The global spun polyester fabric market is valued at USD 1,574.1 million in 2025 and is projected to reach USD 2,241.9 million by 2035, growing at a CAGR of 3.6% during the forecast period. This expansion, amounting to an absolute increase of USD 667.8 million and a 1.42X growth in overall market size, is being shaped by a combination of structural trends across textile production, consumer preference, and industrial applications. One of the most significant factors influencing growth is the increased reliance on blended fabrics in apparel manufacturing, where polyester is mixed with cotton, viscose, or spandex to improve performance, comfort, and cost efficiency. Rising global demand for wrinkle-resistant, easy-care, and durable fabrics has positioned spun polyester as a preferred solution across both formal and casual wear categories, reinforcing its importance in large-scale apparel production hubs in the Asia-Pacific.

Home textiles represent another critical trend driving market expansion, with spun polyester fabrics increasingly used in curtains, upholstery, and decorative furnishings due to their strength, fade resistance, and affordability compared to natural fibers. The shift in consumer spending toward premium and longer-lasting interior products is encouraging greater use of spun polyester as a substitute for cotton in home décor. Technical innovation in dyeing and finishing processes is also elevating the aesthetic appeal of polyester fabrics, allowing them to capture a larger share in both traditional textile markets and fast-fashion supply chains.

Another emerging trend is the growing role of sustainability in fabric production. Although polyester is a synthetic material, recycled spun polyester made from PET bottles and post-consumer waste is gaining traction as apparel brands and textile producers seek to reduce their environmental footprints while maintaining durability standards. Demand for recycled polyester yarns is expected to accelerate, particularly in Europe and North America, where regulatory pressures and growing consumer awareness of eco-friendly textiles are influencing procurement decisions. Process innovations in spinning technology are reducing energy consumption and improving output quality, strengthening supply efficiency for textile mills worldwide. Industrial and workwear applications further reinforce market demand, as spun polyester fabrics offer superior resistance to abrasion, stretching, and shrinking. The fabric’s dimensional stability makes it well-suited for uniforms and protective wear, especially in manufacturing and service industries where longevity and functionality are critical. This trend is anticipated to extend into technical textile applications, where polyester blends are being adopted in filter fabrics, geotextiles, and specialty industrial cloth due to their resilience under challenging operating conditions.

Between 2025 and 2030, the spun polyester fabric market is projected to expand from USD 1,574.1 million to USD 1,878.5 million, resulting in a value increase of USD 304.4 million, which represents 45.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of advanced textile manufacturing technologies, rising demand for high-performance fabric solutions, and growing emphasis on versatile apparel manufacturing with enhanced durability characteristics. Textile manufacturers are expanding their production capabilities to address the growing demand for clothing applications, home textile requirements, and specialty fabric treatment needs.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,574.1 million |

| Forecast Value in (2035F) | USD 2,241.9 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

From 2030 to 2035, the spun polyester fabric market is forecast to grow from USD 1,878.5 million to USD 2,241.9 million, adding another USD 363.4 million, which constitutes 54.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of automated textile production technologies, the integration of smart manufacturing systems, and the development of multi-functional fabric platforms with enhanced performance capabilities. The growing adoption of advanced manufacturing practices will drive demand for spun polyester fabrics with superior quality characteristics and compatibility with modern textile processing across manufacturing operations.

Between 2020 and 2025, the spun polyester fabric market experienced steady growth, driven by increasing demand for modern textile applications and growing recognition of polyester fabric technology as an essential material for efficient textile manufacturing across apparel production, home textile management, and specialty fabric applications. The spun polyester fabric market developed as manufacturers recognized the potential for spun polyester fabrics to provide cost-effective solutions while maintaining quality standards and enabling versatile application protocols. Technological advancement in spinning processes and fabric treatment mechanisms began emphasizing the critical importance of maintaining quality consistency and performance reliability in diverse textile environments.

Market expansion is being supported by the increasing global demand for versatile textile solutions and the corresponding need for durable materials that can provide superior performance characteristics and application versatility while enabling cost-effective production and enhanced durability across various apparel and home textile applications. Modern textile operations and fabric manufacturers are increasingly focused on implementing polyester technologies that can deliver consistent quality, prevent fabric degradation, and provide reliable performance throughout complex manufacturing processes and diverse application conditions. Spun polyester fabrics' proven ability to deliver exceptional versatility against wear and tear, enable efficient production operations, and support cost-effective manufacturing protocols make them essential materials for contemporary textile and apparel manufacturing operations.

The growing emphasis on textile efficiency and manufacturing optimization is driving demand for spun polyester fabrics that can support large-scale production requirements, improve product quality outcomes, and enable automated manufacturing systems. Manufacturers' preference for materials that combine effective performance with operational reliability and resource efficiency is creating opportunities for innovative fabric implementations. The rising influence of smart textiles and advanced manufacturing practices is also contributing to increased demand for spun polyester fabrics that can provide consistent quality, enhanced durability capabilities, and reliable performance across extended production periods.

The spun polyester fabric market is poised for steady growth and transformation. As industries across apparel, home textiles, industrial textiles, and specialty applications seek materials that deliver exceptional quality consistency, manufacturing efficiency, and performance reliability, spun polyester fabrics are gaining prominence not just as standard materials but as strategic enablers of modern textile manufacturing and product development.

Rising advanced textile adoption in Asia-Pacific and expanding smart manufacturing initiatives globally amplify demand, while producers are leveraging innovations in fiber technology systems, automated production controls, and integrated quality management technologies.

Pathways like high-performance fabric platforms, ai-powered manufacturing systems, and specialized application solutions promise strong margin uplift, especially in premium textile segments. Geographic expansion and technology integration will capture volume, particularly where local textile practices and advanced manufacturing adoption are critical. Regulatory support around textile modernization, quality standards requirements, and manufacturing efficiency guidelines give structural support.

The spun polyester fabric market is segmented by fabric type, application, fiber blend ratio, manufacturing process, end-use sector, and region. By fabric type, the spun polyester fabric market is divided into 100% spun polyester fabric and blended spun polyester fabric categories. By application, it covers clothing, bedding and mattresses, luggage, and others. By fiber blend ratio, the spun polyester fabric market includes high polyester content (>75%), medium polyester content (50-75%), and low polyester content (<50%). By manufacturing process, the spun polyester fabric market covers ring spinning, open-end spinning, and compact spinning. By end-use sector, it is categorized into apparel manufacturing, home textiles, industrial textiles, and specialty applications. Regionally, the spun polyester fabric market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

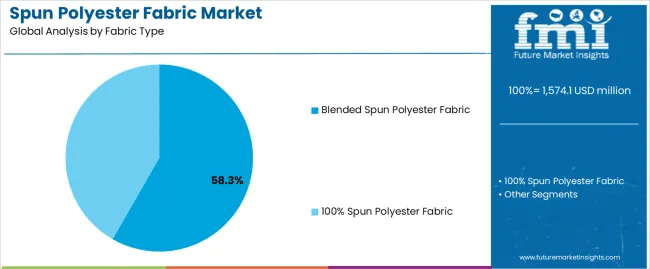

The blended spun polyester fabric segment is projected to account for 58.5% of the spun polyester fabric market in 2025, reaffirming its position as the leading fabric category. Apparel manufacturers and textile producers increasingly utilize blended spun polyester fabrics for their superior versatility capabilities when operating across diverse textile applications, excellent performance characteristics, and cost-effectiveness in applications ranging from clothing production to home textile manufacturing. Blended spun polyester fabric technology's advanced fiber combination capabilities and enhanced durability directly address the industrial requirements for comprehensive performance in large-scale textile environments.

This fabric segment forms the foundation of modern textile manufacturing operations, as it represents the fabric type with the greatest application versatility and established market demand across multiple application categories and manufacturing sectors. Producer investments in enhanced blending technologies and automated processing compatibility continue to strengthen adoption among textile manufacturers and apparel producers. With companies prioritizing performance optimization and cost efficiency, blended spun polyester fabrics align with both quality requirements and economic efficiency objectives, making them the central component of comprehensive textile manufacturing strategies.

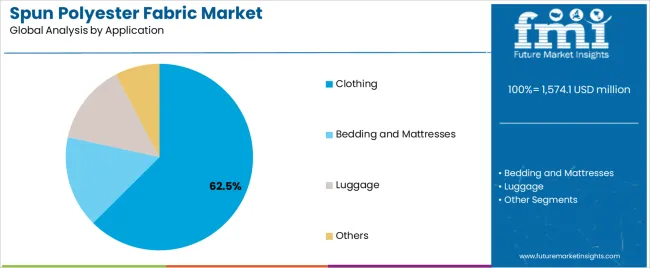

Clothing applications are projected to represent 62.5% of spun polyester fabric demand in 2025, underscoring their critical role as the primary textile consumers of versatile fabric technology for apparel production, garment manufacturing, and clothing treatment applications. Apparel manufacturers prefer spun polyester fabrics for their exceptional quality consistency capabilities, cost-effective operational characteristics, and ability to provide durable performance while ensuring effective production throughout diverse clothing manufacturing programs. Positioned as essential materials for modern apparel operations, spun polyester fabrics offer both efficiency advantages and quality consistency benefits.

The segment is supported by continuous innovation in fabric manufacturing technologies and the growing availability of specialized blending systems that enable variable composition applications with enhanced quality uniformity and rapid production capabilities. Additionally, apparel manufacturers are investing in advanced manufacturing systems to support large-scale fabric utilization and production planning. As advanced textile demand becomes more prevalent and manufacturing efficiency requirements increase, clothing applications will continue to dominate the end-use market while supporting advanced textile manufacturing utilization and apparel production strategies.

The spun polyester fabric market is advancing steadily due to increasing demand for versatile textile technologies and growing adoption of cost-effective fabric solutions that provide superior quality consistency and manufacturing efficiency while enabling reduced production costs across diverse apparel and textile manufacturing applications. However, the spun polyester fabric market faces challenges, including raw material price volatility, environmental compliance requirements, and the need for specialized manufacturing equipment and quality control programs. Innovation in advanced fiber technologies and automated manufacturing systems continues to influence product development and market expansion patterns.

The growing adoption of automated production systems, ai-powered quality monitoring algorithms, and machine learning-based manufacturing optimization is enabling producers to manufacture advanced spun polyester fabrics with superior quality characteristics, enhanced production precision, and automated quality control functionalities. Advanced manufacturing systems provide improved quality consistency while allowing more efficient production capabilities and consistent performance across various fabric types and application conditions. Manufacturers are increasingly recognizing the competitive advantages of automated production capabilities for operational differentiation and premium market positioning.

Modern spun polyester fabric producers are incorporating advanced fiber technologies, enhanced treatment processes, and integrated performance enhancement systems to improve textile functionality, enable advanced application capabilities, and deliver value-added solutions to textile customers. These technologies improve manufacturing efficiency while enabling new performance capabilities, including enhanced durability characteristics, improved comfort properties, and reduced production complexity. Advanced fiber integration also allows manufacturers to support comprehensive textile systems and manufacturing modernization beyond traditional fabric production approaches.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| USA | 3.4% |

| UK | 3.1% |

| Japan | 2.7% |

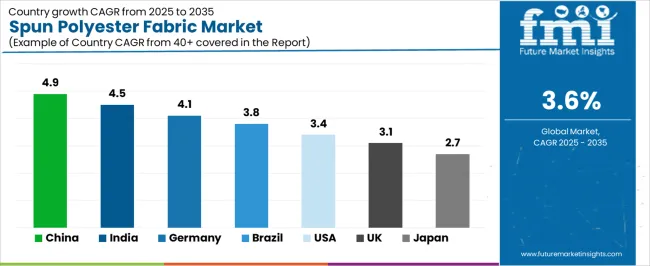

The spun polyester fabric market is experiencing steady growth globally, with China leading at a 4.9% CAGR through 2035, driven by the expanding textile manufacturing programs, growing apparel production adoption, and significant investment in fabric technology development. India follows at 4.5%, supported by government initiatives promoting textile manufacturing, increasing production capacity demand, and growing fabric quality requirements. Germany shows growth at 4.1%, emphasizing advanced textile innovation and high-performance fabric technology development. Brazil records 3.8%, focusing on large-scale textile expansion and commercial manufacturing modernization. The USA demonstrates 3.4% growth, prioritizing textile efficiency standards and manufacturing automation excellence. The UK exhibits 3.1% growth, emphasizing textile technology adoption and advanced manufacturing development. Japan shows 2.7% growth, supported by high-tech textile initiatives and precision manufacturing concentration.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from spun polyester fabrics in China is projected to exhibit strong growth with a CAGR of 4.9% through 2035, driven by expanding textile manufacturing programs and rapidly growing apparel production adoption supported by government initiatives promoting textile technology development. The country's strong position in fabric manufacturing and increasing investment in smart textile infrastructure are creating substantial demand for advanced spun polyester fabric solutions. Major textile manufacturers and apparel enterprises are establishing comprehensive production capabilities to serve both domestic clothing demand and textile efficiency markets.

Revenue from spun polyester fabrics in India is expanding at a CAGR of 4.5%, supported by the country's massive textile sector, expanding government support for manufacturing modernization, and increasing adoption of advanced fabric solutions. The country's initiatives promoting textile technology and growing manufacturer awareness are driving requirements for advanced fabric quality capabilities. International suppliers and domestic manufacturers are establishing extensive production and service capabilities to address the growing demand for spun polyester fabric products.

Revenue from spun polyester fabrics in Germany is expanding at a CAGR of 4.1%, supported by the country's advanced textile manufacturing capabilities, strong emphasis on fabric technology innovation, and robust demand for high-performance textile automation in apparel production and manufacturing applications. The nation's mature textile sector and efficiency-focused operations are driving sophisticated spun polyester fabric systems throughout the manufacturing industry. Leading producers and technology providers are investing extensively in automated systems and precision manufacturing technologies to serve both domestic and international markets.

Revenue from spun polyester fabrics in Brazil is growing at a CAGR of 3.8%, driven by the country's expanding textile sector, growing commercial apparel operations, and increasing investment in textile technology development. Brazil's large textile market and commitment to manufacturing modernization are supporting demand for efficient spun polyester fabric solutions across multiple production segments. Manufacturers are establishing comprehensive service capabilities to serve the growing domestic market and textile export opportunities.

Revenue from spun polyester fabrics in the USA is expanding at a CAGR of 3.4%, supported by the country's advanced textile technology sector, strategic focus on manufacturing efficiency, and established advanced textile capabilities. The USA's textile innovation leadership and technology integration are driving demand for spun polyester fabrics in commercial apparel, specialty textile production, and manufacturing service applications. Manufacturers are investing in comprehensive technology development to serve both domestic textile markets and international specialty applications.

Revenue from spun polyester fabrics in the UK is growing at a CAGR of 3.1%, driven by the country's focus on textile technology advancement, emphasis on manufacturing efficiency, and strong position in advanced textile development. The UK's established textile innovation capabilities and commitment to manufacturing modernization are supporting investment in advanced fabric technologies throughout major textile regions. Industry leaders are establishing comprehensive technology integration systems to serve domestic manufacturing operations and specialty textile applications.

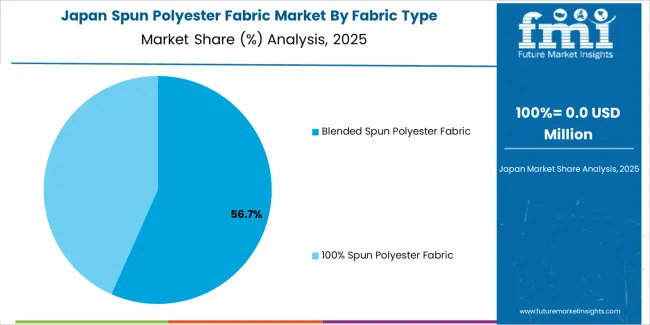

Revenue from spun polyester fabrics in Japan is expanding at a CAGR of 2.7%, supported by the country's high-tech textile initiatives, growing precision manufacturing sector, and strategic emphasis on textile automation development. Japan's advanced technology capabilities and integrated textile systems are driving demand for high-performance spun polyester fabrics in specialty textile production, precision manufacturing, and high-value textile applications. Leading manufacturers are investing in specialized capabilities to serve the stringent requirements of high-tech textiles and precision manufacturing industries.

The spun polyester fabric market in Europe is projected to grow from USD 298.2 million in 2025 to USD 423.8 million by 2035, registering a CAGR of 3.6% over the forecast period. Germany is expected to maintain its leadership position with a 42.3% market share in 2025, declining slightly to 41.8% by 2035, supported by its strong advanced textile sector, high-performance manufacturing capabilities, and comprehensive textile automation industry serving diverse spun polyester fabric applications across Europe.

France follows with a 19.2% share in 2025, projected to reach 19.6% by 2035, driven by robust demand for spun polyester fabrics in fashion production, textile modernization programs, and apparel manufacturing applications, combined with established textile technology infrastructure and specialty fabric expertise. The United Kingdom holds a 16.1% share in 2025, expected to reach 16.4% by 2035, supported by strong textile technology sector and growing advanced manufacturing activities. Italy commands a 11.8% share in 2025, projected to reach 12.1% by 2035, while Spain accounts for 7.2% in 2025, expected to reach 7.4% by 2035. The Netherlands maintains a 2.1% share in 2025, growing to 2.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 1.3% to 0.5% by 2035, attributed to increasing textile modernization in Eastern Europe and growing advanced manufacturing penetration in Nordic countries implementing advanced textile technology programs.

The spun polyester fabric market is characterized by competition among established textile manufacturers, specialized fiber technology producers, and integrated textile solutions providers. Companies are investing in advanced manufacturing technology research, quality optimization, precision production system development, and comprehensive product portfolios to deliver consistent, high-performance, and application-specific spun polyester fabric solutions. Innovation in automated manufacturing systems, quality control integration, and operational efficiency enhancement is central to strengthening market position and competitive advantage.

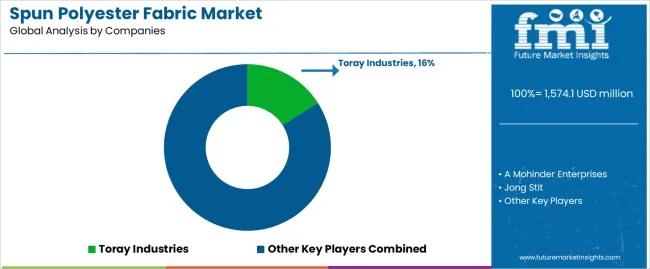

Toray Industries leads the spun polyester fabric market with a strong market share, offering comprehensive spun polyester fabric solutions including advanced fiber technology systems with a focus on apparel and industrial applications. A Mohinder Enterprises provides specialized textile manufacturing capabilities with an emphasis on quality fabric systems and automated production operations. Jong Stit delivers innovative textile products with a focus on high-performance platforms and commercial textile services. Greentex specializes in textile manufacturing and spun polyester fabric technologies for large-scale production applications. Wayne Mills Co. Inc focuses on precision textile equipment and integrated manufacturing solutions. RaiNSUN INTERNATIONAL offers specialized fabric platforms with emphasis on commercial textile and apparel applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,574.1 million |

| Fabric Type | 100% Spun Polyester Fabric, Blended Spun Polyester Fabric |

| Application | Clothing, Bedding and Mattresses, Luggage, Others |

| Fiber Blend Ratio | High Polyester Content (>75%), Medium Polyester Content (50-75%), Low Polyester Content (<50%) |

| Manufacturing Process | Ring Spinning, Open-End Spinning, Compact Spinning |

| End-Use Sector | Apparel Manufacturing, Home Textiles, Industrial Textiles, Specialty Applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Toray Industries, A Mohinder Enterprises, Jong Stit, Greentex, Wayne Mills Co. Inc, and RaiNSUN INTERNATIONAL |

| Additional Attributes | Dollar sales by fabric type and application category, regional demand trends, competitive landscape, technological advancements in manufacturing systems, quality control development, automation integration innovation, and textile service integration |

The global spun polyester fabric market is estimated to be valued at USD 1,574.1 million in 2025.

The market size for the spun polyester fabric market is projected to reach USD 2,241.9 million by 2035.

The spun polyester fabric market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in spun polyester fabric market are blended spun polyester fabric and 100% spun polyester fabric.

In terms of application, clothing segment to command 62.5% share in the spun polyester fabric market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spun Yarn Paper Cone Market

Polyester Polyol Market Size and Share Forecast Outlook 2025 to 2035

Polyester Hot Melt Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyester Straps Market Size and Share Forecast Outlook 2025 to 2035

Polyester Fiber Market Size and Share Forecast Outlook 2025 to 2035

Polyester Labels Market – Growth & Demand 2025 to 2035

Polyester Resin Dispersion Market Analysis & Forecast by Viscosity Type, Process, End-Use Industry and Region through 2025 to 2035

Industry Share Analysis for Polyester Straps Companies

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Saturated Polyester Resin Market Growth – Trends & Forecast 2024-2034

Metallised Polyester Films Market Size and Share Forecast Outlook 2025 to 2035

High-Strength Polyester Thread Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Softener Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fabric Filter System Market Size & Forecast 2025 to 2035

Fabric Softener Market Analysis by Nature, Product Type, End Use, Sales Channel & Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA