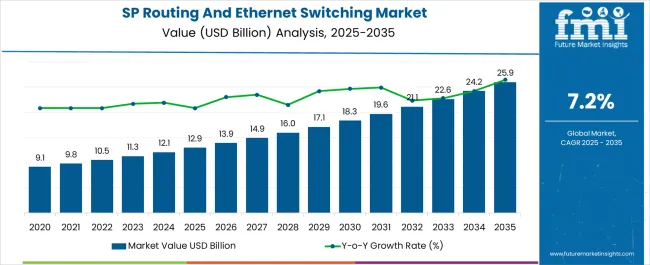

The SP Routing And Ethernet Switching Market is estimated to be valued at USD 12.9 billion in 2025 and is projected to reach USD 25.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| SP Routing And Ethernet Switching Market Estimated Value in (2025 E) | USD 12.9 billion |

| SP Routing And Ethernet Switching Market Forecast Value in (2035 F) | USD 25.9 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The SP routing and ethernet switching market is expanding steadily as demand for high speed connectivity, reliable data management, and scalable network infrastructure continues to intensify. Growth is being supported by rising data traffic volumes driven by cloud services, video streaming, and enterprise digital transformation initiatives.

Telecom operators and service providers are increasingly investing in advanced routing and switching solutions to support 5G rollout, IoT proliferation, and edge computing requirements. The market is also benefitting from continuous innovation in packet forwarding techniques, energy efficient designs, and automation enabled management platforms.

Regulatory frameworks promoting data security and operational efficiency are further accelerating adoption. The overall outlook remains positive as enterprises and service providers prioritize network resilience, low latency, and cost effective scalability in a highly competitive digital ecosystem.

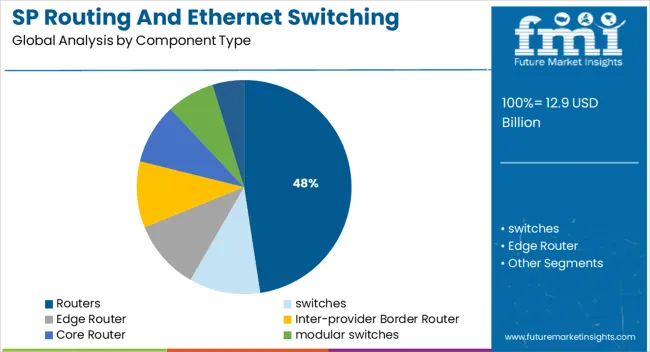

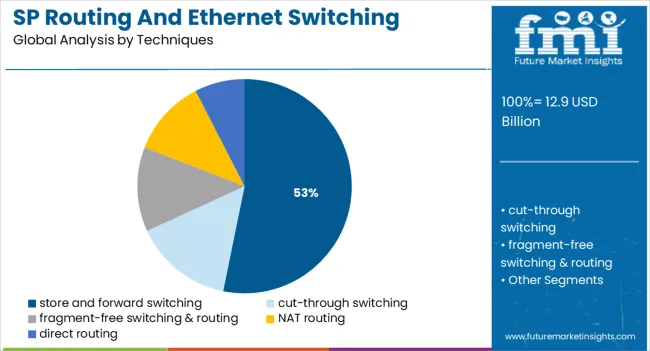

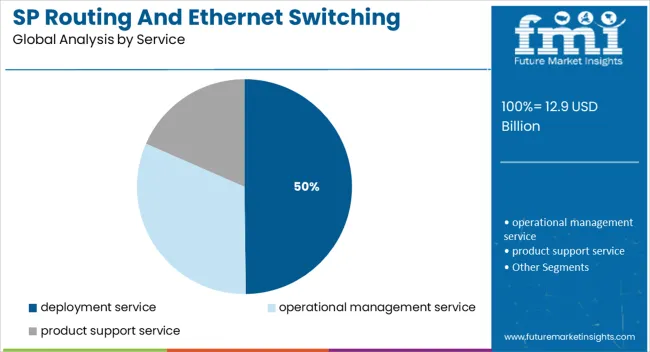

The market is segmented by Component Type, Techniques, Service, and End User Type and region. By Component Type, the market is divided into Routers, switches, Edge Router, Inter-provider Border Router, Core Router, modular switches, and fixed configuration switches. In terms of Techniques, the market is classified into store and forward switching, cut-through switching, fragment-free switching & routing, NAT routing, and direct routing. Based on Service, the market is segmented into deployment service, operational management service, and product support service. By End User Type, the market is divided into automotive, consumer packaged goods, education, energy, financial services, government, healthcare, and hospitality and life sciences. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The routers segment is projected to hold 47.60% of total market revenue by 2025 within the component type category, making it the leading segment. This share is attributed to the rising need for reliable traffic management, secure connectivity, and efficient routing capabilities across enterprise and service provider networks.

Routers are being increasingly deployed to support cloud integration, data center expansion, and remote workforce connectivity. Their role in ensuring optimal bandwidth utilization and delivering secure, multi protocol routing solutions has been widely recognized.

With ongoing advancements in software defined routing and network virtualization, the router segment is expected to maintain its dominance in driving seamless connectivity and operational efficiency.

The store and forward switching segment is expected to account for 53.20% of total revenue by 2025 within the techniques category, establishing it as the most prominent approach. This is driven by its ability to ensure error free data transmission by validating entire data packets before forwarding, thereby enhancing reliability.

The method has been favored in enterprise and service provider environments where data integrity and security are prioritized. Its compatibility with evolving Ethernet standards and high performance networking environments has further reinforced adoption.

With enterprises demanding lower downtime, improved quality of service, and advanced traffic management, store and forward switching continues to represent the preferred technique across multiple network applications.

The deployment service segment is anticipated to contribute 49.80% of overall market revenue by 2025 under the service category, positioning it as the dominant segment. This growth is being supported by the complexity of modern networking architectures which require expert installation, configuration, and integration.

Service providers and enterprises are relying on deployment services to ensure optimized performance, scalability, and compliance with regulatory frameworks. The need for seamless migration from legacy systems to next generation routing and switching solutions has also driven reliance on professional deployment.

With digital transformation accelerating globally and service providers expanding their infrastructure, deployment services are set to remain the most critical element in enabling successful adoption of SP routing and Ethernet switching technologies.

However, the demand for SP routing and ethernet switching is being held back by problems with installation and a lack of trained employees to rectify the defects. Inefficient communication is a direct outcome of the increased network load caused by dynamic routing.

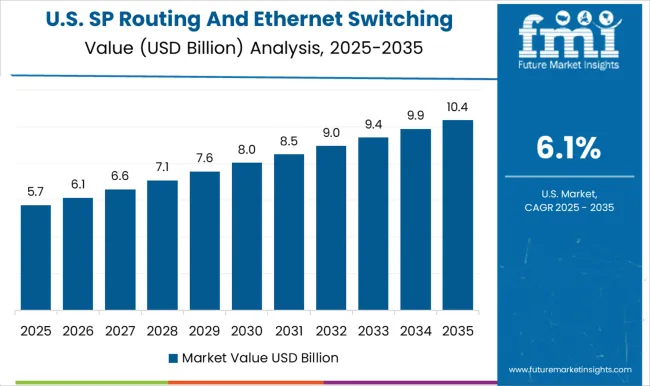

Demand for SP routing and ethernet switching is anticipated to be high in North America. The region also boasts a substantial presence of network routers vendors. Companies like Cisco Systems, Inc., Dell EMC, and Juniper Networks, Inc. are fueling the expansion of the market.

The market for network routers, which includes ethernet service edge routers, multiservice edge routers, service provider core routers, and internet exchange routers, is expected to grow to USD 11,950 million by 2025 in the United States, with the expectation of high market growth possibly moving towards SP routing and ethernet switching market in 2025.

However, the SP routing and ethernet switching market is being stifled by concerns about privacy and security. The survey found that 56% of routers in the USA were using insecure, out-of-date firmware, which in turn restrains the global market expansion.

Devices like routers can be exploited to plant a variety of viruses into handheld devices used by employees in a circumstance where many employees are currently working from home owing to a COVID-19 pandemic or access Wi-Fi networks that run at enterprise-level security. Subex has been monitoring the distribution of malware and the frequency of cyberattacks through its honeypot network, which is set up in 62 different cities.

With the advent of new technologies like big data and cloud computing, more people can use the internet for their own reasons as well as for business and industrial ones. Big data is used by IT departments in ways apart from rolling out new applications and platforms like Hadoop. New system architectures, administrative abilities, and data management tactics are becoming increasingly important in the IT industry as a result of these developments.

Hadoop and other Big Data applications built for the cloud are examples of distributed programs that use many-to-many communication patterns to function across multiple servers. For these dispersed systems to function reliably, it is crucial to maintain a constant network bandwidth and latency for all traffic types. This drives up demand for Ethernet switches and helps the Ethernet switches industry expand.

SP routing and Ethernet switching are the processes that involves in the transmission of data from one point to another point inside the computer network. In the computer network while accessing the internet or another computer over the network, the data sent or received, travelled through different nodes over the transmission media.

The mechanism of transmitting information between different computer network and network segment is called switching & the intelligent device responsible to connect two system & network segment over the wired network is known as Ethernet switch.

During communication over the network there are so many paths existing between the two nodes or between source and destination, but which path is suitable for setup communication between the source and destination is decided by the intelligent device named Router and the process of selecting the suitable path among all the existing path is known as routing,

As the demand of bandwidth & high data speed is continuously increasing and also the global internet users growing up with a great speed hence, SP routing & Ethernet switching market is expected to experience drastic growth during forecast period.

The key trend responsible for the growth of global SP Routing & Ethernet switching market is that the vendors are focusing on the advanced emerging technologies as top companies are coming up with emerging terabit networking where terabit routing and switching takes place.

The key drivers which are driving the global SP routing & Ethernet switching market are; the increased digital data traffic over the existing network and the rapid increasing demand of bandwidth, rising market of data centers, increase in cloud storage adoption by different organizations are some of them.

On the flip side the key restraints which are acting as hurdles in the growth of SP routing & Ethernet switching market are; Ethernet switches & SP routers are difficult to install and use, they often need training personals if network goes down. Dynamic router causes additional traffic over the network because of which the efficiency of communication decreases.

On the basis of Geography, global SP routing & Ethernet switching market is segmented into seven reasons as; North America, Latin America, Western Europe, Eastern Europe, Asia-Pacific (excluding Japan), Japan as a separate region and Middle East & Africa. Among all the regions, APAC is having the maximum market share of global SP routing & Ethernet Switching market.

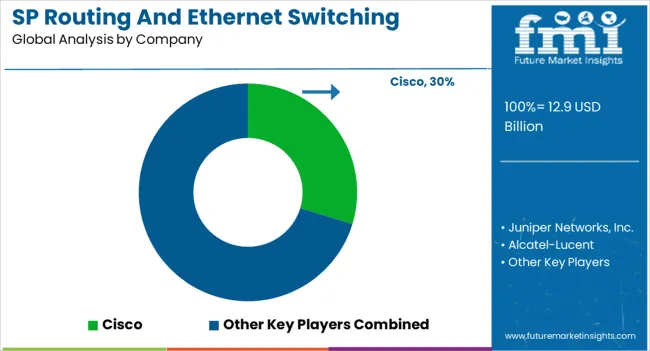

The key players of global SP routing & Ethernet Switching market are Cisco, Juniper Networks, Inc., Alcatel-Lucent, Hewlett-Packard Development Company, L.P. & others.

The global sp routing and ethernet switching market is estimated to be valued at USD 12.9 billion in 2025.

The market size for the sp routing and ethernet switching market is projected to reach USD 25.9 billion by 2035.

The sp routing and ethernet switching market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in sp routing and ethernet switching market are routers, switches, edge router, inter-provider border router, core router, modular switches and fixed configuration switches.

In terms of techniques, store and forward switching segment to command 53.2% share in the sp routing and ethernet switching market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

SpO2 Medical Cable Market Size and Share Forecast Outlook 2025 to 2035

Spain Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sponge City Rainwater Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Specialty Film Market Size and Share Forecast Outlook 2025 to 2035

Special Sealant for Photovoltaic Modules Market Forecast and Outlook 2025 to 2035

Spark Detection System Market Forecast and Outlook 2025 to 2035

Splash Shield Market Size and Share Forecast Outlook 2025 to 2035

Special-Purpose Analog-to-Digital Converters (ADCs) Market Forecast and Outlook 2025 to 2035

Spun Polyester Fabric Market Size and Share Forecast Outlook 2025 to 2035

Spider Silk Fibers Market Size and Share Forecast Outlook 2025 to 2035

Spider Silk Fabric Market Size and Share Forecast Outlook 2025 to 2035

Spinal Access Systems Market Size and Share Forecast Outlook 2025 to 2035

Splicing Tape Market Size and Share Forecast Outlook 2025 to 2035

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Spin Filters Market Size and Share Forecast Outlook 2025 to 2035

Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Specific Protein Testing Market Size and Share Forecast Outlook 2025 to 2035

Special Coagulation Tests Market Size and Share Forecast Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spine Pain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA