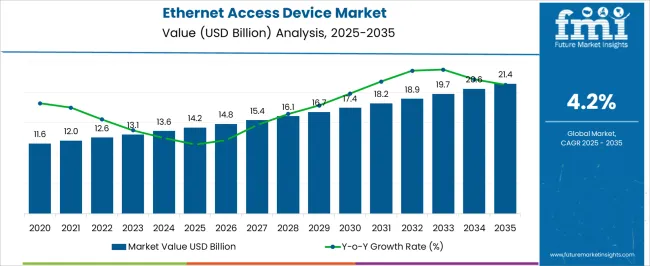

The Ethernet Access Device Market is estimated to be valued at USD 14.2 billion in 2025 and is projected to reach USD 21.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Ethernet Access Device Market Estimated Value in (2025E) | USD 14.2 billion |

| Ethernet Access Device Market Forecast Value in (2035F) | USD 21.4 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The Ethernet access device market is witnessing consistent growth as network service providers and enterprises prioritize high-speed connectivity, low-latency access, and scalable bandwidth delivery. The push toward 5G deployment, IoT integration, and cloud-native services is amplifying the need for robust Ethernet aggregation and demarcation solutions at the edge.

Network operators are modernizing infrastructure to support enterprise-grade SLAs and deliver higher performance at lower operational costs. Increased investment in smart cities, data centers, and SD-WAN expansion has further driven demand for Ethernet-based solutions.

Equipment manufacturers are integrating features such as advanced traffic management, real-time performance monitoring, and MEF compliance to enhance value proposition. With digital transformation accelerating across industries, and regulatory focus increasing on secure and resilient communication frameworks, Ethernet access devices are expected to play a critical role in ensuring seamless connectivity and service reliability across global network topologies.

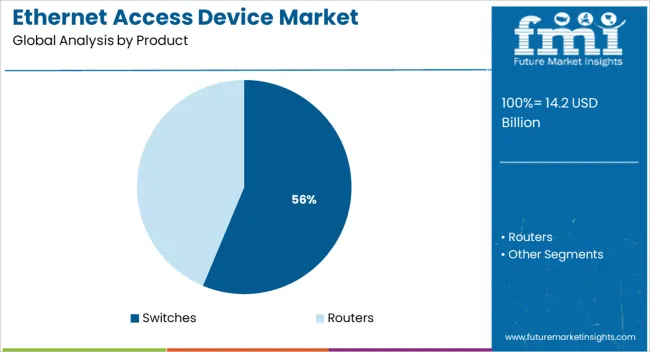

The market is segmented by Product and region. By Product, the market is divided into Switches and Routers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Switches are projected to account for 56.3% of the total revenue in the product category in 2025, positioning them as the leading subsegment. This dominance is being driven by their core role in delivering flexible, cost-effective, and high-capacity Ethernet connectivity across enterprise and service provider networks.

The integration of Layer 2 and Layer 3 switching capabilities has enabled efficient traffic routing and service isolation, supporting both business-critical applications and residential broadband access. Their modular configurations and power efficiency have made them the preferred choice for metro access, campus aggregation, and distributed cloud environments.

As demand increases for service scalability, energy efficiency, and simplified network management, switches are being embedded with automation-ready protocols and real-time diagnostics to enhance performance visibility. The ability of switches to seamlessly integrate with multi-access edge computing and deliver bandwidth guarantees has reinforced their leadership in the Ethernet access device market.

Growing Adoption of Ethernet Access Device in Telecom to Drive the Growth of the Market

Increasing adoption of Ethernet access device in telecom networks backhaul and decrease in price of Ethernet access device are the main drivers for the market growth. In addition to this, the Ethernet access device enables the service providers to deliver high-bandwidth and high-quality Carrier Ethernet services with low delay over multiple copper pairs to customers.

This is a cost-effective solution for service provider to enhance the quality when users increase. Also customer uptake of Ethernet connections and services is the driving factor for the growth of the market. Rising luxuries with advancing technologies in cellular connectivity drives the market growth. Having a fast Ethernet connection to obtain all the data in real time is the need of the day. The real time transfer of information is required in all the applications from a simple transfer of message to navigation in real time.

These conditions dominate the life of the fast paced modern world giving rise to an increased demand for such devices like Ethernet access device, which boost the quality of network even when the people using the network increases exponentially.

High Implementation Cost May Hinder the Grow of the Market

Although the ethernet access device market has numerous end-uses, there are numerous obstacles that likely pose a challenge to market growth. The high implementation cost and long-term return on investment are some of the factors that can restrain the growth of the global Ethernet Access Device market.

Factors are hindering the growth of the global ethernet access device market, are fluctuating price of raw materials being used to manufacture switches and the presence of low-quality cheap products by other manufacturers in the market key restraints of the global Ethernet access device market.

Presence of Leading Market Players in the Region Provide Opportunity for the Growth of the Market

North America dominated the global ethernet access device market in 2025. North America accounts for a market share of 29.0% in the global Ethernet access device market.

The USA is offering the opportunity for revenue generation over the forecast period, owing to the introduction of advanced technologies and increasing investment by companies in various sectors for smart production techniques and process automation.

North America hosts corporate complexes more than the rest of the world. All corporate consumers want a private network loop from their service providers in order to allay security concerns. LAN effectively addresses this security concern, which is mostly deployed on EADs. The demand for wireless hotspots and Wi-Fi solutions and services is expected to increase due to the rise in wireless technology investments by the major companies in this region.

Rise in Adoption of 5G Technology to propel adoption of Ethernet Access Devices

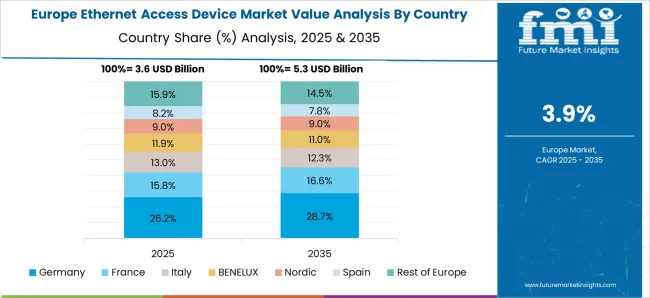

According to Future Market Insights, Europe is expected to provide immense growth opportunities for the ethernet access device market, owing to presence of significant number of leading market players in the region. The Europe ethernet access device market accounts for 25.4% share of the total global market.

The increasing demand for higher bandwidth internet connection, rise in adoption of 5G technology, an increasing number of data centers, and digitalization of businesses to boost the growth of the market in the region.

Increasing Advancements in Telecommunications to Boost the Ethernet Access Device Market

The ethernet access device market in the Asia Pacific is projected to expand at a rapid pace during the forecast period. The Asia Pacific, which follows North America, are expected to witness an increase in demand for Ethernet access device in the near future, as the demand for reliable, fast, and high-speed internet is rising in these regions.

The growing emergence of power over Ethernet (PoE) in various industries is projected to offer remunerative opportunities to the Ethernet access device market in Asia Pacific. Technological advancement in the telecommunication sector in the region to boost the Ethernet access device market.

The new entrants in the ethernet access device market are continually indulging in several collaborations and highly investing in research and development activities to provide more convenient solutions to industry verticals. Some of the major start-ups that are leading the development of the market are – Nimbus Technology, SecureTel Networks Inc., Embsys Technologies Private Limited

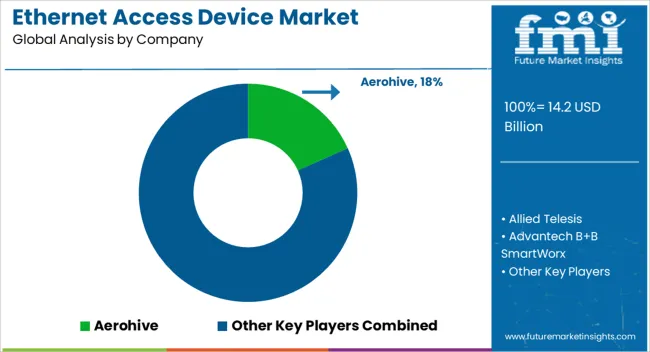

Some of the key participants present in the global ethernet access device market include Aerohive, Allied Telesis, Advantech B+B SmartWorx, Ericsson, Huawei, Mellanox Technologies, Moxa, NEC, NETGEAR, Oracle, PLANET Technology, Siemens, Telco Systems, Westermo (Beijer Electronics Group), ZTE among others.

Attributed to the presence of such a high number of participants, the market is highly competitive. While global players such as Aerohive, Allied Telesis, Advantech B+B SmartWorx, Ericsson account for considerable market size, several regional-level players are also operating across key growth regions, particularly in the Asia Pacific

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.2% from 2025 to 2035 |

| Expected Market Value (2025) | USD 14.2 billion |

| Anticipated Forecast Value (2035) | USD 21.4 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Mexico, Brazil, Germany, Italy, France, UK, Spain, Russia, China, Japan, South Korea, Australia, Saudi Arabia, South Africa, UAE, Israel |

| Key Companies Profiled | Aerohive; Allied Telesis; Advantech B+B SmartWorx; Ericsson; Huawei; Mellanox Technologies; Moxa; NEC; NETGEAR; Oracle; PLANET Technology; Siemens; Telco Systems; Westermo (Beijer Electronics Group), ZTE |

| Customization | Available Upon Request |

The global ethernet access device market is estimated to be valued at USD 14.2 billion in 2025.

The market size for the ethernet access device market is projected to reach USD 21.4 billion by 2035.

The ethernet access device market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in ethernet access device market are switches and routers.

In terms of , segment to command 0.0% share in the ethernet access device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Fabric Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Backhaul Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Switch Market

TSN Ethernet Chips Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Ethernet Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Solutions Market Size and Share Forecast Outlook 2025 to 2035

PoE Solutions Market - Growth, Demand & Forecast 2025 to 2035

In-Vehicle Ethernet System Market Growth – Trends & Forecast 2025 to 2035

SP Routing And Ethernet Switching Market Size and Share Forecast Outlook 2025 to 2035

Access Control as a Service Market Size and Share Forecast Outlook 2025 to 2035

Access Control Market Analysis - Size, Share, and Forecast 2025 to 2035

Access Control and Authentication Market Analysis & Forecast by Technology, Component, Application and Region through 2035

Access Control Readers Market

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Lab Accessory Market Analysis – Size, Share & Forecast 2024-2034

Bar Accessories Market

Jack Accessories Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA