to 2035.

The competitive landscape of the network traffic analysis solutions market is diversified, and vibrant and makes the market more tightly for new players. Companies also collaborate and merge with other companies, which strengthens their roots and expands their distributional channels.

Key Players:

The global network traffic analysis solutions market is estimated to be valued at USD 4.0 billion in 2025.

It is projected to reach USD 11.7 billion by 2035.

The market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types are cloud and on-premises.

small and medium enterprise (sme) segment is expected to dominate with a 54.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Slicing Market Size and Share Forecast Outlook 2025 to 2035

Network Optimization Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA