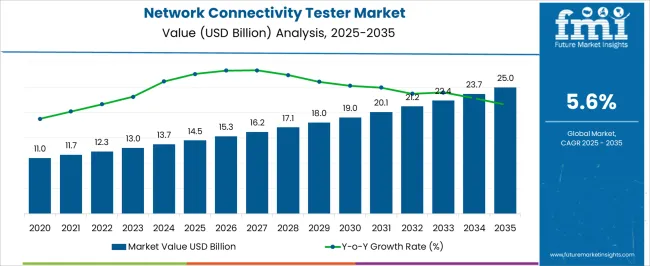

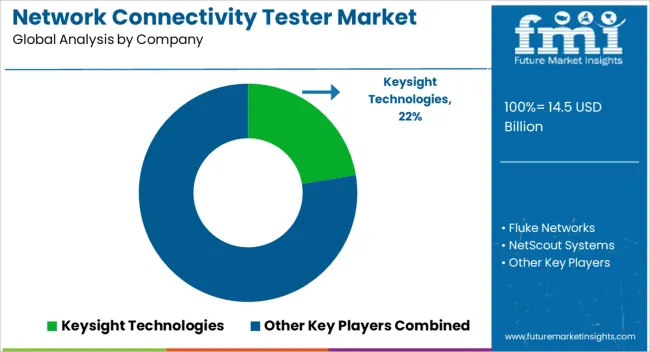

The Network Connectivity Tester Market is estimated to be valued at USD 14.5 billion in 2025 and is projected to reach USD 25.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Network Connectivity Tester Market Estimated Value in (2025 E) | USD 14.5 billion |

| Network Connectivity Tester Market Forecast Value in (2035 F) | USD 25.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Network Connectivity Tester market is experiencing substantial growth due to the increasing demand for efficient network installation, maintenance, and troubleshooting solutions. The current market scenario is characterized by the adoption of advanced connectivity testing tools that provide accurate diagnostics for complex networking environments. Rising investments in enterprise IT infrastructure, data centers, and smart building networks are driving the need for reliable testing solutions.

The shift towards high-speed data transmission and the expansion of broadband and optical fiber networks have further fueled the adoption of these devices. Technological advancements, such as automated testing, multi-protocol compatibility, and real-time analytics, are enabling faster network deployment while minimizing downtime.

As organizations increasingly focus on operational efficiency, cost reduction, and network reliability, the demand for versatile and scalable network testing solutions is expected to expand The future outlook is supported by continuous development of hardware components, integration of software-driven diagnostics, and growing adoption in industries such as IT, telecommunications, and electronics.

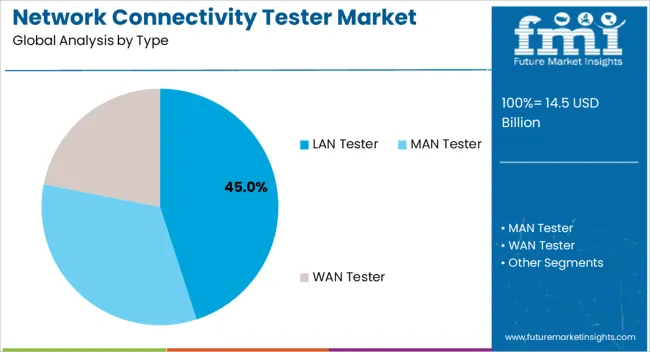

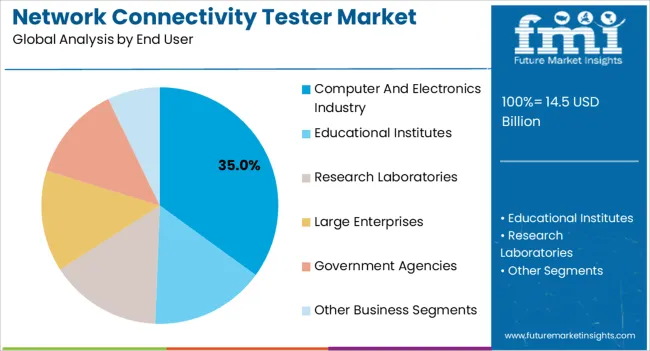

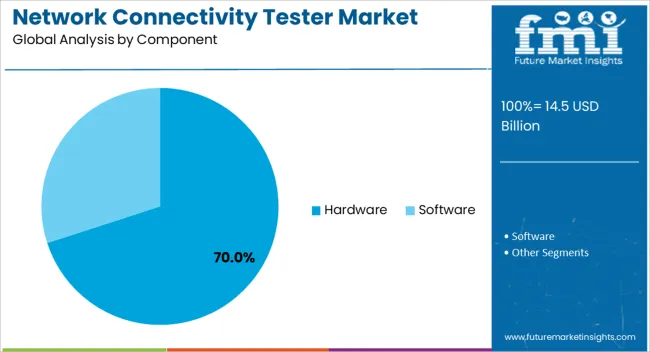

The network connectivity tester market is segmented by type, end user, component, distribution channel, and geographic regions. By type, network connectivity tester market is divided into LAN Tester, MAN Tester, and WAN Tester. In terms of end user, network connectivity tester market is classified into Computer And Electronics Industry, Educational Institutes, Research Laboratories, Large Enterprises, Government Agencies, and Other Business Segments. Based on component, network connectivity tester market is segmented into Hardware and Software. By distribution channel, network connectivity tester market is segmented into OEMs, Distributors, and E-Commerce Portals. Regionally, the network connectivity tester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LAN Tester type is projected to hold 45.0% of the Network Connectivity Tester market revenue share in 2025, making it the leading segment in terms of type. This dominance is being driven by its extensive application in diagnosing and verifying local area network connections within corporate, industrial, and data center environments.

The growth has been reinforced by the increasing complexity of network topologies and the need for accurate fault detection, cable testing, and connectivity verification. LAN testers are preferred because they offer high reliability, ease of use, and rapid results, which are crucial for minimizing operational downtime.

Additionally, the ability to support multiple protocols, measure signal integrity, and detect miswiring has strengthened their position in the market As businesses continue to invest in IT infrastructure and network modernization, the LAN tester segment is expected to maintain its leading share due to its adaptability, accuracy, and long-term value in ensuring network performance and operational continuity.

The Computer and Electronics Industry end-user segment is anticipated to capture 35.0% of the Network Connectivity Tester market revenue in 2025, establishing it as the largest consumer sector. This leadership is being driven by the rapid growth of IT infrastructure, data centers, and electronic manufacturing facilities where network reliability is critical.

The segment has benefited from the increasing deployment of sophisticated networking systems, rising adoption of cloud computing, and expansion of enterprise networks. Network connectivity testers are extensively used for ensuring installation accuracy, performing routine maintenance, and troubleshooting complex connectivity issues, which is essential for operational efficiency.

The segment has also gained traction from rising automation in electronics and manufacturing facilities that rely on uninterrupted network performance As enterprises continue to digitize and modernize their IT systems, the demand for testing tools in this industry is expected to remain strong, with software and hardware integration playing a key role in ensuring accurate and timely diagnostics.

The Hardware component segment is projected to hold 70.0% of the Network Connectivity Tester market revenue share in 2025, reflecting its dominant position in the market. This leadership is being driven by the necessity for durable, reliable, and high-performance devices capable of handling complex network environments.

Hardware components provide the foundational capabilities for precise measurement, signal detection, and fault analysis, which are critical for maintaining network stability. Growth in this segment has been supported by continuous innovation in electronic circuitry, sensor technologies, and portable device design, allowing users to perform efficient on-site testing.

Additionally, the segment benefits from the growing preference for stand-alone hardware devices that offer immediate results without extensive software dependency As organizations increasingly prioritize network reliability, hardware components are expected to remain a primary revenue driver, enabling technicians and engineers to conduct accurate and timely diagnostics while supporting the scalability and evolution of modern network infrastructures.

The network is the communication between two or more computer systems. In practice, a network is comprised of a number of different computer systems connected by physical and/or wireless connections. Digital transformation has led to exponential growth of IP-connected devices, including wireless access points, digital lighting, and access control devices, etc.

As more organizations embrace mobile computing and consumers increasingly rely on mobile devices to manage their always-on, hyper-connected world, Wi-Fi networks are quickly becoming the backbone for delivering optimal user experience.

The immense use and dependency on the network, put some pressure on the entire network infrastructure, requiring major updates including new, high-powered power over Ethernet across the industry segments. The fast and seamless network becomes critical when most of the government and business operative depend on it.

For organizations challenged by the rapid growth of network-connected devices, network connectivity testers, enables installers and IT professional to accelerate deployments and identify the uneven speed problem as well as improve the efficiency and effectiveness of the work. Network connectivity testers thus become a necessity of every network system across the globe.

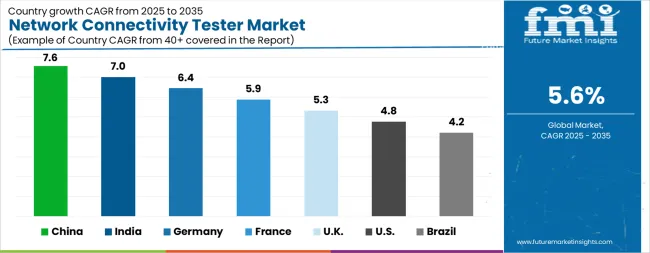

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| U.K. | 5.3% |

| U.S. | 4.8% |

| Brazil | 4.2% |

The Network Connectivity Tester Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Network Connectivity Tester Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The U.S. Network Connectivity Tester Market is estimated to be valued at USD 5.4 billion in 2025 and is anticipated to reach a valuation of USD 8.6 billion by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 781.0 million and USD 417.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.5 Billion |

| Type | LAN Tester, MAN Tester, and WAN Tester |

| End User | Computer And Electronics Industry, Educational Institutes, Research Laboratories, Large Enterprises, Government Agencies, and Other Business Segments |

| Component | Hardware and Software |

| Distribution Channel | OEMs, Distributors, and E-Commerce Portals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Keysight Technologies, Fluke Networks, NetScout Systems, Anritsu Corporation, VIAVI Solutions, EXFO Inc., Teledyne LeCroy, and Rohde & Schwarz |

The global network connectivity tester market is estimated to be valued at USD 14.5 billion in 2025.

The market size for the network connectivity tester market is projected to reach USD 25.0 billion by 2035.

The network connectivity tester market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in network connectivity tester market are lan tester, man tester and wan tester.

In terms of end user, computer and electronics industry segment to command 35.0% share in the network connectivity tester market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Network Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Network Security Policy Management Market Size and Share Forecast Outlook 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analysis Solutions Market Size and Share Forecast Outlook 2025 to 2035

Network Slicing Market Size and Share Forecast Outlook 2025 to 2035

Network Optimization Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA