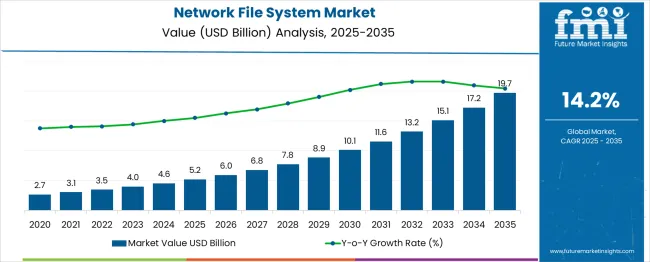

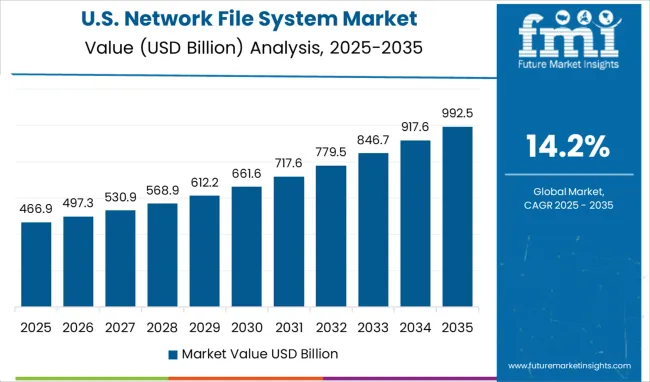

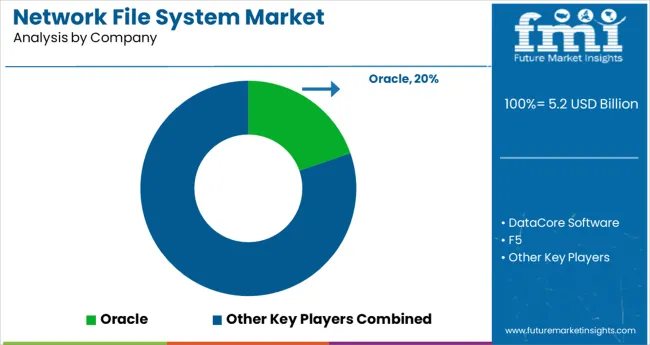

The Network File System Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 19.7 billion by 2035, registering a compound annual growth rate (CAGR) of 14.2% over the forecast period.

The network file system market is experiencing steady growth, driven by the increasing demand for efficient data sharing and storage solutions within enterprises. The rise of digital transformation initiatives has led organizations to prioritize scalable and secure file access systems that support remote collaboration and centralized data management. Improvements in network infrastructure and the need for seamless integration across heterogeneous environments have further accelerated market adoption.

Enterprises are focusing on enhancing system reliability and performance to minimize downtime and data loss. Growing regulatory compliance requirements have also emphasized the importance of robust file management systems with enhanced security features.

The market outlook remains positive as organizations continue to expand their IT infrastructure and seek solutions that improve operational efficiency. Segment growth is expected to be driven by adoption in large enterprises, preference for the NFSv4 version, and the integration of disaster recovery features.

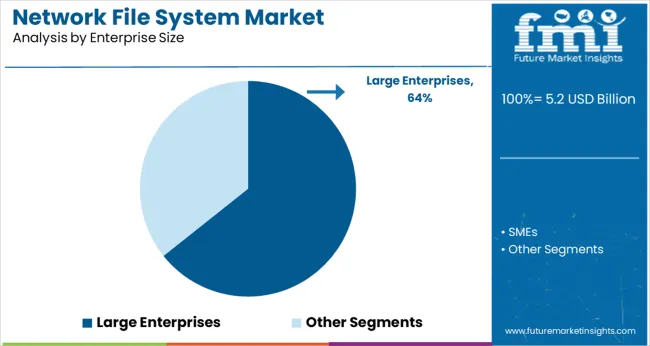

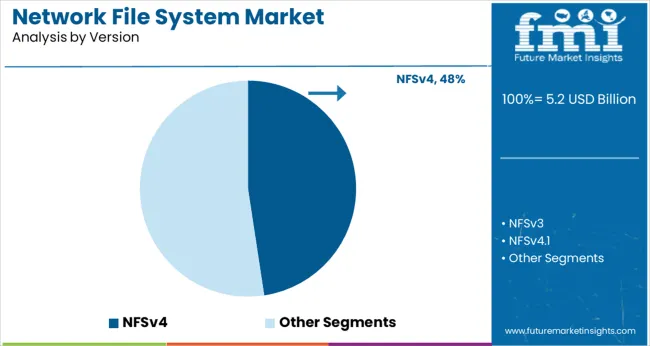

The market is segmented by Enterprise Size, Version, and Features and region. By Enterprise Size, the market is divided into Large Enterprises and SMEs. In terms of Version, the market is classified into NFSv4, NFSv3, NFSv4.1, and NFSv4.2.

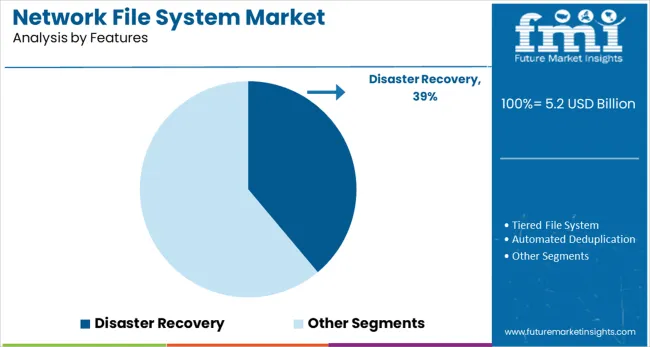

Based on Features, the market is segmented into Disaster Recovery, Tiered File System, Automated Deduplication, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Enterprise Size, Version, and Features and region. By Enterprise Size, the market is divided into Large Enterprises and SMEs. In terms of Version, the market is classified into NFSv4, NFSv3, NFSv4.1, and NFSv4.2.

Based on Features, the market is segmented into Disaster Recovery, Tiered File System, Automated Deduplication, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The large enterprises segment is projected to hold 64.3% of the network file system market revenue in 2025, retaining its dominant position. This growth is attributed to the complex data management needs of large organizations that operate across multiple locations and require reliable file sharing solutions. Large enterprises have prioritized network file systems that support high availability and scalability to accommodate growing data volumes.

Additionally, they demand systems capable of integrating with diverse IT environments and providing secure access controls. The segment has benefited from substantial IT budgets and strategic investments in data infrastructure.

As digital workloads increase, large enterprises will continue to drive demand for advanced network file system solutions.

The NFSv4 version segment is expected to contribute 47.6% of the market revenue in 2025, establishing it as the leading version in use. This version’s growth is driven by its enhanced security features and improved performance over previous iterations. NFSv4 offers better support for firewalls, stronger authentication mechanisms, and improved protocol efficiency.

Organizations have adopted NFSv4 to address evolving security threats and to ensure seamless interoperability across systems.

Its backward compatibility and support for stateful operations have made it a preferred choice among IT administrators. The demand for this version is expected to rise as enterprises seek to modernize their file system infrastructure with secure and scalable solutions.

The disaster recovery features segment is projected to account for 38.9% of the network file system market revenue in 2025, highlighting its critical role in maintaining data integrity and business continuity. The increasing frequency of cyber threats and natural disasters has underscored the need for resilient file systems capable of rapid data recovery.

Disaster recovery capabilities ensure that organizations can restore access to critical files with minimal downtime, reducing operational risks. Network file systems equipped with built-in replication, backup, and failover mechanisms have gained preference among enterprises aiming to safeguard data assets.

These features support compliance with regulatory requirements for data protection and enable proactive risk management. As businesses place greater emphasis on uninterrupted operations, the disaster recovery segment will continue to expand its market share.

The ever-growing internet traffic is the major driver in the network file system market share during the forecast period. Moreover, factors such as continuous up-gradation in data centres, resulting in obsolescence in existing data centres, is likely to the demand for network file system.

Quick response, deployment, and technical advancements are also some important factors are like to influence the network file system market during the forecast period. However, data security concerns and inflexibility are some challenges faced in the network file system, which decline the network file system market during the forecasted period. Another factor that can restrain the growth of the network file system market is reduction in the data inconsistency.

As per the FMI report, the key industries play a vital role all around the regions that growing the network file system market share during the forecast period from 2025 to 2035. Based on the product segment, it is further categorised into NFSv3, NFSv4, NFSv2 and others that are likely to rise in the network file system market size during the forecast period as per network file system market report.

The market is supposed to fluctuate at the time of COVID-19 situations & start again with the same speed with the help of market participants including vendors, distributors, suppliers, manufacturers, and end-users to raise the lion’s share in the network file system market growth.

The network file system delivers more with few resources resulting in the reduction of the capital expenditures in data centres. Companies are adopting the network file system infrastructure as it also caters for the need for a quick response in business processes are likely to increase the adoption of network file system in the coming period.

North America region holds a prominent share in the network file system market growth due to the presence of a wide variety of end-user enterprises and a competitive environment in the region during the forecast period from 2025 to 2035.

It acquires 32.6% of the share in the global network file system market size during the forecast period. The various industries are likely to grow the North American network file system market analysis.

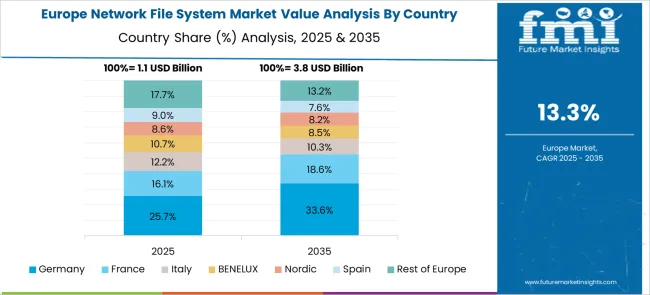

In Europe, the network file system market is likely to grow at a significant pace due to the rise in business demands and IT needs. Europe placed in the second position in the network file system market by acquiring 21.7% of the share in the network file system market. The adoption of network file system rising due to the large-scale outsourcing of managed hosting services in this region during the forecast period from 2025 to 2035.

The network file system is allowed to share the file & data among the client by providing centralized administration and data security, which are likely to grow the network file market key trends & opportunities in the recent year.

The network file system uses in several application operating systems including macOS, Linus and Unix which are used in almost every enterprise leading to an increase in the network file system market size.

The adoption of network file system allows the users to make use of a single file which gives the available information, latest trends using the same file are anticipated to grow the network file system future trends during the forecast period from 2025 to 2035.

CenturyLink, Cisco, IBM Corporation, Digital Realty, Equinix, Inc., RACKSPACE, Global Switch, Level 3 Communications, and NTT Communications Corporation, are some of the key players in the network file system market.

Other prominent players in this market include Ascenty, AT&T, CentriLogic, China Telecom, CtrlS Datacenters, Cyrus, Expedient Data Centers, Telefonica, Telehouse (KDDI), Datapipe, Digiplex, DuPont Fabros, Fujitsu, HCL, Interoute Communications, Interxion, IO, NaviSite, PCCW Global, Singtel, Telstra International, Verizon Enterprise, and Zayo Group.

Recent Development in Network File System Market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 14.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Enterprise Size, Version, Features, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | CenturyLink; Cisco; IBM Corporation; Digital Realty; Equinix, Inc; RACKSPACE; Global Switch; Level 3 Communications; NTT Communications Corporation |

| Customization | Available Upon Request |

The global network file system market is estimated to be valued at USD 5.2 billion in 2025.

It is projected to reach USD 19.7 billion by 2035.

The market is expected to grow at a 14.2% CAGR between 2025 and 2035.

The key product types are large enterprises and smes.

nfsv4 segment is expected to dominate with a 47.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA